Home / Labor Law / Payment and benefits / Wages

Back

Published: 03/03/2016

Reading time: 9 min

0

3327

The minimum wage, also called the minimum wage, is established by the government at the federal level and is needed to regulate wages in Russia, as well as to determine various payments and benefits, the amount of which directly depends on the minimum wage (for example, the amount of sick leave, maternity benefits and childbirth, fines, taxes, fees and other payments).

The minimum wage changes almost every year due to inflation. From January 1 of this year it amounted to 7,500 rubles per month.

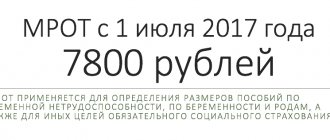

On July 1, 2021, the minimum wage will increase to 7,800 rubles per month.

- Minimum wage for the last 11 years

- How are things going in the regions?

- Minimum wage and living wage

Increase in the minimum wage from July 1, 2021

From July 1, the minimum wage is 7,800 rubles. instead of 7500 rub. From this date, take the new minimum into account when calculating wages and benefits.

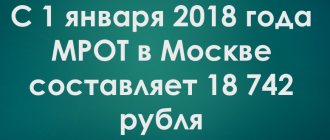

At the same time, constituent entities of the Russian Federation (regions) are given the right to establish on their territory a minimum wage that differs from the federal minimum wage (Article 133.1 of the Labor Code of the Russian Federation). The regional “minimum wage” is established by a tripartite agreement. It is agreed upon at the level of the government or administration of the subject (region, territory, autonomous district, etc.), associations of trade unions and associations of employers. So, for example, from July 1, 2021, the minimum wage in Moscow increased to 17,624 rubles. See “Minimum wage in Moscow from July 1, 2021.”

But what minimum wage should workers’ salaries be compared with – regional or federal? The answer is simple: compare the monthly payment with the “minimum wage” that is higher. The final amount must be in favor of the employee. At the same time, keep in mind that the totality of all payments established to the employee that make up his salary must be no less than the regional minimum wage (Article 129 of the Labor Code of the Russian Federation). That is, not only salary, but also compensation with bonuses.

Typically, the regional minimum wage is higher than the federal one. However, in July 2017, a situation cannot be ruled out when the federal minimum wage is higher than the regional one. So, for example, in the Arkhangelsk region the minimum wage is set for the entire 2021 - 7,500 rubles per month, and the federal one from July 1 - 7,800 rubles. It turns out that from July 1 in the Arkhangelsk region, for calculations and determination of earnings, it is necessary to take into account the federal minimum wage (7,800 rubles).

Also note that in addition to wages, the minimum wage affects three types of benefits:

- sick leave;

- for pregnancy and childbirth;

- for child care up to 1.5 years.

However, keep in mind that these benefits are considered from the federal, not the regional minimum wage. For more information, see “Benefits from July 1, 2021: new dimensions.”

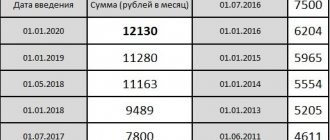

Minimum wage for the last 11 years

In order to clearly see the dynamics of changes in the minimum wage in Russia, pay attention to the table below.

| Minimum wage establishment date | Minimum wage (RUB) | Equivalent in US dollars (USD) (data are given at the exchange rate of the year corresponding to the change) |

| May 1, 2006 | 1100 | 40,33 |

| September 1, 2007 | 2300 | 89,77 |

| January 1, 2009 | 4330 | 147,32 |

| June 1, 2011 | 4611 | 164,79 |

| January 1, 2013 | 5205 | 171,38 |

| January 1, 2014 | 5554 | 170,10 |

| January 1, 2015 | 5965 | 106,08 |

| January 1, 2021 | 6204 | 84,84 |

| January 1, 2021 | 7500 | 125,84 |

Minimum wage and taxes

Some employers set the employee's salary strictly in accordance with the minimum wage (no more and no less). However, if an employee’s salary is equal to the minimum wage, personal income tax and insurance premiums, including “for injuries,” should still be withheld from it. This is confirmed by legal norms:

- Personal income tax – articles 210 and 217 of the Tax Code of the Russian Federation;

- insurance contributions for compulsory pension (social, medical) insurance - Articles 420 and 422 of the Tax Code of the Russian Federation;

- insurance premiums for insurance against industrial accidents and occupational diseases (“injuries”) - Articles 20.1 and 20.2 of the Law of July 24, 1998 No. 125-FZ.

Minimum wage from July 1, 2021: table by region

Below we present a table with the minimum wage from July 1, 2021 (by region). Also, for convenience, the values are broken down by federal district.

| Central Federal District | ||

| Region | Minimum wage until July 1, 2021, rub. | Minimum wage from July 1, 2021, rub. |

| Belgorodskaya | Not lower than the subsistence level (for extra-budgetary sphere) | 8,368 (for enterprises financed from the regional and local budget) |

| 7800 (for enterprises financed from the federal budget) | ||

| 8046 (for enterprises financed from the regional and local budget) | ||

| 7500 (for enterprises financed from the federal budget) | ||

| Bryansk | 7500 | 7800 |

| Vladimirskaya | 8500 | 8840 |

| 7500 (for state employees) | 7800 | |

| Voronezh | Living wage | 7800 |

| Ivanovskaya | — | |

| Kaluzhskaya | — | |

| Kostromskaya | — | |

| Kursk | 9665 | |

| 7800 (for state employees) | ||

| Lipetskaya | 1.2 living wage | — |

| Moscow | 12500 | 13750 |

| 7,500 (for state employees) | 7,800 (for state employees) | |

| Orlovskaya | Living wage | 10000 |

| Ryazan | 7500 | 7800 |

| Smolenskaya | ||

| Tambovskaya | ||

| Tverskaya | ||

| Tula | 13000 | 13520 |

| 11,000 (for state and municipal institutions) | 11440 | |

| Yaroslavskaya | 9640 | 10026 |

| 8021 (for small and medium-sized businesses) | 8,342 (for small and medium-sized businesses) | |

| 7560 (for state employees) | 7,800 (for state employees) | |

| Moscow | 17561 | 17624 |

| Northwestern Federal District | ||

| Region | Minimum wage until July 1, 2021, rub. | Minimum wage from July 1, 2021, rub. |

| Karelia | Living wage | |

| Komi | 8100 | — |

| Arkhangelskaya | 7500 | 7800 |

| Vologda | ||

| Pskovskaya | ||

| Kaliningradskaya | 10000 | 10400 |

| 7500 (for state employees) | 7800 (for state employees) | |

| Leningradskaya | 7800 excluding compensation and incentive payments | 10850 |

| 7500 (for state employees) | 7800 (for state employees) | |

| Murmansk | 14281 | — |

| Novgorodskaya | Living wage | — |

| Saint Petersburg | 11,700 excluding compensation and incentive payments | 16000 |

| Nenets Aut. district | 12420 | 12917 |

| 7500 (for state employees) | 7,800 (for state employees) | |

| Southern Federal District | ||

| Region | Minimum wage until July 1, 2021, rub. | Minimum wage from July 1, 2021, rub. |

| Adygea, Kalmykia | 7500 | 7800 |

| Krasnodar region | Living wage | |

| Astrakhan | 7500 | 7800 |

| Volgogradskaya | 1.2 living wage | — |

| Rostov | 7500 | 7800 |

| North Caucasus Federal District | ||

| Region | Minimum wage until July 1, 2021, rub. | Minimum wage from July 1, 2021, rub. |

| Dagestan, Ingushetia | 7500 | 7800 |

| Kabardino-Balkaria | Living wage | Living wage |

| 7500 (for state and municipal institutions, as well as companies financed from the federal budget) | 7,800 (for state and municipal institutions, as well as companies financed from the federal budget) | |

| Karachay-Cherkessia | 7500 | 7800 |

| North Ossetia Alania | ||

| Chechen Republic | 9274 | 9274 |

| 7500 (for state employees) | 7800 | |

| Stavropol region | 7500 | 7800 |

| Volga Federal District | ||

| Region | Minimum wage until July 1, 2021, rub. | Minimum wage from July 1, 2021, rub. |

| Bashkortostan | 8900 (including allowances for work in special climatic conditions) | 8900 |

| 7500 (for state employees) | 7800 | |

| Mari El | 9251 | 9621 |

| 7500 (for state employees) | 7800 | |

| Mordovia | 7500 | 7800 |

| Udmurtia | ||

| Tatarstan | 8252 | |

| Chuvashia | 7800 | |

| Perm region | Living wage | — |

| Nizhny Novgorod | 9000 | 9360 |

| 7500 (for state employees) | 7800 | |

| Orenburgskaya, | 7500 | 7800 |

| Penzenskaya, Kirovskaya | ||

| Samara | ||

| Saratovskaya | 7900 | 7900 |

| 7500 (for state employees) | 7800 | |

| Ulyanovskaya | 10,000 (not below the subsistence level) | 10342 |

| 7500 (for state employees) | 7800 | |

| Ural federal district | ||

| Region | Minimum wage until July 1, 2021, rub. | Minimum wage from July 1, 2021, rub. |

| Kurganskaya | 7620 | 7925 |

| 7500 (for state employees) | 7,800 (for state employees) | |

| Sverdlovskaya | from 8,154 to 8,862 | from 8 216 to 9216 |

| 7800 | ||

| 7,500 (for state employees) | ||

| Tyumen | 9950 | — |

| 8500 (for state employees) | ||

| Khanty-Mansi Autonomous Okrug | 16500 | — |

| Chelyabinsk | 9200 | 9568 |

| 7800 | ||

| 7500 (for state employees) | ||

| Yamalo-Nenets Aut. district | 12,431 (including surcharges and allowances) | 12,927 (including surcharges and allowances) |

| 7500 (for state employees) | 7800 | |

| Siberian Federal District | ||

| Region | Minimum wage until July 1, 2021, rub. | Minimum wage from July 1, 2021, rub. |

| Altai | 8751 - for non-budgetary companies, except for organizations and individual entrepreneurs operating in the field of agriculture and education) | 9 101 and |

| 7800 respectively | ||

| 7500 - for agricultural organizations, | ||

| Buryatia, Tyva, | 7500 | 7800 |

| Khakassia | ||

| Altai region | 9400 (for extra-budgetary organizations, with the exception of housing and communal services, disabled people employed under the established quota in public associations, and those who participate in public works or are temporarily employed under agreements between employers and employment service bodies | — |

| 8116 (for disabled people employed under an established quota in public organizations of disabled people, as well as for non-budgetary organizations of housing and communal services, with the exception of those who participate in public works or are temporarily employed under agreements between employers and employment service bodies) | ||

| Transbaikal region | 7500 (for agricultural and budgetary organizations) | 7,800 rub. (for agricultural and public sector employees) |

| 9066 - in Kalarsky district | ||

| 7857 - in Tungiro-Olekminsky and Tungokochensky districts | ||

| 8059 (for the non-budgetary sector of the economy (except agriculture) | ||

| for the non-budgetary sector of the economy (except for agriculture) operating in the Far North and equivalent areas: | ||

| 10,429 - in Canary | ||

| 9480 - in Tungiro-Olekminsky and Tungokochensky districts | ||

| Krasnoyarsk region | 16 130 — Norilsk | — |

| 14 269 - North Yenisei district | ||

| 16 130 - Taimyr Dolgano-Nenets municipal district (except for the rural settlement of Khatanga) | ||

| 24 026 — Khatanga | ||

| 15 313 — Turukhansky district | ||

| 19 009 - Evenki municipal district | ||

| 14 114 — Yeniseisk | ||

| 11 167 — Lesosibirsk | ||

| 13 788 — Boguchansky | ||

| 15 200 - Yeniseisky | ||

| 13 571 — Kezhemsky | ||

| 14 548 — Motyginsky districts | ||

| 9926 (for other areas) | ||

| Irkutsk | 12,652 (for companies and individual entrepreneurs in the Far North) | 95% of the living wage |

| 9717 (for companies and individual entrepreneurs in other areas) | ||

| 10,754 (for state and budgetary enterprises) | ||

| 8259 (for state and budget enterprises in other areas) | ||

| 7500 (for agriculture) | ||

| Kemerovo | 1.5 living wage (except for the sphere of regulated pricing and individual entrepreneurs) | |

| 7500 (for state employees) | 7800 (for state employees) | |

| Novosibirsk | 7500 (for agriculture) | 7800 (for agriculture) |

| 9030 (for the public sector except federal budget organizations) | ||

| 9390 (for extra-budgetary sphere except agriculture) | ||

| Omsk | 7500 (for agriculture) | |

| 9030 (for the public sector, except for federal budget organizations) | ||

| 9390 (for extra-budgetary sphere, except agriculture) | ||

| Tomsk | 8925 (for municipal autonomous, budgetary and government institutions financed from the budget of the municipal formation of the city of Tomsk, as well as other employers operating in the territory of Tomsk) | 9,282 (for municipal autonomous...) |

| 7500 (for organizations financed from the regional and local budgets, territorial state extra-budgetary funds of the Tomsk region, other employers (except for municipal autonomous, budgetary and government institutions financed from the budget of the municipality of Tomsk, as well as other employers operating in the territory Tomsk) | 7,800 (for organizations financed from budgets...) | |

| Far Eastern Federal District | ||

| Region | Minimum wage until July 1, 2021, rub. | Minimum wage from July 1, 2021, rub. |

| The Republic of Sakha (Yakutia) | 16824 | 7800 |

| 7500 (for state employees) | ||

| Kamchatka Krai | 18 210 (for organizations in the Koryak district) | — |

| 19,510 (for organizations in the Aleutian municipal district) | ||

| 16,910 (for organizations in the rest of the Kamchatka Territory) | ||

| Primorsky Krai | 7500 | 7800 |

| Khabarovsk region | 11 414 (for Bikinsky, Vyazemsky, Lazo, Nanaisky, Khabarovsk districts and Khabarovsk) | 11 871 |

| 12 408 (for Amursky, Vaninsky, Verkhnebureinsky, Komsomolsky, Nikolaevsky, named after Polina Osipenko, Sovetsko-Gavansky, Solnechny, Tuguro-Chumikansky, Ulchsky districts and Komsomolsk-on-Amur) | 12 904 | |

| 14,269 (for Ayano-Maisky district) | 14 840 | |

| 15,510 (for Okhotsk region) | 16 130 | |

| respectively | ||

| Amurskaya | 7500 | 7800 |

| Magadan | 18,750 (for the non-budgetary sector of the Magadan region, with the exception of the North-Evensky urban district) | — |

| 20,250 (for the non-budgetary sector in the North-Evensky urban district of the Magadan region) | ||

| Sakhalinskaya | 15,000 (for workers in Aleksandrovsk-Sakhalinsky, Anivsky, Dolinsky, Korsakovsky, Makarovsky, Nevelsky, Poronaisky, Smirnykhovsky, Tomarinsky, Tymovsky, Uglegorsky, Kholmsky districts, the city of Yuzhno-Sakhalinsk) | 15 150 |

| 18,571 (for workers in Nogliki and Okha districts) | 18 757 | |

| 20,000 (for workers in the Kuril, North Kuril and South Kuril regions) | 20 200 | |

| 7,500 (for state employees) | 7 800 | |

| respectively | ||

| Jewish Autonomous | 7500 (taking into account the regional coefficient and percentage bonus for work experience in the southern regions of the Far East) | 7800 |

| Chukotka Autonomous Republic district | 7500 | |

| Crimea | ||

| Region | Minimum wage until July 1, 2021, rub. | Minimum wage from July 1, 2021, rub. |

| Crimea | 7650 | 7800 |

| 7500 (for state employees) | ||

| Sevastopol | 8000 | |

| 7500 (for state employees) | ||

Regional agreement on the minimum wage in St. Petersburg for 2021

(Concluded in St. Petersburg on November 28, 2018 No. 332/18-C)

The Government of St. Petersburg, the public organization Interregional St. Petersburg and the Leningrad Region association of trade union organizations "Leningrad Federation of Trade Unions" (hereinafter referred to as the Trade Unions) and the regional association of employers "Union of Industrialists and Entrepreneurs of St. Petersburg" (hereinafter referred to as the Employers), hereinafter referred to as the Parties, on the basis of Article 133.1 of the Labor Code of the Russian Federation, we have entered into this Agreement as follows.

Subject of this Agreement

1.1. Establish a minimum wage in St. Petersburg from January 1, 2021 in the amount of 18,000 rubles. In this case, the tariff rate (salary) of a 1st category worker should not be less than 13,500 rubles.

1.2. The parties agreed that the amount of the minimum wage is not a limitation for the implementation of higher wage guarantees and includes the minimum amount of payments to an employee who has worked the standard working hours established by the legislation of the Russian Federation and has fulfilled labor standards (job duties), including the tariff rate (salary ) or remuneration under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments made in accordance with Articles 147, 151, 152, 153, 154 of the Labor Code of the Russian Federation.

1.3. The monthly salary of an employee working in the territory of St. Petersburg and who is in an employment relationship with the employer in respect of whom this Agreement is valid cannot be lower than the minimum wage established in paragraph 1.1 of this Agreement, provided that the specified employee has fully worked during this period, the standard working hours and labor standards (job responsibilities) are fulfilled.

Obligations of the Parties

2.1. The parties undertake: 2.1.1. Control and monitor the implementation of this Agreement. 2.1.2. Consider the results of monitoring the implementation of this Agreement within the framework of the Tripartite Commission of St. Petersburg for the regulation of social and labor relations. 2.2. The Government of St. Petersburg undertakes: 2.2.1. Publish the text of this Agreement in the media within five days from the date of signing this Agreement. 2.2.2. Provide funding for the implementation of this Agreement in full for organizations financed from the budget of St. Petersburg. 2.3. Employers undertake to establish by collective agreements, agreements, and local regulations a minimum wage in an amount not lower than the amount established in clause 1.1 of this Agreement. 2.4. Trade unions undertake: 2.4.1. Initiate the inclusion in collective bargaining agreements and agreements of provisions on establishing the minimum wage in accordance with clause 1.1 of this Agreement. 2.4.2. Monitor the implementation of this Agreement in the manner prescribed by federal legislation and the legislation of St. Petersburg.

Responsibility of the Parties

In case of non-fulfillment or improper fulfillment of obligations under this Agreement, the Parties bear responsibility under federal legislation and the legislation of St. Petersburg.

Validity of this Agreement

4.1. This Agreement applies to organizations - legal entities, individual entrepreneurs without forming a legal entity, operating in the territory of St. Petersburg, who have concluded this Agreement or acceded to this Agreement in accordance with Article 133.1 of the Labor Code of the Russian Federation, with the exception of organizations financed from the federal budget . 4.2. The agreements reached by the parties remain in force until a new Agreement is concluded or amendments and additions are made to this Agreement.

Regional agreement on the minimum wage in St. Petersburg for 2021 dated September 20, 2017 No. 323/17-C

The Government of St. Petersburg, the public organization Interregional St. Petersburg and Leningrad Region association of trade union organizations "Leningrad Federation of Trade Unions" (hereinafter referred to as the Trade Unions) and the regional association of employers "Union of Industrialists and Entrepreneurs of St. Petersburg" (hereinafter referred to as the Employers), hereinafter referred to as the Parties, on the basis of Article 133.1 of the Labor Code of the Russian Federation, we have entered into this Agreement as follows.

SUBJECT OF THIS AGREEMENT

1.1. Establish a minimum wage in St. Petersburg from January 1, 2021 in the amount of 17,000 rubles. In this case, the tariff rate (salary) of a 1st category employee should not be less than 13,500 rubles.

1.2. The parties agreed that the amount of the minimum wage is not a limitation for the implementation of higher wage guarantees and includes the minimum amount of payments to an employee who has worked the standard working hours established by the legislation of the Russian Federation and fulfilled his labor duties (labor standard), including the tariff rate ( salary), or remuneration under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments made in accordance with Articles 147, 151, 152, 153, 154 of the Labor Code of the Russian Federation.

1.3. The monthly salary of an employee working in the territory of St. Petersburg and who is in an employment relationship with the employer in respect of whom this Agreement is valid cannot be lower than the minimum wage established in paragraph 1.1 of this Agreement, provided that the specified employee has fully worked during this period, the standard working hours and labor standards (job responsibilities) are fulfilled.

OBLIGATIONS OF THE PARTIES

2.1. The parties undertake: 2.1.1. Control and monitor the implementation of this Agreement. 2.1.2. Consider the results of monitoring the implementation of this Agreement within the framework of the Tripartite Commission of St. Petersburg for the regulation of social and labor relations. 2.2. The Government of St. Petersburg undertakes: 2.2.1. Publish the text of this Agreement in the media within five days from the date of signing this Agreement. 2.2.2. Provide funding for the implementation of this Agreement in full for organizations financed from the budget of St. Petersburg. 2.3. Employers undertake to establish by collective agreements, agreements, and local regulations a minimum wage in an amount not lower than the amount established in clause 1.1 of this Agreement. 2.4. Trade unions undertake: 2.4.1. Initiate the inclusion in collective bargaining agreements and agreements of provisions on establishing the minimum wage in accordance with clause 1.1 of this Agreement. 2.4.2. Monitor the implementation of this Agreement in the manner prescribed by federal legislation and the legislation of St. Petersburg.

RESPONSIBILITY OF THE PARTIES

In case of non-fulfillment or improper fulfillment of obligations under this Agreement, the Parties bear responsibility under federal legislation and the legislation of St. Petersburg.

EFFECTIVENESS OF THIS AGREEMENT

4.1. This Agreement applies to organizations - legal entities, individual entrepreneurs without forming a legal entity, operating in the territory of St. Petersburg, who have concluded this Agreement or acceded to this Agreement in accordance with Article 133.1 of the Labor Code of the Russian Federation, with the exception of organizations financed from the federal budget .

4.2. The agreements reached by the parties remain in force until a new Agreement is concluded or amendments and additions are made to this Agreement.

The article was written and posted on June 22, 2021. Added - 12/15/2017, 02/16/2018, 12/11/2018

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.

How to refuse the regional minimum wage from July

The agreement on the regional minimum wage from July 1, 2021 becomes binding only for those who accepted it after publication in the media. After publication, the employer is given 30 days to submit to the regional administration an application for refusal to apply the regional “minimum wage”. Such a refusal requires an explanation of the reasons why the employer cannot pay the regional minimum wage to employees. Here is a sample refusal on the minimum wage in the region:

If the regional administration does not receive a refusal on time, then it is considered that the employer “by default” agreed to the agreement on the minimum wage from July 1, 2021 in the corresponding region and, as a result, must pay wages not lower than the value established by the law of the constituent entity of the Russian Federation .

Can a salary or salary be less than the minimum wage?

Indeed, it is worth distinguishing between an employee’s salary and wages; these, as a rule, can be different amounts. According to Art. 129 of the Labor Code of the Russian Federation, wages include:

- Official salary

is a fixed amount of remuneration for an employee for the performance of labor (official) duties of a certain complexity for a calendar month, excluding compensation and incentive payments. - Compensation payments

- additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in territories exposed to radioactive contamination and other compensation payments. - Incentive payments

- additional payments and bonuses of an incentive nature, bonuses and other incentive payments.

Thus, since wages can include several groups of payments, the official salary can be set by the employer below the minimum wage, but only on the condition that, taking into account compensation and incentive payments, the total amount of wages will not be lower than the minimum wage.

If an employee receives only one salary, then in this case its value also cannot be lower than the minimum wage. It should also be said that the wages paid to the employee may be lower than the accrued wages. For example, if an employee worked for less than a full month or did not fulfill his job duties. In this case, the monthly salary paid may be lower than the minimum wage.

Responsibility of employers for low wages

If the employer does not send a refusal and does not increase earnings to the regional level established from July 1, 2021, then sanctions are possible.

Let's list the administrative fines under Article 5.27 of the Code of Administrative Offenses of the Russian Federation:

- for an official (for example, a director) – from 10,000 to 20,000 rubles;

- for an individual entrepreneur (employer) – from 1000 to 5000 rubles;

- for an organization (legal entity) – from 30,000 to 50,000 rubles.

If the organization commits a violation again, the liability will be stricter:

- for an official (for example, a director) – a fine of 20,000 to 30,000 rubles.

- or disqualification for a period of one to three years;

- for individual entrepreneurs – a fine from 10,000 to 30,000 rubles;

- for a company – a fine from 50,000 to 100,000 rubles.

The issue of administrative punishment of violators is considered by the labor inspectorate or the court (Parts 1, 2 of Article 23.1, 23.12 of the Code of Administrative Offenses of the Russian Federation).

Also keep in mind that if you refuse the regional minimum wage, the employer may be called to the Federal Tax Service for a salary commission. We discussed this issue in the article “Minimum wage in Moscow from July 1, 2021.”

Read also

30.06.2017