Last modified: January 2021

When faced with financial difficulties, an enterprise is forced to make unpopular decisions and carry out structural reorganization. One of such measures is often dismissal due to staff reduction, designed to optimize the number and professional composition of personnel. Having decided to take such a step, the employer must have a holistic understanding of the upcoming procedure, the rules for selecting candidates for calculation and the amounts of compensation due.

What is dismissal due to reduction

A reduction in the number or staff of an organization’s employees is one of the grounds on which an employer can terminate a contract on its own initiative (Clause 2 of Article 81 of the Labor Code of the Russian Federation).

It is worth distinguishing that in the first case, the company reduces the number of employees in one position (for example, instead of 8 lawyers there are 4 left), and in the second, certain categories of positions are completely excluded from the staffing table. Contrary to popular belief, the employer can make such a decision at any time without any justification or explanation to employees, the trade union or third parties, which is confirmed in the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2. Which is quite logical, since the issue of staff reduction concerns organization of activities within the enterprise and depends on the success of business.

It is also not mandatory for company management to obtain the consent of a citizen or trade union. However, notifying the employee and obtaining the opinion of the trade union are one of the conditions for maintaining the legality of the dismissal procedure for staff reduction. In addition, payment of all compensation required by law is required.

Dismissal procedure: list of actions

Since the legislator seeks to protect the interests of workers as much as possible, the reduction procedure is quite strictly regulated. A certain algorithm must be followed:

- Issuance by the manager of an order to reduce staff and approval of a new staffing table or changes to be made to it.

- Notification of the employment service and trade union.

- Determining the circle of persons who have the right of priority to remain at work.

- Delivery of layoff notices to staff against signature.

- Offering laid-off employees free vacancies, that is, other jobs.

- Requesting the union's opinion on the dismissal of an employee who is a member of it.

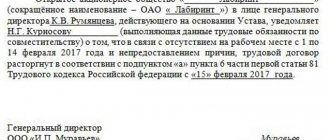

- Termination of the employment contract.

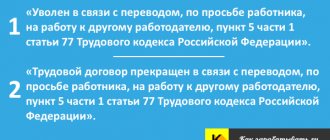

- On the day of dismissal due to staff reduction, a settlement is made with the employee, and a work book is issued with a note of dismissal due to staff reduction on the basis of clause 2 of Art. 81 Labor Code of the Russian Federation.

Conditions

There are a number of conditions under which a reduction will be legal:

- Absolutely complete compliance with the law regarding the reduction procedure. If the enterprise’s acts indicate the conditions for this type of dismissal, then they must also be fully complied with.

- The expediency of dismissal. First of all, the order must indicate the reasons for termination of the employment contract.

- Notification of the Employment Center about the release of workers. Many employers miss this point, as a result of which they pay fines to the state and forced absenteeism of the employee

Step-by-step instruction

Step 1. Before issuing an order to reduce staff or number of employees, it is necessary to make such a decision in accordance with the procedure established in the organization. It is necessary to identify positions that are subject to reduction, make sure that the list of those being dismissed does not include citizens who cannot be dismissed on this basis, and identify persons who are granted benefits by law. It is necessary to take into account that employees with higher qualifications have a preferential right to retain their jobs. When deciding who exactly will be laid off, the presence of dependents, injury at work or occupational illness, and the presence of other breadwinners in the family are taken into account. The order must indicate which staffing units and in what quantity are subject to exclusion from the staffing table, the reason for making such a decision, describe in detail the upcoming reduction procedure, indicating all activities and the timing of their implementation, as well as provide a list of responsible persons at all stages. All responsible persons are familiarized with the order and signed.

Step 2. All notifications to interested parties are sent on time in the approved or recommended form. It is imperative that all notices be dated so that there is evidence that deadlines have been met. It is possible to dismiss employees before two months only with their written consent with the payment of additional compensation for average earnings according to the remaining time of work, according to the notice.

Step 3. Before issuing a notice, you need to offer another job. Moreover, the legislation does not indicate that the proposed workplace must correspond to the previous one or the qualifications of the specialist. If you are being made redundant, you can also offer a low-paying job, lower in position, this is allowed. Of course, all notifications and refusals of offered work, which the employee also does not have to explain, are documented in writing. It is a mistake to think that in any case you can limit yourself to one sentence. If new vacancies suitable for health reasons appear within a two-month period, the employer is obliged to offer them to the dismissed employee.

Step 4. The notification to the employment service must indicate the positions, professions and specialties of the dismissed workers. In addition, you need to notify the employment service about their level of qualifications and the conditions of payment for each employee. The employment service must be notified of mass layoffs three months in advance. The employment service is obliged to inform the prosecutor's office about all enterprises that have not sent a notice of staff reduction.

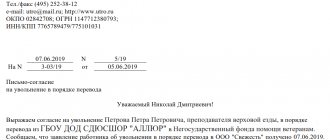

Step 5. Based on the general order, a specific order is issued for each employee with whom he gets acquainted with signature. The contract is terminated after the expiration of a two-month period (the period is counted from the next day after receipt of the notification) and after changes are made to the staffing table. Moreover, there should be no similar vacant positions left in the staffing table, otherwise the legality of the employer’s decision may be challenged. The order is issued in a unified form, the work book is drawn up in accordance with the Labor Code of the Russian Federation.

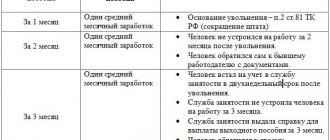

Step 6. Payment of compensation.

Reduction of workforce in 2021: important changes

Reduction of employees of pre-retirement age in 2021

The innovation in the field of pension legislation, which sets a higher age threshold for the transition to full state support, has had some impact on labor law standards.

From the beginning of 2021, workers of pre-retirement age will have additional guarantees in case of dismissal.

An employee of pre-retirement age is a person who needs to work for no more than 5 years before receiving an insurance pension (the age limit for receiving state support will gradually increase, which will entail a shift in the pre-retirement qualification).

Before the entry into force of the pension reform, the reduction of staff mainly affected the elderly contingent of the company, since employers often believe that their production indicators are significantly inferior to those of young specialists.

In the new year, legislative amendments indicate that citizens of pre-retirement age can be dismissed only in the presence of compelling circumstances, including:

- staff reduction;

- liquidation of the enterprise;

- reduction in numbers;

- expiration of the fixed-term contract;

- loss of trust, theft, serious violation of labor discipline or safety regulations;

- voluntary desire of the employee.

If there is a need to reduce the number of employees of an enterprise, elderly people can be dismissed by the employer on their own initiative and without consequences, subject to the following conditions:

- The procedure involves the subsequent liquidation of the position;

- Compliance with labor standards for layoffs (regulated by the Labor Code of the Russian Federation - Articles 82, 179, 180, 373), including the procedure and deadline for notification of upcoming structural changes;

- The employee does not have an advantage over other colleagues.

In case of non-compliance with regulatory requirements when laying off an elderly employee, the following penalties may be imposed on the manager:

- Compulsory work for a period of up to 360 hours;

- Penalties in the amount of no more than 200 thousand rubles;

- Withholding a portion of income or other remuneration for a period of up to one and a half years.

Reduction of staff due to occupational illness in 2020

Regulatory regulations establish equal labor guarantees for every working citizen, therefore, staff reductions due to occupational illness in 2021 are carried out on a general basis, unless there are exceptional circumstances.

As a general rule, when an employer decides to reduce the number of employees at an enterprise, the likelihood of termination of an employment contract at the initiative of the employer can equally affect everyone - both a completely healthy employee and one with an occupational disease.

In practice, there are exceptional situations when an employee with an occupational disease becomes the main candidate for dismissal and the reasons for this are as follows:

- the existing illness does not allow you to perform the assigned job function properly and of the required quality;

- A medical report was drawn up for the employee, according to which he should be completely removed from work.

Each of the above grounds must have documentary evidence, in particular:

| Due to the discrepancy between the work and the quality | According to medical report |

| Documents on identifying defects from the production volume performed by an employee with an occupational disease | According to honey conclusion, the employee is prescribed easier working conditions, which the employer does not have |

| Acts recording employee errors at work | The employee refused to be transferred to another job offered to him with working conditions suitable for his health condition |

| A medical document recognizes the employee as completely incapable of working |

A medical report indicating the need to temporarily transfer an employee with an occupational disease to another job function (for a period of no more than 4 months) cannot become grounds for dismissal, even if the conditioned employee refuses to change working conditions to easier ones.

In this case, the following rules apply:

- suspension from work for the period specified in the medical report;

- retention of the employee's position;

- no accrual of maintenance (except for cases specified in the legal regulations).

Reduction of staff due to occupational illness in 2020

Regulatory regulations establish equal labor guarantees for every working citizen, therefore, staff reductions due to occupational illness in 2021 are carried out on a general basis, unless there are exceptional circumstances.

As a general rule, when an employer decides to reduce the number of employees at an enterprise, the likelihood of termination of an employment contract at the initiative of the employer can equally affect everyone - both a completely healthy employee and one with an occupational disease.

In practice, there are exceptional situations when an employee with an occupational disease becomes the main candidate for dismissal and the reasons for this are as follows:

- the existing illness does not allow you to perform the assigned job function properly and of the required quality;

- A medical report was drawn up for the employee, according to which he should be completely removed from work.

Each of the above grounds must have documentary evidence, in particular:

| Due to the discrepancy between the work and the quality | According to medical report |

| Documents on identifying defects from the production volume performed by an employee with an occupational disease | According to honey conclusion, the employee is prescribed easier working conditions, which the employer does not have |

| Acts recording employee errors at work | The employee refused to be transferred to another job offered to him with working conditions suitable for his health condition |

| A medical document recognizes the employee as completely incapable of working |

A medical report indicating the need to temporarily transfer an employee with an occupational disease to another job function (for a period of no more than 4 months) cannot become grounds for dismissal, even if the conditioned employee refuses to change working conditions to easier ones.

In this case, the following rules apply:

- suspension from work for the period specified in the medical report;

- retention of the employee's position;

- no accrual of maintenance (except for cases specified in the legal regulations).

Who should not be fired

To avoid negative consequences and fines, the employer must remember which employees, due to their special situation, cannot be laid off, in accordance with Article 261 of the Labor Code of the Russian Federation:

- pregnant women;

- workers with children under three years of age;

- single mothers with a disabled child who has not reached the age of majority;

- single mother with a child under 14 years old;

- other persons who raise such children without a mother.

Also, an employer cannot unilaterally dismiss an employee who is on sick leave or on vacation (Article 81 of the Labor Code of the Russian Federation).

Features of dismissal of pensioners, pre-retirees, part-time workers and other categories of workers

Pensioners are dismissed due to staff reduction in the same manner, with the same compensation being paid. The only controversial issue remains the payment of the third benefit, since a pensioner cannot register with the employment service and receive benefits, since he receives a pension. However, if there are circumstances worthy of attention, employment centers provide pensioners with the certificates necessary to receive the third benefit.

Rostrud recommended that employers separately consider the issue of providing pre-retirees with a preferential right to retain their jobs in case of staff reduction. This is logical, because if there is a suspicion of dismissal due to reaching the appropriate age, the administration may be held criminally liable.

The part-time worker is paid the average monthly salary for the second and third months only if he provides evidence in the form of an entry in the work book about dismissal from the main place of work before dismissal from the part-time job.

A seasonal employee is notified 7 days in advance of a planned dismissal, and is paid compensation in the amount of two weeks' average earnings. No other compensation is provided for them.

Northerners, or residents of the Far North, can qualify for average earnings for 4-6 months of unsuccessful employment if they provide the appropriate documents from the employment service, provided that they are registered within 30 days from the date of dismissal. The third allowance is issued even in the absence of registration.

Reasons

It is possible to dismiss a full-time employee due to redundancy if:

- Reduction of employer staff;

- Complete elimination of a specific position.

It is possible to eliminate certain positions when switching to automated means of work (for example, there was a watchman, now a security alarm is used) or if it is financially impossible to maintain so many jobs.

The Constitutional Court of the Russian Federation established that layoffs are the right of the employer, determined by economic feasibility.

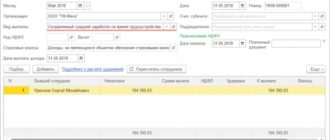

Calculation example

Ivanov I.I. worked as a manager for two years and was dismissed due to staff reduction on 01/01/2018. On January 10, he contacted the employment center and was registered, but could not find a job until 04/01/2018, that is, until that moment he retained his unemployed status. Ivanov I.I.’s work schedule was standard with a 5-day work week. Initial data: for 2021 Ivanov I.I. he worked 247 days, 28 calendar days and 19 working days he was on vacation: from 08/01/2017 to 08/28/2017. The salary of Ivanova I.I. was unchanged for the entire 2021 and amounted to 30,000 per month.

Formula for calculating severance pay by Ivanova I. upon dismissal due to staff reduction:

- actual shifts worked: 247 - 19 = 228;

- average salary per day: 331,428.57 / 228 =1453.63;

- amount for January: 1453.63 × 17 = 24,711.71;

- February amount: 26,165.34;

- amount for March: 31,979.86.

Ivanov would be entitled to benefits for the first month, that is, payment of compensation for January, even if he was employed. But benefits for February and March, if you start a new job during these months, would be calculated in proportion to the days of unemployment.

Additional guarantees

In addition, current legislation establishes another guarantee for employees - preservation of wages during the period of employment. According to Article 178 of the Labor Code of the Russian Federation, a dismissed employee retains his average monthly earnings for a period not exceeding two months. In exceptional cases, a salary can be issued for the third month of unsuccessful job search (if the citizen registered with the employment service within two weeks from the date of dismissal), but the employee must provide confirmation from the employment service that he applied to this body and was not employed.

Longer terms for maintaining the average wage are established for those who work in the Far North and equivalent territories. For such categories of workers, the paid period of employment can be up to six months after layoff (Article 318 of the Labor Code of the Russian Federation).

Advantages and disadvantages

Of course, layoffs are not a pleasant thing for an employee, especially during a crisis in the labor market. But still, a reduction, in contrast to voluntary dismissal, has a plus - it is severance pay, paid in the amount of average monthly earnings and retained by the employee for at least two months.

For the employer, the advantages are obvious - his initiative, that is, the employee cannot refuse, further optimization of expenses and reduction of the fund for wages. However, such a procedure will only further reduce the fund, since the reduction procedure itself is expensive.

Retirement

Russian legislation also has such a concept as early retirement. According to Art. 32 Federal Law “On Employment...” dated April 19, 1991, persons have the right to apply for early retirement if the following conditions are met:

- at least 20 years of experience for women and 25 for men;

- age is 2 years less than the established retirement age;

- lack of employment opportunities for another job. This circumstance must be confirmed at the employment center.

When such persons are laid off, they have the right to retire early, but only with their consent. After employment or retirement, payments stop.

To whom compensation is not paid?

In Article 349.3 of the Labor Code of the Russian Federation, the legislator established a restriction on the provision of severance pay for managers, their deputies, chief accountants, as well as members of executive bodies:

- state corporations;

- organizations in whose authorized capital the share of participation of the Russian Federation is more than 50% of state extra-budgetary funds;

- state and municipal institutions.

However, if the payment of compensation is provided for in an employment or collective agreement, then it is still paid, but in a limited amount - no more than three average monthly salaries.

Regulatory rationale

The basic requirements for carrying out the procedure for reducing the number of employees are prescribed in the Labor Code:

- Article 180 – procedure for reporting future termination of relations;

- Article 179 – on the procedure for assessing qualifications and selecting candidates for dismissal;

- Article 178 – on financial support for released specialists.

If an enterprise conducts mass layoffs, then personnel officers and management need to take into account the norms of Government Decree No. 99 of 1993 and Federal Law No. 1032-1 of 1991, and also take into account the requirements of Art. 373 of the Labor Code on the motivated opinion of the trade union.

Responsibility for violation of payments

For violation by the employer of labor legislation and failure to pay statutory deductions on time, Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation provides for the following fines:

- for officials - from 10,000 to 20,000 rubles;

- for persons carrying out entrepreneurial activities without forming a legal entity - from 1000 to 5000 rubles;

- for legal entities - from 30,000 to 50,000 rubles.