Within the framework of labor legislation, the layoff of an employee requires a two-month notice of termination of employment, which predetermines the initial establishment of the cut-off date for dismissal.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

But it is impossible to warn about illness in advance, and therefore the question of payment for days of incapacity for work and, in general, the possibility of terminating cooperation arises.

Sick leave after dismissal due to staff reduction: how is payment made?

The employer pays for the certificate of incapacity for work issued in connection with the illness of the employee himself. Sick leave issued when family members of a redundant employee fall ill is not subject to payment. An employee has the right to sickness benefit in the amount of 60% of average earnings, regardless of his or her total length of service.

When calculating the amount, the procedure corresponds to the conditions for paying sick leave to employees of the enterprise. To calculate benefits, the earnings received by employees in the previous 2 years are used. If the person’s total length of service is less than 6 months, payment is made based on the minimum wage.

How to transfer a document to your former boss

After the sick leave is closed, the employee must transfer it to the organization where he was previously employed. In accordance with Article 12 F3 No. 255, an employee is given 6 months from the date of its closure to present sick leave. In practice, citizens apply for accrual of payments immediately.

The sick leave can be submitted to the accounting department or the human resources department. If a person cannot bring a sick leave certificate on his own, he can send it by registered mail with notification.

If a document is brought by an authorized person for it, you must provide a passport and a document confirming your authority, that is, a power of attorney

Deadlines for presentation and payment of certificates of incapacity for work

When receiving payment, the employee and employer must comply with the documentation deadlines.

| Condition | Fixed time |

| The onset of a disease confirmed by sick leave | The opening date must not be later than 30 days after the day of reduction |

| Deadline for submitting sick leave | No later than 6 months from the date of dismissal |

| Benefit payment period | Within 10 days from the date of presentation of the document |

| Payment deadline when applying for payment to the Social Insurance Fund | Within 10 days from the date of submission of the application and sick leave |

| Deadline for receiving accrued benefits | 3 years from the date of accrual |

Violation of the deadlines for document flow entails the refusal of the Social Insurance Fund to recognize the legality of the payment of benefits.

The employee fell ill after reading the order

If an employee’s sick leave is issued after reviewing the information about dismissal, then the employer has written consent.

In this case, there are two options:

- the person is fired within the period established and specified in the notice. But this can only be done if the employee has already provided a closed sick leave certificate,

- The employment contract with the person will be terminated after he returns to work from sick leave.

If the administration committed violations of the notification period, this must occur no later than two months before the date of reduction. If the notification is received later, then the date of dismissal must be postponed to the required period of time.

Watch the video. How to apply for sick leave?

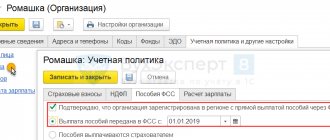

Withholding personal income tax and paying contributions from accrued benefits

The employer has the obligation to withhold and transfer personal income tax to the budget from the amounts of accrued payments. Benefits paid in connection with illness are not considered non-taxable payments and are subject to taxation. When withholding tax, standard and other deductions are not applied due to their expiration on the day of termination of the employment contract.

Insurance premiums due for accrual from payments to employees are not accrued on the certificate of incapacity for work of a dismissed employee. The procedure applies to the entire document, regardless of the source of payment.

Documentation of payment for employee illness after layoff

In connection with a person’s illness or injury, a medical institution provides a standard form of sick leave. A document issued to a person without a specific place of employment does not contain the name of the enterprise. When paying for the period of illness of a dismissed person, the employer independently enters the name of the enterprise on the list of incapacity for work. Benefits are paid subject to certain conditions being met. Read also the article: → “When sick leave is not paid. 2 examples”

| Condition | Explanations |

| A document base | Certificate of incapacity for work opened by a medical institution within 30 days after layoff |

| Additional documents | Statement from the employee, a copy of the work record book indicating that the employee was not hired during the period of incapacity for work |

| Duration and end date of sick leave | The expiration date of incapacity for work is not taken into account |

| Sick person | An employee of an enterprise dismissed due to layoffs |

| The need for prior notice to the employer | Absent |

Contacting the employer within a period exceeding 6 months leads to refusal of payment. The period can be restored if there are special circumstances. Valid reasons include missing a deadline due to insurmountable natural circumstances, moving to another area, illness lasting more than six months, or other reasons. The restoration of the period is carried out in court.

Payment of maternity benefits

The Labor Code of the Russian Federation prohibits layoffs of women during pregnancy. The grounds for terminating an employment contract with a pregnant employee are:

- Liquidation of an enterprise or termination of the activities of an individual entrepreneur.

- The employee’s own desire, for example, in connection with her husband’s transfer to service or work in another locality.

- Dismissal of an employee when a temporarily absent employee is hired for a position. When a permanent employee starts work, the employer must present vacant positions to the temporarily hired person who is pregnant. If the employee refuses, he is dismissed due to the termination of the contract.

After dismissal, the employee has the right to register with the employment center. When receiving sick leave for pregnancy and childbirth, payments from the employment center are terminated and resumed after the end of the period.

Payments of maternity benefits to employees during liquidation are made by the social insurance fund. Unlike other grounds for dismissal, the employee will receive benefits based on income. Average earnings are calculated based on the income received by the employee over the previous 2 years. The right to sick pay is available for 12 months from the date of registration with the employment center and recognition as unemployed.

| Grounds for dismissal | Payment of maternity benefits |

| Liquidation of an enterprise or termination of the activities of an individual entrepreneur | Payment is made by social insurance authorities |

| Personal initiative of the employee | Payment is not made, except in cases of opening a certificate for maternity leave within 30 days from the date of dismissal |

| Dismissal under the terms of a fixed-term contract due to the departure of a permanent employee | Similar to voluntary dismissal |

Support from the Social Insurance Fund. How to get a?

In the event of a global staff reduction due to a lack of material resources, the insured person has the right to receive benefits from the Social Insurance Fund. Since the company's circumstances do not deprive the employee of benefits. All data must be valid and documented. Situations when the Social Insurance Fund pays benefits instead of the employer (if the defendant is the fund):

- complete termination of the former employer's activities;

- the company went bankrupt and cannot pay for sick leave;

- a bankruptcy procedure was carried out in relation to the organization, there was a complete lack of property.

All labor disputes are related specifically to appealing against layoffs. To prevent such an incident from happening, it would be advisable to organize a commission with a detailed, step-by-step plan for reduction. The plan must take into account all risks and costs.

Categories of workers, with their own characteristics, deserve special attention at the time of reduction:

- minors;

- trade union members;

- seasonal employees (notify at least 7 calendar days in advance);

- employees who have entered into a fixed-term contract for two months (notify 3 calendar days in advance).

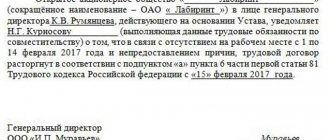

Notice and reduction during the period of incapacity for work

If an employee falls ill at the time of the planned notice of layoff, a corresponding valuable letter with an enclosed inventory is sent by mail. The signature put by the person on the delivery notice indicates receipt of information about the upcoming staff reduction.

The occurrence of an illness or injury may prevent dismissal on the day about which the employee was notified 2 months in advance. An employee cannot be fired on the day he is absent from work due to illness, which requires postponing the date of termination of the contract. Sick leave may be opened due to a child becoming ill. Payment for sick leave opened before the day of layoff is made in full according to the total length of service.

Let's sum it up

Legislation protects workers laid off due to layoffs. The amount of all due payments and compensation during layoffs can be quite significant. In addition, these payments are spread out over time. In fact, a person who no longer works for an employer needs to pay wages for another 2 months.

We recommend that employers who want to reduce personnel costs through layoffs and thereby improve their financial situation, first calculate how much the entire procedure will cost.

Let us remind you that failure to pay all due amounts is a violation of labor laws, including allowing employees to challenge dismissal as a violation of procedure.

Payment for disability occurring after liquidation

An employee dismissed due to the liquidation of an enterprise has the right to payment for the period of incapacity from the Social Insurance Fund. During liquidation, all employees are subject to dismissal, including pregnant employees and persons with children under 3 years of age. The FSS makes the payment to the person’s account or sends the required amount by postal order to the applicant’s registered address. To receive payment, the person provides:

- A copy of your identification document.

- A certificate of incapacity for work issued within a month from the date of liquidation.

- A copy of the work book with a record of liquidation, confirming the lack of employment.

- Certificates of income for the previous 2 years. An employee who has not received a certificate of income from the enterprise’s accounting department attaches an application asking the Social Insurance Fund to send a request to the Pension Fund of the Russian Federation about the amounts received by the person.

- An application addressed to the head of the FSS department with a request for payment of benefits.

An employee has the right to receive sickness benefits even in the event of a difficult financial situation of an enterprise that is in the process of bankruptcy. An employee dismissed due to the liquidation of a bankrupt enterprise that was not removed from the register due to the end of the procedure receives payments through the Social Insurance Fund. To receive the required amount, a certificate issued by the bankruptcy trustee and a copy of the court decision on the initiation of bankruptcy proceedings for the enterprise are required.

Sick leave issued when laying off civil servants

Persons recognized as civil servants have similar rights to other employees. When an illness occurs, the organization pays benefits:

- According to a sheet opened within 30 days from the date of reduction at the rate of 60% of average earnings.

- For sick leave, which begins before the day of layoff or falls on the last day of employment, in the amount of average earnings depending on length of service.

- If the length of service is less than 6 months - based on the minimum wage.

A special procedure is provided for persons who are contract employees in the RF Ministry of Defense or the Ministry of Internal Affairs. Employees are not subject to the terms of the Labor Code of the Russian Federation or payments from the Social Insurance Fund. Payment for the period of incapacity for work is carried out according to departmental legislative acts. After layoffs, payment for sick leave is not carried out. Also, be sure to check out the example of filling out a sick leave form after layoff.

Peculiarities of document flow for individual entrepreneurs

An individual entrepreneur, as an employer, has the right not to comply with notice periods and payment procedures when laying off workers. The requirements of the Labor Code of the Russian Federation are established only for legal entities. The entrepreneur independently determines the notice period and the possibility of paying severance pay. Conditions for different types of contracts can be included in labor or collective agreements or approved by orders.

A certificate of incapacity for work for an employee, opened within 30 days after the dismissal of an individual entrepreneur, is paid in accordance with the established procedure. Similarly to legal entities, the employee is required to provide sick leave, a work book and an application.

Legislative basis

The Labor Code of the Russian Federation establishes the norms of relationships between employers and employees. This also applies to issues of dismissal and the employee being on sick leave. In accordance with Federal Law No. 255, social guarantees are established for all categories of workers.

According to the norms of the legislative act, a person working under an employment contract has the right to receive benefits during the period of sick leave. Also, the period of incapacity for work is required to be paid after dismissal, if the person falls ill within one month after the employment contract was terminated.

How many sick days can you take per year?