Online cash registers - what is it?

At its core, an online cash register is a special device with the help of which information about the receipt of cash proceeds is recorded on fiscal media, as well as with access to the Internet.

In order to transfer information about punched checks to a special website. The business entity itself, the tax authorities, and the buyer or customer have access to it.

Therefore, enterprises and individual entrepreneurs must necessarily draw up agreements with the fiscal data operator (FDO), which professionally stores information from online cash registers and, if necessary, transfers the information it has to the tax authorities.

Like the previous generation of cash registers, the online cash register has a serial number located on the outer body of the machine, a means for printing control receipts (except for some online cash registers intended for trading via the Internet), and a clock mechanism for recording the time of the transaction.

The main purpose of introducing new cash registers was to establish complete control by the Federal Tax Service over all income received by taxpayers to verify the correctness of calculation of mandatory payments to the budget.

Legislation requires that an online cash register receipt contain a number of mandatory elements:

- First of all, these include the name of the product (service, work).

- Quantitative measurement.

- Price and purchase amount.

- There is also a QR code with which you can check the validity of the check on the tax website.

Attention!

The buyer may also ask to receive a copy of the receipt electronically via email. This is the main difference between online cash registers and previous generation machines. In connection with these, the use of old cash registers is prohibited from the second half of 2021, and registration is not carried out after January 2021.

Business entities can modernize old cash registers by installing special devices for connecting to the Internet. However, it must be taken into account that not all devices can undergo modernization, and its cost may not be much less than a new cash register.

See How to register an online cash register with the Federal Tax Service and the OFD.

Fiscal operator

In order to transfer information about transactions carried out through online cash registers to the Federal Tax Service, you must enter into an agreement with an accredited fiscal data operator (Article 4.6 of Law No. 54-FZ). These are organizations located on the territory of the Russian Federation and received permission to process fiscal information. The decision to issue or cancel a permit for an operator’s activities is made by the tax service (Articles 4.4., 4.5 of Law 54-FZ).

The Federal Tax Service website maintains ]]>a register of fiscal data operators]]>, where all accredited organizations are listed.

For each punched check, the online cash register generates a fiscal attribute, which is sent to the fiscal operator, where it is stored, in return the seller receives a unique check number, and all information about the completed sale is sent to the Federal Tax Service. In fact, the fiscal operator is an intermediary between the online cash register and the Federal Tax Service.

Who should use online cash registers from 2017

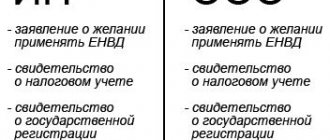

From 2021, new cash register machines could be used by any business entity on a voluntary basis. The new law determines who uses online cash registers from 2021. The deadlines for the transition of existing companies, as well as for new companies - when opening an LLC or registering an individual entrepreneur - have been agreed upon.

The rules established a transition period during which companies and individual entrepreneurs could switch to the new rules gradually. During this period, it was possible to use EKLZ, but registering cash registers with them and renewing their validity was already prohibited.

From the second half of the year, all taxpayers under the general and simplified taxation systems must use only online cash registers when accounting for cash income. This is primarily due to the fact that they keep records of actual income for tax purposes.

Attention! New changes in legislation have determined the obligation of alcohol sellers to purchase new devices from March 31, 2017. The same law first determined the obligation to install online cash registers for individual entrepreneurs on UTII and for companies on UTII. However, in a subsequent clarification, the deadlines for holders and applicators of the patent were postponed.

Do I need a cash register for individual entrepreneurs and who can work without it?

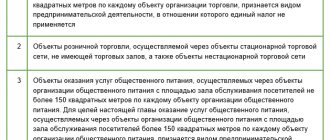

The list of those who are allowed to work without a cash register is given in Article 2 of Article 54-FZ. Here are some examples of when you can skip the checkout.

- If an entrepreneur cooperates only with an individual entrepreneur or LLC, and receives money to a current account or through a bank. Or if an entrepreneur sells retail, but the client pays directly through the bank.

- Sale of newspapers, securities and travel passes.

- Sale of non-alcoholic drinks on tap, as well as milk, kvass and butter from barrels.

- Trading at markets, fairs, exhibitions, as well as trading from carts, trays or baskets. But a cash register is still needed when selling some goods, for example, clothing, leather or furniture.

- Some services: shoe repair, canteens in educational institutions, nannies and caregivers.

- Individual entrepreneurs do not need an online cash register when renting out their home.

Exceptions do not apply to sellers of excisable goods: alcohol, cigarettes, precious metals.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Who should switch to the new CCP from 2018

From the 2nd half of 2021, an online cash register will become necessary for individual entrepreneurs on a patent and entities that use the imputed taxation system. This category of business entities is currently exempt from using online cash registers, due to the fact that their taxation is not based on actual income. Therefore, the regulatory authorities have given them some relief for now.

But from the 2nd half of 2021, all business entities will have to use online cash registers, not only those who are on the simplified taxation system and the general OSNO taxation system.

Attention, changes! On November 22, 2021, amendments were made to the law according to which the need to use cash registers for these categories of business is postponed from July 1, 2021 to July 1, 2019. Those. The obligation to install online cash registers was delayed for a year.

New fines

The Federal Tax Service will fine for violations of the new rules. Collections will begin on February 1, 2021. Amount of penalties: from 3,000 rubles, up to a trade ban.

| Use of CCP that does not meet the requirements | For individual entrepreneurs: 3,000 rubles For LLCs: 10,000 rubles |

| Work without an online cash register | For individual entrepreneurs: 25-50% of sales, no less than 10,000 rubles For LLCs: 75-100% of sales, no less than 30,000 rubles |

| If the buyer is not sent a receipt upon request | From 10,000 rubles |

The procedure for registering an administrative violation has become simpler. In some cases, for the first violation, a verbal warning is possible, but for a repeated violation, trade is suspended for up to 3 months, and this is actually death for the store.

To avoid problems, comply with all requirements of the new legislation.

In what case can you not use online cash registers?

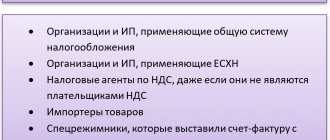

The legislation defines a list of companies and entrepreneurs who, even from the 2nd half of 2021, have the right not to use online cash registers.

These include:

- Entities involved in the sale of goods from vehicles.

- Entities involved in the sale of goods in unorganized and unequipped markets and fairs.

- Selling goods from tank trucks.

- Selling magazines and newspapers at kiosks.

- Selling ice cream and drinks in unequipped kiosks.

- Subjects repairing shoes.

- Entities that repair and manufacture keys, etc.

- Renting premises owned by individual entrepreneurs.

- Pharmacy points located in rural clinics and paramedic stations.

- Enterprises and individual entrepreneurs whose economic activities are carried out in remote areas and localities. The list of such territories is determined by federal legislation.

You might be interested in:

Advance report: what can be taken into account, sample filling, main transactions

It is important to understand that if a taxpayer carries out activities only using non-cash payments, that is, he does not have cash proceeds, he does not need to use an online cash register.

Attention! It is also allowed not to install online cash registers for credit institutions, enterprises on the securities market engaged in public catering in kindergartens, schools, and other institutions and educational institutions.

The new devices can be used on a voluntary basis by religious organizations, postage stamp sellers, as well as persons selling handicrafts.

Example: choose a cash register for a hairdresser

Or in other words: you have several hairdressing salons around the city. Naturally, you do not sell any alcohol and do not intend to. You collect information about clients into a common CRM system. There is a computer specialist on staff who sets up this system and helps solve other technical problems.

In this case, a budget kit is enough for you: KKT Wiki Print 57 F and the Wiki Micro system unit. Your technician will find all the necessary instructions in the support section of Dreamkas and the OFD that you choose.

If you do not have an ordinary hairdressing salon, but a premium salon, then the Wiki Classic and Wiki Print 80 Plus F set is more suitable for you - it does not differ much in function from budget cash registers, but its design is designed specifically for boutiques, salons and expensive cafes.

Benefits when using new cash registers

Legislative bodies are currently considering a draft act, according to which entities using UTII and PSN will be able to receive a tax deduction in the amount of 18,000 rubles if they purchase a cash register with an Internet connection and use it.

This tax reduction can be made upon the purchase of each new device. It is assumed that the date of purchase of the online cash register should be no earlier than 2021.

The draft provides for the possibility of transferring unused deductions, in whole or in part, to subsequent tax periods.

Important! There is a limitation according to which the deduction can only be used once for a given car. Therefore, the transition from UTII to PSN and back will not allow you to use this benefit a second time.

Currently, dissatisfaction among subjects on the simplified tax system is growing, as they also want to receive this benefit. However, until now the rules establishing the possibility of using benefits when purchasing online cash registers remain only drafts.

Changes made to the content of sales receipts and BSO

The CCP Law 2021 introduced a number of changes to the content of sales receipts and strict reporting forms. The list of required details includes the following information:

- the tax regime applied by the seller;

- OFD website address;

- payment type – incoming or outgoing transaction;

- calculation of the amount including VAT;

- payment option - cash or non-cash;

- information about the serial number that the fiscal drive has;

- information about the purchase - when (date and time) and where (address of the outlet) was made;

- name of the purchased goods;

- phone number or email address of the seller (when issuing an electronic check).

Cost of switching to new cash registers

The law requires the use of devices that send data to the Federal Tax Service. It is now prohibited to use old cash registers with ECLZ. Before the beginning of the 2nd half of 2021, all entities were required to either purchase new devices or carry out the modernization procedure.

In the second case, equipment manufacturers have released kits that allow you to convert the device from using ECLZ to installing a fiscal drive. The price of the modernization kit, based on the cash register model, varies from 7 to 16 thousand rubles.

The modernization process usually includes the installation of a fiscal storage device and equipment for connecting to the Internet. When choosing this approach, it is necessary to analyze how many products will be in the product range, as well as what the number of operations will be.

If a significant amount of these indicators is expected, then it is more advisable to purchase a new cash register designed to work with a large list of goods.

| Device brand | Area of use | Estimated price |

| "Atol 30F" | It is best used in small organizations, with a small number of goods and customers | RUB 20,200 |

| "Viki Print 57 F" | Recommended for small retail outlets. Can work with the EGAIS system | 20300 rub. |

| "Atol 11F" | This device is best used in small organizations with a small number of customers. Maintains connection with the EGAIS system. | 24200 rub. |

| "Viki Print 80 Plus F" | The cash register for medium and large retail outlets has a large number of additional functions - for example, it can automatically cut off receipts. Supports work with the EGAIS system. | 32000 rub. |

| "Atol 55F" | A cash register with many additional functions - it can cut receipts, it can be connected to a cash drawer, etc. It is recommended for use in large outlets with a large daily turnover. Can work with the EGAIS system. | RUR 30,700 |

| "Atol FPrint-22PTK" | Cash register with many additional functions. For medium and large stores. Supports work with EGAIS. | 32900 rub. |

| "Atol 90F" | You can connect a battery to this device, which will allow you to operate autonomously for up to 20 hours. The cash register can be used for delivery trade. Supports work with EGAIS. | 18000 rub. |

| "Evotor ST2F" | The device is recommended for use in small shops, catering establishments, hairdressing salons, etc. It is equipped with a touch screen, an Android system, and a program for maintaining inventory records. | 28000 rub. |

| "SHTRIX-ON-LINE" | Recommended for small stores with a limited number of products. | 22000 rub. |

| "SHTRIKH-M-01F" | Recommended for large stores, has a large number of additional functions, and can be connected to a point-of-sale terminal. | 30400 rub. |

| "KKM Elwes-MF" | Recommended for small retail outlets. Thanks to the presence of a battery, it can be used for remote and delivery trade. | 19900 rub. |

| "ATOL 42 FS" | Cash register for online stores without a mechanism for printing paper receipts | 19000 rub. |

| "ModuleKassa" | A device that supports both full integration with an online store and the ability to punch simple checks. The device has a display, a battery with up to 24 hours of operation, and an Android system. | 28500 rub. |

| "Dreamkas-F" | A device that can be connected to an online store and also used to punch simple checks. It is possible to connect a terminal for card payments, a scanner, and a cash drawer. | 20,000 rub. |

Cash desk service procedure

The new act on cash registers abolished the obligation to periodically check and service new devices in specialized workshops.

After purchasing an online cash register, the owner himself makes the decision to call a specialist for the purpose of carrying out preventive maintenance or carrying out repairs. It is expected that such functions will continue to be performed by maintenance centers.

Also, the new law abolished the obligation for centers to register with the Federal Tax Service when performing repair or maintenance work on cash registers. It is planned that thanks to this, new specialists and companies will come to the industry.

Due to the abolition of mandatory maintenance, CCP owners now have the opportunity to choose:

- Sign a long-term contract with the service center;

- Involve center specialists only if a cash register malfunction occurs;

- Hire craftsmen who do not work in cash register service centers, but have all the necessary knowledge to repair a cash register;

- If the company has a lot of new devices, then you can add a separate specialist to your staff who will repair and maintain cash registers.

You might be interested in:

Online cash register for an online store: which one to choose and how to work with them

How do online cash register systems work?

The new law establishes the following operating principle of cash register equipment:

- You buy a cash register or upgrade an existing one. The main difference from old cash registers is the presence of a memory block in it, which is called a fiscal drive. It is encrypted and data about all operations carried out through this device is recorded on it. The second difference is the interface for transmitting information over the Internet.

- Each operation involving the issuance of a check (whether electronic or paper) will be recorded in the memory of the fiscal drive and sent through the network to fiscal data operators (FDO), who check the correctness of the data and confirm their receipt, returning transaction accounting data for the buyer and the check. If there is no connection to the network, then only a memory entry is made, and online checks are carried out when the connection is restored.

- Next, the OFD transmits the data directly to the tax office, which records transactions in an automated mode.

- The buyer can check at any time whether a tax transaction has been registered and carried out using a unique transaction number or QR code. If there is no transaction, then a complaint can be filed with the Federal Tax Service.

Features of cash discipline

Before the introduction of online cash registers, the cashier was responsible for preparing documents KM-1 - KM-9, including:

- Certificate of return of funds to the buyer (KM-3);

- Magazine for cashier-operator (KM-4).

Now reports similar to these are generated automatically thanks to the transfer of information to the Federal Tax Service. Therefore, the use of such forms is not necessary. However, organizations and entrepreneurs can apply them on their own initiative, indicating this in internal administrative local acts.

Another key document when using previous generation devices was the Z-report. It had to be removed at the end of the working day, and based on its data, entries should be made in the cashier’s journal.

Attention! Now the Z-report has been replaced by another document - the “Shift Closing Report”, which is generated at the end of the working day, or with the transfer of a shift from one cashier to another.

Its main feature is that, like checks, it is also automatically sent to the Federal Tax Service. At the same time, the new report includes all information about the movement of money during the day: payments in cash, cards, returns for each type of payment, partial prepayment, etc.

How much is it?

The minimum cost of the new procedure for using cash registers will be no more than 25 thousand rubles. It includes the purchase of a new cash register with a fiscal drive with a fiscal key key validity period of at least 36 months, services of a fiscal data operator and services of a telecom operator.

Annual costs in the next two years may amount to no more than 4 thousand rubles, including the services of a fiscal data operator and telecom operator services.

According to the estimates of cash register manufacturers, the cost of modernizing a cash register currently used will be about 4-6 thousand rubles.

The costs of purchasing a cash register (up to 18,000 rubles per cash register) can be taken into account in expenses, including when applying the simplified tax system.

Features of using online cash registers for online stores

The main reason why online cash registers were introduced is to control the functioning of online stores.

Until this moment, entrepreneurs opened websites for the sale of goods and services, and accepted payments by electronic money. Entering online wallets, such income was difficult to track and oblige taxpayers to pay tax on it.

Now an online store is required to use a cash register when selling any type of goods. An online cash register for an online store must send the purchase receipt to the client by email exactly on time after receipt of payment.

Attention! There is one exception to this rule - if payment is made by receipt or invoice and goes directly to the bank account of a company or entrepreneur, there is no need to use a new cash register to record this sale.

The Federal Tax Service also clarified by its order that the deferment for entrepreneurs and companies applying imputation or a patent also applies to online stores. This means that if a business entity by law has the right not to use a new type of cash register now, but is obliged to do so only from the 2nd quarter of 2018, this also applies to online commerce.

The obligation to use an online cash register, as well as send a check by email, applies not only to payments by bank cards, but also to all types of electronic money.

For a device that is used in online stores, there is one feature - if payment is made electronically, then there is no need to issue a paper check, you only need to send an electronic one. Until recently, only one device of this kind was offered - ATOL 42 FS.

Now manufacturers of cash register equipment are moving in several directions:

- An attempt to integrate existing online cash registers with websites using third-party programs. There are currently few such solutions;

- Specialized cash registers for Bitrix – connect to the server on which the online store is hosted;

- Devices capable of both punching checks when accepting cash and working with an online store only in electronic format.

Attention! The check that the cash desk sends to the online buyer is no different from a simple check and contains all the same details. If a store delivers goods by courier and receives payment in cash, it must have a portable cash register with it in order to immediately punch the receipt. In such a situation, it is beneficial to have a machine that can handle both paper checks and online payments.

Registration of CCP

One of the advantages of introducing online cash registers is the simplification of the procedure for registering them with the Federal Tax Service. An application for registration or re-registration of cash register machines can now be submitted not only on paper, but also electronically without visiting the inspection office (Article 4.2 of Law No. 54-FZ).

Online registration of cash registers is carried out on the Federal Tax Service website in the taxpayer’s personal account in the “Cash register equipment” section. To do this you need:

- fill out a special form and send an application to the Federal Tax Service,

- after checking the received data, the Federal Tax Service will assign a registration number to the online cash register, which should be entered into the fiscal drive along with information about the organization or individual entrepreneur, and generate a registration report at the cash desk,

- complete the registration of the cash register by adding data from the registration report to your personal account.

If everything is done correctly, the registration date and expiration date of the fiscal drive will appear in your personal account.