In order to collect receivables in court, you need to carefully prepare. It is necessary to collect evidence, correctly formulate the statement of claim and determine which arbitration court it should be submitted to. An appeal to the court can be made only after 30 days have passed after the claim was sent to the debtor. Next, we will consider the steps that should be taken before filing an appeal to the court.

It is worth recalling that accounts receivable is the amount of debt that an organization owes from customers or other debtors. The company expects to receive this amount within a certain time frame.

There are hardly any organizations that have not faced the need to collect receivables from dishonest counterparties. Some of them manage to achieve results by filing a claim, but this method is quite rarely effective. Most often, creditors are forced to go to court to protect their own rights and interests.

Send claims to the debtor

Before the creditor decides to go to court with a statement of claim containing information about the collection of overdue receivables, he needs to perform certain preparatory steps. First, you need to send a claim to the debtor, which must indicate the amount of the debt, as well as the grounds on which it arose. The claim must be accompanied by details that should be used to repay the amount, and copies of documents indicating the occurrence of the debt. If no response to the claim is received within a reasonable period of time, then you can begin preparing documentation for going to court.

Based on the practice of communicating with our clients, in order to simplify the preparation and sending of a letter of claim to the debtor, it is better to automate this process.

By automating the process of submitting a claim, we mean:

- Creation of claim letters in bulk based on a predefined template;

- Be able to add details and contact information of the debtor en masse to a template from the database;

- The ability to create a business process that will automatically send claim letters to a group of debtors who have reached a certain level of delinquency;

- Integration with the Russian Post service for automated sending of letters to debtors in bulk.

Get more detailed advice

When do documents fail to prove a debt?

Let us turn to the Resolution of the AS UO dated December 16, 2016 No. F09-10392/16. The subscriber was billed for international communication services that he did not order or consume. Based on the fact of an unauthorized connection, the subscriber contacted the investigative authorities, but the initiation of a criminal case was refused due to the fact that access to the subscriber line was free for a sufficiently long distance.

Thus, proper measures were not taken by the telecom operator to protect telephone lines. Moreover, actions to prevent unauthorized access were carried out by the subscriber himself, who demanded that the provision of long-distance communication services be stopped in advance. However, the operator continued to provide these services without ensuring adequate protection of the communication line. The inspection reports submitted by the operator, refuting what was said and drawn up unilaterally, were not taken into account by the arbitrators. As a result, the telecom operator was unable to prove the subscriber’s debt for the disputed services.

For comparison: in a similar situation, the operator was able to prove the subscriber’s debt for significantly exceeded consumed services. But the consumer of mobile communications services was largely to blame for this. As follows from the Resolution of the Ninth Arbitration Court of Appeal dated December 8, 2016 No. 09AP-55053/2016-GK, the operator provided the enterprise with corporate communications. An employee of the enterprise lost one of the identification modules (SIM card), which was not reported to the operator in a timely manner, and communication services continued to be provided.

The Rules for the Provision of Telephone Services [1] clearly state that the subscriber is obligated to pay for mobile services provided by the telecom operator until the telecom operator receives notification of the loss of the identification module. This was also stated in the agreement concluded by the enterprise with the telecom operator. Actions aimed at obtaining services performed with subscriber equipment - with a working SIM card of the subscriber - are considered to be performed on his behalf and in his interests.

The fact that the operator did not pay attention to the significant increase in consumption of communication services does not constitute grounds for the subscriber’s unilateral refusal to fulfill the payment obligation. The terms of the agreement provide for the operator’s right to restrict the provision of services in case of exceeding the credit limit, but not the obligation to introduce such a restriction. In itself, the consumption of mobile communication services specifically in the interests of the subscriber is not a significant circumstance in the case, since the lost SIM card was registered with the enterprise until the loss was reported.

As a result, the negligence of the employee, who did not promptly report the loss of the identification module, cost the enterprise dearly, which had to repay the debt for communication services before the lost SIM card was blocked.

Check primary documents

A significant point in preparing for judicial debt collection is that the creditor has the originals of primary documentation, which confirms the fact that legal relations have been established. Of primary importance is the contract, which must contain essential terms and be signed by all authorized persons.

In some cases, there may be no agreement. In such a situation, the creditor, when going to court, has the right to provide another document. This possibility is specified in paragraph 2 of Art. 434 of the Civil Code of the Russian Federation, according to which it is permissible to conclude an agreement not only through the preparation of a single document signed by the parties, but also through the exchange of telegrams, letters, faxes and other documentation transmitted through various communication channels, including electronic. The only condition in the latter case is the possibility of reliably establishing that the document was sent by a party to the contract.

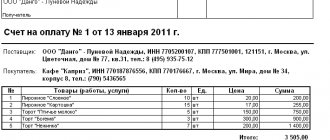

In addition, the creditor can confirm the existence of an obligation by providing certificates of completion of work, invoices and other primary documentation. Situations are quite common when the debtor repays the debt partially. This fact can be confirmed by payment documentation certifying partial payment (payment and other cash documents). When going to court, such circumstances must be taken into account.

An important point for debt collection is the existence of a reconciliation act carried out for mutual settlements. This document certifies the debtor's acceptance of the recognition and fulfillment of the debt. The specified act must be properly executed, having personally signed signatures of persons who are authorized representatives of the parties, and a transcript of these signatures. The document must necessarily contain an indication of the legal relations existing between the parties and their amount. The reconciliation act will assist the court in making an informed decision.

Why do you need to confirm the debt?

In the process of transactions (execution of contract terms), the parties have rights, requirements and obligations. The latter must be executed properly in accordance with their terms and provisions of the law (Article 309 of the Civil Code of the Russian Federation). The debtor bears the costs of fulfilling the obligation based on its terms. In particular, upon receiving the goods, the buyer must pay for it. Likewise, the seller must ship the goods upon receipt of advance payment. Documents confirming the occurrence of obligations are shipping (waybills, waybills) and banking (payment orders, bank account statements) documents.

With services it is more difficult. It is more difficult to confirm the fact of their provision, and, accordingly, the emergence of an obligation to the customer to the contractor, especially if there is no tangible result. In civil legislation (neither in Chapter 37 “Contracting”, nor in Chapter 39 “Paid provision of services”) there are no clear instructions on how a contractor (performer) can record the volume and cost of work performed (services provided) and confirm them with documents. It all depends on the specific situation.

Read more: Mortgage for a young family with maternity capital

Determine the possibility of debt collection in court

After checking the information specified above, the creditor needs to determine whether it is possible to go to court to collect the receivables. To do this, you need to clarify a number of questions:

- Has the debtor been liquidated?

If an entry was made in the Unified State Register of Legal Entities according to which the debtor’s activities were terminated due to liquidation, then it is impossible to bring a claim against him. However, if the debtor is in the process of bankruptcy, at one of its stages, then collection of receivables is carried out in the manner established by the Federal Law “On Insolvency”, that is, by including the claim in the existing register of creditors’ claims. Debt collection will be carried out in the order established by law.

If the debtor is an individual entrepreneur, then it should be taken into account that the termination of the functioning of an individual entrepreneur is not an obstacle to filing a claim for collection of receivables in court, since an individual undertakes to answer for all his existing obligations, including those formed in the course of business activities .

- Has the statute of limitations expired?

In general, this period is three years. Its calculation is carried out from the moment when the payment deadline was established. At the same time, if the parties did not indicate a payment deadline, then the rule of the second paragraph of Part 2 of Art. 200 Civil Code of the Russian Federation. According to it, if a deadline for fulfillment was not specified for obligations, then the limitation period should be calculated from the moment when the creditor acquired the right to make a claim regarding the fulfillment of obligations. If the debtor is given a certain period to fulfill such a requirement, then the beginning of the limitation period should be counted after the end of this period. In this case, the limitation period cannot be more than ten years, counted from the date of establishment of the obligations.

If more than three years have passed since the payment due date, you should check whether the debtor has retained any documentation that certifies the recognition of the debt (for example, a document confirming partial repayment). In accordance with Article 203 of the Civil Code of the Russian Federation, the commission by the obligated person of actions that indicate his recognition of the debt interrupts the calculation of the limitation period. After this break, a new countdown begins.

It should be noted that even if the statute of limitations has expired, the creditor is not deprived of the opportunity to go to court due to a violated obligation. In such a situation, if there is no petition on the part of the debtor to skip the statute of limitations and there is evidence confirming the occurrence of the debt, the court will be able to make a decision to collect the receivables.

On what date should a bad debt be written off?

The Tax Code does not directly establish a special date for writing off bad debt and reducing the tax base for income tax. Based on practice, the most acceptable is the last day of the reporting or tax period in which the debt is recognized as bad (subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation).

In turn, the date of recognition of the debt as uncollectible will be the date of drawing up the corresponding document, the date of making an entry in the Unified State Register of Legal Entities on the liquidation of the organization, the date of drawing up the act of the state body, the date of the bailiff's decision on the completion of enforcement proceedings.

If bankruptcy proceedings have been opened against your debtor, then they are considered completed from the date of making an entry on the liquidation of the debtor in the Unified State Register of Legal Entities (Article 149 of the Federal Law “On Insolvency (Bankruptcy)”).

A bankrupt's receivable can be considered hopeless after the completion of bankruptcy proceedings and an entry in the Unified State Register of Legal Entities about its exclusion from the register (Letter of the Ministry of Finance dated March 18, 2021 No. 03-03-06/1/17813).

Select the court to which you need to file an application for collection

Another significant issue is the choice of the court in which to file a claim for collection of receivables. According to current legislation, such an application must be submitted to the court located at the location of the defendant:

- when filing a claim against an individual entrepreneur or legal entity, its location is the state registration address, and the claim must be sent to the appropriately located arbitration court;

- in the event of a claim being brought against an individual, the place of his location is considered to be the address at which he is registered, and the claim must be sent to the appropriate court of general jurisdiction.

In addition, the parties have the right to indicate in the contract another court that will deal with their dispute.

Are contractual relationships required?

The user with whom the contractual relationship is concluded is a subscriber who is obliged to pay for the services provided to him. However, in practice, not everyone who uses communication services is a subscriber. Sometimes services are consumed by persons with whom contractual relations have not been formalized in the prescribed manner. Does this give them the right not to pay bills for consumed communication services?

A systemic interpretation of the provisions of the Communications Law leads to the conclusion that users of communication services are required to pay (regardless of whether or not telecom operators have formalized relations with them). This is confirmed by court decisions. One of the situations encountered is the lack of contractual relations among government customers. Or rather, there were initially contractual relations, but then the contract expired, nevertheless, the operator continues to provide communication services even without a contract.

He is obligated to do this by the aforementioned law, according to which telecom operators do not have the right to unilaterally suspend and (or) terminate the provision of communication services for the needs of defense, state security and law enforcement. Therefore, operators cannot stop providing services due to the lack of a government contract, which does not relieve the customer who has consumed the services from the obligation to pay for them. Resolution of the AS SZO dated January 13, 2017 No. F07-12336/2016 is further proof of this.

The provision of services to a military institution as a government customer is confirmed by data obtained using the plaintiff’s equipment used to record the volume of communication services provided, invoices, and invoices for payment. This is enough to satisfy the claim of the service provider even without a valid contract. Moreover, even in the described case, relations between the parties took place (business transactions were carried out), they were simply not formalized in the prescribed manner.

Prepare a statement of claim

This stage is conventionally divided into two parts: drafting the text of the statement of claim and fulfilling the legal requirements that are associated with filing the application. The application must be prepared in accordance with the legally established requirements for its content and form. The statement of claim must include the following provisions:

- The name of the arbitration court to which it is presented. Before filing a claim for collection of receivables from a legal entity, it is necessary to establish the jurisdiction of the dispute to a certain arbitration court. According to the rule of territorial jurisdiction, the case must be heard by an arbitration court that operates in the same territory where the defendant is located. In other words, in order to determine the jurisdiction of a case by any arbitration court, it is necessary to establish the location of the company that acts as a defendant in the case. The determination of territorial jurisdiction in most cases has no connection with the nature of the case.

- The names of the parties, their addresses and other identifying information, as well as the channels that can be used to contact the plaintiff.

- The plaintiff's claims are on the merits. The arbitration court can satisfy only the stated requirements. If the requirements are formulated incorrectly, the submitted application may be rejected. For this reason, it is important to pay special attention to the formulation of requirements and take a responsible approach to the inclusion of references to the rules of law that are subject to application in the dispute resolution process.

- Circumstances that form the basis of the requirements. It is required to describe in detail the essence of the dispute, referring to specific existing evidence.

- Extracts from the unified register of legal entities or individual entrepreneurs. They are necessary to establish the current status and location of the defendant. It is important to take into account that these extracts must be received no earlier than thirty days before the date when the appeal will be sent to the court.

- The cost of the claim, including the calculation of the disputed or recovered amount of money.

- Amount of debt. It is necessary to provide calculations of the amount that is formed not only from the principal debt, but also from penalties that are imposed in the form of penalties and forfeits.

- Signature of an authorized person. It is necessary to ensure that the person signing the application has the appropriate authority. In general, if we talk about a legal entity, such powers are vested in the sole executive body, which has the right to act on behalf of the legal entity without a power of attorney. Evidence demonstrating the existence of authority to sign the application must also be provided to the court.

Block No. 2 – working with the site https://www.fedresurs.ru/

This portal is an all-Russian state platform for bidding on property and receivables of citizens and organizations.

Working with this resource is difficult, so there are paid alternative options, for example, https://bankrot-pro.com/.

The advantage of paid sites is their ease of use.

The downside is that not everything can be found. Some options are not in the database. Therefore, you may miss your chance.

What do statuses and trades mean?

Type of bidding – Public offer. The cheapest remote sensing is exhibited here. Bidding goes down; if you choose an auction, bidding goes up. This will result in a significant overpayment. Prices are initially inflated.

Status – Open acceptance of applications and Announced tenders.

The bankruptcy trustee is obliged to put up the claim for open acceptance of applications, so most of the lots are located in this section. Most people only open it and don't look at other sections.

If the bankruptcy trustee has his own interests in the lot, he may “forget” to change the status and put the property claim up for auction. This is where you can find the best deals. Don't forget to review.

Acceptance of applications in the status of Announced Bidding has not yet begun. But we can obtain information and make a request to the bankruptcy trustee for the lot that interests us.

Search and view lots

Often sentences repeat the same organization. We don’t have to open the auction every time and see what the bankruptcy trustee is selling. All you have to do is go to the page, all the property and personal information of the debtor are presented there.

As you can see, all lots are on one page. If the DZ is not among them, then we will not open this lot again. Of course, unless you want to buy the property.

This is approximately what the remote control that needs to be found looks like.

Go to the tab – Messages and click – Sales Message, where in the window that opens we copy the organization’s TIN.

We enter the TIN in the Legal Entities section (described above) and should receive an active organization. Not bankrupt or in liquidation. The data is taken from the example of another company.

Click on an organization and get complete information about it. We pay special attention to the net asset value line. Just because they aren't listed doesn't mean they don't exist.

We copy the debtor’s TIN and paste it onto the website https://kad.arbitr.ru/ where we look at all the files on this company.

Looking through the documents, we can see that the debtor was not declared bankrupt. Theoretically, this remote sensing will suit us.

We carefully study all the debtor’s documents, look at the deadlines for appealing decisions, changes of directors, changes of address, check the owner of the organization in the bailiff database and draw the following conclusion:

- The company is active.

- She is suing and trying to reduce her debt.

- The organization does not want to go bankrupt.

Therefore, we can collect the debt.

Don't forget to look at the records made at the tax office. As you can see, the organization is functioning, which means we are on the right track.

We try to get as much information as possible about remote sensing. In the future, this will help save not only money, but also time.

Independent work (homework)

- Check 20 debtors every day to find the best deal.

- Study documents on open databases in full.

- Check the directors.

- Look at Google, Yandex and 2GIS maps for the addresses of enterprises. Are they located there?

- Keep an eye on the statute of limitations.

- If you find a good offer, call the organization and find out if they are currently working.

- Call the bailiffs, perhaps they have already collected the debt. After re-registration of rights of claim, you will immediately receive money.

A small trick: the property can be sold to the debtor himself without contacting the bailiffs.

Pay the state fee

Details for paying the state fee can be easily found on the website of the court that has jurisdiction over the current dispute. On the same resource of the arbitration court there is a state duty calculator, with which you can get the exact amount, avoiding errors in calculations.

The creation of claims and the calculation of state fees can also be automated.

At the moment when the decision to file a lawsuit is made, claims can be created based on the current schedule. Claims can be created either for the entire debt or for part of it. In this case, an unlimited number of claims can be filed for the loan. Accordingly, the amount of claims when resubmitted to court may differ.

When filing claims, the type of proceedings is selected: claim or writ and the state duty is calculated.

Get more detailed advice

Send the defendant a copy of the statement of claim

The law obliges the plaintiff to send to the defendant a copy of the filed statement of claim, supplemented by the documentation attached to it, which the defendant does not have, by registered mail with notification. Evidence of this direction must be provided in the case file. If there are no documents in the case file confirming the payment of the state fee or the filing of the claim, the statement of claim will be guaranteed to be left without progress, which will significantly delay the consideration of the dispute. If the claim procedure has not been followed, the submitted application will be returned by the court without consideration. When sending a statement of claim, you should take into account the possibilities of summary and writ proceedings, but it is best to be prepared for a lengthy trial. It is worth remembering that when collecting receivables through the court, you may encounter certain problems.

Collection of receivables from a legal entity within the framework of writ proceedings

Writ proceedings are the procedure for considering an application regarding the issuance of a court order, which is a judicial act issued by a single judge, acting as an executive document. In writ proceedings, only the documentation submitted by the claimant is examined. After studying these documents, a decision is made regarding the issuance of a court order, which can be applied for in the following cases:

- The basis for demands for collection of receivables from a legal entity is non-fulfillment or improper fulfillment of the terms of the contract. These requirements must be supported by documentation that establishes the monetary obligations recognized by the debtor. The size of these obligations should not exceed 400 thousand.

- The requirements are based on the notary’s undating of acceptance, non-acceptance and protest of the bill of exchange for payment. In this case, their size cannot be more than 400 thousand.

- Requirements have been made regarding the collection of sanctions and mandatory payments. Their size cannot be more than 100 thousand.

The documents provided must clearly demonstrate that the defendant undertakes to satisfy the demands placed on him. At the same time, there should be no legal dispute between the collector and the debtor regarding the collection of receivables.

What forms are there for certificates of receivables (and payables)?

Among the most common unified forms used to reflect receivables (and, if required, payables) debts is form No. INV-17, approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88. We are talking about an act of inventory of settlements of a business entity with its debtors and creditors.

This document can be used in strict accordance with the legally approved form or as a basis for drawing up a certificate.

You can learn more about the specifics of working with form No. INV-17 in the article: “Unified form No. INV-17 - form and sample.”

Another popular unified document is the form of a certificate of accounts receivable and payable, approved in Appendix No. 3 to the order of the Ministry of Justice dated July 30, 1999. The jurisdiction of this order is departmental, but the form of the certificate proposed in it allows any interested business entity to reflect in detail the structure of its receivables and payables.

Simplified production

Summary proceedings, unlike writs, have an actionable nature, implying an adversarial process, the provision of arguments and evidence from both parties, even though it is carried out without their direct summons. The following categories of cases can be considered under simplified proceedings:

- for claims for collection of funds, including claims for collection of receivables from a legal entity, if the cost of the claim is no more than 800 thousand rubles for legal entities (from 10/01/2019) and 400 thousand rubles for individual entrepreneurs;

- on the collection of sanctions and mandatory payments, if the generalized amount of the amount collected is from 100 to 200 thousand rubles (from 10/01/2019).

Determining the price threshold is the basis for distinguishing between cases that are considered in simplified and writ proceedings.

The features of making and issuing a court decision include the following:

- According to the general rule, the decision is made by the court immediately after the end of the trial by signing the operative part in the judicial act. The adopted decision becomes valid 15 days after the day of its adoption.

- To draw up a reasoned court decision, that is, in full, it is necessary to submit a corresponding application by the initiative person taking part in the process within five days from the date of formation of the operative part. In this case, the decision becomes valid only after a month, since this is the period allotted for filing an appeal.

Thus, in the absence of a statement from one of the parties, the judge is freed from the need to prepare a reasoning part of the decision, which allows speeding up the legal process.

Application of interim measures

The peculiarities of the arbitration process provide defendants with many ways to delay the consideration of a dispute. More than a year may pass from the moment of going to court until the date of entry into force of the judicial act, during which time the debtor gets the opportunity to get rid of assets, which makes it impossible to actually collect receivables. To protect creditors from abuse of rights, there is a mechanism that allows you to take measures aimed at enforcing a judicial act in the future. The following interim measures are most often encountered in judicial practice:

- Seizure of funds and other property.

- Prohibiting the defendant from performing certain actions.

- Prohibition for government agencies to perform registration actions in relation to property.

A broader list of measures is contained in Art. 91 of the Arbitration Procedure Code of the Russian Federation, which is not exhaustive, therefore the law allows the use of security not included in the list. The court will take only those measures that are proportionate to the main requirement and motivated, so it will be necessary to prove why their non-application will lead to the impossibility of executing the judicial act. The application is considered within a day from the moment of receipt, and if it is satisfied, a writ of execution is issued, which is sent to the bailiff service, or the state body carrying out registration actions.

Measures can be taken at any stage of the judicial process, and in exceptional cases, preliminary security is applied, aimed at protecting the property interests of the applicant. Preliminary measures are applied on the basis of a petition received by the court before filing a claim, provided that the latter is filed no later than 15 days from the date of taking the measures.

The provision of counter collateral, which includes:

- Depositing funds with the court.

- Bank guarantee.

- Guarantee agreement.

The risk is that if the claim is refused and the measures cause losses to the counterparty, they are compensated through the counter collateral.