Account 52 is the accounting account on which currency transactions are reflected. Russian companies have the right to store funds not only in rubles, but also in current accounts in banking and credit organizations opened in foreign currency. In this article we will tell you how to organize accounting for foreign currency accounts.

A current account (DAC) opened in foreign currency can be used by an organization for the following purposes:

- payment for goods, works and services;

- transfer of wages to your employees;

- provision of bank guarantees for concluding international transactions;

- other company expenses.

Please note that payment of labor in foreign money is allowed only from February 2021.

Transactions on foreign currency DMC should be reflected in a special accounting account 52. The basis for making accounting entries are bank statements and similar documents received from the credit or banking organization in which this DMC is opened.

Legislative standards for accounting for currency transactions

If a company needs to conduct any transactions in foreign currency, it needs to open a foreign currency account with a bank.

Bank statements and the settlement documents attached to them (applications for transfers, applications for the sale/purchase of currency, etc.) show the movement of currency and are the basis for accounting for foreign exchange outgoings and incoming transactions. In accounting, account 52 is a reflection of foreign currency transactions. It has its own characteristics, and they must be fulfilled.

For proper accounting of account 52 - Currency accounts, several legislative standards have been adopted: Chart of Accounts and Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n), Law “On Accounting” dated December 6, 2011 No. 402-FZ, PBU 3/2006 “Accounting for assets and liabilities in foreign currency”, Law “On Currency Regulation and Currency Control” dated December 10, 2003 No. 173-FZ, Regulations of the Central Bank of the Russian Federation “On the procedure for purchasing and issuing foreign currency to pay travel expenses” dated June 25, 1997 No. 62, etc.

conclusions

Accounting account 52 reflects non-cash cash movements and balances on the organization’s bank accounts in foreign currency.

Servicing financial institutions strictly control all currency transactions carried out on customer accounts.

The active status of the 52-account determines the recording of debit receipts and credit write-offs.

Subaccounts 52-accounts allow you to separately account for non-cash transactions on domestic and foreign currency accounts of a business entity in banks.

Characteristics of account 52 (activity, subaccounts, reflection in the account statement and balance sheet)

Account 52 of the accounting is active: the debit reflects the receipt of currency (purchase of currency, payments from buyers, returns from suppliers, receipt of loans), the credit reflects its write-off (sale of currency, payments to suppliers, repayment of loans).

You can open sub-accounts for the account (according to the Instructions for using the Chart of Accounts):

- 52-1 “Currency accounts within the country”;

- 52-2 “Currency accounts abroad.”

Analytical accounting should be maintained for each currency and foreign currency account separately. To detail currency accounting, subaccounts of the following order are opened to the above subaccounts: for example, 52-1-1/1 - accounting for the movement of US dollars in a current account, 52-1-1/2 - in a transit account, etc.

Accounting in the Russian Federation must be in rubles, that is, accounting in the turnover sheet for account 52 is carried out in foreign currency and in rubles at the same time. On the day of the transaction, the currency amount is converted into rubles (at the exchange rate of the Central Bank of the Russian Federation). The same procedure must be carried out at the end of each month. Due to changes in exchange rates during conversion, exchange rate differences arise, which are taken into account as other income/expenses in account 91.

The balance in rubles in the debit of the account at the end of the period is reflected in line 1250 “Cash and cash equivalents” of the balance sheet.

Subaccounts and analytics

The current account through which currency transactions will be carried out can be opened in Russian or foreign banks. This involves opening a number of sub-accounts to the main accounting account:

- 52.01 - accounts in Russian financial organizations;

- 52.02 - accounts in foreign banks.

An extract from a financial institution is used as the basis for conducting and recording transactions.

Separate analytics are maintained for each bank, as well as for each account opened in these banks.

Typical transactions for account 52

Instructions for using the Chart of Accounts for accounting for currency transactions offer many postings to 52 accounts.

The most popular typical transactions for account 52:

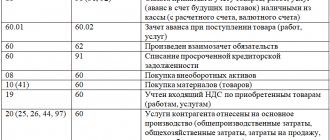

| Debit | Credit | Contents of operation |

| 52 | 50 | Transferring cash currency from the company's cash desk to a bank account |

| 52 | 57 | Purchase of foreign currency funds |

| 52 | 62 | Payment for goods, works, services by a non-resident buyer |

| 52 | 66/67 | Replenishment of foreign currency funds under a loan agreement |

| 52 | 75 | Depositing foreign currency from the founder |

| 52 | 76 | Receipt of currency from other counterparties |

| 52 | 79 | Receipt of foreign currency from a branch/division of the company |

| 52 | 91.1 | Positive exchange rate difference |

| 50 | 52 | Receipt of cash from a bank account to the company's cash desk |

| 57 | 52 | Transfer of currency for sale |

| 60 | 52 | Payment for the supply of goods, works, services to a foreign supplier |

| 66/67 | 52 | Loan repayment, loan interest payment |

| 75 | 52 | Return of currency funds to the founder |

| 76 | 52 | Payment for services to other contractors |

| 79 | 52 | Transfer of foreign currency to your branch/division |

| 91.2 | 52 | Negative exchange rate difference |

What is it for - characteristics

If an organization makes non-cash transactions in foreign monetary units with its counterparties, it uses a foreign currency bank account through which the corresponding operations are carried out - payments are made, cash receipts are received, and currency is converted.

Read how to open a foreign currency account here.

All incoming and outgoing transactions carried out by an organization on its foreign currency bank accounts must be confirmed by the necessary papers - payment documents (orders for wire transfers, applications for the purchase or sale of currency, other documents), as well as bank statements.

Supporting documentation reflects and certifies the non-cash movement of foreign currency, its information is used for accounting of relevant transactions.

If we talk about the purpose of account 52 in accounting, it should be noted that it records non-cash monetary transactions performed by the company in foreign currency.

Correct reflection of such transactions is not possible without strict compliance with the rules and regulations provided for by certain provisions of the current domestic legislation.

Business entities that take part in foreign economic activity, that is, cooperate with foreign buyers and suppliers, must open and use bank foreign currency accounts.

Accounting for non-cash transactions in foreign monetary units is carried out by the company using accounting account 52.

Features of using 52 accounts in accounting:

- Great importance is always attached to the date of currency conversion into domestic rubles.

- The monetary value of an asset/liability expressed in foreign currency is recalculated into Russian rubles at the official exchange rate of this monetary unit to domestic rubles established by the Central Bank of the Russian Federation.

- The difference in rates, which often arises during recalculation, is taken into account by the organization for the corresponding reporting period. Differences in exchange rates can be positive (related to non-operating income) or negative (taken into account in non-operating costs).

Active or passive

Account 52 is active in the organization’s accounting.

In other words, debit records all non-cash foreign exchange receipts (for example, a company’s purchase of foreign currency, receipt of revenue from customers, return of money from a supplier, raising borrowed funds).

The loan reflects non-cash write-offs and expenditures of foreign currency (this may be the sale of available foreign currency funds, repayment of relevant loans, payments to counterparties).

Subaccounts

Current bank accounts, through which an economic entity that is a resident of the Russian Federation carries out non-cash currency transactions, can be opened both in domestic banks and in foreign financial institutions.

Consequently, within account 52 the following subaccounts can be allocated:

- subaccount 52-1 (for accounts opened by a company within the territorial boundaries of the Russian Federation);

- subaccount 52-2 (for accounts opened by a company outside the territorial borders of the Russian Federation).

Analytical accounting is carried out separately within the above-mentioned subaccounts for each currency used, for each servicing bank, for each account in a particular financial institution.

Example:

Subaccount 52-1-1/1 can take into account the movement of USD on a specific current account opened by a business entity in a specific bank directly operating in the territory of the Russian Federation.

Accounting Features

Credit and financial institutions, as a rule, open for their clients - business entities carrying out settlement transactions in foreign monetary units - not one, but two bank foreign currency accounts:

- Current – to record the organization’s cash receipts in foreign currency (for example, the revenue of an exporting company).

- Transit - for depositing received foreign currency funds, in respect of which the account owner - the recipient of the money - must provide the servicing bank with papers that make it possible to clearly establish the purpose of these funds. It can also be used to sell foreign currency earnings.

The rules of domestic accounting provide that foreign exchange transactions recorded under account 52 must be reflected in the equivalent of the national monetary unit (Russian ruble).

This requirement implies compliance with the following conditions:

- the company accounts for its foreign exchange transactions in two monetary units simultaneously (in Russian rubles and in the corresponding foreign currency);

- Fund balances are necessarily recalculated by the business entity on the date of the transaction and on the date of reporting.

In addition, it should be remembered that foreign currency in a bank account can be used not only as a means of non-cash payments, but also as an item of purchase and sale (conversion).

It is also important to know that there is an official ban on making payments in foreign currency between Russian residents (with the exception of some typical situations).

However, the presence of such a prohibition does not mean at all that the account under consideration 52 reflects only settlements with non-resident counterparties and monetary results from the conversion of currency amounts into the ruble equivalent.

The accounting plan provides for the possibility of correspondence between account 52 and most other accounting accounts. Thus, taking into account the current ban on currency transactions with resident counterparties, it can be noted that non-cash funds in foreign monetary units can be successfully used for the following purposes:

- monetary settlements between the organization and its divisions and founders;

- providing financial loans to third parties;

- raising borrowed funds from various lenders;

- settlements with various counterparties;

- making tax payments;

- opening and using special accounts to save/increase money;

- payment of salaries to employees;

- financing of travel expenses.

Typical transactions for foreign exchange transactions

| Operation | Debit | Credit |

| Currency in cash is transferred from the company's cash desk to an account at a financial institution | 52 | 50 |

| Purchase of foreign currency by an organization | 52 | 57 |

| Receiving foreign currency earnings from a non-resident buyer | 52 | 62 |

| Raising a loan | 52 | 67(66) |

| Receiving a founding contribution | 52 | 75 |

| Receipts from other counterparties | 52 | 76 |

| Foreign currency funds came from a division of the company | 52 | 79 |

| A positive exchange rate difference is recorded | 52 | 91/1 |

| Currency in cash arrived at the company's cash desk from an account at a financial institution | 50 | 52 |

| Currency for sale (sale) is listed | 57 | 52 |

| Payment for a consignment of goods to a non-resident supplier | 60 | 52 |

| The loan is repaid (principal, interest) | 67(66) | 52 |

| The founder is returned funds in foreign currency | 75 | 52 |

| Services of other contractors are paid | 76 | 52 |

| Funds are transferred to a division of the company | 79 | 52 |

| Negative exchange rate difference is fixed | 91/2 | 52 |

Chart of accounts: 52 account

In the Chart of Accounts, account 52 is classified as active. Debit turnover refers to the receipt of funds in foreign currencies by non-cash means. Credit entries are created on the basis of transactions to write off monetary resources from the enterprise's foreign currency accounts at the bank. If, during the verification of statements, the presence of amounts erroneously attributed to a currency transaction was revealed, they should be transferred to account 76.2.

Conversion of foreign currency into rubles is carried out at the rate of the Central Bank in effect on the day of the transaction with foreign currency resources. Account 52 in accounting must be revalued in ruble equivalent as of each reporting date when preparing financial statements.

For foreign currency accounts, enterprises can use subaccounts:

- For accounts in foreign currency opened in Russia – 52.1.

- For foreign currency accounts in foreign banks – 52.2.

Analytics is carried out in the context of all accounts intended for storing enterprise funds in foreign currencies.

During the organization’s activities, the currency valuation in ruble equivalent may change due to currency exchange rate fluctuations. As a result, exchange rate differences arise, which can be positive or negative. In the first case, the tax base when calculating income tax increases, in the second, it decreases.

Concept and structure of an accounting account

During the operation of an enterprise, many different economic processes occur: raw materials and supplies are received, products are produced and sold, wages are calculated and paid, etc.

In order to correctly reflect numerous business transactions in accounting, they are grouped according to homogeneous business characteristics. Accounting accounts are used for this grouping. The list of all accounts changing in accounting is given in the standard chart of accounts. Depending on what funds are recorded in the accounting accounts, they are divided into:

Active accounts

Active accounting accounts keep records of the enterprise's assets (presence, receipt and disposal of business assets).

Active account scheme

The ending balance is calculated using the following formula:

Sk = Sn + Od - Ok

Active accounts have the following features:

- the opening balance is always a debit balance and shows the availability of funds at the beginning of the reporting period;

- debit turnover reflects the receipt of funds;

- loan turnover reflects a decrease in funds;

- the final balance is always a debit balance and shows the balance at the end of the reporting period;

- active accounts reflect the presence and movement of economic assets and property of the enterprise.

- 01 Fixed assets;

- 04 Intangible assets;

- 10 Materials;

- 20 Main production;

- 43 Finished products;

- 50 Cashier;

- 51 Current accounts;

- 52 Currency accounts;

- 58 Financial investments;

Passive accounts

Passive accounting accounts keep records of the sources of economic assets.

Passive account scheme

The final balance is calculated using the following formula:

Sk = Sn + Ok - Od

Passive accounts have the following features:

- The opening balance is always a credit balance and shows the amount of capital or the presence of liabilities of the enterprise at the beginning of the reporting period;

- Debit turnover shows a decrease in the capital or liabilities of the enterprise;

- The final balance is always a credit balance and shows the amount of capital or the presence of liabilities of the enterprise at the end of the reporting period;

- On passive accounts, records are kept of the sources of formation of the enterprise’s economic assets, i.e. capital or liabilities.

The main passive accounts include:

- 60 Settlements with suppliers and contractors;

- 66 Calculations for short-term loans and borrowings;

- 67 Calculations for long-term loans and borrowings;

- 68 Calculations for taxes and fees;

- 69 Calculations for social insurance and security;

- 70 Settlements with personnel for wages;

- 80 Authorized capital;

- 82 Reserve capital;

- 83 Additional capital;

- 99 Profits and losses.

Active-passive accounts

Designed for simultaneous accounting of both property and the sources of its formation.

Active-passive account scheme

- 71 Settlements with accountable persons;

- 75 Settlements with founders;

- 76 Settlements with various debtors and creditors;

- 99 Profits and losses.

If the enterprise is owed by other organizations or individuals, then these debtors are called debtors, and their debt to the enterprise is called receivable.

If an enterprise uses borrowed or attracted funds, then it has accounts payable to other organizations or individuals who are creditors to it.

The company owes creditors, and debtors owe the company itself.

Classification of accounting accounts

This is the combination of accounts into groups based on the principle of homogeneity of economic content, the indicators of property, liabilities and business transactions reflected in them.

Accounts are classified:

- By structure (Active, Passive, Active-passive);

- According to the economic content, accounts of property and sources of its formation are distinguished, as well as according to business transactions in the areas of supply, production and sales;

- By purpose:

- Inventory - for accounting of the organization’s property, always active. Accounting is carried out in monetary and natural measures;

- Cash - for accounting for cash, always active. Accounting is carried out only in monetary terms;

- Current accounts - designed to record all types of payments. Accounting is carried out in monetary terms. Almost all are active-passive;

- Regulatory - clarify the assessment of certain types of property. Accounting is carried out in monetary terms. Always passive;

- Collection and distribution - designed to take into account indirect costs that require preliminary distribution. Always active;

- Reporting and distribution - designed to distribute costs between reporting periods;

- Calculation - designed for accounting and control of costs and for determining costs;

- Operational-effective - designed to identify the result of economic activity. Active-passive. Accounting is carried out in monetary terms;

- Financial-effective - designed to take into account accumulation and losses as a financial result. Active-passive accounts;

- Fund accounts are intended for accounting and control over the capital of an enterprise. Always passive.

Accounting accounts can also be divided into two groups:

- Balance sheet accounts are all balance sheet accounts combined into one system, having correspondence with each other and ensuring accounting of all financial and economic activities of the organization;

- Off-balance sheet accounts are accounts whose balances are not included in the balance sheet, but are shown behind its total, i.e. behind the balance. Accounting for them is carried out without using the double entry method. Entries are made in special statements according to the columns Income and Expense. In the chart of accounts, they are numbered in three accounts from 001 to 011. They are intended for accounting for property that is not the property of the organization.

Double entry of business transactions in accounting accounts

Double entry is an entry as a result of which each business transaction is reflected in the accounting accounts twice, in the debit of one account and in the credit of another, related account for the same amount. The double entry method determines the existence of such concepts as correspondence of accounts and accounting entries.

Passive accounts

Passive accounts are those that demonstrate methods of forming property (loans provided, contributions from participants, etc.).

An increase in funds is reflected as a credit, a decrease - as a debit. At the end of the reporting period, the balance of the passive account is credit.

The following accounts are considered passive: 02, 05, 42, 59, 63, 66, 67, 70, 77, 80, 82, 83, 96, 98.

The only participant in Shtrabak LLC was granted a loan. Loan in the amount of 150,000 rubles. arrived at the bank account of Shtrabak LLC.

Shtrabak LLC keeps records of settlements for short-term loans on account 66. The initial credit balance on this account is 0 rubles.

The accountant reflected the receipt of 150,000 on the loan, since the account is passive. Loan turnover—RUB 150,000.

In less than a month, 50,000 rubles. were returned to the lender. The accountant completed the posting, and an entry appeared in the debit of account 66 - 50,000 rubles. The total turnover on the debit of the account is 50,000 rubles.

The final credit balance is RUB 100,000.

Posting examples

Here are typical accounting entries for foreign currency accounts.

| Operation | Wiring |

| Income of non-cash foreign currency depending on the source of funds | It can be reflected as follows (order of the Ministry of Finance dated October 31, 2000 No. 94n): Dt 52 – Kt:

|

| Retirement of money | They are issued with the following postings: Dt 60/62/66/57, etc. – Kt 52 |

| Amounts erroneously credited to a foreign currency account and discovered when checking bank statements | Reflected in settlements with various debtors and creditors (account 76, subaccount “Settlements for claims”) |

| As a result of recalculation, exchange rate differences arise | They are reflected like this: Dt 52 – Kt 91 “Other income and expenses” Or Dt 91 – Kt 52 |

Accounting is kept in rubles, so foreign exchange transactions are reflected simultaneously in the currency of settlements and in rubles (clause 20 of PBU 3/2006). In this case, the recalculation is done at the rate of the Central Bank of the Russian Federation on the date of the operation (clause 5 of PBU 3/2006). In addition, foreign currency account balances are recalculated at the end of each month (clause 7 of PBU 3/2006).

In the balance sheet, the ruble debit balance of account 52, recalculated at the Bank of Russia exchange rate as of the reporting date, is reflected in line 1250 “Cash and cash equivalents” (Order of the Ministry of Finance dated July 2, 2010 No. 66n).

Active accounts

Active accounts are those that are used to record information about the property of the enterprise. For example: money, including in foreign currency, transfers in transit, own shares.

An increase in funds in an active account is reflected as a debit, and a decrease as a credit. At the end of the period, the balance of the active account is debit.

Active accounts include: 01, 03, 04, 07, 08, 09, 10, 11, 19, 20, 21, 23, 25, 26, 28, 29, 41, 43, 44, 45, 46, 50, 51 , 52, 55, 57, 58, 81, 94, 97.

Shtrabak LLC purchased a laptop. The cost of the laptop is 87,000 rubles. without VAT. The debit of account 01 “Fixed assets” has an opening balance of 0 rubles. The accountant reflected the acceptance of the laptop as a debit, since the account used is active. The final debit balance is RUB 87,000.

Account 52 in accounting

Related publications

The operations of enterprises on the movement of non-cash funds in foreign currencies are systematized by account 52 “Currency accounts”. It opens in banking structures operating in Russia and other countries. The basis for the formation of turnover and balances on foreign currency accounts are statements from servicing financial institutions with a set of attached monetary settlement documentation. The regulatory function is assigned to PBU 3/2006. In accordance with accounting standards, enterprise assets are reflected in the form of foreign currency only in ruble equivalent.

Scope of application

The chart of accounts is a list systematized on the basis of the economic content of each position included in it. The current list is a mandatory basis for drawing up a working chart of accounts for all organizations operating on the territory of the Russian Federation and maintaining accounting using the double entry method. The exception is banks and government agencies.

The double entry method is a registration system that involves simultaneous reflection of a transaction on two accounts: withdrawal ( credit ) of a certain amount of money from one and receipt ( debit ) of the same amount to another account .

The chart of accounts is characterized by a strict structural hierarchy, which is based on:

- synthetic accounts

– designed to record generalized information about transactions, types of property, liabilities; - subaccounts

– used to obtain detailed data.

Subaccounts can be combined or excluded from the organization's working chart of accounts. Company specialists can introduce additional subaccounts. However, changing the names and purposes of synthetic accounts is unacceptable. Based on the division of the balance sheet into assets and liabilities, the following types of accounts are distinguished:

- active

– accounting for the movement of funds at the disposal of the enterprise; - passive

- accounting for sources of funds, displaying information about profits, types of capital, and obligations of the organization; - active-passive

– cumulative accounting of property and sources of its formation.

Off-balance sheet accounts

Off-balance sheet accounts are classified as auxiliary accounts. They are used in cases where an accountant needs to systematize information that is not stored on the company’s balance sheet. These accounts record information about the movement of property that does not belong to the organization, but is temporarily in its use, or assets of the enterprise written off as expenses.

Important: Off-balance sheet account data is not reflected in the financial statements.

The chart of accounts provides for 12 off-balance sheet accounts:

- 001 - leased fixed assets (fixed assets);

- 002 - inventory items accepted for safekeeping;

- 003 - materials accepted for processing;

- 004 - goods accepted for commission;

- 005 - equipment accepted for installation;

- 006 - strict reporting forms;

- 007 - debt of insolvent debtors written off at a loss;

- 008 - security for obligations and payments received;

- 009 - security for obligations and payments issued;

- 010 - OS wear;

- 011 - fixed assets leased;

- 012 - land.

Features of currency transactions

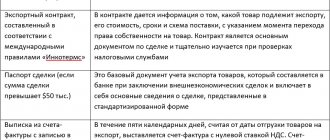

An organization that sells goods (materials, services) to foreign buyers or purchases goods (materials, services) from foreign suppliers carries out the following operations: purchase, sale, registration of a transaction in foreign currency.

For settlement transactions, the organization opens a foreign currency account in a bank. In most cases, the bank opens two foreign currency accounts for companies - current and transit:

- The current currency account is used to reflect credited foreign currency funds for the export sale of goods (materials, services);

- A transit currency account is used to execute the sale of foreign currency proceeds transferred to counterparties who are not residents of the Russian Federation in payment for goods (materials, services). After transfer, the bank transfers the balance of the currency from the transit account to the current currency account.

When conducting transactions with foreign currency, the following legislation must be taken into account:

It is important to note that foreign exchange transactions are recorded only in rubles, since foreign exchange rates are constantly changing. It is necessary to pay special attention to the date of recalculation of foreign currency into rubles. PBU 3/2006 specifies the main aspects of using account 52:

Get 267 video lessons on 1C for free:

When recalculating, positive (increasing profit) or negative (decreasing profit) exchange differences may arise, which are included in non-operating expenses or income. In accounting, non-operating expenses and income are reflected in account 91 “Other income and expenses”.

Changes that came into effect in 2015 regarding the accounting of exchange rate differences in foreign exchange transactions allow the recalculation of assets and liabilities to be performed on the last date of the current month. Law of April 24, 2015 No. 81-FZ allows you to equate exchange rate differences in accounting to exchange rate differences in tax accounting.

Instructions for the Chart of Accounts

The instructions help to simplify and systematize work with the Chart of Accounts. Its use allows:

- obtain basic information about the methodological principles of accounting;

- get acquainted with a brief description of synthetic and subaccounts;

- understand the accounting procedures for typical transactions.

Drawing up a working chart of accounts for an organization in accordance with the provisions of the Instructions makes it possible to organize a unified standardized approach to accounting and preparation of financial statements.

Currency account posting

I just can’t find how to do this using standard methods.

Try the new free service for quick code analysis of typical configurations 1c-api.com

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the “Refresh” button in the browser.

The thread has been archived. Adding messages is not possible.

But you can create a new thread and they will definitely answer you!

Every hour on the Magic Forum there are more 2000

Human.

- Articles

How to organize accounting on a foreign currency account

To correctly account for transactions with foreign currency, sub-accounts should be opened for account 52:

52-1 “Currency accounts within the country”;

52-2 “Currency accounts abroad.”

In addition, it is advisable to open second-order subaccounts for subaccount 52-1:

— 52-1-1 “Current foreign currency account”;

— 52-1-2 “Transit currency account”;

— 52-1-3 “Special bank account.”

The company has the right to open accounts in various currencies (US dollars, euros, etc.). In this case, it is better to record transactions for each type of currency in separate sub-accounts.

Commission of the bank

You have to pay a commission for the bank's account servicing services. The amount of the commission is established by mutual agreement between the bank and the client in the agreement for settlement and cash services. Payment can be made both in rubles and in foreign currency.

The commission can be withheld:

— bank of a Russian organization;

- a bank of a foreign company.

The commission is retained by the bank of the Russian organization

If the commission is retained by the bank of a Russian organization, the proceeds from the foreign company are received in the amount specified in the contract.

Expenses associated with paying for bank services are reflected in the following entries:

Debit 60 (76) Credit 51 (52)

— the commission was written off based on the bank statement;

Debit 91 subaccount “Other expenses”

Credit 60 (76)

— the amount of the commission is taken into account as part of other expenses.

Example 1. Mir CJSC entered into an agreement for the sale of products with an American company in the amount of $20,000. The proceeds were transferred to the foreign exchange account of Mir CJSC in March 2006. The amount of the bank’s commission was USD 200. Let's assume that the US dollar exchange rate on the date the commission was written off was 27.6 rubles/USD. The accountant of Mir CJSC wrote down:

Debit 62

Credit 90 subaccount “Revenue”

— 552,000 rub. (20,000 USD x 27.6 rubles/USD) - revenue from the sale is reflected;

Debit 52 subaccount “Transit currency account”

Credit 62

— 552,000 rub. (20,000 USD x 27.6 rubles/USD) - proceeds are credited to the transit currency account;

Debit 76

Credit 52 subaccount “Transit currency account”

— 5520 rub. (200 USD x 27.6 rubles/USD) - the commission amount is written off based on the bank statement;

Debit 91 subaccount “Other expenses”

Credit 76

— 5520 rub.

Selling currency in 1C 8.3: example, transactions

— the amount of the commission is taken into account as part of other expenses.

In tax accounting, a company’s expenses for paying for bank services can be taken into account either as expenses associated with production and sales (clause 25, clause 1, article 264 of the Tax Code of the Russian Federation), or as non-operating expenses (clause 15, clause

1 tbsp. 265 of the Tax Code of the Russian Federation). An organization has the right to independently determine in its accounting policy which specific group of costs it will include expenses for paying for bank services (clause 4 of Article 252 of the Tax Code of the Russian Federation).

The commission is retained by the bank of the foreign company

The bank of a foreign company can transfer proceeds to the foreign currency account of a Russian exporter, having previously withheld the commission amount from it. In this case, the amount of revenue received will differ from the amount reflected in the contract.

In such a situation, we advise you to stipulate in advance in the contract at whose expense the costs associated with the transfer of proceeds to a foreign currency account will be covered. If the contract stipulates that the costs of transferring the payment are incurred at the expense of the Russian organization, the bank commission is reflected by posting:

Debit 76 Credit 62

— the costs of transferring the payment are reflected.

This entry is made on the basis of a wire or telex message or a Community System for Worldwide Interbank Financial Telecommunications (SWIFT) funds transfer message indicating the amount of the fee withheld.

Example 2. Let's use the condition of the previous example, but with a caveat. Let us assume that, according to the terms of the contract, all costs associated with the transfer of money are paid by Mir CJSC. The American bank commission was also $200.

Thus, 19,800 US dollars (20,000 - 200) were received into the foreign currency account of the Russian company. On the same day, Mir CJSC received documents confirming the payment of a commission to a foreign bank.

The accountant of Mir CJSC made the following entries:

Debit 62

Credit 90 subaccount “Revenue”

— 552,000 rub. (20,000 USD x 27.6 rubles/USD) - revenue from the sale is reflected;

Debit 52 subaccount “Transit currency account”

Credit 62

— 546,480 rub. (USD 19,800 x RUB 27.6/USD)—revenue is credited to the foreign currency account minus the withheld commission;

Debit 76 Credit 62

— 5520 rub. (200 USD x 27.6 rubles/USD) - the commission of an American bank is reflected;

Debit 91 subaccount “Other expenses”

Credit 76

— 5520 rub. — the amount of the commission is taken into account as part of other expenses.

If the contract does not stipulate that the costs of transferring currency to the account of a Russian organization are made at its expense, the amount of the commission will be taken into account as uncollected receivables.

In this case, the Russian company will have to amend the contract and indicate that it is the company that pays the commission to the foreign bank. You will also have to re-issue the transaction passport. In this regard, we once again recommend that you stipulate in advance in the contract which party will cover the costs associated with the transfer of money.

Please note: the amount of VAT that is paid to suppliers and directly relates to the costs of production and sale of exported products can be reimbursed from the budget.

Such compensation is made only after the exporter’s account receives money in payment for the export contract (clause 2, clause 1, article 165 of the Tax Code of the Russian Federation).

However, tax inspectors often refuse to refund VAT, citing the fact that the proceeds did not go to the exporter’s account in full, but minus the bank commission. In this case, you have every right to go to court.

Courts usually support the position of exporters if, under the terms of the contract, a commission is paid by a Russian company.

Account abroad

Clause 8.1 currency conversion

Source: https://bookerlife.ru/valjutnyj-schet-provodki/