Basic rules for issuing accountable money

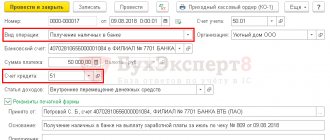

According to clause 6.3 of Directive 3210-U, the issuance of funds to an accountable person is registered with an expense cash order after he has previously drawn up a written application addressed to the head of the company or received an order from the manager on the need to issue the accountable amount.

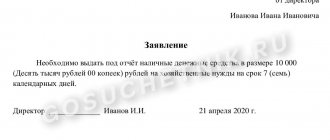

In the application, the reporting employee argues for the need to issue the amount with a mandatory indication of its size and the deadline for providing the money. After a certain time, the employee must submit an advance report attaching primary documents proving the expenses incurred. From November 30, 2020, the organization can independently set the deadline for the accountable person to submit the advance report. The previous requirement that the JSC must be submitted no later than 3 working days after the expiration date for which the reports were issued, or from the date of return to work, has been cancelled.

What else has changed in reporting and cash transactions since November 30, 2020, see here.

The balance of the unused amount is credited to the cash register on the basis of a cash receipt order, and excess funds spent are issued to the employee on the basis of an expenditure cash order.

ConsultantPlus experts explained in detail what to do if an employee has not returned the accountable amount. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

For the main points about accountable amounts, see the article “Settlements with accountable persons - regulatory documents.”

Recommendations for maintaining advance reporting

For business entities of all forms of ownership (except for budgetary organizations), a single form of advance report No. OA-1TEXT_LINKS has been developed. The first block of the form is filled out by the accountant. Here are indicated:

document details (number, date)- name of legal entity

- Full name of responsible employees receiving money

- amount of money issued

- amount of money spent

- account numbers confirming the movement of money

- information about refunds or overspending

In the next block, the accountant records the data that the report has been received for verification. The accountant tears off this part of the form and hands it to the reporting employee.

On the back of OA-1, information is entered by the accountant and the accountable citizen. The accountant enters the details and attaches checks, receipts and other documentation confirming the expenditure of money. The accountant writes the advance amount and invoices into the accounting system confirming the movement of funds.

Issuance for household needs: registration of correspondence on accounts

The issue for reporting purposes for business needs must be recorded by an accountant using a cash receipt order. The entire settlement mechanism involves the preparation of the following entries:

- Dt 71 Kt 50, 51 - accountable funds were issued from the cash register or by transfer from a current account to the employee’s bank card;

- Dt 10, 20, 26... Kt 71 - reflects the costs of the provided accountable amount aimed at purchasing materials, paying general production expenses, general business expenses, etc.;

- Dt 50, 51 Kt 71 - the balance of the unspent accountable amount is returned to the cash desk or to the current account;

- Dt 70 Kt 71 - the balance of the unspent accountable amount is withheld from the employee’s salary.

You can familiarize yourself with the analytical accounting of accountable amounts in the article “Maintaining analytical accounting of settlements with accountable persons.”

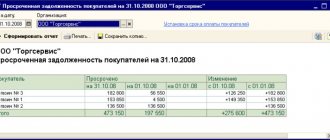

Transactions on settlements with accountable persons

Settlements between the employer and the accountable person include the following main transactions:

- issuing funds to the employee for expenses for the needs of the enterprise;

- recognition of expenses incurred by the employee;

- subsequent settlements with the employee.

Let's look at each of them in more detail.

Issuance of money on account

The first possible option for issuing accountable amounts is non-cash. In many cases, Russian employers file accounts by bank transfer, opening special card accounts in which accountable funds are placed.

To reflect such operations, as a rule, a separate sub-account is used on account 55. As soon as an employee withdraws the required amount from a special account, this fact is reflected in accounting by posting: Dt 71 Kt 55. If a regular current account is used (with a corporate card linked to it ), the wiring will be as follows: Dt 71 Kt 51.

The second option is to issue cash. This operation is shown by another posting: Dt 71 Kt 50.

In many cases, the employer gives the employee not cash, but monetary documents: for example, train or plane tickets. Such an operation is accounted for in a special subaccount under cash account 50: Dt 71 Kt 50.3.

Recognition of accountant's expenses

Inventory assets, non-current assets, works and services purchased by an accountable person for the needs of the company are registered. At the same time, their value is debited to one or another suitable account for accounting for assets, for example:

- 08 - if expenses related to the acquisition of fixed assets are made;

- 10 - if inventories are purchased;

- 41 - if goods are purchased.

The operation of capitalizing these assets will be reflected by posting Dt 08 (10, 41 or other active account) Kt 71.

More complex cases are also possible, in which additional entries are added to correspondence with account 71. For example, for account 60, which shows settlements with suppliers, as well as for tax accounts - 19, 68.

Despite the fact that in the general Chart of Accounts, approved. By Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94-n, accounts 71 and 60 do not correspond; nothing prevents you from securing the use of such correspondence in your working chart of accounts.

Example

The employee is instructed to pay in cash to the employer's counterparty for previously delivered goods. Let's agree that the counterparty and the employer pay VAT.

The accountant will record the following entries in the accounting:

- Dt 41 Kt 60 (reflects the cost of goods supplied excluding VAT);

- Dt 19 Kt 60 (VAT reflected on the cost of goods);

- Dt 68 (sub-account “VAT”) Kt 19 (VAT accepted for deduction);

- Dt 71 Kt 50 (the employee received cash to pay for goods to the supplier);

- Dt 60 Kt 71 (goods paid for by the employee, advance report submitted).

If the accountant did not buy anything for the needs of the company, but made certain reasonable expenses (for example, had lunch while on a business trip), such expenses, based on the expense report and the checks attached to it, are written off as production expenses: Dt 20 (26, 44 or other production account) Kt 71.

Nuances of reflecting accountable money in accounting

When reflecting transactions with accountable amounts in accounting, you must remember the following important points:

- The company must have an officially approved list of employees who have the right to receive funds on account.

- In order to correctly process settlements with accountable persons, an order must be issued that specifies the limit of accountable amounts and the procedure for their issuance and return.

- Advance reports drawn up with errors and corrections, as well as not supported by relevant expense documents, should not be accepted for accounting.

Check whether you are issuing money correctly on account and recording the calculation in accounting, using a Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

You can read more about these and other rules in the article “Procedure for issuing advances to accountable persons (nuances).”

Due date and responsibility

The period of time during which the accountant must give the accountant an advance report is determined by management before the money is transferred to the accountant. To do this, you should write a statement to the manager. In its text it is necessary to indicate:

- basis for issuing funds on account

- amount of money required to be issued

- advance report period

Within 3 days from the date indicated in the application, the citizen should report to the accounting department about the costs incurred. Sometimes money is given to the accountable for a long period of time (during vacation, sick leave, business trips). In this situation, the advance report must be sent to the accounting service within 3 days after starting work. Next, the document is checked and approved.

Video about the rules for filling out the report:

If the accountable person traveled outside the country, then the report must be submitted within 10 days after returning to the Russian Federation. In the absence of a report, cash discipline is violated. If tax inspectors discover this fact, penalties may be imposed on the company.

Results

Correct execution of advance reports and cash documents for the issuance and acceptance of accountable amounts guarantees competent accounting for account 71 “Settlements with accountable persons.”

The formation of transactions must be carried out in accordance with the chart of accounts current in the Russian Federation, and the mechanism for issuing and receiving accountable amounts - in accordance with the instructions of the Central Bank of the Russian Federation No. 3210-U. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Control and approval

To receive money, the employee will need to present the accountant with a statement signed by management. Based on the submitted document, the accounting department generates an expense cash order (RKO) or a payment slip to transfer a certain amount of money to a citizen. The allocated funds can only be spent on the needs of the organization: purchasing goods for work, paying for services, travel expenses, etc. Transferring the reporting amount to other citizens is prohibited by law.

Unspent funds are returned to the accountant and are issued with a cash receipt order. The form is certified by the signatures of the reporting employee, accountant and chief accountant after verification. It is then approved by management.

Purchase by bank transfer

For non-cash payments, the seller of fuels and lubricants (gas station) and the business entity enter into a purchase and sale agreement. In this case, postings are made according to the delivery note and invoice provided by the seller.

Accounting for refueling coupons is reflected in account 50 “Cashier”, subaccount 50-3 “Cash documents”.

The wiring should be like this:

- prepayment for coupons: D 60 (settlements with suppliers) – K 51 (current accounts);

- posting coupons: D 50-3 – K 60;

- transfer of coupons to drivers: D 71 – K 50-3;

- cost of fuel filled into tanks: D 10 (materials) – K 71;

- the amount of VAT presented by the seller: D 19 (VAT) – K 71;

- VAT refundable on purchased fuel: D 68 (tax calculations) – K 19.

Return to bank account

The need to independently return accountable amounts arises in situations where the organization does not provide for cash transactions. In this case, the manager is obliged to approve in the accounting policy or in a separate order the procedure for issuing accountable funds, their use and return.

If a banking organization charges a commission, whether to reimburse this type of expense or not is determined by the manager in the regulation on settlements with accountants or in a separate order.

If the institution does not have a cash register or there is no opportunity to deposit money, for example, an urgent business trip or long-term illness, then the employee can repay the debt on his own. To do this, he will need payment details. Particular attention should be paid to the purpose of the payment and the budget classification code.

The purpose of the payment is “return of unused accountable amounts.” Otherwise, the funds will go to uncleared payments or to the organization’s income, and this is wrong. The money must be received strictly as reimbursement of expenses.

The BCC for return to a budgetary institution depends on the purpose of the report:

- for daily allowance, accommodation (hotel) and travel (tickets) - 000000000000000000112;

- allocated for economic needs - 000000000000000000244;

- issued for the purchase of goods/works/services in the field of information and communication technologies - 000000000000000000242;

- for state duties - 000000000000000000852.

Formation of the Advance report form in 1C

The amount of the advance payment and the total amount for which the employee reported are displayed in the footer of the document:

- Advances issued —advance amount received from the Advances ;

- Expenses - the amount of accountable funds spent from the Products , Payment , Other ;

- Remaining/Overexpenditure - the difference between the amounts of the fields Advances issued and Expenses . The result can be in the form of: a negative amount - i.e. overspending if the amount is displayed with a minus sign;

- positive amount - i.e. the balance of funds with the accountant, which must be returned, for example, to the cashier. More details Return of unused accountable funds.

The purpose of the advance and the number of documents confirming the expenses of the accountant are also reflected in the footer of the document.

After employee Druzhnikov G.P. provided all the primary documents, from 1C you can print the Advance report form using the Print button - Advance report (AO-1). PDF

When purchasing materials, you can print a Receipt Order in form M-4 by clicking Print - Receipt Order (M-4). PDF

Printable forms can also be saved to your computer or sent via email.

Test yourself! Take the test:

- Test No. 52. Typical scheme for purchasing goods in wholesale trade in 1C

- Test No. 55. Purchasing materials with additional delivery costs