Will Article 381 of the Tax Code of the Russian Federation help you save money?

The dream of any person engaged in commercial activities is to earn more without extra costs. There are not many ways to help companies, without violating established norms and rules, save themselves from unnecessary material expenses. This opportunity is provided, in particular, by Art. 381 Tax Code of the Russian Federation. From its contents it becomes clear when you can save on paying property taxes.

This is achievable only if the property (cars, machines, equipment) belongs to the company and is recognized in its accounting as depreciable property. So if the company uses only a rented office and transport, the provisions of Art. 381 of the Tax Code of the Russian Federation will not help you save money.

If you have property, it would be a good idea to check the list of organizations that are legally allowed not to pay taxes on it. What if you get lucky too?

Who is exempt from paying property tax, see here.

But unfortunately, most commercial firms are not included in this list and will not be able to be completely exempt from the tax. So, in the list of beneficiaries under Art. 381 of the Tax Code of the Russian Federation includes institutions of the penal system, religious organizations, public organizations of disabled people, etc.

This article does not apply to individuals.

Next, we will consider issues related to the specific application of clause 25 of Art. 381 of the Tax Code of the Russian Federation in 2017-2018.

According to this clause, movable property registered with a legal entity after 01/01/2013 is exempt from tax, with the exception of those received:

- from a related party;

- as a result of liquidation or reorganization.

From 01/01/2017, these exceptions do not apply to railway rolling stock manufactured after 01/01/2013.

From 2021, the application of clause 25 of Art. 381 of the Tax Code of the Russian Federation is influenced by the new art. introduced into the code in 2021. 381.1, transferring the right to decide on the application of tax exemption on movable property to the regions.

Read more about this change in the article “Tax on movable property of organizations from 2021”.

In this regard, if a decision on such an exemption had not been made in the region at the beginning of 2021, then movable property registered with the taxpayer after 01/01/2013 should be subject to property tax.

See, for example: “Abolition of the tax on movable property - Moscow is already doing this.”

And about how the property tax for legal entities has changed in recent years, read: “Latest changes in the Tax Code of the Russian Federation on property tax .

Information for taxpayers

The Department of Tax and Customs Tariff Policy has reviewed the letter on the application of paragraph 25 of Article 381 of the Tax Code of the Russian Federation and reports.

In accordance with paragraph 1 of Article 374 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), objects of taxation for Russian organizations are movable and immovable property (including property transferred for temporary possession, use, disposal, trust management, contributed to joint activities or received under a concession agreement), recorded on the balance sheet as fixed assets in the manner established for accounting, unless otherwise provided by Articles 378, 378.1 and 378.2 of the Code.

Paragraph 25 of Article 381 of the Code establishes that organizations are exempt from taxation from January 1, 2015 in relation to movable property registered as fixed assets from January 1, 2013, with the exception of the following movable property items registered as a result:

reorganization or liquidation of legal entities;

transfer, including acquisition, of property between persons recognized as interdependent in accordance with the provisions of paragraph 2 of Article 105.1 of the Code.

Therefore, movable property registered as fixed assets as a result of reorganization or liquidation, transfer (acquisition) from interdependent persons (including during 2013-2014) is recognized as an object of taxation for corporate property tax from January 1, 2015.

The rules for the formation in accounting of information about an organization’s fixed assets are established by the Accounting Regulations “Accounting for Fixed Assets” (PBU 6/01), approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n, and the Chart of Accounts for accounting the financial and economic activities of organizations and instructions on its use, approved by order of the Ministry of Finance of Russia dated October 31, 2001 N 94n.

Taking into account the provisions of PBU 6/01 and the Chart of Accounts for accounting the financial and economic activities of organizations and instructions for its application, the specified tax benefit applies to fixed assets recorded by the organization as fixed assets in accounting accounts 01 “Fixed Assets” and 03 "Profitable investments in material assets."

According to the Chart of Accounts for accounting the financial and economic activities of organizations and instructions for its application, objects of labor intended for processing, processing or use in production, or for economic needs, means of labor, are not taken into account as fixed assets, but are subject to reflection as inventories according to accounting account 10 “Materials”.

By virtue of Article 374 of the Code, industrial inventories are not recognized as an object of taxation for corporate property tax.

Consequently, movable property items made from materials purchased after January 1, 2013 from a related party (not recognized as a related party), recorded as fixed assets, are not subject to taxation in accordance with paragraph 25 of Article 381 of the Code.

Paragraphs 14 and 27 of PBU 6/01 stipulate that changes in the initial cost of fixed assets, in which they are accepted for accounting, are allowed in cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets. At the same time, the costs of modernization and reconstruction of a fixed asset object after their completion increase the initial cost of such an object if, as a result of modernization and reconstruction, the initially adopted standard performance indicators (useful life, power, quality of use, etc.) of the object are improved (increased) fixed assets.

Therefore, if the corporate property tax benefit under paragraph 25 of Article 381 of the Code was applied to fixed assets, then the effect of the specified tax benefit in relation to fixed assets restored with the use of materials purchased from an interdependent entity for its modernization and reconstruction is preserved. f

What is movable property?

Before talking about the benefits hidden for a legal entity in Art. 381 of the Tax Code of the Russian Federation, let’s understand the term “movable property”, because it is precisely this that is the subject of the benefit.

In the ordinary understanding, we call movable objects that move in space - either themselves (for example, vehicles) or someone carries them (things, objects). However, for the norms of paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, such a description will not be accurate.

An attempt to characterize movable items was made by officials of the Russian Ministry of Finance (letter dated February 25, 2013 No. 03-05-05-01/5322). They came to the conclusion that if things can be moved without damaging their condition and other objects from which they are removed will not be damaged, we can talk about movable property.

Read about the Federal Tax Service's approach to classifying objects into movable and immovable here.

The accuracy of the property tax amount depends on how correctly you differentiate your assets into movable and real estate.

For example, difficulties may arise when classifying water supply and sewerage systems located indoors. Essentially, these are pipelines and other structural elements that can be disassembled and moved to another location. But the Ministry of Finance thinks differently and does not recognize them as movable (letter dated 08/15/2013 No. 03-04-06/33238). Another example is cable lines. Judges and officials classify them as movable objects (clause 5 of the Government of the Russian Federation Resolution No. 68 dated February 11, 2005, letter of the Russian Ministry of Finance dated March 27, 2013 No. 03-05-05-01/9648).

Not everything is clear with regard to the air conditioning and alarm systems often used by most legal entities. If their structural elements are built into the walls of the room, this is real estate, but if they can be disassembled without causing damage to the building, these are movable objects (letter of the Ministry of Finance of Russia dated April 11, 2013 No. 03-05-05-01/11960).

Read more about the principles of property tax formation in the material “What is the procedure for calculating property tax for organizations?” .

See also: “The benefit for movable property during a chamberlain will be asked to be documented.”

How does interdependence interfere with benefit?

Clause 25 Art. 381 of the Tax Code of the Russian Federation indicates that if a company bought a movable object from a related party, then its value must be taken into account when calculating property tax. Art. is dedicated to interdependent persons. 105.1 of the Tax Code of the Russian Federation, from clause 1 of which it becomes clear that their main feature is the ability to influence the conditions and (or) results of transactions between them.

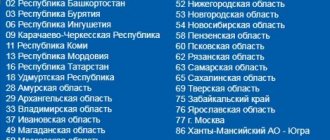

The list of such persons is given in paragraph 2 of Art. 105.1 Tax Code of the Russian Federation. It is very important to scrupulously evaluate the party transferring the objects, because this directly determines whether it will be possible to take advantage of the tax break under clause 25 of Art. 381 Tax Code of the Russian Federation. Thus, the participation of Russia and its constituent entities, as well as municipalities in Russian companies does not mean that these companies are interdependent (Letter of the Ministry of Finance dated May 28, 2015 No. 03-05-05-01/30848). The main thing is whether the parties were such at the time of transfer of movable objects.

Read more about the taxation of property received from interdependent persons in the articles:

- "When Interdependence Matters for Property Tax";

- “The property moves to the interdependent company and back - the right to the benefit is lost”.

Cancellation of corporate property tax benefits from 2021: detailed description of changes

As of January 1, 2021, payments for movable property will no longer be collected. The legislative act regulating this was signed by V.V. Putin. What is considered real estate and why is taxation removed from enterprises and business projects?

Cancellation of corporate property tax benefits from 2021

About cancellation of benefits

Today, taxation (VAT) has been increased for business organizations from 18 to 20%, a legislative act confirming this was signed by the President of the Russian Federation, but the Government approved the decision that taxation on movable property should be abolished. Russian President V.V. Putin signed Federal Law No. 302 dated August 3, 2018, with many changes to the Tax Code of the Russian Federation.

Among these amendments was included the most expected for accounting employees of companies - the elimination of taxation of movable property values of legal entities.

It is important to know! Adjustments have been introduced to Article 374 of the Tax Code of the Russian Federation; now the phrase “movable property” is completely absent from it.

Excerpt from Article 374 of the Tax Code of the Russian Federation

Now only real estate that is on the balance sheet as an object of basic income, as well as real estate acquired under a concession agreement, is subject to taxation.

However, what is considered to be movable property value is not specified in the Tax Code of the Russian Federation. The Federal Tax Service of the Russian Federation helped with clarifications, promptly posting a letter dated August 2, 2021 No. BS-4-21 with specific explanations of the types of property objects in order to use the provisions of Chapter 30 of the Tax Code of the Russian Federation.

Historical development of the issue

Not all countries subject movable property to taxation. Even the terms of movable and immovable objects are different for the Russian Federation and foreign countries. For example, in the Russian Federation, airplanes are considered immovable property, but abroad, even taking into account the impressive cost of airplanes, they are usually considered movable property, so there is no tax on them.

It is important to know! Attracting investment due to the absence of taxation of movable property was identified in the following countries: Croatia, Cayman Islands, Cook Islands, Seychelles, Bahrain, Liechtenstein, Dominican Republic, Fiji, Sri Lanka, Oman, Malta, Turks and Caicos Islands, Qatar, Monaco and Israel . Colombia, Costa Rica, Ecuador and Nicaragua are familiar with the concept of property taxes, but these obligations are actually very small.

In Russia, foreign practice was used, and the movable property tax was abolished

Foreign practice was used when the decision to abolish taxation on movable property was developed. In fact, in 2013, preferential conditions were introduced for this tax levy.

Then in 2015, amendments were made to prevent the use of benefits for related parties. Prescribed in paragraph 25 of Art.

381 of the Tax Code of the Russian Federation, the benefit paid for movable property is not taken into account when receiving (purchasing) property from an interdependent person.

Persons have the status of interdependent (according to clause 1 of Article 105.1 of the Tax Code of the Russian Federation), if the nuances of their relationships have the ability to influence the conditions and (or) results of transactions carried out by these persons, and (or) the results of the economic activities of these persons or the activities of persons by their representation.

Excerpt from Article 105.1 of the Tax Code of the Russian Federation

Typically, interdependent persons are considered to be:

- enterprises, in a situation where one enterprise directly and (or) indirectly participates in the activities of another enterprise, and this participation constitutes a share of more than 25%;

- an individual and an organization when this individual directly and (or) indirectly participates in such an organization, and this participation constitutes a share of more than 25%;

- organizations in a situation where the same person directly and (or) indirectly participates in these organizations, and the share of such participation for each organization is more than 25%;

- an enterprise and a person who has the rights to appoint (elect) a sole executive body of this enterprise or to appoint (elect) at least 50% of the composition of a collegial executive body or board of directors (supervisory board) of this enterprise; other persons established by current law.

Previously, the benefit paid for movable property is not taken into account when receiving (purchasing) property from an interdependent person

In 2021, taxation on movable objects has returned. The tariff on the basis of which tax payments are collected is 1.1%, but regional governments have the right to change the interest rate at their discretion, without exceeding the specified rate.

In some places taxation has been abolished, in others the percentage has been reduced for everyone, but usually local organizations are divided into certain categories. As a result, some pay the tax in full, others are exempt from payments, and still others pay the tax at a reduced rate.

It can be concluded that tax collection takes place differently in different regions. The disadvantages of returning taxation on movable property include the loss of relevance of fundamental organizational funds and lack of investment.

The same economic result is a consequence of the limitation on the transfer of losses to the future in the amount of 50%. It was expected that in 2020 the interest rate of this taxation would double.

It is important to know! The increase in the tax amount ultimately had a great negative impact on taxation.

That is why, from 2021, taxation on movable property has been completely abolished, which has greatly simplified the life of accounting employees of large Russian companies. The main disadvantage of the tax on movable property is its extremely complex calculation - in 2021 this problem has been eliminated.

From 2021, taxation on movable property has been completely abolished

What is meant by movable property?

Tax officials noted that the legislative grounds for recognizing one or another object as movable or immovable property must be determined by the norms of civil legislation on the conditions for assigning a thing the status of movable or immovable, in particular by the regulations of Articles 130-131 of the Civil Code of the Russian Federation.

Movable material value is property whose characteristics cannot classify it as real estate. A distinctive feature of such property values is the possibility of their transfer from one individual to another.

Source: https://posobie-expert.com/otmena-lgoty-po-nalogu-na-imushhestvo-organizatsii-s-2020-goda/

Does movable property of the 1st and 2nd groups suffer from the interdependence of persons?

The answer to this question is obvious. In sub. 8 clause 4 art. 374 of the Tax Code of the Russian Federation establishes that property of the 1st and 2nd depreciation groups is not taken into account when calculating property tax. The Ministry of Finance does not argue with this (letters dated January 16, 2015 No. 03-05-05-01/676, dated April 6, 2015 No. 03-05-05-01/19071, dated March 27, 2015 No. 03-05-04-01 /17031). The interdependence of persons in this case does not matter.

IMPORTANT! In order to legally save money by applying subclause. 8 clause 4 art. 374 of the Tax Code of the Russian Federation, it is necessary to correctly classify property as a depreciation group in accordance with the Classification of fixed assets approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1.

Read more about the nuances of calculating tax on movable property in the material “Taxation of movable property: changes in 2017, 2018” .

What codes should be indicated in 2021 for a taxpayer applying for a benefit under clause 25 of Art. 381 of the Tax Code of the Russian Federation?

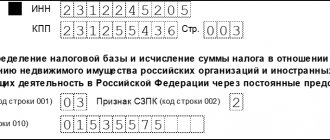

To answer this question, let us turn to the explanations of the controllers. In their letters, they advise writing code 2012000 in line 130 of section 2 of the advance calculation for property tax. After a fraction after this code, you need to enter the number, paragraph and subparagraph of the article of the law of the subject of the Russian Federation, in accordance with which the benefit is provided (letters of the Federal Tax Service dated May 24, 2018 No. BS-4-21/9062, dated 03/14/2018 No. BS-4-21/ [email protected] ).

We talked in more detail about how to correctly fill out reports on movable property here, and here you will find an example of filling out a preferential line.

IMPORTANT! In 2021, the form and format for submitting an electronic tax return and calculating advance payments for property tax, approved. by order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21/ [email protected] And with reporting for the 1st quarter of 2021, new reporting forms are being introduced.

For information on how to correctly fill out a property tax return, read the article “Nuances of filling out a property tax return .

Can a JSC take advantage of the benefit under clause 25 of Art. 381 of the Tax Code of the Russian Federation after re-registration?

Clause 25 Art. 381 of the Tax Code of the Russian Federation not only gives tax relief to organizations, but also limits them in its application. For example, the benefit is not given if the property came to the taxpayer after the reorganization or liquidation of the legal entity.

The question rightfully arises: if, as required by law, an organization is obliged to transform from an OJSC into a public JSC, is it possible to continue to apply the relaxation under clause 25 of Art. 381 of the Tax Code of the Russian Federation?

IMPORTANT! In accordance with Art. 66.3 of the Civil Code of the Russian Federation, in order for a JSC to acquire public status, it must either include in its charter and corporate name an indication that it is such, or publicly place securities.

The position of the officials will please you.

The letter of the Ministry of Finance dated 02/09/2015 No. 03-05-05-01/5111 states that the fact of bringing the constituent documents and name of a company created before the entry into force of the law dated 05/05/2014 No. 99-FZ is not a reorganization (liquidation) of legal entities “On amendments to Chapter 4 of Part 1 of the Civil Code of the Russian Federation and on the recognition as invalid of certain provisions of legislative acts of the Russian Federation”, in accordance with the norms of Chapter 4 of the Civil Code of the Russian Federation. Therefore, there is no reason to refuse the benefit. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The Constitutional Court clarified the application of the norm of the Tax Code, which will lose force in the new year

On December 21, the Constitutional Court of the Russian Federation issued a ruling in the case challenging paragraph 25 of Art. 381 of the Tax Code of the Russian Federation by joint-stock companies Inkar, Leasing.

According to this norm, payers are exempt from corporate property tax in relation to movable property adopted from January 1, 2013.

registered as fixed assets, with the exception of those registered as a result of the reorganization or liquidation of legal entities, as well as the transfer, including acquisition, of property between related parties.

Facts of the case

In 2014 and 2015 Joint Stock Company "Inkar" purchased vehicles from legal entities interdependent in relation to it, which, in turn, acquired them after January 1, 2013. At the same time, the company took advantage of the benefit provided for in paragraph.

25 Art. 381 NK. Based on the results of a desk audit for 2015.

The tax inspectorate considered that Inkar had unreasonably taken advantage of the tax benefit, and assessed additional corporate property tax to the company, and also fined it for incomplete payment of the tax.

The joint-stock company “New Transportation Company” was subjected to a similar sanction with additional penalties. As a result of the reorganization in the form of the merger of another legal entity, the company acquired transport, which was accepted for its registration after January 1, 2013 and was not subject to taxation.

In all three cases, the decisions of the tax inspectorates received support from higher tax authorities. Challenging them in court was unsuccessful. All three taxpayers were also denied the transfer of their cassation complaints for consideration by the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation. In this regard, they were forced to appeal to the Constitutional Court.

According to the applicants, the contested norm does not comply with a number of articles of the Constitution of the Russian Federation, since its application has different economic and legal consequences for organizations when taxing property of the same category, depending only on the formal conditions (sources) of its acquisition.

Conclusions of the Constitutional Court of the Russian Federation

Having studied the circumstances of the case, the Constitutional Court of the Russian Federation recalled that clause 25 was included in Art. 381 of the Tax Code of the Russian Federation by law of November 24, 2014 No. 366-FZ.

This legal regulation was intended to limit the application of tax incentives to such acquisition of fixed assets, which does not produce the expected economic consequences, but consists of a formal transfer of previously acquired property through the reorganization or liquidation of legal entities, as well as through the transfer of property between related parties.

From January 1, 2015, movable property of organizations was again recognized as an object of taxation, except for those included in the first and second depreciation groups. As a result, movable property recorded as fixed assets outside the two specified groups again became taxable, but conditionally, since at the same time clause 25 of Art.

381 of the Tax Code of the Russian Federation, as a benefit, exempted from taxation all movable property that the organization accepted as fixed assets for registration from January 1, 2013.

, and limited the spread of this benefit to objects registered as a result of the reorganization or liquidation of legal entities or as a result of the transfer of property between related parties.

As the Court pointed out, paragraph 25 of Art. 381 Tax Code in conjunction with sub. 8 clause 4 art.

374 of the Code is interpreted in law enforcement practice in such a way that movable property recorded as fixed assets of an organization is taxed (except for fixed assets of the first and second depreciation groups) regardless of the time of its creation, initial and subsequent acquisitions and regardless of its wear and tear (condition) or the tax regime of the previous owners under the only condition - the taxpayer acquired property as a result of reorganization or liquidation or from an interdependent person.

The Constitutional Court noted that the application of the contested clause in this interpretation has a restrictive effect, since it deters business entities from participating in civil transactions if transactions with movable property are associated with the reorganization or liquidation of legal entities or are accompanied by the interdependence of counterparties. “By denying a taxpayer an exemption from paying tax under such conditions, despite the fact that otherwise such exemption, being of a general nature, is publicly available and applies equally to all taxpayers, the said legal provision restrains business entities from intending to be in any way involved in the reorganization or liquidation of a legal entity.” persons or be in such interdependence that is not prohibited by law, does not in itself constitute an offense and does not entail liability, but leads to property losses in the tax sphere,” noted in the text of the resolution.

In this regard, the Constitutional Court recalled its own legal position, set out in a number of decisions, according to which taxes and fees must have an economic basis and cannot be arbitrary, and legal regulation in the field of taxation must imply its uniformity, neutrality and fairness. In addition, the Court noted the inadmissibility of terminating a tax benefit used in the legitimate activities of the taxpayer in the absence of proven offenses or abuse of law.

Thus, the Constitutional Court of the Russian Federation recognized clause 25 of Art. 381 of the Tax Code of the Russian Federation does not contradict the Constitution.

The Constitutional Court also ordered the review of judicial decisions against three taxpayers.

Expert opinions

Senior lawyer of the Bureau of Chartered Attorneys "Freitak and Sons" Andrey Belik called the decision of the Constitutional Court unexpected, since two months ago the Supreme Court of the Russian Federation already spoke out on this issue in its Determination of October 16, as AG wrote about.

At the same time, the expert considered the Constitutional Court’s conclusion logical, since the judges of the Constitutional Court, in principle, supported their colleagues from the RF Supreme Court.

The expert expressed the hope that the resolution will finally stop the desire of some territorial tax authorities to formally approach the interpretation of the benefit provided for in paragraph 25 of Art. 381 Tax Code of the Russian Federation.

The Supreme Court explained when assets received from an interdependent person are not subject to property tax. The Supreme Court interpreted the norm of the Tax Code of the Russian Federation on establishing a tax benefit for the property tax of organizations in a systematic relationship with the general principles of tax legislation

Senior expert of the Tax Consulting Department of FBK Pravo Irina Pimenova explained how the Constitutional Court resolution is beneficial for taxpayers. According to the expert, what is noteworthy in this case is that the Constitutional Court of the Russian Federation actually gave the contested provision the legal meaning that the legislator originally had in mind.

“The latter’s insufficient elaboration of the content of this norm has led in practice to the fact that, due to its literal interpretation by regulatory authorities and courts, discriminatory legal restrictions arose in relation to bona fide participants in civil transactions who received movable property in the process of reorganization (liquidation) or from interdependent persons that was not subject to taxation from the previous owner,” the expert explained.

Irina Pimenova is sure that the revealed constitutional and legal meaning of paragraph 25 of Art. 381 of the Tax Code of the Russian Federation will exclude any other interpretation when making decisions by courts or regulatory authorities during tax audits.

“We can only regret that such a significant document was adopted almost at the end of the implementation of this norm of the Tax Code of the Russian Federation, because clause 25 of Art. 381 of the Tax Code of the Russian Federation is declared invalid from January 1, 2021,” she added.

Source: https://www.advgazeta.ru/novosti/ks-razyasnil-primenenie-normy-nk-kotoraya-utratit-silu-v-novom-godu/