Step-by-step instruction

On March 12, the Organization paid the supplier:

- drinking water in the amount of 10 pcs. for the amount of 120 rubles. (including VAT 20%);

- reusable deposit container - 19 liter water bottle in the amount of 1 pc. for the amount of 250 rubles. (without VAT).

On the same day, the supplier delivered 1 bottle of water.

According to the terms of the agreement, the bottle is a returnable collateral container.

The accounting policy stipulates that the program keeps records of collateral and other people's property in off-balance sheet accounts.

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Transfer of advance payment to the supplier | |||||||

| March 12 | 60.02 | 51 | 1 200 | 1 200 | Transfer of advance payment to the supplier | Debiting from the current account - Payment to the supplier | |

| 76.05 | 51 | 250 | 250 | Transfer of deposit to supplier | |||

| Accounting for the amount of collateral on the balance sheet | |||||||

| March 12 | 009.01 | — | 250 | Accounting for the amount of collateral in an off-balance sheet account | Manual entry - Operation | ||

| Purchasing water | |||||||

| March 12 | 60.01 | 60.02 | 120 | 120 | 120 | Advance offset | Receipt (act, invoice, UPD) - Goods |

| 10.01 | 60.01 | 100 | 100 | 100 | Acceptance of materials for accounting | ||

| 19.03 | 60.01 | 20 | 20 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| March 12 | — | — | 120 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.03 | 20 | Acceptance of VAT for deduction | ||||

| — | — | 20 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Receipt of returnable reusable packaging | |||||||

| March 12 | 002 | — | 250 | Accounting for containers on an off-balance sheet account | Manual entry - Operation | ||

| Write-off of water for general household needs | |||||||

| March 12 | 26 | 10.01 | 100 | 100 | 100 | Write-off of materials | Requirement - invoice |

General information

The document in question is intended for processing returns to suppliers of previously accepted units (in our system, all transactions related to suppliers are located in the “Purchases” block).

Fig.1 General information

It is generated in two ways:

- Based on “Purchase of goods and services”;

- From the automated workplace “Purchases” - “Returns” - “Returns of goods to suppliers”.

The process for clearing the shipment of returned units depends on the warehouse from which they are being returned:

- Unordered warehouse;

- Order warehouse (in the examples it is considered without the use of premises and cells).

From a non-order warehouse, the actual write-off occurs after the transaction. At the order warehouse, the returned return is an indication for shipment through the “Goods issue order”.

Document business transaction options:

- Return of goods to the supplier;

- Return of goods to the consignor.

Fig.2 Options for document business transactions

When specifying the source of information about the purchase in the “Return of goods to supplier”, the goods must be returned to the supplier in the same quality in which they were received (otherwise the system will not allow you to post the document). Here we will be helped by the functional option “Quality of Goods”, which will allow us to transfer the goods “Good” to the quality “Limited Good/Not Good” (“Damage of Goods”).

If there is a need to conduct analytics on defects, then returns to a specific supplier can be filled with items with changed quality without indicating the original purchase data.

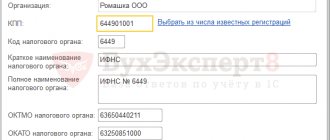

Transfer of advance payment and deposit amount to the supplier

Complete the transfer of funds to the water supplier by debiting from the current account transaction type Payment to the supplier (Bank and cash desk - Bank statements).

Break the payment into 2 lines:

- reflect the advance payment for water in the usual manner;

- on the line with the amount of the deposit for the packaging, indicate: Expense item - item with the type Other payments for current operations ;

- Debt repayment - Do not repay ;

- Settlement account - 76.05 “Settlements with other suppliers and contractors.”

Postings

After returning the container to the supplier and receiving the deposit amount from him, issue a Receipt to the bank account :

- Type of operation - Other receipt ;

- Settlement account — 76.05;

- Income item with the type Other receipts from current operations .

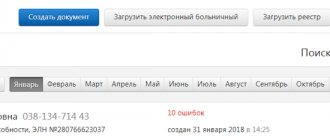

Registration of a return to the supplier

You can find this document in the “Purchases” section. All previously reflected returns are also located there.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

In the header of the document, we will first indicate our organization - Store No. 23. It is there that the product is listed for which you need to make a return to the supplier in 1C. You can also indicate a department, but this field is not required.

Next, we will indicate the counterparty, that is, the organization from which we purchased this product and the agreement with it as a supplier. The last thing that remains to be clarified in the header is the receipt document for the goods that we are going to return. If you cannot find it in the selection list, most likely one of the header parameters is not filled in correctly.

Now you can proceed to directly filling out the table of goods we return. E can be filled in manually or automatically. Automatic filling is much more convenient. It is located in the “Fill” menu and consists of two items.

When you select the “Fill in upon receipt” item, the program will add to the table all the products from the document that you specified in the header. If you selected the “Add from receipt” item, then in this case you will need to indicate in the window that appears from which other receipt from the specified supplier the goods will be returned.

Simply put, the first filling option adds lines from the receipt in the header to the second of any others. In this example, we will fill from the receipt indicated in the header.

A completely filled line with the nomenclature “Candy “Bar”” has been added to the tabular part. All values in the table can be edited. This may be necessary, for example, if we do not return all received goods, but only a part.

In this document, all that remains is to indicate the availability of returnable packaging, for example, if we bought draft drinks in aluminum kegs and they need to be returned along with the goods. On the “Calculations” tab, those accounts that will participate in document movements are indicated. On the “Advanced” tab, if necessary, you can specify the consignee and consignor.

Purchasing water

Costs for ensuring normal working conditions (including the purchase of drinking water) can be taken into account when calculating income tax (clause 7, clause 1, article 264 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation 03/23/2020 N 03-03-07/22134) .

VAT on such expenses is accepted for deduction in the usual manner (clause 1 of Article 172 of the Tax Code of the Russian Federation).

Reflect the receipt of water with the document Receipt (act, invoice, UPD) document type Goods (invoice, UPD) (Purchases - Receipt (acts, invoice, UPD)).

Filling out a document is no different from the usual receipt of materials.

Postings

According to FSBU 5/2019, drinking water does not belong to reserves, therefore, to reduce the number of operations in the program, you can take it into account at the time of receipt in expenses, bypassing account 10:

- create a directory element Nomenclature for water with the Type of nomenclature Services ;

- create a document Receipt (act, invoice, UPD) document type Services (act, UPD) .

Then you will not need to fill out a demand invoice.

To register an incoming invoice, indicate its number and date at the bottom of the document form Receipts (acts, invoices, UPD) - Goods (invoice, UPD) and click the Register .

The document is filled in automatically.

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings

Options for accepting inventory items for accounting in 1C: Accounting 8.3

Following the chronology of operations in reality, the enterprise first carries out an inventory, and based on its results, the identified surplus is capitalized. This option is established by law.

However, a situation may occur when a product that is not in the accounting data is accidentally discovered in the warehouse. This is possible in the following cases:

- a small product fell behind the rack during storage,

- materially responsible persons made a mistake when accepting and/or moving products,

- parts remaining after disassembling the equipment and released for sale.

In this case, you can use the second method - immediately post the goods directly through the document “Posting of Goods”.

Each of the options will be presented below in the corresponding section.

In order to take into account extra units, select the “Warehouse” menu - section “Inventory” - “Inventory of goods”.

Clicking the “Create” button opens the “Inventory of goods (creation)” form. Here you select the organization, the warehouse where the inventory is carried out, the person in charge, the date, and the document number.

The table section contains 3 tabs:

- Goods,

- Carrying out inventory,

- Inventory commission.

Each of these tabs is designed to enter data related to the test being performed.

Receipt of returnable reusable packaging

Returnable packaging does not meet the definition of inventory (clauses 3, 5 of FSBU 5/2019). Ownership of it does not pass to the buyer, therefore it is recorded on the balance sheet in account 002 “Inventory assets accepted for safekeeping” at the cost indicated in the acceptance documents.

Reflect the security deposit behind the balance sheet using the document Transaction entered manually (Transactions - Transactions entered manually).

Fill in the information about the supplier, the quantity and cost of the deposit containers according to the invoice.

Reflect the return of the deposit container to the supplier with a return entry.

Accounting for non-returnable packaging

Accounting for non-returnable packaging depends on whether its cost is included in the cost of materials (goods) or whether the organization pays for the packaging separately.

If the cost of the container is not highlighted separately, it is not necessary to take it into account separately, since it forms the cost of materials (goods) that were received in this container (clause 63 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, clause 6 PBU 5/01).

However, if an organization plans to use packaging in its activities or sell it, it must be taken into account at the market price as part of the organization’s other income. Determine the market price based on the amount that can be received from the sale of this container (paragraph 2, clause 9 of PBU 5/01). Take into account the packaging at the time of receipt of materials (goods) that were received in this container (clause 178 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

Do the following wiring:

Debit 10-4 (41-3) Credit 91-1

– packaging has been capitalized, the cost of which the organization does not pay.

This procedure is established in paragraphs 42, 44, 178 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and the Instructions for the Chart of Accounts.

The contract may provide that the organization must pay for non-returnable packaging separately from the materials (goods) received in it. In this case, consider the container at the actual cost. Determine the actual cost of the container received based on the data from the primary documents. The name, quantity and cost of the container must be highlighted as a separate line in shipping documents (for example, in a payment request, invoice, waybill, etc.). Also, containers can be received on the basis of a separate primary document. This procedure is established in paragraphs 42, 44, 178 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n. In this case, reflect the receipt of non-returnable packaging with the following entries:

Debit 10-4 (41-3) Credit 60 (76)

– packaging has been capitalized, the cost of which is paid separately by the organization;

Debit 19 Credit 60 (76)

– VAT on purchased packaging is taken into account.

If the organization does not plan to further use non-returnable packaging, the cost of which was paid separately, take it into account along with the materials (goods) purchased in it (clause 178 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n). In this case, do the wiring:

Debit 10-1 (41-1) Credit 60 (76)

– materials (goods) in containers are capitalized;

Debit 19 Credit 60 (76)

– VAT on purchased materials (goods) in containers is taken into account.

This procedure is established in the Instructions for the chart of accounts (accounts 10, 41, 19).

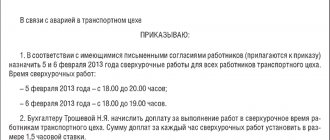

Write-off of water for general household needs

On the same day, fill out the Requirement-invoice document (Warehouse - Requirements-invoices).

It is better to create it based on the receipt document, then the document header and the Materials will be filled in automatically.

Attribute the cost of water to other expenses in BU and NU.

Postings

To access the section, log in to the site.

Capitalization in 1C through the “Inventory of goods” form

By clicking on the “Create based on” button, “Receipt of goods” opens, in which, firstly, you need to fill out:

- Name of the organization,

- The warehouse where the products are received,

- Number, date of document,

- Income item.

In the last line, you need to select in the directory “Other income and expenses” - “Capitalization of surplus”.

The “Inventory” line is filled in automatically with data about the document on the basis of which the goods receipt is created.

Inventory materials are reflected in tabular form based on the data of the audit. The “Invoice for goods receipt” button allows you to print a document of the same name, which is a table containing data about the received trade item: location, quantity, price and amount.

Enterprises selling alcoholic products must transfer data to the Unified State Automated Information System. Therefore, 1C has implemented data transfer when working in various program solutions.

Such transfer of detected unaccounted units of alcoholic products is possible by clicking the “Upload to EGAIS” button. An act of registration on the EGAIS balance sheet will open, in which the tabular part with the identified surplus of alcoholic products will be filled out. Additionally, the “Basic” tab is filled in. The basis is automatically filled in there - posting of goods, you need to select the organization "EGAIS", mark the responsible person, put a marker in front of the required register for booking.

By pressing the “Exchange Protocol” key, data transfer will begin, after which the document is processed and closed with the button of the same name.

Meanwhile, the document “Receipt of goods” has been filled out, the invoice has been printed, and the data on alcoholic products has been transferred to the Unified State Automated Information System. The document is closed with the “Post and Close” button.

Collateral container. Accounting Features

The contract for the supply of building materials may provide for the return of containers to the supplier. However, to ensure returns, the supplier usually sets security prices. The article describes how an accountant of a construction company can record transactions related to the turnover of returnable packaging.

Legal aspects

In most cases, when a contract includes a provision for the return of packaging to the supplier, we are talking about so-called reusable packaging. That is, about property that can be used repeatedly (for example, wooden construction pallets or pallets). The general rule directly provides that the buyer is obliged to return such containers to the supplier (Article 517 of the Civil Code of the Russian Federation). And the contract often specifies that the container must be returned in good condition, suitable for reuse. A contract for the supply of construction materials may contain a condition that for reusable containers the supplier will charge the buyer a deposit (in excess of the cost of materials), which will be returned to the buyer after receiving empty containers from him in good condition. The amount of the collateral value is also determined in the contract (or in the specification for it). It should be noted that the establishment of deposit prices for reusable containers is fully consistent with the norms of civil legislation. After all, the parties have the right to include in the contract any conditions that do not contradict the law (clause 4 of Article 421 of the Civil Code of the Russian Federation).