Home / Labor Law / Payment and benefits / Wages

Back

Published: 04/27/2016

Reading time: 8 min

0

2082

A salary certificate reflects information about the income a person receives. It may be required in both public and private commercial organizations.

The purpose of the certificate is to show that the owner has stable and official financial income, and therefore is economically reliable.

- Where may proof of income be required?

- Where and how to get the document?

- What's in the document?

- Features of calculations

- Dismissal with certificate

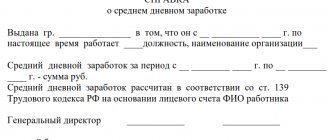

What form of salary certificate is valid in 2020

Many people mistakenly believe that this certificate is in the form of 2-NDFL. However, this is not quite true. Of course, there is data on wages here. Typically, this form is required by financial organizations when a citizen wishes to receive a loan. However, if the organization does not have an approved form, this document is allowed to be drawn up in free form.

The law allows the employee to request this certificate. He is not obliged to ask for it, but must receive it upon request. The data specified in the certificate is protected by law. That is why the document is handed over personally. Upon receiving such a certificate, the employee writes a receipt. This information is also recorded in the appropriate journal of the organization. Naturally, the entry must correspond to the information in the certificate.

When calculating average earnings, accounting takes into account all bonuses and additional remunerations. Former employees can also receive this certificate. They should also write a statement.

( Video : “01 Salary Certificate”)

Where and how to get the document?

Officially working citizens need to contact the HR department or accounting department to obtain a salary certificate, where specialists will advise what to do for employees of each specific enterprise.

Usually a written application addressed to the manager is required, the response to which is prepared within three working days. The application is drawn up in any form and must be signed by the employee. It can be transmitted by mail or through third parties, but in this case it is necessary to issue a power of attorney to the authorized person.

Applications for a salary certificate can be found here.

The information specified in the response is protected by the Law “On Personal Data”, therefore the document is handed over to the applicant after registration in a special journal.

The certificate must be reliable and reflect the current state of affairs so as not to become the cause of litigation. All data specified in it can be easily verified.

IMPORTANT! A salary certificate is made and issued free of charge .

When do you need a certificate of average earnings?

Naturally, a certificate is required for a bank loan. However, other organizations may also require it:

- For the embassy . If a citizen is going to obtain a visa to enter another country, he needs to confirm his financial reliability. In addition, representatives of a foreign state must be sure that you are going to return home. Among other things, this is confirmed by the presence of a stable income and permanent work in the homeland. Naturally, the person who has a large income is more likely to receive a visa. The key to obtaining a visa is to provide a certificate of income in the established form. Countries included in the Schengen area adhere to general rules. However, different embassies may have different requirements.

- For maternity leave . It is worth noting that while on maternity leave, a woman has the same rights as other employees. Therefore, at any time he may require a certificate of income. Maternity leave must be paid, but the amount of payments directly depends on wages. This takes into account the average daily earnings, the billing period, and the duration of maternity leave. A young mother should receive 40 percent of the average salary.

- For the employment center (labor exchange) . Regardless of the reasons for which a person is left without work, he can register at the labor exchange, receiving the status of an unemployed citizen. At the same time, he has the right to receive benefits. However, the amount of this benefit depends on the salary that was accrued to him at his previous job. As a rule, there is enough information here for the last three months of work.

- For social security subsidies . In a social state, which is the Russian Federation, every citizen, finding himself in a difficult situation, can hope for support. The social service can assign benefits, allowances, and compensation for housing and communal services. As a rule, this is possible if the cost of living is higher than his income. Naturally, to do this, you will need to bring a document confirming your low salary to the social security authorities.

- For the court . During legal proceedings, the court may require a document confirming the income of the participants in the process. Most often this is associated with proceedings regarding alimony payments, division of property, preservation or deprivation of parental rights. Taking into account the information received from representatives of both parties, the court makes a fair decision.

Where may proof of income be required?

- In the pension fund for calculating and assigning pensions;

- at embassies to obtain a visa;

- in financial institutions to obtain loans, mortgage or consumer lending;

- at the employment center to register and determine benefits;

- for various reasons to other organizations, including tax and guardianship services;

- in situations where it is necessary to confirm official income and stability of financial situation;

- in social protection authorities.

Most often, citizens are faced with the need to obtain a salary certificate when they decide to take out a loan or mortgage.

Based on this document, the creditworthiness of the person planning to become a borrower is established, and a final decision is made on the provision of money.

Also, such paper is needed to pay various benefits and benefits, so it is required when applying to social security authorities to prove the need for allowances. The employment service needs a certificate both for regular registration and for professional retraining or participation in advanced training courses.

There is no clear standard for a salary certificate, so the content may vary depending on the purpose. When submitting an application for issuing paper, you should indicate for what purposes it is required.

Help contents

Regardless of what form the certificate has, the following mandatory information must be present:

- name of the organization that issued the document and its details;

- passport details;

- average monthly salary;

- the amount of accruals and funds actually received;

- date of issue of the document;

- the locality in which the organization is located;

- confirmation that the person is an employee of this company;

- job title.

In addition, here you can indicate the amount of deductions of insurance premiums and taxes. If you need a “net” salary, this information can be omitted. If the organization has some kind of debt to an employee, it would also be useful to indicate it.

Information about income can be specified in a list. However, it is more convenient to read by drawing up a table. Here the amounts received can be listed monthly. After the table, the validity period of the employment contract concluded with the employee is indicated. Even if an open-ended contract was concluded, this must be indicated in the certificate.

Responsible persons must sign the document. These are the director of the company and its chief accountant. By putting their signatures here, they confirm that the information provided is correct. Naturally, all information must correspond to reality. Supervisory authorities can freely check the data. If they are indicated incorrectly, the responsible persons, namely the director of the company and the chief accountant, will be fined a fairly large amount.

Detailed analysis of institutions where the document is required

When considering a loan application, banks often ask for information about the potential borrower's income. In this case, the help should display the following information:

- Details of the organization that issued the document.

- Information about the employee: place of registration, passport details.

- Salary information for the last 6 months.

- Personal income tax amount.

Why is payroll T-53 needed and when is it used? The answer is here.

Would you like to formalize the withdrawal of a participant from the LLC? Then we invite you to follow the link.

A sample power of attorney for the right to sign is located in the article.

But sometimes, in order to collect complete information about the borrower, the bank also requires a certificate in form 2-NDFL. When submitting documents to a representative office of another state to obtain a visa, you must have a certificate confirming your income. It should indicate:

- work experience;

- job title;

- amount of income.

There are no strict requirements for registration. But in any case, information about the organization that issued it (name, details, etc.) must be indicated there.

Rules for issuing a salary certificate from your place of work

As a rule, a salary certificate is written on an A4 sheet. An organization can also develop its own letterhead. By law, the certificate can be filled out not only by hand. A document submitted in printed form is also valid.

The certificate may have several copies. The employee must indicate their number in his application. In this case, the employee may not report for what specific purposes he needs a certain number of certificates. A prerequisite for the correct execution of the document is the presence of signatures of the manager and the chief accountant. The organization stamp must also be present here. The only exception is the situation when the certificate is issued by companies or individual entrepreneurs who have the right to work without using stamps.

Bodies to which a salary certificate can be submitted

There are many different organizations that may require proof of your financial independence or, conversely, proof of too little income. In addition to the organizations listed above, this document may be required by other bodies:

- guardianship authorities, when deciding which parent the child should live with;

- Pension Fund. The certificate submitted along with other documents is the basis for calculating pensions;

- tax office.

Rules for drawing up a certificate

There are several types of certificates that have approved forms. We have listed them above. Basically, such documents are issued arbitrarily - there is no single form of certificate of employment, template or sample. The organization itself can develop and introduce a form for such certificates. Then it must be included in the enterprise’s document flow and approved by order.

There are general rules that must be followed when preparing documents of this type.

Who issues the certificate

Depending on the type of certificate, different departments can issue it:

- about salaries, paid contributions - accounting;

- about work experience in this organization - HR department;

- the immediate supervisor also has the right to issue a certificate if it does not indicate special information.

| Important! Regardless of who prepares the certificate, it must be certified by the head of the organization or an authorized employee. |

The traditional validity period for such documents is 10 days.

Who has the right to request a certificate

According to the general rule, defined in Articles and 84.1 of the Labor Code, an employee has the right to demand work-related documents from the employer. To do this, he needs to contact the management of the organization in writing. An employee has the right to request from the employer copies of documents, certificates, extracts related to his work activity, both while working for this employer and after dismissal. Labor legislation does not establish an exhaustive list of such documents, as well as a sample certificate of employment.

| Important! The statutory deadline is three days for the issuance of documents relating to the employee’s work activities. |

Rules for issuing a certificate

And although there is no approved form for a certificate of employment, you can list some typical data that the document should contain. Be sure to provide the following details:

- Name of the organization;

- date of issue;

- a description of the information that needs to be confirmed;

- signature of the company director.

It is not necessary to indicate where and what the certificate is intended for. Instead of this data, it is often indicated: “At the place of requirement.”

Key points to fill out

The document (in paragraph 3) reflects the amount of earnings for the two calendar years preceding the year of termination of work or the year of application for work, and the current calendar year for which insurance premiums were calculated.

The number of calendar days falling within the periods is also indicated (in paragraph 4):

- temporary disability;

- maternity leave;

- maternity leave;

- releasing an employee from work with full or partial retention of wages in accordance with the law, if insurance premiums were not accrued on the retained wages (clause 3, part 2, article 4.1 of Law No. 255-FZ).

The filling out requirements are established by the procedure for issuing a certificate of the amount of average earnings (approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n (as amended on January 9, 2017)), according to which:

- the document is filled out based on the employer’s accounting and reporting data;

- it must be filled out by hand with black or blue ink (ballpoint pen) or using technical means (computer or typewriter);

- Erasures and corrections are not allowed.

The seal of the employer's organization (if any) should not cover the signature. If the employer does not have a seal, copies of the following documents must be attached:

- document(s) confirming the authority of the person who signed the document to act on behalf of the legal entity without a power of attorney;

- power of attorney for signing with attached documents confirming the authority of the person who issued the power of attorney;

- identification document of an individual;

- certificate of state registration of an individual as an individual entrepreneur.

Special cases

In normal situations, filling out form 182n does not cause any difficulties. Let's consider atypical situations.

1. If an employee worked in several organizations during the billing period and presented sick leave for payment in one of them, but did not provide a document on earnings from the previous place of work. The benefit in this case is calculated on the basis of the data available for calculation (Part 2.1 of Article 15 of Law No. 255-FZ). If an employee wants earnings accrued at his previous place of work to be included in the calculation of sick leave, he must provide a document on the amount of average earnings, after which the assigned benefit is recalculated for the entire past time, but no more than three years preceding the day the document was provided. the amount of average earnings or information from the Pension Fund.

2. If the employee quit during the period of maternity leave and temporary disability benefits are accrued to her by the new employer, then the previous employer in section 4 must reflect the number of calendar days for the period of maternity leave (if the employee quit during such leave) up to moment of dismissal. When calculating temporary disability benefits, a new employer should proceed from the average daily earnings, determined by dividing the accrued salary for the billing period by 730 (clause 15(1) of the Regulations on the specifics of the procedure for calculating benefits).

3. The next case is that a quit employee needs a certificate of average earnings to register with the Employment Center and determine the amount of unemployment benefits. The current legislation does not approve the form and procedure for its issuance. The Russian Ministry of Labor has sent the certificate of average earnings recommended by Letter No. 16-5/B-421 of August 15, 2016 for use for such purposes.