The net assets (NA) of a company are a basic indicator that characterizes the overall welfare of the company, and also shows the potential value of everything that the company has. Having a correct idea of the size of a company’s NAV is also important for a potential investor, since the higher the value of the indicator, the greater the income from investing in such a company can be. That is why it is important to remember a number of essential points that will help you avoid making mistakes when calculating your net assets.

Determination of net assets

The regulations for calculating the net asset indicator are given in the Order of the Ministry of Finance dated August 28, 2014 No. 84n. The legal act specifies that the amount of net assets subject to regular analysis is reflected in the financial statements. The calculated value is taken from line 1600 of the balance sheet; it must be adjusted downward by the amount:

- current liabilities of the company;

- outstanding debt of the founders for contributions to the authorized capital at the time of drawing up the report;

- In the form for calculating net assets with a minus sign, data on future income, expressed in the form of gratuitously received assistance, is entered.

Results

, any organization, be it a JSC or an LLC, faces a situation where it is necessary to determine the cost of the asset Companies must constantly monitor the current value of this indicator in order to prevent a crisis situation in the enterprise, the most negative consequence of which could be its liquidation. You should also know the current value of net assets when paying dividends or when paying a participant who decides to leave the company the value of his share in the organization. Therefore, you need to remember that all the necessary basis for calculating net assets as of the current date can be obtained by preparing interim financial statements at the end of the previous month. In addition, the correct calculation of the amount of net assets is important for the investor.

For this purpose, it is advisable for the organization to draw up the most detailed and transparent certificate calculating the value of such a company indicator. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation form structure

The concept of net assets covers the entire range of property involved in turnover in the process of core business, the source of payment for which was:

- own funds;

- borrowed resources with a long repayment period.

Law No. 14-FZ dated 02/08/198 approved the norm for including in annual reporting information on net assets, the nature of their changes and the reasons for negative trends (if any). To do this, a form for calculating the net asset value is first filled out. The results of settlement operations can be demanded by internal and external users:

- owners and management of the company;

- credit structures when assessing the client’s solvency;

- potential investors when deciding on financing a business project;

- insurance companies at the stage of determining the risk factor under the insurance contract.

There are no legal requirements for the execution of calculation and analytical procedures for the structure of assets and liabilities. The form for calculating net assets (2020) can be drawn up on the basis of the template proposed in Order of the Ministry of Finance No. 10n and FCSM No. 03-6/pz, dated January 29, 2003. The regulatory document has lost its relevance, but the sample document given in it can be used by entities management.

The calculation form template must contain the following information:

- the procedure for distributing assets into homogeneous groups;

- grouping diagram of balance sheet liability indicators;

- the value of each cost parameter;

- the form for net assets must necessarily reflect the total amounts for each group of funds and the overall valuation of the entire complex of resources.

The content and formulas used in the analysis process are approved by Order No. 84n dated August 28, 2014. The result should be guided by the rule that the amount of assets exceeds the size of the authorized capital. If this control ratio is violated, it is necessary to take emergency measures to improve the financial position of the company - increase the estimated value of assets or reduce the amount of capital shown in the statements. The value of working capital can be influenced by revaluation or contributions from the founders.

If you find an error, please select a piece of text and press Ctrl+Enter.

Formula for calculating the indicator

To calculate, you need to find the difference between assets and liabilities. That is, the difference between the company’s property and existing obligations is determined. The assets combine:

- Real estate owned by the structure.

- Land.

- Income from activities.

- Various property, including equipment, tools, furniture, office equipment.

The assets do not include receivables of the founders for contributions to the management company. Liabilities are the company’s debts: short-term and long-term liabilities, various loans, collections. They do not include income from subsequent periods received in connection with state assistance or gratuitous acquisition of property.

So, the following formula is used for calculation:

(line 1600 – charger) – (line 1400 + line 1500 – DBP)

The formula uses the following definitions:

- ZU – debt of the founders for contributions to the management company.

- DBP – income of the following periods in the form of government assistance or gratuitous acquisition of property.

All relevant lines are taken from the balance sheet.

Analysis of calculation results

There are three net asset values obtained as a result of calculations:

- Negative. Indicates the predominance of liabilities over income. That is, the company's activities are not commercially successful. The organization is completely financially dependent on creditors. She has no own funds.

- Positive. Indicates a positive increase in funds. That is, the company fully covers all its debts and also has its own funds.

- Zero. Indicates that the company is breaking even, but does not bring any profit.

Negative calculation results indicate a high risk of bankruptcy of the organization.

How to get a certificate

As noted above, there is no official form of such documentation in the regulatory framework. For this reason, the corresponding form should be approved by the company management independently. The details specified in the Law of December 6, 2011 No. 402-FZ may not be taken into account in such a certificate, because Such a certificate is not a primary accounting document.

Here are the details that, in our opinion, should be reflected in such a certificate:

- the date on which the document was generated;

- reference to lines of financial statements containing relevant information;

- information by groups of assets or for each asset (if necessary);

- summary information (if necessary);

- signatures of responsible persons (for example, accountant, chief accountant, financial director, general director).

Why do you need a certificate?

Enterprises must comply with the law's requirement that net assets exceed their authorized capital. If this is not the case, net assets need to be increased. If this is not done, then after the expiration of periods specified by law, forced liquidation is possible.

The data obtained on the basis of the certificate will allow you to:

- carry out timely intervention in the financial condition of the enterprise;

- achieve the correct ratio of net assets and authorized capital.

What is reflected in the certificate of book value of assets

Why and who needs such a certificate?

It is not mandatory for preparation when submitting financial statements. There is simply no form approved by current legislation. A certificate of the book value of an organization's assets provides data on its non-current and current assets. The certificate shows their value. It is of interest to third-party users of financial statements who need information about the financial position, capabilities and solvency of the company. For example, for credit institutions (banks), insurance companies.

The assets of an enterprise are all its property. They can act as a source of profit for the organization when conducting business activities, that is, they can be converted into cash. The assets of a company are also called the left side of the balance sheet.

If you need to use the new balance sheet form, you can download it on our website in the article “Filling out Balance Sheet Form 1”

They are divided into 2 groups: non-current and current assets. Non-current assets include property (fixed assets) and non-property (intangible) assets. Non-current assets have a lower degree of liquidity, that is, they are more difficult to convert into financial assets. Current assets are more liquid. These include inventories (materials, goods, finished products), accounts receivable, cash in current accounts and in the cash register of the enterprise.

Important! An enterprise will be most liquid and solvent when current assets exceed non-current assets. Each potential user will be able to assess how solvent the company is based on a certificate of the book value of assets.

General concepts

Successful business conduct is impossible without a detailed analysis of the financial and economic indicators of the economic activity of an economic entity. In order to assess the property and financial position of an organization and make the right management decisions in a timely manner, it is necessary to determine important solvency and profitability ratios. One of the key calculation indicators is the calculation of the value of net assets on the balance sheet.

The organization's net assets (NA) are the amount of funds of an economic entity, determined by calculation, which will remain at the disposal of the company after full repayment of debt obligations. In other words, the value of net assets is calculated as the arithmetic difference between the total indicators of the company’s property, material and financial assets and assumed liabilities.

Formula for calculating net assets

The key procedure for calculating the value of net assets on the balance sheet is determined by the Ministry of Finance of the Russian Federation and is presented in a separate order No. 84n dated August 28, 2014. Please note that previously a different procedure was in effect, but it is not currently used.

This formula for net assets on the balance sheet is applicable to the following range of economic entities:

- public or non-public joint stock companies;

- state or municipal unitary enterprises;

- limited liability companies;

- production cooperatives or housing cooperatives;

- business partnerships.

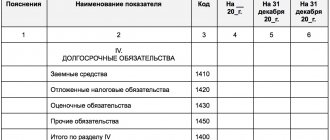

Net assets formula:

- JSC - the amount of non-current and current assets of an economic entity as of the reporting date;

- DE - debt of the founder incurred to the enterprise for the formation of the authorized capital;

- FOR - debt on own shares generated upon issue;

- OB - the sum of the company's short-term and long-term liabilities;

- DBP - future income in the form of state financial support or gratuitous transfer of property assets.

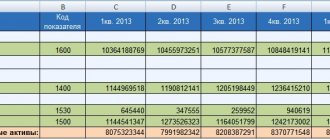

How to calculate net assets according to balance sheet lines?

To calculate the net asset value on the balance sheet, the calculation lines use the following:

Calculating the amount of net assets in the balance sheet (the lines indicated above) using a pencil calculator is not enough. This calculation must be documented. However, a unified form for reflecting calculated data is not provided for in Order No. 84n. Organizations are required to independently develop a form and regulate it in their accounting policies.

Note that before the approval of Order No. 84n, the old form was in force (Order of the Ministry of Finance of the Russian Federation No. 10 and the Federal Commission for the Securities Market of Russia dated January 29, 2003 No. 03-6/pz). In the new instructions, the Russian Ministry of Finance has not prohibited the use of this form, therefore, firms can use it to prepare calculations of net assets in the balance sheet (the document lines contain all the necessary information).

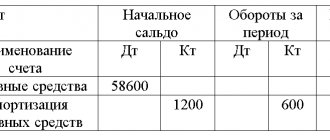

How to quickly increase your net worth

The “normal” way to increase net worth is to make a profit. All retained earnings fall into section III of the balance sheet and “automatically” increase net assets. But what to do if there is no profit, or its amount is not enough?

Then the founders will have to resort to other ways to increase net assets:

- Increase the authorized capital.

- Pay off debt on deposits in the management company.

- Make contributions to the company's property without increasing the authorized capital.

- Conduct a revaluation of assets.

- Write off accounts payable.

The best of the options listed is a contribution to property . It is available to every organization, does not require complex registration and, in most cases, does not entail tax consequences.

An increase in the charter capital requires amendments to the Charter and state registration. Repayment of debt on contributions to the authorized capital is possible only if such debts exist, i.e. This option is not suitable for every company.

The last two methods are also not available to everyone. After all, not every organization has overdue accounts payable or assets for revaluation in sufficient quantities. In addition, when writing off a “creditor”, you will have to pay income tax, and an increase in the value of fixed assets can lead to an increase in the taxable base for property tax.

How to calculate net assets on a balance sheet, example

Let's look at a specific example of how to calculate net assets on a balance sheet.

Vesna LLC prepared annual financial statements, including a balance sheet in the OKUD form 0710001.

Based on the balance sheet data, the following calculations were made:

NA = (13,800 +19,283 – 0) – (12,930 – 0) = 20,153 rubles.

Where do the financial statements contain information about the value of net assets?

net assets as accurately as possible, one must have a reliable basis for calculation. Where can I get such a base? In the company's financial statements. Most of the indicators that are necessary to calculate NAV are contained in the company's balance sheet.

A balance sheet is required to calculate net assets , since all assets involved in the calculation must be taken at the value indicated in the balance sheet (clause 7 of Order No. 84n).

For more information about what information from the balance sheet is needed to calculate net assets, see the article “The procedure for calculating net assets on the balance sheet - formula 2015”, as well as in the publication “Net assets - what is it in the balance sheet (nuances)?”.

Please pay attention! The balance sheet, as a rule, is compiled by the company based on the results of the past year. However, if it is necessary to calculate the value of the company’s equity capital as of the current date, then for this it is advisable to draw up interim financial statements, including an interim balance sheet as of the last day of the previous month. Then the value of net assets will reflect the current situation in the company as accurately as possible.

Analysis of indicators

Having completed the arithmetic calculations, we move on to analyzing the result obtained. With a positive amount of net assets in the balance sheet, we can conclude that the company is profitable and has high solvency. And, accordingly, the higher the indicator, the more profitable the enterprise.

Negative net assets are an indicator of the low solvency of an enterprise. In other words, a company with a negative NAV will most likely go bankrupt soon; the company will simply have nothing to pay off its debts. However, in such a situation, exceptional circumstances must be taken into account. For example, the company has just been formed and has not yet covered its costs, or the company received a large loan for expansion.

An increase in net assets can be achieved by increasing the authorized, reserve or additional capital or by reducing the founder’s debts to the enterprise.

Conclusion

Net assets are the most important financial indicator, the growth of which indicates the efficient operation of the business. Net assets are generally formed from the authorized capital, reserve funds and retained earnings.

The law does not allow the reduction of net assets to an amount not exceeding the amount of the authorized capital. This rule must be followed both within the framework of current activities and in settlements with the founders.

If the accumulated profit is not enough, then the company owners can invest additional funds in the authorized capital or property of the LLC. Also, the growth of net assets can be achieved through accounting operations: writing off accounts payable and revaluing assets.

The simplest and most profitable way for founders to support a company in order to increase its net assets is to contribute to the company’s property without changing the authorized capital.

spravka.jpg

Related publications

Net assets are the actual value of property and funds at the disposal of an LLC, partnership, JSC, unitary enterprise, fund, etc. (hereinafter referred to as the “Society”). The owner must calculate their size annually, based on the financial results of the year. Based on these calculations, a certificate of the value of net assets is drawn up, a sample of which the owner, in accordance with current legislative norms, can develop independently.

Calculation of net asset value

According to paragraph 2 of Article 30 of Law No. 14-FZ dated 02.02.1998, the cost is calculated according to balance sheet data in the manner determined by Order of the Ministry of Finance of the Russian Federation dated 08.28.2014 No. 84n. We calculate using the following formula:

Af = (X – ( Y 1… + Yn ))+ D – Z

Af – actual value of net assets

X – the cost of all assets at the disposal of the Company, indicated in the balance sheet (line 1600)

( Y 1... + Yn ) – liabilities (sum of all debt obligations of the Company, lines 1400 and 1500);

D – deferred income (line 1530);

Z – total amount of debt in the authorized capital of participants on deposits (line 1170).

Net assets in unprofitable activities

If the company is operating at a loss, then the balance sheet line 1370 may become negative. Therefore, the formula for calculating net assets will take the form

NA = UK + RF – NU (uncovered loss)

If the reserve fund is less than the accumulated loss (or is absent altogether), then the net assets will become less than the authorized capital.

In this case, the management company will no longer be able to perform one of its main functions - to guarantee the company’s counterparties the fulfillment of their obligations to them. After all, after all the calculations, the business owners will actually have at their disposal an amount less than the amount of the authorized capital indicated in the balance sheet.

If the amount of the company’s net assets remains below the authorized capital for two years in a row, then the organization must reduce the authorized capital to the amount of net assets within 6 months. The first year of work “does not count.” Thus, the law gives a new business the opportunity to develop without imposing requirements at the initial stage of activity.

But the Criminal Code can only be reduced to a certain limit. In general, its minimum amount for an LLC is 10 thousand rubles. If net assets fall below this amount, then the owners must decide to liquidate the organization . For this purpose, 6 months are also allotted after the end of the two-year period of reduction in the value of net assets (clause 4 of Article 30 of Law No. 14-FZ).

Why do we need a certificate of net assets and their control?

The need to control the value of net assets is determined not only by the rules of law regulating the principle of the ratio of the value of net assets to the authorized capital, but also by the interests of the Company's participants.

The amount of net assets cannot have negative values and must exceed the amount of the authorized capital. Failure to comply with the ratio between these indicators may lead to forced liquidation after the expiration of the deadlines established by law for increasing the size of net assets. There are no other types of liability for violation of the relationship between net assets and capital, except for forced liquidation, provided by law.

Controlling the value of net assets allows the Company's participants to conduct an analytical study:

- dynamics of the Company’s financial activities for a specific period:

- operational efficiency and appropriateness of property use;

- to optimize the structure of assets and their efficient use;

- identifying factors for the subsequent growth of the Company’s financial stability and its investment attractiveness.

The amount of net assets is confirmed by a certificate. The information reflected in such a certificate may be relevant for:

- owners/shareholders – to have up-to-date information on financial condition;

- top managers of the Company - to build a commercial concept for the company, develop a strategy and tactics for its development;

- to creditors and suppliers - to confirm the payment and creditworthiness of the Company;

- investors – to assess the profitability and financial analytics of investment projects.

In fact, a statement of net asset value is an information report that is useful for:

- obtaining up-to-date information on the value of the share of participants in the Company;

- determining the amount of dividend payments;

- revising the size of the authorized capital upward or downward;

- assessment of the quality of management and management decisions by the Company's top managers.

Data on the amount of net assets must be reflected in section 3 of the Statement of Changes in Capital (“Net Assets”).

Net assets in settlements with founders

There are two main situations when an operating LLC makes payments to its members:

- Dividend payment.

- Payment of the actual value of the share when a participant leaves the company.

In both of these cases, the size of net assets must be taken into account.

When the founders intend to use the profit received or part of it to pay dividends, it is necessary, in particular, to comply with the following rules (Article 29 of Law No. 14-FZ):

- The size of net assets should not be less than the sum of the authorized capital and reserve funds at the time of the decision or actual payment.

- The amount of net assets should not fall below this amount after payment of dividends.

A participant who leaves the company must receive a portion of the net assets corresponding to his share. The net asset value is determined based on the financial statements for the previous year.

The rule here is similar to the situation with the payment of dividends. Payment of the actual value of the share should not result in the company's net assets being less than its authorized capital. Otherwise, the organization must first reduce the capital, and only then make settlements with the exiting participant.

Since the law has established restrictions for reducing the authorized capital, the maximum amount that a participant can receive upon leaving the LLC is also limited. It is equal to the difference between the current size of net assets and the minimum size of the capital company (Clause 8, Article 23 of Law No. 14-FZ).

Certificate of net assets: form and content

Since a unified form for the certificate has not been approved at the federal level, the Company retains the right to present information in free form. However, a certificate of net assets, a sample of which is approved by the meeting of members of the Company, must contain:

- legal name of the Company,

- document registration data,

- time of determining the net asset value;

- financial information on the amount of net assets, with a breakdown of current and non-current assets;

- information about the period for which the financial statements data were used to prepare the certificate;

- signatures of officials.

Net assets - why you need to calculate and where to report

There is far more than one definition for this concept. For example, net assets are the amount that will remain at the disposal of the company if it suddenly pays off all its liabilities at once. Or is it the real value of the company’s property, determined annually minus its debts. That is, the meaning does not change and, simply put, a net asset is an asset that an organization can freely dispose of, since it is not bound by any counter-obligation.

The value of net assets is of interest to investors, potential lenders, borrowers, government agencies, and the owners themselves. The latter, for example, must monitor the state of net assets in order, firstly, to know about the possibility of paying dividends, and secondly, to take appropriate measures in a timely manner so as not to be liquidated in court.

Until January 1, 2012, information on net assets was reflected on the information resource of the Unified State Register of Legal Entities, and in 2013 another, similar in its functions, resource of the Unified State Register of Legal Entities was open to everyone. The changes are related to the entry into force of Federal Law No. 228-FZ of July 18, 2011. This law, by the way, obliged, in addition to open joint-stock companies, also limited liability companies to fill out a section on the state of net assets in their reports. Information on net assets can only be seen in interim and annual reports. In the annual report - in the form of changes in capital, in the interim - in additional information accompanying the financial statements. Moreover, if the value of the company’s net assets turns out to be less than its authorized capital, the annual report must not only present the results of an analysis of the reasons and factors that led to such a decrease, but also list measures to bring the value of the company’s net assets in line with the size of its authorized capital.