OKVED concept

The abbreviation OKVED refers to the main classifier used in the Russian statistics system. These are codes that indicate what type of activity an entrepreneur can engage in. The indicator is assigned upon company registration. The statistics agency is responsible for maintaining the register of codes.

OKVED is a leading indicator of entrepreneurial activity

You can also get a new value if the company is already registered, but reorganization and the start of a new type of activity are necessary. The subject can select codes independently.

The classifier is used for the following purposes:

- Obtaining information for analyzing macroeconomic indicators.

- Collection of statistical data and distribution of them through reference books and state registers.

- Conducting an analysis of information about all companies that operate in certain areas.

- Calculation of the tax base in certain sectors of the economy.

Important! OKVED is a mandatory requisite for both individual entrepreneurs and LLCs. The code is indicated in all reporting documents; it is needed when opening a bank account.

Assigning a code is a mandatory procedure for any businessman

Legal basis

The all-Russian classifier, which is used in statistics today, was approved by Order of the Social Insurance Fund of December 31, 2014 No. 742. Also, the procedure for using and assigning codes is regulated by Order of the Ministry of Labor and Social Protection of the Russian Federation No. 851N of December 30, 2016.

Previously, there was a classifier OK 029-2001, but it has lost its validity since 01/01/2017. Accordingly, in 2021, a new procedure for assigning OKVED codes was already in effect.

Licenses, taxes and OKVED

A formal approach to specifying codes leads to difficulties in obtaining permits.

For example, the registration form contains the main code 47.73 Retail sale of medicines in specialized stores (pharmacies). A decision is made to obtain a license to produce medicines. The production of medicines, OKVED code 21.20, is a licensed activity (Federal Law No. 99-FZ of May 4, 2011). The licensing authority will refuse a license if code 21.20 is missing.

Entrepreneurs enjoy tax preferences according to the main OKVED code.

Entrepreneurs on the simplified taxation system (STS), by decision of the local authorities, are given a zero rate if the OKVED codes correspond to the production, social, and scientific spheres (Article 346.20 of the Tax Code of the Russian Federation).

How the codes and the choice of taxation mode are related can be seen in the example.

An entrepreneur plans to sell books. To trade books in the store, the code is 47.61. Code 47.91 applies to selling books online. Books are sold online using the simplified tax system. Selling books in a store is allowed under the simplified tax system and UTII (Unified Tax on Imputed Income).

Table: tax regime and OKVED code

| Kind of activity | OKVED code | Decoding the code | Tax regime |

| Selling books in a store | 47.61 | Retail sale of books in a specialized store | USN, UTII (Unified tax on imputed income) |

| Selling books online | 47.91 | Retail trade by mail or via the Internet information and communication network | simplified tax system |

General rules for selecting code for doing business

The concept OKVED stands for a classifier of types of economic activity. It is approved by the Federal Statistics Authority and has nationwide significance. The OKVED list contains all types of activities classified into classes, subclasses and groups. Decoding the code gives an idea not only of the main activity in which the company is engaged, but also of the group and class in which it is included.

The codes chosen by the entrepreneur affect many aspects of the activity:

- The business owner has the opportunity to legally operate

- Formation of a tax base based on the sphere of employment.

- Determining the scope of reporting.

To select a code when registering a business, it is recommended to follow simple instructions:

- Decide what the company will do. For example, this will be retail sales of goods for children, clothing.

- Next, you need to establish the place where the trade will take place - using the example in your own store.

- In such a situation, 47.71.1 is selected, which denotes retail sale of clothing in specialized stores. This includes any type of clothing, including men's, women's and children's.

- Next, you need to fill in the details, since the sale of sportswear and underwear will have different code numbers.

- It is recommended to write down all types of activities that the company will engage in and the codes for them. It is important to note that for each code you need to see if a license is required.

- The code must consist of at least four digits. All subgroups are included in it automatically.

- Then you need to choose your main activity. There can only be one. It is important to indicate the one that will bring the most profit.

If the company has not indicated the main direction of employment within the established time frame, the Social Insurance Fund will determine it independently based on the income received by the company. Tariffs for insurance premiums for employees depend on the main type of activity.

For reference! The law does not limit entrepreneurs in the number of codes. But it is recommended to indicate no more than 20. In practice, most often there are 5-6.

The OKVED structure for retail trade may look like this. In the example, the number 9 indicates the value in the code:

• 99. - class;

• 99.9 - subclass;

• 99.99 – group;

• 99.99.9 – subgroup;

• 99.99.99 – type of activity.

The more symbols in OKVED, the more detailed the activities of the enterprise are deciphered. But lawyers do not recommend specifying codes in too much detail, so that they do not have to be redone if changes occur in one area. For example, an individual entrepreneur sold retail meat and fish, but decided to sell fruit, he will need to redo the code in detail.

The statistics service is responsible for assigning codes and maintaining the register.

Methods of selling goods

The right to apply UTII depends on the place in which the trade takes place. UTII is taxed on retail sales of goods:

- through stationary retail chain facilities with trading floors (shops and pavilions) with an area of no more than 150 sq. m for each object;

- through facilities that do not have sales areas (kiosks, tents, trays, vending machines, etc.);

- during delivery and peddling trade.

This follows from subparagraphs 6 and 7 of paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation.

Situation: is it possible to recognize a premises as an object of a stationary retail chain if the title documents for this premises do not confirm its functional purpose as an object intended for trading?

Answer: no, you can't.

From a literal reading of paragraph 13 of Article 346.27 of the Tax Code of the Russian Federation, we can conclude that the objects of a stationary retail chain include not only those premises that are intended for trading, but also those that are actually used for these purposes. That is, if an organization conducts trading activities in premises not intended for trade, such premises can be recognized as a stationary retail facility, regardless of the content of the title (inventory) documents.

However, regulatory agencies consider this norm in conjunction with the provisions of paragraphs 14 and 15 of Article 346.27 of the Tax Code of the Russian Federation, which defines a stationary retail chain with and without sales floors. Both definitions refer only to objects specifically intended for trading. Objects that are not intended, but are actually used in trading activities, are not mentioned in these definitions. Consequently, the application of UTII in relation to retail trade that an organization carries out in such premises is unlawful.

You can confirm that an object is intended for trade using title (inventory) documents that indicate its functional purpose. If a premises not intended for trading activities is used as a stationary object of trade, then in order to apply UTII, the functional purpose of this premises in the title (inventory) documents should be changed.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated February 1, 2012 No. 03-11-06/3/5, dated May 2, 2007 No. 03-11-05/91, dated April 9, 2007 No. 03-11- 04/3/107, dated April 9, 2007 No. 03-11-05/65. The legality of this approach is confirmed by Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 28, 2012 No. 14139/11.

Situation: is it possible to apply UTII in relation to retail trade if the location of the premises in which the purchase and sale transaction is executed (documents are issued confirming the receipt of funds) does not coincide with the place where the goods are transferred to the buyer?

Answer: yes, it is possible, but only if the transaction is executed in a premises that is recognized as an object of a stationary retail chain.

Thus, the answer to this question depends on whether the premises in which the transaction is executed (documents are issued confirming the receipt of funds) can be classified as a stationary retail chain facility.

Retail trade is recognized as activities related to the trade of goods (including in cash, as well as using payment cards) on the basis of retail purchase and sale contracts. For the purposes of applying UTII, this type of activity does not include the sale of goods based on samples and catalogs outside a stationary retail network (including mail order trade, trade through teleshopping, the Internet, using telephone communications). Such restrictions are established in paragraph 12 of Article 346.27 of the Tax Code of the Russian Federation. The Ministry of Finance of Russia has equated trade through terminals to trading using samples and catalogs outside a stationary retail network (letter dated December 25, 2007 No. 03-11-04/3/517).

From the provisions of paragraph 12 of Article 346.27 of the Tax Code of the Russian Federation, the following conclusion can be drawn. If the execution of a trade transaction (issuance of documents confirming the receipt of funds) takes place in a premises that is not recognized as an object of a stationary retail chain, and the goods are transferred to the buyer outside this premises, then this type of retail trade should be qualified as the sale of goods outside a stationary retail chain. This means that such activities are not subject to transfer to UTII. A similar point of view is reflected in letters of the Ministry of Finance of Russia dated February 11, 2013 No. 03-11-06/3/3381, dated December 4, 2012 No. 03-11-11/357, dated January 23, 2012 No. 03-11 -11/9, dated January 23, 2012 No. 03-11-06/3/2. The same conclusion is contained in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 15, 2011 No. 12364/10.

If a trade transaction is concluded in premises (including rented premises), which is recognized as an object of a stationary retail chain, then the organization has the right to apply UTII regardless of where and in what way the goods are demonstrated and transferred to the buyer. For example, if samples of goods are presented on the organization’s website, or the goods are received at a warehouse. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated March 31, 2014 No. 03-11-11/13995, dated August 8, 2012 No. 03-11-11/231, dated July 4, 2012 No. 03-11-11/ 202, dated February 22, 2012 No. 03-11-11/54. The legality of this approach is confirmed by Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 16, 2013 No. 15460/12.

Situation: can UTII be applied to the retail trade of goods that the seller demonstrates at the buyer’s home? The organization does not trade based on samples and catalogues.

Answer: yes, you can.

Retail trade is recognized as activities related to the trade of goods on the basis of retail purchase and sale contracts (paragraph 12 of article 346.27 of the Tax Code of the Russian Federation).

In particular, retail sales of goods fall under UTII:

- through the facilities of a stationary retail chain that does not have sales floors;

- through retail trade and sales through other objects of the non-stationary network.

This is stated in subparagraph 7 of paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation.

In this situation, the following options for completing a retail trade transaction are possible:

- the seller demonstrates the goods at the buyer’s home, after which the goods are transferred to the buyer and paid for there;

- the seller demonstrates the product at the buyer’s home, and the transfer of this product and its payment takes place in a stationary retail chain facility that does not have a sales floor (for example, in the seller’s office).

In the first case, the activity of selling goods should be considered as retail trade (paragraph 18, article 346.27 of the Tax Code of the Russian Federation). In the second case - as retail trade through a stationary retail chain facility that does not have sales floors (paragraph 15 of Article 346.27 of the Tax Code of the Russian Federation). In both cases, the organization has the right to apply UTII (subclause 7, clause 2, article 346.26 of the Tax Code of the Russian Federation).

Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated December 30, 2010 No. KE-37-3/19025.

OKVED codes for retail trade in food and grocery products

Business owners who decide to engage in retail trade must choose a code from section G. LLCs and individual entrepreneurs can choose from two types of classifiers:

- OKVED 45 is a group that contains codes for the sale of vehicles and equipment. For example, if an entrepreneur decides to sell auto parts, he chooses a code from this category.

- OKVED 47 is a group of codes that are intended for conducting trade operations not related to the automotive sector. This includes the sale of non-food and food products. For example, trade in confectionery, soft drinks, and vegetables is allowed. Codes will be selected from the same group if a businessman plans to open a store selling building materials, office supplies, cosmetics and perfumes, furniture, household chemicals, plumbing equipment, and household goods.

Attention! Special permits must be obtained for certain areas of retail and wholesale trade. This applies to the sale of beer and other alcoholic products, as well as tobacco products.

As soon as a businessman decides on the category of product that he will sell, he needs to determine additional characteristics. These include specialized or non-specialized stores. For example, the owner will have a stationary store, a place in the market, or it will be outdoor trading.

If you plan to have a wide range of products in one chain of stores, then you need to choose 47.1 from the groups. OKVED retail trade in tobacco products, food and drinks in specialized stores is designated by coding 47.2.

OKVED for food stores is selected taking into account the type of product and type of store

Licensed trade

Trading activity itself is not licensed, but a license is needed if you plan to sell the following goods:

- alcoholic products, except beer, cider, poiret and mead (only organizations can obtain a license for alcohol)

- medicines;

- weapons and ammunition;

- scrap of ferrous and non-ferrous metals;

- counterfeit-proof printed products;

- special technical means designed to secretly obtain information.

For information on how to obtain a license, if you need one, read the article Licensing of activities.

OKVED codes for retail trade of non-food products

OKVED codes wholesale and retail trade in non-food products are classified in section 52. It includes a list of areas of activity that are associated with different types of trade. Classification involves division into subclasses:

- 52.1 - non-specialized stores;

- 52.2 - food;

- 52.3 - medical and cosmetic products;

- 52.4 - other trade in specialized stores;

- 52.5 - sale of used goods;

- 52.6 - trade outside the store;

- 52.7 - repair of household products.

Attention! Based on the classifier, retail and wholesale trade are classified into different subsections.

Retail trade OKVED in 2019-2020 non-food products are designated by code 46.4. This section is called “Wholesale trade of non-food consumer goods.” It contains a wide range of activities. These include trade:

- household items, including textiles;

- clothes, fur;

- shoes;

- household appliances;

- sewing machines.

Section 46 describes wholesale trade, but excludes sales of motor vehicles and motorcycles. In category number 47 is the retail trade of non-food products. Each item specifies in detail in which type of store a certain type of activity can be carried out.

For example, section 47.78 specifies retail trade, which is carried out in special stores. This includes folk crafts, optics, souvenirs, and religious goods.

Certain categories indicate trade in non-food products

Sale of discount cards

Situation: is it possible to apply UTII when selling discount cards? Discount cards are issued by an organization that is engaged in retail trade and pays UTII.

Answer: no, you can't.

For the purposes of UTII, retail trade means trade in goods on the basis of retail purchase and sale contracts (Article 346.27 of the Tax Code of the Russian Federation). In this case, any property that is sold or intended for sale is recognized as goods (Clause 3, Article 38 of the Tax Code of the Russian Federation).

In tax legislation, property rights do not relate to property, and therefore cannot be qualified as goods (clause 2 of article 38 of the Tax Code of the Russian Federation, article 128 of the Civil Code of the Russian Federation). Meanwhile, a discount card provides its owner with a property right - the right to receive discounts from the issuer of the card when purchasing goods from him in the future. Since discount cards are tangible carriers of property rights, they are not recognized as goods. Consequently, income from the sale of your own discount cards is not subject to UTII. Taxes on such income must be paid in accordance with the general or simplified taxation system. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated January 18, 2011 No. 03-11-06/3/1, dated March 25, 2005 No. 03-06-05-04/74 and the Federal Tax Service of Russia dated July 15, 2011 No. ED-4-3/11487.

OKVED codes trade and procurement activities

Assignment of OKVED is also necessary in cases where the company is engaged in procurement activities.

Note! The classifier does not have a separate section that will indicate “participation in procurement,” but the company must have a code indicating trade in the subject of procurement.

For example, we are talking about ordering computers for a school. An auction is held, a potential participant company nominates itself, and it must have a code confirming the sale of computer equipment. For intermediary activities there is a universal code - 51.19.

OKVED for retail trade is an important parameter for individual entrepreneurs and LLCs. Its assignment is mandatory when registering an activity. OKVED is necessary not only for maintaining statistical records, but also for the formation of taxation.

What information is contained in the code?

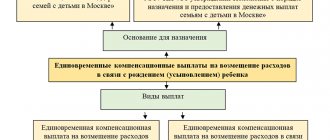

The structure of the OKVED code classifier for 2021 with decoding is based on the division of all the codes listed in it:

- to classes;

- subclasses;

- groups;

- subgroups;

- kinds.

This gradation makes it possible to detail the activity being carried out, identifying smaller groups within it that specify individual additional characteristics (for example, by field of activity, production process or materials used).

The code of the smallest group (type) consists of 6 digits, separated in pairs by dots. The transition upward (to each larger unit) will be accompanied by the exclusion of the last digit from the set of characters corresponding to the next level.

The assignment of codes corresponding to the main and additional types of activity of an economic entity occurs at the time of its registration. All necessary codes are indicated in the unified state register (Unified State Register of Legal Entities or Unified State Register of Legal Entities) along with other mandatory data entered into this register. When changing types of activities, it is necessary to submit information about this to the registration authority so that the register reflects information about them that corresponds to reality.

Read more about the procedure for changing codes here.