Who submits the invoice journal

Only intermediary organizations are required to submit an invoice journal to the Federal Tax Service.

An exception is when an agreement has been reached between the counterparties not to issue invoices. In October 2021, the Russian Ministry of Finance, in letter dated October 31, 2016 No. 03-11-11/63683, provided clarification on the following issue. The seller and the agent using the simplified tax system agreed that they will not issue invoices. In this case, the agent buys goods for the individual principal. It turns out that invoices are not issued to the latter either. Will the agent violate the law if he neither maintains nor submits to the Federal Tax Service a journal of invoices regarding these commercial transactions?

The Ministry of Finance of the Russian Federation clarified that this will not be counted as a violation. When the buyer does not pay VAT, he and the seller can sign an agreement not to issue invoices. It turns out that since invoices are not issued, the agent is not required to maintain an invoice log regarding the procedures for purchasing goods for a given principal.

The obligation to keep a journal does not depend on whether you pay VAT. It is carried out by those who pay tax, are exempt from it, or are not payers at all.

Who should lead

From January 1, 2015, only intermediaries who act in the interests of third parties (customers) on their own behalf must keep a log of received and issued invoices.

As a rule, these are commission agents or agents (clause 1 of Article 990, clause 1 of Article 1005 of the Civil Code of the Russian Federation). The following are also considered intermediaries:

- forwarders who organize the performance of services with the involvement of third parties, but do not themselves participate in transportation (clause 1 of Article 801, Article 805 of the Civil Code of the Russian Federation);

- developers who organize construction with the involvement of contractors, but do not participate in the execution of contract work themselves.

The obligation to keep accounting records does not depend on the taxation system that the intermediary applies, nor on whether he is a VAT payer or a VAT tax agent.

This procedure follows from the provisions of paragraphs 3 and 3.1 of Article 169, paragraphs 5 and 5.1 of Article 174 of the Tax Code of the Russian Federation, paragraph 22 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33.

Situation: should retail trade organizations that sell goods as commission agents (agents) under intermediary agreements keep an invoice journal?

No, they shouldn't.

Firstly, retail trade organizations do not issue invoices when selling goods to the public (Clause 7, Article 168 of the Tax Code of the Russian Federation). Instead, buyers are issued cash receipts or strict reporting documents. In the intermediary reports that retailers prepare for principals, they include copies of either cash register tapes or receipts issued. Because of these workflow features, the intermediary simply will not have invoices that he could record in the accounting journal.

Secondly, customers purchasing goods at retail do not claim VAT for deduction. This means that there is no point in tax inspectors monitoring the correspondence between the amounts of deductions and the amounts that the committents (principals) accrue to the budget for such operations.

Thirdly, paragraph 3.1 of Article 169 of the Tax Code of the Russian Federation, which establishes the responsibilities for maintaining an accounting journal, refers to intermediaries issuing (receiving) invoices, and not any other documents. Intermediaries who do not issue invoices are not subject to the provisions of this paragraph.

From the above we can conclude: if a retail trade organization on its own behalf sells goods of third parties under intermediary agreements, such transactions do not need to be registered in the invoice journal. In relation to other intermediary activities, such organizations are not exempt from the obligation to keep a journal of invoices.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated January 30, 2015 No. 03-07-11/3488.

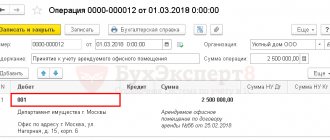

Sample of filling out the journal (the intermediary does not pay VAT)

The customer JSC Gamma-Sigma signed commission agreement No. 15 dated January 19 with Psi-Omega LLC, an intermediary who is not a VAT payer. The terms of the agreement are such that Psi-Omega sells a batch of 300 books, which belong to Gamma Sigma by right of ownership. A batch of goods costs 750,000 rubles (including VAT - 125,000 rubles).

As a remuneration for the services of the intermediary, an amount of 25,000 rubles is provided. On February 10, “Psi-omega” and JSC “Proizvodstvennaya” entered into an agreement for the supply of a batch of books (300 pieces). On February 20, the goods were shipped to the buyer, and at the same time Psi-Omega issued an invoice dated February 20, No. 28, to Kappa Lambda and gave a copy of it to Gamma Sigma.

In the accounting department of Psi-Omega, this document was registered in part 1 of the invoice journal; this invoice was not registered in the sales book.

For the amount of goods sold, Gamma-Sigma issued an invoice dated February 20, No. 128, to Psi-Omega. In the accounting department of Psi-Omega, this document was registered in part 2 of the invoice journal, in the Psi-Omega sales book. Omega" this invoice was not registered.

Since Psi Omega is not a VAT payer, it does not issue an invoice to Gamma Sigma for the amount of its remuneration.

Methods of management

You can keep a journal of invoices both on paper and in electronic form (clause 1 of Appendix 3 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). However, the journal can be submitted to the inspectorate as tax reporting only in electronic form via telecommunication channels (clause 5.2 of Article 174 of the Tax Code of the Russian Federation). Therefore, it is advisable for intermediaries who are not VAT payers and are not recognized as tax agents to immediately keep invoice logs in electronic format (approved by Order of the Federal Tax Service of Russia dated March 4, 2015 No. ММВ-7-6/93).

Other organizations (VAT payers or tax agents) can keep accounting journals on paper. But they will still have to transfer the data from these logs into VAT returns, which can be transmitted to the inspectorates only in electronic form through special operators (clauses 5–5.1 of Article 174 of the Tax Code of the Russian Federation).

Sample of filling out the journal (the intermediary is a VAT payer)

The customer Mu-upsilon JSC concluded a commission agreement dated June 2 with the intermediary Zeta-theta LLC, which pays VAT. Under the agreement, Zeta-Theta sells a batch of dictionaries (200 pieces) owned by Mu-Upsilon. The batch costs 320,000 rubles (including VAT - 53,333.33 rubles). The intermediary is provided with a remuneration of 16,500 rubles (including VAT - 2,750 rubles).

On June 15, Zeta-Theta entered into a supply agreement with Xi-omicron JSC for the supply of a batch of 200 dictionaries. Delivery took place on June 18. At the same time, Zeta Theta issued an invoice dated June 18, No. 812, to Xi-omicron, and a copy of it was given to Mu-upsilon. This document was registered in the Zeta-Theta accounting department in part 1 of the invoice journal, but not in the sales book.

For the amount of dictionaries sold, “Mu-upsilon” issued an invoice to “Zeta-theta” dated June 18, No. 375. The invoice received from “Mu-upsilon” was registered in the accounting department of “Zeta-theta” in part 2 of the invoice journal. invoices, but not in the purchase book.

Since “Zeta-theta” is a VAT payer, he issued an invoice to the customer dated June 18, No. 987, for the amount of his remuneration. This document is subject to registration in the sales book, but not in the invoice register.

Purchase book and sales book

From January 1, 2012, the form of the purchase book and sales book changed. The main changes are related to the appearance of the adjustment invoice.

An organization can prepare both books – both on paper and in electronic form. Additional sheets of the purchase books and sales books should also be compiled in one of these two ways, depending on how the book itself is maintained.

After the end of the quarter, before the 20th day of the next month, purchase and sales books compiled on paper must be certified with the personal signature of the head of the organization (an authorized person), laced, and their pages numbered and sealed with the organization’s seal.

The books compiled electronically for the quarter are certified by the electronic digital signature of the head of the organization or his authorized person. This only needs to be done when they are submitted to the tax authority.

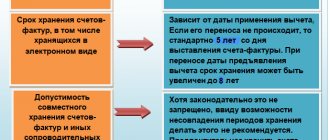

Purchase books and sales books, as well as additional sheets to them, must be kept for at least four full years from the date of the last entry.

Operation type codes

When cross-checking suppliers and buyers who participate in an intermediary transaction, inspectors pay attention to how correctly the transaction type codes are indicated. As you know, in accordance with the Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected], codes of types of VAT transactions must be indicated in the invoice journal. These are 24 codes that are included in one table.

The tax authorities also explained what values of codes and other details must be entered in the journal in order to reflect certain transactions of the intermediary. For example, if an intermediary sells goods belonging to the principal, then the invoice issued by the intermediary in the name of the buyer is reissued by the principal and is reflected in the sales book of the principal (principal) and in part 2 of the intermediary's journal. Also, KVO - 01 is entered in both parts of the journal.

Another situation is when an intermediary sells the principal’s goods and at the same time his own goods, that is, he is both a commission agent and a supplier. In this case, the intermediary issues an invoice for all goods - both those that belong to the consignor and his own. In this case, the intermediary is registered as the seller. This document under code KVO 15 must be registered both in the intermediary’s sales book and in part 1 of the intermediary’s journal. And in the buyer’s purchase book it is necessary to enter KVO 01.

Next, the consignor re-issues an invoice, where he enters only his goods. This invoice must be reflected under code 01 in the principal's sales book and under code 15 in part 2 of the intermediary's journal.

Let's look at an example:

The commission agent Tau-Iota LLC shipped 30 goods to the buyer Phi-Hi-Psi LLC, 22 of which are the property of the principal JSC Gimel-Yod and are sold under an intermediary agreement. Gimel-iodine products cost 264,000 rubles (including VAT - 44,000 rubles). The remaining 8 products belong to Tau-Iota and cost 178,000 rubles (including VAT - 29,666.67 rubles).

Tau-Iota LLC issued invoice No. 657 in the name of Phi-Hi-Psi LLC for a total amount of 442,000 rubles (264,000 + 178,000) indicating 20% VAT in the amount of 73,666.67 rubles (44,000 + 29,666.67). This invoice was registered by both Tau-Iota LLC and Phi Phi LLC.

Then Tau-Iota LLC transferred the figures of invoice No. 657 to Gimel-Yod JSC, and the accountant of Gimel-Yod JSC issued invoice No. 909 in the name of Tau-Yota in the amount of 264,000 rubles, including VAT. in the amount of 44,000 rubles. This document was registered with Gimel-Iod JSC and Tau-Iota LLC.

Let's look at another case - the intermediary makes purchases of goods for the consignor. Here the supplier issues an invoice in the name of the intermediary, and the intermediary enters it in part 2 of the journal. The supplier also registers it in the sales book. Next, the intermediary re-issues an invoice in the name of the principal, where he registers the actual supplier as the seller. This document must be registered both in the first part of the intermediary's journal and in the principal's purchase book. In all cases, the operation code is 01.

For example, the intermediary Nun-lamed LLC purchased goods from the supplier Kaf-he LLC. At the same time, part of the goods was purchased for the consignor JSC Zain-mem under an intermediary agreement. The cost of purchases for Zain-mem amounted to 609,000 rubles (including VAT - 101,500 rubles). “Nun-lamed” purchased the rest of the goods for himself. The cost of goods purchased for Nun-lamed amounted to 389,000 rubles (including VAT - 64,833.33 rubles).

"Kaf-he" issued invoice No. 1026 in the name of "Nun-lamed" in the amount of 998,000 rubles (609,000 + 389,000) indicating 20% VAT in the amount of 166,333.33 rubles (101,500 + 64,833.33 ). This document was registered with Kaf-he and Nun-lamed.

After this, Nun-lamed issued invoice No. 262 in the name of Zain-mem JSC. This document reflects goods in the amount of 609,000 rubles purchased from Kaf-he for Zain-mem JSC, and indicates VAT 20% on the amount of 101,500 rubles. Invoice No. 262 is registered with Nun-lamed and Zain-mem.

Why do you need a magazine?

This document can be attributed to methods of control over those organizations that do not submit value added tax declarations to the tax inspectorates (due to exemption in accordance with the law, or the absence of such an obligation in principle).

Based on the data taken from the accounting journal, tax authorities check whether the VAT indicated by intermediaries in the sale of inventory items corresponds to the tax amounts accepted by the purchasers of these goods and materials for deduction. And exactly the same in the opposite direction: do the amounts of deductions indicated by the principals for purchased goods and materials correspond to the VAT accrued by the sellers of these goods for tax payments.

The journal is maintained quarterly and reflects information on invoices issued during the three-month reporting period.

About consolidated invoices

In 2014, the Government of the Russian Federation allowed the preparation of so-called consolidated invoices - data is entered there when goods are purchased from several sellers at once. This reduces the number of invoices when processing transactions.

For example, the customer JSC Het-bet, in order to erect a structure, turns to the developer Omega-upsilon LLC. The latter, in turn, cooperates with several contractors and suppliers and reissues the invoices received from them to Het-bet.

In the first quarter, Omega-upsilon received invoice No. 743 dated July 27, 2020 from the supplier Shin-ain JSC, and invoice No. 219 dated July 27, 2020 from the contractor Sameh-pe JSC.

Based on these invoices, Omega Upsilon compiled a consolidated invoice and issued it to Het-bet JSC on July 27, 2021. Omega-upsilon registered the consolidated invoice issued to Het-bet and the invoices received from the performers in the invoice journal. Het-bet recorded the resulting consolidated invoice in Part 2 of the invoice journal.

The procedure for filling out an invoice, including consolidated and zero

To be registered with the tax authority, the invoice must contain this type of information:

- Serial number and date of compilation.

- The name of the seller (supplier), his address and identification numbers.

- Name of the buyer (customer), his address and identification numbers.

- Name of the shipper and consignee, his address.

- The name of the goods sold or description of the services provided, their unit of measurement.

- The number of goods sold or the volume of services provided.

- The currency of the document that is used when transferring funds.

- The price per unit of a product or service excluding tax.

- The full cost of goods sold and services provided.

- Tax rate.

- Tax amount.

- The full cost of goods and services provided, including the amount of tax.

- Country of origin of the goods and customs declaration number (only for imported goods).

Every accountant can fill out an invoice, but to do it correctly, you will need certain knowledge. The document form can be downloaded here.

The legislation provides for a new column “1a” to record the code of the type of goods

In 2021, the invoice is issued slightly differently than before:

- column “1a” has been added to the form for the code of the type of goods in accordance with the unified Product Nomenclature. It should be filled out only by those organizations that supply goods to the countries of the EAEU (members of the Eurasian Economic Union). In the absence of such goods, a dash is placed in this column;

- a column was added to the form for the signature of the authorized person signing the invoice for the individual entrepreneur. Previously, columns were provided only for signatures of persons signing for the manager or chief accountant. For more detailed information, you can refer to the Decree of the Government of the Russian Federation No. 981.

A sample for filling out an invoice is here.

Table: some nuances of preparing an invoice

| Data recorded in the document | Design characteristics |

| Unit code (indicated in column 2 of the form) | The code is taken from OKEI (all-Russian classifier of units of measurement). It is used by all entrepreneurs in the process of document execution. The classifier was approved by Decree of the State Standard of the Russian Federation No. 366. |

| Country of origin of goods (displayed in columns 10 and 10a) | This kind of information is needed by the tax service that controls the movement of imports. A special reference book specifies the country code. If the product was produced by the joint efforts of several countries, then the code of one of the European Union countries is indicated in column 10, and the common name (European Union) is indicated in column 10a. These columns are filled in for goods produced outside of Russia. |

| Address | Many citizens have questions related to this particular column of the invoice. As you know, an organization can have a legal and actual address. Legal is associated with the place of registration of the organization, actual speaks of its location. In line 2a it is necessary to indicate the address of legal entities recorded in the Unified State Register of Legal Entities (in the Unified State Register of Legal Entities), or the address of the place of residence of the individual entrepreneur entered in the Unified State Register of Individual Entrepreneurs (Unified State Register of Individual Entrepreneurs). |

| Document serial number | It must be end-to-end and increasing. |

More information about the rules for issuing an invoice can be found here.

In some cases, partial acceptance of the goods is allowed, for example, if the quality of the purchased product is inadequate. The rejected goods are returned to the supplier, who, in turn, issues an adjustment invoice for the reduced volume of goods supplied. In this situation, the buyer does not issue an invoice (if the goods are not accepted for registration). More on this below.

Table: features of zero and consolidated invoices

| Invoice name | When the need arises |

| Zero invoice | If an individual entrepreneur and a commercial organization are exempt from paying VAT, then, according to the Tax Code, there is no need to issue an invoice. However, it is not prohibited to issue invoices with a zero tax amount. If the buyer nevertheless asked to issue a zero invoice, then the column of the form in which the VAT rate is usually indicated is not filled out by the seller. A rate of 0% cannot be entered in the column, because this will mean that there is still a real rate. Otherwise, the rules for issuing a zero invoice are the same as for a regular invoice. |

| Summary invoice | Often the supplier uses the services of an intermediary to sell his goods. In this case, it is the intermediary who, when selling the goods to the buyer, issues an invoice on his own behalf. After this, he must provide the supplier with a sales report. Copies of invoices for shipped goods are attached to the report. Based on this report, the supplier issues his invoices for this sale, where he reflects himself as the seller. If the intermediary has more than one buyer, the supplier must create a separate document for each. For this purpose, a consolidated invoice is used so that the data is consolidated in one document. The details of consolidated invoices should include the following:

In this case, all goods sold (or services provided) are indicated in the general list. |

Invoice for provision of services

Invoices are used by accountants not only when selling goods or providing any work, but also when providing services. The same applies to rental services.

In this case, deviations from the general design rules are allowed, i.e.:

- there is no need to provide the name of the shipper and consignee (a dash is placed), since in this case no goods are shipped;

- when it is difficult to determine a specific unit of measurement for a service, it may not be specified. In this case, a dash is placed in the corresponding column. If a unit is nevertheless determined, its name should be taken from the OK 015–94 classifier;

- excise taxes on services in the Russian Federation are not established by law, therefore in the corresponding column there will be an entry: “Without excise tax”;

- data on goods imported from abroad are not filled in in the service document (a dash is placed).

The name of the service recorded in the invoice must correspond to that specified in the contract for its provision. A sample invoice for the provision of services is here.

In case of provision of services subject to VAT, an invoice is required.

Who has the right to sign an invoice?

The invoice must be signed and certified with the organization's seal. This responsibility lies with the manager and chief accountant of the organization supplying goods (or providing services). The invoice can also be signed by other people authorized by management. In this case, a corresponding power of attorney is issued (clause 6 of Article 169 of the Tax Code of the Russian Federation). A sample order is here. To certify a document, seals of separate departments and special seals “for invoices” can be used. The main requirement for them is that they must contain mandatory data.

Required data includes:

- TIN of the organization;

- full name of the organization in Russian;

- location of the organization (subject of the Russian Federation).

If the invoice is issued by an individual entrepreneur, the document is signed by him. The individual entrepreneur is required to indicate the details of the state registration certificate.

Acceptable and unacceptable errors when issuing invoices

During the process of filling out the document, various types of errors may occur. Some of them are considered minor (that is, they will not affect the amount of VAT deduction), while other errors may lead to the fact that the invoice will not be accepted by the tax service.

Serious errors include the following:

- Incorrect information about the buyer or seller that does not allow the entity to be identified. Marks do not raise any questions, but if the TIN and name are indicated incorrectly, such a document will not be accepted.

- Information that does not allow one to determine which products were sold or purchased (including indication of another product).

- It is impossible to determine the amount of production or prepayment. Often mistakes are made in indicating the currency in which payments are made between organizations or determining its code. Arithmetic errors in the general cost calculation are also unacceptable.

- Errors in determining the tax rate and amount. Such inaccuracies arise when the interest rate for a specific type of product is incorrectly indicated.

If invoices are prepared with serious errors, the tax office will not accept them for consideration.

Correction after passing

Intermediaries who do not pay VAT may have a question: if an organization submitted a journal and then found errors there, should it submit a corrected invoice journal to the Federal Tax Service? The answer here is the following: the law does not stipulate that the corrected journal must be submitted to the Federal Tax Service. However, it is better to do this. To make changes to the document, cancel the incorrect invoice. This means, indicate the cost of goods and the amount of tax with a “–” sign. Register the correct invoice with a “+” sign.

For example, an intermediary purchased goods for a customer. The intermediary's accounting department saw that the incorrect details of the invoice received from the seller were entered in the accounting journal for the second quarter. Indicated: No. 9769 dated March 9, 2021. Should be: No. 3131 dated February 18, 2021. Moreover, the journal is already in the inspection. Then the accountant canceled the incorrect entry in Part 1 of the journal and indicated the total indicators with a “–” sign. In the next line I entered the same as in the canceled line and corrected column 12 by indicating the correct invoice number. Cost indicators - indicated with a “+” sign.

In Part 2 of the journal, I canceled the incorrect entry and reflected the totals with a “–” sign. In the next line he indicated the same thing as in the canceled one, but corrected column 4, where he corrected the invoice number. Cost indicators are indicated with a “+” sign.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

When and by whom is an invoice issued?

When they talk about an invoice, they mean a special document that necessarily indicates information about the services that the organization provides, as well as about the goods that it sells.

The rules for issuing invoices are regulated at the legislative level by a number of acts:

- Tax Code of the Russian Federation;

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax”;

- Decree of the Government of the Russian Federation of August 19, 2021 No. 981 (regulates changes in design), the document can be found here.

An invoice is needed to confirm outgoing VAT when selling goods or providing services, as well as to write off incoming VAT when purchasing goods or services.

It is no secret that the price of a product includes value added tax (VAT). The buyer must always pay it. For legal entities and individuals, there is an opportunity provided by the state to obtain a VAT tax deduction. This option applies when large wholesale purchases are made.

An invoice may not be issued if the buyer is not a VAT payer. In this case, both parties to the purchase and sale transaction must sign a corresponding agreement.

If the seller is exempt from VAT (this possibility is provided for in Article 145 of the Tax Code of the Russian Federation), then he has the right to issue invoices without VAT. According to the law, companies or individual entrepreneurs can do this if they do not sell excisable goods. Similar actions are possible if their revenue for three consecutive months does not exceed 2 million rubles. Taxpayers must do the following:

- notify the Federal Tax Service (tax authority) of your intention not to pay VAT;

- apply the exemption for at least 12 consecutive calendar months, unless conditions for loss of the right to it are created;

- at the end of 12 calendar months, confirm to the Federal Tax Service that during this period they did not lose the right to exemption, and submit a notification about the extension of the goods for VAT exemption or waive this right.

The SF is issued by the supplier to the customer after the product (service) has been accepted. There are two ways to send this document:

- by mail;

- along with the shipped goods.

Table: types of invoices

| Name | Characteristic |

| Standard invoice | No later than five days after payment for the goods or services, it is issued by the supplier. A similar scheme applies if there is a need to return the goods to the supplier. |

| Advance invoice | Issued on account of future delivery if there has been an advance payment. It records the details of the payment document. |

Do not confuse an invoice and a delivery note.

A consignment note is documented evidence of the transfer of ownership of a particular product.

The delivery note has a number of differences from the invoice

The differences between these documents can be seen in the following:

- In the design. The invoice can be drawn up in free form, while the invoice must be filled out according to the model proposed by law.

- On purpose. Only the invoice is used to deduct VAT. The invoice serves as proof that the goods have been transferred to the customer.

- In filing claims against the supplier. The customer can make claims based on the invoice. An invoice is not used in this way.

- In the number of copies provided. The delivery note is signed in two copies (by the seller and the buyer), while the invoice is signed only by the seller.

In addition, an invoice is different from an invoice.

An invoice is a documented notification of payment for a product/service issued to the buyer by the seller.

If the contract involves a multiple-time service, for example, monthly throughout the year, the invoice can be issued both for a year and for each month as needed. The tabular part of the document must have the name of the position, its unit of measurement, quantity, price per unit and amount for each position. In addition, the invoice contains details according to which it is necessary to transfer funds to the contractor’s account.

The invoice does not concern VAT obligations, it is intended solely for creating a payment document

There are the following differences between an invoice and an invoice:

- the invoice does not concern VAT obligations;

- the terms for issuing an invoice are not defined (unless specific terms are specified in the contract);

- The invoice is not a strict reporting form provided by the Federal Tax Service.

Video: when an invoice is issued

https://youtube.com/watch?v=i9hRlFEEyVs

How to make changes to the log

The new version of clause 12 of the journal keeping rules contains instructions on how to make changes to the journal, including after the end of the tax period. An entry that needs correction does not need to be crossed out. Instead, two new entries should be made in the same period. The first is the “original”, that is, incorrect entry, with a negative value. The second is a corrected entry with a positive value.

When deleting an erroneously made entry from the journal, strikethrough is also not applied. In this case, it is enough to make exactly the same entry in the same period, but with a negative value.

An important detail: if the above corrections were made in a particular period after the VAT return for this period has already been submitted, the intermediary must submit a “clarification”.

What is new about the forms?

New forms of books differ from old ones by the presence of three columns:

- number and date of correction of the seller's invoice;

- number and date of the seller's adjustment invoice;

- number and date of correction of the seller's adjustment invoice.

Some of the graphs have been renamed. In the purchase book, the names of columns 6–12 have changed. Only column 6 has changed significantly. Now from its name it follows that the country of origin must be indicated in the form of a digital code.

But in the sales book, the names of columns 4–9 have changed slightly.

Innovation for intermediaries - VAT tax agents

A significant amendment has been made in relation to intermediaries - tax agents who sell goods, works or services on the territory of the Russian Federation that belong to foreign suppliers who are not registered with the Russian tax authorities (they are mentioned in paragraph 5 of Article 161 of the Tax Code of the Russian Federation). From October 2021, such withholding agents may not maintain a log (newly created clause 1(3) of the journal rules).

Please note: no exception is made for intermediaries - tax agents purchasing goods from a foreign supplier not registered with the Russian tax authorities. Such tax agents fill out a journal. At the same time, in columns 10 and 12 of part 1 they indicate information from the invoice drawn up by them in a single copy, and in column 4 of part 2 - the number and date of this invoice. As for column 11 of part 1 and column 9 of part 2 (TIN and KPP of the buyer and seller), they are not filled in (new edition of paragraph 7 and paragraph 11 of the journal keeping rules).

Correction of books

Resolution No. 1137 clarified the procedure for making corrections in the purchase book and sales book. The old rules were not clear on how they would be adjusted in situations where invoices were corrected in the same period in which they were recorded. Previously, it was required that the cancellation of an invoice be recorded on an additional sheet of the purchase ledger in the period in which the original invoice was recorded. The same procedure was established for changes made to the sales book.

Now additional sheets are issued if changes need to be made for past tax periods. Adjustments for the current period are made directly in the book, and not on an additional sheet. To do this, the cost and tax amount of the canceled invoice are entered with negative signs. Positive values are written for the registered invoice.

This is interesting

In the case of simultaneous reflection of several transactions in the invoice, several codes are indicated simultaneously through a separating sign.

Also, according to the old rules, it was not specified whether it is necessary to indicate on additional sheets information about canceled invoices with a negative sign. Now this requirement is contained in paragraph 5 of the Rules for filling out an additional sheet of the purchase book and paragraph 3 of the Rules for filling out an additional sheet of the sales book.

Previously, the question was not resolved in which tax period should a corrected invoice be registered in the purchase book: in the period of receipt of the original or corrected document? The Russian Ministry of Finance provided clarifications on this matter in a letter dated November 3, 2009 No. 03-07-09/53. The corrected invoice had to be recorded in the purchase ledger at the time it was received.

This requirement is now reflected in the new rules: corrected invoices, including adjustment ones, are recorded in the purchase ledger as the right to tax deductions arises.

If previously, in order to register a corrected invoice in the period when the original one was received, it was necessary to issue an additional sheet, now this cannot be done.

At the same time, the courts have repeatedly recognized that the right to a deduction does not depend on the period in which the invoice was corrected (resolutions of the FAS Volga District dated April 12, 2011 No. A55-14064/2009, FAS Moscow District dated June 8, 2011 No. KA-A40/7029-11). This issue remains controversial to this day.

Another controversial provision of the new procedure can be considered the requirement that invoices that do not comply with the established form and the rules for its completion are not registered in the purchase book. That is, the company will not be able to apply a VAT deduction on an invoice that is not drawn up in the prescribed form.

However, it is worth noting that the basis for refusal of a deduction can only be a violation of the requirements of clauses 5, 5.2, 6 of Article 169 of the Tax Code (clause 2 of Article 169 of the Tax Code of the Russian Federation). And the provision that the form of the invoice is established by the Government of the Russian Federation is contained in paragraph 8 of Article 169 of the Tax Code. In addition, there is no liability for violation of paragraph 3 of the Rules for maintaining a purchase ledger.

If you are not ready to argue with the tax authorities, register in the purchase book only those invoices that comply with the current form and the rules for filling it out.