Every company has accountants who must maintain appropriate records for each financial transaction. All actions in the company must be documented.

Working with reports and papers requires not only attentiveness, but also careful handling of this documentation. The legislation of the Russian Federation establishes corresponding storage lines for a certain type of reporting. Therefore, it is strictly forbidden to destroy documents from the accounting department before the end of their validity period. What are the storage lines for this type of documentation? You can find all the necessary information on this topic in this article.

On storing payment orders in electronic form

It usually reflects:

- state of an account;

- cash flow on it for a specific period of time.

According to the provisions of Article 9 of the Law <О

- for preparing tax reporting;

- calculation and payment of tax;

- confirmation of income received and expenses incurred.

This rule fully applies to the storage of electronic documents between the bank and clients, including client-bank. However, there is also an order of the Ministry of Culture of Russia dated No. 558 with a List of standard management archival documents generated in the course of the activities of organizations, indicating storage periods. How long should LLC bank statements be kept according to it? Position 362 refers to the storage of “bank documents”. Duration – 5 years. Now you know how long bank statements are kept. This is a minimum of 5 years.

Why keep accounting documents?

All work of the accounting and office work departments in Russia is coordinated by the Federal Archive Agency (Rosarkhiv). The same department draws up guidelines for participants in the document flow system, creates rules for the movement and storage of accounting documents.

Responsibility for the condition of primary and other accounting and reporting documents is assigned to the responsible person from the accounting department. If there is a change of responsible persons, this is accompanied by the preparation of an appropriate acceptance certificate.

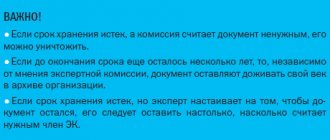

Many people wonder why the retention period for accounting documents in 2021 for a key number of positions is at least 5 years? Why can’t documents be destroyed at the end of the reporting period? The answer to this question is obvious: the documents mentioned above are needed not only for accounting and preparation of financial statements, but they are the basis for inspection by regulatory authorities, if necessary.

If at the time of the on-site inspection (and it can cover three calendar years preceding the year when the inspection is scheduled) the organization does not have the necessary documentation, then an administrative fine in the amount of 200 thousand to 300 thousand rubles will be imposed on the organization and the responsible person (Administrative Code RF, Article 13.25). To avoid such troubles, the storage period for accounting documents in the organization should be strictly observed.

How long does the bank keep statements?

Traditionally, the bank generates the requested statement in 2 copies. The first is issued to the client, and the second is stored in the archives of the credit institution.

At the same time, the bank keeps all statements that for one reason or another were not in demand by clients for 4 months. Then they draw up a corresponding act, and they go for destruction.

The bank keeps statements in its electronic data registers for the period of storage of bank statements - 5 years. Upon receipt of a written request from a client, they are found in the archive, printed and issued on paper.

ADVICE When signing an agreement for banking services, pay attention to the procedure for issuing bank statements in force at this credit institution. Please note that the bank client is responsible for receiving statements.

How long is an account statement kept?

According to Federal Law No. 395-1 “On the Activities of Banks” there are the following requirements:

- all calculations must be documented according to the standards of the Central Bank (Article 31);

- banks must keep information on all transactions for 5 years and provide them upon request (Article 40.1).

Example! Sidorov Vasily contacted Sberbank in February 2021 and requested an extract for May of the last five years: from 2014 to 2021. A Sberbank specialist refused to issue an extract for 2014 because more than 5 years had passed and it had been destroyed. For the remaining years, Vasily received a report on the account.

The accountant or the head of the company decides how long to keep the statement.

, taking into account the scope of activity. Some large companies choose to store information for 10 years or longer.

With the advent of Internet banking, storing information is simplified.

Account statement for entrepreneurs and organizations

A bank statement is generated on a daily basis for each account opened at a financial institution. This can be a current account through which the company conducts its business, making a profit and interacting with counterparties and suppliers, or an account opened for credit needs.

You can request a bank account statement at any time. It is formed for a certain period that is interesting to the customer. This certificate reflects the following information:

- about the receipt of funds;

- transfer of money in favor of third parties;

- bank commissions.

Bank statements can be requested when the responsible authorized person contacts the branch of the financial institution. Different companies require different times to prepare a certificate. This can take from a few minutes to 3 business days depending on the organization’s regulations.

Article on the topic: how to get an extract from a personal account in Sberbank

In addition, for enterprises that have cash settlement services in a specific bank, remote access to the current one is often provided through the client bank. In this service, you can generate such a document online, but it will not have legal force. To submit the certificate to the regulatory authorities, the seal and signature of an employee of the banking company is required.

What problems does the electronic archive solve?

Electronic archive is a successful business technology, since the implementation of this system within an organization allows you to solve a number of problems: putting the archive in full order according to given parameters, reducing the risks associated with various checks, and increasing the level of protection of bank documents, reducing the overall costs of doing business and improving workday efficiency.

Organization of structured storage

Often, before proceeding with the direct digitization of a bank archive, it is necessary to give it a clear coordinate system, that is, to restore order. What is it for? Structured storage will allow you to solve several problems at once. First of all, an organized system of (for now) paper documents will help facilitate searches in the physical archive in the event that the original on paper is needed. The manager or responsible person will always have an idea of how many documents related to one division or type of agreement are stored in his archive. In addition, when creating an electronic archive, having a clear structure will simplify and, therefore, speed up the process of implementing the system, since part of the structuring work has already been done at the preparatory stage.