Translation of goods into materials and back in the program “1C: Enterprise Accounting 8”

Biryukov Sergey, head of consulting department — 01.02.2009

Attention: all examples are shown in the program “1C: Enterprise Accounting 8”, edition 1.6.

In the software product "1C: Enterprise Accounting 8" there are two ways to convert goods into materials and materials into goods. By translation we mean the transfer of a quantitative and total expression from CT account 10 to DT account 41 and, conversely, from CT account 41 to DT account 10. This need arises if an organization sells the same type of item that it uses in production . For example, an organization is engaged in the sale of boards and at the same time the production of any products from the boards. During the purchasing process, it is impossible to determine for sure how many boards need to be credited to account 10 and which to account 41, due to the fact that the needs of trade and production may vary, and therefore there is a need for adjustment. In the standard functionality there is no separate document for performing this operation, and therefore you need to proceed as follows:

1st method

This method is the most correct - in the current month, you should correct the documents for the receipt of materials/goods (the document “Receipt of goods and services”), correcting the accounting accounts in them retroactively. After this, the documents should be re-posted. This method can only be used in the current open month. If you need more materials, then you need to find the latest documents for the receipt of goods in the current month and change the accounting accounts to 10 and again re-post the documents. Thus, the goods will be capitalized as materials.

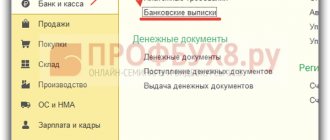

2nd method

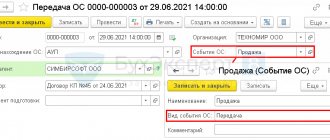

To convert goods into materials and vice versa, use the document “Movement of goods” (Warehouse → Movement of goods). On the “Products” tab, materials or goods are indicated. The sending and receiving warehouse is the same. In the column “account desp. (BU)" will indicate from which account the goods/materials are sent, and in the column "account received. (BU)” manually indicate the account to which you want to transfer the goods/material. Similar actions are performed for NU accounts.

Example: An organization moves goods into materials:

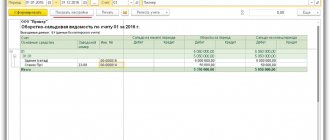

Postings are generated in BU and NU:

If the accounting policy of the enterprise establishes that the organization applies shipment without VAT and/or VAT with 0%, then there is also a movement through the accumulation register “VAT on inventory lots” using the resources “Account” and, if necessary, “Warehouse”, taking into account VAT on additional expenses, if any:

And in conclusion: Some consultants advise using the document “Request-invoice” for the above purposes, indicating in it instead of a cost account the account for the receipt of goods or materials (10 or 41). However, using the “Demand-invoice” document to move the quantitative-cumulative expression of a certain item from account to account, in our opinion, is irrational and may be associated with a number of certain inconveniences and inaccuracies, namely:

1. In the “Request-invoice” document, you can move only one type of product to the material and back. 2. If the organization applies shipment without VAT and/or VAT with 0%, then in the accumulation register “VAT by inventory lots” there is an expense for this item, which indicates that in the future the program will not keep records for the item tied to this item VAT amount. This will most likely cause errors in the implementation of this item when including VAT in the cost of this item, writing off VAT on expenses, etc.

Have fun and productive work!

Regulatory regulation

BOO. The legislation on accounting and PBU 5/01 does not provide for the translation of goods into materials. If an organization decides to use goods for production or business purposes, there is no need to transfer them to account 10 “Materials”.

An organization can write off goods directly from account 41 (Letter of the Ministry of Finance of the Russian Federation dated October 6, 2015 N 07-01-06/56934).

USN. Goods and materials are accepted as expenses for tax purposes under the simplified tax system in different ways.

The cost of goods is included in expenses when the following conditions are met:

- goods are accepted for accounting;

- payment for them was made to the supplier (clause 2 of article 346.17 of the Tax Code of the Russian Federation);

- the goods were sold to the buyer (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of the Russian Federation dated March 18, 2014 N ГД-4-3/ [email protected] ).

Material expenses are accepted for tax purposes when the following conditions are met:

- materials are accepted for accounting,

- payment has been made for them (clause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Since the re-qualification of goods into materials is not provided for by law, there is a risk that the tax authorities will consider it unlawful to recognize in expenses inventory items that were originally purchased as goods when the conditions for materials are met.

Receipt of goods

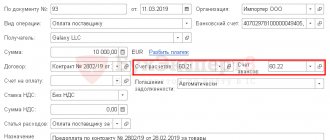

Reflect the receipt of goods with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipts (acts, invoices) - button Receipt - Goods (invoice).

Please indicate:

- Nomenclature - name of the product, selected from the Nomenclature directory;

- Accounting account - the account in which goods are recorded, in our example - 41.01 “Goods in warehouses”;

- Expenses (NU) - Accepted .

Register the invoice from the supplier using the Register .

Postings according to the document

The document generates transactions:

- Dt 60.01 Kt 60.02 - prepayment to the supplier is credited;

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

The document generates movements according to the Expenses register under the simplified tax system:

- registration record with the type Receipt and the status Not written off, not paid for the amount of acquisition costs;

- a registration record with the type Expense and the status Not written off, not paid for the amount of acquisition costs;

- a registration record with the type Receipt and the status Not written off for the amount of acquisition costs.

This status means that in order to recognize an expense, it is necessary to register in the program a document for the sale of goods to the buyer.

Transfer for sale to another type of asset is impossible - position of regulatory authorities

State financial authorities take an unambiguous position on the issue of transferring fixed assets into goods for sale - it is impossible. This opinion is based on the fact that PBU 6/01 does not provide for the transfer of fixed assets into goods, and writing off fixed assets from accounting is possible only upon their disposal. This position is also supported by judges (resolutions of the FAS of the Volga District dated November 13, 2012 No. A49-2601/2012, AS of the Volga District dated February 5, 2016 No. F06-5311/2015).

Therefore, from the point of view of regulatory authorities, an object originally acquired as a fixed asset must remain in this status until it is sold (or disposed of for other reasons). It follows from this that property tax must be paid on this object until the moment of its sale (disposal). This opinion is reflected, in particular, in the letter of the Ministry of Finance dated March 2, 2010 No. 03-05-05-01/04.

Accounting entries when transferring fixed assets into goods

Let us say right away that entries for the transfer of fixed assets into goods are not provided for in the Instructions for the use of the Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n. But here you can take advantage of the fact that both accounts involved (01 “Fixed assets” and 41 “Goods”) correspond with account 91 “Other income and expenses”. Then the postings for the situation when the OS becomes a product will be as follows:

Dt 01 (subaccount “Disposal of fixed assets”) Kt 01 - the initial cost of fixed assets is written off.

Dt 02 Kt 01 (subaccount “Disposal of fixed assets”) - the cost of accrued depreciation of fixed assets is written off.

Dt 91-2 Kt 01 (subaccount “Disposal of fixed assets”) - the residual value of fixed assets is written off.

Dt 41 Kt 91-1 - the fixed asset is accounted for as a product at its residual value.

IMPORTANT! When using non-standard postings, do not forget about the risk of imposing liability for incorrect reflection of business transactions on accounting accounts, provided for in Art. 120 Tax Code of the Russian Federation.

Results

The transfer of fixed assets into goods is not provided for by current regulations. From the point of view of the regulatory authorities, this operation does not comply with the law and is carried out solely for the purpose of understating the property tax base. On the other hand, the legislation does not contain a direct ban on this action.

If you want to make such a transfer, you need to prepare to defend your position in court. However, before converting a fixed asset into a commodity, evaluate the feasibility of this action. Thus, for objects with a useful life of less than 10 years, conversion to goods is simply unprofitable, since in this case more significant savings are achieved by including accrued depreciation in income tax costs.

If you can’t, but really want to... or how can you justify the translation?

Despite the principled position of tax authorities on this issue, organizations are still trying to optimize property taxes in this way. A taxpayer can try to convert fixed assets into goods only if he is prepared for the fact that he will have to defend his position in court. Let's consider what arguments can help in a dispute with tax authorities on this issue.

The taxpayer’s position here is based on the same PBU 6/01, which is also referred to by the tax authorities. Clause 4 of this regulatory act lists the conditions that allow an object to be classified as an OS. These conditions must be met simultaneously. One of these criteria is that the organization does not intend to resell the acquired object. Consequently, if such an intention has appeared, then the object no longer meets all the conditions for classification as fixed assets and can be transferred to another category of assets.

In this case, it is necessary to provide documents confirming the intention to implement the disputed object, namely:

- an order from the manager stating that there is no need to use this OS for the company’s core activities and the intention to sell it;

- documents that indicate the search for buyers: market research, sales announcements, agreements with intermediaries, etc.;

- if a potential buyer has already been found, then a preliminary agreement or correspondence with him.

If there are such grounds, arbitration courts take the side of the taxpayer. Examples are the resolutions of the Federal Antimonopoly Service of the North-Western District dated 04/16/2010 No. A56-26848/2009, and the Federal Antimonopoly Service of the West Siberian District dated 06.28.2011 No. A70-6665/2010.

IMPORTANT! Positive decisions in favor of taxpayers regarding the transfer of fixed assets into goods were made more actively in past years, but today’s trend, unfortunately, is the opposite.

Is it necessary to translate at all? An alternative view of the problem

The organization needs the transfer of fixed assets into goods, first of all, to save on property taxes. But in this case, the accrual of depreciation stops, i.e., the income tax base increases.

Example

The organization acquired a fixed asset with a useful life of 10 years and an initial cost of 120,000 rubles. The accounting policy for accounting and tax accounting purposes provides for a straight-line method of calculating depreciation.

Depreciation in the amount of 1000 rubles will be charged per month for this object.

(RUB 120,000 / (10 years × 12 months)).

The tax base for property tax for the first year of use will be: (120,000 + 119,000 + 118,000 + 117,000 + 116,000 + 115,000 + 114,000 + 113,000 + 112,000 + 111,000 + 110,000 + 109,000 + 108 000) / 13 = 114,000 rub.

Property tax for the year will be

NI = 114,000

× 2.2% = 2,508 rubles.

On the other hand, for the same period, depreciation in the amount of 12,000 rubles was accrued and included in expenses.

(1000 rubles × 12 months).

This led to a reduction in the amount of income tax: NP = 12,000 rubles.

× 20% = 2400 rub.

As can be seen from the example, the amounts of income tax savings and property tax costs in this case are almost the same.

If the useful life is less than 10 years, then the fixed assets will depreciate faster, and the transfer to goods will become unprofitable. But with long periods of use and relatively small monthly depreciation, the profit savings will be less than the cost of property tax. Therefore, in this case, it would be advisable to consider the option of transferring to goods.

IMPORTANT! If you decide that the transfer to goods is not profitable for you, then you should keep in mind that the tax authorities may not accept depreciation on unused fixed assets as expenses. Therefore, in this case, it will be necessary to have confirmation that, until the moment of sale, the OS was used for the main activities of the organization.

Fixed asset or product - when the difference becomes clear

The status of accounting objects and the rules for working with them are determined primarily by the relevant accounting provisions (PBU). According to PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance dated March 30, 2001 No. 26n, one of the criteria for classifying an object as a fixed asset (hereinafter referred to as fixed assets) is that the organization does not intend to use it in the future for resale (Clause 4 PBU 6/01).

On the contrary, in accordance with PBU 5/01 “Accounting for inventories”, approved by Order of the Ministry of Finance dated 06/09/2001 No. 44n, the main characteristic of goods is precisely their intended purpose for sale (clause 2 of PBU 5/01).

And the main distinguishing feature of a fixed asset is that this object can bring economic benefits to the organization for a long time (more than 12 months).

Thus, if we are talking about a newly acquired object of “long-term use,” then the question of which category it should be classified in comes down only to the presence or absence of the organization’s intention to resell it in the future.

But the intention can change. At the time of acquisition, the organization intended to use the facility for its activities, but then market conditions changed, the owners had other plans for business development, etc.

This means that this property needs to be sold. But the sale process may be delayed, and during the period of searching for buyers, the object will no longer be an asset that brings benefits to the organization. So why should it be considered a fixed asset and subject to property tax all this time?

Let's consider different views on this problem.