When does the employer pay the December salary?

Data on income paid to employees and the tax withheld from it is disclosed by the employer in a report on Form 6-NDFL. The form consists of a title page and two sections. The calculation is submitted to the regulatory authority quarterly. From the first quarter of 2021, the form and filling out rules are regulated by Federal Tax Service Order No. ED-7-11 / [email protected] dated 10/15/2020.

Organizations practice several options for paying wages for the last month:

- in December, which is technically an advance;

- 31st;

- in January next year.

Depending on the day the funds are transferred and the deadline for paying the tax, sections 1 and 2 of the form will be filled out differently. Regardless of the date of actual payment of wages, the date of accrual of income is December 31, 2020. The date of deduction of the calculated tax is the day of payment of funds, the deadline for transfer is the next business day.

ConsultantPlus experts discussed how to correctly fill out 6-NDFL according to the new rules that will come into force in 2021. Use these instructions for free.

to read.

When to pay salary for December

The employer determines the date of payment of wages to employees depending on the terms of the employment contract and in accordance with the norms of the Labor Code. According to labor legislation, an organization must comply with the following principles when remunerating labor:

- Salary payments are made at least twice a month;

- if the date of payment of wages falls on a weekend, then the deadline is postponed to the last working day;

- payment is transferred no later than 15 days after the end of the period for which it was calculated.

When the deadline for issuing a salary falls on holidays, for example on January 5, the employer is obliged to transfer the payment the day before. If the time of settlements with personnel falls on the first working days of the new year, it is permissible to issue the payment after the New Year's weekend.

At the end of the reporting period, the employer reports to the Federal Tax Service on the amounts withheld from employees’ wages. The report on Form 6-NDFL is submitted quarterly, and income certificates, which show personal income tax on an accrual basis for January - December for each employee, are submitted once at the end of the year no later than March 1 of the year following the reporting year.

According to paragraph 2 of Article 223 of the Tax Code of the Russian Federation, the date of recognition of December income is the last day of the year. This amount and the accrued personal income tax are reflected in the report for 2021 (lines 020 and 040), but depending on the date of payment, the rules for filling out sections 1 and 2 of the report are different.

How to fill out a report if money was paid in December

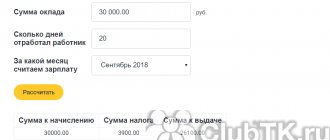

If the salary is transferred in advance, the payment is reflected in both sections of the form for 2021. Let’s say the employer paid income on December 30, 2020 in the amount of 800,000 rubles. Deductions in the amount of 104,000 rubles were transferred to the inspectorate on the same day. Report 6-NDFL, if the salary in December was paid before the 31st, looks like this:

If the payment for the last month was transferred to employees on December 31, then this payment will be included in the report for 2021 and for the first quarter of 2021. This happens as a result of the fact that the deadline for paying tax deductions is postponed to 01/11/2021. Here is a sample of how to fill out 6-NDFL if wages were paid on December 31, 2021 for the current period:

Section 2 of the calculation remains blank, since the deadline for transferring income tax falls on the first quarter of 2021, and the indicators for the last calendar month will be reflected in the report for this period as follows:

How to pay an employee on vacation

Sometimes workers take time off at the end of December or after the holidays to extend their New Year holidays. The question arises: when to issue vacation pay, when to pay salaries and how to withhold personal income tax.

Submit personal income tax reports online for free

If the holiday is before the holidays

Vacationers are paid on the same dates as other employees. At the same time, when the salary is paid “by bank transfer”, the money is transferred to the vacationer’s card. If money needs to be withdrawn in cash from the cash register, the vacationer can do this personally or entrust it to another person by drawing up a power of attorney (Clause 3 of Article 185.1 of the Civil Code of the Russian Federation). When no one receives money, it must be deposited taking into account personal income tax and paid after the employee returns to work (letter of the Ministry of Finance of Russia dated June 23, 2017 No. 03-04-05/39846).

On your own initiative, you can pay the vacationer’s salary for December ahead of schedule (letter of the Ministry of Labor dated November 12, 2018 No. 14-1/OOG-8602). Personal income tax is not withheld when paying, but additionally is withheld from the January advance.

If the vacation is after the holidays

If the vacation begins on January 11, vacation pay and salary for December are supposed to be issued at the same time - on December 31 (Article 136 of the Labor Code of the Russian Federation). Withhold personal income tax from both amounts and transfer them to the budget at different times: for vacation pay - on the same day, for salary - after the holidays (clause 6 of article 226, clause 7 of article 6.1 of the Tax Code of the Russian Federation). Transactions will fall into different 6-NDFL: vacation pay - in the annual calculation, and salary - in section 2 of the calculation for the first quarter of 2021.

The employer has the right to pay both amounts earlier (letter of Rostrud dated May 14, 2020 No. PG/20884-6-1). In this case, personal income tax is withheld only from vacation pay and transferred to the budget no later than December 31 (clause 6 of Article 226, clause 1 of Article 223 of the Tax Code of the Russian Federation). Personal income tax from early wages will be calculated on December 31 and deducted from the January advance.

How to fill out the calculation if the money was transferred in the first quarter

When paying the December salary in January, the amounts of income and mandatory payments will be included in the calculation for 2021 and for the 1st quarter of 2021. Let us assume that management decided to pay wages on January 11, 2021 in the amount of 800,000 rubles. Deductions in the amount of 104,000 rubles were transferred to the inspectorate on the same day. The deadline for transfer according to law is 01/12/2021. In the report for the fourth quarter, only lines 020 and 040 of the first section are completed.

The indicators of the transferred income are included in the calculation for the first quarter of 2021 and must be filled out in a new form.

Let’s summarize how to fill out 6-NDFL and 2-NDFL if the tax for December is transferred in January 2021:

- In the calculation for the first quarter, the tax is shown in any case.

- In the report for 2021, only line 040 is filled in.

- Certificate 2-NDFL is submitted based on the results of the tax period, which reflects personal income tax on an accrual basis for January-December.

It may happen that payments to personnel are made in products or in another “commodity” way. The calculation and reflection of deductions in the report, if December income in kind is withheld in January, is similar to cash settlements with employees.

What to do if the company has a holiday on December 31

Strictly formally, regional authorities do not have the right to declare days off, and they can declare non-working holidays only as religious ones according to the law “On Freedom of Conscience” (Articles 6, 111 and 112 of the Labor Code of the Russian Federation, Resolution of the Constitutional Court of the Russian Federation dated 01/09/1998 No. 1- P, Resolution of the Presidium of the Armed Forces of the Russian Federation dated December 21, 2011 No. 20-ПВ11). However, in 2021, the regions are going beyond their powers and making December 31 a day off on the recommendation of the President.

December 31st is a day off for everyone

In regions where the law made December 31 a day off or a non-working holiday for everyone, the rules of the Labor Code of the Russian Federation on payment “the day before” and the rules of paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation on postponing the deadline for transferring personal income tax to the budget. This means that in such regions salaries must be paid on the 30th. If personal income tax was withheld, then it must be transferred to the budget no later than January 11. There is no need to issue two advances in January.

December 31st – recommended day off

In regions where employers were advised to make December 31 a day off, nothing changes. There are no grounds established by the Labor Code of the Russian Federation for payment “the day before”, therefore payment of the December salary on December 30 is a standard early payment with all legal consequences (letter of the Ministry of Labor of Russia dated November 12, 2018 No. 14-1 / OOG-8602). The deadline for transferring personal income tax, if it was withheld on December 30, remains December 31 and is not postponed to January 11.

Remember that salaries must be paid out at least every half month, that is, once every 14–15 days, depending on the length of the month (Article 136 of the Labor Code of the Russian Federation).

This means that if the salary for December is paid ahead of schedule, for example on December 30, then in January the advance must be paid no later than the 14th. And this will require payment of the second advance no later than January 29. Otherwise, the organization and the manager may be brought to administrative responsibility for violating the frequency of payment of wages (Part 6, Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Example. At Zvezda LLC, the accountant paid all employees salaries for December on December 30. To comply with the rules for issuing salaries, the accountant issues an advance for January 10-13 on the 14th, an advance for January 14-24 on the 25th, and balances for January 25-31 on February 10.

Reflection of recalculation in 2-NDFL

2-NDFL certificates should be sent to the tax office before March 2, 2020. From 2021, the deadlines for submitting 2-NDFL and 6-NDFL are the same. So again there are two options:

- 2-NDFL certificates for 2021 have not been submitted.

In this case, it is necessary to fill them in with correct data on December wages, taking into account recalculation. If by the time the certificate is drawn up, all problems associated with the erroneous calculation have been resolved (for example, the overly withheld tax has been returned to the taxpayer), then the certificate lines “Calculated Tax,” “Tax Withheld,” and “Tax Remitted” will be equal.

If at the time of drawing up the certificate any debts still remain, it is necessary to fill out the certificate with the data that was current at the date of its preparation. Later, when the issue is resolved, it is necessary to submit a corrective form 2-NDFL.

- 2-NDFL certificates for 2021 have already been submitted.

It is necessary to submit clarifying certificates for 2021. Certificates for 2020 will not be affected by the recalculation.

The conclusions expressed in the article are also contained in the Letter of the Federal Tax Service of Russia dated July 21, 2017 No. BS-4-11/14329.

About the report form

Employers fill out the 6-NDFL calculation quarterly. The form and rules for filling it out were approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018). Employers must prepare and submit a report to the Federal Tax Service for 2021 within the new deadline - no later than March 2, 2021 (due to the day off coinciding with 03/01/2020, the deadline was moved to Monday).

The procedure for reporting information has not changed in 2021, but filling out 6-NDFL for December wages still raises many questions. Let's figure out how to show the payment of December remuneration for labor in the calculation.

Transfer of personal income tax to the budget

If the salary was paid on December 31, 2020, then personal income tax must be transferred from it no later than the next working day. Taking into account weekends and holidays this is 01/11/2020.

If the salary was paid on December 30, 2020, then ZUP 3 will consider December 31, 2020 as the next working day, since it is not marked as a day off the Production calendar However, leaving the payment of personal income tax until December 31, 2020 can be dangerous, since it is unknown how banks will work on this day. The safest option is to transfer personal income tax to the budget immediately when paying wages on December 30, 2020.

If personal income tax is transferred to the budget on the day of salary payment on December 30th or 31st, then in the Sheet... is transferred along with the salary checkbox should be left selected by default and personal income tax will be considered transferred exactly on the day the salary is paid.

If the transfer is made later than the date of payment of the salary, then to ensure the reliability of the registration of the date of transfer (it is shown only in the report Register of Tax Accounting for Personal Income Tax ), you can uncheck the Tax is transferred along with the salary in the document Statement... and reflect the fact of transfer in the document Transfer of personal income tax to the budget (Taxes and contributions - All documents of transfer to the personal income tax budget - Transfer of personal income tax to the budget).

The date of actual transfer of personal income tax is taken into account only when filling out the report Tax Accounting Register for Personal Income Tax (Taxes and Contributions - Reports on Taxes and Contributions - Tax Accounting Register for Personal Income Tax) and does not affect the completion of 6-NDFL and 2-NDFL . If it is not critical that in this report the date of transfer will not exactly correspond to the actual date of transfer, then you can not enter the document Transfer of personal income tax to the budget and leave the checkbox in the document Statement... so that it reflects the fact of transfer of personal income tax.

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C:ZUP, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Which month of payment is correct to indicate in the document “Statement...”, and what results from filling it out incorrectly...

- Attention! When updating to ZUP 3.1.8, personal accounts of employees may “fly off” Colleagues, please note, after updating to ZUP 3.1.8 they may “fly off”...

- Revolution in the calculation of personal income tax (ZUP 3.1.8) In version ZUP 3.1.8, another revolution in the calculation of personal income tax took place. Previously…

- Incorrect automatic change of work schedule settings when updating to ZUP 3.1.13.188 and 3.1.10.416...

General rules for filling out 6-NDFL

Let's look at how to reflect the recalculation of personal income tax in form 6-NDFL. The procedure for entering data into the calculation of 6-NDFL is established by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450.

We will present the calculation structure in the diagram (we will show only those lines that will be involved in answering the question):

The date of actual receipt of salary is the last day of the month (Clause 2 of Article 223 of the Tax Code of the Russian Federation). Thus, accrued wages should be reflected on line 020 of Section 1 of the period to which the month of their accrual relates. The place of personal income tax calculated from this amount of wages is line 040 of Section 1. The salary for December is reflected in Section 1 of the personal income tax calculation for 2021.

Let's consider a situation where the December salary was calculated incorrectly. In February 2021, the error was corrected, so the recalculation should be reflected in 6-NDFL. How to reflect will depend on several factors.

Payroll in 1C ZUP 3

If a decision is made to pay wages for December 31.12.2020, then in 1C ZUP 3 it is necessary to indicate this exact date for the document Statement...

If 12/31/2020 is declared a holiday in the organization and payment is made on 12/30/2020, then the Gazette... sets the date 12/30/2020.

If the salary payment will be made on December 30 or 31, 2020, then read the article - A safe option for paying an advance for January. Registration of two advances in 1C ZUP 3

Let's sum it up

- If an arithmetic error was made when calculating wages in December 2021, you should submit the calculation with clarifications in Section 1 for the 4th quarter of 2021.

- If, due to an error in calculating wages, an incorrect amount was paid in December 2019 and personal income tax was withheld incorrectly in January 2020, then the settlement of the error will be reflected in 6-personal income tax for the 1st quarter of 2021.

- Whether or not it is necessary to clarify the 2-NDFL if an arithmetic error is detected in the salary for December 2021 depends on the situation: If the 2-NDFL have not yet been submitted, you should immediately generate the certificates correctly. In this case, you need to remember to comply with the control ratios between 2-NDFL and 6-NDFL (it is recommended to submit the updated calculation of 6-NDFL for the 4th quarter of 2019 before submitting 2-NDFL or together with certificates).

- If the 2-personal income tax forms have already been submitted with an error, you should submit updated certificates in any case.

If you find an error, please select a piece of text and press Ctrl+Enter.