Form 1-enterprise

Statistical form 1-enterprise is intended to display information about the activities of the organization. Respondents must generate this report based on accounting and tax reporting data. The data contained in the document can be divided into two parts: basic information about the business entity and information about income and expenses. The document must include data on the business entity as a whole, taking into account branches and separate divisions.

A detailed procedure for filling out Form 1-enterprise for 2021 can be found in Appendix No. 1 to Rosstat Order No. 411 and in Rosstat Order No. 2 dated January 13, 2020.

The document can be filled out manually or on a computer. When designing, it is allowed to use ink of any color, with the exception of red and green. Amounts for all indicators are displayed in thousands of rubles with one decimal place.

Filling out the report

The address part of the forms indicates the full name of the reporting organization in accordance with the constituent documents registered in the prescribed manner, and then the short name in brackets. The form containing information on a separate division of a legal entity indicates the name of the separate division and the legal entity to which it belongs.

The line “ Postal address ” indicates the name of the subject of the Russian Federation, the legal address of the organization with a postal code; if the actual address does not coincide with the legal address, then the actual postal address is also indicated. For separate divisions that do not have a legal address, a postal address with a postal code is indicated.

The legal entity enters the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) in the code part of the form. For separate divisions of a legal entity, an identification number is indicated, which is established by the territorial body of Rosstat at the location of the separate division.

Paragraph 4 of the Instructions stipulates that information is presented for April 2011. Information is filled out in the units of measurement provided in the form.

Columns 3 and 4 show data on payroll employees hired for permanent, temporary, seasonal work (including employees who worked part-time in accordance with an employment contract), to whom wages were accrued for April, with the exception of the following groups of employees:

— hired after April 1 or fired before May 1;

— those who had certificates of temporary incapacity for work in April;

— those on maternity leave or additional parental leave;

- those who worked part-time (in accordance with the employment contract), if it was less than half of the normal working time;

- those who were on leave without pay at the written request of the employee for more than five working days in April;

- those who did not work due to downtime due to the fault of the employer or for reasons beyond the control of the employer and employee for more than five working days in April (payment for which is carried out in accordance with Article 157 of the Labor Code of the Russian Federation);

- those who worked part-time at the initiative of the employer, if the unworked time was more than 40 hours in April;

— those who worked on external part-time basis;

— performing work under civil contracts.

When filling out column 3, the number of employees is distributed according to wages based on the amounts accrued to each employee (including personal income tax), only for the days of April in monetary and non-monetary forms, regardless of the sources of their payment, budget items, tax benefits provided and regardless of the period of their actual payment (clause 6 of the Instructions).

The composition of payments included in wages accrued to employees is determined in accordance with clause 89 of the Instructions for filling out federal statistical observation forms N P-1, N P-2, N P-3, N P-4, taking into account the following features:

- the employee’s salary does not include: remuneration based on the results of work for the year, one-time remuneration for length of service, paid once a year, one-time bonuses and incentives, including the cost of gifts, financial assistance for vacation, as well as other payments of a one-time nature, regardless of whether they were provided to individual or all employees;

- when bonuses are awarded based on the results of work for the month, the wages include the amounts provided for in the April payroll - for work in April or for work in March (if bonuses are calculated in April);

— if wages or a part thereof (bonuses, other payments) are calculated based on the results of work for the quarter, then the employee’s earnings for April, subject to reflection in the form, include one third of the quarterly amount accrued based on the results of work for the first quarter (regardless of , in what month it was accrued);

— if wages are accrued to an employee for a period exceeding one month (for example, with a rotational method of organizing work), then the data for such an employee is given per month. To do this, the salary of one hour worked is calculated (the total amount of wages accrued to the employee is divided by the number of hours worked), which is then multiplied by the established number of working hours in April;

— bonuses for the commissioning of production facilities and construction projects are included in the report if they are accrued for payment in April;

— if an employee combines two positions (professions) in one organization, then the employee’s earnings include the total amount of remuneration accrued for the main and combined positions (professions);

— wages do not include payment for the cost of free food or food at reduced prices in cases where there is no information about the amounts per employee;

— if the employee was on annual or additional paid leave, then his salary includes only that part of the accrued amount for vacation that falls on vacation days in April.

In the “For reference” section, line 23 “From line 02 - the number of employees who were accrued wages in an amount below the minimum wage (4330 rubles)” shows the number of employees, including those working part-time, who were accrued wages in the amount of 4200 .1 to 4329.9 rub.

Who must submit Form 1-enterprise for 2021

Form 1-enterprise (annual) is required to be submitted by organizations of all forms of ownership; individual entrepreneurs do not need to submit it. Non-profit organizations must prepare this statistical report only if they manufacture goods and sell them to other business entities or provide them with services. Branches and divisions of foreign companies operating in Russia must also report.

The form is also not submitted:

- micro and small enterprises;

- insurance companies and financial and credit organizations;

- banks;

- Insurance companies;

- budgetary institutions.

Form 1-enterprise: due date

Form 1-enterprise is an annual statistical report. The title page of the document indicates the deadline before which respondents must submit a report to the statistical authorities - April 1. Thus, Form 1-Enterprise for 2021 must be submitted no later than April 1, 2021.

If a business entity does not operate at its location, the report must be submitted at the place of actual activity. If the organization did not conduct activities during the reporting period, it is necessary to submit a zero report to Rosstat or send a corresponding letter to the department.

If respondents have doubts about whether they need to submit a statistical report in Form 1-enterprise, they can clarify the information they are interested in using a special Rosstat service. To do this, just enter just one detail: OKPO, INN or OGRN and click on the “Receive” button. Please note that information on the lists of forms is updated monthly.

If Form 1-enterprise submitted to Rosstat is not submitted on time or the document contains false information, penalties will be imposed on the business entity. The amount of the fine is determined in accordance with Art. 13.19 Code of Administrative Offenses of the Russian Federation. For organizations it ranges from 20 to 70 thousand rubles, for responsible employees - from 10 to 20 thousand rubles. If regulatory authorities detect a repeated violation, the fines will increase significantly.

You will find a list of reporting forms sent to Rosstat here.

Who should report to?

Russian statistics, form 1 labor force 2021, who takes the test is determined by the main type of economic activity. In most cases, Rosstat representatives send out special notifications about the need to submit a report. However, due to the huge number of economic entities falling under statistical surveillance, it is likely that the notification will not arrive.

Important! If the organization is named in the list of accountable persons, but the notification has not been received, then you will still have to submit Form 1 workforce for 2021. Let us remind you that for failure to provide statistical information there is a fine of up to 70,000 rubles. And the absence of an official request is not a valid reason.

How to fill out form 1-enterprise

Form 1-enterprise is quite voluminous - it consists of a title page and nine sections.

Form 1-enterprise must be filled out in the following order:

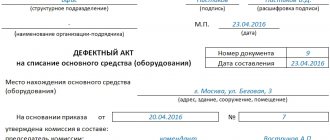

- The title page indicates: the name (full and short) and postal address of the legal entity, reporting period, OKPO code.

- Section No. 1 specifies the date of state registration of the company.

- Section No. 2 indicates how the authorized capital is distributed among shareholders (founders) at the end of the reporting year. The section consists of a table with indicators.

- Section No. 3 displays data on contributions of foreign companies and individuals to the authorized capital.

- Section No. 4 indicates the number of territorially separate divisions that are part of the organization.

- Section No. 5 displays data on the volume of production and shipment of goods (work, services). Accounting data and related analytics are used.

- Section No. 6 shows how much money was spent on the production and sale of goods. The data is entered in aggregate for all departments and activities.

- Section No. 7 displays the amount of expenses for payment for services of third-party organizations (decoding line 657 of section 6).

- Section No. 8 indicates what types of economic activities the organization carried out in the reporting year (according to OKVED codes).

- Section No. 9 is intended to display information about the head unit and territorially separate units (fill in if there is at least one separate unit).

When filling out a statistical report, you must use accounting data broken down by cost item. It is important that the indicators indicated in the report for the previous reporting period coincide with the data from last year’s form. Discrepancies are not allowed. The information is entered taking into account the detailed instructions on form 1-enterprise (Order of Rosstat dated January 13, 2020 No. 2).

Forms 1-enterprise can be found below.

Stage No. 4. We fill out the reference information section and put signatures.

If information is available, we enter the data in the third section of the reporting document. Then we write down the position and full name of the responsible employee. We indicate the contact phone number and the date of reporting.

IMPORTANT!

You can submit Form 1 labor force form electronically. However, electronic filing of reports will require an enhanced digital signature.