Private organizations can themselves develop and approve the forms used in their work. They are not required to use established patterns. In contrast, government agencies work only with officially approved forms. As a rule, they are not allowed to use any others. Therefore, if you need to draw up a document from this article, you can fill out a free statement for the issuance of material assets. The type of this form is approved by law, and it is intended for the transfer of material assets for economic, educational or scientific needs. In its function, it resembles a demand invoice.

Which organizations use the statement?

This type of statement can be used in a variety of institutions: state and non-state. Most often it is used in educational institutions, scientific and medical centers. Sometimes this document can also be found in commercial companies, since it is convenient in that it contains all the necessary information for accounting for a certain group of inventory items.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

When is it compiled?

Whatever sample form for the act of acceptance and transfer of material assets you choose, remember that it should be drawn up, checked, and signed directly on the day the user of the property changes. This is usually done by the recipient or his authorized representatives: they indicate a specific date for the actual completion of the transaction.

In practice, control over the correct filling and approval is most often carried out by the head of the enterprise. He also determines which of his subordinates will be responsible for storing and ensuring the safety of the asset, as well as what compensation will have to be compensated in the event of damage, theft, or loss of the agreed items.

What materials are included in the document

Not all materials used in the activities of the organization are subject to reflection in this type of documentation. Only those items that are used to carry out work to achieve the goals and solve the professional tasks of the institution and whose price per unit does not exceed three thousand rubles should be included here. In particular, these are office supplies (office paper, pens, markers, pencils, hole punches), office equipment, consumables and replacement accessories, etc.

The regulatory legal acts of the institution must necessarily indicate the category of inventory items recorded on the statement, with a detailed description of them.

Why is an act of transfer of material assets required?

It is proof of the fact of a change in the user of the property. Its error-free execution implies that the responsibility for the safety of the asset will be borne by the recipient, who will have to pay compensation in the event of loss or damage. With his name on hand, you can safely go to court with a statement of claim to recover the appropriate amount from the guilty party.

The one who gives something for a while is considered a depositor, the one who receives is considered a custodian. Information about these legal entities is necessarily written down in the business paper, along with the period and terms of the agreement. Immediately after the expiration of the agreed period, another document is created - indicating the return of the property.

When performing external operations, it is drawn up as an annex to the concluded business agreement. It also helps to record the fact of the direction of an asset from one structural division of the company to another, as a result of which the control of transferred objects is simplified (especially when branches are geographically remote from the head office and administrations). This approach allows you not to travel for business papers and not to carry them with you, but to use those that are locally available.

Why do you need a statement?

A statement is a reporting document on the basis of which an organization carries out accounting, write-off of material assets and fixed assets worth up to three thousand rubles.

The main advantage of this document is that its formation does not require convening a special commission (as in the case of writing off goods and materials with a higher value).

The statement itself is not particularly complicated, but, nevertheless, its preparation should be taken extremely carefully and seriously, since during control actions carried out by supervisory authorities, it is such documentation that is checked first. Identification of even the slightest inaccuracies in the completed form in comparison with information from other papers is fraught with the imposition of an administrative fine on management and financially responsible employees.

Write-off with disposal

After drawing up an act confirming that material assets are recognized as written off, the accountant needs to make the following entries:

- Dt 94 Kt 10. In this posting, the accountant reflects the book value of written-off inventory items, the data is taken directly from the act;

- Dt 20 Kt 94. It reflects the cost of shortage, loss or damage of materials within the limits of their maximum loss. Such information can also be provided in the act, or it should be requested separately and documented in a special accounting certificate. If the natural loss limit is exceeded, you cannot post from the Dt 20 account; you must additionally create subaccounts.

These are the main transactions; in some cases you will need to specify other accounts. For example, in the event of damage to property as a result of a natural disaster, a posting is made Dt 99 Kt 100. When generating data on accounts and registering transactions for the movement of inventory items, data from the act is used.

How to make a statement

The list of issuance of material assets for the needs of the institution refers to the primary documentation used mainly, as mentioned above, in state budgetary organizations. That is why its unified form is used, developed relatively recently - in 2015 (the previously valid form was no longer valid) and filled out in a certain order

The statement can be made in “live” form or in printed form, but in the second case it must be printed (for approval). If the statement is made on paper, the remaining empty lines should be crossed out; if in electronic format, then the empty lines must be deleted (to avoid all kinds of manipulations with the document)

It is formed in one original copy, which is initially compiled in the department for issuing inventory items, and then transferred to the accounting department.

Information about the finished statement must be entered into a special accounting document - a journal, and then handed over to the responsible employee for storage. The storage period for the statement is determined either by the accounting policy of the institution or by the laws governing the creation of this type of documentation. After the statement loses its significance, it can be disposed of (subject to the procedure also established by law).

Write-off procedure

The procedure consists of 8 stages:

- A commission is created. The head of the organization can also join the commission if he so desires. An order is issued on the creation of the commission. It provides a list of the persons who make up the commission, and also contains an indication of the need to compile a list of valuables to be written off.

- The commission examines the values themselves, establishes the reasons for write-off: breakdown, damage, natural loss, identifies those responsible and further actions in relation to written-off material assets.

- The commission examines and analyzes documents confirming the state and composition of values: work reports, lists, expense reports, calculations, etc.

- The commission fixes the volume that needs to be written off, approves the list and sums up the amount and book value.

- All this data is reflected in a document signed by all members of the commission.

- The act is submitted to the manager for approval.

- Accounting makes the necessary entries and notes in accounting, financial and reporting documents.

- The commission exercises control over the destruction of written-off property, if necessary.

If a guilty person is identified, he may also be involved in the work of the commission. In this case, a note is made in the act on the procedure for reimbursing the organization’s expenses.

The accounting department records valuables at the actual cost of their acquisition, while indirect taxes paid to the supplier are not reflected in the final amount. The write-off method must be established in the accounting policy (at the cost of each unit, according to average cost indicators).

The write-off method approved in local regulatory documents cannot be changed during the write-off process. Sometimes the act is drawn up in the presence of third-party organizations, for example, with the participation of sanitary or fire inspectors.

Order template

The template is not unified, so an organization can develop its own template, including additional details and provisions in accordance with current legislation.

Although the company itself has the right to develop forms of orders and other documents, we must not forget that they must be approved in the internal accounting policies of the organization and comply with it. This document approves the forms of primary documentation at the enterprise for accounting purposes.

Sample statement

- On the right, at the top of the statement, several lines are reserved for the signature of the head of the institution.

- Below is the date of formation of the statement, the name of the organization (full) and the structural unit in which it was issued.

- Next, enter information about the financially responsible person: it is enough to indicate here his last name, first name and patronymic.

- Then comes the main section. It begins with accounting records of the postings of inventory items entered on the form.

- Below, the chief accountant and the employee who issued the goods and materials according to this statement put their signatures; the document is dated again.

- The second part of the form contains the actual information about inventory items, formatted in the form of a table.

- The full name of the employee who received them is entered in the first column, and he also signs at the end of the corresponding line.

- The vertical columns contain data about the objects to be accounted for (their name and code) and the unit of measurement (also in the form of name and code).

- After the statement is completed, its results are summed up: the issued quantity of each item of materials, as well as their cost per piece and the total cost for all columns.

Specifics of write-off for production

The need to write-off from warehouse to production arises for enterprises that are engaged in production activities. Such an act must reflect the following information:

- Date of completion;

- information about the sender of the document (name of the structural unit and its type of activity);

- information about the recipients (also the name of the specific structural unit and the type of its activity);

- why the property is written off, the purpose of this action (for example, for the production of accessories);

- the name of the property being written off, allowing it to be identified indicating the item number;

- unit of measurement of materials being written off;

- the amount of materials written off, that is, released into production;

- price.

Sample act for writing off materials for production

The company can either develop a form for this act independently or decide to use standardized forms. In the latter case, the following standardized forms can be used to confirm the transfer of materials to production:

- limit intake card in form M-8 in the event that materials are transferred systematically and the organization has approved standards and plans for their consumption. Also, under such circumstances, you can use a materials accounting card in form M-17;

- invoice in form M-11 if the materials are transferred to a division of the company that is not geographically separate.

The procedure for transferring property and recording the results

The transfer of values occurs for each item, with inspection and recalculation.

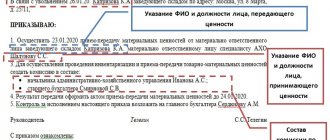

All this is done in the presence of the receiver, the renter and the commission, which checks the provided list of property with the items presented for acceptance. Based on the results of the transfer, an act of acceptance and transfer of valuables is drawn up in any form. It states:

- FULL NAME. handing over and accepting the values of employees, their positions;

- list of all property, incl. names and quantities;

- if a shortage is identified, a note must be made about this in the act;

- signatures of the donor, the receiver and members of the commission.

FORM OF THE ACT OF ACCEPTANCE AND TRANSFER OF VALUABLES

The act is drawn up in 2 copies : for the employer and the resigning employee.