Organizations and individual entrepreneurs that are tax agents for personal income tax are required to report to the Federal Tax Service on the amounts of income paid to individuals at the end of the year. To do this, you need to submit certificates in form 2-NDFL for each individual who received income. What are the new deadlines for submitting 2-NDFL in 2021? When to submit certificates with signs 1 and 2? Let me explain. Also see “ Overview of changes in personal income tax from 2021 ”.

Changes for 2021: important

The Federal Tax Service has warned that from the beginning of 2021, the rules for submitting personal income tax reporting to the tax authorities will change. The letter dated November 15, 2019 No. BS-4-11/ states that Federal Law No. 325-FZ dated September 29, 2019 amended paragraph six of paragraph 2 of Article 230 of the Tax Code of the Russian Federation. They reduced the number of employees from 25 to 10 people in order to provide information on the income of individuals in Form No. 2-NDFL and calculate personal income tax amounts in Form No. 6-NDFL on paper. According to paragraph 3 of Article 3 of Federal Law No. 325-FZ, these changes come into force on January 1, 2021.

Therefore, from January 1, 2021, tax reporting in Form No. 6-NDFL and information on the income of individuals in Form 2-NDFL for 2019 can be submitted on paper only if the number of employees is no more than 10 people. If the number of employees is more than 10 people, forms 2-NDFL and 6-NDFL for 2021 should be submitted electronically.

In addition, amendments to Article 230 of the Tax Code of the Russian Federation postponed the deadline for submitting tax reporting in Form No. 6-NDFL and information on the income of individuals in Form 2-NDFL to March 1 of the year following the expired tax period.

Since March 1, 2021 is a holiday, tax reporting in Form No. 6-NDFL and information on the income of individuals in Form 2-NDFL for 2021 must be submitted no later than March 2, 2020.

How to submit 2-NDFL certificates

2-NDFL certificates must be submitted to the tax office at the place of registration of the organization or at the place of residence of the individual entrepreneur via telecommunication channels.

You can submit certificates on paper if the number of employees does not exceed 10 people (Clause 2 of Article 230 of the Tax Code of the Russian Federation).

2-NDFL certificates on paper can be submitted to:

- personally to the tax office. This can be done by a manager (IP) or another person by proxy (clause 1 of article 26, clause 1 of article 27, article 29 of the Tax Code of the Russian Federation);

- send by mail with a description of the attachment.

If certificates are submitted in person to the inspectorate, they will be considered submitted on the day of submission, and if sent by mail, on the day the letter is sent.

To submit 2-NDFL certificates on paper, you need to draw up an accompanying register in two copies. The register form is given in Appendix 1 to the Order of the Federal Tax Service of Russia dated October 2, 2021 No. ММВ-7-11/ [email protected]

If an organization has separate divisions, then for the employees of these divisions and for individuals with whom the division has entered into civil contracts, certificates must be submitted to the tax office where the separate division is registered (clause 2 of Article 230 of the Tax Code of the Russian Federation).

Read in the berator “Practical Encyclopedia of an Accountant”

Certificate 2-NDFL of a separate division

Table: new deadlines for submitting 2-NDFL

After the changes, you must submit 2-NDFL to the Federal Tax Service within the following deadlines:

| Situation | Deadline for submitting 2-NDFL |

| 2-NDFL certificates are submitted to the Federal Tax Service for individuals to whom the tax agent paid income in the reporting year, but personal income tax was not withheld from this income | No later than March 1 of the year following the reporting year |

| 2-NDFL certificates are submitted to the INFS for absolutely all individuals to whom the tax agent paid income in the reporting year | No later than March 1 of the year following the reporting year |

Employers' reports (forms 2-NDFL, 6-NDFL)

Employers (organizations and individual entrepreneurs) are required to keep records for each individual to whom income was paid.

As a general rule, when paying income to an individual, the employer must withhold tax. The tax was called personal income tax

- personal income tax, and the employer -

tax agent

.

Tax agents are required to calculate, withhold and transfer personal income tax to the budget from payments to individuals. The exception is payments to individuals under sales and purchase agreements and agreements concluded with individual entrepreneurs.

If the individual leasing the premises is not an entrepreneur, then the company is obliged to calculate and withhold personal income tax when paying rent.

- Calculus

- Hold

- Transfer

Calculate

Personal income tax is required for each individual, separately for each rate. To calculate tax you need:

- Determine whether the payment is taxable

- Choose the right tax rate. The most commonly used rate is 13%

- Calculate the tax base taking into account tax deductions

- Calculate personal income tax

Income tax is calculated in full rubles

.

Tax agents do not have the right to pay income tax from their own funds.

Personal income tax should be withheld

directly from the income of an individual upon their actual payment.

The date of actual receipt of income

may differ from the date of actual

payment

Date of actual receipt of income

– the date on which the tax agent must calculate the amount of personal income tax. In particular, the day of receipt of income in the form of wages is considered to be the last day of the month in which it was accrued.

Date of actual payment

– date of actual receipt of income by an individual.

The company transferred the employee's salary for January on February 4. In this case, the date of actual receipt of income will be January 31, and the date of actual payment will be February 4.

The table shows how the date of actual receipt of income is determined.

| Income | Date of actual receipt of income |

| Salary | The last day of the month for which wages are accrued |

| Final settlement with the dismissed employee | Employee's last working day |

| Vacation and sick leave | The day when the money was withdrawn from the cash register or transferred to the employee’s card |

| Travel expenses that are not documented | The last day of the month in which the advance payment is approved |

| Over-limit daily allowance | |

| Gifts in excess of 4,000 rubles, material assistance subject to personal income tax and other income not related to wages | The day when the money was withdrawn from the cash register or transferred to the employee’s card. For income in kind – the day of transfer of goods and materials, payment for work or services per person |

| Contractor's remuneration | The day when the money was issued from the cash register or transferred to the contractor’s card |

| Material benefits from loans | The last day of each month during the period for which the loan was issued |

| Dividends | The day when the money was issued from the cash register or transferred to the card of the company member (shareholder) |

Hold

Tax on personal income is due on the day of actual payment of income. An exception is the payment of an advance salary to an employee. In this case, income tax should be withheld once upon the final calculation of the employee’s income for the entire month.

Tax calculated on income in kind and material benefits from loans must be withheld from the next cash payment.

When it is not possible to withhold personal income tax

If the company was unable to withhold personal income tax by the end of the calendar year, then no later than March 1

next year you need to report this to the Federal Tax Service and the individual.

The message is issued with a certificate in form 2-NDFL. When filling out the certificate, indicate:

- in the “Characteristic” field – the value “2”;

- in section 3 - the amount of income from which tax is not withheld;

- in section 5 - the amount of calculated but not withheld personal income tax.

There are two deadlines for transferring tax withheld from a taxpayer to the budget:

- For wages

- no later than the day following the day of payment of income. - For vacation

and

sick pay

- the last day of the month in which payments occurred. No later, but not necessarily on the last day of the month - that is, later is not possible, earlier is possible.

If the deadline for transferring personal income tax falls on a weekend, it is postponed to the next working day.

If the amount of withheld tax is less than 100 rubles, it is not paid this month, but is added to the amount of personal income tax, which will be transferred next month. However, such a transfer is possible no later than December of the current year.

For late transfer of personal income tax, the tax agent will be fined in the amount of 20% of the amount of non-payment. In addition to the fine, a penalty will be charged.

Income tax is paid by the tax agent to the budget at the place of his registration. An exception applies to organizations that have separate divisions.

How to issue a payment order for the transfer of personal income tax?

When transferring personal income tax to the budget, it is important to correctly fill out all the details of the payment document

. If there are errors in the payment, the tax authorities will not be able to correctly account for such a payment. The company will either have to clarify the payment or transfer the personal income tax amounts again.

When filling out the payment form, you need to pay attention to the following.

- Field 101 indicates the payer status

–

02 - Field 107 reflects the month number and year

- “MS.08.2020” (personal income tax on wages for August 2021) - Fields 16, 61 and 103 indicate the details of the tax authority

Field 104 indicates KBK

- 182 1 0100 110

In addition to correct calculation, withholding and timely transfer of personal income tax to the budget, tax agents must submit reports to the tax authority.

Tax agent reporting

Tax agent companies must report to tax authorities on income paid to individuals and on personal income tax calculated and withheld from them.

The agent's reporting consists of a 6-NDFL calculation and a 2-NDFL certificate.

The reports differ from each other in that in the 6-NDFL calculation, general information is indicated for all individuals who received income from the tax agent, and in the 2-NDFL certificate, for each individual individually.

Each type of reporting has its own deadlines for submission.

If there are no employees and no payments to individuals, the company is not a tax agent. In this case, there is no obligation to submit zero forms 2-NDFL and 6-NDFL.

Starting with the submission of information for 2021 certificate 2-NDFL

will be included in the calculation of

6-NDFL

Report forms

Officials change reporting forms quite often. But the rule remains unchanged - the report is submitted in the form that was in force in the tax period for which the document is submitted.

| Forms 2-NDFL | Forms 6-NDFL |

The employer needs to prepare three certificates:

- for 2021 it is necessary to prepare the 2-NDFL form, which was valid in 2021,

- for 2021 and 2021 - a certificate of income, the form of which is valid from 2021.

Different 2-NDFL forms have been approved for submission to the tax office and for issuance to the employee (starting from 2018).

Deadlines for submitting personal income tax reports

Certificates in form 2-NDFL are submitted annually, and calculations of 6-NDFL are submitted quarterly.

- Certificates 2-NDFL

- Calculation of 6-NDFL

Starting with the provision of 2-NDFL

For 2021,

the deadline

is no later than

March 1

.

Previously, information on the usual form had to be submitted before April 1. However, starting from 01/01/2020, a new rule applies:

- The deadline for submitting 2-NDFL with sign 1

(regular form) or 3 is no later than March 1 of the year following the year in which the income was paid to the individual. - The deadline for submitting 2-NDFL with sign 2 or 4 is no later than March 1

of the year following the year of payment of income.

For each 2-NDFL certificate not submitted on time, the company will be fined 200 rubles.

Deadline for submitting calculations 6-NDFL

depends on the period for which it is rented:

- for the first quarter – no later than April 30;

- for half a year - no later than July 31;

- for nine months - no later than October 31;

- for the year - no later than March 1 of the following year.

For violation of the deadline for submitting a calculation, a fine of 1,000

rubles is provided for each full or partial month of delay.

If the filing date falls on a weekend or non-working holiday, the report must be submitted no later than the next working day.

Deadline for submitting annual calculations 6-NDFL

and information in form

2-NDFL – March 1

of the next year.

Where does a tax agent submit personal income tax reports?

For employees of the head office, organizations submit reports at the place of registration of the company, individual entrepreneurs on the general system or simplified system - at the place of residence, on imputation or patent - at the place of registration as a payer of UTII or PSN.

Information about which inspection the reports must be submitted to, as well as which code of the place of submission must be indicated in Form 6‑NDFL, is given in the table.

| Tax agent | Where is the report submitted? | Accounting location code |

| For employees of the company's head office | At the place of registration of the company | 212 |

| For employees of the company, the largest taxpayer | At the place of registration of the company as the largest taxpayer | 213 |

| For employees of a separate division of the company | At the place of registration of a separate division | 220 |

| For employees of a separate division of the company - the largest taxpayer | At the place of registration of the division or at the place of registration of the company as the largest taxpayer | 220 or 213 |

| For contractors | At the place of registration of the company or division - depending on where the contractor entered into the contract | 212 (220) or 213 |

| For the entrepreneur’s employees on OSNO or simplified tax system | At the place of residence of the entrepreneur | 120 |

| For the entrepreneur’s employees on UTII or PSN | At the place of registration of the entrepreneur as a payer of imputation or patent | 320 |

How can I submit personal income tax reporting?

How to submit reports - electronically or on paper - depends on the number of individuals to whom the tax agent paid income:

- if there are 10 people or more - in electronic form;

- if up to 10 people - on paper or electronically.

When sending electronic documents, an electronic digital signature is required. We recommend purchasing an electronic digital signature from the Certification Center of the Central Bank of Ukraine and using it throughout the year to submit reports to the Tax Office, Pension Fund, Social Insurance, etc.

For violation of the electronic method of submitting 6-NDFL calculations, the tax agent faces a fine of 200

rubles

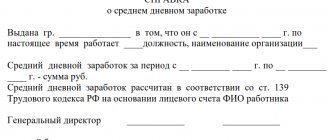

Certificate on form 2-NDFL for individuals

The company is obliged to issue a certificate in form 2-NDFL to any person to whom payments subject to personal income tax were made. To do this, an individual needs to submit an application for a certificate.

The certificate must be issued:

- for a resigning employee - on the last day of his work;

- other employees (including former employees) - within 3 working days from the date of receipt of the application.

Certificate 2-NDFL is usually required:

- to obtain a loan,

- when changing jobs,

- when declaring to receive property and social deductions,

- to calculate pension,

- when adopting a child,

- when participating in various legal proceedings (usually regarding the resolution of labor disputes),

- when calculating the amount of alimony payments,

- for obtaining a visa, etc.

The income certificate has no validity period

, if used to verify income.

If the certificate is used, for example, to obtain a loan from a bank, then its validity period in this case is set by the bank.

What are the penalties for personal income tax reports?

Tax authorities can fine an employer both for late reporting and for errors in it.

- Calculation of 6-NDFL

- Help 2-NDFL

- Failure to submit a calculation on time will result in a fine of 1,000 rubles. for each full or incomplete month of delay (clause 1.2 of Article 126 of the Tax Code).

- False information in the calculation - a fine of 500 rubles. for each unreliable document (Article 126.1 of the Tax Code).

- Violation of the method of presenting calculations – a fine of 200 rubles. (Article 119.1 Tax Code)

Tax officials also have the right to block bank accounts if the payment is not submitted within 10 working days after the due date

- Errors and false information in 2-NDFL - a fine of 500 rubles. for each erroneous document (Article 126.1 of the Tax Code).

- Missed the deadline for filing 2-NDFL - a fine of 200 rubles. for each document not submitted (clause 1 of Article 126 of the Tax Code)

Tax officials do not have the right to block a current account for failure to submit 2-NDFL.

Additionally, for failure to submit a 6-NDFL calculation or a 2-NDFL certificate within the prescribed period, the employee of the organization responsible for its provision may be fined in the amount of 300

up to

500

rubles (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Deadlines for submitting 2-NDFL for 2021

Having studied the table above, the question of when to submit 2-NDFL for 2021 disappears:

- If you paid income to individuals in 2021 from which personal income tax was not withheld, then no later than 03/02/2020 you must submit to the Federal Tax Service certificates 2-NDFL in relation to these individuals indicating the sign “2”. By the way, within the same period the “physicist” himself must be notified about the unwithheld tax;

- for all individuals to whom you paid income in 2021 (including those from whose income tax was not withheld), 2-NDFL certificates must also be submitted to the Federal Tax Service no later than 03/02/2019.

Special cases

There are special situations when an income certificate is issued. This may be the case, for example, with military personnel. This category of citizens receives such a document from the Unified Settlement Center of the Ministry of Defense of the Russian Federation, since in this situation the state acts as the employer.

If it so happens that during the reporting period a serviceman received a salary from several units of the same organization, then the form of the certificate in such a situation will be slightly different.

In addition, a situation may arise when the current employer requests such a document from an employee from a previous place. This is necessary in order to issue a tax deduction, accrue sick leave and accrue vacation pay.

Total: deadlines for submitting 2-NDFL in 2021 (table)

For 2021, personal income tax agents will have to report in 2021.

| Situation | Deadline for submitting 2-NDFL |

| Personal income tax was not withheld from income paid in 2021 | No later than 03/02/2020 (March 1 – Sunday) |

| In 2021, individuals were paid income | No later than 03/02/2020 |

Consequently, the deadlines for submitting 2-NDFL certificates with sign 1 and sign 2 have become the same.

How can they be fined?

If you miss the deadline for submitting 2-NDFL certificates, the tax inspectorate will charge you a fine of 200 rubles for each certificate (clause 1 of Article 126 of the Tax Code of the Russian Federation).

In addition, in this case, the head of the organization faces from 300 to 500 rubles (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Please note: you, as a tax agent, will not be fined if you independently discover errors and submit updated documents to the tax office before you learn that tax inspectors discovered inaccuracies contained in the documents (information) you provided (clause 2). Article 126.1 of the Tax Code of the Russian Federation).

What to do if the employer refuses to issue a certificate

Rarely, but there are still situations when an employer refuses to issue a 2-NDFL certificate to a dismissed employee. Most often, due to the fact that the company has problems with tax accounting. In this case, the employee will need to comply with all the rules of the law in order to achieve his goal.

You will have to write a statement in writing and send it to the employer. It is preferable to send such an application by a valuable letter - then you will have an inventory of the attachment with a mark from the postal operator. If within the established period (three days from the date of receipt of the application by the employer) the certificate is not provided, you can contact the labor inspectorate directly with a complaint about the inaction of company officials.

To learn about the consequences of not issuing a certificate to an employee, read the material “The employee was not issued a 2-NDFL certificate? Wait for the trial .

Where can an unemployed person or a pensioner get a certificate?

An unemployed person can receive a certificate of income received in the form of unemployment benefits at the employment center. All you have to do is submit an application and then pick up the completed certificate. But this will not be Form 2-NDFL. If an individual has not worked for more than three years and is not registered with the employment center, then there is simply nowhere for him to get a certificate of income, because officially there was none.

If a non-working person had income from other sources, it is necessary to report them by indicating in the 3-NDFL declaration. In addition, you will need to calculate the tax yourself and transfer it to the budget. In this case, evidence of income received and taxes paid on it will be a copy of the tax return.

Pensioners receiving payments from non-state pension funds can request 2-NDFL from the local branch of their fund. But disabled citizens who receive state pensions will not be able to obtain such a certificate from the Pension Fund of the Russian Federation, since such pensions are not subject to personal income tax.

What's new in the procedure for obtaining a certificate

As mentioned above, starting from 2021, 2-NDFL is issued on a new form. Or rather, on two forms:

- The first - it is now called 2-NDFL - is used for submission to the Federal Tax Service.

It has a new structure: it consists of some kind of title page, three sections and one appendix. At the very beginning of the document, information about the tax agent is provided, in section 1 - information about the individual in respect of whom the certificate is being filled out, in section 2 - information about the total amount of income, tax base and personal income tax, in section 3 - deductions provided by the agent: standard, social and property, and the appendix provides a breakdown of income and deductions by month.

- The second form, which is issued to the employee, is simply called “Certificate of income and tax amounts of an individual” (without the usual “2-NDFL”). It almost completely repeats the previous form (from the order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/ [email protected] ).

For income for 2021, 2-NDFL as an independent report has been cancelled.