Selecting a period for calculating the average salary

The Labor Code of the Russian Federation establishes a period of 12 months for determining average earnings. This is the most objective calculation method, taking into account the fact that unworked time, for example, business trips, is subtracted from the period. For some workers, wages fluctuate greatly throughout the year. This is especially true for the piecework form of payment and additional bonus payments to the salary.

In cases where an employee receives wages every month in equal parts, to simplify the calculation, the company has the right to establish a shorter billing period: 3, 6 months, or any other. The main condition is the absence of a negative impact of changes on employees.

DAM for the 4th quarter: new report form

The government changed the current DAM form in the 4th quarter of 2021. The Federal Tax Service approved a new form for calculating insurance premiums, the procedure for filling it out and the electronic format (Federal Tax Service order No. ED-7-11 dated October 15, 2020 / [email protected] ). The amended form must be used for the first time when submitting the DAM for 2021. Please note that Appendix 5.1 of Section 1 applies starting from the reporting period, the first quarter of 2021. Individual entrepreneurs and companies with more than 10 people provide the report electronically. The rest have the right to submit a paper version of the Calculation of Insurance Premiums for the 4th quarter of 2020. The form relevant for submitting a report to the Federal Tax Service for 2021 can be downloaded below.

The DAM for the 4th quarter of 2020 must be submitted to the tax office no later than February 1, 2021, since January 30 and 31 are days off.

Rules for determining the billing period for calculating the average salary

According to labor legislation, the recommended and maximum pay period is a year (for the purpose of determining the average salary). But this does not mean that all 365–366 days will be included in the calculation. During calculations, only days actually worked are taken into account. It is recommended to exclude from the calculation:

- The periods during which the employee received average wages. Hence, breaks to feed the baby should be excluded.

- Time of incapacity for work on sick leave.

- Maternity leave.

- Duration of unpaid leave.

- Paid days off provided additionally to care for disabled children.

- Periods of downtime due to the fault of the employer.

- The time of a strike in which the employee did not take part, but could not work because of it.

- Other periods provided for by the legislation of the Russian Federation.

Having excluded such periods from the total duration of the period of time under consideration, the accountant can begin to calculate the average salary.

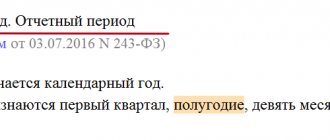

Reflection of the period in 4-FSS

Belonging to a specific reporting period in 4-FSS is indicated using a code in a special field on the title page. This code, combined with the number next to it corresponding to the year of reporting, allows you to unambiguously determine the period of time covered by the report.

The period codes for 4-FSS are as follows (clause 5.4 of Appendix No. 2 to Order No. 381):

- 03 - first quarter;

- 06 - half a year;

- 09 - 9 months;

- 12 - year.

The field intended for them is formed by four cells, divided into pairs by a slash. Of these two pairs, only the first pair should be used to indicate the period code (clause 5.4 of Appendix No. 2 to Order No. 381). The second is used to indicate the serial numbers of reports submitted to the Social Insurance Fund in order to reimburse funds spent by the policyholder from there, and the cells of the first pair in this case remain empty.

An example of determining the period for calculating the average salary

Consider a situation in which it is necessary to calculate the average salary for the past 12-month period:

The employee went on a business trip on February 14, 2021. For this period, the company paid him an average salary. To calculate the value, it is necessary to consider the period from 1.01. until 31.12. last year, 2015. The employee was not at the workplace all the time:

- from April 12 to April 23, 2015 – on a business trip;

- from July 5 to July 25, 2015 – was on unpaid leave;

- from November 20 to November 28, 2015 – was incapacitated for work on sick leave.

Based on these data, the accountant determined the billing period:

- from January 1 to April 11;

- from April 24 to July 4;

- from July 26 to November 19;

- from November 29 to December 31.

According to the working time schedule, weekends will be excluded from the total number of days.

The legislative framework

| Legislative act | Content |

| Article 139 of the Labor Code of the Russian Federation | "Calculation of average wages" |

| Decree of the Government of the Russian Federation No. 922 of December 24, 2007 | “On the peculiarities of the procedure for calculating average wages” |

| Article 75 of the Labor Code of the Russian Federation | “Labor relations when changing the owner of the organization’s property, changing the jurisdiction of the organization, its reorganization, etc.” |

| Article 114 of the Labor Code of the Russian Federation | "Annual paid holidays" |

Calculation period for vacation: rules for determining

The length of the period for which the number of days of paid leave is calculated depends on the duration of the employee’s work at the enterprise. But in general, it cannot last more than 12 months. Regardless of which half of the year the employee goes on vacation, the period will consist of one year. In this case, it begins from the first day of the calendar month of the start of the holiday until the last date of the 12th month. For example, an employee was on legal vacation from 12/28/15 to 01/15/16. The billing period for vacation will be determined in the interval from 12/1/14 to 30/11. 15.

In cases where the employee actually worked less than a year, the calculated period is considered to be from the first working day until the last day of the month preceding the vacation. For example, an employee was hired on August 1, 2015, and his vacation falls on December 27–14.01. In this case, the billing period is the time from 1.08. until November 30, 2015.

The Labor Code of the Russian Federation provides the opportunity to set the terms on the basis of which vacation payments are calculated independently. A prerequisite is to indicate the period in the personal or collective employment contract.

The billing month under the contract is

3.1.21 billing period

calculation period: The period of time considered when performing calculations.

Note - A calculation period can be divided into a number of calculation calculation steps.

5. Billing period

— the expected period of provision of residential premises under a social tenancy agreement to persons registered as needing improved housing conditions or the provision of residential premises, for which the income of the citizen and his family members is calculated when calculating their total income.

See also related terms:

3.14 billing period of the year:

The most unfavorable period of the year for road pavement (usually spring), when, due to decompaction during thawing and waterlogging of the subgrade soil, the road pavement operates with maximum deflections.

45 estimated gas supply period:

The period agreed upon by the parties to the gas supply agreement, for which the volume of gas supplied must be determined, mutual settlements must be made between the supplier, the gas distribution organization and the gas consumer for the supplied gas and its transportation.

Dictionary-reference book of terms of normative and technical documentation. academic.ru. 2015.

See what “Billing period” is in other dictionaries:

settlement period - The period during which the calculation is carried out. Note The calculation period can be divided into a number of calculation steps, into a number of calculation intervals. [GOST R 54860 2011] billing period The period agreed upon by the parties to the contract for which ... ... Technical Translator's Directory

“billing period” - the period for which gas consumption must be determined and mutual settlements made between the supplier, gas distribution organization and consumer for the supplied gas. The billing period agreed upon by the parties is indicated in the contract; Source... Dictionary-reference book of terms of normative and technical documentation

Settlement period is the time allocated for the purchase and sale of securities on the stock exchange. In English: Account period See also: Exchange stock transactions Financial Dictionary Finam ... Financial Dictionary

SETTLEMENT PERIOD - the loan repayment period, calculated from the date of the first to the date of the last payment to repay the loan ... Foreign Economic Explanatory Dictionary

Billing period is the period of time established by the contract for which the consumed electrical energy and power must be taken into account and fully paid by the payer. Methodological recommendations for regulating relations between the energy supply organization and... ... Commercial electric power industry. Dictionary-reference book

The billing period for gas supplies is the billing period agreed upon by the parties to the contract, the period for which the volume of gas supplied must be determined, mutual settlements must be made between the supplier, gas transportation, gas distribution organizations and the buyer for the supplied... ... Official terminology

Accrual of vacation payments in days

After determining total earnings, to calculate vacation pay, you should calculate the average daily wage. If the employee has worked in full for the last 12 months, without deductions for the days of the pay period, then the calculation is made using the formula: SD.z. = Salary : 12 : 29.3.

Where:

- Salary – the total amount of earnings for the entire period;

- 29.3 – average number of days in one month;

- 12 – value of the billing period in months (in this case the year is set).

Let's consider an example of calculating average daily earnings for calculating vacation payments: from March 14 to April 27, 2021, accountant X will be granted annual paid leave. For the calculation, the period from 03/01/15 to 02/29/16 is used, which is fully worked out, without deductions. X receives a monthly fixed salary of 18 thousand rubles. Calculate average daily earnings.

Let's do the calculations:

- The total salary for the year will be: 18,000 × 12 = 216,000 rubles.

- The average daily wage will be determined at: 216,000: 12: 29.3 = 614.33 rubles.

- In total, for 14 days of vacation, the company must pay the amount: 614.33 × 14 = 8600.62 rubles.

Accrual of vacation pay for periods not fully worked

When determining the period of work for which an employee is granted paid rest, the following time is not taken into account:

- receiving average earnings;

- illness, maternity leave;

- unpaid leave;

- additional days off to care for a disabled child;

- downtime due to the fault of the enterprise;

- other cases provided for by law.

When subtracting the listed periods, it turns out that the employee did not work the entire period calculated for vacation, but only part of it. This results in an incomplete rest time that needs to be determined.

To find how many calendar days of the pay period the employee is due for vacation, you need to perform several mathematical operations:

1. Calculate the number of days worked in a part-time working month: Td. = 29.3 : Td.m. × Tot.d., where:

- Td.m. – number of calendar days of the month;

- That.d. – number of days actually worked.

2. Determine the amount of average daily earnings using the formula: SD. = Z: (29.3 × Tm. + Td.), where:

- Z – total amount of earnings accrued for the period;

- Tm. – number of fully worked months;

- etc. – the number of days worked in a part-time working month (see clause 1).

If there are several incomplete months in one period, the calculation should be made separately for each of them, and then the results should be summed up.

How to use a card with a grace period

To use a credit limit without interest, you need to understand how this scheme works. For a card with an approximate limit of 50,000 rubles and a grace period of 50 days, only 30 of them constitute the billing period. The remaining 20 days are called the payment period. You can spend your credit limit without interest for 30 days, and pay off your debt in 20 days. You can do this in the following ways:

- make the minimum required payment. At the end of the payment period, interest is accrued on the debt amount from the first day of lending;

- pay off the debt in full. This is called preferential terms, in this case there is no need to pay interest, it is not charged.

If a customer fails to make even the minimum payment, a late fee will be added to their interest after the end of the payment period. In addition, the bank can send data about the overdue payment to the credit history bureau.

If you deposit money on time, a new interest-free period opens for the remaining credit card limit. Not all credit cards offer repeated interest-free periods; you need to clarify this point when concluding a loan agreement with the bank. Some banks provide a new interest-free period only after full repayment of the previous debt.

An example of calculating average daily earnings for an incomplete period

Consider the situation: an employee will be granted paid leave from June 15, 2021. The monthly billing period for payments is from 06/1/15 to 05/31/16, this time was not fully worked: from February 18 to 25, the employee was sick. In addition to sick leave payments, the employee is due a salary totaling 240 thousand rubles.

Let's make the calculation:

- Number of days for fully worked months: 11 × 29.3 = 322, for February: 29.3: 29 × 21 = 21.

- In total, the following will be used to calculate vacation pay: 322 + 21 = 343 days.

- Average daily earnings will be: 240,000: 343 = 699.7 rubles.

Calculation period of sick leave benefits

An officially employed employee has the right to receive financial compensation for a period of illness if the fact is confirmed by a doctor and sick leave is provided. The period for calculating the amount of payment is considered to be 2 years. The amount is calculated based on total earnings for the period by multiplying it by the compensation coefficient and the number of days of disability. The resulting number is divided into 730–732 days.

When making payments to employees, it is extremely important to correctly determine the period for which payments are due to an individual. The established time limits directly affect the average salary and many other social benefits and compensations.

Reporting rules according to Form 4-FSS

The 4-FSS report is devoted to contributions for injuries.

In 2020-2021, it is drawn up in the form approved by Order No. 381 of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016. The same order also contains the rules applied when filling out the report. In addition to the title page, 4-FSS includes sections reflecting:

- parameters of the main indicators influencing the calculation of contributions (Table 1);

- calculation data provided by another policyholder (Table 1.1);

- status of settlements with the fund for the period (table 2);

- information on expenses incurred from the fund (Table 3);

- information about insured events (Table 4);

- data on special assessments of working conditions and medical examinations (Table 5).

It is not necessary to fill out all the tables, but for them (except for Table 5, which contains information as of the beginning of the year), the cumulative total rule applies, which corresponds to a similar principle applied when calculating the amount of contributions (Clause 9, Article 22.1 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ).

The need to include data on the expenditure of FSS funds in the report is caused by the fact that the policyholder makes such expenses from his own funds (clause 7, article 15 of law No. 125-FZ) and this gives him the right then (clauses 7, 8 of article 22.1 of law no. 125-FZ):

- by the amount of these expenses, reduce the amount of contributions payable;

- offset the resulting overpayment against future payments;

- return from the fund the amount of expenses not covered by contributions.

Taking into account the amounts of funds spent by the policyholder, Table 2 is filled out in the report, which allows you to see the status of settlements with the fund for contributions over time and taking into account the data affecting the final amounts.

You can see samples of filling out Form 4-FSS for different reporting periods, as well as a line-by-line algorithm for filling out a report in ConsultantPlus. If you do not have access to this legal system, a full access trial is available for free online.