On a quarterly basis, tax agents paying remuneration to individuals must report to the Federal Tax Service in Form 6-NDFL. The calculation form was approved by Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018). In 6-NDFL, the amount of tax withheld is reflected according to certain rules, non-compliance with which may lead to a violation of control ratios. There is a fine for inaccurate reporting. Let's look at how to fill out the form for withheld income tax amounts in accordance with the requirements of the tax service.

The amount of personal income tax deductions for employees should not exceed the total amount of accrued income

In line 020 of section 1 of form 6-NDFL, the organization indicates the total amount of income accrued to all individuals since the beginning of the year (see fragment of the report below). In line 030 of the same section, the company reflects the amount of personal income tax deductions provided (clause 3.3 of the Procedure for filling out form 6-NDFL).

Line 020 must be greater than or equal to line 030 (clause 1.2 of Control Relations). If line 020 is less than line 030, the organization has overestimated the amount of personal income tax deductions.

Check information about all personal income tax deductions provided to employees. Pay special attention to employees who are entitled to a property deduction in connection with the purchase of housing (Article 220 of the Tax Code of the Russian Federation). It is possible that Form 6-NDFL included the maximum deduction amount for the employee for the year, and not what was actually provided for the first quarter.

If the tax authorities discover this error in the report, they will inform the company about it and offer to either explain the discrepancies or make corrections (clause 3 of Article 88 of the Tax Code of the Russian Federation).

Explanations will not work in this case. Because this is an obvious mistake. This means that you will need to correct it and retake Form 6-NDFL. There are five working days for this from the date of receipt of a message about discrepancies from inspectors (clause 6 of article 6.1 of the Tax Code of the Russian Federation).

Basic correlations to check

In 2021, the control ratios for form 6-NDFL are still approved by letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/3852. Below we present them all, but in a form that is simplified for understanding and use.

| Reference ratio (CR) | If the CS is not performed | |||

| Which norm of the Tax Code of the Russian Federation may have been violated? | Description of the violation | |||

| Title page 6-NDFL (page 001) | 1.1 | Submission date <= established by Art. 230 Tax Code of the Russian Federation deadline | clause 1.2 art. 126 clause 2 art. 230 Tax Code of the Russian Federation | If the date of submission is > the deadline established by the Tax Code of the Russian Federation, then a violation is possible - failure to submit the calculation deadline established by the Tax Code of the Russian Federation |

| KS inside 6-NDFL | ||||

| 6-NDFL | 1.2 | line 020 => line 030 | Art. 126.1 Art. 210 Art. 23 Art. 24 Tax Code of the Russian Federation | If line 020 < line 030, then the amount of tax deductions is overstated |

| 6-NDFL | 1.3 | (line 020 – line 030) / 100 × line 010 = line 040 (taking into account ratio 1.2). | Art. 126.1 Art. 210 Art. 23 Art. 24 Tax Code of the Russian Federation | If line 020 – line 030 / 100 × line 010 <, > line 040 (taking into account ratio 1.2), then the amount of accrued tax is over/underestimated. At the same time, taking into account clause 6 of Art. 52 Code of the Russian Federation, an error in both directions is permissible, determined as follows: line 060 × 1 rub. × number of lines 100 |

| 6-NDFL | 1.4 | line 040 > = line 050 | Art. 126.1 Art. 227.1 Art. 23 Art. 24 Tax Code of the Russian Federation | If line 040 < line 050, then the amount of the fixed advance payment is overestimated |

| 6-NDFL, KRSB NA | 2.1 | line 070 – line 090 < = KRSB data (personal income tax paid from the beginning of the tax period) | Art. 226 Art. 23 Art. 24 Tax Code of the Russian Federation | If line 070 – line 090 > KRSB NA data (personal income tax paid from the beginning of the tax period), then the tax amount may not have been transferred to the budget |

| 6-NDFL, KRSB NA | 2.2 | Date on line 120 > = date of transfer according to KRSB NA data (date of payment of the personal income tax amount) | Art. 226 Art. 23 Art. 24 Tax Code of the Russian Federation | If the date on line 120 is < the date of transfer according to the KRSB NA data (the date of payment of the personal income tax amount on line 140), then the deadline for transferring the withheld personal income tax amount may be violated |

| 6-NDFL, 2-NDFL, income tax return (hereinafter referred to as DNP) | 3.1 | Line 020 at the corresponding rate (line 010) = the sum of lines “Total amount of income” at the corresponding tax rate of 2-NDFL certificates with attribute 1, presented for all payers, and lines 020 at the corresponding tax rate (line 010) of appendices No. 2 to DNI submitted for all payers by this tax agent Please note: the ratio applies to 6-NDFL for the year | Art. 126.1 Art. 226 Art. 226.1 Art. 230 Art. 23 Art. 24 Tax Code of the Russian Federation | If line 020 at the corresponding rate (line 010) <, > the sum of lines “Total amount of income” at the corresponding tax rate of 2-NDFL certificates with attribute 1, submitted for all payers, and lines 020 at the corresponding tax rate (line 010) appendices No. 2 to the DNP, presented for all payers, then the amount of accrued income is underestimated/overestimated |

| 6-NDFL, 2-NDFL, DNP | 3.2 | Line 025 = the amount of income in the form of dividends (according to income code 1010) of 2-NDFL certificates with attribute 1, presented for all payers, and income in the form of dividends (according to income code 1010) of Appendix No. 2 to the DNP, presented for all payers Please note: the ratio is applied to 6-personal income tax per year | Art. 126.1 Art. 226 Art. 226.1 Art. 230 Art. 23 Art. 24 Tax Code of the Russian Federation | If line 025 <, > the amount of income in the form of dividends (according to income code 1010) of 2-NDFL certificates with attribute 1, submitted for all payers or by a tax agent, and income in the form of dividends (according to income code 1010) of Appendix No. 2 to the DNP, presented for all payers, then the amount of accrued income in the form of dividends is under/overestimated |

| 6-NDFL, 2-NDFL, DNP | 3.3 | Line 040 for the corresponding tax rate (line 010) = the sum of lines “Tax amount calculated” for the corresponding tax rate of 2-NDFL certificates with attribute 1, submitted for all payers, and lines 030 for the corresponding tax rate (line 010) of appendices No. 2 to the personal income tax presented for all payers Please note: the ratio applies to 6-personal income tax for the year | Art. 126.1 Art. 226 Art. 226.1 Art. 230 Art. 23 Art. 24 Tax Code of the Russian Federation | If line 040 for the corresponding tax rate (line 010) <, > the sum of lines “Tax amount calculated” for the corresponding tax rate of 2-NDFL certificates with attribute 1, presented for all payers, and lines 030 for the corresponding tax rate (line 010) appendices No. 2 to the DNP, then the amount of calculated tax may be underestimated/overestimated |

| 6-NDFL, 2-NDFL, DNP | 3.4 | Line 080 = the sum of lines “Amount of tax not withheld by the tax agent” of 2-NDFL certificates with attribute 1, presented for all payers, and lines 034 of Appendix No. 2 to the Tax Income Tax, presented for all payers | Art. 126.1 Art. 226 Art. 226.1 Art. 230 Art. 23 Art. 24 Tax Code of the Russian Federation | If line 080 <, > is the sum of the lines “Amount of tax not withheld by the tax agent” of 2-NDFL certificates with attribute 1, presented for all payers, and lines 034 of Appendix No. 2 to the DNP, presented for all payers, then the amount may be under/overstated tax not withheld by the tax agent |

| 6-NDFL, 2-NDFL | 3.5 | Line 060 = total number of 2-NDFL certificates with sign 1 and appendices No. 2 to the DNP, submitted for all payers Please note: the ratio applies to 6-NDFL for the year | Art. 126.1 Art. 230 Art. 23 Art. 24 Tax Code of the Russian Federation | If line 060 <, > the total number of 2-NDFL certificates with sign 1 and appendices No. 2 to the DNP, submitted for all payers, then the number of individuals who received income is over/underestimated, or 2-NDFL are not fully represented |

| 6-NDFL, foreigner’s patent | 4.1 | line 050 > 0 if there is an issued patent notice | Art. 126.1 Art. 226 Art. 227.1 Art. 23 Art. 24 Tax Code of the Russian Federation | If line 050 > 0 in the absence of information about the issuance of a patent notice, then the amount of calculated tax is unlawfully reduced by the amount of fixed advance payments |

Line 070 in 6-NDFL

Form 6-NDFL includes information about accrued and withheld tax on income paid to individuals by the tax agent. In Calculation 6-NDFL, line 070 is provided for withheld tax amounts, and when filling it out, you should take into account some features. The procedure for filling out the Calculation (approved by Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/450) does not provide detailed explanations on line 070, indicating only that the withheld personal income tax must be shown on an accrual basis from the beginning of the year and in the total amount.

Our article is about how to fill out line 070 in 6-NDFL and what mistakes should not be made.

Linking string values within a form

Checking the 6-NDFL control ratio begins with linking the lines according to the proposed formulas.

For example, the ratio is considered correct when line 020 ≥ page 030. If the inequality is not maintained, then there is an error, since the total tax deduction (030) should not exceed the amount of accrued income (020).

The control ratios of 6-NDFL line 040 are expressed in the formula:

- page 040 = (page 020 – page 030) x page 010, i.e. the amount of accrued tax corresponds to the product of accrued income (minus deductions) by the current rate. If the equation does not hold true, therefore, the amount of accrued tax is incorrect (underestimated or, conversely, overestimated). In this calculation, a minor error due to rounding is acceptable, calculated by multiplying line 060 (number of employees) by 1 rub. and the number of lines is 100 (date of receipt of income).

- line 040 ≥ line 050. If the value of line 040 is less than the value of line 050, then most likely the amount of the fixed advance payment is overestimated.

Withheld tax: how to reflect it in 6-NDFL

In Section 1 of Form 6-NDFL, all indicators are entered incrementally from the beginning of the year. Withheld tax is no exception; it is also indicated in an incremental manner: when filling out, for example, the Calculation for 9 months, in line 070 you need to show the tax withheld from January to September of the reporting year.

Lines 060-090 are grouped into the subsection “Total for all bets”. All of them, including line 070, are filled out collectively for all applicable rates, and the total amount of tax withheld is shown. When tax on income paid is calculated at different rates, then lines 010-050 for each of them are filled out on a separate page, and lines 060-090 only once - on the first page of Section 1.

The amount of tax withheld in 6-NDFL is indicated without kopecks. This is obvious, because the cells allocated to reflect the amounts of income and tax deductions provide for the indication of rubles with kopecks, but for personal income tax amounts there are no “penny” cells, and they are indicated in full rubles.

General principles for forming the 2nd section of the form

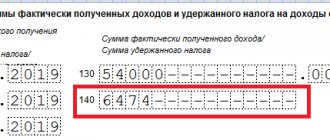

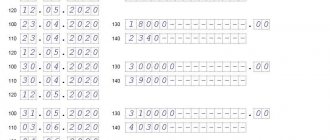

The 140th line is an integral part of the information blocks that form the 2nd section of 6-NDFL. Each block is intended for entering into the report information about one payment of income to individuals with one deadline for transferring personal income tax to the budget. The block structure consists of lines with serial numbering from 100 to 140. Data is posted into the block in a certain sequence:

- first, line 100 indicates the date of receipt of income by individuals (taking into account the norms of Article 223 of the Tax Code of the Russian Federation);

- then line 130 shows the actual amount of payment received on the day indicated on line 100 (in full, including personal income tax);

- then on line 110 the day is entered when personal income tax must be withheld from the payment, information on which is entered in line 100 and line 130 (in accordance with Article 226 of the Tax Code of the Russian Federation);

- after this, in line 140 you must indicate the amount of tax withheld from the payment for which the block is filled out;

- Finally, line 120 of the report reflects the day no later than which the personal income tax shown on line 140 must be transferred to the budget.

Thus, the indicator on line 140 is interconnected with the characteristics of filling out other lines in each specific report.

6-NDFL: lines 070 and 140

Tell me, should the sum of lines 140 (withheld tax in section 2) and line 070 (withheld tax in section 1) converge? I understand that line 070 is from the beginning of the year, and section 2 is for the quarter, but quarters can be summed up. There is no such thing in control ratios, apparently they cannot be compared, but why, in what cases? Probably connected with transition months, when, for example, tax was withheld in April for March, as a result it will end up in section 2 in the 2nd quarter, and in section 1 in the first quarter? Well, that's me for example. It’s just that the 1st section must correspond to 2-NDFL, and in 2-NDFL the withheld tax does not transfer to another year if we paid the salary in January. So this reason comes to mind.

Advertising space is empty

1 — 05.07.16 — 17:12

(0 ) in section 1 will also fall into the second quarter. Read the instructions carefully

2 — 05.07.16 — 17:17

3 — 05.07.16 — 17:21

(2) this is for accountants, probably. I've been given such a crazy amount of instructions since April that I'm even at a loss. Now they will probably release more in the second quarter, so for now there is no point in taking on this 6-NDFL at all, we have to wait 2 weeks.

4 — 05.07.16 — 17:33

6 — 05.07.16 — 17:35

— Question: About filling out the calculation in form 6-NDFL for the first quarter, if the salary for March was paid in April. — Answer: Since in the situation under consideration, the tax agent must withhold the amount of tax on income in the form of wages accrued for March, but paid in April, in April directly upon payment of wages, in lines 070 and 080 of section 1 of the 6-NDFL calculation for the first quarter of 2021 is marked “0”. This tax amount is reflected only in line 040 of section 1 of the 6-NDFL calculation for the first quarter of 2021.

7 — 05.07.16 — 17:36

(5) Only Odin’s implementation of this letter completely plunged me into a stupor.

8 — 05.07.16 — 17:37

although I remember when they handed it over, it was different, in line 070 they put 0, and in line 080 just the unwithheld amount, which will be withheld in April. And now it turns out everything has changed.

Nuances of filling

When filling out the form, you need to know an important nuance: the amount of calculated tax is calculated when the employee receives income. For example, wages are considered paid:

- the last day of the salary payment month;

- the last working day upon dismissal or termination of an employment contract before the end of the salary month;

When it comes to bonuses or temporary disability benefits, the date of payment is considered the date of actual receipt of funds. Consequently, the 6-NDFL report will reflect the benefits and bonuses that were actually paid to employees as of the date of the report. That is, if 6-NDFL is submitted for six months, then the income line includes all actual payments of benefits and bonuses made before June 30. And accrued but unpaid amounts are not included in the calculation (including vacation pay).

Similar articles

- Amount of accrued income 6-NDFL

- Report 6-NDFL

- Filling out section 1 6-NDFL

- Personal income tax calculated and withheld, what is the difference?

- Calculation of 6-NDFL for the 1st quarter of 2018

Errors in 6-NDFL

6-NDFL only indicates income actually received

Some accounting programs filled out 6-NDFL with errors. In particular, they transferred to line 130 only the amount that the employees received.

To correct the error in 6-NDFL, in line 130 of Section 2, you need to record the income of employees with personal income tax. This is stated in the order of filling out the calculation (approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] ). But the company can withhold not only taxes from the employee, but also, for example, alimony. Therefore, inspectors believe that it is correct to write accrued income in line 130. Otherwise, the information may be distorted.

The employee's salary is 100 thousand rubles. Tax - 13,000 rubles. (RUB 100,000 × 13%). In addition, the company withholds 25 percent for alimony - 21,750 rubles. ((RUB 100,000 – RUB 13,000) × 25%). The employee received 65,250 rubles. (100,000 – 13,000 – 21,750). In line 130, write down 100 thousand rubles.

Nuances of reflecting a foreign worker’s patent

If, when calculating the tax of a foreign employee, payments made by him under a patent are taken into account, the procedure for forming 6-NDFL has its own characteristics.

If payments under a patent exceed the amount of tax that the tax agent must withhold, all settlements with such an employee will actually be reflected in the 1st section of the report:

- for 020 - amount of income (accrued);

- for 040 - the estimated amount of personal income tax from charges in favor of a foreigner on a patent;

- for 050 - the amount to reduce the accrued tax due to fixed payments.

In the 2nd section, the only (essentially reference) information will be the indication of the date of receipt and amount of payment from the tax agent by a foreign individual:

- 100 - day of payment;

- 130 each - the amount of payment;

- at 110 - 00.00.0000;

- at 120 - 00.00.0000;

- for 140 - 0.

NOTE! It is possible that the amount of payments under a patent is not sufficient to cover the amount of personal income tax payable. Then the agent’s taxable portion of the income appears. In this case, according to the above logic, according to the 1st section, personal income tax is formed for withholding and additional payment by the tax agent (the difference between lines 040 and 050).