Accounting in organizations serving the housing and communal services sector has some features. The nuances of accounting arise due to the diversity of income, mutual settlements, and the specifics of taxation. In the article we will tell you about accounting in housing and communal services, we will give examples of calculations with transactions.

Accounting in housing and communal services enterprises is not regulated by any specific regulations. Its conduct is subject to generally accepted rules, methods and laws relating to other organizations. In accordance with accounting standards, organizations operating in the field of housing and communal services can develop their own methods of conducting it, fixing them in their accounting policies.

Accounting for settlements with suppliers and consumers

The most common option for a management company to organize settlements with suppliers and consumers of utility payments is to conclude an agreement on the paid nature of the services provided. In this case, funds received from apartment owners are classified as income of the organization, and the cost of services invoiced by suppliers is classified as expenses.

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 20 | 60 | For the amount of utilities provided by suppliers for payment |

| 19 | 60 | VAT on supplier services |

| 68 | 19 | VAT offset |

| 62 | 90/1 | Bills submitted for payment to utility service consumers |

| 90/3 | 68 | VAT calculation |

| 90/2 | 20 | Write-off of expenses |

| 50, 51 | 62 | Receipt of funds to pay utility bills |

| 60 | 51 | Transferred to the supplier for utilities |

Features of accounting for utility payments

The volume of utility resources used is determined based on meter readings. If there are no meters in the premises, the volume of services provided is calculated based on the laws. For each communal resource, its own regulatory act has been created.

For example, for heating services, Federal Law No. 190 “On Heat Supply” dated July 27, 2010 is relevant. If representatives of the company do not agree with the accrued amount of resources, they can contact the structure involved in the supply of resources. If this structure agrees with the company’s claims, a document with changed data will be generated. Based on this document, the company issues an adjustment invoice.

Utility payments are accounted for on account 60. The following transactions appear as part of accounting:

- DT60 KT51. Transfer of payment.

- DT60/1 KT51. Posting is used if the agreement with the supplying organization specifies a condition for advance payment. Performed for the amount of the advance.

- DT60 KT60 “Advance” subaccount. This wiring is used in conjunction with the previous one. It is relevant when the company has received receipts. The payment debt is repaid in advance, transferred earlier.

Postings are carried out on the basis of an agreement on the provision of utility services and receipts.

Settlements of the management company with the ERCC

The management company can cooperate with the unified cash settlement center (UCSC) subject to the conclusion of an agency agreement. To account for settlements with the ERCC, a separate subaccount of account 76 is used.

| Account correspondence | Contents of operation | |

| Debit | Credit | |

| 51 | 76 | Funds received from ERCC |

| 76 | 62 | Utilities paid by homeowners |

| 62 | 90/1 | Income shown |

General approach to accounting in housing and communal services

Housing and communal services enterprises (HCS) directly or indirectly relate to all organizations and citizens. This relationship is manifested not only in the consumption of housing and communal services, but also in the emergence of a set of rights and obligations of consumers and providers of housing and communal services.

In practice, 2 options are common:

- consumers enter into direct contracts with resource supply companies in the housing and communal services sector;

- interact with them indirectly - through the landlord, HOA, management company, etc.

Accounting for costs of managing apartment buildings

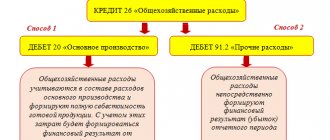

An important nuance of accounting for the property and obligations of housing and communal services organizations is the obligation to keep separate records of income and expenses by type. In accordance with this, real estate management services are accounted for separately on account 20. Since the main income of such organizations is revenue from managing an apartment building, expenses for this type of activity should be taken into account as basic, and not as general business expenses.

Account 26 should reflect expenses not directly related to the main activity.

Account 26 in the management company is used to reflect expenses for other activities.

Accounting for payments from the lessor

There are two options for paying for services by the landlord:

- Payments are included in the premises fee.

- Service fees are reimbursed by the tenant.

Accounting in these two cases will be performed differently.

Payments are included in the rental fee

The lessor will make payments on the basis of invoices. They will be included in the expenses. The accounting treatment is determined by whether the provision of premises for rent is the main activity of the lessor company. If this is the main activity, payments are included in expenses for ordinary activities. Otherwise, they are included in operating expenses. The lessor's transactions will be as follows:

- DT62 KT90/1. Profit from renting out the property.

- DT90/3 KT68. VAT accrual.

- DT26 KT60. Expenses for services.

- DT19 KT60. VAT claimed by the utility company.

- DT86 KT19. Acceptance of VAT for deduction.

- DT90/2 KT26. Writing off the cost of resources.

- DT60 KT51. Payment for services.

If leasing premises is the main form of activity, expenses based on paragraph 1 of Article 254 of the Tax Code of the Russian Federation are included in material expenses. If this is not the main activity, expenses can be included either in other expenses (clause 1 of Article 264 of the Tax Code of the Russian Federation) or in non-operating expenses (clause 1 of Article 265 of the Tax Code of the Russian Federation).

IMPORTANT! The tax authorities believe that compensation received from the tenant is considered income related to the provision of rental services. These revenues will multiply the VAT tax base on the basis of paragraph 1 of Article 162 of the Tax Code of the Russian Federation. The company providing the premises can deduct VAT transferred to utility structures in full.

Tax accounting at housing and communal services enterprises

Organizations operating in the housing and communal services system can apply both general and special taxation regimes. OSNO is the easiest to use. But it should be taken into account that the use of such a system causes a fairly high tax burden. The organization is a payer of income tax and VAT.

For most companies working in the housing and communal services sector, the simplified tax system is preferable. This option is acceptable when:

- the number of company employees does not reach 100 people;

- income in the reporting period does not exceed 60,000,000 rubles;

- the cost of fixed assets on the organization’s balance sheet did not reach 100,000,000 rubles.

By choosing the “simplified” system, the company receives an exemption from the obligation to pay income tax at a rate of 20% and VAT. These payments are replaced by the tax provided for by the simplified tax system at a rate of 15% if taxation is carried out according to the “income-expenses” system, or at a rate of 6% if income is taxed.

The simplified tax system is attractive for companies whose activities most often result in a loss. In this case, the tax rate for them will be 1% of their income.

Accounting for payments from the tenant

The most comfortable option for the tenant is to include utility bills in the rent. Why is this convenient? The company will not have to contact utilities directly. No need to waste time processing payments. In this case, expenses will be included in other expenses. The basis for this is paragraph 1 of Article 264 of the Tax Code of the Russian Federation. The company renting the premises can deduct input VAT. This operation is performed based on the invoice. The postings will be like this:

- DT76 KT51. Payment of rent.

- DT20 KT76. Write-off for rental expenses.

- DT19 KT76. VAT accounting.

- DT68 KT19. Acceptance of VAT for deduction.

ATTENTION! The letter of the Ministry of Finance No. 07-05-06/234 dated September 6, 2005 states: if the payment for electricity is not included in the rent, the lessor will not issue an invoice. This payment is expected to be paid as compensation.

Accounting statements of housing and communal services organization

The responsibilities of a legal entity working in the housing and communal services sector include maintaining accounting records and providing reporting. This obligation applies to any company, regardless of which taxation system is applied. The reporting set for the year includes:

- balance sheet;

- Profits and Losses Report;

- Explanation of the balance sheet and income statement;

- statement of changes in equity;

- cash flow statement.

Interim reporting includes only the first two forms. If the organization belongs to a small business, the reporting also includes only the balance sheet and income statement. When applying the simplified tax system, reporting is provided in a simplified form and includes a balance sheet, a statement of financial results and a report on the intended use of funds.

In addition, housing and communal services organizations regularly provide information on the number of personnel and data on income tax 2-NDFL. If an enterprise uses OSNO, then it is necessary to submit a tax return for income tax and VAT. Organizations that use the simplified tax system submit a single tax return even if there are no income or expenses in the reporting period.

Accounting in HOAs

The question of how to make accounting entries in the accounting of HOAs still remains relevant. The recommendations of some experts on the use of account 96, discussions regarding the qualification of HOA activities as the sale of services and work for tax purposes, as well as the lack of clear requirements in regulations and explanations from authorized bodies indicate a lack of certainty in the professional community. In this article we will justify our own judgment about how the HOA reflects business transactions in accounting.

Current accounting standards do not describe the accounting procedure for the main statutory activities of a non-profit organization. At the same time, to reflect transactions within the framework of income-generating activities, the NPO is guided by such standards. In fact, the only guideline for HOAs can be the commentary on account 86 “Targeted Financing” from the Instructions for Using the Chart of Accounts.

It is known that many HOA accountants, who built tax accounting based on the explanations of the Ministry of Finance that fees for the maintenance of common property and utilities are the HOA’s revenue, transfer this principle to accounting. That is, they generate income from sales in the same way as management companies do.

In addition, some HOAs follow expert recommendations to use account 96 to reserve expenses according to the estimate, and reflect utilities as transit transactions (using account 76).

We do not consider these approaches to be correct. Let us remember that, by virtue of clause 6 of PBU 1/2008 “Accounting Policies of an Organization,” one of the requirements for accounting policies is the requirement of priority of content over form, according to which facts of economic activity should be reflected in accounting based not so much on their legal form, but on their economic content and business conditions.

Accounting for HOAs. Economic content of the statutory activities of the HOA

From the point of view of the legal status in relation to persons legally using premises in a house managed by an HOA, a partnership, in essence, is no different from a professional management company.

- The HOA is the provider of utility services and bears all the responsibilities established by the Rules for the provision of utility services. It is obliged to enter into resource supply agreements. The only relief given to the HOA compared to the management company is a slightly lower amount of penalties in the first months of late payments under such agreements.

- The HOA is fully subject to the Rules for the implementation of activities related to the management of apartment buildings. A significant difference from the management company is that the activities of the HOA to manage the house, the owners of the premises in which it was created, are not subject to licensing.

- For HOAs, as for management companies, the Rules for the maintenance of common property, the Minimum list of services and works required to ensure the proper maintenance of common property in apartment buildings, as well as the Rules and Norms for the technical operation of the housing stock apply. The HOA is required by law to take the necessary measures to ensure the proper condition of the common property, regardless of the availability of a source of financing.

- Legal relations regarding the provision of paid services between the HOA and consumers are subject to legislation on the protection of consumer rights, even if these consumers are members of the HOA.

This describes the legal essence of the partnership’s activities. The economic essence of its activities differs significantly from the essence of the activities of the management company:

The main feature of an HOA is that the owners of the premises are both participants in the legal entity and consumers of its services. That is why they have the right to receive a report not only on the actual provision of services, but also on the amount of expenses of the HOA. The law gives them the right to expect that the HOA will spend the money contributed by the owners of the premises for exactly the purpose that was agreed upon by the owners themselves. And this is the characteristic of targeted financing funds and their difference from revenue from the provision of services and performance of work.

Accounting for HOAs. Special-purpose financing

According to the Instructions for the use of the Chart of Accounts, account 86 is intended to summarize information on the movement of funds necessary for the implementation of targeted activities, funds received from other organizations and individuals, budgetary funds, etc. Targeted funds received as sources of financing for certain activities , are reflected on the credit of account 86 in correspondence with account 76.

The use of targeted financing funds is reflected in the debit of account 86 in correspondence with accounts 20 or 26 (when sending targeted financing funds for the maintenance of NPOs), 83 (when using targeted financing funds received in the form of investments), 98 (when a commercial organization sends budget funds for financing expenses), etc. Thus, the HOA collects the costs incurred in accounts 20 and 26 in the general manner. To classify costs, you can use the recommendations relevant for management companies:

– account 20 accumulates costs directly related to the provision of services to premises owners (including wages of workers, if they are on staff);

– account 26 collects costs associated with managing the organization as a whole (salaries of the chairman (manager), accountant, office maintenance costs, postal, office expenses).

At the end of the month, these costs should be written off using targeted funding.

Often, NPOs take into account targeted funding only in the amount of actual amounts received. However, for HOAs it is necessary to make accruals for the debt of premises owners so that the following are reflected in the accounting simultaneously:

– real obligations of the HOA to the owners (an entry on the credit of account 86 means that the HOA has undertaken an obligation to spend these amounts for the intended purpose; the funding deficit caused by non-payments does not relieve the HOA of its obligations to properly maintain common property and conduct settlements with the RSO and contractors);

– obligations of the owners of the premises to the HOA (the debit of account 76 should reflect the amount of receivables from the owners, which the partnership has the right to collect forcibly).

The accrual of arrears in payments to property owners indicates that there will inevitably be a need to create a reserve for doubtful debts and write off uncollectible debts from the balance sheet. This obligation is established by accounting legislation in relation to each organization. The only source of expenses in the form of deductions to the reserve and written-off debts is targeted financing, which means that the corresponding expense item will have to be justified when approving the estimate at the general meeting of HOA members.

Example 1. According to the decision of the general meeting of the HOA members, the amount of payment for the maintenance of residential premises was established - 40 rubles / sq. m. m per month. The total area of premises in the house is 25,000 sq. m. m. According to statistical data for previous years, the payment discipline of premises owners is estimated at 96% (the accounting policy stipulates that this indicator is used to assess the likelihood of repaying the debt of the population as a whole), the cost estimate includes deductions to the reserve for doubtful debts in the amount of 1.6 rub/sq. m. In 2021, the statute of limitations on the rent debt in the amount of 40,000 rubles expired, the debt was written off from the reserve.

In the working chart of accounts of the HOA:

– to account 20 “Main production”, a subaccount 20-1 “Maintenance of common property” was opened;

– to account 76 “Settlements with various debtors and creditors”, a subaccount 76-6-1 “Accrued fees” was opened;

– subaccount 86-1 “Maintenance and repair of common property” has been opened to account 86 “Targeted financing”.

The following entries will be made in the accounting records of the HOA:

Accounting for HOAs. Maintenance and repair of common property

According to Part 8 of Art. 156, paragraph 4, part 2, art. 145 of the Housing Code of the Russian Federation, making a decision on the amount of contributions of HOA members related to the payment of expenses for the maintenance and repair of common property in apartment buildings falls within the exclusive competence of the general meeting of members of the partnership. Since the burden of maintaining common property is borne by all owners, regardless of the status of the premises (residential or non-residential), the category of the owner himself (legal or individual, individual entrepreneur), his relationship with the HOA (member or non-member), the amount of payments for members and non-members of the partnership is the same.

Thus, the HOA charges monthly payments for the maintenance and repair of common property (at the same time this is the debt of the owners and a source of financing) in the amount established by the decision of the general meeting of members of the partnership. An increase in the amount of fees is possible only legally; the board (chairman) does not have the right to unilaterally make a decision on charging additional amounts. If this was done and was subsequently not approved by a legitimate meeting of HOA members, the partnership may be fined and forced by controllers to recalculate the amount of fees for past periods (Resolution of the Armed Forces of the Russian Federation dated 01.09.2016 N 306-AD16-10838, Determination of the Armed Forces of the Russian Federation dated 02.09.2016 N 304-KG16-10443).

Subsequently, the general meeting of HOA members must determine the source of financing for expenses actually incurred previously in the absence of a source of financing.

The general rule for correcting significant errors states that the corresponding account for the accounts for which entries are corrected is the account for retained earnings (uncovered loss) (clause 9 of PBU 22/2010 “Correcting errors in accounting and reporting”). However, for NPOs in general and HOAs in particular, account 84 in this case should be replaced by account 86. This conclusion is confirmed by the recommendations presented in paragraph 25 of Information PZ-1/2015.

Example 2. By decision of the general meeting in 2013, the fee was set at 40 rubles/sq.m. m per month (total area of premises – 25,000 sq. m). In 2014, the HOA charged payments in the amount of 1.5 rubles/sq.m. that were not provided for in the estimate and decision. m for removal of solid waste (in excess of that removed from budget funds), 0.3 rubles/sq. m for servicing VDGO (the amount of the fee is predetermined based on the costs of services of third-party organizations). According to the order of the GZHN body issued in 2021, the HOA recalculated payments for solid waste removal and VDGO maintenance for the 12 months of 2014, reducing consumer debt (reflected in payment documents for September 2021). The error is assessed as significant, since the general meeting of HOA members will raise the issue of covering actual expenses incurred.

In the working chart of accounts of the HOA:

– to account 20 “Main production”, a subaccount 20-1 “Maintenance of common property” was opened;

– to account 60 “Settlements with suppliers and contractors”, a subaccount 60-1 “Settlements for work performed, services rendered” was opened;

– to account 76 “Settlements with various debtors and creditors”, a subaccount 76-6-1 “Accrued fees” was opened;

– subaccounts 86-1 “Maintenance and repair of common property”, 86-7 “Expenses not included in the estimate” were opened to account 86 “Targeted financing”.

The following entries will be made in the accounting records of the HOA:

Costs actually incurred during the month in connection with the maintenance and repair of common property are reflected in account 20 in the general manner. Corresponding accounts are most often accounts 60, 76, as well as accounts 70, 69, 10.

It is possible that in some months the source of funding may not be fully spent or, on the contrary, there will be an excess of actual costs incurred over the available amounts of targeted funding.

In case of savings, no additional entries are made. The savings generated at the end of the year must be made public at the general meeting and, by decision of the general meeting, directed to any targeted activities. Please note that the HOA (represented by members of the board) does not have the right to independently spend money beyond the approved budget (for example, it is impossible to pay bonuses to employees or remuneration to board members using savings if these actions were not approved by the general meeting).

In the event of a funding deficit, the HOA does not have the right to refuse to reflect any costs in accounting: all expenses that were actually incurred must be taken into account. The source of funding is determined in accordance with the estimate. If any costs were not included in the estimate (for example, there was a need to perform urgent unplanned work or pay an administrative fine in the absence of a reserve for unforeseen expenses), in the author’s opinion, it is necessary to open a special sub-account to account 86, for example a sub-account “Costs for maintaining common property , not included in the estimate,” and write off actually incurred expenses in his debit (after all, there is no reason to leave them on account 20). Subsequently, at the general meeting, the board must “defend” these expenses, prove their validity and invite members of the partnership to make additional contributions to compensate for them. There is no legal basis for arbitrarily displaying actual expenses incurred in receipts in excess of the HOA estimate (see the Appeal ruling of the Kemerovo Regional Court dated May 26, 2015 in case No. 33-5241/2015).

Example 3. In November 2015, the HOA repaired a roof leak using a contract method. The estimate did not include such expenses, and no contingency fund was formed. Expenses amounted to 48,000 rubles. By decision of the general meeting of HOA members held in 2021, a contingency fund was formed (contributions per month amounted to 20,000 rubles starting in March 2016), and at its expense the costs incurred in November 2015 were covered.

In the working chart of accounts of the HOA, subaccount 86-3 “Unexpected Expenses Fund” has been opened to account 86 “Targeted Financing”.

The following entries are made in the accounting records of the HOA:

It may happen that the HOA board will be able to identify those responsible for the circumstances that necessitated the need to carry out urgent work. For example, the HOA corrected the deficiencies in the roof repair contractor's work, compensated the tenant for the damage, and then recovered all these amounts from the contractor. In this case, a new source of financing arises, and you just need to show its use.

Example 4. As a result of an accident, a barrier installed by the HOA in the local area was damaged due to contributions from the owners of the premises. The HOA restored it (the costs amounted to 4,500 rubles) and subsequently received compensation from the guilty party at the cash desk.

The following entries will be made in accounting:

Public utilities

In judicial practice since 2010, the principle of identity of the obligations of the HOA as a provider of public utilities to the RSO and the obligations of the owners of premises (consumers) to the HOA has been declared. However, at present, regulatory legal acts contain a lot of specially regulated situations when this principle is not respected: for example, when applying increasing coefficients, paying for a utility resource provided to a public service station in excess of the established consumption standard, using meter readings in calculations that provide accounting for the volume of utility resources differentiated by time of day.

In addition, the HOA, as the provider of utility services, is considered as an independent economic entity. The main principle is that the fact of non-payment of premises owners for utilities does not in any way affect the obligations of the HOA to the RSO to pay for utilities.

These circumstances indicate that the HOA cannot be considered as an intermediary in settlements between the RSO and consumers. The terms of resource supply agreements, in which the HOA acts as an agent for the owners of the premises, provided that the HOA management method is chosen in the house, do not comply with the law. Since the HOA is not an intermediary, it is incorrect to reflect payments for utilities and services through transit accounts. At the same time, the economic essence of the activities of the HOA (the absence of other sources of financing other than contributions from the owners of the premises, as well as the need to account for the resulting savings and the inability to manage them independently) indicates the illegality of reflecting transactions for the provision of utility services as sales. Therefore, it appears that business transactions within the framework of the provision of public services are reflected in the same way as operations for the maintenance and repair of common property.

In other words, the cost of utility resources presented for payment by RSO is accepted for accounting by the accounting entry Debit 20 Credit 60. Charges for utilities to premises owners are recorded in accounting by posting Debit 76 Credit 86. The third standard entry - Debit 86 Credit 20 - reflects the use of the source financing (payments from owners) to cover expenses incurred.

Utilities at ODN

Separately, it is necessary to discuss the issues of paying for utilities on one-way street. If the general meeting of premises owners makes a decision on the full distribution of the resource volume on the ODN to consumers, the HOA charges consumers a fee in the same amount as the RSO presents for payment the cost of the resource. If such a decision is not made, it is known that the HOA’s source of funding (consumer fees) is less than the target expenses (naturally, if the actual amount of resource for the ODN, according to the OPU, exceeds the normative one, and this is the most common situation). Therefore, it is advisable to debit the excess expenditure on one-way services to the debit of account 86, subaccount “Expenses not included in the estimate.” Subsequently, the HOA board must report on the amount and reasons for such expenses and propose possible ways to compensate for them. The same is true if, from July 1, 2021, the relationship between the RSO and the HOA falls under clause 21(1) of the Rules for concluding resource supply agreements.

If the house has non-residential premises, the owners of which have entered into direct contracts with the RSO, the HOA has the right to present them with payment for utility services on ODN (see clause 18 of the Rules for the provision of utility services). Here the accounting entries will be the same as in the general case.

In accordance with the current edition of the housing legislation, payment for utility resources consumed at the public service station (within the limits of consumption standards) from 2021 should become an element of the payment for the maintenance of residential premises. In this regard, the accounting entries of the HOA will not change; you will only need to select the correct subaccounts.

Increasing coefficients

Due to the use of increasing coefficients when calculating fees for utility services in the absence of IPU and the technical ability to install them, as well as the obligation to equip the premises with metering devices, the HOA charges consumers a fee in a larger amount than it has obligations to the RSO. According to paragraphs. “y(1)” clause 31 of the Rules for the provision of public utility services, this difference should be aimed at implementing measures to save energy and increase energy efficiency. Insufficient specification of the responsibilities of the building manager regarding the use of disputed amounts at the regulatory level necessitates the need to put this issue on the agenda of the general meeting of HOA members. In this regard, charges for utility services should be calculated separately in the amount of the cost of actually consumed services and in the amount of amounts received as a result of applying the increasing coefficient (the Ministry of Construction of Russia spoke in favor of separately reflecting these amounts in the payment document in Letter dated September 2, 2016 N 28483 -ACh/04). This proposal is implemented by introducing a subaccount to account 86.

Major repairs of common property

In Information PZ-1/2015, the Ministry of Finance of Russia clearly spoke out for the need to reflect in the accounting of non-profit organizations that form a fund for capital repairs of common property in apartment buildings:

– accounts receivable for contributions from owners of premises for major repairs (clause 9) (the general rules on the formation of a reserve for doubtful debts are fully applicable here);

– funds in a special account intended for the formation of a capital repair fund (clause 11);

– funds for targeted financing in the form of contributions for capital repairs that were not used as of the reporting date, penalties paid by the owners of premises in connection with non-payment of contributions, interest accrued for the use of funds in a special account (clause 15).

In other words, the accrual of contributions to the fund is reflected in accounting in the same way as payments for the maintenance of common property. It seems that the expenditure of funds from the fund to pay for major repairs should be carried out by reflecting expenses on account 20 and their subsequent debit to account 86. The main thing is to ensure separate accounting on account 86.

In the Letter of the Ministry of Finance of Russia dated April 14, 2016 N 07-01-09/21509, it is specially noted: if a non-profit organization creates a reserve of doubtful debts in relation to debts paid by the owners of premises in apartment buildings for major repairs of common property, the amount of such a reserve is debited to account 86 "Special-purpose financing". The regulations of the Russian Federation establish clear directions for the use of the fund’s funds, and among them there are no deductions to the reserve for doubtful debts or for writing off bad debts. Meanwhile, in the case of the formation of a fund in a special account, the fund is formed in the form of funds located in a special account (clause 1, part 3, article 170 of the Housing Code of the Russian Federation). That is, these are funds actually received into the account. Unfulfilled obligations to pay contributions for capital repairs are not formally considered a capital repair fund. Therefore, it seems that the reservation of doubtful debts, and even more so the write-off of bad debts, should be carried out at the expense of a source of financing in the form of assessed contributions for major repairs, but not fees for the maintenance of residential premises according to the estimate of the HOA.

Simplified ways of accounting

According to the recommendations presented in paragraph 34 of Information PZ-1/2015, an NPO that uses simplified accounting methods has the right to write off expenses for carrying out statutory activities to account 86 without first reflecting them on accounts intended for recording production costs.

Let us remind you that simplified methods of accounting can be used by all HOAs, with the exception of those whose financial statements are subject to mandatory audit in accordance with the legislation of the Russian Federation (Parts 4, 5, Article 6 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” "). In particular, a mandatory audit is carried out by an organization if the volume of revenue from the sale of products (performance of work, provision of services) for the previous reporting year exceeds 400 million rubles. or the amount of assets on the balance sheet as of the end of the previous reporting year exceeds 60 million rubles. (clause 4, part 1, article 5 of the Federal Law of December 30, 2008 N 307-FZ “On Auditing Activities”). Since the HOA does not generate accounting revenue for the main activities of the HOA, the risk of falling under a mandatory audit can be associated, rather, with the accumulation of a capital repair fund in a special account of the HOA, which increases the balance sheet currency.

Example 5. The HOA uses simplified accounting methods. According to the accounting policy, expenses within the framework of the statutory activities of the partnership for the management of apartment buildings are reflected without the use of production cost accounts. In September 2021, a fee was charged for the maintenance and repair of common property in the amount of 1,200,000 rubles, including for the formation of a contingency fund - 150,000 rubles. In fact, in September 2016, the following expenses were incurred: for remuneration of personnel - 160,000 rubles, for payment of mandatory insurance contributions - 32,000 rubles, for payment for various services of contractors (maintenance of common property, landscaping of the local area, provision of banking and information services ) – 840,000 rub.

The following entries will be made in the accounting records of the HOA:

Additional income

Along with targeted financing of statutory activities, the amounts of which are received by the HOA with already known and fixed areas of use, the partnership may also receive some amounts that should be qualified as income in accounting. Among them are:

– penalties paid by the owners of premises for late payment of fees for housing and communal services;

– payments by users of elements of the common property of the owners of premises in an apartment building, if by decision of the general meeting of the HOA that manages the house, the authority of the lessor of such property is vested;

– interest accrued by the bank on funds in the account (temporarily available funds placed on deposit, or the balance on the current account according to the terms of the agreement), except for interest accrued on funds in a special account opened for the formation of a capital repair fund (these amounts constitute the fund capital repairs - targeted financing for HOAs).

Of course, all these proceeds will ultimately be spent by decision of the general meeting of members of the partnership for purposes related to the management of the apartment building. However, this does not make them targetable at the time of admission. The fact is that the intended purpose of the funds is determined by the source of their receipt: the members of the HOA approve the cost estimate, to finance which payments are made. Interest comes from the bank, and rental payments come from the tenant, who cannot dictate to the HOA the direction of the intended use of the funds. As for penalties, they actually come from the source of financing, which ultimately determines their purpose, however, firstly, this is an unplanned source, and secondly, their payment is not determined by the will to transfer funds to the HOA for its intended purpose, but is a measure liability for improper fulfillment of obligations. The transferred proceeds are traditionally reflected as other income.

In addition, the HOA has the right, unless otherwise provided by the charter, to conduct activities to provide services outside the scope of the statutory activities for managing the apartment building in which it was created. Payments from consumers are recognized as income from ordinary activities.

Example 6. According to the decision of the general meeting of owners of premises in an apartment building, the HOA is empowered to act as a lessor of such elements of common property as non-residential premises, parts of a land plot, wall surfaces in elevators, etc.: conclude lease agreements on the most favorable terms, conduct calculations, accumulate payments. In August 2021, income from rental agreements was accrued in the amount of RUB 50,000. The HOA applies the simplified tax system.

The following entries will be made in accounting:

Separately, it should be said about the amounts of various compensations, for example, compensation for damage caused to common property (if the deficiencies were eliminated by the HOA), compensation for legal expenses. In the accounting of a commercial organization, this is always other income. However, in accounting for NPOs, these amounts essentially compensate for expenses previously incurred at the expense of targeted revenues. Therefore, when receiving compensation, it is necessary to restore the previously used source of funding.

Example 7 . As a result of the accident, the barrier installed by the HOA in the local area was damaged at the expense of contributions from the owners of the premises. The HOA restored it (expenses amounted to 4,500 rubles) from the contingency fund and subsequently received compensation from the guilty party at the cash desk.

The following entries will be made in accounting:

* * *

The economic essence of the HOA’s activities in managing apartment buildings (regardless of the principles of taxation that the partnership adheres to) dictates the rules of accounting: charging fees for housing and communal services is the formation of targeted financing funds. In the general case, expenses are accumulated in accounts 20, 26 and written off at the source (Debit 86 Credit 20); if simplified accounting methods are used, the use of production cost accounts can be avoided. If there is a funding shortage, the actual costs incurred must be reflected by writing them off to a separate sub-account to account 86, which can be called “Expenses not included in the estimate.” Resolving the issue of covering the deficit is within the competence of the general meeting of HOA members.

“Housing and communal services: accounting and taxation”

If you find an error, please select a piece of text and press Ctrl+Enter.

Lawyers' recommendations

The distribution of expenses for the maintenance of leased property remains a controversial issue. Regulations describe only standard situations. In practice, the number of schemes is much larger. Thus, transaction participants often have the following questions:

| Situation | Solution |

| The tenant does not pay utility bills | If the obligation to pay for consumed resources is specified in the contract, the lessor has the right to sue. In court, you will need to submit a calculation of the debt (decision of the Tver Region Court in case A66-4815/2018). The absence of a corresponding clause in the agreement complicates collection. The tenant may request that compensation be included in the total payment under the contract. The courts have not developed a unified legal position on such disputes. Lawyers recommend that owners refer to Art. 616 of the Civil Code of the Russian Federation and the ruling of the Supreme Arbitration Court in case A35-10186/2009. In the absence of specific circumstances, the servants of Themis take the side of the plaintiffs (Resolution of the FAS SZO No. A05-3280/2006) |

| The object is simultaneously rented by several people or organizations. Some participants evade paying utility bills | In this case, the content of the contract will matter. Thus, many owners assign the responsibility for maintaining the property to one tenant. The remaining participants pay such a partner independently. For this purpose, an additional agreement may be concluded. The presence of such a condition greatly facilitates the debt collection process. The dispute is resolved without involving co-defendants according to the rules described above. If the obligation to reimburse utility costs lies with all tenants, each non-payer will have to be dealt with. In this case, you will need to justify the size of the requirements. The simplest option is to install separate metering devices. The arrears are collected according to their indicators. An alternative is proportional division. The balance of obligations of the parties is specified in the contract. This allows you to collect the debt from the tenant who evades payment. The principle of proportionality is widely applied by courts. Examples are Resolution 9 of the AAS No. 9AP-31629/2019 and the decision of the Voronezh Region Arbitration Court in case A14-2652/2019 |

| The landlord overstates compensation for utility costs | The amount of payments to resource supplying organizations is established by regional and municipal acts. You can identify the landlord’s deception by referring to such documents. In Moscow, for example, there are regulations No. 848-P, 1497-P, as well as orders of the economic development department No. 233-TR, 387-TR. If the amounts received by the owner turn out to be greater, it makes sense to talk about unjust enrichment (Article 1102 of the Civil Code of the Russian Federation). It will have to be collected in court. In this case, it is important to prove the discrepancy between the rates used by the defendant and local tariffs (case A40-116782/15). Attempts to inflate compensation are often disguised. Thus, the text of the contract includes a condition on compensation for wear of communication units or metering devices. Such actions cannot be recognized as legal. Article 611 of the Civil Code of the Russian Federation obliges the lease of property with all equipment. The object must be suitable for use. Separating meters or communication systems into a separate object contradicts the general meaning of the norm. A similar conclusion was voiced in a letter from the Moscow Department of Tax Administration No. 03-12/25844. Moreover, certain types of activities are subject to licensing (Article 12 of Law 99-FZ). Receiving payment from a counterparty for the operation of communication centers, for example, threatens the lessor with claims from regulatory authorities. The owner may be accused of conducting business without the appropriate permission (Article 14.1 of the Code of Administrative Offenses of the Russian Federation, Article 171 of the Criminal Code of the Russian Federation) |

In conclusion, we note that transparency of accruals ensures prompt resolution of financial disputes and also reduces the risk of abuse. When drawing up agreements, lawyers recommend using samples. Free legal reference systems provide a large number of such documents. Moreover, each template is subject to adaptation to specific relationships.