14.08.2019

0

306

3 min.

A copy of the SZV-M form is filled out and issued upon dismissal of an employee. This is a mandatory document that the former employee receives along with 2-NDFL and a work book. The need for its preparation is provided for in Federal Law-27. Its main purpose is to inform the Pension Fund about the length of service of a particular person. The requirement applies not only to employees employed on a permanent basis, but also to those who temporarily performed duties under a civil contract.

As it was before

Until 2021, all insurers were required to issue all their employees with a copy of the reports submitted for them in the SZV-M form. Organizations and individual entrepreneurs were obliged to do this by paragraph 4 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.” It said that a copy of the SZV-M had to be given to employees within the deadline established for submitting the SZV-M. That is, employers were required to issue copies no later than the 10th day of the month following the reporting month.

In addition, previously some additional deadlines for issuing copies were previously provided for in certain cases (clause 4 of article 11 of the Federal Law of 01.04.96 No. 27-FZ):

- performers (contractors) - it was necessary to issue a copy of the SZV-M on the day of termination of the civil contract;

- for those who quit – on the day of dismissal;

- for those who retire - within 10 calendar days from the date when the employee submits an application that he requires documents to be submitted to the Pension Fund.

What period should be reflected in the statement?

The legislation does not have a separate provision regarding the procedure for filling out SZV-M upon dismissal. For what period to generate an extract - for the entire period of work (but not earlier than April 2021, when this reporting form was first introduced) or only for the last month, the employer decides. The most logical option seems to be the issuance of a document for the last months of work, information about which has not yet been transferred to the Pension Fund.

For example, when an employee was dismissed on 09/04/2020, the company has not yet reported in the SZV-M form for the past month - August (the deadline for submitting the document to the Pension Fund of Russia is the 15th day of the month following the reporting month), and September has not yet ended. Therefore, it is worth filling out and handing over 2 SZV-M forms to the resigning person - for August and September 2021.

Indirectly confirmed the position that information is presented only for the last reporting month, the Main Directorate - OPFR for Moscow and the Moscow Region in a letter dated 04/03/2018 No. B-4510-08/7361. Then, if necessary, the former employee will be able to request other information later - upon written request, the company will issue it within 5 days.

What were the difficulties?

The obligation to issue copies of SZV-M to employees and contractors caused many complaints among accountants. They were connected with the fact that many issues were simply not regulated by law, for example:

- it was not said which month a copy of the SZV-M should be given to resigning employees;

- it was not specified in what form exactly copies of the SZV-M should be given to employees (considering that they contain personal data of other employees);

- it did not explain how to confirm that employees had received copies. Do I need to take receipts with it?

We discussed these issues in detail in the article “Copy of SZV-M to employees and contractors: to issue or not?”

At the same time, we note that until 2021 there was no liability for failure to issue copies of SZV-M to employees. In this regard, many policyholders simply ignored the requirement to provide employees with copies of the SZV-M.

Now we’ll tell you what to do regarding issuing copies of SZV-M upon dismissal in 2021.

Penalty for failure to issue a certificate

Federal Law No. 27 did not provide for special liability for the employer for failure to issue SZV-M and SZV-Stazh certificates upon dismissal to an employee.

But it is noted that the provision of these papers is the responsibility of the head of the organization. This means that failure to issue SZV-M and SZV-Stazh is considered a violation of labor laws.

Employees of Rostrud note in private explanations that providing a subordinate with personalized accounting information upon dismissal corresponds to the norms of labor law. Therefore, an employer who did not issue these certificates to an employee upon termination of an employment contract with him may be held administratively liable.

Expert opinion

Irina Vasilyeva

Civil law expert

According to part one of Article No. 5.27 of the Code of Administrative Offenses of Russia, for violating labor legislation, a legal entity will have to pay a fine in the amount of 30,000 to 50,000 rubles.

Copies of SZV-M: what to do in 2021

The legislation was amended to paragraph 4 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ, which regulated the issue of issuing copies of SZV-M to employees. Let us explain the procedure for issuing copies of SZV-M to employees in 2021.

Copy of SZV-M upon request

In 2021, an organization or individual entrepreneur (policyholder) is obliged to issue to the insured persons copies of the SZV-M handed over for them no later than five calendar days from the date of its application. Thus, in 2021, policyholders are required to issue copies of SZV-M solely at the request of employees or contractors. There is no need to issue copies of monthly reports based on the results of each month.

But in what form should the request come from an employee or contractor? The law says nothing on this matter. In our opinion, in 2021, an employer can issue copies of SZV-M upon oral request to employees. However, in this case, it is not entirely clear how to ensure that the employer complies with the issuance deadlines?

To protect yourself, it may make sense to ask employees (contractors) for written applications to provide them with copies of SZV-M reports. Of course, there is no form for such an appeal. Its employees have the right to draw it up in any form. A sample employee appeal, in our opinion, may look like this:

Having received such a request, the policyholder will be obliged to provide the employee or contractor with a copy of the required SZV-M report no later than five calendar days from the date of the request. Accordingly, if the employee applied on January 18, 2021, then a copy must be issued no later than January 22, 2021.

An employee has the right to submit an application for a copy of SZV-M in 2021 at any time. And he is not obliged to explain why he needed such a copy.

Copies of SZV-M upon dismissal and for contractors

The provisions of paragraph 4 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ, in force in 2021, provide that the policyholder is obliged to issue copies of the SZV-M:

- on the day of dismissal of the employee;

- on the day of termination of a civil contract for which insurance premiums are calculated.

Note that in 2021, in paragraph 4 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ, there is no provision that employers are required to issue a copy of the SZV-M to employees retiring.

In 2021, copies of SZV-M must be issued on the day of dismissal or termination of a civil contract. No applications from employees or contractors are required for this.

How to fill out the SZV-Stazh correctly: step-by-step instructions

The SZV-Experience certificate upon dismissal of an employee is filled out in accordance with the procedure approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018.

The registration rules are given below:

- enter data in writing or using a computer;

- do not make corrections or blots;

- It is prohibited to tape over the lines of the form;

- Ballpoint pen paste can be any color other than green and red;

- the use of a corrector is excluded.

Information must be entered on the basis of the policyholder’s documents, the algorithm is:

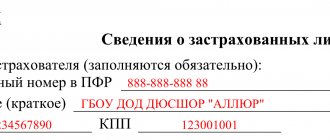

- in section No. 1, information about the policyholder is indicated: registration code in the Pension Fund, TIN, KPP, name);

- in the second section the reporting period (calendar year) is written;

- in the third section, a table of information about the periods of work of the resigning employee is filled out. Full name, SNILS number, periods of work, calculation of length of service must be indicated. It is not necessary to fill out column No. 14 “Information on the dismissal of the insured person”;

- Section No. 4 provides information on accrued (paid) insurance contributions to the Pension Fund;

- the fifth section indicates information about paid pension contributions in accordance with the early non-state pension agreement;

- At the end, the position, full name of the employer is given, his personal signature is placed, and the date the certificate was prepared.

An extract from SZV-Stazh is issued on the day of termination of the employment contract. The obligation to provide the form is provided for in Article No. 11 of Federal Law No. 27 of April 1, 1996.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

How to issue copies: procedure

Unfortunately, no innovations that would more clearly explain how exactly to issue copies of SZV-M to employees in 2021 have appeared in the legislation. In this regard, we consider it appropriate to remind you that an exact copy of the SZV-M with data on all employees of a company or individual entrepreneur cannot be issued to anyone. The fact is that the reports contain personal data (full name, SNILS and INN). This information is considered secret, which the policyholder has no right to disclose to other employees. This follows from Article 7 of the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data”.

In order not to violate anything, employees can be given extracts from the submitted reports, which will relate directly to the insured persons themselves. Such statements, as a rule, allow you to create many accounting programs necessary for submitting electronic reporting. Here is a sample extract from SZV-M, which can be issued to employees as copies of the report:

Issuing a receipt for receipt

You must receive confirmation of the issuance of SZV-M and SZV-Stazh to an employee upon dismissal. This is usually done by signing a second copy of the document, registering it in a journal, or drawing up a receipt. The last option is the most common. The receipt is written on A4 paper in free form. Usually the document is drawn up by hand.

Design rules:

- use a purple or blue ballpoint pen for writing;

- write correctly;

- refer to the legislation of the Russian Federation;

- put a personal signature and date;

- Do not correct the text by proofreading or crossing out.

An example of a receipt for receiving SZV-M is given below.

To the Director of Vector LLC

Kipreev D.I.

Sidorov Ivan Pavlovich

Confirmation

I, Sidorov Ivan Pavlovich, confirm that in accordance with Article No. 11 of Federal Law No. 27 dated April 1, 1996, upon termination of the employment contract, I received an extract from SZV-M from Vector LLC for the entire period of work at Vector LLC.

10/24/2019 (signature) I.P. Sidorov

Delivery confirmation

To confirm that the accounting department has issued the SZV-M form to an employee, it makes sense to take appropriate confirmation from the individual. Such a document can be drawn up in any form.

SAMPLE CONFIRMATION OF ISSUANCE OF FORM SZV-M TO AN EMPLOYEE

Also in 2021, there are other possible options for obtaining confirmation of receipt of copies, namely:

- the employee’s signature on the second copy of the SZV-M copy;

- maintaining a log of issuing copies of SZV-M.

Read more about this in the article: “Copy of SZV-M to employees and contractors: to issue or not?”

Sample of filling out the statement

In most cases, when submitting SZV-M electronically, work programs have a function for creating an extract from SZV-M for a specific employee. That is, the document can be generated using software. However, those who submit SZV-M reports in paper form or who for some reason do not have the opportunity to generate an extract in the program should use a sample when preparing it.

A working sample for filling out an extract from SZV-M manually can be downloaded from our website.

Why doesn't everyone issue statements monthly?

Despite the requirement established by Law No. 27-FZ to provide extracts from the information submitted to the Pension Fund at the same time as sending this information to the fund, in practice employers usually do not do this.

- For failure to issue such statements in the current manner, no penalties have yet been established for employers (except for cases where the provision of information is mandatory, for example, upon dismissal or retirement).

- Extracts are not requested by employees. For example, the employee is already aware that he worked in this organization for the past month. That is, an extract is sometimes needed to confirm the fact of work to a third party, and not to the employee himself.

You will need to draw up an extract from the SZV-M in cases where information about the employee’s work must be provided to third parties (for example, the Pension Fund for the purpose of granting a pension). The organization must retain confirmation of the issue of the extract. If you need to generate a statement manually, you can use the sample form on our website.

The employee got a part-time job

Question : Anna Kuznetsova got a part-time job on February 17, 2021. What must an employer indicate on the SZV-TD form?

Answer : In column 4 you need to indicate that Anna is a part-time worker. At the time she started a new job, all entries in her employment history were made by another employer. This means that “Vernisage” in the SZV-TD form for Anna must indicate information only about the February event - RECEPTION.

The reason for dismissal was indicated in free form

Question : Evgenia Mironova is a young specialist, she just came to work in the HR department instead of the previous specialist who retired. And the very next day at a new job, one of the employees decided to quit of his own free will. What should Evgeniya take into account when filling out the SZV-TD form?

Answer : Firstly, in columns 2 and 3 you need to indicate the date of the personnel event and its type - DISMISSAL. Secondly, it is very important to avoid arbitrary wording in column 6 so that problems do not arise later. The name of the reason for dismissal must coincide with the wording in the Labor Code of the Russian Federation. This means that instead of “At your own request” in column 6 you need to indicate “The employment contract was terminated at the initiative of the employee, paragraph 3 of part one of Article 77 of the Labor Code of the Russian Federation.”

Extracts from the document

Upon dismissal, the employee is given extracts from reports for the entire period of his work starting from April 2021 (the first reporting period on this form).

Since the report for the period in which the employee is dismissed will be submitted to the Pension Fund only next month, a separate report is prepared for the employee for the month of his dismissal.

The statements must contain information only about the dismissed employee. Including other persons or providing copies of full reports would be a violation of personal data.

Making a report

The reporting procedure may vary:

- The company has just opened, it does not have a hired director, but only the founder(s). In this case, there is no need to submit a report to the Pension Fund. When a director is hired on the basis of an employment agreement, the report is submitted with one employee, regardless of whether activities are in progress or not, i.e., the indicators on accrual of contributions may be zero.

- The company suspends operations and dismisses employees. If they are not present in the reporting period, then from that moment f. SZV-M is not for rent, because there are no insurance premiums. But until the contracts are terminated, for example, employees may be sent on leave without pay, f. SZV-M will have to be passed.

The sample form for filling out will also be different:

- In the absence of a hired director, it is considered that the founder is performing his duties, although an employment contract has not been concluded with him. The report is not submitted.

- An employment contract has been concluded with the founder until another person is hired, which means that a salary is accrued to him, which is subject to pension contributions. The report is submitted with one founder.

When an individual entrepreneur does not have employees in the reporting period, give him f. SZV-M is not needed.

Staffing has changed

Question : Tatyana Smirnova was hired on August 15, 2021. However, on March 10, 2021, the staffing table changed: Tatyana’s position and her structural unit are now called differently. What needs to be reflected in the SZV-TD form?

Answer : Since this is Tatyana’s first personnel event in 2021, the form should reflect the last entry from the work book as of January 1, 2020 (this is a hire dated August 15, 2021). Changes in job titles and department names must be formalized as a TRANSLATION.

Got it? Test yourself - answer 6 tricky questions from our experts.

Elena Kulakova, expert of Kontur.Externa

Confirmation of the employee's insurance record upon dismissal

When dismissing an employee, it is important to promptly and fully issue him the documents required by law. One of such documents are extracts from SVZ-M reports. Failure to provide them threatens the employer with serious consequences. However, avoiding troubles is not difficult - all you need to do is take a few simple steps.

One of the main elements of social protection of the population upon reaching a working age is pension payments. At the same time, the mere fact of reaching a certain age is not the basis for granting a pension. One of the essential conditions is the presence of the required insurance period, during which pension insurance payments were made to the employee.

The employee has improved his qualifications

Question : In December 2021, Vladimir Sidorov improved his qualifications, but he has not had any personnel events since the beginning of 2021. On July 10, 2021, he decided that he did not want to give up keeping paperwork and submitted a corresponding application. What needs to be indicated in the SZV-TD form?

Answer : In this case, in the SZV-TD form for July, you need to indicate the date of filing the application in the line “An application to continue maintaining the work book has been submitted.” The form also needs to reflect the assignment of a new qualification, since this information about Vladimir is being presented for the first time. To do this, fill out the line about the last personnel event as of January 1, 2021 and indicate ESTABLISHMENT (ASSIGNMENT) there. However, the Ministry of Labor explains that the SZV-TD needs to reflect only the qualifications assigned by the employer himself. This means that if Vladimir Sidorov had received additional education not at his place of work, then this information would not have been included in the SZV-TD report (Letter of the Ministry of Labor of Russia dated 03/05/2020 No. 14-0/10/B-1703).

An employee cannot carry out his activities by a court decision

Question : By a court verdict dated May 19, 2021, driver Ilya Ivanov was deprived of the right to engage in this type of activity for one and a half years. During the ban, the employer temporarily transferred him to another position. What needs to be reflected in the SZV-TD form?

Answer : Previously, the employer did not need to reflect a temporary transfer to another position; only the event (BAN TO OCCUPY A POSITION (TYPE OF ACTIVITY)) and the period of the ban were indicated. However, the Ministry of Labor recently issued clarifications (Letter of the Ministry of Labor of Russia dated 03/05/2020 No. 14-0/10/B-1704). So, now information about the ban on holding a position must be included in the SZV-TD only if the employee resigns (clause 4, part 1, article 84 of the Labor Code of the Russian Federation). That is, information about Ilya Ivanov does not need to be included in the SZV-TD form for May.