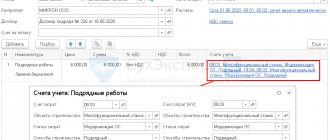

Accounting entries for fixed assets in budgetary organizations

Budgetary organizations are institutions financed from budgetary funds.

Accounting in such organizations is carried out on the basis of a special chart of accounts for budgetary institutions with their own entries, which is approved by Order No. 174n of the Ministry of Finance of the Russian Federation dated December 16, 2021. In all budgetary institutions, fixed assets, according to Instruction No. 25n, are accounted for in account No. 010100000 - Basic facilities. Fixed assets are recorded in accounting registers at their original cost. It includes the costs of purchasing and constructing facilities, consulting services, delivery and other costs required to bring the facility into a state of readiness for operation, taking into account the VAT charged. Accounting in budget accounting accounts is carried out in rubles and kopecks.

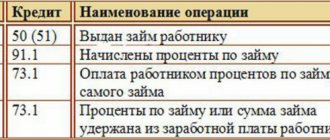

In the budget, the return of funds from the social security service is posted

Reflection in accounting of compensation from the Federal Social Insurance Fund of the Russian Federation In accordance with Articles 183 and 184 of the Labor Code of the Russian Federation, the employer is obliged to provide the employee with guarantees in case of temporary disability, as well as in the event of an industrial accident and occupational disease. Such guarantees are reflected as payment of the related benefit.

D 26 K 69.1. how to take into account what the FSS owes us?? And what will be the wiring when the money is transferred to our account. Re: Reimbursement of expenses from the Social Insurance Fund for the payment of benefits to employees D26 K70 - in the amount of b/l paid by the employer; D69.1 K70 - for the amount of b/l reimbursed from the Social Insurance Fund.

Typical entries for budget accounting (examples)

Digits 1–17 encode the classification attribute of receipts and disposals and are formed from the BCC. Budget accounting instruction No. 162n contains a separate Appendix 2, in which for each account it is specified which BCC must be indicated: the code intended for budget expenditures (KRB), budget revenues (KDB) or sources of financing the budget deficit (CIF). Moreover, for institutions, categories 4–20 of the BCC are taken, and for financial authorities, categories 1–17.

Public sector organizations keep records based on the provisions of the Unified Chart of Accounts and instructions thereto, approved by Order of the Ministry of Finance of the Russian Federation dated December 1, 2021 No. 157n. According to clause 21 of instruction No. 157n, private charts of accounts for specific types of organizations also apply.

Procedure for using account 209 00: taking into account changes

- Accounting for debtors' debts for damage and other income in foreign currencies is simultaneously carried out in the corresponding foreign currency and in the ruble equivalent on the date of accrual of debt (revenue recognition).

- Revaluation of payers' settlements for damage and other income in foreign currencies is carried out on the date of transactions for payment (return) of settlements in the corresponding foreign currency.

- Positive (negative) exchange rate differences that arose when calculating the ruble equivalent are attributed to the increase (decrease) in calculations of income in foreign currency, with exchange rate differences attributed to the financial result of the current financial year from the revaluation of assets.

The general provisions for the use of account 209 00 are given in Instruction No. 157n, which defines a unified procedure for organizing and maintaining accounting (budget) records in state (municipal) institutions. At the same time, there is no correspondence of accounts using this account in Instruction No. 157n.

Features of writing off shortages in budgetary and autonomous institutions

During the inventory process carried out in the institution before the formation of annual financial statements, it was discovered that one computer did not have a monitor. The person responsible for the loss has not been identified. The computer was purchased through a grant for other purposes and is considered particularly valuable property. It is used in the main activities of the institution, which are not subject to VAT.

Reflection in accounting for the disposal of parts of a fixed asset will depend on the decision of the manager on the procedure for using and accounting for material assets remaining at the disposal of the institution after theft is detected. This decision should be made based on technical capabilities and economic feasibility.

Repayment of the deficiency at the expense of the guilty party

Shortage (damage) of material assets within the limits of natural loss norms is not taken into account in account 0 209 00 000 “Calculations for property damage”, but is attributed in accordance with the order of the manager to the expenses of the institution (cost of finished products, works, services).

Account 0 209 00 000 “Calculations for property damage” is intended to record calculations for the amounts of identified shortages, thefts of funds, other valuables, for the amounts of damage caused to the property of the institution, subject to compensation by the perpetrators in the prescribed manner (clause 220 of Instruction No. 157n, p 107 Instructions No. 174n).

KOSGU for payment of reimbursement of expenses under the writ of execution

[On the application of KOSGU in relation to expenses of a budgetary institution for the transfer of funds to the deposit account of the arbitration court to pay for forensic examination, work (services) for the maintenance, servicing, repair of non-financial assets, recycling, waste disposal]

State institution Administration of Trusovsky district. Earlier, the tree broke and fell on a citizen’s car. At the moment, we have received a writ of execution for compensation of expenses: - 93,000 rubles - compensation for damage caused; - 5,000 rubles - compensation for expenses for the examination; - 3,158 rubles - reimbursement for payment of state fees; - 8,000 rubles - compensation for payment of expenses for services representative (lawyer). Which KOSGU should I pay for reimbursement of expenses? (all according to KOSGU 290)?

Repayment of Deficiencies in Budget Institution Postings in 2021

At the same time, the disposal of fixed assets when a shortage is identified is reflected in the debit of the corresponding analytical accounting accounts, account 0 104 00 000 “Depreciation”, account 0 401 10 172 “Income from transactions with assets” in correspondence with the credit of the corresponding analytical accounting accounts, account 0 101 00 000 “Fixed assets” (clause 12 of Instruction No. 157n). At the same time, if the object was accounted for in off-balance sheet account 21 “Fixed assets worth up to 3,000 rubles inclusive in operation,” its disposal as a result of a shortage is reflected by reducing this off-balance sheet account (clause 332 of Instruction No. 157n). At the same time, the amounts of identified damage are reflected in debit accounts 0 209 74 000 “Calculations for damage to inventories” and 0 209 71 000 “Calculations for damage to fixed assets” (clause 109 of Instruction No. 174n, clauses 220, 221 of Instruction No. 157n).

- Posting food shortage

- Budgetary accounting of calculations of shortages

- Accounting for food products in budgetary institutions*(1)

- Compensation for shortages by the guilty parties, reflected in accounting

- Surpluses, shortages, mis-grading. how to reflect it in accounting? (Alekseeva M.)

- Postings on food shortages in a budgetary institution

Calculations for damage and other income

Source: Journal “State institutions: accounting and taxation”

In the activities of state institutions, situations may arise when the institution suffers damage, expressed in the form of shortages that occurred in excess of the norms of natural loss, theft and other circumstances, as well as damage as a result of inappropriate use of property . In this article we will look at the features of reflecting calculations for damage and other income in budget accounting.

Accounts for settlements of damages and other income

According to the updated (as amended by Order of the Ministry of Finance of the Russian Federation dated August 29, 2014 No. 89n ) Instruction No. 157n, account 1,209,00,000 is used to record calculations for damage and other income .

Analytical accounting for the specified account is kept in the card for accounting for funds and settlements (f. 0504051) in the context of persons responsible for compensation for damage caused (perpetrators), types of property and amounts of damage, including identified thefts and shortages ( clause 222 of the Instructions No. 157n ).

In accordance with clause 221 of Instruction No. 157n, the grouping of settlements for damage and other income is carried out on the following accounts of accounting objects:

a) 1 209 30 000 “Calculations for compensation of costs”;

b) 1,209,40,000 “Calculations for forced seizure amounts”;

c) 1,209,70,000 “Calculations for damage to non-financial assets”:

– 1 209 71 000 “Calculations for damage to fixed assets”;

– 1 209 72 000 “Calculations for damage to intangible assets”;

– 1 209 73 000 “Calculations for damage to non-produced assets”;

– 1 209 74 000 “Calculations for damage to inventories”;

d) 1 209 80 000 “Calculations for other income”:

– 1 209 81 000 “Calculations for cash shortages”;

– 1 209 82 000 “Calculations for shortages of other financial assets”;

– 1 209 83 000 “Calculations for other income.”

Valuation of damage caused

If it is discovered that damage has been caused to an institution, the amount of damage caused should be assessed.

In this case, when determining the amount of damage caused by shortages or theft, one should proceed from the current replacement cost of material assets on the day the damage was discovered. The current replacement cost is understood as the amount of money that is necessary to restore the specified assets ( clause 220 of Instruction No. 157n ).

Please note that before the changes were made by Order of the Ministry of Finance of the Russian Federation No. 89n to Instruction No. 157n, when determining the amount of damage caused to an institution due to loss, damage, or theft of property, one should proceed from the market value of the property on the day the damage was discovered ( clause 220 of Instruction No. 157n ).

Based on the provisions of Art. 246 of the Labor Code of the Russian Federation, the amount of damage caused by an employee is determined by actual losses, calculated from market prices prevailing in the area on the day the damage was caused, but not lower than the value of the property according to accounting data, taking into account the degree of wear and tear.

Thus, the amount of damage caused by an employee cannot be lower than the value of the property (taking into account its depreciation) according to budget accounting data.

In addition, federal law may establish a special procedure for determining the amount of damage subject to compensation caused to the employer by theft, intentional damage, shortage or loss of certain types of property and other valuables, as well as in cases where its actual amount exceeds the nominal amount.

Before making a decision on compensation for damage by specific employees, the employer is obliged to conduct an inspection to establish the amount of damage caused and the reasons for its occurrence. To conduct such a check, the employer has the right to create a commission with the participation of relevant specialists.

Requiring a written explanation from the employee to establish the cause of the damage is mandatory. In case of refusal or evasion of the employee from providing the specified explanation, a corresponding act is drawn up.

Compensation for damage

Based on the provisions of Art. 238 of the Labor Code of the Russian Federation , the employee is obliged to compensate the employer for direct actual damage caused to him, except for the cases specified in Art. 239 of the Labor Code of the Russian Federation , namely if the damage arose as a result of:

- force majeure;

- normal economic risk;

- extreme necessity;

- necessary defense;

- failure by the employer to fulfill the obligation to provide appropriate conditions for storing property entrusted to the employee.

Direct actual damage is understood as a real decrease in the employer’s available property or deterioration in the condition of said property (including property of third parties located at the employer, if the employer is responsible for the safety of this property), as well as the need for the employer to make costs or excessive payments for the acquisition, restoration of property or compensation for damage caused by the employee to third parties ( Article 238 of the Labor Code of the Russian Federation ).

For damage caused, the employee bears financial responsibility within the limits of his average monthly earnings ( Article 241 of the Labor Code of the Russian Federation ).

According to the provisions of Art. 248 of the Labor Code of the Russian Federation, recovery from the guilty employee of the amount of damage caused, not exceeding the average monthly earnings, is carried out by order of the employer. The order can be made no later than one month from the date of final determination by the employer of the amount of damage caused by the employee.

If the month period has expired or the employee does not agree to voluntarily compensate for the damage caused to the employer, and the amount of damage caused to be recovered from the employee exceeds his average monthly earnings, then recovery can only be carried out by the court.

If an agreement on full financial liability has been concluded with an employee, he is obliged to compensate the damage caused to the employer in full ( Article 243 of the Labor Code of the Russian Federation ).

Financial liability in the full amount of damage caused is assigned to the employee in the following cases:

- imposing, in accordance with the Labor Code of the Russian Federation or other federal laws, on the employee financial liability in full for damage caused to the employer during the performance of the employee’s job duties;

- shortage of valuables entrusted to him on the basis of a special written agreement or received by him under a one-time document;

- intentional causing of damage;

- causing damage while under the influence of alcohol, drugs or other toxic substances;

- causing damage as a result of the employee’s criminal actions established by a court verdict;

- causing damage as a result of an administrative violation, if established by the relevant government body;

- disclosure of information constituting a secret protected by law (state, official, commercial or other), if provided for by federal laws;

- causing damage not while the employee was performing his job duties.

If facts of theft, abuse or damage to property are detected in an institution, an inventory must be carried out ( clause 1.5 of the Guidelines for the inventory of property and financial obligations , approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49

Source: https://otchetonline.ru/art/buh/45966-raschety-po-uscherbu-i-inym-dohodam.html

Reflection in postings of surpluses and shortages in the cash register

The cash register inventory can be carried out unscheduled, suddenly and without warning, in order to control the responsibility of the MOL. The timing and procedure for unscheduled inventory are also established by the regulations of the enterprise.

The commission must include at least three people. The presence of the MOL on the commission's list is mandatory. In addition, the presence of security and internal audit employees (if available) is desirable. If there is no signature of even one of the commission members, the inventory is considered invalid.

Write-off of accounts payable in a budget institution (postings)

The inventory must be approached with special care and thoroughness. It is the inventory of receivables and payables that allows timely identification of doubtful and bad debts. Based on the results of the audit, work is carried out in management accounting with receivables and a reserve for doubtful debts is formed.

Inventory initiated by an enterprise decision implies that accounts can be selected at the discretion of the organization . Afterwards, an order is issued indicating the commission, the name and list of accounts and creditors, deadlines and a list of necessary documentation.

Accounting for receipt of materials

Sources of materials according to the standard are:

- acquisition;

- receipt from other organizations;

- creation for use in one’s own activities;

- production for alienation (sale).

The institution chooses the unit of accounting for inventories independently. These may be (clause 8 of the Federal Budgetary Accounting Standards “Reserves”):

- nomenclature (register) units;

- batches, homogeneous (registry) inventory groups. In this case, analytical accounting of inventories must be ensured, the procedure for maintaining which is prescribed in the accounting policy.

If reserves that can be used for more than 12 months are taken into account, the institution (special commission) must determine their useful life.

Materials are received by institutions on the basis of primary documents at original cost (before the new Federal Accounting Standards came into force, assessments were required to be made at actual cost). The procedure for calculating the initial cost depends on the method of receipt of assets and is described in detail in paragraphs. 19-26 FSBU “Reserves”.

Institutions are also required to carry out subsequent revaluation of inventories with the creation of a reserve. The rules are stated in paragraphs. 29-33 FSBU “Reserves”. In some cases, it is possible to reclassify inventories, i.e., transfer them to another group of inventories or even to a different category of assets (for example, in fixed assets). The procedure and conditions are set out in clause 27 of the Federal Accounting Service.

To reflect receipts in the chart of accounts, separate analytical accounts “Material inventories” are allocated, in categories 24–26 of which code 340 is used for each type of materials: 010521340 - 010526340, 010531340 - 010536340, 010538340 (see order No. 174n).

See the table below for the main entries for the receipt of materials; other transactions can be found in clause 34 of the Instructions for the chart of accounts (order No. 174n).

| Wiring | Wiring Description |

| Dt 010500000 “Inventory” (010521340 - 010526340, 010531340 - 010536340, 010538340) Kt 030234730 “Increase in accounts payable for the acquisition of inventories”, 020834660 “Decrease in accounts receivable of accountable persons for the acquisition of inventories” | Purchasing materials |

| Dt 010500000 “Inventory” (010521340 - 010526340, 010531340 - 010536340, 010538340) Kt 030404340 “Internal departmental settlements for the acquisition of inventories” | Transfer of materials from a higher institution |

| Dt 010500000 “Inventory” (010521340 - 010526340, 010531340 - 010536340, 010538340) Kt 010600000 “Investments in non-financial assets” (010624340, 010634340) | Independent production of materials, purchase under a number of contracts (cost of materials, transportation costs, consulting services, etc.) |

Postings on food shortages in a budgetary institution

The inventory commission found that the vegetables had become unsuitable for further use due to non-compliance with their storage conditions. The financially responsible person was found guilty. The latter admitted guilt and voluntarily agreed to compensate for the damage caused. The amount of damage according to the loss assessment report is 90 UAH. The guilty person compensated for the damage caused by depositing cash into the institution's cash desk.

Important!

From the amounts collected from the perpetrators, compensation is made for losses caused to the institution, taking into account the actual costs of restoring damaged or acquiring new material assets and the cost of work to restore them.

Types of deductions under a writ of execution from wages

Enforcement documents are binding from the day they are received by the enterprise by mail or through the claimant. The document is received through the claimant by indicating the monthly amount of deductions not exceeding 25 thousand rubles.

A writ of execution is mandatory for recovery from an individual’s income, regardless of the employer’s wishes. Deduction is made when accruing income - wages and other receipts from the employer. The legislation establishes a number of payments for which no deduction is made. Amounts received in the form of compensation payments, compensation for harm, and social benefits are exempt from collection. We will tell you in the article how deductions are made from wages based on a writ of execution, and what entries are made.

Capitalization of surplus during inventory in a budgetary institution

Fixed assets, materials and finished products are classified as particularly valuable property. The identified discrepancies were reflected in the statements. The identified assets (fixed assets and materials) are planned to be used within the framework of activities financed by a subsidy for the implementation of government assignments. Goods and finished products are used in the income-generating activities of the institution.

According to paragraph 7 of Instruction No. 148n, an inventory of property, financial assets and liabilities is carried out by a budgetary institution in accordance with the regulatory legal acts of the Ministry of Finance of Russia. In turn, the procedure for conducting an inventory and recording its results is established by the Methodological Guidelines for the Inventory of Property and Financial Liabilities, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49 (hereinafter referred to as the Guidelines).

Accrual of penalties for transactions with a budgetary institution in 2021

Recognition of expenses in accounting does not depend on the intention to generate income and the form of expenses. As an illustrative example, consider a situation where a building is confiscated from an organization in order to pay a tax, and subsequently sold through an auction. Postings for the operation (without displaying specific numbers) will be as follows: Dt 76 Kt 91-1 Display of proceeds from the sale of the building Dt 91-2 Kt 68 VAT accrued Dt 91-2 Kt 01 subaccount “Disposal of fixed assets” Write-off of the value of the building on the balance sheet Dt 68 Kt 76 Repayment of tax debt Dt 91-2 Kt 76 Display of enforcement fee Dt 91-2 Kt 76 Display of auction costs and organizer remuneration Dt 91-2 Kt 76 Display of the amount of the withheld fine Dt 51 Kt 76 Receipt of the amount remaining from the sale of the building Features for budget institutions In budgetary institutions, accounting is carried out in accordance with Instruction No. 174n.

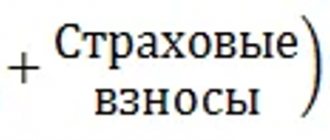

Changes in postings for insurance premiums and penalties in 2021-2021 During the transition period (2021-2021), situations are possible when you will have to make adjustments or pay insurance premiums for the years preceding 2021, i.e. those in which the calculations were carried out directly with funds. To avoid confusion in calculations, it is best to create separate second-order subaccounts on account 69 to account for old (for 2021–2021) and new (from 2021) contributions for each type of insurance, thereby ensuring their analytical accounting for correct posting in reporting. IMPORTANT! In order to protect yourself in the event of a tax audit or legal proceedings, add provisions to the accounting policy order regarding changes in the accounting methodology for insurance premiums.

Benefits for victims of a nuclear power plant accident in the Russian Federation

Victims of the Chernobyl disaster are entitled by law to such privileges. The leave of Chernobyl survivors can be extended in terms of duration. All Russians who suffered in some way from the Chernobyl disaster or during the liquidation of the accident have the right to regular leave, for which the employer will pay. Russians determine the start time of their vacation independently. In addition, Chernobyl victims can take additional rest for a period of up to 14 days.

We recommend reading: Who has benefits for customs clearance of a car in

Since Evgeniy Yuryevich is a liquidator of the consequences of the Chernobyl nuclear power plant, he is entitled to a state old-age pension (250% of the social pension). After indexation in April 2021, it is 13,101.64 rubles (up to 12,585.63 rubles). But citizen Sokolov is also a disabled person of the third group. In this regard, he is entitled to a disability pension, which is 125% (from April 1, 2021 - 6550.82 rubles). That is, twice as much.

Return of accounts receivable from previous years in a budgetary institution 2021

After the advance payment is transferred to third parties, for various reasons the counterparty may violate the contractual terms and fail to deliver the goods. Or not provide services, delay the work. Violation of deadlines also occurs when the accountable is given more funds than actually spent. The resulting debt is subject to repayment by debtors. If the counterparty or accountable person does not object to the return, the funds are transferred within the following time limits:

By virtue of Instructions No. 65n, expenses for the payment of insurance premiums accrued for payments to employees provided for in employment contracts are reflected under KVR 119 and subarticle 213 of KOSGU, in other cases - according to those subarticles (articles) of KOSGU for which expenses for payment of remunerations (income) are reflected ) on which these contributions are calculated.

Writs of execution: deductions, payments, postings

In the common understanding, deduction under writs of execution is the payment of alimony. In fact, there are other situations where it is necessary to withhold part of an employee’s salary by court order. In this material we will look at what it is and look at the main entries for deductions from an employee’s salary based on a writ of execution.

These transfers are not subject to these restrictions. Obligations under the documents must be repaid in full (except for alimony for minors - limited to 70% of total earnings), despite the amount of the employee’s income.

A shortage was detected at the cash register: postings

At enterprises, cash is accounted for in account 50 “Cash”, which has three sub-accounts: 50-1 “Cash of the enterprise”, 50-2 “Operating cash”, 50-3 “Payment documents”. Reporting forms on the off-balance sheet account 006 of the same name are taken into account separately.

The commission, in the presence of the cashier, records meter readings that reflect the amount of revenue. The data is checked against the submitted cash register tape. The difference in the balance at the beginning and end of the day reflects the daily amount of revenue. The numbers in the cash book, on the tape and on the counters must be identical.

Accountant's Directory

Some payroll entries. 40120211 - 30211730 - calculation of the basic salary, 30213730 - 30302830 - calculation of temporary disability benefits, 30211830 - 30301730 - deduction of personal income tax from salary. 40120213 - 30310830 - contributions to the insurance part of the Pension Fund of the Russian Federation have been accrued, 30211830 - 30403730 - transfer of salaries to bank cards (account for other payroll payments).

—-T——————————T———————T———————————————————- ¦ N ¦ Contents of the operation ¦ By old Plan ¦ According to the new Chart of Accounts ¦ ¦п/п¦ ¦ accounts +————————-T————————-T——+ ¦ ¦ ¦ ¦ for treasury ¦ for cash ¦Amount ¦ ¦ ¦ ¦ ¦ budget execution ¦ budget execution ¦ ¦ ¦ ¦ +——T——T——+————T————+————T————+ ¦ ¦ ¦ ¦Debit ¦ Credit¦Amount ¦ Debit ¦ Credit ¦ Debit ¦ Credit ¦ ¦ +—+——————————+——+——+——+————+————+———— +————+——+ ¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ 10 ¦ +—+——————————+——+——+ ——+————+————+————+————+——+ ¦ 1. Treatment and preventive services to an individual ¦ +—T——————————T ——T——T——T————T————T————T————T——+ ¦1.1¦Provided to an individual ¦ 153 ¦ 401 ¦ 500¦2 205 03 560¦ 2 401 01 130¦2 205 03 560¦2 401 01 130¦ 500¦ ¦ ¦ and paid by him paid ¦120.2 ¦ 153 ¦ 500¦2 201 04 510¦2 205 03 660¦2 201 04 510¦2 205 03 660¦ 500¦ ¦ ¦medical services ¦ 401 ¦ 400 ¦ 500¦2 210 02 130¦2 201 04 610¦2 201 01 510¦2 201 04 610¦ 500¦ ¦ ¦ (exempt from VAT) ¦ 11 1¦120.2¦500¦¦ ¦ ¦ ¦ ¦ +—+——————————+——+——+——+————+————+————+————+——+ ¦ 2. Cosmetology services to an individual ¦ +—T——————————T——T——T——T————T————T————T———— T——+ ¦2.1¦Received at the cash desk from ¦ 120 ¦ 155 ¦ 590¦2 201 04 510¦2 205 03 660¦2 201 04 510¦2 205 03 660¦ 590¦ ¦ ¦individual ¦ 111 ¦ 1 20 ¦ 590 ¦2 210 02 130¦2 201 04 610¦2 201 01 510¦2 201 04 610¦ 590¦ ¦ ¦with subsequent delivery ¦155 ¦173NDS¦ 90¦2 302 16 830¦2 303 04 730 ¦2,302 16,830¦ 2 303 04 730¦ 90¦ ¦ ¦to a personal account in OFK ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦advance for paid ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+——————————+——+——+——+————+————+————+————+——+ ¦2.2¦Provided to an individual ¦ 153 ¦ 401 ¦ 1 180 ¦ 2 205 03 560 ¦ 2 401 01 130 ¦ 2 205 03 560 ¦ 2 401 01 130 ¦ 1 180 ¦ ¦ ¦ and paid by him to the cashier paid ¦ 401 ¦ 173 VND ¦ 180¦2 401 01 130¦2 303 04 730¦2 401 01 130¦2 303 04 730¦ 180¦ ¦ ¦cosmetology services ¦120.2 ¦ 153 ¦ 590¦2 201 04 510¦2 205 03 660¦2 201 04 510¦2 205 03 660 ¦ 590¦ ¦ ¦ with offset earlier ¦ 155 ¦ 153 ¦ 500¦ 2 303 04 830 ¦ 2 302 16 830 ¦ 2 303 04 830 ¦ 2 302 16 830 ¦ 90 ¦ ¦ ¦ advance received ¦ 401 ¦ 400 ¦ 500 ¦2 201 04 510¦2 205 03 660¦2 201 04 510¦2 205 03 660¦ 590¦ ¦ ¦ ¦173NDS¦ 155 ¦ 90¦2 210 02 130¦2 201 04 610¦2 201 01 51 0¦2 201 04 610¦ 590 ¦ ¦ ¦ ¦ 111 ¦120.2 ¦ 590¦ ¦ ¦ ¦ ¦ ¦ +—+——————————+——+——+——+————+————+—— ——+————+——+ ¦ 3. Medical services of the organization ¦ +—T——————————T——T——T——T————T———— T————T————T——+ ¦3.1¦Received to personal account ¦ 111 ¦ 155 ¦ 5 000¦2 210 02 130¦2 205 03 660¦2 201 01 510¦2 205 03 660¦ 5 000¦ ¦ ¦in OFK from the organization advance ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦for a paid medical service¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+—————————+——+ ——+——+————+————+————+————+——+ ¦3.2¦Provided organizations and ¦153 ¦401 ¦10,000¦2,205 03,560¦2,401 01 130¦2 205 03 560¦2 401 01 130¦10 000¦ ¦ “paid by her to the personal account¦ 111 ¦ 153 ¦10 000¦2 210 02 130¦2 205 03 660¦2 201 01 510 ¦2 205 03 660 ¦ 5,000¦ ¦ ¦paid medical services ¦ 155 ¦ 153 ¦ 5,000¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ (exempt from VAT) ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ L—+————————— —+——+——+——+————+————+————+————+——-