Staff reduction is a procedure for terminating the employment relationship with an employee at the initiative of the employing organization. This procedure is regulated by clause 2 of article 81 of the Labor Code of the Russian Federation. Upon dismissal, a laid-off employee receives an additional payment in the form of severance pay in accordance with Article 178 of the Labor Code of the Russian Federation.

The article provides all the necessary information about how, to whom, in what time frame and in what amount this type of benefit is accrued. For clarity, the necessary formulas and examples are given.

How much is paid in case of staff reduction?

The amount of payment is specified in Article 178 of the Labor Code of the Russian Federation. In the event of a layoff, the employee receives one average monthly salary on the day of dismissal. That is, he is compensated for the first month’s pay after dismissal. It is assumed that during this time the person will find a new job.

If certain conditions are met and the person is not employed in the subsequent months after dismissal, he can receive two more monthly earnings (for the second and third months). They are calculated according to the same rules as for the first month after leaving.

The amount of severance pay may be increased compared to that prescribed in the Labor Code of the Russian Federation, but cannot be reduced. The employer, on his own initiative, can assign a payment in a larger amount, having previously fixed this norm and the increased amounts in local internal documentation.

If no company acts provide for an increased amount of benefits, then the employee receives the amount prescribed by Article 178 of the Labor Code of the Russian Federation.

The calculation of earnings for severance pay is carried out in accordance with the Regulations to Resolution No. 922 of December 24, 2007.

We recommend reading about the payment of severance pay upon liquidation of an enterprise.

How are payments calculated for the second and third months?

For the first month upon dismissal due to staff reduction, every dismissed employee receives benefits under clause 2 of Article 81 of the Labor Code of the Russian Federation, without exception.

Payment for the second month is received only by citizens for whom the following conditions are met:

- A person was fired due to staff reduction.

- In the first two months after leaving, the person did not find a job in another organization.

Citizens receive payment for the third month

- The dismissal is framed as a layoff.

- Within two weeks after the termination of the employment contract, the person registered with the employment center.

- In the first three months after leaving, the person did not get a job, even with the help of the central employment center.

- There is an official decision from the employment service on the need to issue severance pay for the third month.

To receive funds, a citizen must contact the employer independently.

If for the first month management pays money on the day of dismissal, then for the second and third - only after the redundant has presented the relevant documentation:

- for 2 months - an application, a copy of the work record book, which shows the absence of new employment, a passport;

- 3 months in advance - application, copy of work record book and decision of the employment service, passport.

Terms and procedure for payment according to the Labor Code of the Russian Federation

On the last working day, a person receives all payments provided for by the Labor Code of the Russian Federation - salary, vacation pay compensation, severance pay for the first month. The employee does not need to perform any actions to receive funds. The employer himself issues the required amount on the basis of the Labor Code of the Russian Federation.

The deadline for payment of benefits for the second and third months is on the nearest day of payment of wages for the enterprise after the presentation of the necessary documents by the laid-off employee.

What does dismissal “due to reduction” mean?

Officially, dismissal “due to reduction” is called “termination of an employment contract due to a reduction in the number or staff of employees” (Clause 2, Part 1, Article of the Labor Code of the Russian Federation).

Not only companies, but also entrepreneurs-employers can lay off employees. When staffing is reduced, one or more positions are completely eliminated, excluding them from the staffing table.

Create a staffing table using a ready-made template Try for free

For example, a company that no longer intends to sell retail closes a store and eliminates the positions of salesperson, cashier, and store manager from the staffing table. Accordingly, those who occupy these positions are either transferred to another job or fired “due to layoffs.”

When staffing is reduced, the list of positions in the staffing table remains unchanged. However, the number of employees in one position or another is decreasing. For example, due to the liquidation of several retail outlets, instead of five sellers, there are only three. Those who are “extra” are transferred to other positions or made redundant.

IMPORTANT. There are no fundamental differences in the dismissal procedure depending on what exactly is being reduced - the number of positions or the number of employees. Moreover, these dismissals can be carried out simultaneously. In this case, some positions are completely removed from the staffing table, while for others the number of staff units is reduced.

Submit information about the average number of employees via the Internet for free

How to correctly calculate severance pay upon dismissal?

For correct calculation, it is necessary to determine the amount of average monthly earnings, which is calculated as the product of average daily earnings by the number of working days for payment.

The severance pay paid upon layoff is provided as compensation for the first month after dismissal from the organization. That is, the employer must count the number of working days in the month after termination of the employment contract and multiply by the average earnings per day.

Working days are counted according to the production calendar, based on the schedule of the reduced employee.

Average earnings for one day are calculated based on the rules prescribed in the Regulations to Resolution No. 922.

Formula for calculation:

Severance pay = Average daily earnings * Working days for payment.

Average daily earnings = Total salary for the year / Working days worked for the year.

Working days for payment = Number of scheduled working days for the terminated employee in the month.

What is included in income?

To find out the amount of an employee’s daily earnings, you need to determine the billing period and the total income during this time.

The calculation period is equal to 12 calendar months before the month the employee was laid off.

Example:

If an employee is fired due to a layoff on January 18, 2020, then the calculation is made for the period from January 1, 2019 to December 31, 2020. The current month in which the dismissal is recorded is not taken into account, except when the date of termination of the employment relationship falls on the last day.

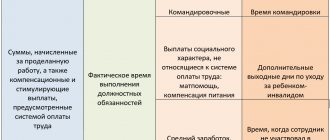

When calculating average earnings, you need to set the estimated time and sum up during this period all the employee’s income related to the payment of his work:

- salary in cash and non-monetary form;

- bonuses in the form of interest, in a fixed amount, related to work activity;

- various incentive payments assigned based on performance results;

All accruals are taken into account the application of an increasing regional coefficient, if one is provided for the region where the organization is located.

are not included in the calculation of average earnings for severance pay:

- compensation - payment for housing, food, communications, travel, study, recreation;

- social - sick leave benefits, maternity benefits;

- financial assistance for various reasons;

- vacation pay for annual and educational leave;

- travel allowances for employee business trips;

- other payments calculated based on average earnings.

Average daily earnings

The period for calculation is 12 months preceding the month of reduction.

Formula for calculation:

Average daily earnings = Salary in total for the period / Working days for the period actually worked.

What is included in the salary for severance pay is listed above. As for the value in the denominator of the formula, you should calculate the number of working days on the employee’s schedule for the billing period, but you can only take into account those in which the person actually went to the workplace to perform job duties.

There is no need to take into account working days when the employee was sick, on a business trip, on vacation, or absent for various reasons.

How to count days?

As stated in Article 178 of the Labor Code of the Russian Federation, on the day of dismissal due to reduction, the employee must be paid one average monthly salary.

This means that you need to calculate the average earnings per day based on the results of the last year, and then multiply by the working days in the month that is subject to compensation. In this case, this is the month immediately following the date of termination of the employment contract.

Example:

The employee was laid off on February 18, 2021, which means that severance pay is assigned for the period from February 19, 2020 to March 18, 2020. If we assume that an employee has a five-day work week, then according to the production calendar, taking into account holidays, the result is 19 working days.

Subsequently, after the second month, if there is no employment, the employee can receive another monthly salary. In this case, you need to calculate the number of working days to pay for the next monthly period.

In exceptional cases, severance pay may be paid for the third month after its end. The calculation of working days for payment is similar to the calculation for the first month.

Taxable or not - personal income tax and insurance premiums

Taxation of severance pay is prescribed in clause 2 of Article 217 of the Tax Code of the Russian Federation and clause 2 of Article 422 of the Tax Code of the Russian Federation. The first article is devoted to the withholding of personal income tax, the second - to the calculation of insurance premiums.

Based on these regulatory points, the following conclusion can be drawn: severance pay is not subject to taxes (income and contributions) if its amount is within three monthly average earnings.

If the employer, at his own request, pays benefits in an increased amount, then the excess amount is subject to taxation: 13 percent of personal income tax must be withheld from it and 30 percent of insurance premiums must be charged on top of it.

Read more about the taxation of severance pay in this article, which provides explanatory examples.

Calculation example in 2021

Initial data:

| Date of dismissal due to reduction | February 7, 2021 |

| Calculation period for severance pay | 01 February 2021 – 31 January 2020 |

| Monthly salary | 33500 |

| Sick leave | From 11/10/2019 – 11/15/2019 (sick leave benefit = 4000, salary for November = 27500) |

| Work schedule | Five day work week |

Calculation:

| Billing period | 01.02.2019 — 31.02.2020 |

| Total salary | 33500 * 11 months. + 27500 = 396000 (sickness benefits are not taken into account) |

| Days worked | Working days in the billing period according to the production calendar = 247. Sick days are not taken into account (5 work days), which means days worked = 247 - 5 = 242. |

| Average daily earnings | 396000 / 242 = 1636,36 |

| First month after layoff | from 02/08/2020 - 03/07/2020 - 19 working days |

| Severance pay for 1 month | 1636,36 * 19 = 31090,84. |

Nuances you need to know

It is not always possible to carry out calculations easily. For example, calculating the average earnings when workers are laid off on a rotational basis can be done without difficulty if the person has worked for a year. But what to do if such an employee has only worked for less than a month? In this case, you should take into account the number of days actually worked and clarify the number of watchmen in order to know the duty schedule. Typically, wages for this category of employees are calculated based on the number of hours worked. So, if a watchman worked every other day, this is equivalent to the fact that he worked for three days, eight hours each.

With such calculations, calendar days off go by the wayside, which means that the employee completes about one and a half times per month. The average salary of such an employee is calculated on an hourly basis.

Additional payments

It is necessary to take into account the mandatory compensation that is due to a company employee when he is laid off. Payments must include vacation pay, health benefits, wages for the last two months of work, and average earnings for the next two months.

Vacation compensation

If during the current year the employee was not able to spend his vacation, this should be taken into account when paying settlement funds. So, he should be paid vacation pay and health benefits, if any. It is worth considering that money can only be paid for part of the vacation if the working year is not over.

Vacation must be accrued according to the length of work. If only a quarter of the working year has been worked out, then vacation pay is due in the amount of one-fourth of all working days for the year. You can also give the employee the opportunity to go on vacation and dismiss him a day later than he returns to work.

Is it possible for early departure at the request of the employee?

As is known, by law the manager must notify employees who are subject to staff reduction 2 months before the upcoming termination of contracts.

That is, the person is warned, then he works for another 2 months as usual, and only after this period he is fired and the required amounts are paid, including severance pay.

It is possible that the employee subject to layoff does not want to wait for the notice period to expire.

If a citizen does not need severance pay, then you can simply write a letter of resignation of your own free will (clause 3 of Article 77 of the Labor Code of the Russian Federation) and, after working for 2 weeks, resign with payment of salary and vacation pay compensation. Of course, on this basis, the dismissed person will not receive severance pay.

If a person still wants to receive an additional payment, then you can try to negotiate with management about early dismissal, but with the issuance of severance pay. In this case, you need to write an application for early dismissal due to staff reduction.

If the director is ready to accommodate and fire ahead of schedule, then he has the right to do so. If the manager does not want to do this, then he has every right to do this, then he will either have to leave of his own free will without severance pay, or continue to work until the expiration of the two-month period before the day of reduction.

Thus, severance pay can be paid in case of early dismissal, but only if an appropriate agreement is reached with management.

What payments are not included in the calculation?

When calculating the average daily (hourly) earnings, on the basis of which the amount of severance pay is determined, it is not necessary to take into account social payments not related to wages. These, in particular, include financial assistance, compensation for the cost of food, travel, training, utilities, recreation, and others (clause 3 of the Regulations).

You must also remember that amounts accrued during the time when the employee did not work are excluded from the billing period. In particular, sick leave is not taken into account, including maternity benefits, remuneration for downtime, payment for additional days to care for disabled children and people with disabilities since childhood. In addition, when calculating, it is necessary to exclude accruals made during the time when the employee did not work (participated in military training, court hearings, investigative actions, etc.). This is stated in paragraph 5 of the Regulations.

conclusions

If an employee is fired due to staff reduction, then, in addition to standard payments, he must receive severance pay. For the first month it is issued on the day of termination of the employment relationship, for the second - after a two-month period after dismissal in the absence of employment, for the third - at the end of a three-month period. by decision of the employment service.

The maximum amount by law is three average monthly earnings. The employer has the right to increase the size by his acts, but he does not have the right to reduce it.

Average monthly earnings are calculated based on work results for the last year before the layoff: average daily income is multiplied by working days to pay benefits.

In case of early dismissal, the issue of issuing severance pay is decided by agreement with the management of the organization.

Taxation

If the amount of the benefit does not exceed three times the average monthly earnings , then in accordance with paragraph 3 of Article 217 of the Tax Code, personal income tax does not need to be withheld from this payment. If the employer assigns benefits in an increased amount, then the amount exceeding three times earnings is subject to personal income tax . It must be withheld at the time of payment (the deadline is the last day of work), and transferred no later than the next day.

The same rule applies to insurance premiums . That is, if the amount of the benefit does not exceed three times the average earnings, then there is no need to accrue contributions from it.

Attention! Child support for minor children should be withheld from the amount of severance pay (letter of the Ministry of Labor dated September 12, 2017 No. 11-1/OSCHG-1816).

Expert commentary on the taxation of benefits with contributions and personal income tax:

Answers to questions from our readers

¿ Question 1 from Nikolay: an employee pays alimony for his child, if his staff is reduced, he is assigned severance pay, is it necessary to withhold alimony from him >>> answer.

¿ Question 2 from Anna Vitalievna: an employee is drafted into the army for military service, does he need to be paid severance pay and in what amount >>> answer.

¿ Question 3 from accountant Olga: please explain when it is necessary to pay an employee wages for three months, and when for two weeks >>> answer.

Classification of employees and maximum allowable amount of payments

Currently, there are special categories of employees, when laying them off, the law provides for other calculation rules. Thus, civil servants are paid the average salary for the last three months of work.

This procedure applies in the event of a regular layoff or bankruptcy of an organization. In this case, the amount of this payment is calculated without taking into account the severance pay itself.

In addition, if it is impossible to employ this civil servant in a position corresponding to his professional skills and qualification level, he will be included in a special reserve present in the register of civil servants of the Russian Federation.

The service of employees in this category will not be interrupted for one year after dismissal.

A collective labor agreement can further strengthen the position of an employee belonging to this group.

Since only the minimum amount is determined by law, the maximum payment amount can be specified in such an agreement, and its value can be any.

Please note: in accordance with the law, personal income tax is not deducted from the above payment, equal to three months’ income.

Such severance pay is subject to income tax only when the total payment exceeds the amount allocated. Personal income tax is withheld only from the difference between these amounts.

For people working in adverse climate zones, the total tax-free benefit is doubled by law. Its value is equal to six monthly earnings.