Starting from 2021, the procedure for withholding income tax when an employee goes on vacation has changed. Considering that the employer acts as a tax agent in this case, it is worth figuring out how to withhold personal income tax from vacation pay, when to pay to the budget in 2021, and what date is recognized as the moment of receipt of income.

What do you need to know?

Sometimes employers and employees themselves are not aware of whether personal income tax is paid on vacation pay. Such a payment is not considered a salary or bonus, but tax is still withheld from it.

Vacation pay is the employee's income and is therefore taxed. The same rule applies to payments for unused vacation days. The withholding of tax from such payments is approved by the Tax Code of Russia. The listed personal income tax must be included in accounting and tax reporting.

Personal income tax is always withheld from vacation pay

Important ! Vacation pay can be provided to the employee in cash or by transfer to a card or bank account.

When transferring funds, tax is withheld from them. Management assumes the role of tax agent and undertakes to follow all rules for the allocation of funds to the state budget.

Funds are transferred to the treasury at the time vacation pay is accrued or a transfer is made to the employee’s card. There is no need to carry out this procedure in advance.

The tax is transferred at the time the vacation pay is received. This is stated in Article 226 of the Tax Code of the Russian Federation.

Excerpt from Article 226 of the Tax Code of the Russian Federation

Employer's liability for late tax payment

In case of untimely or partial transfer of personal income tax to the tax office, various tax sanctions are applied to the employer, and the guilty officials are brought to administrative or criminal liability.

According to Art. 123 of the Tax Code of the Russian Federation, tax agents are fined the same amount - 20% of the tax, which is subject to withholding and (or) transfer. If, in case of violation of the rules for calculating personal income tax, 10% or more of a similar payment was not withheld from vacation pay, then the chief accountant will be fined 5,000–10,000 rubles.

The manager is held administratively liable in the following situations:

- with independent accounting;

- when transferring accounting to a third-party specialized organization - after concluding an outsourcing agreement;

- when signing a written order on accounting by the chief accountant.

Attention! When employees of the Federal Tax Service of the Russian Federation establish facts of deliberate non-payment of personal income tax on vacation pay, the guilty officials are brought to criminal liability (Article 199.1 of the Criminal Code of the Russian Federation).

Article 123 of the Tax Code of the Russian Federation “Failure of a tax agent to fulfill the obligation to withhold and (or) transfer taxes”

Article 199.1 of the Criminal Code of the Russian Federation “Failure to fulfill the duties of a tax agent”

Income tax

Income tax is a type of direct tax. It is collected from all individuals who have income. The Tax Code reflects some types of profit from which tax is not withheld. For example, they are not subject to benefits issued from the state budget.

The tax rate is 13%. In some cases it is equal to 9, 15, 30 and 35%. The rate depends on the type and status of profit that is due to working persons.

The tax base is based on income in full. It is worth considering that individuals have the right to count on a tax deduction.

Income tax is 13%

Income tax for employees with their salary is calculated by management, who is the tax agent and who is responsible for the correct execution of all transactions.

Personal Income Tax is an abbreviation for “personal income tax.” The tax is removed from all employed persons. It is collected from citizens of the Russian Federation, foreigners working in Russia and stateless people. This is the same as income tax

Important ! As a rule, taxpayers are not concerned about the deadlines for paying taxes. But if they have income that was not received for working in an organization, for example, for the sale of an apartment or car, then they need to transfer the information by filling out a declaration.

The reporting period for tax payments is 365 days

The tax reporting period is 365 calendar days. The declaration can be completed on paper or electronically. The deadline for its submission is April 30 of the following reporting year.

Features of personal income tax calculation

The object of taxation is the amount of vacation pay. This amount of money cannot be considered as part of the salary. In this regard, the tax on vacation pay is determined independently of the tax on wages.

Salary

Let's say an employee's salary is 50,000 rubles . He is a resident of Russia, therefore the personal income tax rate of 13% applies. Its amount is calculated as follows: 50,000 / 100 * 13 = 6,500 rubles.

Thus, the situation with wages and personal income tax for this employee is as follows:

- he is awarded a salary in the amount of 50,000 rubles;

- from this amount personal income tax is withheld in the amount of 6,500 rubles ;

- the employee receives 43,500 rubles (50,00 - 6,500).

The situation changes if the employee has children under 18 years of age. In this case, he has the right to a standard personal income tax deduction in the amount of 1,400 rubles for each child . The deduction is applied to the tax base, that is, wages reduced by the deduction amounts will be subject to personal income tax. For example, if there are two children, the tax will be calculated as follows: (50,000 - 2 * 1,400) / 100 * 13 = 6,136 rubles.

The result is the following:

- the employee is paid a salary of 50,000 rubles;

- the amount of personal income tax taking into account the standard deduction is 6,136 rubles ;

- the employee receives 43,864 rubles.

Transfer of personal income tax to the budget from income in the form of wages is made no later than the day following its payment.

Object of taxation

The income that an individual has is subject to taxation. Vacation pay is issued to the employee before his vacation begins. They are the ones who are subject to personal income tax.

The formula for calculating vacation pay is as follows: duration of vacation (in days) * average daily earnings of the employee.

After which the resulting figure is * 13%.

The final number will reflect the amount of tax.

Vacation pay must be issued by the employer before the employee goes on vacation.

In this case, no action is required from the employee. All work falls on the management. He is responsible for the correctness of calculations and timely transfer of money to the treasury.

Right to vacation

If an employee is hired under an employment contract, the employer is obliged to provide him with paid rest annually for 28 calendar days. This is the so-called main leave, and some categories employed in dangerous or harmful working conditions are also entitled to additional leave for a period of at least 7 calendar days.

An employee receives the right to vacation from a specific employer after he has worked continuously for the first six months, but with mutual agreement of the parties, he can go on vacation earlier. The employer's consent is not required to go on vacation earlier than six months if we are talking about women preparing to go on maternity leave; minors; who have adopted a child under three months of age. In such cases, only a statement from the employee is sufficient (Article 122 of the Labor Code of the Russian Federation).

Please note: labor laws do not apply to performers under civil contracts, so they are not entitled to leave at the expense of the employer.

At least three calendar days before the employee leaves for vacation, he must be paid vacation pay. The payment amount is calculated based on average daily earnings, which is multiplied by the number of vacation days. Income can be issued either in cash or by transfer to an individual’s card.

The legislative framework

The main regulatory act that controls the procedure for calculating vacation pay is the Labor Code of Russia. All issues regarding taxation are clarified in the Tax Code of the Russian Federation.

These main legal acts make it possible to count on receiving payments due to the employee and taxing them.

The Labor and Tax Codes provide information regarding vacation pay and tax withholding

Levying tax on holiday pay

Vacation pay is subject to the only tax – personal income tax. For 2021, management's responsibility to pay and retain required funds has not changed. Minor adjustments affected the timing of tax transfers to the treasury. As already mentioned, personal income tax is transferred on the day the employee is paid.

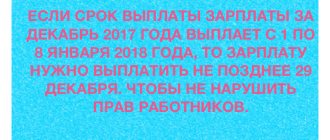

Today the rules have changed. Management must transfer personal income tax before the end of the month in which the employee received vacation pay.

Personal income tax must be transferred by the employer before the end of the month

Important ! Such innovations are more beneficial for the employer. Now it is not necessary to accrue vacation pay to an employee and transfer tax to the budget on the same day, as well as enter transactions for the movement of funds in the appropriate documents.

How to determine the date of actual receipt of income?

When determining the date of actual receipt of income to determine the timing of personal income tax payment, you must refer to Article 223 of the Tax Code of the Russian Federation, which states that the date of actual receipt of income is the day :

- payment of income in cash;

- transfer of income to taxpayer bank accounts;

- transfer of income on behalf of the taxpayer to the accounts of third parties.

Thus, the day of receipt of income is the day of the actual transfer of funds from the payer to the recipient.

When to make tax payments?

Vacation pay is paid to the employee 3 days before the start of the vacation. At the same time, personal income tax is withheld under Art. 226 of the Tax Code of Russia. The time for transferring tax to the state budget depends on the choice of method of payment of vacation pay.

- Cash - on the day the money is credited or the next day. For example, if the money was transferred on Friday, then the tax is paid on that day or on Monday.

- When withdrawing money from a company account - on the same day. The tax must be transferred strictly on the day when vacation money is withdrawn from the company’s account, regardless of when the employee receives the funds.

- Crediting to a bank card or withdrawal from the organization’s account – on the day of crediting.

You cannot transfer personal income tax before the employee has been given vacation pay.

On a note! Most accountants transfer the tax before the holiday pay has been issued. Such actions are wrong.

Payment of tax on compensation for unused vacation days

An employee has the right to go on vacation after working in the organization for at least six months. In the event of dismissal, if he did not take advantage of his vacation, he must be paid compensation.

Compensation is due on the day of care. Tax is also paid along with this. Money is transferred to the treasury on the last day of the month. The compensation paid must be recorded in the appropriate document.

You can go on vacation after at least six months of work

General rules for issuing vacation pay

Vacation pay represents financial support during vacation. Rely on employees who have worked for the company for at least six months. If an employee does not exercise his right to leave and resigns, he is entitled to compensation. The amount of vacation pay depends on the following factors:

- Duration of vacation.

- Average employee salary.

- The period for which the calculation is performed.

The amount of the employee's salary is used to calculate the tax. This amount includes bonuses and various compensations issued for the year preceding the vacation.

IMPORTANT! Both budgetary structures and commercial enterprises and individual entrepreneurs are required to provide annual paid leave to their employees. The amount of vacation pay is calculated based on the official salary.

Payment procedure

Income tax is charged only on the amount due to the employee. This matters when the employee has partially used vacation days. If two or more employees in an organization take vacation at once, the tax is transferred as a total amount.

As already mentioned, management now has the right to transfer money to the budget until the end of the month in which the employee has a vacation. The period for paying vacation pay this year according to the Labor Code of the Russian Federation is 3 days.

Personal income tax is withheld only from the amount that is currently due to the employee

Definition of payment

In tax and accounting reporting, tax must be displayed taking into account the following rules:

- the tax is entered as labor costs;

- if there is an insurance premium, they are classified as other expenses for core activities;

- expenses relate to the month in which they were incurred.

The tax is defined in the financial statements as labor costs

Income tax on maternity leave

Paragraph 1 of Article 217 of the Tax Code of the Russian Federation fully discloses the topic regarding the taxation of maternity leave. According to this article, the tax does not affect payments under the BiR. Payments under the BiR differ from standard sick leave, from which tax is supposed to be collected.

Girls who are not employed cannot take maternity leave. The only exceptions are those women who were forced to quit due to the closure of the enterprise. Like women who are on regular maternity leave, they are accrued all benefits without reduction by the amount of personal income tax.

Excerpt from Article 217 of the Tax Code of the Russian Federation

Also, women in this position are entitled to additional payments.

- One-time benefit. It is available to those who register with the antenatal clinic before 3 months of pregnancy. Its standard size is determined by law and is equal to 330 rubles. Indexation carried out on February 1, 2021 increased the benefit amount to 650 rubles.

- One-time payments for the birth of a baby. Their standard size is determined at the legislative level and is equal to 8 thousand rubles. Indexation also made it possible to increase the amount of payments by more than 2 times, and now they are equal to 17,500 rubles.

Important ! The amount of these benefits is also tax-free.

Various payments for a child are not subject to personal income tax

There are no changes regarding the calculation and taxation of maternity taxes this year. This means that no tax is charged on such payments. But the standard changes affected the amount, which depends on the minimum wage and the employee’s salary, which in turn is subject to income tax.

Taking into account these amounts from the beginning of 2021 for the amount of maternity benefits:

- the minimum amount as a result of the next increase in the minimum wage is 52 thousand rubles in the case of a normal birth;

- the minimum amount for childbirth with complications is 58 thousand rubles;

- the minimum amount for the birth of 2 or more children is 72 thousand rubles;

- the maximum size for normal childbirth is 301 thousand rubles;

- the maximum amount for childbirth with complications is 335 thousand rubles;

- the maximum amount for the birth of 2 or more children is 417 thousand rubles.

The amount of maternity leave depends on the employee’s salary

Are vacation pay for various purposes subject to taxes?

In addition to the right to annual paid leave of standard duration, labor and social security legislation provides for other types of paid leave. Depending on the classification (purpose) of leave, the rules for assessing payments due to the employee with taxes and contributions also change:

| Type of vacation | Legal basis | Who pays for it? | Is the payment taxable? | ||

| Personal income tax | insurance premiums | ||||

| Annual paid vacation | Art. 114 Labor Code of the Russian Federation | Employer | Yes | Yes | |

| Additional leave | Art. 116, 117, 118, 119 Labor Code of the Russian Federation | Employer | Yes | Yes | |

| Target: | educational | Art. 173.1 -176 Labor Code of the Russian Federation | Employer | Yes | Yes |

| in connection with pregnancy and childbirth | Art. 255 Labor Code of the Russian Federation | FSS | No | No | |

| for child care | Art. 256 Labor Code of the Russian Federation | FSS | No | No | |

| in connection with adoption | Art. 257 Labor Code of the Russian Federation | FSS | No | No | |

Thus, we can clearly determine the general principle of taxation of vacation payments:

- If the vacation was paid by the employer, then the amount of vacation pay is subject to taxes and contributions.

- If the payment was made at the expense of the Social Insurance Fund, then payments for vacation are not subject to taxes.

Read more about the calculation and payment of insurance premiums from workers' vacation pay in this material.

NOTE! As part of anti-crisis measures to combat the spread of coronavirus infection, the Russian government approved reduced rates on insurance premiums.

ConsultantPlus experts explained how to correctly and from what period reduced tariffs can be applied. Get free trial access to the K+ legal system and proceed to recommendations and calculation examples.

Who pays maternity benefits and is it possible to collect income tax for individual entrepreneurs?

Responsibility for maternity payments lies entirely with the Social Insurance Fund of Russia, which allocates funds from insurance premiums for social insurance for incapacity and maternity. All employers are required to pay these contributions, regardless of whether they are individual entrepreneurs or legal entities. For the last two years, contributions are made not specifically to the fund, but to the Federal Tax Service. But the Social Insurance Fund is still responsible for the procedure for paying maternity benefits and makes decisions on reimbursement to their superiors.

Important ! In this case, the female employer may lose maternity benefits. She can count on them only if she has signed an agreement with the Social Insurance Fund on voluntary insurance and made a contribution 12 months before going on maternity leave.

The Social Insurance Fund is responsible for the procedure for paying maternity benefits.

For example, having entered into a contractual relationship with the Fund in 2021, a woman needs to pay contributions for all 12 months by December 31, 2018. Then the right to social insurance will be valid from January 1, 2020. If a girl works several jobs at once, she is entitled to maternity leave from all jobs. The boss at a non-main job must pay the B&R allowance in the same way as at the main job.

Income tax calculation

From the vacation pay received, you need to subtract:

- contributions to social and pension funds;

- medical deductions;

- contributions to the insurance fund in case of work injury or illness.

After all these deductions, the tax is calculated. The rate is 13%.

Contributions to the Pension Fund, compulsory medical insurance, etc. are also deducted from income.

simplified tax system

If an organization pays a single tax on the difference between income and expenses, include vacation pay in expenses at the time of payment (subclause 6, clause 1, article 346.16, subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Contributions to pension (social, medical) insurance and contributions to insurance against accidents and occupational diseases will reduce the tax base for the single tax also at the time of their payment (subclause 7, clause 1, article 346.16, subclause 3, clause 2, article 346.17 of the Tax Code RF).

If an organization has chosen income as the object of taxation, the amount of vacation pay will not affect the calculation of the single tax. With this object of taxation, no expenses are taken into account, including wage expenses (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

However, the single tax can be reduced by the amount of contributions to pension (social, medical) insurance and contributions to insurance against accidents and occupational diseases, which are paid from vacation pay (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation). For more information about this, see How to calculate a single tax when simplifying income.

Calculation of personal income tax from additional vacation days

The employee has the right to ask for additional vacation days at the expense of the organization. They are also subject to tax. For each vacation day, the average salary of the employee for 1 shift is calculated. For example, it is equal to 350 rubles. In this case, for 4 days of additional vacation, payments will be 1,400 rubles. To calculate the tax you need 1400*13%. Income tax = 182 rubles.

Personal income tax is also withheld from additional vacation days

Calculation example

Alexander Petrov took a vacation from September 21 to October 4, 2018. To begin with, the amount of vacation pay is determined, which depends on the amount of wages. Petrov receives 49,000 rubles. The average income per shift is 1650 rubles. In September he worked 10 shifts. His actual monthly income will be 24,500 rubles. The accountant makes the following calculations:

49,000 * 8 (number of months worked per year) + 1650 * 14 (number of vacation days) = 415,100 rubles.

1650 * 14 – 1400 (established deduction) = 21,700 rubles. The total is multiplied by 13%. Personal income tax is 2821 rubles.

The amount of income tax depends on the employee's salary

The procedure for calculating tax for unused vacation is identical.

Examples of transferring personal income tax from vacation pay in 2021

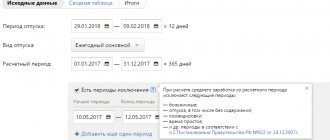

Interested in what's new in personal income tax on vacation pay in 2021, what changes? An example of income tax transfer is given using the following data:

The employee wrote an application for leave from June 7, 2021 for 28 calendar days. The vacationer must receive payments no later than three calendar days before the vacation, so the accountant made the payment on June 3, 2021. In this case, personal income tax is paid no later than June 30, but earlier payment will also not be a violation.

Let's change the example a little: the employee goes on vacation from June 1, 2021. In this case, vacation pay must be paid no later than May 29, 2021. As you can see, the payment month is different here, so you must transfer income tax no later than May 31.

In letter dated April 15, 2016 No. 14-1/B-351, the Russian Ministry of Labor spoke on the issue of personal income tax on vacation pay. An example of calculations is associated with a situation where the holiday period falls on a non-working day on June 12. Should it be taken into account in the total duration of vacation? The Department believes that holidays falling during the vacation period are not included in the number of calendar days of vacation. Non-working holidays must be taken into account when calculating the average salary.

Holiday pay accounting

When collecting personal income tax, the following transactions are used.

- Tax calculations (DT 68).

- Salary expenses (DT 70).

- KT 68 and 51 can be applied to the loan.

Examples

Employee Ivan Andreev has been taking 4 weeks leave since July 5, 2017. His income is 39,000 rubles. The money was transferred to the enterprise reserve account. There are no deductions from vacation pay. Their value is 5,000 rubles. In this case, the following wiring is used.

- DT 70 CT 68. Collection of a tax of 5 thousand rubles.

- DT 68 CT 51. Transfer of tax in the amount of 5 thousand rubles.

Employee Alexander Antonov goes on vacation. The salary is 30,000 rubles. The employee has the right to count on a tax deduction, which is 1,900 rubles. As a result, the amount of vacation pay is 3,650 rubles. The following wiring is used.

- DT 70 CT 68. Collection of income tax in the amount of 3,650 rubles.

- DT 68 CT 51. Transfer of funds to the state budget in the amount of 3,650 rubles.

Accountants must correctly report on vacation pay and personal income tax

Information entered into financial statements must be reflected in the primary documents.

Reflection of compensation for unused vacation in a certificate in 2-NDFL

When recording compensation in tax reporting, you must use a special code. There is no separate number for this type of payment. You can use the following notations.

| Designation | Definition |

| 4800 | Payment of compensation if an employee resigns. |

| 2000 | Salary payments. |

| 2012 | Payment of vacation pay. |

Help 2-NDFL

Main! According to the Tax Service, it is worth using code 2012. But the use of other codes will not constitute a serious violation.

Answers to frequently asked questions

Is personal income tax collected on vacation pay?

As stated in the legislation, all income that an individual has from an employer is subject to income tax. Vacation pay is also included in this number.

I was given vacation pay, from which personal income tax was taken away. But later I was recalled from vacation. As a result, vacation pay was deducted from subsequent salaries. Where does the tax go in such a situation?

It must be returned based on the written statement drawn up by the employee.

If the tax was deducted but the vacation was not used, it will be returned upon application to the employee

Does accounting have the right to calculate vacation pay and wages together and deduct personal income tax from the total amount?

According to the Labor Code of the Russian Federation as amended on December 20, 2001, Article 136, wages are paid no less frequently than every 15 days. A more precise date for calculating an employee’s salary is determined by the norms of the internal work code, a collective agreement or a work contract no later than 15 days from the end of the period for which it is due.

Vacation pay is accrued no later than 3 days before the start. If the dates coincide, salaries and vacation pay are issued together. Personal income tax is charged on both wages and vacation payments.

Salaries and vacation pay can be issued together; accordingly, tax is deducted from both payments

What is the amount of personal income tax??

Income tax is required to be withheld from vacation pay. This is provided for in paragraph 1 of Article 210 of the Tax Code. Tax collection occurs on the day vacation pay is calculated, i.e. the employee is paid funds from which income taxes have already been deducted.

The amount of tax depends on the employee's salary. It makes up 13% of income.

My husband is employed at PCH. When he took a vacation, personal income tax was withheld from his vacation pay. When the vacation ended and he returned to official duties, he was paid his salary without bonuses or other allowances. This is right? Since I was told that at some enterprises, after a vacation, additional accruals are paid in addition to the salary.

The employer must collect personal income tax from all salaries and transfer it to the state budget. The accrual of bonuses is reflected in the employment agreement and other local acts of the Labor Code. According to Art. 135, an employee’s salary is determined on the basis of an employment agreement, taking into account the remuneration system established by management.

Such a system exists along with the amount of tariff rates, official salary, bonuses and other accruals, including work with difficult or unhealthy conditions. All allowances, bonuses, compensation payments are agreed upon and reflected in the collective agreement, local regulations, taking into account the Labor Code of Russia and other acts that refer to labor standards.

Bonuses and other additional payments are specified in the employment contract

If management does not withhold tax on income and does not pay vacation pay at the same time, it argues that the tax rate is not deducted. Are there legal grounds for this?

The bosses have no right to refuse to pay vacation pay. All employees who have worked for at least six months have a legal entitlement to leave. This right is approved in Article 37 of the Russian Constitution, which additionally emphasizes that all officially employed citizens have such a right. According to Article 142 of the Labor Code, in Russia, management and responsible persons who are appointed by management, who delayed the payment of wages to employees or committed other violations of the employment contract, are required to bear responsibility, taking into account current legislation and regulations.

The employer has no right not to pay vacation pay

How does the income tax withholding process work? My situation is as follows: I worked for 2 weeks, part of my salary arrived, after which I went on a 2 -week vacation, of which only 10 days were paid as vacation pay. A 13% tax was withheld from the amount of vacation pay. I received my vacation pay 7 days before payday. I received vacation pay and salary in one total amount. Is this legal?

No, this is not considered legal. Personal income tax is taken into account only once and cannot be withdrawn again. In this case, it is appropriate to file a complaint with the labor inspectorate.

The individual entrepreneur did not withhold personal income tax from his salary; when it was time for vacation, they refused to give it to me, arguing that taxes had been paid for me for 12 months. Can an individual entrepreneur refuse leave?

In this case, you should contact your local prosecutor. According to Article 45 of the Civil Legal Code, the prosecutor must protect the rights of citizens in court if the rights and interests of citizens have not been respected.

A citizen can contact the prosecutor's office if his rights, enshrined in the Labor Code of the Russian Federation and the Constitution, are not fulfilled

So, since vacation pay is considered income of an individual, income tax (NDFL) is deducted from it. It is 13% of income.

When to transfer taxes to the budget

Before amendments were made to Article 226 (6) of the Tax Code of the Russian Federation, there was one general principle for the transfer of personal income tax by tax agents:

- no later than the day of issue when receiving cash at a bank cash desk or transferring it to an individual’s account;

- no later than the next day after the date of actual receipt of income, if they were paid in another way, for example, from cash proceeds.

Difficulties in the question of when to transfer personal income tax from vacation pay were explained by the fact that the legislation did not clearly define this point. The fact is that the norms of the Labor Code include vacation pay as part of the employee’s salary. Thus, Article 136 of the Labor Code of the Russian Federation “Procedure, place and timing of payment of wages” determines that payment for vacation is made no later than three days before its start.

However, the fact that vacation pay belongs to the category of employee remuneration does not mean that the deadlines for transferring personal income tax from vacation pay to the Tax Code of the Russian Federation are given in paragraph 2 of Article 223. This provision applies only to the withholding of tax from wages, but not vacation pay. In particular, this opinion is contained in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/07/2012 No. 11709/11 in case No. A68-14429/2009.

Now there should be no discrepancies when to pay personal income tax on vacation pay in 2021. Law No. 113-FZ of May 2, 2015 establishes that the transfer of personal income tax from payments to an employee must occur within the following deadlines.

| Type of income | Personal income tax payment |

| Wage | No later than the day following the payday |

| Income in kind | No later than the next day after the day of payment of income in kind |

| Disability benefits (sick leave) | No later than the last day of the month in which the benefit was paid |

| Vacation pay | No later than the last day of the month in which vacation pay was paid |

Thus, to the question of when to pay personal income tax on vacation pay in 2021, there is a clear answer: no later than the end of the month in which they were paid . The timing of the transfer of personal income tax from vacation pay this year allows the accountant to pay income tax from several employees at once. This is especially true in the summer, when people go on vacation en masse. In addition, personal income tax on sick leave can be paid in one payment order with income tax on vacation pay if they were paid in the same month.

Please note: Law No. 113-FZ of May 2, 2015 only changed the deadline for paying personal income tax on vacation pay in 2021, i.e. transferring it to the budget. And the calculation and withholding of income tax on vacation pay, as before, occurs upon their actual payment (Article 226 (4) of the Tax Code of the Russian Federation).