How to fill out a balance sheet under the simplified tax system for 2021:

- Enter the data in 5 lines in the asset and 6 lines in the liability without dividing into sections.

- Use 3 years of information.

- Give the completed form to your manager for signature (an accountant’s signature is not required).

Simplified accounting and reporting are not related to taxation. Firms have the right to conduct it both using the simplified tax system and other modes, including the general one. This opportunity is provided to small businesses, non-profit organizations (except for foreign agents) and Skolkovo participants. In the article we will answer the question of whether an LLC submits its balance sheet to the simplified tax system in 2021, and whether the general rules apply to individual entrepreneurs and non-profit organizations.

Small businesses, according to Federal Law No. 209 dated July 24, 2007, in 2019 included organizations and individual entrepreneurs with a staff of up to 100 people and revenue excluding VAT of up to 800 million rubles. The organizational and legal form can be:

- IP;

- NPO;

- OOO.

These rules do not apply to joint stock companies, and they do not have the right to apply simplified accounting. And individual entrepreneurs are allowed not to keep accounting records at all and not to submit any financial reports (Article 6 No. 402-FZ).

The simplified requirements for legal entities are stricter: among other things, the value of their depreciable fixed assets on the balance sheet cannot exceed 100 million rubles.

Federal Law No. 402 and Order of the Ministry of Finance dated July 2, 2010 No. 66n provide for a simplified scheme according to which a balance sheet for an LLC can be drawn up using the simplified tax system for 2021, but the detail of the reporting is left to the discretion of the LLC: full and short versions are acceptable. What balance does the LLC submit to the simplified tax system? Read about it below.

Simplified balance sheet and “simplified” balance sheet: what is the difference

The obligation of companies using the simplified tax system to keep records and draw up a balance sheet today is mandatory for almost all “simplified” companies, with rare exceptions (Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

In most cases, “simplified” companies fall under the criteria of a small enterprise, so they can choose which form to draw up the balance sheet - general or simplified (Clause 4, Article 6 of Law No. 402-FZ).

Consequently, a simplified balance sheet and a “simplified” balance sheet are not the same thing, since this report can be drawn up not only in a simplified form, but also in a generally established form.

Read about what characterizes the balance sheet of the generally established form in the material “Balance Sheet (Assets and Liabilities, Sections, Types).”

NOTE! Organizations subject to mandatory audit and a number of other companies listed in clause 5 of Art. 6 of Law No. 402-FZ.

In order for the compiled balance sheet to be reliable and useful to stakeholders, the company must properly organize the accounting process.

For more information about accounting options, accounting policies and chart of accounts for companies using the simplified tax system, read the article “Procedure for maintaining accounting records under the simplified tax system .

The traditional form of the balance sheet is familiar to everyone, so let’s take a closer look at the simplified form of the report.

Simplified form of balance sheet (STS)

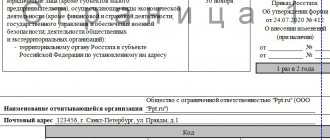

A simplified form of the balance sheet is given in Appendix 5 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

ATTENTION! From 2021, financial statements, incl. simplified, submitted exclusively electronically. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here. We also remind you that in 2021 the reporting forms have been updated.

In all reporting forms (including balance sheet and Form 2):

- the unit of measurement has become thousands of rubles, it is impossible to fill out reports in millions;

- OKVED has been replaced by OKVED2.

In some forms it is replaced by OKUD.

In the traditional balance sheet, a line is introduced to indicate whether the statements are subject to mandatory audit or not. If yes, you need to talk about the auditor.

New machine-readable forms for full and simplified reporting can be downloaded here.

As for the actual differences between the simplified form of the balance sheet and the usual (traditional) one, the simplified one contains fewer lines in assets and liabilities. But this does not mean that something may not be reflected in the balance sheet or may not be included in full.

It is not always necessary to fill out all lines of the simplified balance sheet. This is possible when the company does not have any assets or liabilities at the reporting date. For example, a company uses only leased property and does not create fixed assets itself. In this case, the corresponding balance line is not filled in.

A sample of filling out a simplified balance sheet for 2020 was prepared by ConsultantPlus experts. Get trial access to the K+ system and study the material for free:

Types of receivables in a company

All receivables are divided into two large groups:

- Long-term

- Short term

Both varieties fall into balance after a year.

All debts that are repaid within 12 months constitute short-term “receivables”. As a rule, such debt includes overpayment of taxes, shipments to counterparties “on credit,” or prepayment for goods or services.

Long-term debt appears when the debt is not paid off within a year. As for settlements with counterparties, the possibility of this type of debt arising should be specified in the agreement with the partner. However, if the counterparty simply does not pay its obligations for a long time, then such debt also belongs to the category of long-term.

Of course, it is in the interests of each organization to have a significant share of short-term debt out of the total amount of “receivables”.

It must be taken into account that no matter what type of debt, after missing the repayment deadline, it becomes overdue. It is not in the best interests of the company to have overdue accounts receivable .

There is often great doubt that the debt will ever be repaid. Often such overdue debts are never closed, that is, they become hopeless. A debt can be doubtful for three years, and then becomes uncollectible. Ultimately, such debt must be written off as a loss.

We fill out the balance sheet asset in a simplified form

You must enter data in the following 5 lines:

- "Tangible non-current assets."

ATTENTION! From 2021, reserves must be maintained in accordance with FSBU 5/2019 “Reserves”. PBU 5/01 will no longer be in force. How to switch to inventory accounting according to FSBU 5/2019, read here.

This shows the residual value of assets (balance of accounts 01 and 03 minus balance of account 02) and adds expenses for construction in progress (account 08).

- “Intangible, financial and other non-current assets.”

The residual value of intangible assets is reflected (together with “work in progress” and R&D expenses associated with these assets), deposit balances (account 55), long-term financial investments (account 58), as well as long-term debts reflected in settlement accounts (60, 62 , 68, 69, 70, 71, 73, 75 and 76).

- When filling out the “Inventories” line, you will need information about the balances of materials, goods, finished products (accounts 10, 41, 44, 45), costs in work in progress (account 20), including the balance on account 97 (for expenses with a write-off period of less than 12 months).

- Information about cash and cash equivalents, which must be reflected in line 4, is collected from all “cash” accounts (50, 51, 52, 55, 57) excluding subaccount 55 “Deposit accounts”.

- The line “Financial and other current assets” contains information about short-term financial investments (account 58), the amount of short-term debts reflected in the settlement accounts, as well as all other assets of the company that do not find a place in this section of the report.

NOTE! Financial investments, accounts receivable and inventories in the balance sheet assets must be shown without taking into account reserved amounts (account balances 59, 63, 14), that is, in a net valuation (PBU 4/99).

Income statement

The financial performance statement is intended to reflect information about the income and expenses of the organization. It is compiled based on the results of the reporting period and for the same period of the previous year.

| Indicator name | Line code | What is reflected | Reflection order |

| Revenue | 2110 | Revenue from the sale of products, goods, works and services | Credit turnover on account 90 (subaccount 90-1 “Revenue”) - Debit turnover on account 90 (subaccounts: 90-3 “VAT”, 90-4 “Excise taxes”) |

| Expenses for ordinary activities | 2120 | Expenses associated with the production and sale of products, goods, works and services | Debit turnover on account 90 (sub-account 90-2 “Cost of sales”) |

| Percentage to be paid | 2330 | Expenses in the form of accrued interest payable | Debit turnover on account 91 (subaccount 91-2 “Other expenses” in terms of interest paid) |

| Other income | 2340 | Income from participation in other organizations, interest receivable and other income | Credit turnover on account 91 (subaccount 91-1 “Other income”) - Debit turnover on account 91 (subaccount 91-2 “Other expenses” in terms of VAT, excise taxes and other similar payments) |

| other expenses | 2350 | Other expenses not reflected in other lines of this form | Debit turnover on account 91 (subaccount 91-1 “Other income”) - Debit turnover on account 91 (subaccount 91-2 “Other expenses” in terms of VAT, excise taxes and other similar payments) |

| Profit taxes (income) | 2410 | The amount of income tax accrued for payment to the budget or a single tax paid under the simplified tax system | (Credit turnover – Debit turnover) on account 68 (sub-account “Calculations for current income tax” or “Calculations for single tax”) |

| Net income (loss) | 2400 | Profit (loss) remaining at the disposal of the organization | Turnover on account 99 in correspondence with account 84 line 2400 = line 2110 – line 2120 – line. 2330 + page 2340 – page 2350 – page 2410 (calculated automatically) |

Simplified balance sheet liability

This section of the report, consisting of 6 lines, is filled out in the following order:

- "Capital and reserves".

All credit balances on accounts 80 (minus the debit balance of account 81), 82, 83 and 84 are entered here. If a loss is reflected on account 84 (i.e. there is a debit balance), then it is taken into account in the same way as the data reflected on account 81. If the overall result is negative, it will be shown in parentheses.

- "Long-term borrowed funds."

The figure in this line should reflect the balance of the company's debt on long-term loans and borrowings (account 67). In this case, accrued interest, the maturity of which as of the reporting date is less than 12 months, is excluded.

- "Other long-term liabilities."

Filled out for the amount of long-term liabilities listed in the loan balances in accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76.

- "Short-term borrowed funds."

This line includes the balance of account 66, as well as the balance of accrued interest that was not taken into account when filling out information on long-term loans and borrowings.

- "Accounts payable".

This shows the sum of credit balances in accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76 for all short-term liabilities.

- "Other current liabilities."

A line that may be missing or not filled in if all the necessary information about obligations is reflected in the 5 previous lines.

NOTE! After filling out the liability and asset lines of the balance sheet, you need to compare the results obtained. The sum of all asset lines must be equal to the result of adding the liability lines.

For information on how a balance sheet drawn up in a generally established form is checked, read the article “Procedure for drawing up a balance sheet (example).”

For step-by-step instructions on filling out each line of the simplified balance sheet, see the guide from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Accounting statements of small businesses 2017: sample

Let’s fill out the reporting of a small enterprise, LLC Giatsint, which uses the simplified tax system “Income” using the example:

The company's balance sheet for the year:

Account number Balance at the beginning of the period Revolutions Closing balance D/t K/t D/t K/t D/t K/t 01 400000 400000 02 112000 128000 240000 08 65000 92000 157000 10 50000 32000 18000 41 48000 25000 12000 61000 44 23100 12000 30000 5100 50 26300 65900 50000 42200 51 228600 653000 589000 292600 52 50000 50000 58 85000 85000 60 26500 365000 348000 9500 62 145000 356900 390000 111900 66 175000 10000 165000 68 72000 65000 23000 30000 69 36000 16000 10000 30000 70 63000 428300 423000 57700 71 36000 36000 76 42000 45000 20000 67000 80 500000 500000 82 23000 23000 83 32000 32000 84 159500 43100 202600 90,1 300000 300000 90,2 100000 100000 90,3 32000 32000 91,1 100000 100000 91,2 18000 18000 total 1199000 1199000 2684100 2684100 1289800 1289800 Let’s assume that the interest paid for the loan amounted to 5,000 thousand rubles, the company had no other expenses, and the calculated tax according to the simplified tax system amounted to 69,000 thousand rubles.

To whom and when should the balance be submitted?

The simplifier filled out the balance. What's next? It does not matter in what form this balance sheet is drawn up (traditional or simplified). A company using the simplified tax system is obliged to submit a report (as part of other mandatory accounting reports) to the interested authorities.

Since 2021, the only such government agency is the Federal Tax Service. Most companies no longer need to submit accounting reports to statistics. The due date remains the same - March 31 of the year after the reporting year. This period is determined by both tax (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation) and accounting (clause 2, article 18 of law No. 402-FZ) legislation.

If you are just starting a business and registered after September 30 of the reporting year, you only need to prepare and submit a balance sheet for the first time at the end of the next year. For example, a company was registered on October 10, 2020 - for the first time it is required to report for the period from October 10, 2020 to December 31, 2021 (Clause 3, Article 15 of Law No. 402-FZ).

For presentation to management, owners or counterparties, the balance sheet can be drawn up at any other frequency (clause 4, article 13 of law No. 402-FZ). In this case, the state (represented by tax authorities and statistics) is not required to submit reports.

NOTE! If your company does not send the balance to the tax authorities or does so late, the fine will be 200 rubles. (clause 1 of article 126 of the Tax Code of the Russian Federation). Administrative punishment under Art. 15.6 Code of Administrative Offenses of the Russian Federation. Account blocking does not apply in this case.

In addition, significant fines have been established for failure to approve financial statements.

Who works for the simplified tax system in 2021

The use of a simplified regime by organizations and individual entrepreneurs is possible if a number of requirements are met:

- number of employees less than 100 people;

- annual income not exceeding 150 million rubles;

- use of fixed assets with a residual value of less than 150 million rubles in production activities;

- lack of functioning branches;

- the share of third parties in the authorized capital is less than 25%.

The transition to a simplified taxation regime is possible after submitting an application to the Federal Tax Service: within 30 days from the date of termination of activity with payment of UTII and until the end of the current year in other cases.

In addition, the income received for the first 3 quarters of the current year should be summed up: they should not exceed a fixed amount of 112,500,000 rubles. Until 2021, the limit was calculated as multiplying the deflator coefficient by the income limit established for the previous period. From the beginning of 2021, the deflator is subject to freezing, and from 2021 it will be equal to one.

In case of non-compliance with any requirement, the business entity loses the right to apply the simplified tax system and is obliged to switch to the general taxation regime from the beginning of the quarter in which the violation occurred.

Results

In order to correctly draw up a balance sheet, a company using the simplified tax system must competently organize the accounting process, develop accounting policies and a working chart of accounts. Then you need to decide on the form of the balance sheet. A simplifier can choose between traditional and simplified.

A simplified report is easier to fill out, but the information presented cannot be shortened. The balance sheet must reliably reflect the value of the property and the amount of the company's liabilities as of the reporting date. The finished balance is sent to tax authorities, statistical authorities and all interested parties.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Brief instructions for analyzing receivables

Analysis of debt in a company is important. During its implementation, many indicators are assessed, but even based on the dynamics of changes in debt indicators, some conclusions can already be drawn.

| Index | 2017 | 2018 | Height, % | Deviation, thousand rubles | ||

| Sum | Percent | Sum | Percent | |||

| Total | 233810 | 100 | 324306 | 100 | 138,7 | 90496 |

| Suppliers | 227 | 0,1 | 601 | 0,2 | 264,8 | 374 |

| Buyers | 233353 | 99,7 | 316614 | 97,5 | 2721,1 | 83261 |

| Taxes | 228 | 0,1 | 6204 | 1,9 | 44350 | 5976 |

| Other counterparties | 2 | 887 | 0,3 | 885 | ||

In accordance with the data presented in the table, we can conclude that the largest weight of debt falls on buyer debts. In addition, compared to 2021, in 2018 there was a general increase in receivables for all counterparties.

As for buyers, each of them needs to be considered more carefully, in terms of contracts. It is necessary to determine the dynamics of debt and its change in accordance with the level of revenue. Only after conducting a full analysis can we say what condition the receivables are in and what risks exist for the company.