The storage periods for documents according to the nomenclature of files are the periods from their creation to disposal, approved by regulations. Vary from 3 to 75 years, and some types of records are retained indefinitely.

The nomenclature of cases in organizations allows you to systematize all the cases that have accumulated in the process of work. When compiling it, it is necessary to be guided by various regulations. Let's consider what the list of cases includes for 2021 with new storage periods.

The definition of the concept of “nomenclature of files” is contained in paragraph 3.4.1 of the “Basic rules for the work of archives of organizations”, approved by the decision of the board of Rosarkhiv dated 02/06/2002. This is defined as a systematic list of the names of cases opened in the organization, indicating the period of their content.

The storage period for documents in the organization is 2020-2021.

According to Art. Law “On Archival Affairs” No. 125-FZ of October 22, 2004, the safety of archival documents must be ensured within the time limits established by laws and other regulations, as well as lists of standard documents approved by Rosarkhiv and various federal departments.

Order of the Federal Archive No. 236 dated December 20, 2019 introduced new retention periods for most management, personnel, accounting, tax and other documents from February 18, 2020. The previously valid Order of the Ministry of Culture No. 558 dated August 25, 2010 has lost force and is no longer applicable. Also, some storage periods for documentation are established by the Tax Code of the Russian Federation, the Accounting Law No. 402 of December 6, 2011, and other regulatory documents.

The new periods for storing documents in the archive apply regardless of the legal form of the company, and they also apply to individual entrepreneurs. Subjects can ensure the safety of documentation on their own, or with the help of a specialized archival organization, which is especially important for large volumes of documents.

We present the current storage periods for a number of basic documents generated in the course of enterprise activities.

Formation rules

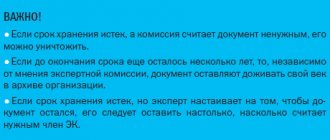

The inventory of affairs is created simultaneously with the formation of a new economic entity, that is, the nomenclature of affairs must be developed and approved along with the creation of the institution. The approved document is subject to annual analysis, that is, if necessary, the institution adjusts the current list of cases and applies the already amended order from the new year.

All outdated forms of affairs that will not be used in the new year should not be rushed to be excluded from the inventory. Check whether the retention periods for this category of forms, files and forms are met. If a specific form has been abolished, but its shelf life for the list of cases in the organization has not yet expired, then do not exclude this form from the inventory.

Add new case and documentation forms to the inventory only if they are planned to be used in the new reporting period. There is no need to register forms just for show.

We also note that it is impossible to simply copy a standard or approximate list of cases submitted by higher ministries and departments. Why? A typical or approximate list of cases cannot take into account the individual characteristics of a particular institution. Let us recall that despite the similarity of subordinate institutions in types and activities, significant differences in structure, staffing levels and legal aspects are inevitable. That is why it is necessary to “refine” the standard standard for the inventory of cases, adding individual forms and eliminating unnecessary cases.

Storage periods for accounting documents - table

Failure to comply with the storage deadlines for accounting and primary documents can result in significant fines for the company, since a document destroyed before the deadline cannot be provided to inspectors in the event of a tax audit.

We present the storage periods for primary documents in the table along with the periods for accounting documentation.

New storage periods for accounting documents. Table 1

| Document | Storage period for accounting documents in an organization | Base |

| Accounting policies and other documents on the organization and maintenance of accounting | Minimum 5 years after the year in which they were last used for accounting purposes | Law No. 402 of December 6, 2011, Part 2 of Art. 29 |

| Accounting registers (general ledger, journals/orders, turnover sheets, registers, cards, transaction journals, etc.) | 5 years (subject to an audit), but not less than 5 years after the reporting year | Law No. 402 of December 6, 2011, Part 1 of Art. 29; List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 276 |

| Accounting (balance sheets, financial statements, reports on intended use, appendices to them) and audit reports on it | Annual - constantly Intermediate – 5 years (permanently – in the absence of annual reporting) | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 268, 286 |

| “Primary” and related supporting documents (cash, bank documents, acceptance certificates and write-offs of property, materials, advance reports, invoices, correspondence) | 5 years (subject to an audit), but not less than 5 years after the reporting year | Law No. 402 of December 6, 2011, Part 1 of Art. 29; List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 277 |

| Waybills | 5 years In the absence of other documents confirming harmful and dangerous working conditions: 50/75 years (75 years - completed with office work before 01/01/2003; 50 years - after 01/01/2003) | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 553 |

| Documents confirming receipt of salary, financial assistance, fees, benefits, etc. (pay slips, payslips) | 6 years In the absence of personal accounts – 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 295, 298 |

| Documents on the payment of benefits, sick leave, financial assistance (applications, lists of employees, conclusions, extracts from protocols, correspondence) | 5 years | |

| Documents on inventory of assets and liabilities | 5 years subject to audit | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 321, 322 |

| Inventory lists of liquidation commissions | Constantly | |

| Documents on revaluation, determination of depreciation, write-off of fixed assets and intangible assets | 5 years after disposal of fixed assets and intangible assets | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 323 |

| GPC agreements with individuals, acceptance certificates for works and services | 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 12, 29, 301 |

| Documents for agreements, agreements, contracts | 5 years | |

| Foundation agreements of the organization | Constantly | |

| Documents on currency transactions carried out in the Russian Federation | Minimum 3 years from the date of the relevant currency transaction, but not earlier than the date of execution of the agreement | Law No. 173-FZ of December 10, 2003, clause 2, part 2, art. 24 |

Sphere of purpose

The key purpose of the nomenclature of files is to systematize document flow within one subject - an institution. That is, the direct purpose of the nomenclature is to group all documentation to facilitate accounting, search, storage of papers, certificates, etc.

The need for the document is due to the solution of the following tasks:

- simplification of classification, accounting and organization of storage of business and personnel documentation;

- reducing the time spent searching for the required form or file in general office work;

- facilitating the process of transferring cases, compiling inventories of forms;

- ensuring a systematic approach to the preservation and destruction of documentation.

Please note that approval of the sample (nomenclature of organization affairs 2020) is mandatory for all state and municipal institutions. In addition to public sector organizations, all companies that submit documentation to state archives are required to maintain nomenclature. For example, non-state firms in terms of reporting and office work on exploited state property.

Tax accounting and reporting: document retention period

The table below reflects the deadlines that apply to taxpayers and tax agents, as well as to payers of insurance premiums.

Reference table with new storage periods for tax accounting documents. table 2

| Document | Shelf life | Base |

| Documents required for the calculation and payment of taxes, incl. confirming the amounts of income/expenses and payment of taxes by taxpayers and tax agents | Minimum 4 years | Tax Code of the Russian Federation, paragraphs. 8 clause 1 art. 23, pp. 5 paragraph 3 art. 24 |

| Tax returns, calculations for all taxes | 5 years IP declarations earlier than 2003 – 75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 310 |

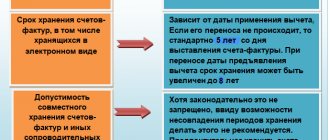

| Invoices | 5 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 317 |

| Logs of received/issued invoices (paper and electronic) | Minimum 4 years from last entry date | Government Decree No. 1137 of December 26, 2011, Appendix No. 3, clause 13 |

| Purchase/sale books (paper and electronic) | Minimum 4 years from last entry date | Government Decree No. 1137 of December 26, 2011, Appendix No. 4, paragraph; Appendix No. 5, paragraph 22 |

| Documents on personal income tax (calculations, messages about the impossibility of withholding, tax registers), certificates of income and tax amounts for individuals | 5 years 50/75 years – in the absence of personal accounts or salary statements | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 311,312 |

| Documents confirming expenses for employee training, for the employee to undergo an independent qualification assessment (for income tax) | During the validity period of the relevant contract and 1 year of the employee’s work, but not less than 4 years | Tax Code of the Russian Federation, clause 3, art. 264, paragraph 4 of Art. 283 |

| Documents confirming the amount of loss incurred (for income tax) | During the entire period of reduction of the tax base of the current period by the amounts of previously received losses | |

| Documents confirming the amount of the loss incurred and the amount by which the tax base was reduced for each tax period (according to the simplified tax system, unified agricultural tax) | During the entire period of use of the right to reduce the tax base by the amount of the loss | Tax Code of the Russian Federation, clause 7, art. 346.18, paragraph 5 of Art. 346.6 |

| Documents required for calculation and payment of insurance premiums | 6 years | Tax Code of the Russian Federation, clause 3.4 art. 23 |

| Calculations for insurance premiums | 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 308, 309 |

| Cards for individual accounting of amounts of payments and accruals of insurance premiums | 6 years 50/75 years – in the absence of personal accounts or payroll records | |

| 4-FSS calculations accepted by the FSS of the Russian Federation in electronic form, incl. receipts | Minimum 5 years from the date of acceptance of the calculation by the Fund | Order of the FSS of the Russian Federation dated February 12, 2010 No. 19, clause 6.2, 6.3 |

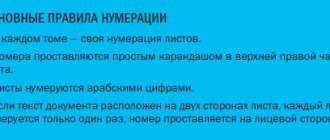

PROCEDURE FOR WORKING WITH THE NOMENCLATURE OF CASES

The 2015 rules divide all organizations into two categories: those that are sources of acquisition of state (municipal) archives, and those that are not. The requirements for the nomenclature of cases of the former, as you might guess, are stricter (Table 1).

1Clause 4.18 of the 2015 Rules.

The form of the nomenclature of cases is given in Appendix No. 25 to the 2015 Rules. It is the same for all organizations (Table 2).

We will present the algorithm for working with the nomenclature of cases step by step in a flowchart and consider in detail each of the stages:

Personnel: document storage periods 2021 - table

Maintaining personnel records is mandatory for all employers, including individual entrepreneurs. Only micro-enterprises have the right to refuse to draw up some local acts, provided that the issues regulated by them will be included in employment contracts with employees (Article 309.2 of the Labor Code of the Russian Federation). But otherwise, the personnel document flow is the same for everyone.

For most HR documents in 2020-2021. Very long storage periods are established, and the employer must often provide appropriate conditions for their safety, because they contain personal data of employees.

Storage periods for personnel documents. Table 3

| Document | Shelf life | Base |

| Documents on personnel, except for those for which a different storage period is established | 50/75 years | Law “On Archival Affairs” No. 125-FZ of October 22, 2004, Art. 22.1 |

| Personal files, personal cards of managers and employees | 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 435, 444, 445 |

| Employment contracts, service contracts, additional agreements to them | 50/75 years | |

| Orders and documents related to the application of disciplinary sanctions | 3 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 454 |

| Documents on the processing of personal data | Constantly | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 440, 441 |

| Consent to the processing of personal data | 3 years after expiration of the consent or its revocation (the contract may provide otherwise) | |

| Personal documents in the original (work books, diplomas, certificates, certificates) | On demand by employees Unclaimed documents are stored for 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 449 |

| Information about work activity and work experience | 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 450 |

| Staffing table | Constantly | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 40 |

| Time sheets (schedules), working time logs | 5 years 50/75 years – under harmful and dangerous working conditions | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 402 |

| Vacation schedules | 3 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 453 |

| Trip reports | 5 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 452 |

| Sick leave certificates and their registration logs | 5 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 618, 619 |

| Orders, instructions and documents thereto | By core activity - constantly On administrative and economic issues – 5 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 19 |

| Orders, instructions for personnel and documents for them | 50/75 years - on admission, transfer, combination, part-time, dismissal, remuneration, advanced training, leave - to care for children, without pay 5 years - on annual and educational leaves, business trips (in the presence of harmful, dangerous working conditions - 50/75 years), on service inspections | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 434 |

| Job descriptions (regulations) | Typical – 3 years after replacement with new ones Workers' instructions – 50/75 years | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 442, 443 |

| Reports on industrial accidents (with investigation materials), accident logs | 45 years | Labor Code of the Russian Federation, art. 230, 230.1 |

| Internal labor regulations | 1 year after replacement with new ones | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 381 |

| Collective agreements | Constantly | List of Rosarkhiv, approved. By Order No. 236 of December 20, 2019, Art. 386 |

New fines for violating documentation storage rules

From October 26, 2021, amendments to Art. 13.20 Code of Administrative Offenses of the Russian Federation. Law No. 341-FZ of October 15, 2020 significantly tightened the punishment for violating the rules of storage, as well as recording, compiling and using archival documents. Now, violators of the document retention period in 2021, the tables of which are given above, face the following fines:

- for citizens 1 – 3 thousand rubles. (or warning);

- for officials – 3 – 5 thousand rubles;

- for an organization – 5 – 10 thousand rubles.

Let us recall that before amendments were made to the Code of Administrative Offenses of the Russian Federation, fines ranged from 100 to 300 rubles. for citizens and 300 - 500 rubles. for officials and for legal entities no sanction was provided at all.

How to switch to a new nomenclature: step-by-step instructions

In the organization's case file, only those items that refer to the 2010 List should be updated. To do this, you need to reconcile the nomenclature and update it.

- Compare the 2021 List with the 2010 List. Note the new thematic subheadings, categories and sets of documents.

- Check headings and shelf life. Please indicate new articles. To account for changes, you should use a working copy of the case list. It will become the basis for the development of a new nomenclature for 2021 (or changes to its original version) and for preparation for the approval of the nomenclature of cases for the next 2021.

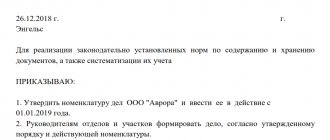

- An order will be required to cancel the old and introduce a new nomenclature, as well as a draft consolidated nomenclature of cases. It should be agreed upon with the heads of structural units and the expert commission of the organization.

For convenience, the approved list of cases can be divided into sections and each of them can be transferred to the appropriate structural unit of the organization.