Why does a director need to understand financial statements?

The manager is responsible for everything that happens in his company, including accounting. Although the chief accountant or another financial specialist prepares the reports, it is the director who certifies them. The current balance sheet form does not provide for a second signature at all.

Naturally, the manager must understand what he is signing and be able to identify dubious places in the report.

In addition, balance sheets of other organizations often end up on the director’s desk. The fact is that when signing an agreement with a new partner, businessmen usually request detailed information about him, which includes financial statements.

Of course, the counterparties' reports will first be analyzed by the company's financiers. But the last word on concluding a contract in any case remains with the director. He must weigh all the factors, including independently studying the reporting of a potential partner, without relying only on the opinion of his subordinates.

We will consider the analysis methodology using the example of simplified forms of financial statements.

The current form of the balance sheet shows data for three dates: the beginning and end of the reporting year, as well as the beginning of the previous year. Form No. 2 also includes two years of information. Therefore, you can see how the indicators change over time

Balance sheet (form No. 1)

Financial results report (form No. 2)

Taxpayer Online - checking reports to the Federal Tax Service and the Pension Fund of Russia

The Taxpayer Service helps organize the submission of electronic reporting. Through the service you can submit reports to the Federal Tax Service, Social Insurance Fund, Pension Fund and Rosstat. Price - from 3,000 rubles. The system will independently check that all forms are filled out correctly. In the program you can generate 2-NDFL and SZV-M for free.

You can also check reports with the Federal Tax Service and the Pension Fund for free. To do this you need to register on the site. You cannot check reports for the Social Insurance Fund and Rosstat for free. Legal advice from a trusted partner

Submit your application

Balance sheet asset

Let's start looking at the balance sheet from the asset. This section reflects the company's resources that it can use to conduct business. Assets are arranged in descending order of liquidity, i.e. the ability to quickly implement them and receive money ( Latin liquidus - “flowing”).

Non-current assets or fixed assets (line 1150) - real estate, equipment, transport, etc.

If your company did not buy or sell fixed assets in the previous two years, then this figure will decrease slightly (on average by several percent per year) due to depreciation. This is the option discussed in the example.

If there were such purchases, then the indicator of non-current assets as of the last reporting date should be higher than for the previous ones.

If you are considering the balance sheet of a third-party company, then the presence of significant fixed assets is one of the indicators that indicates the reliability of a potential partner.

Of course, this does not mean that there is no need to work with counterparties whose indicators on line 1150 are small or zero. For example, many quite successful trading or transport companies actively use rented premises or cars.

Intangible assets (p. 1170) - patents, licenses, etc. They are also subject to depreciation and are reflected in the balance sheet according to the same rules as fixed assets. In our example, they are not present, because we are considering the balance sheet of a small enterprise, for which this type of asset is not very typical.

Inventories (p. 1210) include goods, finished goods, raw materials, and work in progress.

Their growth in dynamics should not exceed the growth rate of revenue, otherwise this indicates that the efficiency of using the company’s resources is decreasing.

To determine the average annual size of inventories, you need to add up the data at the beginning and end of the year and divide the amount by 2. The average annual indicators for other balance sheet items are determined in the same way.

Of course, to more accurately determine average annual figures, it is better to use the values at the beginning of each month. But now we are talking about analysis based on standard balance sheet data, and it does not contain monthly information.

What is meant by reading a document?

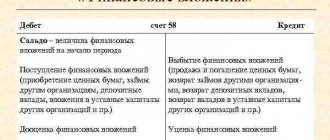

Reading means understanding the information presented and its comprehensive analysis. The report is read in the context of its articles. Balance sheet items are created on the principle of compliance of funds with their formation and purpose. When reading analytically, the balance is presented in table form. It combines these provisions:

- Assets.

- Subject's capital.

- Obligations.

What is the deadline for an extract from the balance sheet ?

When reading, you need to take into account the following analytical relationships:

- A = P. Assets are always equal to liabilities.

- A = K + O. The size of assets can be calculated by adding capital and liabilities. The formula allows you to determine in what relation the company's property includes its own and other people's funds. Based on this formula, the degree of independence of the subject can be established.

- K = A – O. Represents an equation for finding net asset value. By subtracting liabilities from current assets, you can determine the property that will remain after debts are fully paid off.

The PBU states that assets must be distributed according to the degree of increase in liquidity. Illiquid assets are allocated first and then liquid assets. Liabilities are distributed depending on the urgency of their coverage. Perpetual liabilities (equity) come first, followed by current liabilities.

Example

Z2018 = (1820 + 1650) / 2 = 1735 thousand rubles.

Z2019 = (1650 + 1800) / 2 = 1725 thousand rubles.

Z2019 / Z2018 = 1725 / 1735 = 99%

V2019 / V2018 = 28000 / 20000 = 140%

Revenue increased significantly, but inventories remained almost at the same level. This suggests that the company has begun to use them much more effectively.

Accounts receivable (p. 1230) are debts to the company. Primarily we are talking about buyers, but there may also be other types of debts, for example:

- suppliers for advances issued;

- budget for overpayment of taxes;

- personnel for accountable amounts.

The best thing is when the “receivables” decrease. If it grows, then the growth rate should be lower than that of revenue.

It is also desirable that accounts receivable do not exceed accounts payable (p. 1520).

Which companies must undergo an audit?

An audit of financial statements can be mandatory and proactive. The first can only be external, that is, carried out by independent experts from firms specializing in auditing, or by individual auditors who are not employees of the audited company.

Firms that must be subject to the mandatory audit procedure are named in the Federal Law dated December 30, 2008. No. 307 (law “On auditing activities”). These enterprises include:

- companies with the legal form of JSC;

- companies whose securities are admitted to organized trading;

- firms with a certain type of activity (this includes credit, clearing, insurance, companies participating in the securities market, microfinance, self-regulatory organizations, cooperatives, gambling organizers, etc.);

- companies that have revenue over 400 million rubles or assets over 60 million rubles (for the year preceding the reporting year), etc.

A detailed list can be seen in Art. 5 Federal Law No. 307 “On auditing activities”.

An initiative audit can be carried out in certain cases, such as: bank lending, the need to participate in tenders, the desire of company managers to reduce tax risks, checking the qualifications of the accounting department, preparing a report for a potential investor.

Example

DZ2018 = (1300 + 1500) / 2 = 1400 thousand rubles.

DZ2019 = (1500 + 1400) / 2 = 1450 thousand rubles.

KZ2018 = (1900 + 260 + 1820 + 216) / 2 = 2098 thousand rubles.

KZ2019 = (1820 + 216 + 1580 + 40) / 2 = 1828 thousand rubles.

Accounts receivable is growing, but only slightly (1450 / 1400 - 1400 = 4%). This is much lower than the revenue growth rate (40%). In addition, it is significantly lower than accounts payable. This indicates that the company's debt management system is working effectively (provided that accounts payable are repaid without delay).

Cash (p. 1250) is a very fast-moving metric. Many companies almost completely spend all the money they receive, so the figure for this item may be small. But if an organization pays its obligations on time, then the minimum account balance at the end of the period does not indicate problems with the company’s finances.

Liability balance

The liabilities side of the balance sheet lists the sources of funds from which the company finances its assets.

The article “Capital and reserves” (page 1300) for most LLCs consists of two parts:

- Authorized capital is the funds that the founders invested when creating the business. According to the law, for an LLC it must be no less than 10 thousand rubles, and for a public joint-stock company - no less than 100 thousand rubles. The larger the authorized capital, the more reliable the company is in the eyes of counterparties, banks, investors, etc.

- Retained earnings are that part of the company's profits that the founders decided to keep in circulation.

If the authorized capital did not change and the owners of the company did not receive dividends, then the difference between the indicators on line 1300 at the beginning and end of the year will be equal to the financial result. This is exactly the case considered in our example.

Change in capital for 2021 and 2021

K2018 = 2024 – 1640 = 384 thousand rubles.

K2019 = 2480 – 2024 = 456 thousand rubles.

These amounts are equal to the company's net profit on Form No. 2 for 2021 and 2019, respectively.

The item “Long-term borrowed funds” (p. 1410) includes all loans and borrowings received for a period of more than a year.

The article “Short-term borrowed funds” (p. 1510) combines “short-term” loans and borrowings, i.e. received for less than a year.

The mere presence of borrowed funds and an increase in their amount does not mean that the company has problems. However, if loan debts are growing, but revenue remains stagnant or even falls, then this should cause concern. Most likely, in this case, the bank’s money is not invested in development, but is used to “plug holes.”

In our example, revenue increases, but the amount of debt on loans decreases. This indicates the effective use of borrowed funds.

The item “Other long-term liabilities” (page 1450) also lists the company's debts that are due in more than a year. But here we are talking about all other similar debts (except for banks), for example, under long-term contracts with suppliers.

The items “Accounts payable” (p. 1520) and “Other short-term liabilities (p. 1550) include all “non-bank” debts of the organization with a short maturity.

This includes not only debts to counterparties, but also current debts on taxes, wages, accountable amounts, etc.

Short-term accounts payable must be no less than accounts receivable and must not grow at a faster rate than revenue. In our example, the “creditor” even decreases, but the revenue increases.

otchet_o_celevom_ispolzovanii.jpg

Let's check the CS:

| Graphs | Strings | ||

| Line 6400 | = | lines 6100 + 6220 + 6240 + 6250 – 6310 – 6320 – 6330 – 6350 | |

| 3 4 | 6 14 | = = | 14 + 60 – 68 10 + 123 – 119 |

| 3, 4 | 0 | All values in rows 6220 to 6250 | |

| 3, 4 | 0 | All values for rows 6310 to 6350 | |

| Line 6400 columns 4 = 14 | = | Line 6100 columns 3 = 14 | |

The calculation results in the tables show that the reporting forms of GruzTrans LLC contain numerical data that does not contradict each other.

Analysis of financial ratios

To draw conclusions about the financial position of a company, it is necessary not only to analyze absolute indicators, but also to calculate the relationships between them, i.e. – coefficients. They, like absolute numbers, also need to be studied over time in order to draw conclusions about business development trends. Let's consider the main financial indicators that can be obtained based on financial statements.

- Profitability is the ratio of net profit to revenue or assets. To calculate it, not only the balance sheet is used, but also another main accounting form - the income statement.

Return on sales:

Rp = PE / V

Return on assets:

Ra = PE / A

If a company operates successfully, then not only its revenue and net profit should grow, but also its profitability percentage.

CheckPFR and CheckXML - checking reports to the Pension Fund of Russia

The Pension Fund of the Russian Federation offers free downloads of programs for checking employee reports.

- CheckPFR is designed for testing RSV-1, SZV-M and various SZV and ADV.

- CheckXML additionally checks personal data, death certificates, voluntary insurance forms, an application for the exchange of an insurance certificate, and so on.

These programs are used by the Pension Fund itself, so its data can be trusted 100%. There is only one drawback - you cannot check reports for the Federal Tax Service, Social Insurance Fund or Rosstat.

Example

| Period | Revenue | Net profit | Return on sales |

| 2018 | 20000 | 384 | 1,9% |

| 2019 | 28000 | 456 | 1,6% |

| Period | Assets | Net profit | Return on assets |

| 2018 | 4605 | 384 | 8,3% |

| 2019 | 4555 | 456 | 10,0% |

The tables show that, although absolute profit has increased, the percentage of return on sales has decreased slightly. Company management needs to pay attention to the cost structure.

But the return on assets has increased significantly, i.e. The efficiency of using the company's resources as a whole is growing.

- Capital structure. It is characterized by the autonomy coefficient - the ratio of equity capital to assets.

KA = SK / A

In the simplified balance sheet structure, equity is line 1300 “Capital and reserves”. Assets are the result of the balance sheet, i.e. line value 1600.

Sometimes in the economic literature you can find an indication that the normative value of CA should not be lower than 0.5. Those. business owners must finance the company with at least half of their own funds.

However, this approach in many cases resembles measuring the “average temperature in a hospital.” Much depends on the specifics of the business, primarily on the field of activity.

If we are talking about a trading company, then KA may be lower, reaching 0.3. Such companies often rent premises and equipment, and take the goods for sale.

For complex high-tech industries the situation will be the opposite. The owners of such companies usually try to acquire ownership of equipment and production premises. Indeed, in such a situation, any problems with landlords and the need to move can paralyze the business for a long time.

But in any case, the CA should not be overestimated - up to 0.7 - 0.8 or more. This, of course, increases financial stability, but deprives the company of potential income from the use of borrowed funds.

What does ignoring the search for connections entail?

If company representatives do not search for connections, errors and inconsistencies may remain in the reporting. Tax officials are checking documents and looking for logical connections. If discrepancies are found, an additional tax audit may be scheduled. This makes it difficult for the company to operate. During the audit, other errors may be discovered, which will lead to penalties. It’s easier to check the statements first. Any accountant and specialist with a financial education can do this.

FOR YOUR INFORMATION! The duration of the audit depends on the volume of documents being compared and the professionalism of the accountant.

Example

| date | Equity | Assets | CA |

| 31.12.2017 | 1640 | 4600 | 0,36 |

| 31.12.2018 | 2024 | 4610 | 0,44 |

| 31.12.2019 | 2480 | 4500 | 0,55 |

The table shows that CA is growing steadily and reaching the average standard value as of the last reporting date.

- Solvency. The main indicator that characterizes a company's ability to pay off its obligations is the total liquidity ratio. It is equal to the ratio of current assets to short-term liabilities

Klo = OA / KP

Current assets are the sum of inventories, accounts receivable and cash.

OA = page 1210 + page 1230 + page 1250

Short-term liabilities are the sum of all short-term debts of the enterprise.

KP = page 1510 + 1520 + page 1550

The Klo standard can vary from 1 to 2.5. Those. Even in the most extreme case, debts with short maturities should be fully covered by liquid assets.

And here, too, a lot depends on the direction of the company. Trading firms can allow a reduction in KLo to values slightly exceeding 1, because their inventory is usually easy to sell if necessary.

It is usually more difficult for manufacturing enterprises to sell stock balances in warehouses, therefore KLo for them should be higher, approximately in the range of 1.5 - 2.5. But there is no need to increase this coefficient too much either, because while resources are in reserves.

Astral - free online check of reports to the Federal Tax Service, Pension Fund and Social Insurance Fund

Through Astral you can test all forms of reports to the tax office, the Pension Fund, Social Insurance and Rosalkogolregulirovanie for free. It is enough to download the report file in .xml or .txt format. After this, the system will issue a verification protocol.

The service has a full version with extended functionality. Price - from 1,500 rubles.

Example

| date | Current assets | Short-term liabilities | Klaw |

| 31.12.2017 | 3480 | 2960 | 1,18 |

| 31.12.2018 | 3550 | 2586 | 1,37 |

| 31.12.2019 | 3500 | 2020 | 1,73 |

CL is steadily increasing and reached 1.73 as of the last reporting date. This indicator allows you to ensure solvency for a company from any field of activity.