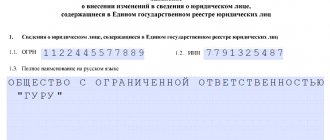

Despite the fact that companies have been using the opportunity to submit documents electronically to the tax office for quite some time, in practice questions arise about the mechanism for sending documents in certain situations.

Current legislation allows the applicant to send registration documents to the tax authority electronically. In order to send documents for state registration of a legal entity or individual entrepreneur in electronic form through the website of the Federal Tax Service of Russia, you must have an electronic digital signature (hereinafter referred to as EDS).

ELECTRONIC DOCUMENT FLOW WITH TAX AUTHORITIES

Important! The possibility of using an electronic digital signature when performing registration actions with the tax inspectorate (registration of an LLC and individual entrepreneur, changing the constituent documents and information of the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs, closing an individual entrepreneur, liquidating an organization) is provided for in Article 9 of Federal Law No. 129-FZ of 08.08.2001 “On State registration of legal entities and individual entrepreneurs"

When is it possible and when is it mandatory to send documents to the tax office electronically?

The flow of documents between tax authorities and taxpayers is enormous.

This is not only the submission of regular tax reports, but also various types of responses to requests, notifications, submission of documents, requirements, etc. Gradually becoming a thing of the past, the days when the taxpayer had to run to the inspector with each piece of paper or bring him boxes with confirming documents on a truck documents. Although the legislation does not contain a ban on paper document flow. Controllers will still accept most documents in paper form. Mandatory sending of documents to the tax office in electronic form is provided only in certain cases. For example, filing VAT returns and documents related to this tax (books of purchases and sales, journal of invoices), as well as sending explanations on VAT reporting to tax authorities is possible only in electronic form (with rare exceptions) .

Find out more about this on our website:

- “Rules for writing and submitting explanations to the VAT return”;

- “The journal for recording issued and received invoices - a new format.”

What is the procedure for submitting documents required by the tax authority? Find out the answer to this question in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Tax authorities accept other types of tax reporting both in electronic and paper form. It all depends on the number of employees of the taxpayer who sends the report (clause 3 of Article 80 of the Tax Code of the Russian Federation). At the same time, ordinary citizens can communicate with controllers and submit any documents to them in a wide variety of ways:

- through the taxpayer’s personal account;

- by coming directly to the inspection;

- by sending documents by post.

It is important to remember the basic rule: if you submitted your return electronically, then further interaction with controllers regarding this tax report should occur electronically. This rule follows from the order of the Federal Tax Service dated April 15, 2015 No. ММВ-7-2/ [email protected] Let’s look at this document in more detail.

ConsultantPlus experts explain in detail how to submit requested electronic documents to the Federal Tax Service that are not compiled in established formats. Get trial access to the system and go to the Tax Guide for free.

Selection of documents for the Federal Tax Service by downloading from disk

the Load from disk button

The user has a choice (Fig. 5):

- on command Scanned document -

upload image files (scanned documents);

- on command Documents from another database

– upload an archive with images or xml files downloaded from another database.

Rice. 5. Options for loading files from disk

Uploading scanned documents

Command Load from Disk – Scanned Document

is used if the scanned documents were not attached to the infobase documents in advance. This opens a standard dialog for selecting files from disk (Fig. 6).

Rice. 6. Selecting a file from disk

Selected scanned documents are included in response to a request for the Open

.

This opens the form Preparing a document for sending

, where the selected documents should be pre-processed as follows (Fig. 7):

- add pages of a scanned document if the document is multi-page (button Add

);

- fill in the field Name, details or other characteristics of the source document

. You can manually enter the document details or select a document from the information base using the selection button;

- fill in the field Name, details or other characteristics of the base document (optional)

, if the added document has a basis document (agreement, invoice for payment or other primary document confirming the emergence of contractual relations between the parties to the transaction);

- in field Notary's signature

select a notary’s electronic signature file if the electronic document contains such a signature (for example, a document related to the registration of a legal entity (IP), power of attorney, etc.).

Rice. 7. Preparing a scanned document for sending

After filling out the required document description, click on the Add button in response to the requirement

(Fig. 7).

This opens the Requirement Item

, where you need to indicate the point of the original requirement from the pdf file, in response to which a scanned document is sent (Fig. 8).

Rice. 8. Item requirement

Click OK

The document data will be stored in the request response form.

Loading an archive of documents from another database

If xml documents or scanned documents that need to be sent in response to the request of the Federal Tax Service are located in another information database, then they can be downloaded from this database into a special archive file (exchange file), and then loaded into the information database from which the response is being prepared to the requirement.

To load documents from another database, click the Load from disk

and select

the Documents from another database

(Fig. 9).

Rice. 9. Loading documents from another database

In this case, a form appears where the Load

You can choose one of two download options:

- Loading 1C-EDO or 1C-Taksk xml documents from another database.

- Uploading scanned documents from another database

.

When you select the first option, a form for downloading electronic documents from the exchange package appears and a standard dialog for selecting files from disk opens. The archived file should be highlighted and selected using the Open

.

The electronic document download form displays a list of xml files from the archive file. The required documents should be marked with flags and added in response to the requirement, having previously indicated the item of the original requirement from the pdf file.

In this case, not only the xml documents themselves are loaded, but also the files of electronic signatures for them.

If you select the second option Upload scanned documents from another database

a form for downloading scanned documents from an external source appears and a standard dialog for selecting files from disk opens.

The exchange file should be highlighted and selected using the Open

.

The Upload Scanned Documents from External Source form will display a list of scanned documents from the exchange file that can be included in response to the request.

Details of the scanned document and its image can be viewed in a separate form, which opens by double-clicking.

The required documents should be marked with flags and added in response to the requirement, having previously indicated the item of the original requirement from the pdf file.

To edit details and other features of a document, as well as the base document, just double-click on the document line. This opens a document editing form, as in Figure 7, where you can make the necessary adjustments.

What is important to remember about deadlines when transferring electronic documents

Typically, taxpayers transfer documents to the tax office electronically at the end of each reporting or tax period. According to the TKS, a significant part of them submit tax and accounting reports to the inspectorate.

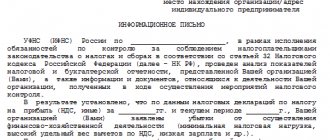

But there are other reasons why you need to submit documents to the tax office electronically: tax officials may request documents during an audit (desk, on-site, counter) or offer to clarify the declaration data or make corrections to them. What should you consider when submitting documents electronically to the inspectorate?

First of all, remember the deadlines:

- 10 working days are given to the taxpayer to prepare and submit documents requested during tax audits;

- 5 working days are given to submit clarifications and correct the declaration (clause 3 of article 88, clause 5 of article 93.1 of the Tax Code of the Russian Federation);

The deadlines must be counted from the date of receipt of the requirement from the inspection. Violation of deadlines is fraught: for each document not submitted, a fine of 200 rubles is provided. (Article 126 of the Tax Code of the Russian Federation).

There are other deadlines to keep in mind. For example, to file objections to a tax audit report under the TKS, the taxpayer has 1 month (clause 6 of Article 100 of the Tax Code of the Russian Federation).

If you have not sent a receipt for the electronic request of the Federal Tax Service for the submission of documents, use the advice of ConsultantPlus experts and find out whether it is possible to avoid liability. Get trial access to the system and study the material for free.

Selection of documents for the Federal Tax Service by selecting from the information base

Click the Select from database button

In response to a request, the user can select documents from the current information database, that is, from the database where the EDI with the Federal Tax Service is configured, and from where the response is sent. In this case, the user has options regarding which documents to add (Fig. 10):

- xml documents received as a result of exchange with counterparties 1C-EDO

and

1C-Takskom

- by command

Electronic documents 1C-EDO, 1C-Takskom

; - xml documents of purchase books, sales books and invoice journals - by command Purchase/sales books, invoice journals

;

- other scans and xml documents - by command Documents from the database

.

Rice. 10. Selection of documents from the database

To add xml documents received as a result of exchange with 1C-EDO

and

1C-Takskom

, a special form is available

Selecting a source document

, where an accountant can quickly select the necessary documents by type, amount, date, number, organization, counterparty and source document (Fig. 11).

Rice. 11. Selection of electronic documents 1C-EDO and 1C-Takskom

To insert the required document into the request response form, select it in the list and click on the Select

. In this case, you will need to indicate the requirement item from the pdf file.

When using the Select from database command – Purchase/sales books, invoice journals

VAT reports in xml format can be attached to the response to the request:

- shopping book;

- sales book;

- journal of received and issued invoices;

- additional sheet of the purchase book;

- additional sheet of the sales book.

To add the specified documents in response to a request, a special selection form is used (Fig. 12), where you can apply selection by period, organization, and set any other search. The list of VAT documents displays the date, number, document type, tax period, organization and comment.

Rice. 12. Selection of electronic VAT reports

If documents for the selected tax period are not in the list, they should be created using the Generate for period

.

To move documents in response to a request, select them in the list and click the Select

, then indicate the requirement item from the pdf file.

When using the Select from database – Documents from database

You can attach arbitrary documents in xml format and scanned documents attached to the information base documents to the response to the request.

To select a document from the database, first select its type (Fig. 13).

Rice. 13. Selecting the type of document

Let’s assume that the document type is Receipt (act, invoice) –

A list of documents of the specified type opens (Fig. 14).

Rice. 14. List of documents of the specified type

Documents from the list can be selected by date, number, organization, counterparty, amount and other key fields. Infobase documents may have attached scans or corresponding xml documents - these are what are needed to be included in response to the requirement. To do this, select them in the list and click the Select button.

For selected documents, a description is automatically generated and attachments are added - xml documents or scans (Fig. 15).

Rice. 15. Preparation of documents of the specified type

From the same form you can add missing scanned documents by selecting them from the disk.

Click the Add button in response to a request

the selected documents are transferred in response to the request. In this case, you should indicate the number of the requirement item from the pdf file.

How to submit electronic documents

Another important issue that must be addressed when submitting electronic documents to the tax office is the method of presentation. Documents in electronic form can be sent to the TCS inspection through an EDI operator or through personal accounts of taxpayers (clause 2 of Article 93 of the Tax Code of the Russian Federation).

Is it possible to submit paper primary documents in electronic form? Yes, this allows clause 2 of Art. 93 of the Tax Code of the Russian Federation - in the form of electronic images created by scanning with the preservation of their details in established formats. The same article of the code stipulates that if the requested electronic documents are transmitted via TCS, then they must be certified by the enhanced CEP of the person being inspected or his representative.

By order of January 18, 2017 No. ММВ-7-6/ [email protected] the Federal Tax Service approved the format of the list of documents that accompanies the electronic document flow between tax authorities and taxpayers (it came into force on January 15, 2018, clause 1.1 of the Federal Tax Service order dated December 27, 2017 No. MMB-7-6/ [email protected] ).

Individuals not related to business activities can also submit documents electronically. For example, a citizen can attach scanned images of supporting documents to the electronic 3-NDFL declaration when applying for a property or social deduction. The scans signed with an electronic signature along with the declaration will be sent to the inspectorate in electronic form.

In any case, tax officials reserve the right to familiarize themselves with the original documents.

We create an inventory

Next, you need to create an inventory, collect and attach all documents to it. This can be done either independently (for example, in an accounting system) or in the tax reporting system in which the request was received. It is more convenient to work in the reporting system in the sense that all inventory details related to the requirement, signature and number of documents sent will be filled in automatically. These are the details on which it depends whether the package of documents will be loaded into the inspection acceptance complex. In this case, it will be possible to send the package immediately without unloading and searching for ways to send it via TKS.

Let us give an example of the procedure for preparing and submitting documents in the Kontur-Extern tax reporting system. To fill out the inventory details, you need to indicate the document form code for the KND (1165034) and the identity of the person who signed the document - the head of the organization (3) or its representative (4).

What free electronic services are there for interacting with tax authorities?

Among the services for sending electronic documents to the tax office are:

Tax officials provide many other free services to taxpayers. They do not allow you to interact with tax authorities on the exchange of electronic documents, but they help solve other important practical tasks (for example, “Check yourself and your counterparty,” “Online appointment for an inspection,” “Find out about a complaint” and others).

Results

Electronic submission of documents to the tax office is carried out by taxpayers regularly in the form of tax and accounting reports. When sending electronic documents to the inspectorate, it is necessary to certify them with an electronic signature and comply with legally established deadlines (when submitting documents at the request of inspectors). A special free tax service allows you to remotely submit documents for registering companies and individual entrepreneurs.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

With Arbitration Courts the situation is different.

Russian courts have their own view on what scans of documents sent to them should be. In particular:

- Only documents in PDF format are accepted;

- The resolution of the scanned document must be 200 DPI;

- All documents are accepted exclusively in black and white. This means that the lines filled in with a blue or purple ballpoint pen in the finished scan should be black;

- The file size should not exceed a “weight” of 10 MB;

- All inscriptions, seals, signatures must be clearly visible;

- The file sent by letter should, like the subject of the letter, reflect the essence of the document being sent in approximately the following format: “Additional agreement No.... from... to agreement No...”;

We dare to assume that the need for different requirements for scanned documents is caused by differences in the content and design of the papers themselves. For example, the format of a lawsuit is still different from a tax return. In view of this, the requirements of the Arbitration Courts can be considered quite fair and justified.