Income statement

The need to submit a report to the Federal Tax Service and its form are established by three regulations:

- clause 1 art. 14 of the Law of December 6, 2011 N 402-FZ;

- section V PBU 4/99;

- By order of the Ministry of Finance of the Russian Federation dated July 2, 2010 N 66n.

The classification of profits and losses in the report is based on PBU 9/99 and PBU 10/99 and divides them into other and from ordinary activities.

In general, the form specified in Appendix 1 to the said Order is applied.

When filling out the form in 2021, you should be very careful because... for individual errors that lead to significant misrepresentation of information, liability may follow under Part 1 of Art. 15.11 Code of Administrative Offenses of the Russian Federation.

The report can be divided into three parts:

- header part (contains basic information about the organization, reporting period, date of preparation of the report);

- main part (table containing sum values characterizing the result of financial and economic activities for the corresponding period of time, including the line “Other”);

- the final part (contains the signature of the head of the organization and the date of the report).

Line 2460 of the income statement and its interpretation

Line 2460 may include, but is not limited to, the following information:

- about sanctions applied to the enterprise for various violations;

- deferred tax asset (written off in Dt 99);

- deferred tax liabilities (written off in Kt 99);

- amount of differences from the recalculation of deferred tax assets and deferred tax liabilities as a result of fluctuations in the income tax rate;

- the amount of accrued trade tax, etc.

Definition

Other 2460 - these are other indicators that influence the amount of net profit of the organization:

- taxes paid when applying special tax regimes,

- penalties and fines,

- income tax surcharges,

- written off deferred tax assets,

- overpayments of income tax,

- written off deferred tax liabilities

If this value in the reporting is without brackets, then it is entered into the anfin.ru services as is.

If the value is in brackets, then it is entered into the anfin.ru services with a minus.

If the values for net profit do not ultimately converge, it means that the signs in the original statements are mixed up.

Accounting information reflected in line 2460

The corresponding indicator of the considered line of the report is taken from the analytical accounting information for account 99 in terms of the above information.

The indicator in the “Other” line is equal to the value obtained by subtracting from the value of turnover under Dt 99 (in terms of fines, written off deferred tax assets) the value of turnover in Kt 99 (in terms of written off deferred tax liabilities).

If the debit indicator exceeds the credit turnover, the corresponding value is included in the report surrounded by parentheses.

If the difference between credit and debit turnover is positive, then the value is indicated in line 2460 without parentheses.

If the enterprise filling out this report form is a “special regime” and is not a payer of income tax, then in the line under consideration it reflects the amount of the corresponding tax paid under such a special regime (for example, simplified tax system or UTII).

Line 2460 "Other"

This line reflects information about other indicators not mentioned above that affect the amount of the organization’s net profit (clause 23 of PBU 4/99). If necessary, the organization can enter several additional lines into the Financial Results Report, naming and coding them independently.

What data can be reflected in line 2460 “Other”

Line 2460 “Other” of the Income Statement may reflect, for example:

— taxes paid by organizations applying special tax regimes, gambling tax (Letters of the Ministry of Finance of Russia dated 08/18/2004 N 07-05-14/215, dated 06/25/2008 N 07-05-09/3);

— penalties paid by organizations for violations of tax and other legislation (clause 83 of the Regulations on accounting and financial reporting, Instructions for the use of the Chart of Accounts, Letter of the Ministry of Finance of Russia dated February 15, 2006 N 07-05-06/31);

— additional charges (amounts to be reduced) for income tax for previous tax periods in connection with the identification of insignificant errors (clause 14 PBU 22/2010, clause 22 PBU 18/02, Letter of the Ministry of Finance of Russia dated 08/23/2004 N 07-05- 14/219, dated December 10, 2004 N 07-05-14/328);

- the amount of deferred tax assets written off to the debit of account 99 “Profits and losses” (clause 17 of PBU 18/02, Instructions for using the Chart of Accounts);

- the amount of deferred tax liabilities written off on credit to account 99 (clause 18 of PBU 18/02, Instructions for using the Chart of Accounts);

— differences arising as a result of recalculation of deferred tax assets and deferred tax liabilities in connection with changes in the tax rate for corporate income tax (paragraph 4, paragraph 14, paragraph 3, paragraph 15 of PBU 18/02).

Accounting data used when filling out line 2460 “Other”

The value of the indicator on line 2460 “Other” (for the reporting period) is determined on the basis of analytical accounting data for account 99 in terms of the payments listed above, adjustments to income tax and written off deferred tax assets and liabilities.

Line 2460 “Other” of the Statement of Financial Results = Turnover on the debit of account 99 in terms of taxes paid when applying tax special regimes, gambling tax, fines, additional charges for income tax, written off deferred tax assets - Turnover on the credit of account 99 in part income tax to be reduced, deferred tax liabilities written off.

If, in the above transactions, the debit turnover on account 99 exceeds the credit turnover, then the indicator on line 2460 is given in parentheses.

The indicator for line 2460 “Other” (for the same reporting period of the previous year) is transferred from the Statement of Financial Results for this reporting period.

Example of filling out line 2460 “Other”

Indicators for account 99 regarding fines based on the results of a tax audit in accounting (there are no other similar mandatory payments):

rub.

| Turnover for the reporting period (2014) | Sum |

| 1 | 2 |

| 1. On the debit of account 99 in terms of fines based on the results of a tax audit | 135 000 |

Fragment of the Financial Results Report for 2013

| Explanations | Indicator name | Code | For 2013 | For 2012 |

| 1 | 2 | 3 | 4 | 5 |

| Other | 2460 | (15) | (79) |

Solution

The amount of sanctions for violation of tax legislation, to be reflected in the “Other” line, is 135 thousand rubles.

A fragment of the Income Statement in the example will look like this.

| Explanations | Indicator name | Code | For 2014 | For 2013 |

| 1 | 2 | 3 | 4 | 5 |

| Other | 2460 | (135) | (15) |

What is an income statement

This is a form included in the financial statements along with the balance sheet and its annexes. The report form was approved by Order of the Ministry of Finance dated 07/02/10 No. 66n (hereinafter referred to as Order No. 66n).

IMPORTANT. The income statement format is not recommended. Using it is an obligation, not a right of organizations. But the company can set the level of detail itself. For example, decipher what business expenses consist of and enter an additional line “Including” for this.

By the way, previously this form was called “profit and loss statement” and “form No. 2”. The modern name was introduced more than six years ago, but some accountants, auditors and other specialists still use the old name.

Net profit

Owners of enterprise property use various criteria to determine the effectiveness of the existence of the corresponding company.

The main indicator of the success of an organization’s activities is net profit, which is the balance of funds after excluding the following expenses from gross revenue:

- cost of products or services;

- tax payments.

This is the formula for calculating the described indicator, reflected in line 2400 of the financial results statement, which is an integral part of the company’s accounting records.

It should be emphasized that the financial result of the enterprise’s activities, which is net profit, remains with the organization and can be directed to:

- payment of dividends to the company's shareholders or distribution among the company's participants;

- replenishment of working capital;

- enterprise development;

- other needs at the discretion of business owners.

It should also be taken into account that net profit is not subject to any additional taxes, and therefore it can be completely spent on certain purposes.

Where are Forms 2 of the financial results statement?

There is a form designed for all organizations (let's call it the general form). It is given in Appendix No. 1 to Order No. 66n. The filling rules given below apply specifically to the general form of the financial results report (using the active link you can download form 2 of the financial results report).

Small businesses can use a special simplified form. It is given in Appendix No. 5 to Order No. 66n.

Fill out your income statement and other financial statements for free

REFERENCE. The financial results report for 2021 and later periods will need to be submitted using an updated form. Amendments to the current form were made by order of the Ministry of Finance dated April 19, 2019 No. 61n. The changes are related to the new edition of PBU 18/02 (see “Instructions for the new edition of PBU 18/02 “Accounting for corporate income tax calculations”, which must be applied from 2021”). Organizations may wish to apply the updated form earlier.

Prepare, check and submit financial statements to the Federal Tax Service via the Internet Submit for free

How to fill out an income statement

The purpose of filling out is to show how the totals were calculated:

- Gross profit (loss);

- profit (loss) from sales;

- profit (loss) before tax;

- Net income (loss).

Each final value is obtained by adding or subtracting intermediate values. For example, to find gross profit, you first need to take two intermediate indicators: revenue and cost of sales. Then subtract the second from the first.

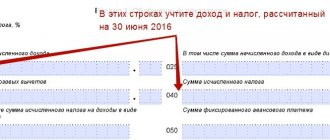

IMPORTANT. Intermediate values that participate in calculations with a minus sign (that is, are subtracted) must be indicated in parentheses. Some indicators are always in parentheses: business expenses, interest payable, etc. But there are also those that can be either in brackets or without them. This is a change in deferred tax assets (DTA) and a change in deferred tax liabilities (DTL).

All lines have an “Explanation” column. It contains the number of explanations that disclose information on this line. If, for example, information about revenue is summarized in a certificate with number 15, then before the line “Revenue” you need to put “15”.

ATTENTION. Previously, financial statements could be filled out in both thousands and millions of rubles. But, starting with reporting for 2021, there is only one option left - in thousands of rubles. These amendments to order No. 66n were made by order of the Ministry of Finance dated 04/19/19 No. 61n.

Maintain accounting and tax records for free in the web service

How profit/loss is calculated

In the balance sheet, line 1370 is allocated to reflect retained earnings (uncovered losses). It indicates the amount of profit minus mandatory payments (in particular, tax), and most often the amount of profit on the balance sheet is not identical to the resulting result for the general financial position, since balance sheet profit includes not only the value for the reporting period, but also the amounts received over the entire period of operation of the company. In the OFR, the amount of profit for one reporting period is calculated.

In accounting, the amount of net profit (NP) is formed by final entries on credit to the account. 84 from the debit of the account. 99, and net loss (NL) - by reverse posting: D/t 99 K/t 84. The main criterion for the correct calculation of the amount of profit is the identity of the calculated amount in accounting with the resulting total of the financial contribution.

Example of filling out a financial results report (sample)

In 2021, the trading organization's performance was as follows:

- revenue 12,000,000 rub. (including VAT 20% - RUB 2,000,000);

- purchase price of goods is 6,000,000 rubles. (including VAT 20% - RUB 1,000,000);

- commercial expenses (for warehousing goods and staff salaries) - RUB 1,500,000;

- interest payable (for using a bank loan) - 500,000 rubles;

- current income tax - 600,000 rubles.

The company did not apply PBU 18/02 and did not form ONA, ONO, PNA and PNO.

The accountant found the totals.

Gross profit - 5,000,000 rubles ((12,000,000 - 2,000,000) - (6,000,000 - 1,000,000)).

Profit from sales - 3,500,000 rubles (5,000,000 - 1,500,000).

Profit before tax - 3,000,000 rubles (3,500,000 - 500,000).

Net profit - 2,400,000 rubles (3,000,000 - 600,000).

The accountant filled out the financial results report as shown in Table 2.

table 2

Report on financial results of a trading company for 2021 (thousand rubles)

| Explanations | Indicator name | For 2021 |

| Revenue | 10 000 | |

| Cost of sales | (5 000) | |

| Gross profit (loss) | 5 000 | |

| Business expenses | (1 500) | |

| Administrative expenses | ||

| Profit (loss) from sales | 3 500 | |

| Income from participation in other organizations | ||

| Interest receivable | ||

| Percentage to be paid | (500) | |

| Other income | ||

| other expenses | ||

| Profit (loss) before tax | 3 000 | |

| Current income tax | (600) | |

| incl. permanent tax liabilities (assets) | ||

| Change in deferred tax liabilities | ||

| Change in deferred tax assets | ||

| Other | ||

| Net income (loss) | 2 400 |

Table 3

The relationship between the balance sheet and the income statement

| Balance indicator | Income statement indicator | Note |

| Line “Retained earnings (uncovered loss) (1370) The difference between the column “As of December 31 of the previous year” and the column “At the end of the reporting period” | Line “Net profit (loss)” (2400) Value at the end of the reporting period | Equal if there were no turnovers on account 84 in the reporting period (not counting balance sheet reformation) |

| Line “Deferred tax assets” (1180) The difference between the column “As of December 31 of the previous year” and the column “At the end of the reporting period” | Line “Change in deferred tax assets” (2450) Value at the end of the reporting period | Equal if SHE and IT are shown expanded in the balance sheet |

| Line “Deferred tax liabilities” (1420) The difference between the column “As of December 31 of the previous year” and the column “At the end of the reporting period” | Line “Change in deferred tax liabilities” (2430) Value at the end of the reporting period | Equal if SHE and IT are shown expanded in the balance sheet |

Fill out and print your balance sheet using the current form for free

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Usually a positive factor

If the indicator decreases

Usually a negative factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- Change in deferred tax liabilities 2430 Definition Change in deferred tax liabilities 2430 is a change in the amount of deferred tax liabilities reflected in the balance sheet on line 1420 (what are deferred tax liabilities). That is…

- Change in deferred tax assets 2450 Definition Change in deferred tax assets 2450 is a change in the value of deferred tax assets reflected in the balance sheet on line 1180 (what are deferred tax assets). That is…

- including: permanent tax liabilities (assets) 2421 Definition including: permanent tax liabilities (assets) 2421 is the balance of permanent tax liabilities (assets). In other words, this is a certain value that either increases or decreases payments...

- Deferred tax liability 1420 Definition Deferred tax liability 1420 is a liability in the form of a portion of deferred income taxes that will result in an increase in income taxes in one or...

- Deferred tax assets 1180 Definition Deferred tax assets 1180 are an asset that will reduce income taxes in future periods, thereby increasing after-tax profits. The presence of such an asset...

- Retained earnings (uncovered loss) 1370 Definition Retained earnings (uncovered loss) 1370 is the amount of retained earnings or uncovered loss of an organization. It is equal to the amount of net profit (net loss) of the reporting period, i.e....

- Intangible assets 1110 Definition Intangible assets 1110 are: works of science, literature and art; programs for electronic computers; inventions; utility models; breeding achievements; production secrets (know-how); commodity...

- Other liabilities 1450 Definition Other liabilities 1450 are other liabilities of the organization, the maturity of which exceeds 12 months, which are not included in other groups of the 4th section of the balance sheet. Their presence...

- Current income tax 2410 Definition Current income tax 2410 is the amount of income tax generated according to tax accounting data for the reporting (tax) period Calculation formula (according to reporting) Line...

- BALANCE 1600 Definition BALANCE 1600 is the sum of indicators on lines 1100 and 1200, that is, the sum of non-current and current assets. These are all the assets that a company uses...

How to present

Until recently, companies could choose in what form to submit their financial statements: on paper or via the Internet.

But as of reporting for 2021, there is only one way left - to submit the balance sheet and other forms via the Internet (via telecommunication channels through an electronic document management operator).

An exception is made only for small businesses. At the end of 2021, they can submit reports, including financial results, on paper. But based on the results of 2020 and later periods, general rules will apply to them. Such changes were made to the Accounting Law by Federal Law No. 444-FZ dated November 28, 2018.