How to calculate wages using an hourly wage system

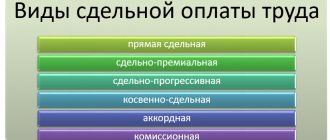

What types of remuneration systems are there and when are they used?

For each group of workers in an enterprise and even for each specific person, the payment system for performing labor functions may vary. Let us highlight the following types of such systems:

- Time-based - an employee’s payment is directly dependent on the time he or she works. In this case, the employee is set an hourly or tariff rate and salary.

- Piecework - the amount of earnings depends on the amount of work performed. Piece rates must be approved here.

- Commission - when it is established, the employee receives a commission (percentage) on a certain indicator, for example, 5% of the store’s daily revenue.

- Variable salary system - an employee's salary is subject to periodic review, for example once a quarter or month. Such a review can be influenced by such an indicator as the completion of the planned amount of work.

- Chord - involves establishing a relationship between the amount of an employee’s salary and the package of work he performs in accordance with the chord assignment for a specific period.

The payment system is approved either in a local regulatory act at the enterprise, for example in the regulations on remuneration, or in a collective or labor agreement.

What is hourly wages and what are its forms?

The hourly wage system is one of the varieties of the time-based system. Here, wages are calculated depending on the amount of time worked - hours - and the established hourly rate.

NOTE! With a time-based system, salaries or tariff rates may also be set, but these are usually tied to a month.

At enterprises, depending on the specifics of production and other factors, the hourly system can take the following forms:

- Standard hourly - when a fixed rate is set for one hour of work. At the same time, the volume and quality of work do not affect wages. This form is typical for the positions of security guard, operator, administrator, etc.

- Premium hourly wage - here the volume and quality of work performed will affect wages. That is, the time worked is paid and to this amount is added the amount of the bonus, the amount of which must be indicated in the regulations on remuneration, employment contract or in other regulations or agreements.

- Standardized hourly rate - in this case, in addition to the hourly rate, an additional payment is guaranteed for strict compliance with the conditions established by the employer. This form is convenient to use when exceeding production standards is undesirable.

When is hourly wages beneficial?

The benefit for employers when setting hourly wages is obvious: they only have to pay for the time worked. This type of payment is especially popular for those employees who do not work full time. Examples include:

- workers with an uneven workload involved in performing work at a specific facility;

- workers whose working hours cannot be regulated (for example, teachers who teach additional classes in educational institutions);

- employees employed on a flexible schedule;

- workers whose labor productivity is very difficult to determine.

However, this system has certain disadvantages. For example, in the absence of bonus payments, employees are usually not interested in working faster and more, i.e. production efficiency decreases. In addition, the employer needs to monitor every hour the employee works, which may require an additional employee to keep track of time, leading to new costs.

What are the nuances of establishing an hourly wage rate in accordance with the Labor Code of the Russian Federation and how to calculate wages for hourly wages in 2021

Monthly earnings are calculated by multiplying the number of hours worked by the hourly rate. The employer can approve any size according to the qualifications of the specialist and the complexity of the work. However, when they are established for hourly wages, according to the Labor Code of the Russian Federation, the requirement must be met: when working the full norm (40 hours per week) in a month, the employee cannot receive less than the minimum wage (minimum wage).

IMPORTANT! From January 1, 2021, the minimum wage is set at RUB 11,280.00.

If the monthly payment at full production does not reach this amount, it is necessary to either revise the rate or make an additional payment to the minimum wage.

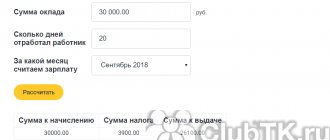

Let us illustrate with an example how to calculate wages at a set hourly rate.

For student Renata Vasilyeva, who came to work part-time at Romashka LLC as an assistant clerk, an hourly rate of 100 rubles was approved. Renata works on a flexible schedule during her free time. In February 2021, she worked 46 hours. Let's calculate her monthly salary:

46 hours × 100 rub./hour = 4600 rub.

If the student had worked the entire month of February - 159 hours, she would have received:

159 hours × 100 rub./hour = 15,900 rub.,

which exceeds the current minimum wage. Thus, Vasilyeva’s hourly wage rate complies with labor law.

How hourly wages are reflected in the staffing table - sample

The staffing table is an internal document of the company, which collects all the information about the personnel structure, composition and number of employees, as well as the monthly payroll. When an employee is hired on an hourly basis, the staffing table must contain a corresponding note about this.

If we take as a basis the unified form T-3, put into circulation by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1, the hourly rate should be indicated in column 5 “Tariff rate (salary), etc., rubles,” and in column 10 “Notes » register “Hourly wages” with reference to the normative act establishing the payment system.

Use the link below to see how the staffing table is drawn up for those employees for whom the hourly form is approved.

What features need to be taken into account in an employment contract for hourly wages - sample

When employing an employee, all aspects relating to the calculation and payment of wages are usually discussed between him and the employer, which must then be formalized in writing by signing an employment contract. In it (or an additional agreement to it), the Labor Code obliges to prescribe the conditions for hourly wages, if one is established for the employee.

NOTE! When transferring employees to hourly pay from another salary system, the employer must notify them of this no later than 2 months before introducing the planned changes. Such changes, by the way, should be reflected in orders and other regulatory documents of the organization.

It is advisable to stipulate in the employment contract:

- the amount of the hourly wage rate (salary);

- the procedure for calculating wages for the month;

- bonus conditions;

- terms of payment for holidays, weekends and night hours;

- deadlines for issuing wages;

- other conditions, which may include a probationary period, social guarantees, etc.

Download a sample extract from an employment contract regarding the establishment of an hourly wage system and hourly rate from the link below.

Results

Hourly wages are one of the types of time-based systems, when, to calculate wages for each specific employee, a rate is set for one hour of work and the number of hours worked is calculated. At the same time, the rate should be such that when working out the monthly quota, the employee is accrued no less than the minimum wage, which in 2021 is equal to 11,280.00 rubles.

All conditions relating to the calculation and payment of wages under the agreed system are included in the text of the employment contract or local regulations of the company. That is, the employee must be familiar with the principles on which his monthly earnings are calculated.

Results

Hourly wages are one of the types of time-based systems, when, to calculate wages for each specific employee, a rate is set for one hour of work and the number of hours worked is calculated. In this case, the rate should be such that when working out the monthly quota, the employee is accrued no less than the minimum wage, which in 2021 is equal to 12,130.00 rubles.

All conditions relating to the calculation and payment of wages under the agreed system are included in the text of the employment contract or local regulations of the company.

That is, the employee must be familiar with the principles on which his monthly earnings are calculated. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to calculate wages?

Calculation of wages at any commercial or state enterprise occurs in accordance with the legislative acts in force at a given time. Its amount depends on the official salary specified in the employment contract, hours worked during a certain period and other details. The amount due for payment is calculated by an accountant based on a number of documents.

What is taken into account when calculating?

Today, two types of fees are most often practiced:

- Time-based . The first provides for a salary determined by the contract for the time worked - hour, day, month. Often a monthly rate is used. In this case, the final amount depends on the time worked during a certain period of time. It is used mainly when calculating salaries for employees on whom the amount of product created does not depend - accountants, teachers, managers.

- Piecework . Depends on the amount of product created over a certain period. Often used in factories. It has several subspecies, which we will consider a little later.

Thus, time-based wages stipulate that the head of the enterprise or other official is required to maintain and fill out a time sheet. It is drawn up according to form No. T-13 and is filled out daily.

It should note:

- number of working hours worked during the day;

- exits “at night” – from 22:00 to 6:00;

- out during non-working hours (weekends, holidays);

- omissions due to various circumstances.

Piece payment requires the availability of a route map or work order for a certain amount of work. In addition, the following are taken into account: sick leave, orders for bonuses, orders for the issuance of financial assistance.

After being hired, each accountant must keep analytical records of wages and record it in form No. T-54. This is the so-called employee personal account. The data specified in it will be taken into account when calculating sick pay, vacation pay and other types of benefits.

You can find out how vacation pay is calculated from this article.

The Labor Code of the Russian Federation provides for a minimum monthly salary of 5,965 rubles. The employer has no right to set payment below this amount. For more information on this topic, read the article - What is the minimum wage in Russia.

Calculation formula and examples

Time-based wages provide for payment of labor according to the time worked and the employee’s salary.

It is calculated as follows:

For monthly salary:

- ZP – salary excluding taxes;

- О – fixed salary per month;

- KOD – days worked;

- KD – number of days in a month.

For hourly/daily fixed salary:

- ZP – salary excluding taxes;

- KOV – amount of time worked;

- O – salary for one unit of time.

Let's look at an example:

Tatyana Ivanovna has a monthly salary of 15,000 rubles. There were 21 working days in a month, but since she took vacation at her own expense, she worked only 15 days. In this regard, she will be paid the following amount:

15,000*(15/21)=15,000*0.71= 10,714 rubles 30 kopecks.

Second example:

Oksana Viktorovna works with a daily salary of 670 rubles. She worked 19 days this month. Her salary will be:

670*19 = 12,730 rubles.

As you can see, the formula for calculating wages for this type of payment is very simple.

Piece payment - how to calculate?

With piecework wages, the amount of work performed is paid. In this case, prices are taken into account in relation to the volume of work.

For piecework wages, wages are calculated using the following formula:

- RI – prices for the production of one unit;

- KT – quantity of products produced.

Consider the following example:

Ivan Ivanovich produced 100 engines in a month. The cost of one engine is 256 rubles. Thus, in a month he earned:

100*256 = 25,600 rubles.

Piece-progressive

It is worth separately considering this type of payment as piecework-progressive, in which the price depends on the quantity of products produced for a certain period.

For example, if a worker produces 100 engines in a month, then he receives 256 rubles for each. If he exceeds this standard, that is, produces over 100 engines per month, the cost of each engine produced in excess of the norm is already 300 rubles.

In this case, earnings for the first 100 engines are calculated separately and separately for subsequent ones. The resulting amounts are added up.

For example:

Ivan Ivanovich manufactured 105 engines. His earnings were:

(100*256)+(5*300)=25,600+1,500= 28,100 rubles.

Other payment systems and their calculations

Depending on the specifics of the work, payment may be:

- Chord . Often used when paying for the work of a team. In this case, the wages of the team as a whole are calculated and given to the foreman. The workers divide the received amount among themselves according to the agreement existing in their brigade.

- Payment based on bonuses or interest . A bonus or commission system is used for employees on whom the company's revenue depends (see also what is revenue). Quite often it is applied to sales consultants and managers. There is a constant, fixed rate and percentage of sales.

- Shift work . The shift method of work provides for payment in accordance with the employment contract - that is, time-based or for completed volumes of work. In this case, percentage bonuses may be calculated for difficult working conditions. For days off on non-working days and holidays, pay is calculated in the amount of at least one daily or hourly rate on top of the salary. In addition, a bonus is paid for shift work from 30% to 75% of the monthly salary. The interest rate depends on the region in which the work takes place. For example, Ivan Petrovich works on a rotational basis. His monthly rate is 12,000 rubles, the bonus for work in this region is 50% of the salary (O). Thus, his salary will be 12,000 + 50% O = 12,000 + 6,000 = 18,000 rubles per month of work.

Payment for holidays and night shifts

When working in shifts, each shift is paid depending on the tariff rate of each shift. It is either established by the employment contract or calculated by an accountant.

It should be taken into account that trips on weekends and holidays are paid at a higher rate - an increase in rate by 20%. In addition, exits at night from 22:00 to 6:00 also have a tariff increase of 20% of the cost of an hour of work.

Payroll taxes

When calculating wages, do not forget about taxes. Thus, the employer is obliged to pay 30% of the amount of calculated wages to the insurance premium fund.

In addition, 13% of personal income tax is deducted from employees. Let's look at how taxes are calculated.

First of all, the tax is calculated on the entire amount of wages, except in cases in which a tax deduction applies. So, a tax deduction is calculated from the total amount of wages and only then the tax rate is calculated on the resulting value.

A number of socially unprotected categories have the right to deduct taxes, the list of which is prescribed in Article 218 of the Tax Code of the Russian Federation. These include:

- Veterans of the Great Patriotic War, disabled people whose activities were related to nuclear power plants. The tax deduction is 3,000 rubles.

- Disabled people, WWII participants, military personnel - 500 rubles.

- Parents who have one or two dependent children – 1,400 rubles.

- Parents who have three dependent children – 3,000 rubles.

For the last two categories there is a restriction. So, after the amount of wages received from the beginning of the calendar year reaches 280,000 rubles, the tax deduction is not applied until the beginning of the next calendar year.

Example:

Ivan Ivanovich’s monthly salary was 14,000 rubles, since he worked for a full month. He became disabled while working at a nuclear power plant. Thus, his tax deduction will be 3,000 rubles.

Personal income tax is calculated for it as follows:

(14,000 – 3,000)*0.13= 1430 rubles. This is the amount that must be withheld when receiving wages.

Thus, he will receive in his hands: 14,000 – 1430 = 12,570 rubles.

Second example:

Alla Petrovna is the mother of two minor children. Her salary is 26,000 per month. By December, the total amount of wages paid to her will be 286,000 rubles, therefore, no tax deduction will be applied to her.

Payment procedure and calculation of delays

According to the same legislation, wages must be paid at least 2 times a month. They provide an advance payment, which is issued in the middle of the month, and the actual salary.

The advance on average ranges from 40 to 50% of the total amount of payments, the rest of the payments are issued at the end of the month. Usually this is the last day of the month; if it falls on a weekend, it is the last working day of the month. If wages are not paid on time, the employer is obliged to pay a fine.

In addition, compensation is provided for the employee, which is issued upon his request and is 1/300 of the rate for each day of delay.

Video: Simple payroll calculation

Familiarize yourself with the basic nuances of calculation and payroll. An experienced accountant will tell you how to correctly calculate wages depending on the wage system you choose.

The calculation of wages is carried out by an accountant based on a number of documents. There are two main wage systems: piecework and time-based. The most popular time-based wage system is quite simple and is used in most industries.

Hourly rate

Related publications

If an employer has to pay its employees for overtime hours worked, or work on weekends, or the specifics of its activities are such that a shift schedule is required, a tariff system of remuneration should be used. With this system, various tariff rates are used, including hourly rates.

What is an hourly tariff rate and how it is calculated - this is discussed further in our article.

Hourly wage

Hourly wage

Related publications

The company's remuneration system is established by collective agreements, industry and regional agreements, local regulations, regulations, in accordance with labor law standards.

The division of remuneration systems into subtypes is quite arbitrary. Typically, there are several forms of remuneration systems:

Time-based – an employee’s salary depends directly on the time worked. The fixed tariff rate can be hourly, daily or monthly;

- Piecework – an employee’s salary depends on the amount of work he performed;

- Commission is a remuneration system in which the employee receives a commission (percentage) on a fixed indicator. For example, 10% of the outlet’s revenue per day;

- A variable salary system is a system in which an employee's salary can change periodically - for example, once a quarter or once a month. Changes may depend on the implementation of the work plan or other indicators;

- Lump-sum – when using such a remuneration system, the employee’s salary will depend on the set of works he performs (in accordance with the lump-sum task) for a certain period of time.

Hourly wages are one of the options for time-based wages. The amount of a worker's salary depends on the number of hours that the employee actually worked.

Which employees should be paid hourly?

Under certain conditions, the use of hourly wages is very beneficial for the employer: only the time that the employee is directly engaged in work is paid, and it is convenient to calculate wages for part-time workers.

For example, these could be:

- Workers with an uneven workload - for example, promoters hired to perform work at a specific facility

- Workers whose working hours are difficult to regulate - for example, teachers who teach additional classes in training centers;

- Workers with flexible work schedules who combine several jobs;

- Workers whose productivity is costly or very difficult to determine.

Employers should take into account that if an employee has worked the standard working hours for a month (based on 40 hours per week), then the amount of wages for this employee cannot be less than the established minimum wage.

How to calculate wages for hourly wages?

If an employee is “salaried,” then his salary is fixed subject to the standard time worked (usually a 40-hour work week). An employee will receive a salary of a certain amount for the standard time worked, regardless of the number of working days according to the schedule according to the production calendar.

When calculating wages for an hourly employee, the calculation algorithm will look like this:

- the number of hours actually worked must be multiplied by the rate established per hour of work. For example, an employee’s tariff rate is 500 rubles per hour. In May, the employee worked 22 hours. This means his salary will be 11 thousand rubles: 500 x 22.

The employee may also be given bonuses, for example, for working on a rotational basis. In this case, the calculation algorithm will become a little more complicated - first you need to calculate the monthly tariff rate using the method described above. The calculation will then look like this:

- the monthly tariff rate must be divided by the number of calendar days in the month, multiplied by the number of days on shift and multiplied by the bonus percentage.

An employment contract with hourly wages (sample) can be downloaded here.

Calculation methods

Depending on the standard working hours per month

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call :

T/h = monthly tariff rate: standard hours (per month)

The norm of hours per month must be taken from the production calendar.

In order to calculate wages, it is necessary to take into account overtime.

- First, the hourly rate is calculated using the formula: 20,000 rubles: 160 hours = 125 rubles per hour.

- We calculate the overtime: 166 – 160 = 6 hours.

For these six hours worked overtime, Inshina must receive a salary supplement. According to labor legislation, the first two hours of overtime are paid with a coefficient of 1.5, subsequent ones - at double the rate:

125 rubles × 2 × 1.5 + 125 rubles × 4 × 2 = 375 rubles. + 1000 rub. — amount of overtime pay. We add them to the salary and get Inshina’s salary for October: 20,000 + 1375 = 21,375 rubles.

If for one reason or another an employee has worked fewer hours than normal, the daily work rate is calculated and multiplied by the number of hours worked.

In order to calculate salaries, the accountant makes calculations:

- Determines the hourly tariff rate: 15,000 rubles: 150 hours = 100 rubles/hour.

- Now you should simply multiply the resulting amount by the number of hours actually worked: 100 rubles/hour * 147 = 14,700 rubles.

This is a fairly simple calculation, however, it has a drawback. The tariff rate depends on the hourly rate, which may be different every month. And the lower the standard hours, the higher the hourly rate will be. It turns out that the employee worked less in one month than in another, but will receive a salary higher than in the month in which he worked more.

Salary for February will be equal to:

- We determine the hourly tariff rate: 19,000 rubles: 150 hours = 126.66 rubles per hour.

- We multiply the result by the time worked: 126.66 rubles/hour * 149 hours = 18872 rubles 34 kopecks.

Salary in March:

- Hourly rate: 19,000 rubles: 155 hours = 122.58 rubles/hour

- 22.58 rubles/hour * 151 hours = 18509 rubles 58 kopecks.

It turns out that Savushkin actually worked two hours less in February than in March, but his salary was 362 rubles 76 kopecks.

Depending on the average monthly number of working hours per year

T/h = tariff rate per month / standard working hours per year: 12 months

Standard working hours are also taken from the production calendar.

- We calculate the tariff rate per hour using the formula: 21,000 rubles / 1,890 hours: 12 months = 133 rubles 33 kopecks.

- We determine the salary for July: 133.33 rubles * 120 hours = 15999 rubles 60 kopecks.

This calculation method allows you not to calculate the hourly rate monthly, but only once a year. And it will not change all this time. So the employee will receive an amount directly dependent on the amount of time actually worked.

Read more: What tax do you need to pay when selling an apartment?

To calculate wages for each month, you need to find out the hourly rate: 2000 rubles / 1800 hours: 12 months = 80 rubles / hour

Total to be accrued:

- 120 hours * 80 rubles/hour = 9600 rubles in March.

- 130 hours * 80 rubles/hour = 10,400 rubles in April.

- 110 hours * 80 rubles/hour = 8800 rubles in May.

How to calculate salary by hour based on salary

How to calculate salary based on salary by hour

The need to determine the size of the hourly wage rate arises when an employee works overtime or, conversely, on a part-time basis. In this case, you need to know exactly how to calculate wages by the hour and be able to apply this knowledge in practice.

Hourly wages are calculated using the following formula:

CHTS - hourly tariff rate;

O - the amount of the official salary established by the staffing table and the provisions of the labor agreement concluded between the employee and the employer;

Chn - standard number of working hours in the reporting month.

An example of calculating hourly wages in 2021

To understand the principle of calculating hourly wages, it is worth using the above formula to solve a specific problem. For example, an employee’s salary is 27,000 rubles. per month. In June 2021 there are 19 working days, and in accordance with Part 1 of Art. 95 of the Labor Code of the Russian Federation, the duration of the pre-holiday day (June 11) is reduced by 1 hour. Thus, the total number of working hours in the reporting month is 151.

With the specified initial data, the hourly rate will be:

NPV = 27,000 rub. / 151 hours = 178.81 rubles/hour.

Salary calculation at hourly rate

Sometimes in practice it becomes necessary to calculate the amount of an employee’s earnings based on the hourly wage rate established for his position. In this case, the calculation is carried out in reverse order using the formula:

Z is the employee’s salary;

Chf - the number of hours actually worked in the reporting period.

So, to calculate the hourly tariff rate, it is necessary to divide the amount of salary paid to the employee by the standard number of hours that he must work in the reporting month. Calculation of wages at an hourly rate is carried out in reverse order - you need to calculate the product of the established rate and the number of hours worked by the employee in the reporting period.

More information on the topic is in the “Salary” section.

What might it be needed for?

May be needed for:

- calculating salaries for employees based on accumulated working hours;

- calculating payment for work above the norm;

- determining the amount of payments on weekends and holidays;

- payment for night shifts;

- calculating payment for work in harmful and difficult conditions.

Calculation of the hourly tariff rate is necessary for cumulative recording of working hours.

Moreover, each employee has a work schedule and an hourly rate that he must work within a certain period of time. Schedules and standards are reflected in the production calendar . Working time in such a schedule is measured in hours, so it is most convenient to calculate the minimum wage for labor exactly per hour. In the event that an employee has exceeded his quota (worked more hours), it is necessary to calculate the hourly tariff rate and make appropriate additional payments.

Have you decided to resign of your own free will? Find out what payments employees are entitled to in this case - read our article.

In state-owned enterprises, employees often receive 13 salaries. You can find out how its size is determined from our article.

How to calculate wages?

Calculation of wages at any commercial or state enterprise occurs in accordance with the legislative acts in force at a given time. Its amount depends on the official salary specified in the employment contract, hours worked during a certain period and other details. The amount due for payment is calculated by an accountant based on a number of documents.

What is taken into account when calculating?

Today, two types of fees are most often practiced:

- Time-based . The first provides for a salary determined by the contract for the time worked - hour, day, month. Often a monthly rate is used. In this case, the final amount depends on the time worked during a certain period of time. It is used mainly when calculating salaries for employees on whom the amount of product created does not depend - accountants, teachers, managers.

- Piecework . Depends on the amount of product created over a certain period. Often used in factories. It has several subspecies, which we will consider a little later.

Thus, time-based wages stipulate that the head of the enterprise or other official is required to maintain and fill out a time sheet. It is drawn up according to form No. T-13 and is filled out daily.

It should note:

- number of working hours worked during the day;

- exits “at night” – from 22:00 to 6:00;

- out during non-working hours (weekends, holidays);

- omissions due to various circumstances.

Piece payment requires the availability of a route map or work order for a certain amount of work. In addition, the following are taken into account: sick leave, orders for bonuses, orders for the issuance of financial assistance.

After being hired, each accountant must keep analytical records of wages and record it in form No. T-54. This is the so-called employee personal account. The data specified in it will be taken into account when calculating sick pay, vacation pay and other types of benefits.

You can find out how vacation pay is calculated from this article.

The Labor Code of the Russian Federation provides for a minimum monthly salary of 5,965 rubles. The employer has no right to set payment below this amount. For more information on this topic, read the article - What is the minimum wage in Russia.

Calculation formula and examples

Time-based wages provide for payment of labor according to the time worked and the employee’s salary.

It is calculated as follows:

For monthly salary:

- ZP – salary excluding taxes;

- О – fixed salary per month;

- KOD – days worked;

- KD – number of days in a month.

For hourly/daily fixed salary:

- ZP – salary excluding taxes;

- KOV – amount of time worked;

- O – salary for one unit of time.

Let's look at an example:

Tatyana Ivanovna has a monthly salary of 15,000 rubles. There were 21 working days in a month, but since she took vacation at her own expense, she worked only 15 days. In this regard, she will be paid the following amount:

15,000*(15/21)=15,000*0.71= 10,714 rubles 30 kopecks.

Second example:

Oksana Viktorovna works with a daily salary of 670 rubles. She worked 19 days this month. Her salary will be:

670*19 = 12,730 rubles.

As you can see, the formula for calculating wages for this type of payment is very simple.

Piece payment - how to calculate?

With piecework wages, the amount of work performed is paid. In this case, prices are taken into account in relation to the volume of work.

For piecework wages, wages are calculated using the following formula:

- RI – prices for the production of one unit;

- KT – quantity of products produced.

Consider the following example:

Ivan Ivanovich produced 100 engines in a month. The cost of one engine is 256 rubles. Thus, in a month he earned:

100*256 = 25,600 rubles.

Piece-progressive

It is worth separately considering this type of payment as piecework-progressive, in which the price depends on the quantity of products produced for a certain period.

For example, if a worker produces 100 engines in a month, then he receives 256 rubles for each. If he exceeds this standard, that is, produces over 100 engines per month, the cost of each engine produced in excess of the norm is already 300 rubles.

In this case, earnings for the first 100 engines are calculated separately and separately for subsequent ones. The resulting amounts are added up.

For example:

Ivan Ivanovich manufactured 105 engines. His earnings were:

(100*256)+(5*300)=25,600+1,500= 28,100 rubles.

Other payment systems and their calculations

Depending on the specifics of the work, payment may be:

- Chord . Often used when paying for the work of a team. In this case, the wages of the team as a whole are calculated and given to the foreman. The workers divide the received amount among themselves according to the agreement existing in their brigade.

- Payment based on bonuses or interest . A bonus or commission system is used for employees on whom the company's revenue depends (see also what is revenue). Quite often it is applied to sales consultants and managers. There is a constant, fixed rate and percentage of sales.

- Shift work . The shift method of work provides for payment in accordance with the employment contract - that is, time-based or for completed volumes of work. In this case, percentage bonuses may be calculated for difficult working conditions. For days off on non-working days and holidays, pay is calculated in the amount of at least one daily or hourly rate on top of the salary. In addition, a bonus is paid for shift work from 30% to 75% of the monthly salary. The interest rate depends on the region in which the work takes place. For example, Ivan Petrovich works on a rotational basis. His monthly rate is 12,000 rubles, the bonus for work in this region is 50% of the salary (O). Thus, his salary will be 12,000 + 50% O = 12,000 + 6,000 = 18,000 rubles per month of work.

Payment for holidays and night shifts

When working in shifts, each shift is paid depending on the tariff rate of each shift. It is either established by the employment contract or calculated by an accountant.

It should be taken into account that trips on weekends and holidays are paid at a higher rate - an increase in rate by 20%. In addition, exits at night from 22:00 to 6:00 also have a tariff increase of 20% of the cost of an hour of work.

Payroll taxes

When calculating wages, do not forget about taxes. Thus, the employer is obliged to pay 30% of the amount of calculated wages to the insurance premium fund.

In addition, 13% of personal income tax is deducted from employees. Let's look at how taxes are calculated.

First of all, the tax is calculated on the entire amount of wages, except in cases in which a tax deduction applies. So, a tax deduction is calculated from the total amount of wages and only then the tax rate is calculated on the resulting value.

A number of socially unprotected categories have the right to deduct taxes, the list of which is prescribed in Article 218 of the Tax Code of the Russian Federation. These include:

- Veterans of the Great Patriotic War, disabled people whose activities were related to nuclear power plants. The tax deduction is 3,000 rubles.

- Disabled people, WWII participants, military personnel - 500 rubles.

- Parents who have one or two dependent children – 1,400 rubles.

- Parents who have three dependent children – 3,000 rubles.

For the last two categories there is a restriction. So, after the amount of wages received from the beginning of the calendar year reaches 280,000 rubles, the tax deduction is not applied until the beginning of the next calendar year.

Example:

Ivan Ivanovich’s monthly salary was 14,000 rubles, since he worked for a full month. He became disabled while working at a nuclear power plant. Thus, his tax deduction will be 3,000 rubles.

Personal income tax is calculated for it as follows:

(14,000 – 3,000)*0.13= 1430 rubles. This is the amount that must be withheld when receiving wages.

Thus, he will receive in his hands: 14,000 – 1430 = 12,570 rubles.

Second example:

Alla Petrovna is the mother of two minor children. Her salary is 26,000 per month. By December, the total amount of wages paid to her will be 286,000 rubles, therefore, no tax deduction will be applied to her.

Payment procedure and calculation of delays

According to the same legislation, wages must be paid at least 2 times a month. They provide an advance payment, which is issued in the middle of the month, and the actual salary.

The advance on average ranges from 40 to 50% of the total amount of payments, the rest of the payments are issued at the end of the month. Usually this is the last day of the month; if it falls on a weekend, it is the last working day of the month. If wages are not paid on time, the employer is obliged to pay a fine.

In addition, compensation is provided for the employee, which is issued upon his request and is 1/300 of the rate for each day of delay.

Tariff rate

According to Art. 129 of the Labor Code of the Russian Federation, the tariff rate is a fixed amount of remuneration for performing certain work during a unit of time, without taking into account compensation, incentives and social payments to the employee. Tariff rates can be calculated per month, day, or hour.

The monthly tariff rate (or salary) does not depend on the number of working days or hours in a particular month - the salary is always calculated in the amount of the salary if all working days of the month are fully worked. Moreover, it does not matter that there may be more working days in one month than in another, this does not affect the amount of earnings.

The daily tariff rate is applied if the length of the working day is always the same, but the number of working days in a month differs from the established norms.

An hourly rate may be needed when calculating payment for hours worked is required, namely:

- to calculate earnings with a shift work schedule and summarized recording of working hours,

- to calculate wages for overtime work,

- for pay for night work,

- to calculate wages on weekends and holidays,

- to pay for work in harmful and dangerous conditions.

On protecting the interests of employees in hazardous industries

If a time-based system is used, you need to ensure that the following parameters are set:

- Regulatory tasks.

- The amount of time required to complete.

- Hourly or monthly rate.

Time sheets and personal cards for employees are the main sources of information for such situations. Monthly salaries are most often set for employees and specialists, and in industry and production we are talking about rates for a certain time.

Payment procedure and calculation of delays

According to the same legislation, wages must be paid at least 2 times a month. They provide an advance payment, which is issued in the middle of the month, and the actual salary.

The advance on average ranges from 40 to 50% of the total amount of payments, the rest of the payments are issued at the end of the month. Usually this is the last day of the month; if it falls on a weekend, it is the last working day of the month. If wages are not paid on time, the employer is obliged to pay a fine.

In addition, compensation is provided for the employee, which is issued upon his request and is 1/300 of the rate for each day of delay.

Nuances of summarized accounting: question - answer

Above we examined the general rules for maintaining summarized records of working time and their payment. Now let’s briefly answer the questions that most often arise when using CS in practice.

How to pay for night hours if they fall on a shift?

Night hours (and this, remember, is the time from 22.00 to 6.00) must be taken into account separately and paid additionally - according to the rules established for payment for work at night. This article explains exactly how.

What if the shifts fall on weekends or holidays?

Shift workers have their own days off. Therefore, the general rules about increased pay for work on days off do not apply here. But there are some nuances when it comes to changing holidays. Read about them in this article.

What to do if, at the end of the accounting period, there is a rework?

Overtime based on the results of the accounting period is overtime. For them, the Labor Code of the Russian Federation also has its own rules, which also apply to shift workers. Read about these rules here.

What to do if an employee has not worked the entire accounting period?

If an employee did not fully work the accounting period (for example, was sick, was on vacation, quit), a reduced standard is calculated for him. To do this, the missed time is subtracted from the general norm. If this truncated standard is exceeded at the end of the period, overtime is paid; if, on the contrary, less time was worked, the work is paid upon the fact. The employee is not required to work hours/days missed for valid reasons.

Piece-progressive

It is worth separately considering this type of payment as piecework-progressive, in which the price depends on the quantity of products produced for a certain period.

For example, if a worker produces 100 engines in a month, then he receives 256 rubles for each. If he exceeds this standard, that is, produces over 100 engines per month, the cost of each engine produced in excess of the norm is already 300 rubles.

In this case, earnings for the first 100 engines are calculated separately and separately for subsequent ones. The resulting amounts are added up.

For example:

Ivan Ivanovich manufactured 105 engines. His earnings were:

(100*256)+(5*300)=25,600+1,500= 28,100 rubles.

What other rules are being established?

The Government of the Russian Federation has established the so-called state tariff schedule. Its effect extends to the entire state. Relevant for calculating wages for the work of so-called budget positions. There are a total of 18 categories in the system, which is enough to cover all specialties. Between the ranks the action of a specific coefficient is characteristic, in the range from 1 to 4.5.

But even the minimum wage rate cannot be lower than the minimum wage. That is, all state values automatically increase when the amount of payment itself increases.