The SZV-STAZH form is submitted annually to the Pension Fund of Russia by all enterprises with any form of ownership. This form of report is required to be submitted by enterprises that have employees with whom labor relations have been established and they receive income subject to insurance contributions. When filling out the report, do not forget anyone, as it is filled out for absolutely all employees.

The SZV-STAZH form must be submitted along with the inventory according to the EDV-1 form. It reflects a list of reports submitted to the Pension Fund and current information about the policyholder. If the number of employees in an organization is more than 25 people, the SZV-STAZH form is submitted electronically, signed with an enhanced qualified signature. Accordingly, if you have less than 25 people, you can submit it on paper.

You will have to report even if at least one employment contract or civil law contract was concluded during the reporting period. You will need to submit a report even if an individual entrepreneur without employees has signed a contract for some repair work with an individual for one month.

The SZV-STAZH form must be submitted by March 1. This means the report for 2021 will need to be submitted by 03/01/2021. But don’t wait until the last minute; it’s better to send it before then. The report can be submitted ahead of schedule by the insured in several cases: during liquidation, reorganization and in the event of termination of the status of a lawyer, the powers of a notary engaged in private practice (Clause 3 of Article 11 of the Law “On Accounting” dated April 1, 1996 No. 27-FZ). But if an employee quits during 2021, and his dismissal is not related to retirement, there is no need to submit the SZV-STAGE form early.

What is the report for?

The SZV-STAZH report and the procedure for its formation were approved by Resolution of the Pension Fund Board of January 11, 2021 No. 3p. In SZV-STAZH with the “initial” information type, you need to include all employees and performers (contractors) under civil contracts. Every year, such a report must be submitted to the Pension Fund authorities no later than March 1 of the year. See “SZV-STAZH: new reporting for all employers: 2021.”

Pension Fund bodies that have received SZV-STAZH reports will monitor the accrual of length of service of individuals to form their pension rights.

Due dates

The report partially replaces the personalized sections of the abolished RSV-1 form. All employers must fill out this document for each employee separately, so in essence it is personalized.

The deadline for submitting the SZV-STAZH for 2021 is 03/01/2021. The obligation to submit this document is provided for in paragraph 2 of Article 8 of the Federal Law dated 04/01/1996 No. 27-FZ, and the form and sample for filling out the SZV-M (STAZH) 2021 were approved in the Resolution of the Board of the Pension Fund of the Russian Federation dated 12/06/2018 No. 507p.

ConsultantPlus experts discussed how to correctly fill out SZV-STAZH and SZV-M when dismissing an employee. Use these instructions for free.

Three types of report

The report form provides that it can be compiled with one of three typical characteristics:

- Type “initial” – when information is submitted for the first time;

- “Additional” type – if the original data contained errors that did not allow the data to be distributed among the personal accounts of the insured persons;

- Type “appointment of pension” - if the insured person, in order to assign an insurance pension, needs to take into account the data of the reporting period (year), for which the SZV-STAZH form has not yet been submitted.

As you can see, this type of information as “Upon dismissal” does not exist. But does this mean that the SZV-STAZH form does not need to be issued to an employee when dismissing him? The answer to this question is given to us by the legislation on individual (personalized) accounting.

How to compose it correctly?

The certificate is drawn up in accordance with Appendix 1 to Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 N 507p, as well as in accordance with the general rules from Sections I and II of Appendix 5. The information is entered in typed or handwritten text with a ballpoint pen in black or blue ink.

If the form is submitted to the Pension Fund in electronic form (upon retirement), the employee is given a printed copy.

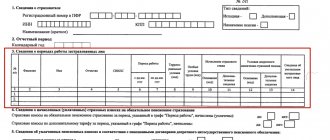

Blank form SZV-STAZH.

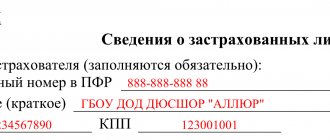

Section I. Information about the policyholder:

- in the “Information Type” field, put opposite “Initial” or “Pension Assignment” if the employee resigns due to retirement;

- indicate the twelve-digit registration number of the Pension Fund received upon registration;

- enter the TIN in accordance with the certificate of registration as an insurer, if the number is less than 12 characters, put a dash in the last cells;

- in the “KPP” column, indicate the reason code for registration, in accordance with the notification from the Pension Fund;

- indicate the short name of the organization in accordance with the constituent documents, for example, Beta LLC or IP Ivanov Ivan Ivanovich (it is allowed to use Latin characters if they are contained in the name).

Section II. Reporting period.

In section II, indicate the reporting period for which personalized accounting information will be provided, in the “yyyy” format. It corresponds to the year of dismissal, based on the explanations of the Rostrud information portal “Online Inspectorate”. Example: "2020"

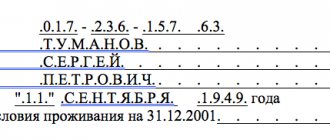

Section III. Information about the insured person:

- in the “N n/n” column, enter the serial number “1”; if, while filling out the form, you need to enter data for one employee in the columns below, the lines do not need to be numbered;

- in columns 2-4, enter the surname, name and patronymic of the employee, for example, Petrov Petr Petrovich;

- in the “SNILS” column, indicate the individual insurance number in the format 000-000-00000;

- in the “Work period”, indicate the period calculated from the beginning of the reporting year until the date of dismissal; for example, if the extract is issued for 2021, in column 6 indicate “from 01/01/2019”; in column d, indicate the date of dismissal, for example, “until 02/08/2019”;

- then indicate the code of territorial working conditions in accordance with the classifiers, if the employee worked under appropriate circumstances; for example, for workers from the Far North, the code is “RKS”;

- fill out column 9 provided that the special working conditions are documented and were paid at an additional rate; indicate the code in accordance with the classifiers; for example, if the employee worked hard, enter “27-2”;

- in “Calculation of insurance length” (10), enter the code of the basis for the classifiers, if the employee has the right to early retirement; for example, in connection with field work, the code is “FIELD”;

- in the right column (11), enter the reasons for which insurance premiums were not deducted for the reporting period in accordance with Part 7 of Art. 430 Tax Code of the Russian Federation; for example, if an employee took parental leave for 3 years, indicate “CHILDREN”; in the “Work period” column opposite the code, reflect the vacation period (for this reason, the code is placed 1 line lower);

- columns 12-13 are filled out by analogy with the previous ones and in accordance with the classifiers given in the Appendix to the resolution, provided that insurance premiums for the reporting period were accrued with an additional payment according to the additional tariff; accordingly, indicate the code of the conditions for early retirement, and in column 13 - the actual time worked (months, days) or the amount of work (share of the rate);

- in column 14 they put o, if the dismissal is made on the last day of the reporting period (December 31), in the format 12/31/yyyy.

Sections IV and V must be completed if the employee leaves due to retirement. Please indicate “Yes” or “No” in the appropriate fields if insurance premiums for the reporting period were accrued and paid, and were also accrued at an additional tariff. Fill out the fifth section only if contributions were paid to a non-state pension fund, indicating the periods in the format “dd.mm.yyyy”. Below, put your signature with a transcript, the name of the manager’s position, for example, “General Director” and the date of completion. If available, please stamp it.

Important! In most cases, many fields are left blank. There is no need to put dashes, just leave them blank.

Sample filling

Check out an example of filling out the SZV-STAZH form.

This is an example of filling for clarity. Your shape may vary.

SZV-STAZH - to every dismissed person

Paragraph 2 of Article 11 of Federal Law No. 27-FZ dated April 1, 1996 “On personalized accounting” establishes that no later than March 1, policyholders are required to submit SZV-STAZH reports to the Pension Fund of Russia.

RULE OF LAW

The policyholder annually, no later than March 1 of the year following the reporting year (except for cases where other deadlines are provided for by this Federal Law), submits information about each insured person working for him (including persons who have entered into contracts of a civil law nature, the remuneration for which is In accordance with the legislation of the Russian Federation on taxes and fees, insurance premiums are calculated) the following information:

- insurance number of an individual personal account;

- last name, first name and patronymic;

- the date of hiring (for an insured person hired by this policyholder during the reporting period) or the date of concluding a civil law contract, for the remuneration for which insurance premiums are calculated in accordance with the legislation of the Russian Federation;

- the date of dismissal (for an insured person dismissed by this policyholder during the reporting period) or the date of termination of a civil contract for which insurance premiums are calculated in accordance with the legislation of the Russian Federation;

- periods of activity included in the length of service in the relevant types of work, determined by special working conditions, work in the Far North and equivalent areas;

- other information necessary for the correct assignment of an insurance pension and funded pension;

- the amount of pension contributions paid for an insured person who is a subject of the early non-state pension system;

- periods of labor activity included in the professional experience of the insured person who is a subject of the early non-state pension system;

- documents confirming the right of the insured person to early assignment of an old-age insurance pension.

In accordance with paragraph 4 of Article 11 of the Federal Law of 04/01/1996 No. 27-FZ, on the day of dismissal of the insured person or on the day of termination of a civil contract for which insurance premiums are calculated, the policyholder is obliged to transfer to the insured person the information provided for in paragraph 2 Article 11.

Paragraph 2 of Article 11 of Federal Law No. 27-FZ dated 01.04.1996 talks about the information contained in reporting in the SZV-STAZH form. Consequently, on the day of dismissal of an employee or on the day of termination of a civil law contract, the organization or individual entrepreneur is obliged to issue the insured person with a completed SZV-STAZH form.

In the SZV-STAZH report, in general, it is necessary to include information on all insured persons. In section 3 “Information about the periods of work of insured persons,” individuals are listed in a list.

However, a dismissed employee is prohibited from issuing a report if it includes information about other people. The fact is that such information refers to personal data. And it is impossible to disclose personal data of individuals without consent. Also see “Personal data from July 1, 2021”. Upon dismissal, only one person must be indicated in SZV-STAZH. After all, this report concerns only him.

Continuous experience and conditions for maintaining it

The amount of continuous work experience affects only the amount of payments under the certificate of incapacity for work. Despite the fact that the main document for its calculation has remained unchanged since 1973, the question of how long continuous work experience can be maintained after voluntary dismissal is very complex.

The inconsistency of the simultaneously valid labor law documents leads some to believe that this period is not interrupted for 3 weeks. And other experts have the right to claim that this period is equal to two months. A more practical approach would be to take a 3-week break between two jobs. This figure should be maintained with any further changes in legislation.

The two-month break now applies to persons who worked in the Far North and in international organizations, or when working in Russian authorities abroad. In case of dismissal as a result of liquidation or reorganization of the enterprise, the break period is increased to three months.

Mothers of minor children have a greater benefit. If they quit their job, their continuity of service remains until the child turns 14 years old. And if the child is disabled, then up to 16 years old.

For those who are dismissed for committing culpable misconduct, continuous service is not maintained. For employees who have been reinstated by the court, their continuity of service is resumed.

The period of continuous service includes service in the army and law enforcement agencies. For such people, the period of maintaining continuity of service lasts up to three months. There is a large category of people for whom the length of service is not interrupted, but it does not include time spent studying or staying abroad as a family member. If a person changes cities, for example to the Far East, the break increases by the time required for the move.

Sample of a completed report

Let’s assume that the employee has been employed under an employment contract since 2014. However, he resigned of his own free will on April 18, 2017. On the day of dismissal, he must be issued a SZV-STAZH certificate. The employee contacted the HR department for a report on the length of service.

In the “Work period” field in Section 3 of the report, the accountant will show the time period from the beginning of 2021 to the date of dismissal: from 01/01/2017 to 04/18/2017.

As follows from the conditions of our example, the employee has been employed under an employment contract since 2014. And for the entire period of work before the date of dismissal, contributions were accrued and paid for remuneration in his favor and, as a result, insurance experience accumulated. But why, then, in section 3 of the SZV-STAZH issued upon dismissal, did you indicate only 2021? The fact is that in paragraph 2.3.2 of the Procedure for filling out the SZV-STAZH, approved by Resolution of the Board of the Pension Fund of January 11, 2021 No. 3p, the following is directly stated:

Quote from the filling rules

“The dates indicated in the “Operation period” column of the table must be within the reporting period specified in section 2 of the form and are filled in: “from (dd.mm.yyyy.)” to “to (dd.mm.yyyy.) "".

Thus, if you strictly follow the rules for filling out the SZV-STAZH, only one reporting period can be recorded in the report - 2021.

HAVE A QUESTION!

But is it necessary to issue the employee the same reports for previous years: 2014, 2015 and 2021? Logically, such reports need to be provided to him so that the person gets a general idea of the deductions for him and his length of service for the entire period of work. But what about the fact that until 2021 the SZV-STAZH form was not yet in effect?

Or, upon dismissal, is it still possible to issue one SZV-STAZH form for the entire period of work? There are no answers to these questions yet. Let's hope that the FIU will soon publish some clarification in this regard.

For what period is it issued?

The SZV form includes information about the employee’s period of work with the specified employer for the period for which the certificate is provided (for example, for 2021).

When submitting SZV-STAZH to the Pension Fund in relation to dismissed employees from 2021, you must include information about the period of work from January 1, 2021 to the date of dismissal , since the Pension Fund of the Russian Federation has information for previous periods of the employee’s work. If the date of dismissal falls on December 31, 2021, then a dash is placed in column 14 of the form.

How to hand over a report to those fired

The legislation does not explain exactly how the SZV-STAZH report must be handed over to the former employee upon dismissal: in person, by mail or electronically. In our opinion, you can use any of these options. The main thing is to have confirmation that the dismissal reports were provided. At the same time, there is no liability for failure to issue SZV-STAZH upon dismissal.

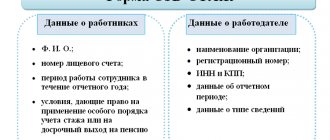

On the employee’s last day of work, pay him and give him:

- work book;

- a certificate of the amount of earnings in the form approved by order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n;

- copies of information in the SZV-M form;

- a copy of information in the form SZV-STAZH;

- a copy of section 3 of the calculation of insurance premiums;

- other documents (upon written application from the employee).

Read also

15.01.2021

How to submit a form to the Pension Fund

To be sent to the Pension Fund of Russia, the completed forms are collected and an additional inventory is compiled for them according to the OVD-1 form. They will only be accepted in this form.

In 2021, personalized reporting will be submitted electronically using special systems and EDI operators. Today, it is impossible to fill out the SZV-STAZH online on the Pension Fund’s website, therefore, to prepare reports, in the absence of specialized programs (1C, Astral, etc.), the Pension Fund recommends using the free programs spu-orb and PU6.

szv-td_pri_uvolnenii.jpg

The sample for filling out the SZV-TD form upon dismissal under other articles of the Labor Code of the Russian Federation will be similar. Only the entry about the reason for dismissal in column 6 of the tabular part of the form will differ.

If Smirnova A.A. was fired not on her own initiative, but by agreement with the employer, the entry in column 6 would look like this:

“The employment contract was terminated by agreement of the parties, paragraph 1 of part one of Article 77 of the Labor Code of the Russian Federation.”

If the employee is dismissed due to retirement, the entry will be as follows:

“The employment contract was terminated at the initiative of the employee in connection with retirement, paragraph 3 of part one of Article 77 of the Labor Code of the Russian Federation.”

If the employee died, the entry in column 6 of the SZV-TD looks like this:

“The employment contract was terminated due to the death of the employee, paragraph 6 of part one of Article 83 of the Labor Code of the Russian Federation.”