To record transactions and prepare financial statements, small businesses often use Form No. K-1 - a book (journal) for recording the facts of economic activity. This form is relevant for companies that work with a small number of accounting accounts and carry out literally a few (up to 30) transactions per month.

The form of the book was approved by Order of the Ministry of Finance of the Russian Federation No. 64n dated December 21, 1998, which recommends the principles of organizing accounting in small companies. It is the ability to keep records in a simplified version that is valued by businessmen, since in this case, of the many accounting forms and registers, only a book of accounting facts of economic activity can be used in work - a document used to register and reflect the transactions performed.

What is a business transaction journal and why is it needed?

A business transaction journal is an accounting document that reflects all transactions taking place in an enterprise.

Using the business transaction log, management, together with the finance and accounting departments, can monitor the current financial situation in the company, analyze changes, and also predict future production needs.

Logbook for introductory training on labor protection: a sample and step-by-step instructions for filling out are contained in the article at the link.

Almost all changes in economic life that occur at the company are subject to reflection in the journal, namely:

- Changing the company's assets (writing off a broken fixed asset, commissioning a new fixed asset, improving an existing one).

- Changes in the company's liabilities (obtaining a loan, repaying a loan, purchasing and selling securities).

- Positive changes in the well-being of the enterprise (in parallel in assets, liabilities and foreign currency).

- Negative changes in the well-being of the company (in parallel in assets, liabilities, as well as in foreign currency).

- Facts of economic life that do not fall into any of the above categories (other changes).

The cashier-operator's journal: purpose, requirements and rules of maintenance were discussed in detail in our new publication at the link.

Business transactions journal form.

Magazine order 8

This register reflects transactions on accounts in accordance with the Chart of Accounts adopted by the organization, in which the organization accounts for:

- settlements for advances and partial payment for goods, works and services. For these purposes, for example, account 61 “Settlements for advances received” or a subaccount to account 62 “Settlements with buyers and customers” can be used;

- calculations with the budget. As a rule, for such calculations, account 68 “Calculations with the budget” is opened;

- settlements with various debtors and creditors - account 76.

Form, content and journal template in excel format

The business transaction journal contains the following information: a posting indicating the debit and credit of the accounts used, a transcript of the posting (the purpose of the posting and the amount), and the posting date. And so on for every business transaction.

Sometimes the journal indicates the primary documents on the basis of which the funds were transferred.

Historically, specific requirements for the journal of business transactions have developed:

- Transactions are reflected from the earliest date to the latest

- Every business transaction must be reflected

- Postings must refer to source documents

- To avoid falsification of information, numbers should be written in words (for example, nine thousand).

How to fill out a log of employment contracts? A sample and step-by-step instructions are contained in the article at the link.

The business transaction log can be kept in paper and electronic form.

At the moment, the electronic version is more popular, as part of an automated enterprise management system. However, there are companies in which records of acts of economic life are kept in the old fashioned way - in the form of a thick bound book - a journal of business transactions.

Journal of business transactions - form can be downloaded for free in Excel format, you can follow this link.

A sample of filling out a journal of business transactions with postings.

KUDiR for individual entrepreneurs and LLCs in 2021

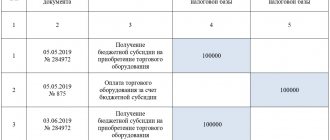

Contains four tables (one for each quarter). Each table consists of 5 columns (columns).

COUNT No. 1

. Serial number of the record.

COUNT No. 2

. Date and number of the primary document confirming income or expenses.

On income:

- If funds are received at the cash desk

, then the date of receipt and the number of the cash report, which is compiled at the end of each shift (formerly Z-report), are recorded.

For example, 01/15/2021, FD No. 54 (report on shift closure)

. - If the funds arrived in the current account

, then the date of arrival and the number of the payment order or bank statement are recorded.

For example, 01/15/2021 payment order No. 100

or

01/15/2021 bank statement No. 100

. - If the funds received on paper BSO

(strict reporting form) (if, by law, the cash register can not be used), then for each such form issued it is not necessary to make a separate line in the KUDIR. Instead, you can write down the date of the working day and issue a PKO, which lists the numbers of all issued BSOs for that day (in this case, the amount of funds for these BSOs is entered in column 4). For example,

01/15/2021 PKO No. 100

. You can group BSOs only if they were discharged within one day.Note!

From July 1, 2021, it is prohibited to use

paper strict reporting forms

instead of cash receipts. BSO should be formed using CCP. However, if the individual entrepreneur uses a deferment until mid-2021 or the business is completely exempt from CCP, then paper BSO can be used as a document confirming the calculation. - a refund

was made for a product or service, then in column 4 the refund amount is entered with a minus sign, and in column 1 the date of the actual return and the number of the payment order or cash receipt for the refund (FD number) are recorded.

Note!

The point of indicating the document number in column 2 of KUDiR is to identify the operation and, if necessary, find it at any time. Previously, the shift closure report (Z-report) had a number. Now, instead of it, you can use the “fiscal document number” attribute - FD. However, each cash register has its own FD numbering. Therefore, if you have several cash registers, it is recommended that in addition to the FD, you indicate the FN (fiscal drive) details or the cash register number.

When an expense is incurred (only for the simplified tax system “Income minus expenses”), the date of the expense and the number of the primary document are recorded, which can be: an invoice, a payment order, a cash report, a sales receipt (if work without a cash register is allowed), etc. For example, 01/15/2021 FD No. 53 (return check)

,

01/15/2021 delivery note No. 55

,

01/15/2021 item No. 55

,

01/15/2021 FD No. 55 (shift closing report)

, etc.

note

that expenses for the purchase of goods for their subsequent resale are entered only after their sale.

COUNT No. 3

. Contents of operation.

This column is not too important.

Examples of filling in income:

- Receipt at the cash register. Payment under agreement No. 100/AA dated January 10, 2021 for the provision of advertising services

. - An advance was received from the buyer LLC Firma for the upcoming delivery of goods under contract No. 100/AA

. - Income received. Trading revenue for 01/15/2021

. - Refund to the buyer under agreement No. 100/AA dated 10/15/2020.

Examples of filling in expenses (only for the simplified tax system “Income minus expenses”):

- Advance paid to employees.

- Wages listed.

- Personal income tax is transferred from wages.

COUNT No. 4

. Income taken into account when calculating the tax base.

note

, that when returning funds to the buyer, the amount is written in this column with a minus sign. Those. not in expenses (column No. 5), but in income (column No. 4).

COUNT No. 5

. Expenses taken into account when calculating the tax base. Filled out only by individual entrepreneurs and organizations using the simplified tax system “Income minus expenses.”

In the “Help for Section I” fill in:

- on the simplified tax system “Income” only line 010 for the entire year;

- on the simplified tax system “Income minus expenses” lines 010, 020 for the whole year and lines 040, 041 (if the amounts are not negative).

The procedure for drawing up and a sample of filling with postings

Depending on the form in which the journal is kept (paper or electronic), the technique for maintaining it changes.

If the journal is paper, then you need to perform a sequence of certain actions:

- First you need to open the magazine.

- Then you need to reflect the business transaction with its details (date, content, type) on a new line.

- If necessary, you can indicate the documents on the basis of which the posting was made.

- Following this, you need to reflect the amount of the transaction.

- After this, you need to indicate the debit and credit of the accounts used (debit usually indicates the obligations to the company and the amount of funds actually received, while credit indicates the company’s obligations to creditors and the amount of funds actually paid).

- And finally, you need to sign and decipher it.

You can find out what a fire extinguisher logbook is and how to fill it out correctly in this article.

This sequence remains the same for any business transaction.

An example of a business transaction journal in electronic form.

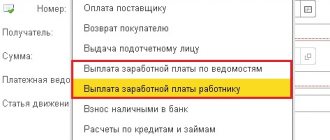

If the journal is kept in electronic form , for example in the 1C Accounting program, then to reflect the business transaction you will need to do the following:

- Open the program with which accounting is carried out, click on the “Menu” tab, find the “Accounting” section, find the “Business Operations” section and click on the “Add” button.

- In the window that opens, you must specify the name of the transaction with all the details (date, type, amount).

- If necessary, you can indicate information in the “From” section.

- Following this, it is necessary to reflect the debits and credits of the accounts used. (In order to link a banking transaction to a transaction, you need to find the required document, right-click on it and select “Approve”, after which the document will correspond with the transaction).

- And finally, you need to save the business operation.

What is a fire safety briefing log and is it mandatory to keep it at an enterprise? Read here.

Basically, the sequence of these actions does not change when reflecting any business transactions.

Who uses the business activity record book

Small business in the Russian Federation is gaining momentum.

Every year there are more and more people who want to separate from large employer companies and start their own business. The state encourages such initiatives and gives small enterprises (SE) not only tax benefits, but also the opportunity to conduct accounting in a simpler way than large enterprises do. A ready-made solution from ConsultantPlus will help you understand in detail who can conduct simplified accounting and how:

If you do not already have access to this legal system, a full access trial is available for free.

For example, small enterprises with the number of monthly business transactions of no more than 30, which are not engaged in production and do not perform costly work, have the right to keep records using a ledger for recording the facts of economic activity. It combines synthetic and analytical accounting of accounts used by small businesses and makes it possible to take into account transactions on each of them.

According to the data collected in the book, it is possible to find out whether the MP has property, the nature of its occurrence, and to draw up financial statements.

ATTENTION! Together with form No. K-1 MP, it is necessary to fill out a salary accounting sheet (form No. B-8, approved by order of the Ministry of Finance of the Russian Federation dated December 21, 1998 No. 64n).

How not to make mistakes when preparing MP reports, read the articles:

- “Simplified accounting reporting for small businesses”;

- “Balance sheet for small businesses (features).”

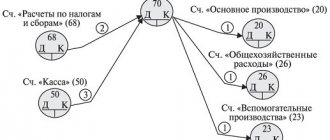

Magazine order 10

This journal for recording business transactions is used to reflect turnover on the credit of accounts intended for accounting:

- material assets (count 10);

- settlements for social insurance and security (account 69);

- settlements with personnel for wages (account 70);

- deferred expenses (account No. 97);

- sinking fund (account No. 86);

- production costs (accounts 20, 23, 24, 25, 26, 29) and shortages and losses from damage to valuables (account 94) in their relationship with production cost accounts.

Possible fines and sanctions

An entrepreneur has the right to independently develop a KUDiR form with mandatory sections that allow him to control the taxation of personal income tax. The recording of transactions should also be carried out nomenclature-wise, but the names of the columns can be changed. The use of the new amended book must be agreed upon with the Federal Tax Service by sending it to the inspectorate with a covering letter.

If your own version of the journal is not agreed upon with the control body, the Federal Tax Service may consider maintaining a new form as its absence. Failure to keep a book entails a fine of 200 rubles for the absence of one document, which is a tax register.

You can see how to fill out this document correctly in the following video:

Who can't keep a book

For entrepreneurs who have not declared the use of special regimes, the OSN is established by default. A number of entrepreneurs registered as individual entrepreneurs do not operate, which means the absence of:

- Cash flows through the cash register and current account.

- Receipts of goods and materials, fixed assets to the warehouse.

- Sales of goods or finished products.

- Payroll and taxes.

- The need to account for fixed assets and depreciation.

If there was no entrepreneurial activity during the tax year, maintaining a book is not required.

Rule THREE

Any fact of economic life must be registered according to the scheme of conditioned reflexes: stimulus - response (SR).

In practice, this means that, having seen the primary document, the accountant, who has formed his ideas according to rules (1) and (2), must automatically say for himself: which account should be debited and which should be credited.

This procedure, when working with a computer, allows you to automatically perform a large complex of purely analytical work, which can be reduced to:

- accumulation of information grouped by accounting accounts,

- calculation of analytical coefficients and

- performing an archival function in relation to the facts of economic life.

Magazine warrant 13

This register is intended to account for depreciation transactions of fixed assets and intangible assets. Entries in journal order No. 13 are made on the basis of the following primary documents: acts for receipt of fixed assets, depreciation calculations, certificates of calculation, accounting certificates, etc. Analytical data in journal order No. 13 contains account indicators for groups of fixed assets in in terms of balances and turnover.

Rule FIFTH

Each fact of the same type of economic life must be qualified uniformly.

Since an alternative choice of information options is theoretically assumed, in order to fulfill the requirement of comparability, facts of the same type must be classified equally within the same organization.

To do this, you should follow the rules adopted in the accounting policies.

It is the accounting policy that predetermines the correspondence of accounts and, accordingly, the methodological techniques chosen in it must be observed from year to year, otherwise comparability will be lost. (However, if desired, the accountant will always find grounds for changing previously adopted rules.)

Full accounting

Full accounting through double entry using accounting registers should be carried out by “simplified” enterprises that are not small enterprises, as well as “simplified” enterprises that have the risk of switching to a general taxation regime.

Even “simplistic” people—“kids”—can do full accounting.

In this case, financial statements must be prepared in accordance with the generally established procedure (that is, in full) according to the forms approved. By order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n.

Why is accounting important for “simplified people”? Based on accounting data, the residual value of fixed assets is monitored in order to continue using the special regime (if, at the end of the reporting (tax) period, the residual value of fixed assets exceeds 150 thousand rubles, then the company loses the right to use the simplified tax system).

Journal warrant 11

Journal-order No. 11 reflects the turnover on the credit of accounts intended to account for shipment, release (in the order of sale) and sale of inventory items in the context of corresponding accounts. This journal-order summarizes the data reflected in statements No. 16 and 17.

The first section of the order journal No. 11 reflects turnover, in particular, on the credit of accounts 40 “Product Output”, 43 “Finished Products”, 45 “Shipped Goods”, 90 “Sales” in the context of corresponding accounts.

The second section of the order journal No. 11 in the table “Analytical data on account 62 “Settlements with buyers and customers”” summarizes data on shipped and released products and material assets, as well as on the movement and sale of shipped goods and on the cost of goods sold and material assets. values.