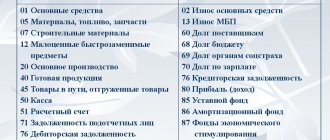

Off-balance sheet account 002 - what is it intended for?

Off-balance sheet accounts in accounting are intended to reflect values that do not belong to the enterprise by right of ownership, that is, those that are in temporary use. These can be not only inventory items, but also conditional rights and obligations:

Account 002 in accounting is an active account; any receipt of inventory items is reflected as a debit of the account, and disposal (movement) as a credit. Valuables in accounting account 002 are accepted at the value indicated in the accompanying documents. If there is no value, then in a conditional or quantitative assessment.

Accounting structure and typical postings

As we noted earlier, accounting account 02 is used to maintain accounting records for the amounts of calculated AM in the context of each property and tangible asset.

02 which account: passive or active? Accounting account 02 is passive, since the amounts of accrued depreciation on property objects are reflected as a credit, and the write-off of the calculated AM is reflected as a debit.

Account structure:

- the credit balance at the beginning of the reporting period shows the amount of calculated depreciation at the beginning of the reporting period;

- credit turnover for the period reflects the amount of accrued AM for the selected period of time;

- debit turnover in accounting account 02 indicates the amount of written-off depreciation charges for retired objects (written off, sold, transferred to third parties);

- The credit balance at the end of the reporting period is the amount of accumulated depreciation charges at the end of the reporting period.

Typical wiring:

| Operation | Debit | Credit |

| Depreciation calculated: | ||

| According to OS of main production | 20 | 02 |

| By property used in auxiliary workshops | 23 | |

| For OS objects operated for general economic and general production needs | 25 26 | |

| Accrued depreciation on the property of a trading company (AM is included in sales expenses) | 44 | |

| For assets leased or leased | 91 | |

| AM was additionally accrued due to the revaluation of fixed assets | 83 | 20 |

Which inventory items are taken into account on account 002

Let's take a closer look at account 002 “Inventory assets accepted for safekeeping.” Account 002 takes into account values that the company, for a number of reasons, cannot reflect on the balance sheet:

- The received goods are defective, damaged, do not meet the stated requirements and characteristics specified in the supply agreement and must be returned to the supplier;

- According to the terms of the contract, ownership of the goods passes not at the time of shipment, but upon payment;

- Inventory and materials are accounted for under the pledge agreement;

- Inventory and materials have been paid for by the buyer, but have not yet been transported from the warehouse for technical or other valid reasons, that is, they are temporarily in safekeeping;

- Inventory and materials were received from the bailor under a storage agreement;

- The goods and materials were received by mistake, by an exchange agreement, etc.

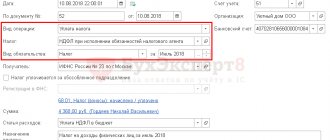

Ease of use in the program

“Accounting 8” automatically distributes incoming finances among various types of activities in accordance with the acquiring agreement. Plus, the size of the bank commission relates entirely to the expenses of the company in our example as direct costs incurred by the company in the process of trading, both retail and commission.

In the case where the commission agreement stipulates that payment for the bank’s services in terms of the principal’s revenue occurs at his expense, we will have to independently adjust the entries in the accounting register and in the “Income and Expenses Book” register (first section) to the required amount.

Typical transactions for off-balance sheet account 002

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 002 | — | 10 000 | Received for safekeeping goods and materials that were found to be defective, non-compliant with quality, assortment and subject to return due to violation of contractual obligations | Invoices TORG-12, 1-T, M-15, certificate of discovery of defects in goods, accounting certificate |

| — | 002 | 10 000 | Inventory items returned to the supplier are written off off-balance sheet | Invoice TORG-12, act of discovery of defects in goods |

| 002 | — | 12 000 | Received for safekeeping of goods and materials, with special conditions for the transfer of ownership, for example, after payment | Invoices TORG-12, 1-T |

| — | 002 | 12 000 | Inventories written off off-balance sheet due to the transfer of ownership to the buyer | Bank statement |

| 002 | — | 15 000 | Goods and materials, paid for but not removed by the buyer, were accepted for safekeeping | Invoice TORG-12 |

| — | 002 | 15 000 | Inventories left by the buyer for safekeeping are written off from off-balance sheet accounting. | Consignment note 1-T |

| 002 | — | 18 000 | Received goods and materials under a storage agreement | Transfer and acceptance certificate MX-1, accounting certificate |

| — | 002 | 18 000 | Return of goods and materials to the owner under a storage agreement | Act MX-3, accounting certificate |

| 002 | — | 20 000 | Inventory and materials were accepted for safekeeping due to the pledgor’s failure to fulfill obligations under the pledge agreement | Pledge agreement, accounting certificate |

| — | 002 | 20 000 | Inventory and materials received under a pledge agreement were sold | Invoice TORG-12 |

Actions in the program

Follow the “Functionality” link and make the settings for our example, namely:

- on the bank and cash desk tab, check the payment cards box;

- on the trade tab – checkboxes for retail trade and sale of goods or services of principals (principals).

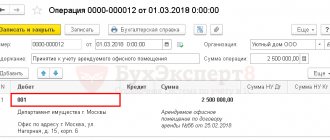

In the accounting system, the receipt of goods is recorded using the corresponding document in the purchases section. Moreover, for your own goods you need to use the “Goods” transaction type, and for commissions - “Goods, services, commission”.

Accounting for transactions on account 002 using an example

Romashka LLC shipped products worth RUB 59,000 to the buyer. The item had not been paid for on the date of shipment. According to the contract, ownership passes to the buyer upon payment.

In the buyer’s accounting, we will reflect the received goods on off-balance sheet account 002 with the following entries:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description |

| 002 | — | 50 000 | The goods are accepted for off-balance sheet accounting |

| 19 | 60 | 9 000 | VAT presented by the supplier is reflected |

| On the date of payment: | |||

| 60 | 51 | 59 000 | Payment made to supplier |

| — | 002 | 50 000 | Goods written off balance sheet |

| 41 | 60 | 50 000 | The goods are accepted for balance sheet accounting at the time of transfer of ownership |

| Dt 68/VAT | 19 | 9 000 | Accepted for deduction of VAT presented by the supplier |

Results

On off-balance sheet account 002, buyers and suppliers reflect inventory items that do not belong to them and are with them temporarily. Receipts of inventory items on account 002 are reflected as a debit, and write-offs are reflected as a credit to this account.

For more information about off-balance sheet accounting of inventory items, read the material “How to put materials into an off-balance sheet account - postings.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Decision-making

Instruction No. 157n (as amended by Order of the Ministry of Finance of the Russian Federation dated March 31, 2018 No. 64n) contains instructions that accountants still need to comprehend. It will be necessary to adjust the usual algorithm for the disposal of fixed assets, including by writing them off. According to the new edition of clause 34 of Instruction No. 157n, the disposal of fixed assets (including as a result of the derecognition of an object as an asset of an accounting entity (disposal from balance sheet accounting)) is carried out on the basis of a decision of the permanent commission for the receipt and disposal of assets, documented by a source document ( primary (consolidated) accounting document). However, by virtue of clause 4 of the Regulations on the write-off of certain types of property of budgetary and autonomous institutions, the decision of the relevant commission must be agreed upon with the federal government bodies in charge of the institutions. Such property includes:

- movable and immovable property held by federal government agencies with the right of operational management;

- real estate (including unfinished construction projects), as well as especially valuable movable property assigned to federal budgetary or autonomous institutions by the founder or acquired using funds allocated by the founder for the acquisition of such property.

State institutions require approval for all property when it is written off. Thus, when disposing of (writing off) the above property, the commission must prepare relevant documents on the decision made and send them to the owner for approval. This is confirmed by the new edition of clause 52 of Instruction No. 157n, according to which acts on the disposal of fixed assets from off-balance sheet account 02 “Tangible assets in storage” or from the corresponding analytical accounts of account 10100 “Fixed Assets” are accepted for recording in accounting availability of agreement on the decision to write off fixed assets in cases provided for by the legislation of the Russian Federation with the owner of the property (with the body exercising the functions and powers of the founder and (or) owner of the property) and the approval of the head of the institution on the acts. That is, Instruction No. 157n confirms the need to agree with the owner of decisions made by the commission on the receipt and disposal of assets, in cases provided for by law. Moreover, such approval is necessary when leaving both balance sheet account 10100 and off-balance sheet account 02. Please note that Instruction No. 157n does not make exceptions or any conditions for this. In addition, paragraph 52 of Instruction No. 157n states that the reflection in accounting of the disposal of a fixed asset item from off-balance sheet account 02 “Tangible assets in storage” before approval in the prescribed manner of a decision on the write-off (disposal) of an asset and the implementation of measures provided for by the act about write-off is not allowed. In order to streamline the procedure for writing off property in accordance with the requirements of the GHS OS, it is advisable to indicate approximately the following in the accounting policy of the institution:

- The decision on the loss of consumer properties by an object of property, as well as the decision on the loss of criteria for classification as fixed assets, are made by the commission for the receipt and disposal of non-financial assets. Decisions are documented in minutes in two copies, one of which is transferred to the accounting department no later than the next working day after the commission meeting. The second copy of the protocol is sent to the commission for writing off fixed assets.

- Based on the protocol, the accounting department prepares documents for write-off no later than one business day from the date of receipt of the commission’s protocol.

- The commission for write-off of fixed assets draws up acts for write-off and other documents in accordance with the Regulations on write-off, and then sends the documents to the owner for approval.

- After receiving documents for write-off of property objects and the consent of the owner, the documents are transferred by the write-off commission to the accounting department.

- The accounting department removes the corresponding objects from the balance sheet, and after the commission completes measures to liquidate the objects, it reflects their write-off from the accounting (off-balance sheet) records.

The procedure for document flow, as well as the sequence of actions when making a decision on the disposal of an asset, including when writing off property, must be described in the local acts of the institution.

Legal regulation of accounting in budgetary organizations

The Unified Chart of Accounts (hereinafter - PS) and instructions, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n, regulate accounting in state and municipal institutions, which, according to paragraph 2 of Art. 9.1 of the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ are divided into:

- to autonomous;

- budgetary;

- state-owned.

Each of them has its own private PS:

- for autonomous organizations it was approved by order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n;

- budgetary - by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n;

- government - by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n.

The phrase “budget accounting” can be used in relation to certain government organizations that are listed in Order No. 162n, for example, government agencies, government agencies, and extra-budgetary funds. The rest of the government agencies maintain accounting records in accordance with the relevant PS (orders No. 174n and 183n), so in this article we operate with the requirements of the Unified PS (order No. 157n) and PS of budget accounting (order No. 162n).

Forms for primary documents, as well as accounting registers and reporting for public sector employees, can be found in ConsultantPlus. Get trial access to the system for free and go to the directory.

What should be considered low-value and wearable property

For a long time, low-value and wearable items were taken into account in account 13. But now it is missing, although the MBPs themselves have not disappeared anywhere. By all criteria, this material resource should be classified as fixed assets, but its value is too small to be included in the corresponding OS account (01). Therefore, although the term IBE is not used in professional accounting language, low value is present.

It includes current assets for which:

- cost - for one unit no more than 40 thousand rubles;

- operating time - up to a year or two;

- subsequent resale is not envisaged.

They are also characterized by:

- application in the manufacture of goods directly or for the purpose of managing the production process;

- assistance in generating income.

Low-value property is included in current assets, and their value is written off as expenses: (click to expand)

- completely, provided that the service life is one year;

- in parts, when he is 2 years old.

Although small business enterprises are written off, they continue to be reflected in accounting (not in tax accounting) as part of industrial property. And at the enterprise, their movement must be constantly monitored to ensure safety. It is for the safety of the physical value that low value, even with zero value, is taken into account in the documentation. And this happens before it is completely worn out. The accounting policy should establish the maximum value of low-priced items.

IBP are items that are purchased by an enterprise in order to use them for a long time. But their cost is immediately written off in full to the cost of production.

Example No. 1. The organization bought a filing cabinet, paying 25 thousand rubles for it. (without VAT). This acquisition relates to furniture, that is, to fixed assets. But since its cost is less than the established limit (40 thousand rubles), the table is considered low-priced. 25 thousand rubles. written off to management expenses immediately upon commissioning.

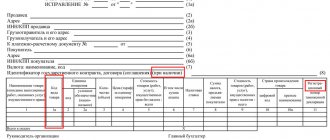

Drawing up an act for writing off low-value property

In order to write off MBPs whose service life is up to a year, the standard MB-8 form is used. It is advisable to draw it up when inexpensive property has completely worn out and has become unsuitable for further use for its intended purpose.

The BM-8 form is not mandatory today. But it can be taken as a basis for developing your own form of act at the enterprise.

The decision to write off low-value assets is made by the liquidation commission. She is appointed as a manager and collaborates with the accounting staff. Low-value property must be recorded at its actual cost when written off. The document is signed by each member of the commission, approved by the head and sent to the accounting department. Based on it, the accounting employee writes off the low value from the account.

Features of using accounts in IBP accounting, depreciation and basic postings

It is most correct for an enterprise in the area of low value to use this approach:

- IBPs whose expected lifespan is more than a year should be taken into account on the account. 01 (on the corresponding sub-account).

- MBP that will be in operation for up to a year - on the account. 10 (subcount 9 or 10).

- In the first case, the corresponding subaccount will serve as a contract account. 02.

- In the second: to the account. 10 (10) → count. 10 (11).

- On the account 10 (9) takes into account inventory and household supplies, so it does not need a contract.

When a low-value asset will be used in production for more than 12 months, the accountant makes the following notes:

| Accounts | Description | |

| Debit | Credit | |

| 08 | 60 | The insignificant assessment was capitalized upon the fact of its receipt |

| 19 (1) | 60 | VAT reflection |

| 01 | 08 | Low assessment transferred to operation |

| 68 | 19 (1) | VAT credited |

| 20 or 23 | 02 | Depreciation has been accrued (you can immediately pay 100% of the value of the low-value property, or part of it for the first quarter or year) |

| 02 | 01 | The depreciation amount is written off (but not before the object is completely written off) |

When using the MBP for less than a year, the postings are as follows:

| Accounts | Description | |

| Debit | Credit | |

| 10 (10) | 60 | IBPs are capitalized according to the facts of their receipt |

| 19 (1) | 60 | VAT |

| 20 or 23 | 10 (11) | Low value is transferred for use |

| 68 | 19 | VAT credited |

| 10 (11) | 02 | Depreciation is written off at 100% of the value of the low value |

Capitalization of inventory and household supplies is carried out according to the account. 10 (9). They will be listed until they go into service. At the same time, this type of low value is written off in its entirety. The cost is included in the costs for the item for which they are used. The wiring is as follows:

| Accounts | Description | |

| Debit | Credit | |

| 10 (9) | 60 | Inventory has been capitalized |

| 20, 23 | 10 (9) | Inventory write-off |

When writing off MBP (with a service life of up to a year) for the corresponding current expenses, their cost is equal to zero. When depreciation is charged in parts, the IBP will have a certain residual value for some time.

Thus, depending on the period of operation of the low-priced asset and the corresponding method of calculating depreciation, a balance is obtained, in the active item of which is the full cost of the IBP, and in the contractual item is a similar minus cost. As a result, the value of the low price is zero.

Example No. 3. The cashier-businessman bought printer paper in the amount of 1,500 rubles for cash. An advance report, supported by a cash receipt, was submitted to the accounting department. It includes VAT - 228.75. The paper has been handed over for use. Accounting entries:

| Debit | Credit | Sum | Operation |

| 60 | 71 | 1500,00 | Advance report received |

| 10 | 60 | 1271,25 | The paper has been capitalized |

| 19 | 60 | 228,75 | Input VAT accepted for deduction |

| 26 (44) | 10 | 1271,25 | The product has been sent to work |

Changes in charts of accounts: what institutions should prepare for

Amendments to the charts of accounts N 162 n, N 174 n and N 183 n are being registered with the Ministry of Justice. They plan to introduce the same innovations that recently appeared in the Unified Chart of Accounts N 157 n. Other changes will also be made. We'll tell you about them in our review.

What amendments will need to be taken into account starting with reporting as of January 1, 2021

Fixed assets

Restore objects on the balance sheet by posting to account 0 401 10 172. The instructions gave two cases when such posting is made. The first situation: an object that no longer meets the criteria of an asset was written off to off-balance sheet account 02. At the same time, the owner of the property demanded that the property be used for a different purpose or transferred to another institution. The second situation: the property is accounted for in off-balance sheet account 21 and the owner has demanded that the property be transferred free of charge to another copyright holder.

When transferring fixed assets to employees for personal use, reflect the property in off-balance sheet account 27. Similar objects worth more than 10 thousand rubles. continue to account for 0 101 00 000, reflecting the internal movement on it.

Supplies

Restore the items accounted for in off-balance sheet accounts 02, 03 and 07 to account 0 105 00 000 by posting to account 0 401 10 172. Do this if the owner has demanded that the inventory be transferred free of charge to another institution.

In a similar manner, take into account the return of supplies that were in the personal use of employees and were listed on off-balance sheet account 27.

Attribute the cost of spent supplies to accounts 0 401 20 214, 0 401 20 223, 0 401 20 263, 0 401 20 265 and 0 401 20 267.

When changing the purpose of the inventory, change its accounting group by internally moving the debit and credit of account 0 105 00 000.

Accrue a reserve for a decrease in the cost of finished and biological products, as well as goods, at the moment when the planned sales or distribution price has decreased. In accounting, reflect the posting to the debit of account 0 401 20 274 and credit of accounts 0 114 87 440, 0 114 88 440. When inventory is disposed of or the price increases, reduce the reserve by reverse entry. In relation to inventories that were sold at reduced prices during the reporting period, write off the balances from accounts 0 105 07 440, 0 105 08 440 to the debit of accounts 0 114 87 440, 0 114 88 440.

Note that in the Unified Chart of Accounts N 157, accounts 114 87 and 114 88 were introduced in 2021. Taking into account the amendments to the charts of accounts of institutions, such accounts must be applied starting with reporting for 2021.

State institutions account for the receipt of supplies as compensation for damage by debiting account 0 105 00 000 and crediting account 0 209 00 000. Posting to account 0 401 10 172 to reflect such a transaction will be excluded. Budgetary and autonomous institutions still have it. We recommend that they agree on the procedure for recording the transaction with the founder and the financial authority.

Land

An increase in the cadastral value of land should be reflected in the credit of account 0 401 10 176, a decrease - in the debit of this account. Do not use the “red reversal” method.

Reflect the division of the land plot with entries to account 0 401 10 172 in the same way as the dismantling of a fixed asset is reflected. According to the same account, the authorized bodies reflect the acceptance of a land plot into the treasury after the delimitation of ownership rights to it.

Calculations for financing transactions from budgets

Reflect transactions with interbudgetary transfers, subsidies to budgetary and autonomous institutions with the entries that the Ministry of Finance provided in system letters dated January 15 and February 4, 2021. These correspondence will be recorded in the instructions for the charts of accounts.

For subsidies to budgetary and autonomous institutions, it will be stipulated that such institutions reflect current period income based on information about the fulfillment of the conditions for the provision of funds. Such information may be a subsidy report, notice (f. 0504805) or another document that is enshrined in the agreement. The Ministry of Finance also explained in what situation each of these documents should be used. Previously, the guidelines for the notification form were also clarified.

For recipients of targeted interbudgetary transfers, the account on which balances of unused funds from the previous year are formed for return will be additionally changed. Such amounts will need to be reflected in account 0 303 05 000, and not in account 0 205 00 000. Note that a similar procedure is now used by budgetary and autonomous institutions when reflecting the balances of last year’s subsidies for return.

Other accounting objects

If, according to one estimate, you create a complex of non-financial asset objects, reflect the disassembly of investments by internal movement in the debit and credit of account 0 106 00 000.

In case of early termination of a lease or gratuitous use agreement, write off the account balances 0 111 40 000, 0 205 20 000, 0 302 20 000, 0 401 40 000, 0 401 50 000 with entries opposite to those that you reflected when recognizing the objects in accounting. Do not use the “red reversal” method. Similar amendments were made to the “Rent” standard this year.

Recover the loss from impairment of non-financial assets by debiting account 0 114 00 000 and crediting account 0 401 20 274.

Budgetary and autonomous institutions reflect the decrease in the value of real estate and especially valuable movable property on account 0 210 06 000 on the credit of account 0 401 10 172. Their founders reduce the figure on account 0 204 33 000 on the debit of account 0 401 10 172. The “red reversal” method does not apply.

In addition to accounts 0 401 41 100 and 0 401 49 100, budgetary institutions use accounts 0 401 42 100, 0 401 43 100 and 0 401 44 100. Additional accounts allocate the amounts of income that will be included in the financial results of the next three years.

In addition, the instructions for the charts of accounts will provide entries for accounting for concessions and operations under long-term construction contracts.

Autonomous institutions will be allowed to introduce letter codes N, R, I, D from 2021 for accounts 0 102 00 000, 0 104 20 000, 0 104 30 000, 0 106 20 000, 0 106 30 000, 0 114 20 000 and 0 114 30,000.

Procedure for transition to new rules

Reflect adjusting entries before reporting as of January 1, 2021. You can introduce innovations in analytical accounting during 2021. Fix this decision in your accounting policy. The right to early implementation of innovations does not apply to changes in synthetic accounts.

What will need to change starting from the inter-reporting period before 2021

When reflecting incoming balances at the beginning of the year, form account numbers in a new way, which contain codes 560 and 730 KOSGU. In the numbers of these accounts, indicate the 3rd category of the KOSGU subarticle. For example, create an account for settlements for utility services with a supplier - another non-financial organization: 0 302 23 004.

Please note that in Instruction No. 157 the rule for annual resetting of KOSGU codes in account numbers is not fully given. Considering the planned changes, be guided by the norms of the instructions for the charts of accounts, and not by the rule of Instruction No. 157 n.

What amendments will need to be taken into account from 2021

Rights to use intangible assets

Accept the acquired rights of use for accounting as the debit of account 0 111 60 000 and the credit of account 0 302 26 730 (0 106 60 000).

Accrue depreciation on the debit of account 0 401 20 226 (0 109 00 000) and credit of account 0 104 60 000. Reflect the termination of use rights on the debit of accounts 0 104 60 000, 0 114 60 000 and credit account 0 111 60 000.

Other accounting objects

In account numbers 0 304 66 000 and 0 304 76 000, indicate the KOSGU code, based on the type of your institution: state-owned provide codes 731 and 831, budgetary and autonomous - codes 732 and 832 KOSGU. Note that a similar procedure is now in effect for accounts 0 304 86 000 and 0 304 96 000.

Authorized bodies record investments in treasury property using a new account 0 106 50 000. Analytical codes for types of property have also been introduced for it. Please note that the amendments to the Unified Chart of Accounts and Instruction No. 157 provide for different start dates for the application of this account. Taking into account the changes in the chart of accounts N 162 n, the innovation needs to be introduced in 2021.

Documentation:

Order of the Ministry of Finance of Russia dated October 28, 2020 N 246 nRead more >>>

Order of the Ministry of Finance of Russia dated October 30, 2020 N 253 n

Order of the Ministry of Finance of Russia dated October 30, 2020 N 256 n

Possible ways to value low-value items

The accounting regulations provide for several options for assessing inventories. It can be carried out at cost:

- each individual unit purchased;

- weighted average;

- first in time for purchasing materials (FIFO method).

Low valuation is a special component of material reserves. The initial cost of the IBP contains all the costs that the enterprise incurred during the purchase. This is reflected in the relevant primary documentation.

Based on this, it is necessary to write in the order on accounting policies that IBP is assessed based on the actual cost of each individual unit. At the same time, you should not forget to add the amount of expenses for its purchase. A list of primary documentation is also included here. With its help, the movement of the IBP from capitalization to write-off will be traced.

IBP does not include workwear, since according to the law it should be classified as a type of property that is taken into account especially.