Certificate of average earnings for the employment center is a document on the basis of which the amount of unemployment benefits is determined.

A person who has lost his job is entitled to state benefits. Its size depends on the citizen’s previous income.

IMPORTANT!

Due to the unfavorable situation in the labor market, formed as a result of restrictive quarantine measures, the government is establishing a new maximum amount of unemployment benefits - 12,130 (equal to the minimum wage for 2020). Decree of the Government of the Russian Federation No. 346 of March 27, 2020 comes into force on the date of its publication. In Moscow and the Moscow region, by decision of local authorities, the benefit is set at 19,500 rubles. You can receive it remotely by registering on the My Job employment service website as an unemployed person.

We'll tell you what a certificate for the labor exchange looks like and what requirements apply to its execution.

Where is salary information required?

Salary certificate is a document that contains information about an employee’s accruals for a certain period of time, as well as information about the length of work experience, position and information about the employer.

There are quite a few situations in which information about the average salary may be required, for example:

- filling out an application for a loan, loan or loan;

- when registering with the employment center;

- to obtain a visa of a foreign country;

- registration of social benefits and insurance payments (pensions and sick leave);

- litigation and disputes;

- receiving subsidies established by law.

Please note that for each case a different form of certificate of average earnings can be used. Any employee, even those fired, has the right to receive an official document. Moreover, the employer is obliged to issue information about wages within three days from the date of application on the basis of Art. 62 Labor Code of the Russian Federation. Below you will find a sample of filling out a certificate of average earnings for each specific case.

Issuance of a certificate upon liquidation of an enterprise

An employee may need a certificate regardless of whether the company exists or has been liquidated. All documentation after the termination of the company's activities is submitted to the archival authorities. The former employee should apply in writing to provide the information he is interested in.

Further, upon request, archive employees search for the salary of this employee in the personal accounts of the liquidated organization. The search for the necessary information is carried out within 30 days.

After this, an archival certificate is drawn up or a copy of the document is made, which is sent to the former employee in writing. You can also contact the archive by phone and request salary information by fax.

In case of reorganization of the enterprise, documentation on accrued wages can be transferred to a higher structure. You can also find out data on the average salary from the former chief accountant or director if you have close friendly relations.

Documents upon dismissal

For all resigning employees, regardless of the reason for termination of employment, the employer is required to provide the following documentation:

| Mandatory | On request |

|

|

IMPORTANT!

Generate information about your salary in a unified document form approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n. Information in form No. 182n is generated for the period worked in the current year, as well as for the two previous calendar years.

How to fill out the document

Although the rules do not provide for a single form for reference, it must contain certain data. The standard sample has the organization's stamp located at the top left. Next comes address information, including postal code.

Each document is assigned a number under which it is entered in the registration journal. On the right is the taxpayer number assigned to the employer. Next, information about earnings is located in the center of the sheet. At the bottom is the number when the document was drawn up.

To obtain an extract, you must contact management with a corresponding written application. Three days are allotted for drawing up the document. The chief accountant of the organization is responsible for the timing of issuance and reliability of information.

Sample of filling out a certificate of average earnings

When an employee retires, another document may be required, for example, a certificate of average earnings for the Pension Fund. This form indicates not only the amount of accrued wages, but also the amount of insurance contributions made by the employer to the insured person (employee). Information is generated for the entire period of employment. Based on this document, representatives of the Pension Fund calculate the amount of the insurance pension.

What time is excluded from the calculation period

In the billing period (three calendar months before the month of dismissal from the first to the first) the following are not counted:

- days of temporary disability, days of maternity leave, days of leave to care for children under one and a half and three years old;

- days of annual leave, leave without pay, study leave;

- days of rest for disabled people since childhood and disabled children;

- days on which the employee was released from work, but at the same time he was paid the average salary in full or in part;

- days of rest that were provided to the employee for previously worked time;

- days of a strike, if the employee did not participate in it, but was not able to start work because of this event.

Be careful: the calculation period includes days of absenteeism and time of participation in strikes at the personal request of the employee.

Data for the employment center

A resigned employee, in addition to the documentation required by law, may need a certificate from the Central Labor Office regarding average earnings. The information is necessary for the employees of the Central Employment Service to calculate and assign unemployment benefits (clause 2, article 3 of the Federal Law of April 19, 1991 No. 1032-1). To prepare information, use the unified form approved in Letter of the Ministry of Labor dated August 15, 2016 No. 16-5/B-421. But providing another form containing all the necessary details will not be considered a violation.

The procedure for calculating and assigning state unemployment benefits is enshrined in Resolution of the Ministry of Labor dated August 12, 2003 No. 62.

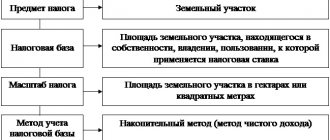

Calculation mechanism

The average salary for the employment center is taken 3 months before dismissal from the first to the last day.

In accordance with the regulated procedure, the calculation of average earnings includes:

- the basic salary calculated on the basis of the official salary, approved interest rates on the tariff and piece rates established by the organization;

- additional payments for combining professions, bonuses for skill and professionalism, rewards for achieved financial indicators provided for by internal local documentation;

- bonuses for production performance for a quarter, half-year or other time interval in the proportions assigned to the corresponding period; the quarterly premium refers to the month for which it is accrued as 1/3, the annual premium - as 1/12, regardless of the time of accrual.

The average monthly income is calculated for the appointment of unemployment benefits by the responsible persons of the fund, taking into account the exclusion of the following payments and related time intervals:

- if there was a vacation or monetary compensation for earned and unused time for rest;

- if the employee did not work fully for a month due to the enterprise being in a state of forced downtime or spending part of the time on business trips;

- if you had sick leave for your own illness or caring for a sick relative.

Time spent on vacations of all types is not included in the calculation period. The average monthly salary does not include payments from the material incentive fund. You need to calculate your average monthly earnings by including only payments for time worked.

The formula for calculating average earnings for an employment center is:

| Average earnings ha 3 months | = | Total income excluding payments for unworked time and funds from the material incentive fund | / | Number of days actually worked | * | Total number of working days in the billing period | / | 3 months |

Working hours included in the formula are calculated according to the work schedule, and not according to statistics. Ignoring the norm leads to a distortion of the result during a shift schedule and irregular work hours.

Information for credit institutions

Most banking organizations providing loans, installment plans and financial loans have abandoned individual forms in favor of 2-NDFL. Why? Tax form KND 1151078 contains all the necessary details and data not only about the individual and his income, but also about his employer. Moreover, administrative liability and fines are provided for errors and inaccuracies in the tax document.

Please note that officials have developed and approved a new reporting structure in form 2-NDFL, according to Order of the Federal Tax Service of Russia dated 10/02/2018 No. ММВ-7-11/ [email protected] Now two forms are filled out: one for the tax inspectorate, and the second for for an employee. To provide information to the bank, for example, to obtain a mortgage or consumer loan, use the new 2-NDFL form (for an employee).

How is the billing period determined?

The billing period is the last three calendar months of work before termination of the employment relationship.

The following days and accrued funds are excluded from this period:

- when the employee was temporarily disabled, which is confirmed in the form of a certificate of incapacity for work issued in the prescribed form by medical institutions;

- the length of time women spend on prenatal and postnatal leave;

- when in fact a person did not work due to downtime of the enterprise and received guaranteed payments, or did not work during strikes, even without directly participating in them;

- Having children recognized as disabled, the employee enjoyed the right to additional rest time, established in agreement with management;

- when, in accordance with legislative norms, he was partially or completely released from work;

- used as time off granted for overtime in excess of the norm for the duration of a work shift or going to work on weekends, holidays, recognized as non-working days;

- other times when, in accordance with legislative norms, the absent employee retained his job and salary.

The calculation does not take into account the period of maternity leave

We apply for a visa, social benefits or subsidies

To obtain a visa to enter a foreign country, representatives of a foreign embassy require confirmation of the citizen’s official employment. Some representatives of European countries also prefer 2-NDFL, explaining this by the fact that the tax form KND 1151078 is documentary evidence of employment, and a certificate of average earnings for a visa can be easily falsified.

To receive social benefits and other financial assistance, for example, social protection authorities will also require confirmation of average income. This is necessary to establish preferential status for the applying citizen.

The certificate of average earnings for social security (sample) does not have a unified form and is compiled in any order. When generating information, please provide the required details:

- name of the organization, its registration and contact details;

- last name, first name and patronymic (if any) of the employee, position;

- information on accruals with a monthly breakdown.

The paperwork for receiving subsidies is prepared in a similar way.

How to calculate earnings if the salary increased?

The period when the salary increase (tariff rate) occurred is taken into account when calculating average earnings:

- if the increase was in the billing period, increase the resulting value by the coefficient obtained by dividing the increased rate by the current tariffs in each month taken to calculate the average value;

- if there is an increase after the three-month period taken to calculate the average earnings, the value of the entire amount is increased;

- in case of changes in salaries and tariffs after termination of employment with an employee, recalculation for reference to the stock exchange about income is not made.

Similarly, increases in bonuses for qualifications or special conditions of public service are taken into account.

Certificate of average daily earnings for the court, sample

You may be required to confirm your income and other receipts in court. For example, when assigning alimony, when considering a case of causing material damage or in violation of the Labor Code. The need to provide data is determined by the prosecutor or lawyer. Fill out the document in accordance with Art. 139 Labor Code of the Russian Federation.

What employee benefits are taken into account for the calculation?

For a certificate to the employment service issued to a dismissed employee, required when submitting documents to the territorial employment service, when calculating the average earnings, they take into account all payments received during the three-month period before dismissal, accrued in accordance with the organization's current remuneration system.

This includes:

- the amount of wages in the amount of the salary or tariff rate for the time actually worked;

- wages accrued at piece rates based on the volume of work performed;

- remuneration as a percentage of completed orders, services provided, sales of goods;

- wages paid in products or goods in an equivalent monetary amount;

- remunerations paid to state (municipal) employees;

- fees for media workers;

- teachers' salaries for overtime hours;

- compensation payments guaranteed for work in special, harmful and dangerous working conditions;

- incentive and incentive bonuses.

The certificate for the labor exchange indicates the calculation of average earnings for a three-month period

How to fill out sick leave and benefits from a previous job

A certificate of average earnings for sick leave (sample form No. 182n) must be provided to the employee on the day of his dismissal or on the last working day, and it is mandatory. The document is required to be provided at a new place of work in order to take into account insurance periods and accrued earnings in the calculation of benefits for temporary disability and in connection with maternity.

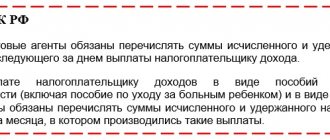

IMPORTANT!

If an employee provided Form 182n from his previous place of work after the assignment and payment of benefits, the employer is obliged to recalculate. Such rules apply to all benefits paid within three years at a new place of work preceding the day the document was provided.

What items must be completed in the certificate?

The certificate form was recommended by the Ministry of Labor in letter No. 16-5/B-421 dated August 15, 2016. However, the text of the document contains a clarification that if the certificate is not issued in the specified form, but contains all the necessary details, there are no grounds for refusing to accept it.

Therefore, it is important to comply with the conditions for the availability of the necessary information and follow the rules for filling it out.

The certificate for the employment service must be filled out on the organization's letterhead or A4 sheet, where the employer's stamp with its full name is affixed in the upper left corner. The document must contain the following information:

- TIN of the employer who issued the certificate;

- OKVED organization;

- Full name of the citizen at whose request the certificate is issued;

- the period of work of the citizen in this organization (start and end date);

- full name of the company or full name of the individual entrepreneur;

- working conditions are filled in in the corresponding lines of a full or part-time working day or week (number of hours of the working day and days of the working week);

- if the employee worked part-time or a week, the article of labor legislation on the basis of which such work mode was applied should be clarified below;

- average earnings based on the last three calendar months of work in numbers and words;

- documents that served as the basis for calculating average earnings (employee personal accounts and other payment documents);

- signatures of the head of the company and the chief accountant with a transcript;

- date of completion and contact telephone number;

- seal of the organization (if available).

If there are periods that were not taken into account in the calculation, they must be listed in the certificate, indicating the beginning, end and reason for not being included.

This is important to know: Federal Law “On the Prosecutor’s Office of the Russian Federation”: latest edition 2021