Materials are the main element of current assets, which are used as an intermediate element in the activities of the organization. Let's look at the basic accounting entries for writing off materials for production, sale and damage.

The receipt of materials into the organization is recorded at the actual purchase price (excluding VAT).

Methodological guidelines

In accounting, the procedure for writing off materials is regulated by PBU 5/01 “Accounting for inventories.” According to clause 16 of this PBU, three options for writing off materials are allowed, focused on:

- the cost of each unit;

- average cost;

- the cost of the first acquisition of inventories (FIFO method).

In tax accounting, when writing off materials, you should focus on Article 254 of the Tax Code of the Russian Federation, where under paragraph number 8 options for the valuation method are indicated, focusing on:

- unit cost of inventory;

- average cost;

- cost of first acquisitions (FIFO).

The accountant should establish in the accounting policy the chosen method of writing off materials for accounting and tax accounting. It is logical that in order to simplify accounting, the same method is chosen in both cases. Write-off of materials at average cost is often used. Write-off at unit cost is appropriate for certain types of production where each unit of materials is unique, for example, jewelry production.

Typical postings for write-off of materials

| Account debit | Account credit | Wiring Description |

| 20 | 10 | Write-off of materials for main production |

| 23 | 10 | Write-off of materials for auxiliary production |

| 25 | 10 | Write-off of materials for general production expenses |

| 26 | 10 | Write-off of materials for general business expenses |

| 44 | 10 | Write-off of materials for expenses associated with the sale of finished products |

| 91.2 | 10 | Disposal of materials when they are transferred free of charge |

| 94 | 10 | Write-off of the cost of materials if they are damaged, stolen, etc. |

| 99 | 10 | Write-off of materials lost due to natural disasters |

Before writing off materials in 1C 8.3, you should set (check) the appropriate accounting policy settings.

Documentation of transactions with inventory items

The document flow system operating in the company is based on a set of unified forms. Their templates must be developed in accordance with the regulatory requirements of the Law of December 6, 2011 No. 402-FZ.

If the law allows the use of arbitrary forms, the business entity draws them up independently and approves them by internal act. Eventually:

- a non-standardized document can be introduced into the document flow by order of the manager;

- the new form can be approved by adding it to one of the annexes to the accounting policy.

Inventory assets are represented by goods, finished products and materials. The set of documents to be drawn up depends on the type of product.

A separate set of documents reflects the following transactions:

- upon receipt of products or raw materials;

- acceptance of goods;

- write-off of valuables;

- reflecting the results of regular monitoring.

| Operation | for materials | for goods | for finished products |

| Receipt of goods and materials | invoices (unified form TORG-12) accounts railway waybills invoices powers of attorney to receive inventory items (forms M-2, M-2a) | invoices for the transfer of finished products (form MX-18) | |

| Acceptance of goods and materials | receipt order (M-4) act of acceptance of materials (M-7) in case of discrepancies between the actual receipt and the invoice data | the act of acceptance of goods (form TORG-1) also fill out the product label (form TORG-11) | log of product receipts (MX-5) data is also entered into warehouse cards (M-17) |

| Internal movement of goods and materials | requirement-invoice for materials (M-11) | invoice for internal movement of goods (TORG-13) | |

| Disposal of inventory items | production order order for issue from a warehouse or limit-fetch card (M-8) when using issue limits invoice for release on the side (M-15) | invoice waybill waybill (f. TORG-12) | invoice waybill waybill (f. TORG-12) invoice for release on the side (M-15) |

| Write-off of inventory items | acts for writing off materials that have become unusable ; acts for identifying shortages | write-off acts (TORG-15, TORG-16) | acts for writing off products that have become unusable ; acts for identifying shortages |

| Any operation | mark on the warehouse registration card (M-17) | mark in the warehouse accounting journal (TORG-18) | mark in the warehouse accounting journal (TORG-18) |

| Availability control, reconciliation with accounting data | statements for accounting of material, production and inventory (MX-19) acts on random checking of the availability of materials (MX-14) reports on the movement of inventory items in storage areas (MX-20, 20a) commodity reports (TORG-29) | ||

Also see “Sample of power of attorney for receiving goods/material assets”.

Accounting policy settings for writing off materials in 1C 8.3

In the settings, we will find the “Accounting Policy” submenu, and in it – “Method for assessing inventories”.

Fig. 1 Method for assessing MPZ

Here you should remember a number of specific features characteristic of the 1C 8.3 configuration.

- Enterprises in general mode can choose any valuation method. If you need a valuation method based on the cost of a unit of material, you should choose the FIFO method.

- For enterprises using the simplified tax system, a method such as FIFO is considered the most suitable. If the simplification is 15%, then in 1C 8.3 there will be a strict setting for writing off materials using the FIFO method, and the choice of the “Average” valuation method will not be available. This is due to the peculiarities of tax accounting under this taxation regime.

- Pay attention to the supporting information 1C, which says that only according to the average, and nothing else, the cost of materials accepted for processing is assessed (account 003).

If you still have questions about setting up your accounting policies, contact our specialists for advice on 1C programs, we will be happy to help you.

Free expert consultation

Natalia Sevorina

Consultant-analyst 1C

Thank you for your request!

A 1C specialist will contact you within 15 minutes.

FIFO

The FIFO method operates according to the “first in, first out” . That is, the batch that arrived first is written off first.

This does not mean that the storekeeper, when releasing material from the warehouse, looks for, for example, the nails that arrived first, no. He doesn't care about our accounting. But the accountant will take into account the cost based on the first batch received.

So, using our data as an example, it would look like this:

We release 600 units of our material from the warehouse. And we begin to copy from the earliest batch, for us this is the remainder from the beginning.

- 100 units x 20 rub. = 2000 rub.

- Then we write off the 1st delivery: 200 units. x 22 rub. = 4400 rub.

- Then 2nd delivery: 150 units. x 21 rub. = 3150 rub.

We have already written off 450 units. We need to write off another 150. Accordingly

We write off 150 units. from the 3rd delivery: 150 units. x 23 rub. = 3450 rub.

Now we can determine the cost of scrapped materials:

2000 rub + 4400 rub. +3150 rub. +3450 rub. = 13,000 rub.

As we can see, the cost amounts when using different methods differ from each other. Using the “average cost” method, we got 13,236 rubles, and using the FIFO method – 13,000 rubles.

Ideally, the inventory valuation method should be consistent with the operations taking place in the warehouse. With a low level of inventory and rapid turnover, the choice of method for estimating the cost of inventory does not play a special role, since each valuation method has its own advantages and disadvantages.

Preference for one method over another may lead to refinement of some indicators and distortion of others. Therefore, it is worth talking not about the advantages of one method or another, but about what is better to be guided in this situation: a more realistic book value of inventories or a lower value of reported profit and tax savings.

Write-off of materials in 1C 8.3

To write off materials in the 1C 8.3 program, you need to fill out and post the “Requirement-invoice” document. The search for it has some variability, that is, it can be carried out in two ways:

- Warehouse => Requirement-invoice

- Production => Requirement-invoice

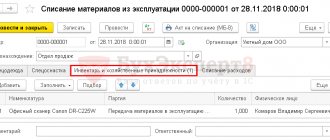

Fig.2 Request-invoice

Let's create a new document. In the document header, select the Warehouse from which we will write off materials. The “Add” button in the document creates records in its tabular part. For ease of selection, you can use the “Selection” button, which allows you to see the remaining materials in quantitative terms. In addition, pay attention to the related parameters - the “Cost Accounts” tab and the “Cost Accounts on the “Materials” tab” checkbox setting.

If the checkbox is not checked, then all items will be written off to one account, which is set on the “Cost Accounts” tab. By default, this is the account that is set in the accounting policy settings (usually 20 or 26). This indicator can be changed manually. If you need to write off materials to different accounts, then check the box, the “Accounts” tab will disappear, and on the “Materials” tab you will be able to set the necessary transactions.

Fig.3 Materials

Below is the form screen when you click the "Select" button. For ease of use, to see only those positions for which there are actual balances, make sure that the “Only balances” button is pressed. We select all the necessary positions, and with a mouse click they go to the “Selected Positions” section. Then click the “Move to Document” button.

Fig.4 Transfer to document

All selected items will be displayed in the tabular part of our document for write-off of materials. Please note that the parameter “Cost accounts on the “Materials” tab” is enabled, and from the selected items “Apple jam” is written off to the 20th account, and “Drinking water” – to the 25th.

In addition, be sure to fill out the sections “Cost division”, “Nomenclature group” and “Cost item”. The first two become available in documents if the settings are set in the system parameters “Keep cost records by department - Use several item groups”. Even if you keep records in a small organization where there is no division into item groups, enter the item “General item group” in the reference book and select it in the documents, otherwise problems may arise when closing the month. At larger enterprises, proper implementation of this analytics will allow you to quickly receive the necessary cost reports. A cost division can be a workshop, a site, a separate store, etc., for which it is necessary to collect the amount of costs.

The product group is associated with the types of products manufactured. The amount of revenue is reflected by product groups. In this case, for example, if different workshops produce the same products, one product group should be indicated. If we want to see separately the amount of revenue and the amount of costs for different types of products, for example, chocolate and caramel candies, we should establish different product groups when releasing raw materials into production. When indicating cost items, be guided at least by the tax code, i.e. you can specify the items “Material costs”, “Labor costs”, etc. This list can be expanded depending on the needs of the enterprise.

Fig.5 Indication of cost items

After specifying all the necessary parameters, click the “Pass and close” button. Now you can see the wiring.

Fig.6 Swipe and close

During further accounting, if you need to issue a similar demand invoice, you can not create the document again, but make a copy using the standard capabilities of the 1C 8.3 program.

Fig.7 1C 8.3

Our company provides support and implementation services for 1C programs, and you can also order modifications to 1C from us. If you have any questions, please contact him, we will be happy to help you.

Postings for receipt and disposal of materials

There are several ways for materials to enter an organization: acquisition for a fee, acceptance as a contribution from the founders, production of materials, free receipt, etc.

Depending on the method of receipt, the following postings for materials appear in accounting.

| Debit | Credit |

| 60, 76 | Receipt of the invoice from the supplier; Wholesale supply of goods is carried out under a sales contract |

| Acquisition of inventories by an accountable person | |

| Founder's contribution; the estimated value of the property must be agreed upon with the person contributing the property | |

| Reflected gratuitous receipt; In this case, the market value of the material is taken as the amount. A similar posting is made when taking into account materials received during the dismantling of fixed assets |

If upon receipt the cost of the material includes VAT, then its amount is reflected in a separate line.

Example 3

Motiv LLC purchased a batch of paper (100 packs) for office needs using an invoice for a total amount of 17,700 rubles, including VAT 18% of 2,700 rubles. The organization made the following entries:

| Debit | Credit | Amount, rub. |

Algorithms for calculating average price

Algorithm for calculating the average price, using the example of the “Apple jam” position. Before write-off, there were two receipts of this material:

100 kg x 1,000 rubles = 100,000 rubles

80 kg x 1,200 rubles = 96,000 rubles

The total average at the time of write-off is (100,000 + 96,000)/(100 + 80) = 1088.89 rubles.

We multiply this amount by 120 kg and get 130,666.67 rubles.

At the time of write-off, we used the so-called moving average.

Then, after the write-off, there was a receipt:

50 kg x 1,100 rubles = 55,000 rubles.

The weighted average for the month is:

(100,000 + 96,000 + 55,000)/(100 + 80 + 50) = 1091.30 rubles.

If we multiply it by 120, we get 130,956.52.

The difference 130,956.52 – 130,666.67 = 289.86 will be written off at the end of the month when performing the routine operation Adjustment of item cost (the difference of 1 kopeck from the calculated one arose in 1C due to rounding).

Fig.8 Adjustment of item cost

Important addition

The generation of invoice requirements and their use for write-off requires the fulfillment of an important condition: all materials written off from the warehouse must be used for production in the same month, that is, writing off their full value as expenses is correct. In fact, this is not always the case. In this case, the transfer of materials from the main warehouse should be reflected as a movement between warehouses, to a separate sub-account of account 10, or, alternatively, to a separate warehouse in the same sub-account in which it is accounted for. With this option, materials should be written off as expenses using a materials write-off act, indicating the actual quantity used.

The version of the act printed on paper should be approved in the accounting policy. In 1C, for this purpose, the document “Production Report for a Shift” is provided, through which, for the products produced, you can write off materials manually, or, if standard products are produced, draw up a specification for 1 unit of product in advance. Then, when specifying the quantity of finished products, the required amount of material will be calculated automatically. This work option will be discussed in more detail in the next article, which will also cover such special cases of write-off of materials as accounting for workwear and write-off of customer-supplied raw materials into production.

If you regularly have questions about setting up 1C programs, contact our specialists. We will be happy to advise you and also select the optimal tariffs for 1C service, focusing on your individual tasks.