Categories of citizens who are required to submit a 3-NDFL report

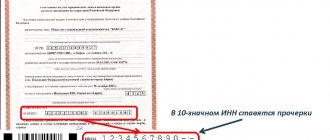

Individuals report for income received additionally from wages in the appropriate form 3-NDFL, coded KND 1151020. The form is regulated at the legislative level by Order of the Federal Tax Service of Russia No. ММВ-7-11/569 dated 10/03/2018. Individuals liable to pay the income tax must declare this tax. Citizens also have the right to reimburse part of the funds paid by filling out the KND form 1151020. It turns out that the person paying the profit tax is the one who must submit 3 personal income taxes. It is important to determine the tax status of the taxpayer - resident or non-resident. In ch. 23 of the Tax Code of the Russian Federation, or more precisely in paragraph 1 of Art. 299 ch. 23 Tax Code of the Russian Federation Federal Law No. 117 dated 05.08.2000 (as amended on 25.12.2018) provides information on who submits 3 personal income taxes:

- individual entrepreneurs, citizens conducting private practice (Article 227 of the Tax Code of the Russian Federation);

- foreigners who work for citizens of the Russian Federation as housekeepers and for individuals engaged in private practice (Article 227.1 of the Tax Code of the Russian Federation);

- according to paragraph 1 of Art. 228 of the Tax Code of the Russian Federation, citizens who received:

- Winnings.

- Remuneration for hired labor under a GPC contract from individuals who are not tax agents.

- Sold movable or immovable property and property.

- Funds outside Russia.

- Other profit on which the tax agent has not withheld a fee.

- Royalties from the authorship of scientific, cultural, literary works, as well as from the creation of the latest models for Russian industry.

- Donated funds from other individuals who do not work as individual entrepreneurs.

- Money from real estate or securities contributed to the endowment capital of an NPO.

Thus, the profit duty is paid by individuals whose income was not subject to the tax agent’s fee. For example, winning a lottery or money from the sale of an apartment, since the citizen receives these funds in a bank account or in hand in full. In the KND form 1151020, a person must indicate these amounts and calculate the amount of the collection from them. If this is not done, then the tax office will in any case find out about the income and fine the citizen for an offense under the article on evasion of payment of fees - Art. 199 of the Criminal Code of the Russian Federation.

Rules for drawing up a declaration, its composition

Filling out 3-NDFL is possible in several different ways:

- Manually.

- On a PC, for example, using a prepared form in pdf format (via Adobe Acrobat Reader).

- Through a special program “Declaration”.

- Through the website of the Federal Tax Service of Russia.

When filling out the form by hand, print capital letters are placed in the margins. If any parameter is missing, a dash is placed in its place. All information in the declaration must be truthful; amendments are prohibited.

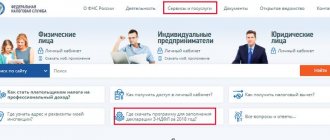

To simplify your work, you can take a simpler route - use the “Declaration” program. It can be easily found on the website of the Federal Tax Service of the Russian Federation in the “Software” section (“Declaration”). Here you can automatically create declarations in two forms: 3-NDFL and 4-NDFL. The convenience is that when entering information, the software independently checks the correctness of the specified information, calculates the necessary parameters and checks the correctness of the calculation of deductions and the amount of taxes. In addition, a final document is generated for subsequent transmission to the Federal Tax Service. The document with the pdf declaration is printed and sent to the Federal Tax Service (in person or by Russian post). The second option is to send the completed document electronically through the tax payer’s personal account.

For confident network users, the method of submitting a declaration to the Federal Tax Service electronically through the tax service website is suitable. To do this, you need to go to a special service for filling out and submitting the 3-NDFL tax return electronically. The point is to enter the necessary information online, generate an xml file and submit it electronically to the tax service.

Using the electronic service, the generated document is signed with an electronic digital signature (enhanced or qualified). Next, the declaration and scanned copies of accompanying papers are sent to the Federal Tax Service. Using an electronic digital signature and sending a signed document to the Federal Tax Service using the service is possible for a declaration created using the “Declaration” software or other software.

The 3-NDFL must contain the following information:

- Profit received during the tax period (unless otherwise specified in the Tax Code of the Russian Federation, Article 229, paragraph 4).

- Sources of income transfer and tax deductions.

- The amount of tax payments withheld by agents.

- The volume of actually transferred advance payments for the entire tax period.

- The amount of tax that must be paid or refunded based on the results of the tax period.

The following information is not required to be included in the declaration:

- Profit that is not subject to tax or is exempt from it. Such information can be found in the Tax Code of the Russian Federation (Article 217).

- Profit, upon the calculation of which the tax is fully withheld by tax agents (with the exception of situations where this fact prevents the tax payer from receiving the deductions required by law).

Before entering information into the declaration, you must study the letter of the Federal Tax Service dated December 12, 2017 (number - GD-4-11 / [email protected] ). The document discusses common mistakes that are made when entering information into 3-NDFL.

drawing up a 3-NDFL declaration

Form 3-NDFL for 2021 ()

Persons required to file 3-NDFL due to duty

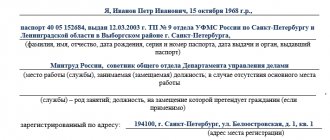

Sometimes citizens confuse the 3-NDFL declaration with a certificate of income, which is regulated by Decree of the President of the Russian Federation No. 460 of June 23, 2014 (as amended on October 9, 2017). This documentation is filled out by civil servants, the list of positions of which is prescribed in Decree of the President of the Russian Federation No. 557 of May 18, 2009 (as amended on July 3, 2018). In the profit certificate, civil servants (employees of the State Duma, the Ministry of Internal Affairs, the Ministry of Defense and the like) write down information about income in a brief form, and the KND form 1151020 reveals in more detail information about the additional money of individuals. In paragraph 3 of Art. 207 of the Tax Code of the Russian Federation is written about who fills out 3 personal income taxes on duty:

- Russian military personnel;

- employees of government bodies;

- local government employees who are sent to serve abroad.

Thus, according to duty, employees in the Russian troops working in the state at the federal and municipal levels report additional income, regardless of their actual location. The listed citizens may be on a business trip, but are required to calculate tax funds and fill out the appropriate form for income received from other financial transactions.

Subtleties of filing a declaration

The Tax Code of the Russian Federation (Article 80) states that a declaration can be submitted by the payer to the Federal Tax Service in three ways:

- On your own or with the assistance of a representative.

- By mail (in this case the contents of the letter are described).

- In the form of electronic paper through the personal account of the tax payer (all manipulations are carried out through nalog.ru).

The option that takes the most time is to transfer 3-NDFL yourself or by a representative. To save time, it is recommended to choose the option of transferring electronically through your personal account. When choosing this method, there is no need to visit the Federal Tax Service, because the exchange file is generated automatically based on the format approved by the tax authority.

As noted, submitting a declaration electronically is only possible if you have an electronic signature (issued by a special center). When submitting a declaration through your personal account on the Federal Tax Service website, you are required to come to the tax authority and take a registration card. The latter contains the account information for logging into your personal account. This option is suitable for people who plan to submit their declaration regularly.

If the goal is to submit the declaration only once, it is better to use the mail. For reliability, it is recommended to use a valuable parcel post with a mandatory list of attachments and information about delivery. The date of transmission is the day indicated on the postal plug. This means that sending a declaration is possible even on the last day of the deadline for submitting 3-NDFL.

3-NDFL for tax deductions

In addition to reporting income, citizens have the right to return part of the taxes paid. For refunds, the form contains the following sections:

- standard,

- social,

- property,

- investment deductions.

Submitting 3 personal income taxes to the Federal Tax Service for reimbursement involves filling out the appropriate section and calculating the deduction.

The difference between reporting profits and submitting a form for a refund is that the latter is submitted voluntarily. To return part of the funds paid for fees, contributions, charity, treatment or education is a personal decision of a Russian citizen. Since it is not always possible to issue KND form 1151020 before April 30, an individual has the right to submit 3-NDFL for deduction throughout the year that began after payment of the funds spent. For example, a person paid for treatment in 2021, which means it is possible to return part of the money in 2018.

Should an entrepreneur report on Form 3-NDFL?

According to paragraph 1 of Art. 229 of the Tax Code of the Russian Federation, businessmen must report additional profits on the same basis as individuals. The filing deadline is the same - until April 30 of the reporting year. If an entrepreneur has stopped working and is no longer engaged in business, then providing a completed 3-NDFL within 5 working days after the closure of the business is the main obligation to the tax authorities (clause 1 of Article 119 of the Tax Code of the Russian Federation). The amount of the sanction is 5% of the unpaid tax amount, but not less than 1000 rubles and not more than 30% of the tax amount.

Income that is not subject to taxation

Profits that are not subject to tax are covered in a separate article in the tax code. According to Art. 217 of the Tax Code of the Russian Federation, not subject to taxation, types of profit:

- state benefits for unemployment, pregnancy, and childbirth. An exception is payments for temporary disability;

- pensions, including fixed, social supplements, insurance, old-age savings benefits;

- additional payments for the appearance (birth, adoption) of the first and second child;

- volunteers’ income from unpaid work;

- income of blood donors, mother's milk, etc.;

- alimony received by fee payers;

- grants received by foreign companies to promote science, art, education;

- awards in monetary equivalent after participation in sports competitions and other events that are sponsored by NPOs with grants from foreign companies;

- the cost of travel to the venue of the competitions and the above events;

- fees for great discoveries and achievements in the field of science, education, culture received abroad;

- one-time additional payments;

- Monetary donations.

- Awards for assistance in searching for criminals, preventing terrorist attacks, and other assistance to executive authorities.

- Funds received for reconstruction after natural disasters and terrorist attacks.

- scholarships for students, graduate students, residents;

- compensation: free housing; compensation for harm; money spent on food, sports equipment; payments upon dismissal. With the exception of:

- Unused vacation.

- Severance pay.

- Additional payments of 3 and 6 times the average monthly salary for laid-off employees in the Far North.

- Benefits related to the death of military and civil servants while on duty.

- Expenses for staff development.

- Business trips.

Recent payments and benefits are subject to a fee in accordance with the Legislation of the Russian Federation. This list is not complete, since there are many types of profit that are not subject to taxes. To clarify the full list, it is worth looking at Art. 217 Tax Code of the Russian Federation.

Who will have to pay higher tax rates in 2019

According to the legislation, all tax rates are established by Art. 224 Tax Code of the Russian Federation.

The basic personal income tax rate in Russia is 13%. But there are other, higher rates of 30 and 35%. The list of taxes at this rate is quite impressive.

A tax rate of 35% is established in relation to:

- the cost of any winnings and prizes received in competitions, games and other events for the purpose of advertising goods, works and services, to the extent that they exceed 4 thousand rubles;

- interest income on deposits in banks to the extent that they exceed the amounts specified in Art. 214.2 of the Tax Code of the Russian Federation (for example, for ruble deposits - refinancing rate + 5%);

- the amount of savings on interest when taxpayers receive borrowed (credit) funds in terms of exceeding the amounts specified in clause 2 of Art. 212 of the Tax Code of the Russian Federation (for example, for interest expressed in rubles - 2/3 of the refinancing rate over the amount of interest calculated based on the terms of the agreement);

- in the form of a fee for the use of funds of members of a credit consumer cooperative (shareholders), as well as interest for the use by an agricultural credit consumer cooperative of funds raised in the form of loans from members of an agricultural credit consumer cooperative or associated members of an agricultural credit consumer cooperative, to the extent that the amount of the specified fee exceeds , interest accrued over the amount of the fee, interest calculated based on the refinancing rate + 5%.

A tax rate of 30% is established for all income received by individuals who are not tax residents of the Russian Federation, with the exception of income received:

- in the form of dividends from equity participation in the activities of Russian organizations, in respect of which the tax rate is set at 15%;

- from carrying out labor activities, in respect of which the tax rate is set at 13%;

- from carrying out labor activities as a highly qualified specialist, in respect of which the tax rate is set at 13%;

- from the implementation of labor activities by participants in the state program to assist the voluntary resettlement to the Russian Federation of compatriots living abroad, as well as members of their families who jointly moved to permanent residence in Russia, in respect of whom the tax rate is set at 13%;

- from the performance of labor duties by crew members of ships flying the State Flag of the Russian Federation, in respect of which the tax rate is set at 13%;

- from carrying out labor activities by foreign citizens or stateless persons, recognized refugees or who have received temporary asylum in the territory of the Russian Federation, in respect of whom the tax rate is set at 13 percent;

- in the form of dividends on shares (stakes) of international holding companies that are public companies on the day such a company decides to pay dividends, in respect of which the tax rate is set at 5%.

Another tax rate of 9% is established for income in the form of interest on mortgage-backed bonds issued before January 1, 2007, as well as for income of the founders of trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued by mortgage coverage managers until January 1, 2007.

Fines for non-payment of personal income tax

Since January 1, 2021, the 2019 declaration campaign has been in effect, which obliges Russian citizens to report on income for 2018 by April 30, 2021. But you can issue and submit the KND 1151020 deduction form throughout the year. If a person wants to report and reimburse the funds, then the deadline remains stated - until April 30.

Despite the limited deadline for submitting the completed form, an individual has the right to pay the fee until July 15, 2021. If the fee is not paid, then the tax authorities have the right to punish the offender by deducting a percentage of the calculated amount of the fee in accordance with Art. 122 Tax Code of the Russian Federation:

- primary unintentional - 20%;

- intentional - 40%.

In case of categorical evasion of payment, Art. 199 of the Criminal Code of the Russian Federation - 100,000-300,000 rubles, 100% of wages or imprisonment for a period of 1-2 years.

Certificate of income, expenses, property and property-related obligations

Federal Law No. 303-FZ of November 3, 2015 established the obligation to annually ( before April 1 ) submit information on your income, expenses, property and property-related obligations, as well as on income, expenses, property and property-related obligations of your spouse ) and minor children for:

- deputies of the State Duma

- members of the Federation Council

- deputies of the legislative (representative) body of state power of a constituent entity of the Russian Federation

- deputies of local governments

- heads of municipalities

- heads of local administrations

- members of an elected local government body

- elected local government officials

- other persons holding municipal positions

Failure to provide or untimely submission of the specified information is grounds for early termination of the powers of these persons.

Based on paragraph 1 of Article 8 of Federal Law No. 273-FZ “On Combating Corruption” and Part 1 of Article 3 of Federal Law No. 230-FZ “On Control of the Compliance of Expenses of Persons Holding Public Positions and Other Persons with Their Income” (hereinafter referred to as the Law No. 230-FZ), a person holding (occupying) one of the positions specified in paragraph 1 of part 1 of Article 2 of Law No. 230-FZ is required to annually submit information about:

- his income received during the reporting period (from January 1 to December 31) from all sources (including salary, pensions, benefits, other payments), as well as about the property belonging to him by right of ownership, and about his obligations of a property nature as of at the end of the calendar year;

- income of the spouse and minor children received during the reporting period (from January 1 to December 31) from all sources (including wages, pensions, benefits, other payments), as well as about property owned by them, and about their property liabilities as of the end of the reporting period;

- their expenses for each transaction for the acquisition of a land plot, other real estate, vehicle, securities, shares (participatory interests, shares in the authorized (share) capital of organizations), if the transaction amount exceeds the total income of the person and his spouse for the last three years preceding the transaction, and the sources of funds at the expense of which the transaction was completed.

Each government body develops and approves lists of positions in the state civil service, when filling which state civil servants are required to provide information about their income, property and property-related obligations, as well as information about the income, property and property-related obligations of their spouse. and minor children.

In accordance with subparagraph “b” of paragraph 3 of the Regulations on the submission by citizens applying for positions in the federal civil service and federal civil servants of information on income, property and liabilities of a property nature, approved by Decree of the President of the Russian Federation of May 18, 2009 No. 559, as amended. dated July 15, 2015, the certificate is submitted annually by April 30 of the year following the reporting year. Such information is submitted to the personnel departments at the place of work (service).

The obligation to submit certificates of income, expenses, property and property-related obligations applies to:

- persons holding (occupying): a) government positions of the Russian Federation, in respect of which federal constitutional laws or federal laws do not establish a different procedure for monitoring expenses; b) positions of members of the Board of Directors of the Central Bank of the Russian Federation; c) government positions in the constituent entities of the Russian Federation; d) municipal positions on a permanent basis; e) positions in the federal public service, the exercise of powers for which entails the obligation to provide information about one’s income, property and property-related obligations, as well as information about the income, property and property-related obligations of one’s spouse and minor children; f) positions of the state civil service of the constituent entities of the Russian Federation, the exercise of powers for which entails the obligation to provide information on one’s income, property and property-related obligations, as well as information on income, property and property-related obligations of one’s spouse and minors children; g) positions of the municipal service, the exercise of powers for which entails the obligation to provide information about one’s income, property and property-related obligations, as well as information about the income, property and property-related obligations of one’s spouse and minor children; h) positions in the Bank of Russia, the exercise of powers for which entails the obligation to provide information about your income, property and property-related obligations, as well as information about the income, property and property-related obligations of your spouse and minor children; i) positions in state corporations, the exercise of powers for which entails the obligation to provide information about their income, property and property-related obligations, as well as information about the income, property and property-related obligations of their spouse and minor children; j) positions in the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, the exercise of powers for which entails the obligation to provide information about one’s income, property and property-related obligations, as well as information about income and property and property obligations of their spouse and minor children; k) positions in other organizations created by the Russian Federation on the basis of federal laws, the exercise of powers under which entails the obligation to provide information about one’s income, property and property-related obligations, as well as information about the income, property and property-related obligations of one’s spouse (spouse) and minor children; l) individual positions on the basis of an employment contract in organizations created to perform tasks assigned to federal government bodies, the exercise of powers for which entails the obligation to provide information about one’s income, property and property-related obligations, as well as information about income, property and property-related obligations of their spouse and minor children;

- spouses and minor children of persons holding (holding) positions specified in the previous paragraph.

To summarize, we can draw up the following list of persons who are required to annually provide information about their income and expenses, as well as information about the income of their spouse and minor children, about property owned by them, and the property obligations of their spouse: and minor children (according to the established form):

Deputies of all levels (until April 1) - on the basis of Federal Law No. 303-FZ of November 3, 2015

Persons holding elective positions in regional authorities and local governments (until April 1) - on the basis of Federal Law No. 303-FZ of November 3, 2015

Judges (until April 30) - on the basis of Article 8.1 of the Law of the Russian Federation of June 26, 1992 No. 3132-1 “On the status of judges in the Russian Federation”

Civil servants (until April 30 - on the basis of Decree of the President of the Russian Federation dated May 18, 2009 No. 559 as amended on July 15, 2015):

- civil servants (in accordance with the list approved by Decree of the President of the Russian Federation dated May 18, 2009 No. 557 as amended on March 8, 2015)):

- Ministry of Internal Affairs

- Ministry of Emergency Situations

- Ministry of Defense

- State courier service

- SVR

- FSB

- FSKN

- FSO

- FMS

- FSIN

- Spetsstroy

- Special Objects Services under the President of the Russian Federation

- FCS

- Prosecutor's Office

- Investigative Committee of the Russian Federation

- Positions of all names of the apparatus of the Minister of Internal Affairs of the Russian Federation and Deputy Ministers of Internal Affairs of the Russian Federation.

Family members of government employees

Form of certificate of income, expenses, property and property obligations

The form of the certificate was approved by Decree of the President of the Russian Federation of June 23, 2014 No. 460 “On approval of the form of a certificate of income, expenses, property and property-related obligations and amendments to certain acts of the President of the Russian Federation.”

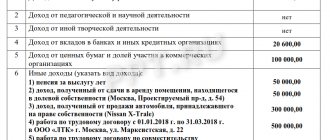

The certificate consists of a text (introductory) part, which reflects data identifying the employee (citizen), his spouse and his minor children, as well as a tabular part, which includes six sections.

Let's look at the features of filling out the tabular part of the help.

| Column number | Features of filling out information in the column |

| Section 1 “Information on income” | |

| Column 3 | Income (including pensions, benefits, and other payments) for the reporting period is indicated. Income received in foreign currency is indicated in rubles at the Bank of Russia exchange rate on the date of receipt of income |

| Section 2 "Information about expenses" | |

| Box 5 | The name and details of the document that is the legal basis for the emergence of ownership rights are reflected. A copy of the document is attached to this certificate |

| Section 3 “Information about property” | |

| Column 3 subsection. 3.1 | The type of ownership (individual, shared, common) of real estate is indicated; for joint ownership, other persons (full name or name) who own the property are indicated; for shared ownership, the share of the person whose property information is provided is indicated |

| Column 6 subsection. 3.1 | The name and details of the document that is the legal basis for the emergence of ownership of real estate is recorded, as well as in the cases provided for in paragraph 1 of Art. 4 of the Federal Law of 05/07/2013 N 79-FZ “On the prohibition of certain categories of persons from opening and having accounts (deposits), storing cash and valuables in foreign banks located outside the territory of the Russian Federation, owning and (or) using foreign financial instruments”, the source of funds from which the property was acquired |

| Column 3 subsection. 3.2 | The type of ownership (individual, general) for vehicles is indicated; for joint ownership, other persons (full name or name) who own the property are indicated; for shared ownership, the share of the person whose property information is provided is indicated |

| Section 4 “Information on accounts in banks and other credit institutions” | |

| Column 3 | The type of account (deposit, current, settlement, loan, etc.) and account currency are reflected |

| Box 5 | The account balance as of the reporting date is entered. For accounts in foreign currency, the balance is indicated in rubles at the Bank of Russia exchange rate as of the reporting date |

| Box 6 | The total amount of cash receipts to the account for the reporting period is indicated if it exceeds the total income of the person and his spouse for the reporting period and the two years preceding it. In this case, the certificate is accompanied by an extract of cash flows on this account for the reporting period. For accounts in foreign currency, the amount is indicated in rubles at the Bank of Russia exchange rate as of the reporting date |

| Section 5 “Information on securities” | |

| Column 2 subsection. 5.1 | The full or abbreviated official name of the organization and its legal form (joint stock company, limited liability company, partnership, production cooperative, foundation, etc.) are indicated. |

| Column 4 subsection. 5.1 | The authorized capital is reflected in accordance with the constituent documents of the organization as of the reporting date. For authorized capital expressed in foreign currency, it is indicated in rubles at the Bank of Russia exchange rate as of the reporting date |

| Column 5 subsection. 5.1 | The share of participation expressed as a percentage of the authorized capital is shown. For joint stock companies, the par value and number of shares are also indicated. |

| Column 6 subsection. 5.1 | The basis for acquiring a participation interest (founding agreement, privatization, purchase, exchange, donation, inheritance, etc.), as well as details (date, number) of the corresponding agreement or act are indicated |

| Column 2 subsection. 5.2 | All securities by type (bonds, bills, etc.) are entered, with the exception of shares specified in subsection. 5.1 |

| Column 6 subsection. 5.2 | The total value of securities of this type is indicated based on the cost of their acquisition (if it cannot be determined - based on market value or nominal value). For liabilities expressed in foreign currency, the cost is indicated in rubles at the Bank of Russia exchange rate as of the reporting date |

| Section 6 “Information on obligations of a property nature” | |

| Column 2 subsection. 6.1 | The type of real estate (land, residential building, dacha, etc.) in use is indicated |

| Column 3 subsection. 6.1 | The type of use of real estate (rent, free use, etc.) and the terms of use are reflected. |

| Column 4 subsection. 6.1 | The basis for the use of real estate is recorded (agreement, actual provision, etc.), as well as details (date, number) of the corresponding agreement or act. |

| Column 2 subsection. 6.2 | Indicate current financial obligations (loan, credit, etc.) available as of the reporting date in an amount equal to or exceeding RUB 500,000, for which the creditor or debtor is the person whose obligations are presented |

| Column 3 subsection. 6.2 | The second side of the financial obligation is reflected: creditor or debtor, his full name. (name of legal entity), address |

| Column 4 subsection. 6.2 | The basis for the occurrence of the financial obligation is indicated, as well as the details (date, number) of the corresponding agreement or act |

| Column 5 subsection. 6.2 | The amount of the main financial liability (excluding interest) and the amount of the liability as of the reporting date are displayed. For liabilities expressed in foreign currency, the amount is indicated in rubles at the Bank of Russia exchange rate as of the reporting date |

| Column 6 subsection. 6.2 | The annual interest rate of the financial obligation, property pledged to secure the obligation, guarantees and sureties issued to secure the obligation are indicated. |

The article was written and posted in 2010. Added - 09/20/2014, 12/08/2014, 10/26/2015, 11/05/2015, 02/04/2016, 04/18/2017