Complex issues of calculating personal income tax when a participant leaves an LLC | IT company Simple solutions

When a business is at the initial stage, the founders of an LLC do not think about what tax consequences their withdrawal from the membership will entail. Let's look at these issues in detail.

In today's material we will focus on the issues of personal income tax, which the retiring participant will have to pay. We will consider the following situations: sale of his share in whole or in part to another participant or third party investor; exit from the LLC when the share becomes the property of the company itself.

How to become a member of an LLC

Let us say right away that the procedure for calculating and paying taxes arising from the alienation of a share is directly related to how exactly this share was acquired and subsequently alienated. Therefore, before moving on to the intricacies of taxation, you need to understand in more detail how an individual can become the owner of a share in an LLC, as well as the ways in which a share can be disposed of.

Let's start in order, with the acquisition. If we put aside such exotic methods as inheriting a share or receiving it through reorganization, then, by and large, there are only two possible ways to become a member of an LLC.

True, each of them has several branches. From the point of view of civil law, there is no big difference in how exactly the share was acquired. The scope of rights and obligations of a participant depends only on the size of the share.

But for tax purposes, the procedure for receiving a share is very important.

Capital contribution

So, the first option is to receive a share by contributing money (or other property) to the authorized capital of the organization. Note that this can happen not only during the creation (establishment) of an organization, but also subsequently, in relation to an already existing company.

After all, paragraph 2 of Art. 17 and art. 19 Federal Law of 08.02.

98 No. 14-FZ “On Limited Liability Companies” allows for an increase in the authorized capital of an already existing LLC both from contributions of participants and from contributions of third parties accepted into the company.

There is one important nuance here: in both cases, the company is not obliged to use everything received from participants (no matter old or new) to increase the authorized capital. In Art.

19 of the LLC Law directly states that in the case of additional contributions, the decision to amend the company’s charter in connection with an increase in the authorized capital and to determine the nominal value and size of the share, as well as to change the size of the shares of the company’s participants, is made by the general meeting (in companies consisting of one participant - them alone).

It is separately stipulated that the nominal value of the share can be determined by the general meeting (participant) either equal to the contribution made or at a level less than the value of the contribution.

Accordingly, in cases where the nominal value of the share is determined at a level lower than the value of the contribution, part of the money contributed by the participant will be used not to increase the authorized capital, but to other needs determined by the general meeting (decision of the sole participant).

But even in this case, the entire amount contributed by the participant is recognized as his contribution to the LLC, which directly follows from the wording of Art. 19 of the LLC Law. This point is very important, because...

in the future, when determining tax liabilities for amounts received upon sale of a share or exit from the LLC, the former participant will have the opportunity to reduce the tax base by these amounts.

Buying a share

The second way to get a share is to buy it. Not only one of the participants, but also the company itself can sell a share. The company has such an opportunity if the share of the withdrawing participant is transferred to it.

Either the entire share or part of it can be sold. For example, a participant who owns 100 percent of the share can sell part of his share to third parties. As a result, the number of LLC participants will increase. But, unlike the above-mentioned case of admitting a new participant to an LLC, the money for the share is received not by the LLC, but directly by the participant.

Regardless of who the seller is (participant or company), and regardless of the size of the share being sold, no special subtleties that could subsequently affect taxation arise when registering such transactions. It is only important for a new LLC participant not to lose documents confirming the actual payment of the share.

How to sell a share

Now, keeping in mind the two different ways of acquiring a share, let's move on to issues related to its alienation. Here the participant also has a choice. A member may sell his share to another member, or, if permitted by the company's articles of association, to any third party.

In addition, a participant can write an application to withdraw from the LLC and receive from the company the actual value of the share, which will be determined according to the accounting records of the LLC for the last reporting period preceding the one in which the application to withdraw was submitted.

In the first case, a share purchase and sale agreement is drawn up. Clause 4 art. 454 of the Civil Code of the Russian Federation directly allows its use in the implementation of property rights, a type of which is precisely a share in an LLC. This means that from the point of view of taxation we are talking about the sale of a share, or, in terms of Art. 38 and art. 39 of the Tax Code of the Russian Federation, implementation of property rights.

It is somewhat more difficult to qualify the essence of what is happening in the case when a participant leaves the LLC, giving his share to the company in exchange for part of its net assets. According to Art. 26 of the Law on LLC “a company participant has the right to leave the company by alienating a share to the company.”

As we can see, the legislator has established that upon leaving the company, the share belonging to the participant is alienated in favor of the company itself. Moreover, if we look at clause 2 of Art.

21 of the LLC Law, we will see that by the term “alienation” the legislator understands, among other things, the sale of a share.

Thus, in its legal essence, the alienation of a share upon exit from an LLC is completely identical to a purchase and sale transaction. After all, in this case there also occurs a compensated (in exchange for part of the net assets) transfer (from the participant to the LLC) of ownership of the property right (share). And in addition, the legislator directly calls what is happening alienation, a term equivalent to sale.

Member's personal taxes

Having understood the legal nuances of what is happening, you can move on to taxation issues. Here you need to pay attention to the following points.

Firstly, there is a provision in clause 17.2 of Art. 217 of the Tax Code of the Russian Federation, which makes it possible to completely exempt from taxation everything received by the taxpayer upon the sale of a share. But for this to happen, two conditions must be met.

First: the share in the LLC must be acquired by the participant after December 31, 2010. The method of acquisition (purchase, inheritance, establishment or joining an existing legal entity) does not matter in this case; all these methods are equivalent.

Second: at the time of sale, the participant must continuously own such a share for more than 5 years.

Please note that in this provision the legislator used the general term “implementation”. It is clear that the sale of a share falls under it without any problems.

What about the income upon exit? We have already come to the conclusion above that from the point of view of the Civil Code of the Russian Federation, this operation is identical to purchase and sale. From the point of view of the Tax Code of the Russian Federation, the situation is even simpler. After all, the definition of the term “implementation” is in Art.

39 of the Tax Code of the Russian Federation and it means the transfer of ownership rights on a paid basis. This is exactly what happens when leaving an LLC.

So the exemption provided for in paragraph 17.2 of Art. 217 of the Tax Code of the Russian Federation, applies equally both when selling a share to other LLC participants or third parties, and when leaving the LLC by transferring the share to the disposal of the company. Which, by the way, is confirmed by the Ministry of Finance (see letter dated 09/06/16 No. 03-04-05/52095). Additionally, when applying clause 17.2 of Art.

217 of the Tax Code of the Russian Federation, it must be taken into account that the exemption is applied without providing any documents on the value of the property contributed by the participant “at the entrance” and any other documents, because information on the date of acquisition of the share and the period of continuous ownership can be obtained directly from the Unified State Register of Legal Entities. Also, this exemption does not require the provision of a tax return (clause

4 tbsp. 229 of the Tax Code of the Russian Federation).

Secondly, those participants whose conditions of ownership of shares do not allow them to take advantage of the exemption on the basis of Art. 217 of the Tax Code of the Russian Federation (i.e. their share was acquired before December 31.

2010 inclusive, or after, but at the time of exit they continuously owned the share for less than 5 years), are entitled to a tax deduction according to the rules of paragraphs. 1 clause 1 art. 220 code. Moreover, in this provision, the legislator directly provided for both possible options for “getting rid of” a share: both sale and exit.

So there won’t be any tricks in this part. But they are sufficient in the remaining part related to the size of the deduction and the procedure for its application.

So, the main deduction option, according to paragraphs. 2 p. 2 art. 220 of the Tax Code of the Russian Federation, represents a reduction in the amount of income received upon the sale of a share (part thereof), or upon exit from an LLC, by the amount of actually incurred and documented expenses associated with its acquisition.

Here, the first thing you need to pay attention to is that not any expenses are taken into account, but only those directly named in Art. 220 Tax Code of the Russian Federation. In particular, such expenses include initial and subsequent contributions to the management company, as well as expenses for the acquisition of a share.

This means that only contributions to the authorized capital are taken into account (no matter whether they were made upon establishment or after), as well as the amounts indicated (and actually paid) in the application when joining an LLC or when increasing a share, as well as in the purchase agreement -sales.

Conversely, contributions to the property of the LLC that do not increase the authorized capital, which were made during the period of ownership of the share, are not taken into account.

It is important to remember that a decrease in income is possible only if there are documents confirming the costs of acquiring the share. If there are no such documents, the taxpayer has the right to apply a fixed deduction in the amount of income received as a result of termination of participation in the company, but not more than 250,000 rubles for the tax period.

Thus, if the amount that a participant receives upon parting with the LLC does not exceed 250,000 rubles, then there is no point in searching for documents confirming the costs of acquiring the share. After all, the entire amount of income will be exempt from personal income tax even without it.

Also, documents will not be needed if the actual costs of acquiring a share are less than 250,000 rubles.

But if the payment exceeds a quarter of a million, and the actual costs of acquiring it are higher, then you should worry about searching for supporting documents to further reduce the tax amount.

When and in what order should the actual value of the share be paid?

The standard period for payment of DSD is three months from the date of withdrawal of the participant from the company. In general, the exit date is the date the entry about the participant’s exit is made in the state register. If a participant is expelled from the society by a court decision, then the date of withdrawal is considered to be the date this decision comes into force.

The Charter may also provide for another period for payment: less or more than three months. Maximum - one year (clause 2 and clause 8 of Article 23 of Law No. 14-FZ).

Typically, DSD is paid in cash. In cash or by transfer to an account - the parties agree among themselves. Also, if the participant agrees, the company can issue the share in property.

If the company violates the terms, it is obliged to pay the former participant not only the amount of DSD, but also interest for the period of delay, taking into account the refinancing rate of the Central Bank of the Russian Federation (Article 395 of the Civil Code of the Russian Federation). At the beginning of October 2021, the current refinancing rate is 4.25% per annum. This means that for each day of delay the company will have to pay the participant 0.012% of the DSD amount (4.25% / 366 days).

Personal income tax from the share of the withdrawing participant, which was distributed among the others

Source: Glavbukh magazine

The share of the participant who leaves is distributed among those who remained in the society

Small businesses are usually registered as an LLC.

Of course, there may be one participant in a society, but, as a rule, the required amount of starting capital is formed by several people.

However, after some time, one of the partners may start his own business by writing a statement that he is leaving the society. In this case, the company is obliged to pay him the actual value of his share. This is recorded in paragraph 6.1 of Article 23 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as Law No. 14-FZ).

Let us note that the right for a participant to leave the LLC at his request must be recorded in the company’s charter. Otherwise, a person will not be able to voluntarily withdraw from the membership.

By decision of the general meeting of the company’s participants, the share of the withdrawing participant can be distributed among the remaining participants in proportion to their shares in the authorized capital (Part 2 of Article 24 of Law No. 14-FZ).

Financiers insist that tax must be withheld from remaining participants

For the fact that participants received an additional share, they do not pay anything to society. Therefore, the Russian Ministry of Finance believes that they have taxable income.

Let's consider the financiers' arguments in more detail.

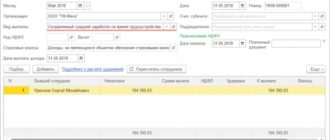

In order to calculate personal income tax, an organization must take into account all the taxpayer’s income received by him, both in cash and in kind (clause 1 of Article 210 of the Tax Code of the Russian Federation).

When a member of a company leaves it, he is paid the actual value of his share. How to determine it? According to the financial statements for the last period that preceded the time when the participant wrote a letter of resignation from the company.

According to financiers, the taxable income of the remaining participants is determined based on the actual value of the share of the departing participant.

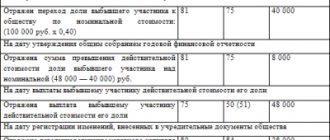

EXAMPLE 1

The founders of the company are Ivanov Fedorov and Pirogov. The share of the first two people is 30 percent of the authorized capital, Pirogov’s is 40 percent.

The authorized capital of the LLC is 500,000 rubles.

Pirogov decided to withdraw from the society. The value of the company's net assets for the last reporting period preceding the day when Pirogov submitted his resignation letter is equal to 10,000,000 rubles.

Thus, the actual value of Pirogov’s share is 4,000,000 rubles. (RUB 10,000,000 x 40%). The company distributed it between the two remaining participants: the shares of Ivanov and Fedorov increased by 20 percent.

According to financiers, this brought each remaining participant an income of 2,000,000 rubles. Accordingly, the tax from each must be withheld in the amount of 260,000 rubles. (RUB 2,000,000 x 13%).

Experts believe that there is no income for society participants

A company participant may at some point receive income subject to personal income tax. We are talking about dividends, income from the sale of the share itself, property during the liquidation of the company in excess of the contribution to the authorized capital.

Now let's turn to paragraph 8 of Article 23 of Law No. 14-FZ. It says here that the actual value of the share to the withdrawing participant is paid out of the difference between the value of the company’s net assets and the size of its authorized capital.

Thus, the value of the company's net assets is reduced by the amount that corresponds to the share of the withdrawing participant. At the same time, the part of net assets that corresponds to the shares of the remaining participants does not change. Therefore they do not receive any income.

EXAMPLE 2

Let's use the data from the previous example.

The difference between the value of the company's net assets and the size of its authorized capital is RUB 9,500,000. (10,000,000 – 500,000). Due to this difference, Pirogov was paid a share of 4,000,000 rubles. (RUB 10,000,000 x 40%).

Before this, the total value of net assets, which accounted for the shares of Ivanov and Fedorov, was 6,000,000 rubles. (RUB 10,000,000 x 60%), that is, RUB 3,000,000 each. to each.

After paying the share to Pirogov, the value of the company’s net assets decreased to 6,000,000 rubles. (10,000,000 – 4,000,000). But the shares of the remaining participants increased to 50 percent. This is again 3,000,000 rubles each. for everyone.

If you nevertheless dare to argue with officials, we will give you an argument that will help you defend your position and not withhold personal income tax from the remaining participants.

So. When calculating personal income tax, all income of the taxpayer that he received in cash or in kind is taken into account (clause 1 of article 210 of the Tax Code of the Russian Federation). What is considered income? This is an economic benefit that can be assessed and taken into account (Article 41 of the Tax Code of the Russian Federation).

Income in kind (this is how financiers evaluate the distribution of shares among the remaining participants in the company) is when a person received goods (work, services) or other property (clause 1 of Article 211 of the Tax Code of the Russian Federation).

As a result of the distribution of the share of a participant who left the company, the remaining participant receives property rights. But property rights and property are two different things!

Therefore, property rights cannot be attributed to the income that a person receives in kind. That is, there is no need to withhold personal income tax from the share of the withdrawing participant, which was distributed among the others.

Elena Nikolaeva,

senior lecturer of the Department of Internal Affairs of the Federal State Budgetary Educational Institution of Higher Education RGAU - Moscow Agricultural Academy named after K. A. Timiryazev

Source: https://otchetonline.ru/art/buh/47138-ndfl-s-doli-vyshedshego-uchastnika-kotoruyu-raspredelili-mezhdu-ostal-nymi.html