Business lawyer > Accounting > Accounting and reporting > How to correctly write off materials and document the process

The main activity of the enterprise is practically impossible without the acquisition of special materials. They are important not only for production, or in the sale of goods and services, but also for meeting the needs of the administrative apparatus.

In a warehouse, the storekeeper or the head of the department is responsible for storing such valuables. For accounting, an account of 10 is usually used. The situation changes after the so-called departure of materials from the warehouse. In this connection, the write-off procedure is applied.

Techniques

The regulations for accounting of inventories approved by the Ministry of Finance introduce strict procedures that are generally followed. More precisely, these are three options, respectively, the same number of ways to get rid of the entries made in the documentation.

Values can be calculated based on:

- The cost of an individual unit of inventory. And it doesn’t matter in what specific form it is contained. The unit can be chosen arbitrarily, but for convenience it is usually divided into equal parts. By box, by weight (ton, kilogram), by piece products (one set). Thus, the company has the opportunity to eliminate the inventory at the purchase price, the cost of the actual purchase.

- Average cost. Perhaps the most popular method. After all, several groups of different valuables often go into a warehouse at once. And how to write off materials, the regulations for such a procedure with the calculation of each unit is a dubious idea. In fact, one cycle of the production process can require hundreds of different related products: coatings, catalysts, packaging, all kinds of lubricants, while at the same time disposable personal protective equipment, gloves, protective suits, and various equipment used during the procedure are consumed. Calculating the purchase price of each object and, based on this, calculating consumption is like scooping up the sea with a ladle. It is much easier to look at the total price for all lost resources and, based on this, form some kind of average cost.

- FIFO method. Recently it has become increasingly popular. And it should be noted that it is also effective. Although its use remains situational. In fact, the technique allows you to include all costs in the cost calculation. For resources that were purchased at the initial stages of the cycle, processed long ago, removed from the list, as well as for the services provided by third-party companies that were necessary in the production cycle. And the work expended by employees of their own company, based on their wages, which they will receive during the period of participation in the cycle or in a practical way. Many experts are confident that this method is the standard for how to correctly write off materials in accounting and consumables in production. But it cannot be denied that this is a resource-intensive method that wastes a lot of time on the part of those responsible for preparing the documentation.

As a result, we see that each approach has a number of positive and negative aspects. And the organization, guided by its own needs, the number of positions of various resources spent during work, as well as the desired type of reporting, must decide which methodology will be more profitable in the current conditions. But at the same time, no one bothers you to combine several options at different stages. The main thing is to clearly understand when exactly to use this or that technique.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

Write-off: how to register

Business transactions must always be accompanied by the documentation used in primary accounting. The rule makes no exceptions to the write-off procedure. In any organization, the manager has the right to determine for himself which papers will be used to organize primary accounting. Therefore, specific registration rules may differ from company to company.

The main thing is that the accounting policy contains information about the approved documentation. And monitor the presence of the mandatory details specified in the current legislation.

There are several standard forms, the use of which is permissible when writing off:

Warehouse write-off

- Invoices for the release of materials to third parties.

- Salary cards with certain limits.

- Invoice forms with a description of the requirement.

The organization can choose for itself which details are not needed and which ones will definitely be needed in a particular process.

The use of invoices with requirements allows you to organize accounting for the internal movement of material assets, with the participation of responsible persons or structural divisions.

Registration of invoices is the responsibility of the persons who deal with valuables. Only two copies are needed. The write-off is processed by one, and the second is needed for capitalization.

Rules for writing off materials in accounting with industry nuances

The Russian Federation has a huge number of enterprises from small businesses to large holdings. And a significant number of production and non-production areas. It is noteworthy that virtually every industry has its own small nuances that slightly change the general procedure. This means that the exclusion of objects from the list will be stored on the basis of different principles. Now we will focus on this aspect. But it is worth understanding that there are thousands of spheres in the country. Therefore, in our review we clearly do not need to divide them into the narrowest parts and go into deep specialization. We will go through the most broad and in-demand areas. Let's figure out how to properly write off materials in various industries.

Construction

The main nuance is considered to be the fact that a significant number of different resources are involved in the processes. Such as sand, cement, gravel, brick, cinder block, aerated concrete, crushed stone. The list goes on for a long time. As a result, accurate accounting must be maintained at all times. After all, calculations are not carried out on a monthly cycle. This means that you will have to take inventory. And based on the identified expenses, exclude resources from the general list in connection with the number of units spent (cubic meters, kilograms, tons, pieces).

There is one more aspect that distinguishes this type of write-off of materials in accounting and tax accounting, paperwork. You will need an unexpectedly large package of papers. More specifically:

- Comparison of the specified standard resource consumption and the actual one. And in the vast majority of cases there will be a difference.

- Estimates. There are two types of techniques used. The first is by event or its duration. And the second - specifically for the object, after its delivery to the customer or contractor.

- Reports from local responsible persons. Often this means documents submitted by foremen or a single package that is compiled by the head of the entire site, based on cumulative reports.

- Standards set by management at the facility. That is, a certain resource consumption that is regulated on the site.

- Object logs.

The list, as you can see, is quite massive. And this is perhaps the central feature of the entire sphere. Indeed, during construction, when consumable resources are often simply piled up on the site (sand, crushed stone), it is very important to conduct a complete analysis of product care. Otherwise, uncontrollable shortages will constantly appear.

Agriculture

There are also plenty of documentary reports in this area. Among them:

- Act of consumption of planting seeds.

- Feed list.

- Livestock disposal act.

And what’s noteworthy is that in the industry, for every unaccounted item, an exact justification is required. If an animal died, then it is necessary to understand the reasons, and if it was a disease, then an accurate diagnosis should be made, a veterinarian should be involved, and the threat of an epidemic should be analyzed. If this is some kind of injury, it is required to give a clear definition under what circumstances it was received. Determining the presence of the culprit. When this is an oversight of an employee, or his negligent attitude, then the expense is indicated in the form of debt of a particular employee or deduction of his bonuses and wages. That is, how materials are written off in accounting in the agricultural sector is a complex issue. And it is entirely based on rational spending.

How to evaluate supplies

The valuation of inventories in budget accounting depends on the method of receipt of the asset by the government agency. There are options:

| Way | Cost formation procedure |

| Purchase, acquisition for a fee | At the actual cost paid to the seller, or at the actual costs incurred by the enterprise for the purchase of MH |

| Free transfer | At actual, book value, upon receipt of the Ministry of Health for intradepartmental, interdepartmental and interbudgetary transfers. At the current estimated value on the date of receipt, upon receipt of MH for other transfers |

| Production of metal parts in an economic way | At the actual cost of costs incurred or at the planned cost in the manufacture of finished products |

| Unaccounted assets identified during inventory | Account for fair value |

| Disassembled valuables | |

| MH received as a result of write-off of fixed assets | |

| Received as compensation for damage |

Valuation of unusable resources

Of course, such a situation is not at all uncommon. In no production facility is there a 100% guarantee that human errors or machine malfunctions will not lead to waste. And here two factors become important. The first is whether a particular employee or group of employees was to blame for such a result. And also whether the indicated loss falls within the normal limit or is already beyond it.

If all losses are within acceptable limits, then even if someone is at fault, the account will be production. But it will become personal if the guilt of the employees is obvious, and the expense has gone beyond the regulated norm.

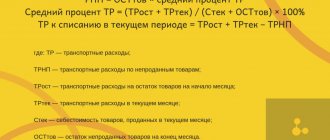

Algorithms for calculating average price

Algorithm for calculating the average price, using the example of the “Apple jam” position. Before write-off, there were two receipts of this material:

100 kg x 1,000 rubles = 100,000 rubles

80 kg x 1,200 rubles = 96,000 rubles

The total average at the time of write-off is (100,000 + 96,000)/(100 + 80) = 1088.89 rubles.

We multiply this amount by 120 kg and get 130,666.67 rubles.

At the time of write-off, we used the so-called moving average.

Then, after the write-off, there was a receipt:

50 kg x 1,100 rubles = 55,000 rubles.

The weighted average for the month is:

(100,000 + 96,000 + 55,000)/(100 + 80 + 50) = 1091.30 rubles.

If we multiply it by 120, we get 130,956.52.

The difference 130,956.52 – 130,666.67 = 289.86 will be written off at the end of the month when performing the routine operation Adjustment of item cost (the difference of 1 kopeck from the calculated one arose in 1C due to rounding).

Fig.8 Adjustment of item cost

How materials are written off in accounting, drawing up an order and a sample

The first stage of the procedure is the order. It is authorized to be issued by the director, manager, or the person replacing him and acting. The first point of the order is the creation of a commission. In principle, we understand that the main task will be to identify shortcomings. This means that an inventory will be needed. It is clear that even for a routine inspection it is always necessary to appoint a full commission. Where there will be both representatives of the accounting department and responsible persons, for example, a storekeeper or someone who receives products and is personally responsible for its safety.

The question often arises of how to write off consumables in production that are not available, and whether it is possible to immediately proceed to document processing. That’s the simple answer; in fact, this procedure should always be preceded by an inventory. And the initiative that appears in the form of an order has a standard or atypical version. The first option is when the work regulations are already assigned in advance in the form of a separate document. And the second - in cases where the order itself contains the entire regulation. This is an inconvenient form, so often everyone uses the first one.

To make the process of inventory, checks, and exclusion of a resource from the list of available ones easier, you will need software of the appropriate level. And the Cleverence software can help with this issue. This:

- Simplifying the inventory procedure, you only need one smartphone.

- Combining reporting, write-offs and inventory itself into a single system, which is again controlled from one device. Significant savings of time and effort.

- The ability to install both packaged software and individual software developed specifically for the needs and specifics of a particular company.

- Mobile applications that integrate into the general reporting system, for example, Bitrix.

- Solutions in accordance with all the latest amendments to Russian legislation.

- Current support. If the law changes, applications immediately adapt to it through updates.

Now let's figure out what should always be in a standard order. Without which points it simply will not be such:

- Full name of the enterprise.

- Date and serial number of a specific order.

- The purpose of the enterprise.

- Composition of the commission.

- Manager's signature.

Documents without which stationery and other office expenses cannot be written off

The cost of the table in accounting is 42,000 rubles. (47,200 rub. – 7,200 rub. + 2,360 rub. – 360 rub.). In accounting this is OS, and for taxation it is MPZ.

Accounting policy Accounting policy is a regulatory document that regulates the combination of legislative norms and independent convenient decisions of the organization on the issue of maintaining financial records.

Subscribe to our YouTube channel to learn more about 1C. There you will find many video tutorials. Waiting for you!

Of course, I would like to write off fuel and lubricants in a larger amount to reduce taxes. However, unjustifiably inflating costs does not lead to anything good. The Tax Code of the Russian Federation clearly states that expenses written off as expenses must be economically justified and documented. Only in this case the tax authority will not have any additional questions.

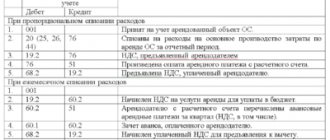

The procedure for decommissioning materials, postings and documents

This procedure is a rigorous process. Order, inspection, reporting. And the last point often raises a lot of questions. And in vain, because this is a common operation with its own nuances.

The first of them is that the set of inventories is credited, that is, 10. In all cases, no matter what part of the operation is involved. But expense accounts are debited by their number.

We get this form:

| Debit part | Credit part (always identical number) | Explanations |

| 20 | 10 | Cost write-off in favor of main production |

| 23 | 10 | Analysis and assessment of resource for auxiliary production processes |

| 94 | 10 | Write-off in case of loss. This includes damage, theft, exceeding the service life, initial defects, breakdown during the production process and similar |

| 99 | 10 | This category includes resources damaged by natural disasters. |

| 91.2 | 10 | All products that were sold under a gratuitous contract. That is, often gifts are for marketing purposes or as a result of charity events |

Disposal of materials to third parties

Material assets received at the warehouse can be used by the enterprise for its internal and production purposes, or they may leave the enterprise. The disposal of materials from an organization to a third party can occur as a result of their sale to third parties, they can be made as a contribution to the authorized capital of another organization, or they can be donated, that is, transferred free of charge (without payment).

How is the disposal of materials recorded in each of these cases? Below we will look at the entries that an accountant must make.

Sales of materials

Since this operation, as a rule, is not a regular type of activity of the organization, the implementation should be processed not through the traditional account 90 “Sales”, but through account 91 “Other income and expenses”.

91 accounting accounts are built according to the following principle:

- In subaccount 1, entries are made only on credit - other income is reflected here

- In subaccount 2, entries are made only in debit - other expenses are reflected here

- subaccount 9 is intended for summing up the final financial result

When selling materials, their cost is written off from the credit account 10 to the debit account 91.2 (entry D91.2 K10).

Materials are sold at market value, and you must remember to include VAT in this price.

An organization selling material assets must pay VAT to the budget. The amount of tax must be separated from the amount of revenue. If the rate of 18% is applied to the materials sold, then to calculate VAT from the amount of revenue, you need to multiply the sales price by 18 and divide by 118. If the VAT rate is 10%, then the sales price is multiplied by 10 and divided by 110.

In accounting, it is necessary to make a posting for the calculation of VAT payable to the budget D91.2 K68.VAT.

The cost of materials and VAT will act as expenses incurred by the enterprise in connection with the sale of material assets. If there are any other expenses (for example, transportation), then they are also written off as a debit to account 91.2 by posting D91.2 K76.

The income will be the sales value, which is reflected by posting D62 K91.1.

Payment by the buyer of the received valuables is reflected using posting D51 K62.

As a result of the sale, account 91 collected all expenses on debit and all income on credit. In subaccount 9, account 91, it is necessary to reflect the overall financial result of the transaction.

To do this, take credit turnover (credit account 91.1) and debit turnover (debit account 91.2). The second value is subtracted from the first value; the resulting value can be either greater than 0 in the case of a profit from the sale, or less than 0 in the case of a loss.

Profit is reflected by posting D91.9 K99, loss - D99 K91.9.

Postings when selling materials:

| Debit | Credit | the name of the operation |

| 91/2 | 10 | The actual cost of materials intended for sale was written off |

| 62 | 91/1 | Revenue from the sale of materials is reflected |

| 91/2 | 68.VAT | The amount of VAT allocated for payment to the budget |

| 91/9 | 99 | Financial result (profit) from the sale of materials |

| 99 | 91/9 | Financial result (loss) from the sale of materials |

| 51 | 62 | Receipt of payment from the buyer to the bank account |

Free transfer of materials

If material assets are transferred to another organization without payment, that is, free of charge, then the operation is also processed through account 91, only in this case only expenses will be present. There will be no income, since the organization will not receive payment for the disposed materials.

The expenses for a donation, just as in the case of a sale, are the cost of material assets, VAT accrued at the average market value for similar materials, as well as other related expenses.

The posting for writing off the cost of materials for gratuitous transfer has the form: D91.2 K10.

Posting for calculating VAT on market value: D91.2 K68.VAT.

Entering materials into the management code of another organization

By contributing material assets to the authorized capital of another organization, an enterprise makes a financial investment from which it will receive income in the form of dividends in the future. That is why the contribution to the Criminal Code is not recognized as an expense and is not registered through account 91.

In this case, it is necessary to use account 58, and the accountant makes the following two entries:

D58 K76 – debt on contribution to the capital of another organization is reflected;

D76 K10 – material assets were transferred.

For any method of disposal of materials from the enterprise, it is necessary to make a note on the M-17 accounting card indicating that the valuables have been disposed of.

Act of write-off of inventories

This is the only way to exclude inventories from the list of active ones when stored in warehouses. It is noteworthy that since 2015, this, in principle, allows the use of any calculation and analysis option: by piece cost or by total cost. In this case, a document is always drawn up in form 0504230.

It consists of two parts. The header contains basic information, order number, date, composition of the commission, full name. leader. The main part, in the form of a table, provides information on the actual loss of inventories. Contains graphs of expenses expected according to the norm, the reasons for such an outcome. In fact, this act is the only legal way to properly write off materials from the warehouse.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Important addition

The generation of invoice requirements and their use for write-off requires the fulfillment of an important condition: all materials written off from the warehouse must be used for production in the same month, that is, writing off their full value as expenses is correct. In fact, this is not always the case. In this case, the transfer of materials from the main warehouse should be reflected as a movement between warehouses, to a separate sub-account of account 10, or, alternatively, to a separate warehouse in the same sub-account in which it is accounted for. With this option, materials should be written off as expenses using a materials write-off act, indicating the actual quantity used.

The version of the act printed on paper should be approved in the accounting policy. In 1C, for this purpose, the document “Production Report for a Shift” is provided, through which, for the products produced, you can write off materials manually, or, if standard products are produced, draw up a specification for 1 unit of product in advance. Then, when specifying the quantity of finished products, the required amount of material will be calculated automatically. This work option will be discussed in more detail in the next article, which will also cover such special cases of write-off of materials as accounting for workwear and write-off of customer-supplied raw materials into production.

If you regularly have questions about setting up 1C programs, contact our specialists. We will be happy to advise you and also select the optimal tariffs for 1C service, focusing on your individual tasks.

What to do if there is a balance

In principle, it is permissible to create a separate sub-account where all excesses are indicated. But this is an optional procedure. Just a way to make your work easier and make your accounting more transparent. But the aspect has nothing to do with the issue under discussion. Since it is strictly prohibited to enter this information into act 0504230, even with reverse values.

How to write off a low value laptop sample

Analytical accounting for it can be carried out in the context of nomenclature, batches of materials in operation or by financially responsible persons.

It includes current assets for which:

- cost - for one unit no more than 40 thousand rubles;

- operating time - up to a year or two;

- subsequent resale is not envisaged.

On every exam, there is an opportunity to cheat when the teacher leaves the room for a few minutes. Do not make sudden movements if the door suddenly opens, otherwise you risk being punished for your attitude towards studying. 5 Do not rustle paper sheets, do not attract attention to yourself. You should also not pass the items on your table to a friend sitting next to you.

Let's sum it up

In fact, the write-off of inventory and materials in tax accounting and accounting has no differences.

If we are talking about white accounting, which does not try to mislead the competent authorities. And it is worth remembering that although the law does not put forward actual rules on the procedure, and a lot remains at the discretion of the manager, the final reporting will be significant documents for the Federal Tax Service. Which they can check at any time. Therefore, it is worth approaching the procedure with all responsibility. At the same time, it is also undesirable to refuse such events or minimize them. Otherwise, accounting will turn into a tangled mess, and expenses will “mysteriously” increase. Number of impressions: 1359

How to account for fixed assets worth up to 100,000 rubles

Low-value fixed assets 2021 are the property of an organization, the value of which does not exceed the limit established by law, and it can be taken into account as part of expenses at a time, and not through depreciation charges. Let’s figure out which fixed assets are considered low-value and how to properly account for them in a budget organization, taking into account the changes in 2021.

Read more about the criteria for classification as fixed assets in the article “Guidelines for accounting of fixed assets.” Despite the fact that such objects are not considered fixed assets, they have a certain service life, after which the company can no longer operate them. In such a situation, it becomes necessary to write off these property items.

Use these fixed asset accounting documents. Our guides will save you from annoying fines and protect you from mistakes. Relevance has been confirmed by BukhSoft program experts. Also familiarize yourself with the basic rules for calculating and paying monthly and quarterly advances on income tax from leading specialists of the Federal Tax Service.

Accounting for low-value fixed assets depends on their compliance with the accounting limit. If in accounting they exceed the limit in value, then from an accounting point of view the object is classified as fixed assets, but from the point of view of income tax - not. If the fixed asset costs less than the accounting limit, then the object is taken into account as inventory in both accounting and taxation.