Intermediary services are generally considered to be the performance by an intermediary company of certain actions for the company ordering these services. In this case, an agreement called an agency agreement (assignments/commissions) must be concluded. In it, the customer (Principal) instructs the contractor (Agent) to perform certain services for a fee. In the future, the agent, fulfilling his obligations, has the right to act on behalf of the customer or his own, but always at the expense of the principal (Article 1005 of the Civil Code of the Russian Federation).

Such an agreement stipulates (but not necessarily) the deadlines for fulfilling the terms of the agreement and submitting a report on expenses incurred with the attached documents. In the absence of such requirements in the contract, reports are submitted by the agent upon fulfillment of obligations (Article 1008 of the Civil Code of the Russian Federation). In addition, the agreement specifies the amount of remuneration for the agent, which can be a fixed amount or a percentage of sales.

The services of an intermediary are subject to VAT at a rate of 18% if he is a tax payer. This rule also applies to the sale of VAT-free goods (Article 149 of the Tax Code of the Russian Federation), with the exception of medical goods, funeral services and rental of premises to foreign companies (Article 156 of the Tax Code of the Russian Federation).

The mechanism for applying an intermediary agreement is simple, but taking into account the difference in the taxation systems of counterparties, we will understand the features that accompany the relationship between agents and principals in the field of recognition of income and expenses and taxation.

Agency agreement under simplified tax system 6% Income

Agency agreements are not only convenient documentation that allows you to consolidate the agreement between the principal and the agent. In most cases, especially recently, agency agreements are a convincing document in various proceedings (including litigation). That is why you should remember the importance of understanding the rules and regulations for drawing up such agreements. One of the most common contracts involved in proceedings are contracts with a simplified tax system of 6%.

The subject of such agency agreements (as well as other types of agreements) is the relationship between the agent and third parties, and the interests that the agent represents completely coincide with the interests of the principal. That is why, in the income and expense books, when signing an agency agreement with a simplified tax system of 6%, you should reflect only the amount of remuneration (agent's fee). This amount should be the difference between the amount that is paid by the buyer and the amount that should be transferred to the principal.

Requirements regarding these procedures are specified in detail in letter of the Ministry of Finance of Russia (dated April 18, 2013) No. 03-1111. According to paragraph 1 of Article 346 of the Tax Code of Russia, income that arises as a result of the transaction must be reflected in tax accounting on the following date:

- actual receipt of funds (as shown in the bank account);

- transfer of property into ownership (in addition to property, there may be work, services, property rights, etc.).

- repaying the debt to the taxpayer in any other way.

This is the case if the agent receives payment in advance, before the report is approved by the principal.

- If the agreement states that funds must be transferred after the agreement is concluded, and it is virtually impossible to determine the amount of remuneration, then according to the letter from the Ministry of Finance of Russia, all funds must be included in income, which will be taken into account when determining the tax base for simplified tax 6%.

- If orders for intermediary services continue, the agent, like the agency as a whole, can make changes to the amount of income that will be transferred to the principal (except for the deducted amount of fees). Such a right is regulated by a letter from the Ministry of Finance dated September 30 (letter No. 03-1106).

Such rules make it possible to avoid situations in which the customer pays the agent for intermediary services before the amount of his fee can be determined accurately.

Filling out KUDIR under the simplified tax system

The nuances of taking into account additional benefits in simplified terms

An additional benefit (AD) when executing an AD arises if the agent made a transaction on terms more favorable than those provided for in the contract.

When purchasing (selling) goods through an intermediary, the following must be taken into account in terms of DV recognition:

- DV may appear if the agent succeeds in:

- sell goods at a price higher than stated in the AD;

- buy goods at a price less than stipulated in the contract.

Example

In January 2020, Bytkhimservis LLC formed a joint venture with Khimtorg LLC to sell its products. The customer applies the simplified tax system, the agent is on the OSNO. According to the terms of the AD, the agent undertakes to sell the customer’s products at a price not lower than RUB 3,126. for a unit. The agent's remuneration consists of a fixed and variable part: the fixed part is 12% of the amount of products sold. In the presence of DV, distribution is made in a 50/50 ratio. The additional benefit due to the agent is a variable part of the agent's remuneration. Khimtorg LLC, thanks to an effective logistics system and with the help of modern marketing techniques, was able to sell products at a price of 3,810 rubles. for a unit. DV calculations are presented in the table:

| Index | Under contract | Actually |

| Product unit price, rub. | 3 126 | 3 810 |

| Volume of products sold, units. | 5 390 | |

| Revenue, rub. | 16 849 140 | 20 535 900 |

| Additional benefit, rub. | 3 686 760 (20 535 900 – 16 849 140) or (5 390 × [3 810 – 3 126]) | |

DV distribution:

| Party to the contract | Spin off | |

| % | Amount, rub. | |

| Bytkhimservice LLC | 50 | 1 843 380 |

| Khimtorg LLC | 50 | 1 843 380 |

| Total DV | 100 | 3 686 760 |

Bytkhimservice LLC transferred 2 amounts to the settlement account of Khimtorg LLC:

- DV = 1,843,380 rub.;

- agent remuneration (12% of the sales amount) / RUB 2,464,308. (RUB 20,535,900 × 12%).

On what date to take into account income when selling goods, works, services through an agent who participates in settlements with buyers, find out in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

In KUDiR in January 20XX, the simplified customer reflected the following information related to AD (other income and expenses of the simplified company, including the purchase price of goods, are not considered in this example):

Income:

- revenue from product sales - RUB 20,535,900;

- the additional benefit received by the customer is included in sales revenue.

Expenses:

- agency fee - RUB 2,464,308.

- additional benefit transferred to the agent - RUB 1,843,380.

Agency agreement under simplified tax system 15% Income minus expenses

In order for a principal who pays taxes under a simplified scheme to be able to sell and purchase goods through an agent (using an “income minus expenses” agreement), he must take into account two types of requirements:

- requirements regarding the execution of an agency agreement under the simplified tax system;

- must recognize income and expenses that directly arise from the agency agreement.

In order to fulfill the requirements associated with the execution of an “income minus expenses” agreement, the principal must examine the content of the subject of the agency agreement, the agent’s rights and obligations, his own rights and obligations, etc. To do this, you need to adopt the norms of the Civil Code of Russia.

For example, when drawing up an agency agreement, you should pay special attention to:

- terms of the agency agreement;

- form of principal-agent relationship;

- specifying the degree of authority of the agent;

- restrictions details.

Let's take a closer look. When studying the terms of the contract, you should understand that the conditions are basic (their essence is disclosed in the subject of the contract) and indirect, complementary. The indirect ones include the cost of the agent’s services in accordance with the provisions of the agency agreement and the speed (timing) of execution. An important condition that the principal must pay attention to is the price and terms on which the agent's fee is paid.

When clarifying the form of the “principal-agent” relationship, it is important to understand which specific orders the agent will perform on his own behalf, and which on behalf of the customer. Specification of the level of authority is necessary in order to understand and provide for that part of the transactions that the agent will perform on his own behalf.

Detailing the restrictions is an important stage, since it is here that the principal has the opportunity to outline the powers of the agent and specify the subtleties with the possibilities or prohibitions regarding the conclusion of subagency agreements (delegation by the agent of part of the task to another agent).

Also, in the agency agreement it would not be superfluous to specify the details of cooperation and points that should appear in the agent’s report (a document drawn up after completing all instructions).

If the payment of funds and delivery of goods to buyers occurs thanks to the work of an agent (through him, for example, through his bank account or the agency’s internal cash desk), then the agency agreement must detail the period during which the agent must notify the principal about the receipt of funds in his account (or to the cashier). Such seemingly trifles may ultimately determine the period during which the profit will be included in income. The result is timely tax payments.

Also, as we have already noted, the principal must recognize income and expenses directly arising from the agency agreement. These requirements are provided for in Chapter 26.2 of the Tax Code of the Russian Federation.

Agent acquires property for a simplified person

The process of using the services of an agent when purchasing goods is associated with the occurrence of 3 groups of expenses:

- purchase expenses - they include the cost of purchased property, goods or other valuables;

- tax expenses - consist of amounts of “input” VAT transferred to the supplier and (or) agent;

- intermediary costs - related to the payment of remuneration to the agent and reimbursement of amounts associated with the execution of the AD.

Expenses included in these groups reduce the income of the simplifier in accordance with clause 2 of Art. 346.18 Tax Code of the Russian Federation. The following accounting scheme is used:

- inclusion of expenses related to AD into the tax base of the simplified customer is made after their payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation);

- The procedure for accounting for intermediary remuneration depends on the type of property acquired by the agent for the simplified customer:

- according to sub. 5 p. 1 art. 346.16, paragraph 2 of Art. 346.16, paragraph 2 of Art. 254 of the Tax Code of the Russian Federation - if, with the help of an agent’s services, inventories are purchased (the agent’s remuneration is included in the initial cost of inventories);

- according to sub. 23–24 paragraph 1 art. 346.16 of the Tax Code of the Russian Federation - when purchasing goods (agent’s remuneration is taken into account as a separate type of expense);

- according to sub. 1 clause 1 and clause 3 art. 346.16 of the Tax Code of the Russian Federation - when purchasing fixed assets and intangible assets (the agent’s remuneration is included in the initial cost of the asset).

VAT accounting scheme:

- as a separate expense (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- as part of the initial cost of acquired fixed assets and intangible assets (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

How does the purpose of an asset affect when a simplifier recognizes its value in expenses - see the material “For the simplified tax system, expenses only for “production” assets are taken into account .

Taxation

As you know, working through an agent is sometimes not only convenient, but also very profitable. One of the immediate advantages of agency agreements under a simplified system is a clear reduction in the tax burden on the simplified system.

According to agency agreements, income is only remuneration, and not the entire circulating amount that passes through the current account. Let's give an example: a taxpayer (for example, an individual entrepreneur) places advertising material as part of his business. The client, as a result of the success of the material, pays the entrepreneur money for the product or service. The businessman sends part of these funds to a service (for example, Yandex). Paying taxes on the full amount is not profitable, and not particularly advisable. The solution is simple: we enter into an agency agreement and take into account only the percentage of net profit in tax deductions.

When calculating taxes under the simplified system, only agency profits need to be taken into account. If a businessman sells, for example, equipment, receiving 5% of sales, then there is no need to pay tax on 500 thousand rubles received from buyers for selling 10 units for 50 thousand. You only need to pay for your 25 thousand profit. This is precisely the advantage of agency agreements under the simplified tax system in small and medium-sized businesses. Similar thoughts apply to excise duties, VAT, etc.

Agency agreements: how an agent pays taxes on the sale of goods and services of the principal - Elba

An agent is an intermediary between the seller and the buyer who helps them complete the transaction. For example, you are a courier and deliver goods from online stores to customers. Or you take a product from a supplier and sell it in your store, receiving a commission for it. In these situations, money received from buyers passes through you and is not your income.

Accounting for income in the simplified tax system

In income when calculating the simplified tax system, take into account only agency fees. For example, you sell laptops and receive 5% of sales. By selling 10 laptops for 50,000 rubles each, you will receive half a million from buyers, of which your revenue will be only 25,000 rubles. This amount must be taken into account in the income of the simplified tax system.

When to take income into account in the simplified tax system depends on the method of payment of remuneration. There may be the following options:

- You deduct remuneration from the money received from the client. Its size is determined by the agency agreement. Take the remuneration into account in the simplified tax system on the day you receive payment from the client.

- The principal transfers the remuneration separately: in advance or based on sales results. Take it into account in the simplified tax system on the day you receive money from the principal.

- You withhold remuneration from the money received from the client, but its amount is not fixed in the contract and is determined in the agent’s report. This is the most unprofitable and difficult accounting method. When receiving payment from a client, the entire amount must be taken into account in the simplified tax system’s income. When the principal approves your compensation in the agent's report, adjust the income. For example, you received 50,000 rubles from a buyer, but you do not know the amount of your remuneration. On this day, you need to take into account the entire amount in the income of the simplified tax system. Then you agree with the principal that your remuneration is 5,000 rubles, and sign the agent’s report. On this day, make an adjusting entry in KUDiR: income of 45,000 rubles with a minus sign.

Accounting for expenses in the simplified tax system

Most of the costs under an agency agreement are covered by the principal. Do not take into account such costs and their reimbursement in the simplified tax system. If the principal does not reimburse some expenses, and you are using the simplified tax system “Income minus expenses,” you can write them off according to the general rules.

The money that you transfer to the principal based on sales results cannot be taken into account as expenses when calculating the simplified tax system.

Documents for the buyer

The buyer must complete the same documents as in a regular transaction. For wholesale sales - an invoice, for retail sales - a cash register or sales receipt. When selling services, draw up a deed. If you are selling on your own behalf, please include your details in the documents. If you are acting in a transaction on behalf of the principal, indicate him in the documents.

In the documents, indicate the entire amount of the transaction, without separately highlighting the agency fee. After all, it makes no difference to the buyer whether he communicates with the seller directly or with his agent.

Documents for the principal

For the principal, draw up an agent report on the work done. Attach documents confirming the expenses that the principal will reimburse. The report also indicates the amount of your remuneration. If the agent's report does not indicate the agency fee, approve it in a separate act.

Agent report template

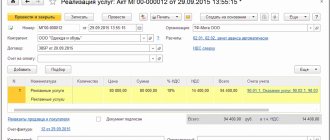

If the principal works with VAT, issue an invoice

If you are selling goods on your own behalf to a principal who works with VAT, you will have to issue invoices for buyers and report to the tax office. At the same time, you do not need to pay VAT itself.

You issue an invoice for the client on your own behalf. In the seller's data you indicate your details, and in the buyer's data - the client's details. You give one copy of the invoice to the client, the second one you keep for yourself and send a copy of it to the principal.

The principal will issue the same invoice on the same date, but in his own name, and give it to you. Both invoices must be recorded in the invoice journal.

By the 20th day of the month following the quarter in which the invoices were issued, you must submit the tax journal in electronic form.

If you work on behalf of the principal, you won’t have to bother with VAT. You can, by proxy of the principal, issue an invoice on his behalf. Or the principal will do it himself. In this situation, you do not need to report to the tax office and pay VAT.

Related articles:

Agency agreements: nuances of execution and benefits for business

How can a principal pay taxes on the sale of goods or services through an agent?

How does an agent pay taxes when purchasing goods or services for a principal?

How does a principal pay taxes when purchasing goods or services through an agent?

The article is current as of 02/06/2020

Source: https://e-kontur.ru/enquiry/227

Document flow between the parties

The main document in the “agent-principal” relationship is (besides, of course, the agency agreement itself) a report on the implementation of the agency agreement. All agents are required to provide such a document, regardless of the type of activity and the specifics of the relationship. Moreover, Article 1008 of the Civil Code of Russia requires agents to provide reports on completed assignments even when the principal allows them not to be provided,

This document must contain not only formal explanations, but also all evidence of expenses that the agent had to make during the execution of the agency agreement. A more complete package of documents (receipts for payment of duties, subagency agreements and agreements with partners or lessors) is stipulated in the agency agreement itself. Thus, in addition to the documents provided for by the Civil Code, the rest of the document flow is regulated exclusively by the principal and agent in the manner of drawing up an agency agreement.

The agent's report on blood pressure under the simplified tax system can be found here.

Sample report of an agent on blood pressure under the simplified tax system

Issuance by the agent of an invoice for the amount of the agency fee

An agent using the simplified tax system does not charge VAT on the amount of remuneration and does not issue an invoice to the principal for the services provided by him under the agency agreement. However, if he does do this, he becomes obligated to submit a VAT return and pay the calculated tax (clause 5 of Article 173 of the Tax Code of the Russian Federation). At the same time, he does not have the right to deduct expenses incurred, since he is not a VAT payer (clause 5 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33).

In turn, the principal has the right to count on a tax deduction, as follows from the resolution of the Constitutional Court of the Russian Federation dated June 3, 2014 No. 17-P. However, to strengthen its position before the tax authority, the principal must:

- the presence of a condition for charging VAT on remuneration in the contract;

- written confirmation from the agent in free form that VAT has been paid to the budget.

In the absence of evidence of coordination of the parties’ actions and a conscious intention to impose the payment of tax on the agent, the right to deduction may be called into question by the court.

Remuneration for blood pressure under the simplified tax system

According to agency agreements, the agent is obliged to carry out instructions from the principals solely for a fee (fee). According to Article 1005 of the Civil Code of the Russian Federation, even if the principal, after fulfilling the agency agreement, entered into personal cooperation with a third party (the entity with whom the agent must work, representing the interests of the principal) and claims that he independently fulfilled his own instructions, the agent should receive a reward.

Moreover, if an agent carries out orders for free (under a pre-agreed agency agreement with zero payment), then the Civil Code requires payment for services in accordance with internal government tariffs.

Also, it should be remembered that according to Article 974 of the Civil Code, everything that an agent receives in the process of executing an assignment under an agency agreement is the property of the principal. Withholding remuneration from the total amount of funds received under the contract is the full right of the principal. In addition, the Civil Code allows agents to deduct their fees from amounts received from third parties under the contract. This right is spelled out in paragraph 2, article 1 and paragraph 4, article 421 of the Civil Code.

Agent on the simplified tax system – principal on the OSNO

If the principal company uses OSNO, then its agent (even a simplifier), regardless of whose name he acts, is obliged to issue invoices with VAT included in them.

In accordance with the Civil Code of the Russian Federation, the principal, transferring the goods to the agent for sale, remains its owner until the moment of sale. The sale is carried out by the principal with the involvement of an intermediary, so the proceeds are taken into account by him when calculating income tax and VAT. An agent on the simplified tax system is remunerated from the principal’s income, and his remuneration will be an expense without VAT, i.e. in this case the agent does not issue an invoice for the remuneration.

Invoices issued by the agent to the purchasers are recorded in the invoice journal, and are not recorded by him in his sales book, but are subsequently transferred to the principal as attachments to the report. The agent using OSNO fills out an invoice for the amount of his remuneration.

Accounting for transactions according to the scheme “Agent on the simplified tax system – principal on the OSNO ” in accounting will be reflected as follows:

| Operation | D/t | K/t |

| At the agent's | ||

| Sales of services under an agency agreement | 62 | 76/settlements with the principal (RP) |

| Receipt of funds from acquirers | 51 | 62 |

| Transfer of funds to the principal minus remuneration | 76/RP | 51 |

| Revenue from agency fees | 62 | 90/1 |

| Agent's remuneration credited | 76/RP | 62 |

| At the principal's | ||

| Based on the agent's report, the sale of services is reflected | 62 | 90/1 |

| Agency fee accrued | 20 (44) | 76 |

| Costs for intermediary services written off | 90/2 | 20 (44) |

| Purchasers of services are charged VAT | 90/3 | 68 |

| Revenue taken into account minus intermediary fees | 51 | 62 |

| Agent's remuneration taken into account | 76/PDK | 62 |

A type of mediation agreement is a commission agreement. The peculiarity of the status of this agreement in comparison with its agency counterpart is that the commission agent (intermediary) can act in it, carrying out the instructions of the principal (customer of services), only on his own behalf, but at the expense of the principal. Accounting according to the scheme “commission agent on the simplified tax system – principal on the OSNO ” will be identical to that presented above.

Accounting and postings

It is customary to keep accounting records of agency agreements on account 76 “Settlements with various debtors and creditors.” You can assign various subaccounts to this account, including agents.

- Since the goods that the agent purchases under the agency agreement are not his property, they are reflected in the balance of account 002 “Inventory assets accepted for safekeeping.”

- If the principal transferred goods to the agent for the purpose of their further sale, then such goods are included in the balances of account 004 “Goods accepted on commission.”

- Agents' fees and their remunerations are displayed in accounts 62 “Settlements with buyers and customers”. This account is the base account for VAT deductions.

Intermediary transactions on the simplified tax system - the topic of this video:

When is the principal's income recognized?

Now the second question is about the moment of recognition of revenue in the Principal’s income.

Income under the simplified tax system is considered to be on a cash basis. Income will be taken into account when funds are received in a bank account or in cash. As a rule, funds from buyers are first transferred to the Agent's account. The agent transfers the proceeds to the Principal, as a rule, minus his remuneration.

Thus, we have two dates for receiving funds. The first date is the receipt of funds from buyers to the Agent’s account. The second date is the receipt of funds into the Principal’s account. The issue is not regulated by law, so we get two positions: the position of the Ministry of Finance and the position of the Federal Tax Service.

In the Letter of the Ministry of Finance dated April 20, 2021 N 03-11-11/23918, it was concluded that the date of receipt of income for the principal will be the day the funds are received in bank accounts and (or) at the cash desk of the principal.

However, Letter N SD-4-3/ [email protected] Service, issued on August 4, 2017, states that the date of receipt of income for the Principal is the day the client pays for the goods (work, services), that is, the day payments are received from clients according to the agency agreement to bank accounts and (or) to the agent’s cash desk or through a payment terminal.

Since we have opposing positions between the Ministry of Finance and the Federal Tax Service, in such cases we recommend writing a addressed request to the Ministry of Finance or the Federal Tax Service. By acting in accordance with the department's targeted response, you will protect yourself from possible sanctions.

Accounting services to companies operating under an agency agreement - leave a request on the website, or find out the cost by phone: (495) 661-35-70

Shiryaeva Natalya

AD for utilities with simplification

For landlords who pay taxes under a simplified scheme, taxes and utility payments are often too high. There are only two options for reduction, and only one of them is absolutely legal. The first is not to pay taxes, the second is to reduce tax deductions by concluding an agency agreement and paying utility bills within the framework of a “principal-agent” relationship.

The Ministry of Finance considers this work scheme to be quite possible and legal. In order to work according to this principle, two agreements must be signed between the landlord and the tenant:

- a lease agreement, which clearly states all rental amounts;

- agency contract.

The first agreement implies that the tenant must pay utilities. The second agreement specifies that at the expense of the tenant and with his full consent and instructions, the landlord purchases services from utility companies.

Sample AD for utilities

Agent on OSNO – principal on simplified tax system

Art. 346.11 of the Tax Code of the Russian Federation exempts simplifiers from the obligation to pay VAT, therefore the principal’s agent on the simplified tax system does not calculate tax on transactions relating to the principal. But at the end of the transaction, the agent issues an invoice for the amount of the remuneration, without registering it in the accounting journal (clause 3.1 of Article 169 of the Tax Code). The VAT presented by the agent is subsequently taken into account by the simplified principal in the costs of the simplified tax system in the usual manner.

A peculiarity of the recognition of income by the principal using the simplified tax system is that, according to tax legislation, the simplified person’s revenue is the entire amount of receipts into the account. Therefore, when the agent deducts remuneration from funds received from transactions, the amount of income will be considered all proceeds from sales received to the agent’s account.