Settings affecting the calculation of personal income tax

Setting up registration in the INFS of an organization and separate divisions

To correctly generate personal income tax reporting, it is necessary to indicate the registration data of the organization and its separate divisions with the tax authority (IFTS), since regulated reporting 6-NDFL and 2-NDFL is generated based on this information.

Registration with the Federal Tax Service of the organization

The organization's registration data with the tax authority (IFTS) is indicated in the organization's card on the Main using the link Change registration data :

The form must indicate the organization’s checkpoint, tax authority code, its short and full name, OKTMO and OKATO codes. Also in the Registration information field is valid from, you must indicate the month from which the registration data will be considered current in 1C 8.3 ZUP. You should be careful when filling out the last details, because... Incorrect indication of the start month of registration may make it impossible to automatically fill out personal income tax reports.

Using the Select from known registrations , you can go to the list of the Registrations with a tax authority to select a registration from the list of information about registration with a tax authority already created in the program.

In the list that opens, you can also create a new registration by clicking the Create .

By clicking on the link History of registration changes, you can view the history of registration changes:

Creation of a separate division in 1C: ZUP, allocated to a separate balance sheet

Separate divisions allocated to a separate balance sheet are registered in the Organization with the This is a branch (separate division) . After checking the box, you must select the parent organization in the Branch's parent organization .

When entering registration data for a separate division, it is recommended to select this data from among the created registrations. This will prevent you from accidentally “overwriting” the organization’s registration data. To do this, you must first follow the link Change registration data :

In the Registration with a tax authority the Select from known registrations link and select the line with pre-entered registration data or create a new element using the Create :

Filling out the registration details for a separate division with the Federal Tax Service is similar to filling out the registration data for the Organization .

Creation of a separate division in 1C: ZUP, not allocated to a separate balance sheet

Separate divisions that are not allocated to a separate balance sheet are registered in the Divisions (Settings - Divisions) with the This is a separate division . You can set up registration with the Federal Tax Service of such a division in the division card using the Change next to the Tax registration field. organ :

Otherwise, the algorithm for filling out registration with the Federal Tax Service is similar to filling out registration data for a separate division allocated to a separate balance sheet.

Setting up an organization's accounting policy

The organization's accounting policy settings are opened by clicking the Accounting Policy on the Accounting Policy and other settings of the Organization directory (Settings - Organizations).

The accounting policy has several settings related to the calculation of personal income tax:

Let's take a closer look at them.

Withholding personal income tax when paying interpayment accruals in advance

setting when paying intersettlement accruals in advance can take the following values:

- Withhold tax (recommended);

- Indicate in the document the need to withhold tax when paying in advance.

This setting appeared in version 3.1.8. The setting solves the problem when, when paying a Business Trip in advance, the withheld tax on the Business Trip is registered on the date of payment of the advance, with the deadline for its transfer being the next day after payment. However, since Business Travel is income under code 2000 (wages), the employer does not have the obligation to transfer personal income tax when paying it for the first half of the month.

Setting up Personal income tax withholding when paying interpayment accruals with an advance allows you not to register personal income tax withholding when paying a Business trip with an advance. If the switch is set to the position Indicate in the document the need to withhold tax when paying in advance , then when specifying the payment method With advance in the document Business trip the Transfer tax field appears , allowing you to choose when to transfer personal income tax: When paying along with the advance or When paying wages after the final calculation _

Applying the standard deduction

The Application of standard deductions setting determines how deductions will be applied in months in which the taxpayer’s income turned out to be less than the deduction due to him:

- On an accrual basis during the tax period - means that the deduction will be applied taking into account income and previously applied deductions during the year on an accrual basis. In this case, the calculated tax can be calculated with a minus.

- Within the limits of the taxpayer’s monthly income - means that the deduction will be applied in an amount not exceeding the accrued income during the month. Thus, personal income tax for the month will not be calculated less than 0.

From a legal point of view, it is more correct to apply the deduction on an accrual basis throughout the year.

Setting up Accruals for personal income tax accounting purposes

Setting up personal income tax assessment for various accruals occurs in the Accruals (Settings - Accruals).

personal income tax code column can be seen already in the list of accruals.

You can adjust the personal income tax taxation settings for calculation on the Taxes, contributions, accounting in the personal income tax .

For personal income tax accruals, you must set the Income Code . The income category is not available for editing for all income codes. For example, by code 2000 the income category is always Remuneration , but by code 2002 the category can be adjusted.

By clicking the Setting up personal income tax, average earnings, etc. , you can view in the list which accruals are subject to personal income tax and which are not, and also adjust the income code:

Entering information about a taxpayer's tax status

Information about an employee's tax status can be specified in the employee card using the Income Tax .

The default status is Resident .

Statuses are selected from a predefined list of values:

You should not forget to fill out the details Installed with . This is important when changing taxpayer status:

Entering information about personal income tax deductions due to employees

You can enter an application for deductions from the employee’s card using the Income Tax :

Another option for entering data on deductions is through the Applications for Deductions (Taxes and contributions - Applications for deductions).

Application for standard deductions

In the employee’s card in the Income Tax , using the link Enter a new application for standard deductions, a new document is created : Application for personal income tax deductions :

In the header of the document you should indicate the month from which standard deductions will apply:

The tabular section contains data on standard deductions for children. Data can be entered into the table after checking the Change deductions for children :

Types of deductions are selected from a predefined list:

In the column Provided by (inclusive) the month for which the deduction will be applied is indicated. In the Document confirming the right to deduction , enter the child’s birth certificate or certificate from the place of study.

Please note that for each child who is eligible for a deduction, a separate line is entered in the tabular section. For example, a statement from an employee who has four minor children would look like this:

Data for applying a personal deduction is entered at the bottom of the form. You should check the Change personal deduction and select the personal deduction code in the Code :

In the Document confirming the right to personal deduction , enter the data of the confirming document.

Notification of the tax authority about the right to property and social deductions

In the employee’s card in the Income tax , follow the link Enter a new cash notification. authority for deductions, a new document is created Notification of the non-commercial organization about the right to deductions :

The header of the document indicates the Tax period in which deductions must be provided, as well as the month from which deductions begin to be applied in the Apply deductions from :

In the Notification of the right to deduction , you should indicate the notification details: Number , Date , as well as the Federal Tax Service :

Information on deductions for the construction and purchase of housing, interest on loans and interest on on-lending is indicated on the Property deductions :

Information about social deductions, such as expenses for your own education and for the education of children, medical expenses, etc. can be specified on the Social deductions :

Entering information about income from a previous job

Information about income from a previous place of employment is necessary to correctly calculate the limit for providing standard deductions to employees hired not from the beginning of the year. You can enter them from the employee’s card using the Income Tax . Information is entered through a special form, which opens by clicking the link Income from previous place of work :

Payroll

Settlements with company personnel for wages are accumulated in account 70. This account is passive, since all calculated amounts of employee earnings are taken into account on a loan. This is done on the last date of the month. And on the 1st day of each next month, the credit balance is reported to employees.

Account analytics is carried out for each employee using personal accounts (cards) in the T-54(a) form.

You will find the current form and the procedure for filling it out in the article “Unified form No. T-54a (personal account (SVT)).”

The amount of accrued salary is posted to the appropriate expense accounts depending on the department in which the employee is registered. Postings in each specific case can be as follows: Dt 20 (23, 26, 44) Kt 70.

If an employee was engaged in the construction or repair of fixed assets, then his earnings should be reflected in the entry: Dt 08 (07) Kt 70.

When calculating sick leave, the calculated amount should be included in debit 69, since it is not an expense of the enterprise and is reimbursed from the budget using the social insurance fund: Dt 69 Kt 70.

Important! The employer pays for the first 3 days of illness of the employee.

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2021 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Why do they buy gold? Selling gold competently is a process that will require you to spend some free time. It will be necessary to find out...

Calculation of personal income tax

Personal income tax is calculated automatically in accrual documents.

See also personal income tax: review of the main legislative innovations of 2021 (from the recording of the broadcast on December 26, 2021)

Calculation of personal income tax in interpayment documents

Personal income tax is calculated in interpayment documents, such as Vacation , Sick Leave , Bonus , etc. In some documents, to automatically calculate personal income tax, you will need to set the Payment to With advance or During the interpayment period .

For example, in the Vacation , the amount of calculated personal income tax is displayed on the Main vacation in the Tax :

You can view the details of tax calculation by clicking the More details about personal income tax calculation (green pencil icon next to the tax amount):

In interpayment documents in which it is possible to accrue to several employees at once, such as Bonus , One-time accrual of the amount of calculated tax is displayed in the personal income tax .

Employee Romashkina M.L. provided sick leave from 01/17/2019 to 01/23/2019. It is necessary to calculate the amount of benefits for sick leave and personal income tax from it. The employee is provided with a standard deduction for the first child.

Let's enter the document Sick leave :

The amount of accrued benefits was RUB 3,291.47. There have been no other incomes in 2021 yet; personal income tax will be automatically calculated:

Taxable base:

- 3,291.47 (Amount of income) – 1,400 (Standard deduction for a child) = 1,891.47 rubles.

Personal income tax:

- 1,891.47 (Taxable base) * 13% (Tax rate) = 245.89 = 246 rubles.

Final personal income tax calculation

The final calculation of personal income tax is made by the documents Calculation of salaries and contributions to and Dismissal .

In the documents Calculation of salaries and contributions and Dismissal, automatic calculation of personal income tax is performed on the personal income tax tab .

By double-clicking on the personal income tax amount, you can open the detailed personal income tax calculation form for the employee:

Features of personal income tax calculation stipulated by law

Personal income tax is calculated in 1C 8.3 ZUP in accordance with current legislation:

- rounded to the nearest whole ruble;

- in the context of individuals;

- cumulative total since the beginning of the year.

Calculation of personal income tax by individuals

This means that if an employee has several jobs in the organization, for example, at the main place of work and at an internal part-time job, then personal income tax will be calculated taking into account income from two places of work. In the program, both elements of the Employees must be associated with one element of the Individuals .

Employee Vasilkov V.V. has been working at his main place of work at Romashka LLC as an accountant in the “Main Division” division since 10.25.2017. From 01/09/2019, he is also hired at Romashka LLC on an internal part-time basis as a HR specialist, also in the “Main Division”. The work will be carried out on a part-time basis, 2 working hours a day, five days a week. It is necessary to calculate wages and personal income tax for V.V. Vasilkov. for January 2021.

Let's enter the document Calculation of salaries and contributions for January 2021 and fill it out. The document included both workplaces of employee V.V. Vasilkov. On the Accruals , payroll was calculated:

He was accrued 20,000 rubles for his main place of work, and 7,500 rubles for his part-time job.

On the personal income tax , the tax was calculated in the total amount for an individual.

Let's check the calculation:

Total income of Vasilkov V.V.:

- 20,000 (income from the main place of work) + 7,500 (income from a part-time job) = 27,500 rubles.

Personal income tax Vasilkova V.V.:

- 27,500 (total income) * 13% = 3,575 rubles.

Calculation of personal income tax on an accrual basis from the beginning of the year

This means that when calculating personal income tax, accrued income and calculated personal income tax from the beginning of the year are always analyzed.

Employee Cheremukhin N.P. works at Romashka LLC with a salary equal to 12,780 rubles for a full month worked. It is necessary to calculate the employee’s personal income tax for January and February 2021. Both months were fully worked.

Let's enter the document Calculation of salaries and contributions for January 2021. On the Accruals , the salary of N.P. Cheremukhin was calculated. in the amount of 12,780 rubles.

On the personal income tax , the tax was calculated in the amount of 1,661 rubles:

Personal income tax for January 2021:

- 12,780 (income) * 13% = 1,661.4 = 1,661 rubles. (after rounding);

Let's enter the document Calculation of salaries and contributions for February 2021. On the Accruals , the salary of N.P. Cheremukhin was also calculated. in the amount of 12,780 rubles.

On the personal income tax , the calculated tax amount is 1,662 rubles:

The amount of personal income tax calculated in February 2021 was 1 ruble more than the personal income tax amount calculated in January 2021, with equal amounts of income, because the calculation took place on a cumulative basis from the beginning of the year.

Income since the beginning of the year:

- 12,780 (income for January 2019) + 12,780 (income for February 2019) = 25,560 rubles.

Personal income tax calculated for 2021:

- 25,560 (income since the beginning of the year) * 13% = 3,322.8 = 3,323 rubles. (after rounding)

Personal income tax for February 2021:

- 3,323 (personal income tax calculated for 2021) - 1,661 (personal income tax calculated in January 2019) = 1,662 rubles.

Registers used in the program for personal income tax accounting

Data on income, calculated and withheld tax are stored in the database in accumulation registers.

Let's list the main registers:

- Income accounting for personal income tax calculation - this register stores data on income received by employees for personal income tax accounting purposes.

- Calculations of taxpayers with the budget for personal income tax - the register contains information about the calculated tax (records with the type Income ) and withheld tax (records with the type Expense ).

- Calculations of tax agents with the budget for personal income tax - this register collects information about withheld personal income tax for transfer to the budget (records with the type Income ) and the transferred tax (records with the type Expense ).

- Provided standard and social deductions (NDFL) - contains information about the provided deductions.

You can view register records directly by opening the register through the Main menu – All functions – Accumulation registers, then select the desired register.

You can view the movements of a specific document by register directly from the form of this document. To do this, open the document and go to the menu Main menu - View - Setting up the form navigation panel. The Navigation Panel Settings window will open :

On the left side of the form there are Available Commands - a list of all registers in which the document can move. On the right side, Selected commands is a list displayed in the document navigation panel (by default, this list is empty and is not displayed in the panel). You can move commands between lists using the buttons located between them, or simply by double-clicking on the name of the register.

If the Selected Commands the Navigation Pane becomes available at the top of the document .

By clicking on the link with the name of the register, you can see the movement of the document in this register:

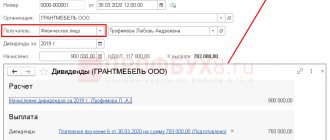

Purchasing works and services from an individual

Another situation that may arise is the purchase of work or services (for example, rental of non-residential premises) by an organization from an individual. By virtue of Art. 226 of the Tax Code of the Russian Federation, in this case, the organization is obliged to withhold personal income tax from the amount of payments, pay it to the budget, and transfer the amount to the seller minus personal income tax at a rate of 13% (with the exception of income listed in Article 217 of the Tax Code of the Russian Federation).

In this case, the following transactions are made:

Dt 20 (26, 44) Kt 76 “F. AND ABOUT." (60) - services and work were purchased from an individual.

Dt 76 "F. AND ABOUT." (60) Kt 68 “Personal Income Tax” - personal income tax is accrued (withheld).

Dt 68 “Personal Income Tax” Kt 51 - Personal income tax is transferred to the budget.

Dt 76 "F. AND ABOUT." (60) Kt 51 - the amount for services and work to an individual is transferred minus personal income tax.

The main thing to remember is that personal income tax is taken from the income of a specific individual, and no matter what account is used when calculating it, it is necessary to conduct analytics on it for each individual from whose income personal income tax was withheld. It should also be remembered that tax-free income of an individual is established by law - all of them are listed in Art. 217 Tax Code of the Russian Federation.

Read more about non-taxable income in the article “Income not subject to personal income tax (2019 – 2021)”.

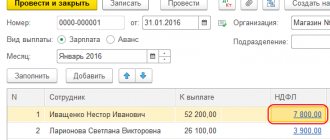

Withholding personal income tax

Withholding of personal income tax in the ZUP 3.1 program is carried out when paying income using the documents Statement: Statement to the bank , Statement to the cashier , Statement to accounts and Statement through the distributor .

The amounts of withheld personal income tax are reflected in the personal income tax column for transfer :

Personal income tax for transfer is filled in with the amounts of calculated but not yet withheld personal income tax according to the documents on which the payment is made.

By clicking the Change tax in the header of the tabular section, you can view details about the withheld personal income tax: Date of receipt of income , Rate , Basis document , etc.

You can also open this form by double-clicking on the personal income tax amount column.

If the amount of income paid is adjusted, for example, with a partial release of accrued amounts, then an amount of tax must be withheld in proportion to the amount of income paid. After adjusting the amounts in the To be paid , click the Update tax .

When paying wages for January 2021, Romashka LLC did not have enough funds to pay wages in full. It was decided to pay 50% of the salary. It is necessary to reflect in the ZUP the payment of 50% of wages, as well as the withholding of personal income tax in proportion to the amounts paid.

We will manually adjust the amounts in the To be paid . At the same time, it is advisable to make adjustments within the breakdown of the amount to be paid according to the supporting documents. The transcript opens by clicking the Change salary or by clicking on the cell to the right of the amount.

Let's adjust the amount in the line where Document basis is Payroll and contributions :

We will similarly adjust the amounts for other employees. column for transfer will not be automatically recalculated.

In order for personal income tax amounts to be recalculated, you must click the Update tax . Update tax button updates the tax only for the selected document lines. To update the tax on all lines of the document at once, you can select all lines using the key combination < Ctrl + A >, and then click the Update tax .

How to calculate personal income tax under an employment contract (formula)

The main type of income for which an organization becomes a tax agent for personal income tax is accruals under an employment contract.

As a rule, such payments are: wages, bonuses of various types, allowances, compensation in excess of the norm related to the employment contract.

In what cases are bonuses not subject to personal income tax, read the article “Are bonuses subject to personal income tax?”

From all these payments, minus the deductions provided (Articles 218, 219, 220 of the Tax Code of the Russian Federation), tax is withheld: monthly in the amount of 13% for residents and 30% for non-residents, except for those listed in Art. 227.1 Tax Code of the Russian Federation.

The formula for calculating personal income tax is as follows:

Personal income tax = (Dex – Deductible) × St,

Where:

- Personal income tax - the amount of tax to be withheld;

- Doh - the amount of employee income for the month, including bonuses, allowances, etc.;

- Deduction - the amount of deductions (children's, property, social) provided at the request of the employee;

- St - tax rate (13% for residents, 30% for non-residents).

Postings are made:

The article “Calculation of personal income tax (personal income tax): procedure and formula” can also help you calculate personal income tax.

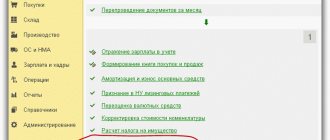

Analytical and regulated reporting on personal income tax

Tax accounting register for personal income tax

Maintaining tax registers for personal income tax is the responsibility of organizations as tax agents. The tax accounting register for personal income tax can be viewed and printed from the section Taxes and contributions – Reports on taxes and contributions – Tax accounting register for personal income tax:

You can also create a Tax Accounting Register for Personal Income Tax directly from the employee’s card using the Print button – Tax Accounting Register for Personal Income Tax :

Analytical reports on personal income tax

From the Taxes and Contributions – Reports on Taxes and Contributions section, you can generate various analytical reports on personal income tax:

- Personal income tax analysis by month;

- Analysis of personal income tax by date of receipt of income;

- Analysis of personal income tax based on documents;

- Analysis of personal income tax by month of the tax period and months of mutual settlements with employees;

- “Summary” certificate 2-NDFL;

- Detailed analysis of personal income tax for an employee.

These reports are convenient to use to check the correctness of personal income tax calculations and fill out regulated reporting.

2-NDFL for employees

A 2-NDFL certificate, which is issued to the employee upon request, can be generated from the section Taxes and contributions - 2-NDFL for employees.

The printed form of the certificate is approved by Order of the Federal Tax Service of the Russian Federation dated October 2, 2018 N ММВ-7-11/ [email protected] :

Regulated report 2-NDFL for transmission to the Federal Tax Service

2-NDFL reporting for transmission to the tax authority can be generated from the Taxes and contributions - 2-NDFL section for transmission to the Federal Tax Service, or from the Reporting, certificates section - 1C-Reporting.

By clicking the Print , you can print printed forms of certificates for transfer to the Federal Tax Service ( Certificate of Income (2-NDFL) ), certificates for issuance to employees ( Certificate of Income for Employees (2-NDFL) ), as well as various forms of Registers .

By clicking the Upload , you can upload an electronic representation of the report in xml for electronic transmission.

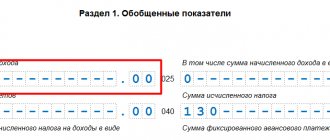

Regulated report 6-NDFL

The regulated 6-NDFL report is generated from section 1C-Reporting. find the report when displaying the By category the Reporting by individuals group :

The report is submitted quarterly and consists of a title page and two sections:

- Section 1 is filled in with a cumulative total from the beginning of the year. It contains information about accrued income, the amount of tax deductions, and calculated taxes broken down by tax rates. There is also data on tax withheld, not withheld and returned.

- Section 2 contains information about withheld tax and deadlines for its transfer based on quarterly results.

The section consists of blocks of lines 100-140, which are filled in according to payments. Payments for which all three dates coincide are combined into one block:

- date of receipt of income - page 100

- tax withholding date (also known as payment date) - page 110

- deadline for transferring tax to the budget - page 120

In Section 2, blocks are included according to the transfer period (p. 120). This means that the report should include only those payments for which the tax payment deadline falls within the reporting period.

See also:

- Revolution in personal income tax calculation (ZUP 3.1.8)

- Revolution in calculating personal income tax (ZUP 3.1.8) (from the broadcast recording dated November 1, 2021)

- Personal income tax to be offset against future payments in 1C 8.3

- Transfer of personal income tax to the budget in ZUP 3.1 - step-by-step instructions

- How to correct personal income tax (from the recording of the broadcast on April 2, 2019)

- The most important thing about personal income tax on bonuses (from the recording of the online seminar dated June 14, 2021)

If you are a subscriber to the BukhExpert8: Rubricator 1C ZUP system, then watch

Account 68 in accounting

Tax liabilities based on the results of economic activity are calculated using account 68. Each type of tax that an organization must transfer has its own subaccount.

According to the methods of calculation, the following types of taxes are distinguished:

- Property. They are paid for the ownership of any object - transport, land, property on the organization’s balance sheet. Taxes are calculated based on the value of the taxable base and do not depend on the results of the company’s activities.

- Indirect taxes are included in the cost of goods or services provided (VAT, excise taxes, customs duties). The final payer is considered to be the direct consumer.

- Taxes based on the results of economic activity. Calculated based on the profit received.

The credit of account 68 shows the accrued amounts that must be transferred to the budget. The data must coincide with the results of tax reporting - declarations, calculations. Debit 68 of account shows transactions to pay off debt or reduce the amount of tax liabilities.