Form of note-calculation upon dismissal according to form T-61

• Download the current form T-61 (Excel format).• Download sample filling T-61.

A settlement note in form T-61 is drawn up upon dismissal of an employee in order to make the final calculation of wages, as well as other payments.

Form T-61 is filled out on the basis of settlement and payment documents, statements that contain information on various charges to the employee (wages, bonuses, allowances, etc.).

The settlement note upon dismissal is a two-sided form. On the front side (filled out by the personnel officer) information about the organization, the employee and the employment contract in force between them is reflected. On the reverse side (filled out by the accountant) vacation pay is calculated.

Which form to use

The calculation note (form No. T-61) is a primary accounting document.

It was approved by Decree of the State Statistics Committee of the Russian Federation No. 1 of 01/05/2004 and is intended to calculate wages and other payments to an employee upon termination of an employment contract. An employer is not required to use Form T-61 when dismissing employees. It is advisory and convenient in that personnel and accounting programs already contain a unified T-61 form. But it is allowed to develop your own form of calculation note to take into account the characteristics of the organization. Use the T-61 as a base, it will simplify the task.

Based on what documents?

When filling out a calculation note, the employer must rely on all settlement and payment documents confirming the facts of payments, and on other internal legal protocols related to the employee at the time of dismissal.

This list includes:

- Employment contract.

- Certificate in form No. 2-NDFL.

- Order of dismissal.

- Article of the Labor Code, according to which the employee was fired.

- Payroll number or cash register number.

- Local regulations on the issuance of bonuses and additional monetary rewards.

- Forms for recording salary issued in non-monetary form.

- Performance list.

- Resolution of the bailiffs.

- Agreement on payment of alimony.

- A court decision imposing financial obligations on an employee.

- Documents confirming the fact of damage caused to the company.

- Acts on the transfer of funds to the pension and/or health insurance account.

- Contributions to trade unions.

Additional clauses are also possible at the discretion of the employer.

Who fills out the calculation note

The calculation note is a two-sided register with an introductory part and a calculation table. The form is filled out by responsible personnel and accounting employees. The personnel officer indicates the proper information about the company and the dismissed employee on the front side, the accountant fills out the columns of the tabular part on the back side.

The calculation note is drawn up on the basis of the necessary documents (statements, payment and settlement documents, which reflect all accruals for the billing period).

Part 1. Information about the employee

- The first part of the calculation note in form T-61 is filled out by the personnel officer and includes information about the company in which the employee worked, with its full name and mandatory indication of the organizational and legal status (IP, LLC, CJSC). Here you need to enter the date of preparation and document number for internal document flow.

- Next, you need to enter information relating to the employee personally, that is, his full name, position, structural unit or department in which he worked, as well as the personnel number assigned to him when he was hired.

- Then you should enter in the form the date of termination of the employment contract and the basis on which the employee was dismissed (this data must correspond to the order of the head of the organization, as well as the entries in the employee’s work book).

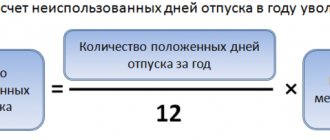

- The last part in this section concerns vacation periods, namely the number of days of remaining unused vacation and, if there was a fact of using vacation “in advance,” fixing the number of “extra” vacation days. In the second case, the amount paid to the employee for vacation previously provided “in advance” is deducted from the final calculations.

- As a final step at this stage, you need to put in this part the date of filling out the document and the signature of the personnel specialist.

How to fill out a note-calculation

Let's look at step by step how to fill out a settlement note upon dismissal.

Step 1. Fill out the front side.

Here the personnel officer indicates:

- full or short name of the organization and its code in accordance with OKPO;

- details of the note itself - document number and date of completion;

- information about the employment contract with the dismissed employee - its number and date of conclusion.

Enter the employee's personnel details:

- last name, first name and patronymic;

- Personnel Number;

- department or structural unit.

Please provide your resignation details below:

- basis in accordance with the Labor Code of the Russian Federation;

- order details;

- date of termination of the employment agreement.

All that remains is to enter the number of unused or advance vacation days.

After entering all the data, the responsible HR employee certifies the front side of the calculation note with a signature.

Step 2. Fill out the back side.

The reverse side consists of four tables in which the accountant calculates vacation pay and calculates compensation.

The first table includes the year of the billing period (column 1) and the calendar months of the reporting year preceding the date of dismissal (column 2). The lines corresponding to each month (column 3) reflect the total amounts of payments to the employee.

The second table of the calculation note reflects the total number of calendar days in the accounting year. Use a production calendar or calculate the number of days based on a conditional average. If the employee worked the entire month, then the number of calendar days will be 29.3.

If the month is not fully worked out, then the number of days is calculated as follows:

(29.3 / total number of days in the reporting month) × number of days actually worked according to the time sheet.

If an employee receives a salary for hours actually worked, then a special column in table No. 2 is filled in.

Now calculate your average daily earnings using the formula:

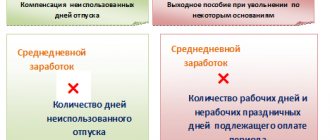

Average daily earnings = total amount of accruals for the billing period / total number of calendar days (hours).

Information about unused or advance-used vacation is entered into the last table of the calculation note, and then the amount of vacation pay to be paid or the amount of deductions that are made is calculated.

Step 3. Calculation of final payments in the note.

At the end, all calculated data is accumulated and the amount of compensation is calculated. The accountant must enter:

- wages for the reporting month;

- vacation pay (from the previous table);

- other charges;

- the total amount of accrued payments;

- estimated personal income tax on all charges;

- other types of deductions (if any);

- total for all types of deductions;

- debt of an organization to an employee or an employee to a company.

When all amounts are indicated, the final amount of payment to the employee upon dismissal is calculated. Then the same amount is written down in numbers and words. The accountant enters the details of the payroll, on the basis of which the employee received the appropriate funds. The accountant responsible for calculating compensation signs the table.

Part 2. Calculation of vacation pay

This section is completed by an employee of the accounting department .

To calculate compensation for unspent vacation days, you must enter the necessary information in all columns of this section according to the algorithm below.

Next comes the column number in numbers and a description for it.

- — the year is entered here (necessary for calculating the average monthly salary of an employee);

- — months are indicated here (before the date of dismissal);

- — here you need to write the employee’s income for each of the months taken into account;

- — the number of days (according to the calendar) in the period taken as the calculation period;

- — is issued only for hourly wages of the employee;

- — the calculated amount of the average daily wage is indicated here;

- — the number of vacation days that were taken in advance;

- — unspent vacation days;

- - the final amount of money due to be paid to the employee for the specified number of unused vacation days. The calculation is made as follows: (from the data in column 8 you need to subtract the data in column 7) multiply the result by the data from column 6.

Features of filling out a note-calculation

Here are the key rules, use them as a reminder:

- The front part of the form contains information about the employee, the grounds for hiring and termination of the employment contract. First, the HR department indicates the date of conclusion and number of the employment contract, full name. employee, his position, department. Then he puts the date of the dismissal order, its number, the basis for termination of the employment relationship, establishes the number of days of unused vacation for calculating compensation or, if the employee took vacation in advance, the amount of days used to make deductions. Signs the first page. Then the calculation note is transferred to the accounting department.

- The reverse side contains information for payment of vacation pay, information about wages and other payments for the period and the final amounts due to the employee. To do this, take a period of 12 months before the month of dismissal and all payments made to the employee during this time.

- After filling out all the columns, the accountant certifies the calculation note with a signature and passes it on for accrual of the amounts due.

- The calculator processes the information received and enters it into the appropriate columns of the form regarding charges and payments. Then it determines the amount of average daily earnings and the amount of compensation or the amount of the employee’s debt due for repayment. The calculation of compensation is determined by multiplying unused days by average daily earnings.

- In addition to compensation, wages are calculated for time worked. All accruals and deductions are reflected in the pay slip, which is issued to the employee, and payment documents for the payment of these amounts are transferred to the appropriate accounting specialist.

How long before dismissal should you write a note?

The legislation does not regulate the period of time during which a settlement note must be drawn up. The norms of the acts only establish the obligation to pay all money due upon dismissal to the employee either on the final day of work, or, if the salary is transferred to the card, then on the next day.

The deadline for its formation is the final working day of the resigning employee. If the employee terminates the contract on his own initiative, then according to the general rules he submits an application two weeks before this date.

Therefore, you can issue a dismissal order and draw up a settlement note from the moment you receive the dismissal application. However, you must also remember the employee’s right to withdraw the application before the end of the notice period. Therefore, the dismissal order and the note may have to be canceled.

You might be interested in:

Application for parental leave up to 1.5 years: deadlines for writing, how to apply correctly in 2021

The personnel specialist must analyze the current situation and independently choose the period how many days before the termination of the employment relationship he should fill out a calculation note.

Are they required to issue?

The payslip contains all the information about charges. Are they obliged to issue it - yes. It should reflect the following information:

- about the exact amount of salary that the employee will receive upon dismissal. This paragraph should also take into account payment in non-monetary form, if the enterprise has one;

- about the interest rate;

- about bonuses, if any are provided for by the collective agreement or regulations of the organization;

- about bonus payments that are awarded as a reward to an employee for the work done;

- on compensation and additional payments;

- on contributions to various funds.

The documents must reflect all payments that will be accrued to the employee, as well as for what period the accrual is made. This information must be contained even if funds are issued in cash.

The document plays the role of an accounting form on which an employee can see what his salary and the final amount of money given upon dismissal are made up of. Any shortcomings may allow the employee to go to court, by which decision the employer may be required to pay monetary compensation to the employee.

By law, a payslip is required. It is issued to all employees, regardless of the type of contract concluded and its duration. This is done so that the employer cannot make payments of an unaccountable type, as well as for transparency of operations, including for the employee. In addition, if during the calculation the employee does not agree with the amount of payment, the employer will be able to prove his case using a payslip.

The payroll must be drawn up by an accounting employee who has full access to data on the employee’s salary and other required payments. After preparing the document, it does not need to be signed by the responsible employee and manager, or certified with the organization’s seal, due to the fact that this sheet is for informational purposes only and does not confirm the fact that the employee has received funds. At the same time, after receiving the sheet, the employee must sign the form, which will confirm the fact that the document was provided to him.

What to do if a document with calculations was not issued?

If upon dismissal an employee discovers that there is no payslip among the mandatory list of documents to be issued, the following procedure should be followed:

- Contact the company's accounting department to resolve the issue.

- If the accounting department refuses to receive the document, then the next step is to contact the labor inspectorate. Upon receipt of a complaint from a dismissed employee, inspectors will conduct an unscheduled inspection of the organization and, if a violation is confirmed, will hold the employer accountable in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

- An employee can file a lawsuit against the employer. In the case of dismissal, a claim in court for violation of labor rights can be filed within a month from the date the employee receives a copy of the dismissal order or work record book (Article 392 of the Labor Code of the Russian Federation).

What is it for?

By receiving a payslip upon dismissal, an employee can find out all the components of his salary and the total amount that the employer will pay him upon payment on the last working day.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

By detailing all accruals and deductions, the employee has the opportunity to determine whether there are any discrepancies in the payments indicated in the form with those that are due to him in accordance with the employment contract and the norms of the Labor Code of the Russian Federation.

A payslip allows you to make the relationship between employer and employee regarding remuneration as transparent as possible. If an employee identifies shortcomings in payments, he or she can recover the missing amount from the employer, and the employer, in the event of unlawful claims regarding accruals made, can prove that he is right by presenting a payslip.

Is it obligatory to issue it after the employee leaves?

Issuing a pay slip is not a right, but an obligation of the employer in accordance with Art. 136 Labor Code of the Russian Federation. Regardless of the type of organizational and legal form and form of ownership of the enterprise, management is obliged to provide staff with information about all payroll payments in writing.

For non-compliance with labor legislation, administrative liability is provided in accordance with Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

In case of repeated violation, the fine increases (Part 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Calculation of payments due

The second part of the reverse side of the form allows you to calculate the final amount of payments due upon termination of the employment contract.

When dismissing an employer, within what time period must an employer make a payment, read here.

This is done like this:

- Column No. 10 indicates the salary level for the number of days worked, and column No. 11 or No. 12 indicates compensation for unused vacation. The first indicator is subtracted from the second to form a subtotal.

- Column No. 14 takes into account the amount of personal income tax and other fees in column No. 15. The total output is displayed in column No. 16.

- In columns No. 16-17, data on the amount of debt to the company is filled in.

- The final calculation is made in column No. 19: additional remunerations are added to the total salary and debts are withheld. The total amount that the company undertakes to pay the employee on the day of dismissal is displayed.

conclusions

When a working citizen resigns, the employer gives him the due payments, a work book, as well as other documentation containing information about the work.

In addition to all kinds of certificates upon dismissal, the retiring employee must receive a payslip, which includes detailed information about accruals, deductions and payments related to the payment of his labor for a specific period of time.

The document is drawn up according to a template approved by the management of the company. It reflects information that allows you to compare accounting information with actual payments.

The legislation clearly states that such a document must be provided to the resigning employee without fail. The employer’s refusal to issue this paper or incorrect reflection of the necessary data may become the basis for claims and complaints from the resigning person.