Hello, Vasily Zhdanov, in this article we will look at the total financial result of the period. This term, let's call it conditionally in the abbreviation SFR, is net profit (loss) for a specific reporting period, adjusted for the results of the revaluation of both non-current assets and other transactions that are not included in it. This definition can be found in almost all economic analytical sources of information, and therefore is perceived today as generally used.

Important! The SFR of each period is reflected in the financial report. results on page 2500.

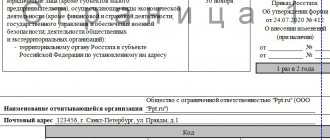

The current form of this report (according to OKUD 0710002) was introduced by Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010 (last amended on April 19, 2019). Economists most often call it Form No. 2. From 2021, an updated report form will be used, which contains the changes introduced by the said Order of 2021. Meanwhile, organizations have the right to make an independent decision about using it before the deadline.

Take our proprietary course on choosing stocks on the stock market → training course

The form is intended for all organizations except credit, insurance and government organizations. Individual entrepreneurs and foreign organizations that operate in the Russian Federation provide this type of reporting upon request. This norm is not their responsibility.

It should also be noted that, starting from 2012 to this day, the profit and loss statement is referred to as a financial statement. results. The basis is information of the Ministry of Finance of the Russian Federation No. PZ-10/2012.

Lines and their names in full-length fin. report No. 2

As you know, there are two forms of this report: full and simplified. The second is intended for those who use simplified methods of accounting. accounting. These include, first of all, representatives of small businesses and non-profit structures. In order to use the simplified form, they should establish the use of the simplified report as the norm in their accounting policies.

Further in the text we will consider the full-format report form, which contains the following lines:

- Page 2110, revenue (profitability from ordinary activities).

- Page 2120, cost of sales (expenses for ordinary activities as part of cost).

- Page 2100, VP (loss).

- Page 2210, commercial expenses (apply equally to the sale of products, services, and works).

- Page 2220, management expenses (related to the management of the organization).

- Page 2200, profit and loss from sales (i.e. directly from activities).

- Page 2310, income from participation in other organizations.

- Page 2320,% receivable (information on interest received).

- Page 2330,% payable (i.e. expenses in the form of interest that must be paid).

- Page 2340, etc. income.

- Page 2350, etc. spending.

- Page 2300, profit and loss before tax.

- Page 2410, current income tax (applied to the calculated amount on the declaration).

- Page 2421, including constant. tax liabilities (assets).

- Page 2460, other.

- Page 2400, emergency, loss.

- Page 2500, SFR.

The listed data is entered as of a specific reporting period. If there is no information on the indicators, dashes are placed on the corresponding lines. Directly on page 2500 the already calculated amount of SFR for the required period is indicated.

The simplified version of the report is a condensed form of the full one. It should be noted that it consists of only seven main lines and does not contain page 2500 (SFR).

Tip 2: How to calculate cost of goods sold

The cost price is understood as the cost of a product taking into account the costs of its production. Costs usually include wages, materials, raw materials, etc. Cost calculation allows you to determine the cost of producing a unit of production in monetary form.

Instruction 1 The generally accepted algorithm for calculating the cost of goods sold looks like this. First you need to determine the costs that vary proportionally with the volume of production, i.e. the amount of variable costs per unit of output. Before this, find the product of the cost norms and the cost of their acquisition. Next, add up the remaining expenses for the period and divide them by specific types of products. These may include costs for equipment repairs, building maintenance, depreciation, and administration costs. 2 At the moment, there are several types of cost calculation: marginal, custom, process and standard. Western economists most often use such methods as target costing, direct costing and others for calculations. 3 Specific production methods apply their own methods. Thus, for large-scale industries associated with the processing of raw materials, the marginal method is often used, the essence of which is that direct costs are reflected in accounting not by type of product, but by limits (certain phases of product manufacturing), and, for example, the custom method takes into account costs based on production orders. 4 Western methods make it possible to take into account the cost of products at the design stage. Thus, the target costing method takes as its basis the concept of target cost. In this case, cost is the difference between price and profit. Price refers to the market value of products, which should be determined using marketing research. And under profit is the desired amount of profit received. Thus, the cost is no longer just a standard indicator, but a value that a company strives for in order to be competitive. Sources:

- cost of goods sold

How to determine the value of the total financial result (CFR)

It should be noted that there are currently no separate detailed explanations for this new indicator. Current regulatory documentation does not explain its economic meaning. Only the procedure for its calculation has been determined, which, in fact, is used everywhere.

As is customary, the value of the SFR is calculated based on the data contained in the financial report. results. To calculate, you need to know three values:

- the amount of emergency, i.e. net profit, loss (registered on page 2400);

- the result obtained from the revaluation of non-current assets (VA), which is not included in the PE for the period under review (registered on line 2510);

- and the result from others. operations that are not considered an emergency (registered on page 2520).

To obtain the amount of SFR, the listed values must be summed. If we translate all this into a mathematical formula for calculation, then the calculation will take the following interpretation:

SFR = Line 2400+ Line 2510+2520

This is the general formula for calculating the SFR according to finance. report. The result of the calculation may be negative, which means a loss. The loss obtained as a result of the calculation should also be displayed on page 2500 as the value of the SFR, but only in parentheses. It should be noted that negative values (i.e. amounts with a minus) are always recorded in the reporting in parentheses, the minus is not placed next to it, because then such an entry will be considered incorrect.

With regard to the SFR indicator, we can conclude that it raises the level of information content of the information displayed in financial data. report No. 2. And this allows you to increase the efficiency of management decisions.

What is the value of the indicator

EBITDA reflects the financial results of an organization without taking into account the influence of credit conditions, taxes and depreciation and amortization. The indicator helps to roughly estimate the organization’s cash flow and compare it with other enterprises in a similar industry. This indicator also allows you to compare different companies, including international ones.

Even companies in the same country operating in the same industry may differ in factors such as cash flows, existing risks and growth prospects.

EBITDA softens differences between companies, allowing them to be compared with each other. Analysts use the indicator to analyze the creditworthiness of entities. Through EBITDA, investors evaluate the company's prospects - whether the company is able to reinvest capital in the future, scale the business and service loans.

Sometimes EBT and EBIT are indicated next to EBITDA:

- EBT is earnings before taxes.

- EBIT is earnings before interest and taxes.

If you add depreciation and amortization expenses and other write-offs to EBIT, you get EBITDA. Together, these three indicators are used in international business assessment. Most rating companies give priority to EBITDA.

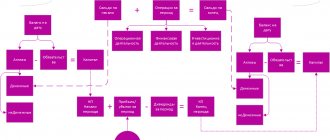

How the total financial result is formed: description of lines 2400, 2510, 2520 fin. report No. 2

So, a significant share of the total result is net profit (NP). It is subject to adjustment for the results of revaluations, which contain lines 2510 and 2520. Therefore, in addition to the emergency situation, these two indicators should also be taken into account. Let's consider the relationship between these three indicators and some features of their display in reporting.

The first indicator. Profit for the current year is shown by account. 90 (sales) and 91 (other income with expenses). The latter are then written off to the account. 99 (profit, loss), which at the end of the current reporting year is closed on the account. 84 (retained earnings).

The second indicator. As for the revaluation of VA, today it is carried out on the last day of the outgoing reporting year. If by this time there are no amounts of additional capital from a previously carried out revaluation, the markdown is shown in other words. spending. When carrying out an additional assessment as part of a previous revaluation, the amounts of which have already been included in the financial. As a result, this revaluation is shown in other things. income, but page 2510 is then left blank. If amounts of additional capital are involved, they are registered on page 2510 in section. "For reference."

The third indicator. This is another ambiguous indicator that appears in the calculation of the SFR - the result from others. operations (page 2520). What is noteworthy is that, within the framework of the applicable standards, it is not defined exactly what kind of operations we are talking about here. There are no strict regulations on this part. As practice shows, this indicator often includes the difference that arises when recalculating the value of existing assets.

For example, when a Russian organization operates in another country and, when using assets, recalculates their value in foreign currency into denominations. rubles When recalculating, the difference is obtained, which is further displayed using additional capital (in relation to PBU 3/2006, approved by Order of the Ministry of Finance of the Russian Federation No. 154n dated November 27, 2006).

In addition to the above, there is an opinion that the third indicator under consideration also includes the amount of errors for the previous year, which were identified by the time the accounts were formed and approved. reporting. In fact, comparable values of indicators for previous periods are adjusted when compiling accounts. reporting with disclosure of information in the relevant explanations. Errors are corrected in the manner indicated in clause 9, part II of PBU 22/2010 (approved by Order of the Ministry of Finance of the Russian Federation No. 63n dated June 28, 2010).

Taking into account the above, the general formula for calculating the SFR can be presented as follows:

Interpretation of indicators: PE - net profit, Y - loss, RPVA - the result from the revaluation of VA, not included in the PE, RPO - the result from other things. operations not classified as an emergency.

Tip 3: How to calculate profit before taxes

The main goal of any organization is to obtain the maximum possible profit. To this end, the company produces products, sells and minimizes costs. When a company sells goods produced with total revenue, this is called gross income. Profit, accordingly, is the difference between gross income and production costs.

You will need

- Determination of variable and fixed costs.

Instruction 1 To calculate profit before tax, it is necessary to subtract the amount spent on production from the total amount of total revenue. 2 However, production costs can be explicit or implicit. When subtracting explicit costs, that is, external ones, from total revenue, the result will be accounting profit. The accounting profit of an organization characterizes the result of the organization's activities over a certain period of time. But explicit and implicit costs may not always be constant. To obtain the amount of economic profit, you need to subtract internal costs and costs of business resources from accounting profit. 3 The amount of economic profit shows the prospects for the organization’s activities and future results, this is how profit before tax is calculated. The costs of entrepreneurial resources show the size of the share of profit that depends on the capabilities of the production manager. 4 At a manufacturing enterprise, the process of generating profit goes through 2 stages. In the first stage, money is invested in production and products are manufactured. That is, 2 factors are involved - capital and labor. This creates a new value for the created goods and generates profit. To calculate the new cost, it is necessary to calculate the difference between the cost of manufactured products and the amount for purchased raw materials and materials. The cost of the finished product includes production costs and new value. 5 From total income, the organization pays rent, interest on loans, etc. In the end, only net profit remains. 6 In the second stage, the profit is realized. The manufacturer's profit is equal to the difference between the price of the product and the cost. The cost consists of the total production costs, and the profit is obtained from the difference between the cost and the price. 7 Costs may also vary depending on production costs. To calculate profit in the short-term production period, you need to determine variable and fixed costs. When calculating profits in the long term, it is necessary to take into account that any costs will be variable. Please note: The manufacturer must not sell its products at a price lower than its value. Helpful advice Do not forget that the cost of production also includes the payment of wages to the company’s employees. Sources:

- calculation of profit before tax

Example 1. Calculation of SFR for filling out line 2500 fin. report of Olmis LLC for the period 2017–2018.

The calculation of the SFR value is based on data from the financial. report No. 2 of Olmis LLC for the period 2017–2018. The general calculation formula is applied. The indicator values used in the proposed example are conditional.

| The name of the indicator and the corresponding financial line. report No. 2 Olmis LLC | Data on it for 2021 from the report of Olmis LLC (thousand Russian rubles) | Data on it for 2021 from the report of Olmis LLC (thousand Russian rubles) |

| State of emergency (loss), page 2400 | 15 000 | 9 980 |

| Result from revaluation of VA, not attributed to emergency (loss), line 2510 | 89 | 130 |

| Result from other operations not classified as an emergency (loss), line 2520 | – | – |

The calculation of the SFR value for Olmis LLC is carried out for each period separately (first for 2021, then for 2021). Since there is no information on line 2520 (there are dashes for it in the financial report), the values that are available are substituted into the general formula for calculation.

SFR calculation for 2021: 15,000 + 89 = 15,089. By analogy, calculation for 2021 is made: 9,980 + 130 = 10,110.

According to the results obtained in Fin. in the report of Olmis LLC on page 2500 for the period 2021, the amount “15,089” should be recorded, and for the period 2021 on the same line - the amount “10,110”.

What is it used for?

EBITDA is often present in corporate financial statements. However, this indicator is not in the list of standards and it is not in the financial statements. EBITDA is calculated to clearly show the current position of capital. The indicator is measured in money (rubles, dollars, euros).

EBITDA column in the ranking

EBITDA began to be used in the 1980s to analyze the financial viability of companies relative to debt obligations. The ratio of the indicator to net profit shows the level of creditworthiness of the company - how much debt it can provide.

Example 2. Calculation of the SFR value for line 2500 in fin. report No. 2 of Prom-Style LLC for 2021

Prom-Style LLC carries out several types of activities, including: retail and wholesale trade in manufactured goods, consulting, intermediary activities. Let's assume that according to financial data. report No. 2 of Prom-Style LLC for 2021, the following data was obtained (see table).

| Indicator from fin. report of Prom-Style LLC | Data on it for 2021 (thousand Russian rubles) | SFR calculation for 2021 |

| Emergency (p. 2400) | 500 350 | SFR = PE – RPO |

| RPO (page 2520) | 8 100 | 500 350 – 8 100 = 492 250 |

Explanations for the calculation. According to financial data. According to the report of Prom-Style LLC, no revaluation of VA was carried out in the period under review (2019). Only the result from others is known. operations (8,100 thousand Russian rubles) and the value of the state of emergency (500,350 thousand Russian rubles).

Taking this into account, the SFR should be calculated using formula 2 (see above), substituting the values of only these two indicators. The calculation result is 492,250 thousand rubles. rub. This is the amount that should be indicated on line 2500 for the 2021 financial year. report of Prom-Style LLC.

More from this section:

Author KakSimply! The financial result will help you reflect the relationship between income and expenses of your enterprise. This indicator can be positive (profit) if income exceeds expenses, and negative (loss) when expenses exceed income. Instruction 1 The main indicators of profit in the accounting system of an enterprise are: profit from sales, profit from sales, gross profit, profit before tax and net profit. 2 The profit that an enterprise receives as a result of the sale of its own products is called profit from the sale of goods or services. In this case, the indicator is calculated as the difference between the revenue received and the cost of goods sold. In its full form, the formula can be presented as follows: Prp = C? Vр - Срп = Vр? (C - Sep), where Prp is the profit from sales of products, C is the price of a unit of production, Vp is the volume of products sold, Srp is the total cost of products sold, Sep is the total cost of a unit of production. 3 If an enterprise only sells goods or services (without producing them), then in this case they talk about profit from sales, which can be calculated as the difference between gross profit and expenses (administrative + commercial). In its full form, the formula is as follows: Psales = B – Srp – KR – UR, where Psales is profit from sales, B – revenue from sales of products, Srp? full cost of goods sold, KR - selling expenses, UR - administrative expenses. 4 Gross profit is calculated as the difference between sales revenue and the total cost of products sold.. 5 To obtain the profit before tax (Pdon), you need to add other income to Psales and subtract other expenses. Having calculated Pdon, the organization pays the necessary taxes and receives net profit. The latter is the source of payment of founder's income and the formation of the enterprise's own capital. Video on the topic

Please note: Do not confuse the categories “income” and “profit”. In the first case, we are talking about economic benefits before subtracting costs.

Who should take it?

First of all, it should be noted that the current legislation of the Russian Federation obliges any legal entities (legal entities) - organizations, firms, enterprises - to annually prepare and submit a financial results report (FPR) exclusively to the tax service (FTS).

At the same time, the vast majority of companies do not need to submit these reports to government statistics agencies (this obligation remains for legal entities that prepare financial statements with information legally classified as a state secret).

It turns out that any enterprise must correctly fill out and promptly submit annual financial statements to the tax service, including a statement of financial results and a balance sheet. This obligation exists for all legal entities, regardless of the applicable taxation systems.

Accounting statements for 2021 for filing in 2021:

- sample of filling out the balance sheet of an enterprise;

- about changes in capital;

- about cash flow.

As for the structural divisions of foreign organizations (as an option, Russian representative offices or branches of foreign companies), they have the right not to submit financial statements (balance sheet, financial statements) to the Federal Tax Service. Individual entrepreneurs (abbreviated as individual entrepreneurs) also may not submit these reports to the tax authority.

The legislation of the Russian Federation clearly establishes that certain legal entities can conduct simplified accounting, which implies the preparation and presentation of financial statements in a simplified (abbreviated) form. This applies to small businesses, as well as organizations legally classified as non-profit organizations. At the same time, such enterprises must prepare a financial statement and balance sheet annually.

Due date in 2021

As stipulated by Russian legislation, annual financial statements, which include a statement of financial results, balance sheet and other reporting forms, must be submitted by a legal entity to the Federal Tax Service no later than 3 (three) months following the reporting year.

This rule applies to both regular (full) reporting and simplified forms.

For 2021, reports must be submitted to the Federal Tax Service by March 31, 2021 inclusive. Since March 31 in 2021 falls on a working day, no postponements are expected.

In what form should I submit to the Federal Tax Service?

Annual reports, compiled on the basis of the enterprise’s accounting records, are submitted by the enterprise to the Federal Tax Service via special-purpose telecommunication channels. At the same time, all financial statements - financial statements, balance sheet, application documents - are compiled exclusively in electronic form .

Electronic accounting reports are sent through an operator - an authorized information intermediary.

In this case, the form for compiling and submitting the report form must comply with the generally binding template OKUD 0710002. This form is contained as an Appendix to Order No. 66n dated 07/02/2010, as amended. from 04/19/2019.

The simplified form of the FRA, used by certain legal entities (for example, non-profit structures, as well as small businesses - SMB), is regulated by Order of the Ministry of Finance of the Russian Federation No. 66n dated 07/02/2010 (please see Appendix 5).

.

Article 2900 “Basic earnings (loss) per share”

This article provides information about basic profit (loss) per share , which reflects the part of the profit (loss) of the reporting period attributable to shareholders - owners of ordinary shares. This line is filled in only by joint stock companies.

When forming basic earnings per share indicators in the financial statements, you should be guided by Order of the Ministry of Finance of the Russian Federation dated March 21, 2000 N29н “On approval of Methodological Recommendations for the disclosure of information on earnings per share” (see letter of the Ministry of Finance of the Russian Federation dated September 9, 2011