“Invoices” or “invoices” – how to say and write correctly? This concept is used quite often, but the question of the correct declension by case and determining the gender of the word “invoice” still arises. And anyway: is this a word or a phrase? Our material will give you the answer to how to use “invoice” when writing and speaking according to all the rules of competent speech.

Also see:

- Invoice and delivery note as one single document

- Certification of invoice: signatures and seal

How is an invoice different from an invoice?

First let's separate these 2 terms, which sound similar but mean completely different things. We are talking about an invoice and an invoice. Let's take a closer look at how an invoice differs from an invoice.

The term “Account”

An invoice is a document according to which payment for goods/work/services is made to a counterparty.

An invoice cannot be considered a primary document. The primary is designed to reflect the accomplished facts of economic life. The account reflects only the desire of one business entity to receive funds for its goods or services from another business entity. When payment occurs, then we can talk about a fait accompli. activities. But for this they use other documents. For example, a bank statement or a cash receipt/expense order.

You can make a payment without having an invoice in hand. For example, in the case of systematically provided services, the price of which remains unchanged from month to month: payment may be made on the basis of an agreement. This condition must be written down in it.

Despite the optionality of using accounts in work, their use is convenient. Invoicing:

- we remind the counterparty that it is time to pay;

- We provide our bank details to the counterparty in a convenient format;

- We monitor the debts of counterparties with proper organization of document flow.

The term “Invoice”

An invoice is one of the most important documents in accounting. It is on the basis of the invoice that VAT is deducted - that is, they receive the right to reduce the tax payable. The invoice is covered in Art. 169 of the Tax Code of the Russian Federation.

It is relevant for organizations paying VAT. These are usually large companies. But small businesses, for various reasons, can apply the general taxation system with the payment of VAT.

Therefore, the term “invoice” is a frequently used one. This is a compound word, so it is not entirely obvious how to use it correctly. Below we will tell you what rules of the Russian language it obeys.

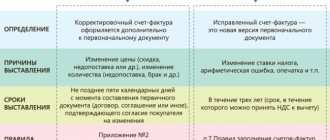

Now let’s summarize in a diagram what is the difference between an invoice and an invoice:

Be careful with yourself

Yourself, yourself, yourself, about yourself... Insidious, insidious words! And their cunning lies in the fact that sometimes you can’t tell who they actually belong to. They confuse, deceive...

“Well,” I hear on the subway, “the boss told me to take the guest to his place.”

To yourself - this is to whom, if “the boss told me”? Where will the guest end up: with the one who is telling this, or with the boss?

If there are several nouns in a sentence, the reflexive pronoun “yourself” (to yourself, etc.) can refer to any of them. For example: “The mother told her daughter to pour herself some water.” This may mean that the water should be poured for the mother or for the daughter...

It is better to avoid such ambiguity, otherwise people simply will not understand us. After all, according to the rules, the reflexive pronoun refers to the word that means the producer of the action. In the case of a mother and daughter, there are two, or rather two, actors: the mother ordered, and the daughter will pour the water. Of course, we can assume that, most likely, the daughter will pour water for herself - but this is just an assumption! In general, this phrase contains ambiguity, and this is always bad. We need to correct the situation.

So let's do this. Let's take one of two clear options: either “The mother ordered the daughter to pour water for her,” or “The mother ordered the daughter to pour water for herself.” This way everything will be put in its place.

The same thing should have been done by the person from whom I heard a clumsy phrase on the subway about the boss and the guest: choose! Either “The boss told me to take the guest to him,” or “The boss told me to take the guest to me.” And no ambiguity!

Like this. Be careful with yourself!

Invoice of the stronger sex

- Don't forget the invoice! - the owner of a small flower shop shouts to the courier.

He turns around at the door:

— What invoice? That is, what is the invoice?.. No, since it’s an invoice, that means it’s...

“Come on,” the hostess waves her hand, “the main thing is don’t forget!”

And yet, still... What kind of invoice?

The interpretation of this complex word is easy to find. This is an invoice with an inventory of the goods sent and details of the sending and receiving parties. It is more difficult to figure out how to inflect this word and combine it with adjectives and pronouns. My invoice? My invoice? Unclear.

Now we'll figure it out. An invoice is a so-called compound word, the same type as a raincoat, a crane, a masquerade ball. Problems often arise with these words: they behave very differently... Cloak-tent - this, for example, has long been a single word of the feminine gender. They say this: my raincoat is a tent, I covered myself with a strong raincoat tent - that is, the first part does not even bend, the agreement comes with the second part - with the tent. This is how the gender of the word is determined.

In other words, the connection between the parts is not as strong. With a masquerade ball, for example, there is always confusion. They say either “at a masquerade ball” or “at a masquerade ball”. But here everything is simpler - both the “ball” and the “masquerade” are masculine. But with the invoice...

As far as I could observe, there are serious fluctuations in the declension and agreement of this word with others. Someone says: haven't you seen my invoice? Others - those who use this word daily, hourly - may no longer incline the first part of “count”. Would they rather say “didn’t see my invoice”?

No, this is clearly not suitable... The difficulty is that dictionaries do not really help us in solving this issue. We must hope that over time this word indicating the gender will appear in them... I would recommend saying and writing “my invoice” (in any case, there will be no mistake). Still, the word “account” is clearly the main one here.

Yes, and here’s another thing: in the Tax Code, “invoice” is masculine. This is already an argument.

Choosing the correct declination

So, an invoice is not a combination of words, but one word - a compound one.

Compound words are words consisting of 2 or more words that are written with a hyphen.

Let us turn to the laws of literate speech for complex words consisting of several.

The words “invoice” and “invoice” are declined each separately, therefore, when declension by case of “invoice”, we decline each word:

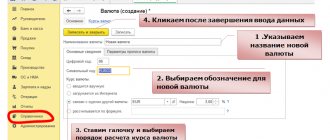

Features of putting down letter values

Some enterprises number advance and adjustment documents using different letters and numbers. For example, advance invoices are assigned the letter A, and adjustment invoices are assigned the letter B. This measure allows you to quickly find the necessary documents. However, it is not recommended to use the method in question, since there are no permissions for this in the law.

There is a risk that the buyer, upon discovering the letter designation, will require correction of the papers. A person’s motivation is to prevent problems from arising during a tax audit.

ATTENTION! There is a compromise method. You can assign both an official and an auxiliary number to an invoice. This measure will not be considered a violation. You can indicate the auxiliary number not only in the accounting program, but also in the document itself. However, the additional value does not need to be mentioned in the Number column. It is indicated after all the details in the “For reference” column. Permission to use additional numbers is given in letters from the Ministry of Finance.

Principles for using words in the plural

How is the word invoice pronounced when we are talking about several documents? That is, if we are dealing with the plural.

The same apply here as for the singular: we decline each of the two words of the compound word.

Let's show what the word “invoice” looks like in the plural:

Let's write down examples of invoice declination if we have in mind not one document, but several:

Actions of the invoice recipient

If a corrected invoice was sent to the buyer, he must change the data in the purchase book, because the parameters of the defective invoice or erroneous data were indicated there. To do this, the buyer needs to use an additional sheet from the Book, only to match the tax period of the purchase. On this sheet, you need to make a record of the cancellation of a specific invoice and calculate the amount of purchases made before this invoice, thus determining the amount corresponding to the canceled invoice.

The buyer has the right to exercise the legal possibility of deducting VAT not only in the tax period when he made the purchase: it is only important that the document is registered on time.

Correct gender

An important question is what type of “invoice”? Intuitively, the conclusion suggests itself that this is feminine, based on the last word - texture. But this is a mistaken opinion.

The gender of a compound word is determined by the gender of the defining, main word. In our case, this is the first word - count.

Counting is masculine. We get the conclusion: invoice also applies to masculine words.

How to correctly use the term “invoice” from the point of view of belonging to the genera, we show in the diagram:

To practice using the term “invoice” correctly, you can read articles and regulations in which this word appears frequently. For example, re-read this article and pay attention to the spelling of a difficult word. The invoice is also often found in the already mentioned article. 169 of the Tax Code of the Russian Federation.

Types of invoice numbers

The numbers can consist of both numbers and letters. Letter designations must be present when document flow is in the following structures:

- Separate units. After the number you need to indicate the index in numbers. Values are separated by slash (/). The index is determined by the company and prescribed under a specific contract.

- People in a partnership or trustee managers. The index separated by a slash must be specified in this case as well.

Compliance with rules is important not only for the implementation of regulations. Correct numbering ensures orderly document flow and prevents confusion.

New operations in the VAT control system

The ASK VAT-2 software package, which the tax service used until recently, has been replaced with another, improved one.

It is called “VAT Control”. It is aimed not only at identifying “direct” VAT evasion schemes, but is able to check second and third level counterparties, as well as those who do not use these schemes themselves, but work with such counterparties.

The previous regulations were “tailored” to identify:

- gaps when the data reflected in your declaration is not included in the declaration of your counterparties;

- discrepancies in declarations.

In these cases, the tax office issues a requirement to provide documents and begins the process of identifying the beneficiary.

With the replacement of the regulations, the following will also be checked:

- discrepancies between journals;

- violation of control ratios;

- unmatched transactions that result from splitting invoices;

- other dubious charges.

How to assign this right to another person?

The authority to sign can be transferred by the manager or chief accountant to other persons through an order for the authority to sign or a power of attorney issued on behalf of the organization. Therefore, to transfer responsibilities it is necessary to draw up one of the specified documents.

Both the power of attorney and the order indicate the following information::

- Personal data of the authorized person.

- A list of specific types of documents that an employee or authorized representative has the right to sign.

IMPORTANT! When completing both forms, the manager must certify a sample signature of the authorized person, which will need to be indicated in the documents.

Results

One of the required details for each type of invoice is its serial number. The word “ordinal” implies numbering in order as documents are drawn up. However, it is not always possible to comply with it, and the attempt at ordering is reflected in the numbering of documents issued later than those whose numbers failed. There is no liability for jumping or missing numbers. The deduction of errors in the number is not prevented.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Possible violations and their consequences

When using numbering, violations will be:

- A number assigned out of sequence (for example, a higher value for an earlier document).

- A number is missing (if, for example, one invoice is dated number 5, and the next one is already dated 7).

But at the same time, you need to remember that a failure in numbering, although a nuisance, is also quite acceptable. You cannot refuse a deduction due to incorrect numbering .

If the buyer encounters a glitch in the invoice, he does not need to do anything. Since, according to the Tax Code of the Russian Federation, such a document is issued by the seller, the buyer is deprived of the opportunity to influence the numbering conditions (read about issuing, payment, and storage of the document here). If the content of the document allows one to clearly identify the parties and the amount of the obligation, the invoice must be accepted by the tax authority.

If the seller made a mistake by assigning the wrong number, then there will be no significant consequences for him either. Letter of the Department of Tax and Customs Policy of the Ministry of Finance of Russia dated No. 03-07-09/411 of 2017 confirms that:

- chronology must be respected;

- but if there is an error, the document will still be accepted for deduction.

Check out other useful materials on our website about invoices. Read about how to correctly fill out an invoice for services and for the return of goods, as well as in what currency the document can be issued and where the money code is displayed.

General requirements

The numbering for invoices should be:

- continuous;

- sequential in chronological order;

- non-repeating - each document must be assigned its own unique number (Order of the Ministry of Finance of the Russian Federation No. 119n of 2001 and Filling Out Rules).

The chronological order requirements apply to both master and adjustment invoices.

In all other respects, the organization is free to choose a numbering system for primary accounting documents .

Reference. If the numbers increase in chronological order, there should be no reason for claims from the Federal Tax Service of the Russian Federation. The main thing is to correctly fill out the remaining columns of the invoice form.

Regulatory acts allow for the possibility of separate numbering for invoices. But this opportunity, according to the Filling Rules, can only be used:

- for organizations operating through branches or representative offices;

- for participants of the partnership;

- for trustees.

In this case, the serial number is divided into two parts:

- Shared room.

- Through a slash - a digital index of a subdivision or an index of an agreement between comrades.

In general, we can conclude: the organization has the right to adopt its own accounting policy regarding invoices, indicating numbering rules in them. The main thing is that the numbers go in ascending order. At the same time, separate numbering for special types of invoices (for example, only for advance invoices) at the enterprise is not provided for by law - but it is not prohibited either. The main thing is to avoid situations in which the same number can be assigned to different documents relating to different counterparties and different obligations.

Omissions in invoice numbers are not a significant violation, and such documents must be accepted by tax authorities for VAT deduction.

You will learn more about filling out the fields in the invoice in this article.