Additional payments up to actual earnings on sick leave

In accordance with Article 183 of the Labor Code, the amount of temporary disability benefits and the conditions for their payment are established by federal law.

The first three days of illness of the employee are paid by the company. The remaining days are paid for from the Social Insurance Fund. The amount of the benefit depends on average earnings and insurance coverage.

The amount of average earnings, on the basis of which sickness benefits, maternity benefits and monthly child care benefits are calculated, should not exceed the maximum base for calculating insurance contributions to the Social Insurance Fund for a calendar year. It was established in accordance with Law No. 212-FZ (Part 3.2 of Article 14 of Law No. 255-FZ).

note

The values of the maximum base for calculating insurance premiums, which is used when calculating sickness benefits, maternity benefits and monthly child care benefits when calculating them in 2021, are as follows: for 2014 - 624,000 rubles, for 2015 - 670 000 rubles. For 2021, it is set at 718,000 rubles (clauses 4 and 5 of Article 8 of Law No. 212-FZ).

However, this does not mean that the employee cannot be paid more. The company can pay the difference between the maximum and actual benefits from its own funds.

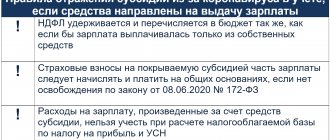

The Ministry of Finance of the Russian Federation allows this difference to be taken into account in expenses if increased sick pay is established by collective or labor agreements on the basis of paragraph 25 of part 2 of Article 255 of the Tax Code of the Russian Federation (see letters dated December 27, 2012 No. 03-03-06/1/723, dated December 8, 2010 No. 03-03-06/2/209, April 28, 2010 No. 03-03-06/1/306, dated April 1, 2010 No. 03-03-06/1/212, dated March 22, 2010 No. 03-03-06/1/158 and September 14, 2009 No. 03-03-06/2/169).

EXAMPLE An employee of Aktiv JSC, Sidorov, was ill from January 17 to January 21, 2016 (5 calendar days). His income taken into account for calculating benefits amounted to 650,000 rubles for 2014, and 670,000 rubles for 2015. Insurance experience exceeded 10 years. In accordance with the employment contract, the company pays benefits for temporary disability based on the employee’s actual earnings. The amount of sick leave calculated from the employee’s actual earnings was (650,000 rubles + 680,000 rubles): 730 days. × 5 days = 9109.59 rubles. The maximum value of the base for calculating insurance premiums, which is also used when calculating sickness benefits, for 2014 is 624,000 rubles, for 2015 - 670,000 rubles. Taking into account this limitation, the amount of benefits payable is equal to (624 000 rub. + 670,000 rub.) : 730 days. × 5 days = 8863.01 rub. (it is from this that the FSS of the Russian Federation will reimburse “Aktiva” for benefits for two calendar days (5–3)). The difference (additional payment to actual earnings) in the amount of 246.58 rubles. (6849.32 – 6678.08) on the day “Active” will pay from its own funds.

Payments to dismissed employees

Workers may be laid off due to a reduction in the number or staff of the company. The decision to dismiss workers for these reasons must be agreed with the trade union (if a trade union has been created in the organization).

Employees should be notified personally of the upcoming dismissal no later than two months before dismissal.

Employees who are dismissed due to a reduction in headcount or staff, in addition to wages for days worked in the month of dismissal and compensation for unused vacation, are paid:

- severance pay in the amount of average monthly earnings;

- average salary for the period of employment, but not more than two months from the date of dismissal (including severance pay).

In exceptional cases (by decision of the employment service authority), the average monthly salary is retained by the dismissed employee for the third month from the date of dismissal. This is possible if, within two weeks after dismissal, the employee contacted the employment service and was not employed (Article 178 of the Labor Code of the Russian Federation).

These payments reduce the company's taxable profit.

Until recently, the Federal Tax Service did not recognize the right of the taxpayer to take into account payments to employees upon dismissal by agreement of the parties. Thus, in its letter dated July 28, 2014 No. GD-4-3/ [email protected] , the Federal Tax Service of Russia indicated that in order to include payments made in favor of an employee as expenses for profit tax purposes, both formal and actual compliance of such payments to the requirements of the Tax Code. Two conditions must be met simultaneously. First, these payments must be reflected in the collective and (or) employment agreement or in additional agreements to them with a mandatory indication that such agreements are an integral part of the collective or employment agreement (formal compliance). Secondly, payments must be of a production nature; they must be related to the work schedule and working conditions (actual compliance).

However, since January 1, 2015, these clarifications have lost their relevance. Now, Article 255 of the Tax Code directly states that all severance payments provided for in employment contracts or separate agreements with the employee, including agreements on termination of the employment contract, collective agreements, and local regulations, are taken into account when taxing profits.

Deductions from employee income

From the salary accrued to the employee, the employer makes deductions:

- mandatory (personal income tax, according to writs of execution);

- at the request of the employee (for example, repaying a loan from an organization).

First of all, personal income tax is withheld from income. All other amounts withheld are calculated from income less taxes.

There are restrictions on deductions from wages (Article 138 of the Labor Code of the Russian Federation). Thus, deductions cannot exceed 20% of accrued wages. For writs of execution, a limit of 50% is established. In exceptional cases (collection of arrears of alimony or compensation for harm caused to life or health), the amount of withholding under a writ of execution can reach 70%.

One-time remuneration for long service

Longevity benefits are awarded to employees who have worked for the company for a long time. As a rule, remuneration is paid as a percentage of the employee’s earnings (salary) received for the year. The amount of remuneration reduces taxable profit. True, provided that the procedure, amount and conditions for its payment are provided for by labor and (or) collective agreements, as well as local regulations, for example, the Regulations on remuneration (see, for example, letter of the Federal Tax Service of Russia dated August 11, 2014 No. GD-4-3/ [email protected] ).

Remuneration can be paid, for example, in the following amounts:

| Work experience | Bonus, % of salary for the year |

| From 3 to 6 years | 5 |

| From 6 to 8 years | 10 |

| Over 8 years | 20 |

EXAMPLE Salesperson Karavaeva has been working at Passiv LLC for 9 years. In accordance with the employment contract, Karavaeva is entitled to a long service bonus in the amount of 20% of the annual salary. Karavaeva’s monthly salary is 15,000 rubles. The one-time bonus for Karavaeva’s length of service will be: 15,000 rubles. × 12 months × 20% = 36,000 rub.

One-time payments to employees for vacation

One-time payments for an employee’s annual leave are taken into account as expenses, provided that they are provided for in an employment (collective) agreement and are related to the employee’s performance of his job duties (letter of the Ministry of Finance of Russia dated September 2, 2014 No. 03-03-06/1/43912).

Any expenses of the taxpayer, if they are economically justified, supported by supporting documents and incurred to carry out activities aimed at generating income, are recognized as expenses for profit tax purposes. The exceptions are those listed in Article 270 of the Tax Code. In particular, these are the amounts of accrued dividends, contributions to the authorized (share capital), penalties and interest transferred to the budget, contributions for voluntary insurance and non-state pension provision, as well as amounts of material assistance to employees (clause 1 of Article 252 of the Tax Code of the Russian Federation) .

In labor costs, the organization has the right to include any accruals to employees in cash or in kind, which are provided for by legislation, labor or collective agreements (Article 255 of the Tax Code of the Russian Federation). According to the Ministry of Finance, we are talking about accruals that are associated with the employee’s performance of his labor function and the payment procedure for which is:

- provided for by the labor (collective) agreement;

- depends on the employee’s salary (for example, an incentive bonus as a percentage of the official salary);

- depends on the employee’s compliance with labor discipline.

Only such payments for annual leave can be considered an element of the remuneration system and taken into account as expenses for tax purposes.

At the same time, amounts of financial assistance paid on other grounds and not related to the employee’s performance of his job duties (for example, financial assistance for the birth of a child or the death of a family member) cannot be taken into account in tax expenses (labor expenses) (clause 23 Article 270 of the Tax Code of the Russian Federation).

note

Therefore, one-time payments for employees’ vacations related to the performance of their labor function are not material assistance within the meaning of Article 270 of the Tax Code. Therefore, they can be taken into account as expenses when calculating income tax.

Is it necessary to pay the salary of the director - the only founder?

For small organizations in the form of an LLC, a typical situation is when the founder serves as the general director. The question arises: how is the director’s salary calculated and is it necessary to calculate it at all? Or is it worth paying only dividends to the founder-director?

Rostrud, in Letter No. 177-6-1 dated March 6, 2013, states that in this case an employment contract is not concluded with the director. In this case, the sole founder decides to take over the management of the company. And to conclude an employment contract, two parties are required. The Ministry of Finance also supports the position of Rostrud, explaining that in this case an employment contract is not concluded with the founding director and no salary is accrued to him.

This position is controversial, but if you decide not to argue with the regulatory authorities, then do not enter into an employment contract with the director - the sole founder. In this case, it is enough to issue an order.

Sample order on non-payment of wages to the director

Average earnings payments

In cases established by the Labor Code, employees are paid average earnings.

The main cases of payment of average earnings according to the Labor Code of the Russian Federation are presented in the table:

| Article of the Labor Code of the Russian Federation | The case of payment of average earnings |

| Art. 167 Labor Code of the Russian Federation | When sending employees on business trips |

| Art. 155 Labor Code of the Russian Federation | In case of failure to comply with labor standards, failure to fulfill labor (official) duties |

| Art. 157 Labor Code of the Russian Federation | Payment for downtime |

| Art. 114 Labor Code of the Russian Federation | Annual paid holidays |

| Art. 126 Labor Code of the Russian Federation | Replacing annual paid leave with cash compensation |

| Art. 220 Labor Code of the Russian Federation | For the duration of the suspension of work in connection with the administrative suspension of activities or a temporary ban on activities in accordance with the legislation of the Russian Federation due to violation of state regulatory labor protection requirements through no fault of the employee |

| Art. 185 Labor Code of the Russian Federation | Guarantees for employees sent for medical examination |

| Art. 254 Labor Code of the Russian Federation | When undergoing a mandatory medical examination in medical organizations |

| Art. 258 Labor Code of the Russian Federation | Baby feeding breaks |

| Art. 186 Labor Code of the Russian Federation | Guarantees and compensation for employees in case they donate blood and its components |

| Art. 254 Labor Code of the Russian Federation | Transfer to another job of pregnant women and women with children under the age of one and a half years |

| Art. 72.2 Labor Code of the Russian Federation | Temporary transfer to another job |

| Art. 182 Labor Code of the Russian Federation | Guarantees when transferring an employee to another lower-paid job |

| Art. 187 Labor Code of the Russian Federation | Guarantees and compensation for employees sent by the employer for vocational training or additional vocational education |

| Art. 173 Labor Code of the Russian Federation | Guarantees and compensations for employees combining work with higher education in bachelor's degree programs, specialty programs or master's programs, and employees entering training in these educational programs |

| Art. 174 Labor Code of the Russian Federation | Guarantees and compensations for employees combining work with obtaining secondary vocational education, and employees enrolling in educational programs of secondary vocational education |

| Art. 176 Labor Code of the Russian Federation | Guarantees and compensations for employees receiving basic general education or secondary general education through part-time and part-time education |

| Art. 127 Labor Code of the Russian Federation | Exercising the right to leave upon dismissal of an employee |

| Art. 178 Labor Code of the Russian Federation | Severance benefits |

| Art. 84 Labor Code of the Russian Federation | Dismissal in violation of the employment contract |

| Art. 318 Labor Code of the Russian Federation | State guarantees for an employee dismissed due to the liquidation of an organization or a reduction in the number or staff of the organization's employees |

| Art. 180 Labor Code of the Russian Federation | Guarantees and compensation for employees in the event of liquidation of an organization, reduction of the number or staff of employees of the organization |

| Art. 279 Labor Code of the Russian Federation | Guarantees to the head of the organization in case of termination of the employment contract |

| Art. 396 Labor Code of the Russian Federation | Execution of decisions on reinstatement |

For all these cases, a single calculation procedure has been established - based on a billing period of 12 calendar months and the amount of payments accrued for this period (Article 139 of the Labor Code of the Russian Federation). All accrued payments are taken into account in tax expenses.

Is it possible to take into account payments to employees for income tax purposes if the average salary was calculated according to the rules of a collective agreement or local regulatory act?

The Labor Code gives the employer the right to calculate average earnings based on a different calculation period. However, this does not give much freedom, since this should not worsen the situation of workers (paragraph 6 of Article 139 of the Labor Code of the Russian Federation).

What does this mean? This means that the amount of average earnings calculated on the basis of another billing period cannot be less than its amount calculated on the basis of a 12-month period. Therefore, the accountant will always have to do the calculation twice:

- based on a self-established billing period;

- based on a 12-month billing period.

From the results obtained, you will need to select the largest one, from which to calculate the average earnings. This will comply with the requirements of the Labor Code of the Russian Federation.

Thus, an organization has the right to take into account as expenses when calculating the tax base for corporate income tax, payments to employees accrued on the basis of the average salary, which is calculated according to the rules established in the collective agreement and (or) local regulations. But only if they do not contradict the norms of the Labor Code (letter of the Ministry of Finance of the Russian Federation dated January 25, 2021 No. 03-03-06/2/2557).

When absence from work is paid

In addition to accruals for time worked, in some cases the employee is entitled to pay for temporary absence from work. As a rule, in this case the average salary is paid. These paid absences include:

- regular, additional, educational leaves;

- days of incapacity;

- business trips;

- days of blood donation and additional days of rest for donors;

- absence due to the performance of state and public duties (participation in a trial, liquidation of an emergency, etc.).

The procedure for calculating average earnings for each situation is different. The calculation of average earnings for most situations is regulated by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. For sick leave, a special procedure is established by Federal Law dated December 29, 2006 No. 255-FZ.