An act of the standard form TORG-15 is generated in case of damage, scrap or damage to inventory items. This document is of some importance, as it allows you to reduce tax expenses caused by the write-off of assets and the depreciation of their value. As practice shows, the correct execution of this act is of fundamental importance. In the article we will tell you about TORG-15 Act on damage, damage, scrap of inventory items, and we will give recommendations on registration.

Since 2013, the use of unified forms of primary documents is not necessary, but it is still safer to draw up such an act. If desired, the company can create its own form, but it is necessary to take into account the presence in the form of the required details established for primary documentation.

How to draw up a TORG-15 act: sample filling and rules

To draw up TORG-15, a special commission is created, composed of members approved by the director of the company. It must include a representative of the enterprise administration, a person financially responsible for the safety of goods, and, if necessary, a representative of the sanitary inspection.

The visa approval of the director of the company must be on the front side of the act. The TORG-15 act is filled out in 3 identical copies, one of which remains in the structural unit, the other is sent to the accountant for display in accounting and withholding the damage from the salary of the guilty employee, and the third is transferred to the person responsible for causing the damage.

When filling out TORG-15, you should pay attention to filling out some points. Thus, the code for the reason for damage/breakage/scrap may not be included in the report if the company does not use an internal coding system. The document must indicate the reason for writing off the damaged goods or marking them down.

For information on how you can organize accounting in trade, read the article “Trading goods with and without VAT (nuances).”

Spoiled (damaged) goods should be listed, indicating their name, main characteristics, quantity and accounting value before and after the markdown. The guilty person (if it is possible to identify him) and his position must also be named.

The final part of TORG-15 contains the text of the manager’s order on the further fate of damaged (damaged) inventory items. Thus, the need for their disposal may be indicated. In addition, you should provide the exact amount of damage and the details of the person at whose expense it will be compensated.

Who signs the completed act?

In conclusion, the TORG-15 act is signed by all members of the commission, including the employee responsible for storing inventory items. After reading the document, the head of the company signs his visa and decides on subsequent actions in relation to the product (write off or discount) and determines which employee is to blame for what happened.

As a rule, the loss of consumer properties of a product occurs due to mismanagement of employees, so damages are recovered from those responsible.

Where to find the form and sample of filling out TORG-15

The TORG-15 form, although unified, is not required for use. Another thing is that the specified form is very convenient - after all, it takes into account all the nuances for documenting the situation with damage/crowbar/damage to goods and materials.

TORG-15 you can on our website.

And if you have difficulties completing this document, we recommend using the sample of its completion posted on our website.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Sample. Act of damage, damage, scrap of goods (material). Form No. 12" and ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

In what cases are TORG-15 and TORG-16 compiled?

All movements of goods and material assets are taken into account by the accounting department on the basis of primary accounting documents. In case of damage to the goods or complete unusability, acts are drawn up approved by the Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132 “On approval of unified forms of primary accounting documentation for recording trade operations”:

- Act on damage, damage, scrap of inventory items (TORG-15).

- Act on write-off of goods (TORG-16).

Since January 2013, filling out these forms is optional; however, the tax office may require documentary evidence of a decrease in tax expenses based on the write-off of inventory items or their markdown. Then correctly drawn up papers will be proof of the legality of these expenses.

The act in the TORG-15 form involves further actions with material assets, such as:

- Sale of goods without changing the price.

- Sale of goods at a reduced price.

- Disposal of goods.

- Complete destruction.

- Disposal to landfill.

Reference. The act in form TORG-16 excludes further use of the goods and is drawn up to remove the goods from the organization’s balance sheet. An act of write-off can be drawn up simultaneously with an act of damage, damage, or scrap of goods.

The specified documents are drawn up in cases of detection of commodity losses:

- Normalized, which appeared as a result of inevitable technological and physical processes (melting, drying, grinding, etc.).

- Non-standardized (damage, destruction, breakdown, incorrect storage technology, losses due to fire, accident, etc.).

Results

The need to draw up a report in the TORG-15 form arises when damage to goods is detected. Based on this act, the goods can be discounted or disposed of. It also indicates the amount of damage caused and the guilty person from whom this amount will need to be withheld, if such a person is identified.

Sources: Resolution of the State Statistics Committee dated December 25, 1998 No. 132

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Registration of an act of damage, damage, scrap of inventory items

Filled out by whom?

To carry out an inventory and draw up a report on damage, scrap, and damage to goods, the head of the organization issues an order to create a special commission (at least three people), which includes a representative of the administration and a financially responsible person. The document is filled out by one of the commission members in triplicate.

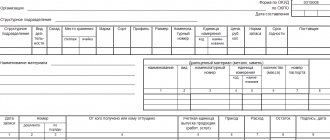

To draw up a document, you can take a unified form in the TORG-15 form or develop your own template based on it. Practice shows that a unified form is easy to fill out and understandable to representatives of regulatory authorities, so it is better to use the approved TORG-15 form. Let's look at the order of filling it out:

- At the top of the document the full name of the organization is indicated, indicating the legal address, telephone number and structural unit in which the inventory is carried out.

- Below is information about the full name of the supplier, indicating its full details, including bank details (current account, BIC, checkpoint).

- In special columns the document number and the date of its preparation are indicated.

- Title of the document: “Act on damage, scrap, destruction of inventory items.”

- A table consisting of fifteen columns is filled in:

- The name and characteristics are written down. For example, “Gingerbread “Mint”.

- Product code.

- Unit of measurement, name. For example, "pieces."

- Unit of measurement, code OKEY (all-Russian measurement code).

- Product article.

- Variety (category). For example, “1st grade”.

- Quantity (mass).

- The accounting price per unit of goods. For example, "75".

- Total amount for all goods. For example, "750".

- Then there is a section that includes four columns, which indicate:

- quantity (weight) of goods;

- new price (cost after markdown);

- total cost;

- markdown amount (the difference between the total amount for the product before and after the price reduction).

- The 14th column indicates the discount percentage.

- The last column indicates the characteristics of the defect. For example, “packaging violation”.

- The reason for the loss is indicated below the table. If the cause is technological processes or physical conditions, then in the line below, data on the perpetrators is not entered, otherwise the surname, first name, patronymic and position of the person responsible for the fight, scrap or damage to goods are indicated.

- On the back of the form, fill out the section entitled “Credit scrap (scrap).” It contains data about the product if it is impossible to further sell or use it.

Attention! When filling out, you must fully indicate the name of material assets, information about the supplier, the reasons and circumstances that led to damage to the goods.

Are mistakes acceptable?

The document must be drawn up without blots or errors. In case of corrections, it is better to reissue it. Calculations of markdowns or write-offs of goods must be made correctly, otherwise this will be the basis for the tax service to refuse to include expenses in taxable profit.

In case of errors in filling out and calculations, recovery of damages from the guilty party will be impossible.

Who signs?

The document is drawn up in triplicate and signed by all members of the commission and the financially responsible person. At the bottom of the act, under the calculations made, after checking the correctness of filling, the chief accountant signs. The papers are handed over to the manager, who, after making a decision, puts his signature on the front side of the act at the top of the form near the number and date of preparation.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Sample.

Act of damage, damage, scrap of goods (material). Form No. 12" was useful for you, we ask you to leave a review about it. Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

Registration of a write-off act

If it is impossible to further use the goods, a write-off report is drawn up. The head of the enterprise issues an order defining the composition of the commission and its tasks. The act is filled out in printed form by one of the commission members and drawn up in triplicate (for the accounting department, for the structural unit, for the financially responsible person).

You can use the unified form TORG-16:

- name of the enterprise and its structural division;

- date of receipt of goods (from invoices - commodity TORG-12 or commodity transport 1-T);

- name of the product, its code;

Important! The document reflects complete information about the product and the reasons for its write-off.

The act is a primary accounting document, therefore corrections and errors in it are unacceptable. It is necessary to redo the document if it is drawn up incorrectly.

The document is signed by all members of the audit commission and the financially responsible person. Below, the manager writes a decision on how the goods will be written off:

- the guilty person indicating the last name, first name, patronymic and position;

- cost;

- profits, etc.

Related documents

- Sample. An act for writing off tools (devices) and exchanging them for suitable ones. Form No. MB-5

- Sample. Act on writing off damaged work record forms

- Sample. Act on write-off of low-value and high-wear items. Form No. MB-8

- Sample. Act on write-off of fixed assets. Form No. os-3 (Resolution of the USSR State Statistics Committee dated December 28, 1989 No. 241)

- Sample. Act on mutual settlements (offsets)

- Sample. Act on liquidation of fixed assets. Form No. os-4 (order of the Central Statistical Office of the USSR dated December 14, 1972 No. 816)

- Sample. Certificate of valuation of machinery, equipment and other fixed assets (appendix to the agreement on the procedure for using federal property assigned to a state educational institution with the right of operational management) (pi

- Sample. Certificate of assessment of the cost of unfinished capital construction and uninstalled equipment (appendix to the agreement on the procedure for using federal property assigned to a state educational institution on the right

- Sample. An act of assessing the value of isolated water bodies, forests, perennial plantings, buildings, structures, aircraft and sea vessels, inland navigation vessels, space objects and other property that is subject to special regulations

- Sample. Act report on the consumption of alcohol from the warehouse

- Sample. Statement No. 1

- Sample. Statement No. 10

- Sample. Statement No. 11

- Sample. Statement No. 12

- Sample. Statement No. 13

- Sample. Statement No. 15

- Sample. Statement No. 16

- Sample. Statement No. 18

- Sample. Statement No. 2

- Sample. Statement No. 2.1

Accounting and tax accounting

Acts on broken/scrap, damage to goods and write-off of goods are the basis for carrying out accounting actions on them.

Example of accounting entries when writing off damaged goods:

- D94 K41 - the cost of goods with an expired expiration date has been written off.

- D73-2 K94 - the cost of damaged goods and materials was written off at the expense of the guilty parties.

- D50(51) K73-2 - the cost of damaged goods and materials was recovered from the guilty parties.

Example of postings in case of markdown of goods:

- D62 K90-1 – shows revenue from the sale of discounted goods.

- D90-2 K41 – the cost of goods is written off.

In accordance with clause 49 of article 264 and clause 20 of article 265 of the Tax Code of the Russian Federation, written-off goods can be classified as non-operating expenses , which makes it possible to reduce the tax base for income tax on other economically justified expenses.

With documentary justification, the cost of written-off goods that are not suitable for sale can be taken into account as part of other or non-operating expenses.

Is it necessary to restore VAT when writing off damaged goods? In paragraph 3 of Art. 170 of the Tax Code of the Russian Federation provides a list of situations when it is necessary to restore VAT. It does not indicate the write-off of the goods.

Accounting for expenses for damaged or expired goods requires proper documentation from identifying such facts to carrying out the necessary accounting operations.

Expert opinion

Kuzmin Ivan Timofeevich

Legal consultant with 6 years of experience. Specializes in the field of civil law. Member of the Bar Association.

An act of the standard form TORG-15 is generated in case of damage, scrap or damage to inventory items. This document is of some importance, as it allows you to reduce tax expenses caused by the write-off of assets and the depreciation of their value.

As practice shows, the correct execution of this act is of fundamental importance. In the article we will tell you about TORG-15 Act on damage, damage, scrap of inventory items, and we will give recommendations for registration.

Since 2013, the use of unified forms of primary documents is not necessary, but it is still safer to draw up such an act. If desired, the company can create its own form, but it is necessary to take into account the presence in the form of the required details established for primary documentation.

Sample of a finished act against spoilage of finished apple products

- Act on the consumption of goods by batches (Unified Form N MX-12) Documents of the enterprise's office work → Act on the consumption of goods by batches (Unified Form N MX-12) document “Act on the consumption of goods by batches (Unified Form N MX-12)” in Excel format you can get from the link “download f...

- Certificate of acceptance of products (goods) by quantity Contract for the supply of goods, products → Certificate of acceptance of products (goods) by quantity act of acceptance of products (goods) by quantity “” 20g. place of drawing up the act and acceptance of products (goods) start time of acceptance of products (goods) end time of acceptance commission consisting of: ...

- Sample. Act on the transfer of goods, containers and equipment when changing bartenders Accounting statements, accounting → Sample.

Writing off spoiled harvest

Debit 91.02 “Non-operating expenses” Credit 94 “Shortages and losses from damage to valuables” - 63 rubles. The remaining 637 rubles. will be attributed to the person responsible. Debit 73 “Settlements with personnel for other operations” Credit 94 “Shortages and losses from damage to valuables” - 637 rubles.

We draw up a write-off act for food products - sample

Attention TORG-15 or in the form developed by the organization. This document will confirm that the organization has revalued the product taking into account the loss of quality and is selling the product discounted due to damage. Such revaluation is carried out by order/order of the head of the organization.

Example 1. Maska LLC, located on the simplified tax system with the “income minus expenses” tax system, July 7, 2013. For retail sale, I purchased 200 kg of strawberries; the actual cost per unit was 45 rubles. for 1 kg. The selling price of 1 kg is 65 rubles.

As a result of improper storage in the heat, the marketability of the berries decreased: spoiled berries appeared, and therefore their market price fell. Organization July 17, 2013 I marked them down for the entire amount of the trade margin (200 kg x 20 rubles = 4000 rubles). The perpetrators have not been identified.

All products after the price reduction were sold at retail until July 20, 2013.

There's nothing here!

Maria Eschenbach) Get free legal advice by phone right now Moscow +7 (812) 467-30-49 St. Petersburg Regions © 2011 - 2021 Sample contracts On our website, everyone can download for free a sample of the contract or sample document of interest, the database of contracts is updated regularly.

Our database contains more than 5,000 contracts and documents of various types. If you notice an inaccuracy in any agreement, or the impossibility of the “download” function of any agreement, please contact us using the contact information. Have a good time! Today and forever - download the document in a convenient format! A unique opportunity to download any document in DOC and PDF absolutely free of charge.

Only we have many documents in such formats.

Sample. act of damage, damage, scrap of goods (material). form No. 12

Accounting statements, accounting → Sample. Act of damage, damage, scrap of goods (material). Form No. 12 ...its markdown (write-off) due to material. (damage, battle, etc.) as a result of the inspection it turned out: - no. quantity actir markdown sum pre- +- +-markdowns skur.name of goods, sorted.grossnetto price sum newamount or materials, art...

- Act on damage, damage, scrap of inventory assets (Unified form N TORG-15) Documents of the enterprise's office work → Act on damage, damage, scrap of inventory assets (Unified form N TORG-15) document “act of damage, damage, scrap of inventory items (unified form n bargaining-15)" in excel format you can get by...

- Act on the return of defective goods Documents of the enterprise's office work → Act on the return of defective goods act No. dated ""20. about returning defective goods 1.

What are the rules for writing off spoiled food?

The norms for the natural loss of food products in the field of trade and public catering were approved by the Order of the Ministry of Economic Development of Russia dated September 7.

2007 N 304, and the norms of natural loss applied during transportation by all types of transport (except pipelines) are approved jointly with the Ministry of Transport of the Russian Federation.

It must be borne in mind that the norms of natural loss of products/goods during storage differ from the norms of loss for the same goods/products, but during their transportation, and also depend on the type of transport by which they are transported. Therefore, for each case it is necessary to look for the appropriate regulatory document.

To determine the amount of product losses due to natural loss, you can use the following formula. The amount of natural loss is determined as the quotient of the product of the mass of goods sold by the rate of natural loss divided by 100.

Free legal consultation by phone: (499) 938-41-64 Moscow St. Petersburg Regions Add to bookmarks / Agreements / Accounting statements, accounting / Download in .doc/.

pdf Forms Text Related Form View all pages in gallery Do you have a legal question? Ask a legal consultant! We will try to help you. Act of damage, damage, scrap of goods (material). Form No. 12 Download as .doc/.pdf Save this document in a convenient format. It's free. Form No. 12 (name of organization) product A K TNo.

FOR DAMAGE, FAILURE, SCRAP material from » » 20. The commission, consisting of: goods, and inspected the subject to markdown (write-off) due to the material. (damage, battle, etc.) As a result of the inspection it turned out: No.¦¦¦¦ Quantity.

The procedure for conducting an inventory is described in the Guidelines for the inventory of property and financial obligations, which are approved by Order of the Ministry of Finance of Russia dated June 13, 1995 N 49. During the inventory process, the actual availability of property is checked by mandatory recalculation, reweighing or re-measuring inventory items. The data obtained is entered into the inventory list (f.

No. INV-3) . Next, based on the accounting data and inventory list, a matching statement is compiled (form No. INV-19), which reflects the discrepancies between the indicators according to the accounting data and the inventory list data. At the same time, a report on spoilage (form No. TORG-15) and an act on write-off of goods (form No. TORG-16) are drawn up for the cost of spoiled food products/goods. The same applies if products have expired.

Source: //redtailer.ru/obrazets-gotovogo-akta-ot-porchi-gotovoj-produktsii-yablok/

Preparation of documentation in case of spoilage of products

If damaged goods can be sold (at a discount), they are accounted for at their possible sale prices. Such rules are established by subparagraph “a” of paragraph 58 of the instructions approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Calculate the amount of losses from shortages (spoilage) in excess of the norms of natural loss using the formula: Amount of losses from shortages (spoilage) in excess of the norms of natural loss = Total amount of losses from shortages (damage) – Amount of losses from shortages (spoilage) within the limits of norms of natural loss Amount of excess losses consists of the purchase price of damaged goods, including VAT, as well as the portion of the transportation and procurement costs attributable to them for this delivery.

Goskomstat of Russia dated March 27, 2000 No. 26. For more details on filling out these forms, see the table. Inventory: markdown and write-off When identifying the fact of damage to goods, the organization can:

- mark down goods for further sale;

- write off goods (if they are not subject to further sale).

If an organization plans to discount (write off) a product due to damage, the head of the organization creates a commission, the composition of which is approved by order. The commission should include:

- a representative of the organization's administration (for example, a manager);

- financially responsible person;

- sanitary inspection representative (if necessary).

The commission's decision to mark down (write off) damaged goods is made in writing.

Force majeure in the archive: actions in case of damage to documents

Spoiled food products may appear in retail establishments, public catering establishments, or storage warehouses for a number of reasons:

- storage and sales conditions were violated,

- transportation conditions were violated or products were loaded of inadequate quality,

- the sell-by date (expiration date) has expired,

If products located in a warehouse or on the sales floor have deteriorated as a result of improper storage before the expiration date, then such damage requires confirmation through an inventory.

As you know, inventory can be planned in accordance with accounting policies, or unplanned as a result of the occurrence of reasons affecting the quantitative indicators of inventory items.

Carrying out an inventory and recording its results

Debit 44 Credit 41 subaccount “Goods subject to markdown” - samples of damaged goods were submitted for examination (if examination is necessary for the sale of damaged goods); Debit 44 Credit 60 – expenses for conducting an examination are reflected (if an examination is required for the sale of damaged goods); Debit 62 Credit 90-1 – revenue from the sale of goods at a discount is reflected; Debit 90-2 Credit 41 subaccount “Goods subject to discounting” - the cost of discounted goods is written off (the cost at which they were capitalized); Debit 90-3 Credit 68 subaccount “Calculations for VAT” – VAT is charged on the sale of discounted goods (if the organization is a VAT payer); Debit 90-2 Credit 44 - costs associated with sales are included in the cost of sales (if an examination is required for the sale of damaged goods).

Consignment note M-15: fill out online

In the MyWarehouse service, you can fill out and print the M-15 demand invoice in a few seconds. Enter or select the previously entered divisions of the sender and recipient and indicate the name and quantity of the product. The system will automatically number and generate the document. Below is the M-15 invoice: a sample from MyWarehouse.

Fill out form M-15

Fill out the M-15 waybill online!

Register in the MoySklad online service - you will be able to: completely free of charge:

- Fill out and print the document online (this is very convenient)

- Download the required form in Excel or Word

To fill out the M-15 form, you need to connect an additional template.

All documents created in MySklad are stored in the archive - you will have round-the-clock access to them, no matter where you are.

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Forms for accounting of goods

Fill out the form without errors in 1 minute!

Free program for automatically filling out all documents for trade and warehouse. Find out more >>

|

|

Business.Ru - quick and convenient filling out of all primary documents

This form is used to register inventory items that arise due to damage, damage or scrap and are subject to markdown or write-off. Losses are written off to the account of the guilty employees.

The act is approved by the head of the organization and drawn up in triplicate. The first is transferred to the accounting department, the second remains in the department, the third is sent to the person to whose account losses from damage are written off.

How to automate work with documents and avoid filling out forms manually

Automatic filling of document forms. Save your time. Get rid of mistakes.

Connect to CLASS365 and take advantage of the full range of features:

- Automatically fill out current standard document forms

- Print documents with signature and seal image

- Create letterheads with your logo and details

- Create the best commercial offers (including using your own templates)

- Upload documents in Excel, PDF, CSV formats

- Send documents by email directly from the system

- Keep records of goods in wholesale trade

Expert opinion

Kuzmin Ivan Timofeevich

Legal consultant with 6 years of experience. Specializes in the field of civil law. Member of the Bar Association.

With CLASS365 you can not only automatically prepare documents. The CLASS365 retail trade management program allows you to manage an entire company in one system, from any device connected to the Internet.

It is easy to organize effective work with clients, partners and staff, to maintain trade, warehouse and financial records. CLASS365 automates the entire enterprise.

Material assets that are listed on the balance sheet of an enterprise, during use and storage, may completely or partially lose their consumer properties or become unusable in the event of damage or damage. How to properly formalize this in order to recover damages from the financially responsible person or write off damage, breakage or scrap of goods as non-operating expenses of the organization?