Deferred income (FPI) is an important criterion taken into account when analyzing the economic and financial functioning of an organization. Regardless of the area, any company can receive income that must be attributed to future periods in accordance with approved regulations.

The correctness and timeliness of accounting for this type of income is very important, since calculated taxes .

In addition, when checking the final data of the accounting statements and financial results for the main activities, it often turns out that the solvency indicators of the organization have worsened compared to previous months and years.

If, during the analysis, the coefficients of autonomy and provision of working capital do not satisfy the usual standard values , then it is necessary to determine how correctly the DBP amounts were allocated in accounting.

What are deferred income (line 1530)

Deferred income is income (including other income) of the enterprise in question that was received (accrued) in the reporting period, but relates to future reporting periods. As such, regulatory documents consider:

Take our proprietary course on choosing stocks on the stock market → training course

- budget funds received by an enterprise to finance its capital or current expenses (depreciation accrued when using property purchased with budget funds is included in other income);

- the initial (market) value of non-current assets that were received free of charge, determined as of the date of their acceptance for accounting, in the part not included in other income as of the reporting date;

- the balance of budget funds that was not used at the end of the reporting period, which the enterprise received as targeted financing and was taken into account on the account. 86 (also – grants, technical assistance (assistance));

- the difference between the cost of the leased property and the total amount of payments under the lease agreement

Important! Application of account 98 since 2011 is limited to situations directly provided for by regulatory documents on accounting.

Important! Advances received by the company from customers are not included in deferred income and are not shown on account 62.

General information

When products are shipped, they are sold. Typically, revenue is recognized during this transaction. Ownership of the goods passes at the moment of its transfer to the acquirer. There are no products in stock, therefore it becomes possible to demand payment from the counterparty. In this case, there is no upcoming income. The prospect of a possible profit is also not relevant. In practice, accounting records only completed transactions and is based on the principle of compliance. It comes down to this. Revenues must correspond to the costs from which they were received.

Line 1530 “Deferred income”: data, filling

Important! In general, the indicators on line 1530 as of December 31 of the previous and previous previous periods are subject to transfer from the balance sheet to the previous year.

The purpose of the article is to display information about income that was taken into account in the current period, but at the same time relates to a future period, as well as information about the balance of unspent funds of targeted funding from the budget. It can be:

- the revenue the company received from freight transportation;

- payment for subscriber communication services under contracts;

- utility payments;

- rental payments for premises temporarily or permanently unused in carrying out the main activity.

On balance sheet line 1530 “deferred income” it is necessary to reflect the credit balance of account 98 “Deferred income”. Information used when filling out this line:

- credit balance on account 98;

- credit balance of account 86 (in terms of targeted financing from the budget, as well as grants and technical assistance (assistance) as of the reporting date).

Line 1530 of the balance sheet is completed in accordance with the following formula:

The formula below is also used:

As for the “Explanations” column, it is necessary to provide instructions on the disclosure of the indicator of income for future periods. Table 9 “State aid” is indicated here, disclosing the indicators of line 1530, if:

- the enterprise receives funding from the budget in the form of subsidies;

- draws up Explanations to the balance sheet and the financial statements using the forms from the Example of the Explanations (contained in Appendix No. 3 to Order No. 66n of the Ministry of Finance of the Russian Federation).

The nature of counting

Account 98 clearly falls into the category of financial distribution items. Here we need to remember the underappreciated issue of accounting policy. The question is this. Which income should be attributed to the current period and which to the future period? To some extent, the answer to this depends on the professional discretion of the chief accountant. Meanwhile, characterizing the account. 98, perhaps it would be more correct to classify it as additional. When used correctly, it complements the 99 count. In this case, the interested person will see the actual amount of profit received, and not the formally recorded amount.

Accounting for deferred income

Important! The list of accounting sub-accounts that must be opened for account 98 “Deferred Income” is open - companies have the right to open any number of clarifying sub-accounts to reflect future income.

Reflection of transactions with deferred income in accounting is as follows:

| Operation | DEBIT | CREDIT |

| Income of future periods is reflected. [An accrual of deferred income (received from the budget to finance the enterprise’s expenses)]. | 86 “Targeted financing” | 98-1 “Income received for deferred periods” |

| The cost of fixed assets received free of charge is reflected. | 08 | 98-2 “Gratuitous receipts” |

| The cost of inventories received free of charge is reflected | 10 “Materials” 41 “Products” | 98-2 “Gratuitous receipts” |

| The amount of upcoming debt receipts for shortfalls identified in previous years is reflected. | 98-3 “Upcoming debt receipts for shortfalls identified in previous years” | |

| The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables is reflected. | 98-4 “The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables” | |

| Other income (revenue) is recognized for: – fixed assets received free of charge (as depreciation is calculated); – other MC received free of charge (as sales expenses are written off to the accounts (accounting for production costs)). | 98 | 91 (90) |

| Write-off of deferred income to the financial results of the enterprise in the period to which the revenue relates: | ||

| Included in income from ordinary activities | 98.1 | 90.1 |

| Included in other income of the enterprise | 98.1 | 91.1 |

| Write-off of accrued depreciation on equipment received free of charge and its inclusion in other income | 98.2 | 91.1 |

Important! Accrued depreciation on fixed assets received free of charge is written off to the financial result of the enterprise in Credit account 91.

Nuances

Some novice specialists often ask: are deferred income an asset or a liability? Actually, the question is quite logical. After all, in essence, we are talking about revenues and profits. Meanwhile, future income is a liability. The situation is different with the costs of the coming years (quarter, month). They belong to the asset. In this case, there is a certain accounting paradox. The actual funds received, presented in liabilities and materialized in assets, reduce the reported profit. At the same time, the costs of the coming years (months, quarters) increase it.

Another point concerns taxation. There are no deferred expenses under the simplified tax system (income minus expenses). There are none with the other “simplified” option either. In addition, there are no deferred income. The simplified tax system does not provide for such concepts at all.

Example of accounting for deferred income

In October 2021, First Track LLC accepted a donation of production equipment from its regular client (free of charge), the market value of which is 550,000 rubles:

| Operation | Amount (rubles) | DEBIT | CREDIT |

| Equipment received free of charge has been capitalized (it is reflected at market value) | 550 000 | 08 | 98.2 |

| Commissioning of new equipment | 550 000 | 01 | 08 |

| Depreciation on equipment (as it is used) | n | 20 (44) | 02 |

| Write-off of equipment cost (gradually) | m | 98.2 | 91.1 |

LLC “First Track” on page 1530 “Deferred income” at the end of the period (2016) will display an indicator equal to the market value of the equipment received free of charge minus the depreciation accrued on it.

Example of filling out line 1530 “Deferred income”

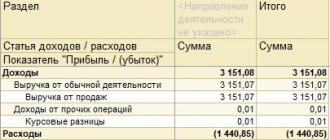

Here is an example of filling out line 1530 of the balance sheet:

| Indicators by account 98 and count. 86 in terms of targeted budget financing (no other targeted financing): rubles | |

| Index | At the reporting date (31 December 2021) |

| 1 | 2 |

| 1 996 757 |

| 799 800 |

Fragment of the Balance Sheet for 2021:

| Explanations | Indicator name | Code | As of December 31, 2021 | As of December 31, 2015 | As of December 31, 2014 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 9 | revenue of the future periods | 1476 | 2645 | 2653 | – |

Solution:

| Revenue of the future periods: | |

| as of December 31, 2021 | 1,996,757 + 799,800 = 2,796,557 rubles |

| as of December 31, 2015 | 2,645,000 rubles |

| as of December 31, 2014 | 2,710,000 rubles |

We enter the data into the balance sheet:

| Explanations | Indicator name | Code | As of December 31, 2021 | As of December 31, 2015 | As of December 31, 2014 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 9 | revenue of the future periods | 1476 | 2 796 | 2 645 | 2 653 |

Record specifics

As stated above, income for the coming periods is shown according to Account 98. Accounts corresponding to it reflect cash flows or settlements with creditors and debtors. According to db count. 98 amounts are written off upon the occurrence of the periods to which they relate. For example, usually, under the terms of a lease agreement, property users pay rent in advance for a quarter or six months. This amount cannot be attributed entirely to the income of the period in which it was received. The funds are divided into equal shares. Each of them is recognized as income for the current period on a monthly basis. In this case, the received amount is credited first to the account. 98. The wiring is as follows:

- db sch. 51 CD count. 98.

This entry is made for the entire amount of receipt. Then, every month, in an equal share, the income of the upcoming periods is written off to the profit of the current one:

- db sch. 98 CD count. 91.

Let's look at an example. The LLC entered into a lease agreement on February 18, 2017 for 120 days. The acceptance certificate was signed on March 1. According to the terms of the agreement, the tenant must transfer the amount six months in advance. On December 25, 24 thousand rubles were transferred to the owner’s account, including VAT of 4 thousand rubles. The accountant makes the following entries:

- db sch. 51 CD count. 98.1 – receipt of funds.

- db sch. 98.1 CD count. 68 – VAT calculation.

At the end of each month an entry is made:

- db sch. 98.1 CD count. 90.1 – monthly rent is reflected in income from the sale of services.

- db sch. 90.3 CD count. 68 – VAT charged.

- db sch. 68 CD count. 98.1 – the tax has been restored for the amount attributable to the reporting month.

Legislative and regulatory acts on the topic “Deferred income”

| Instructions for using the Chart of Accounts (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n) | About maintaining account 98 and subaccounts to it |

| Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n | On the need to reflect future income in Section V “Current liabilities” |

| Chart of accounts for accounting financial and economic activities of an enterprise | About what's on the account. 98 it is necessary to take into account future income, as well as: - gratuitous receipts, – receipts of debts for shortfalls of previous years; – detected differences between the amount to be recovered from the guilty parties and the book value of the assets that were accepted for accounting when shortages/damage were identified. |

| clause 4 of the Instructions on the reflection in accounting of transactions under a leasing agreement | On reflecting in deferred income the difference between the cost of the leased property and the total amount of payments under the leasing agreement. |

| clause 29 of the Guidelines for accounting of fixed assets | About reflection according to CT count. 98 cost of free OS received |

| clause 9 of the Accounting Regulations “Accounting for State Aid” PBU 13/2000 | On accounting for target financing as deferred income |

Why allocate DBP

The matching principle that guides accounting states that income must be consistent with the expenses that generated the income. Sometimes a business receives assets, that is, income that is not specifically related to the current accounting period, because the expense is spread over a longer time. Theoretically, the funds could have been received over a long period, but they all arrived at once. In such situations, accountants prefer to report profit in an amount not exceeding the income of the current period, and transfer funds received that are not related to it to the DBP subaccounts.

Why do this, because you can immediately write down the entire asset received as profit? Yes, it is possible, but we should not forget that the amount of profit is directly proportional to the tax base. And if there is a legal opportunity to reduce it this year, why increase it by income that will only be used in the future?

EXAMPLE. The organization rents out real estate. She was paid rent for three years at once. The asset is there. If you record all of it in this year’s income, the amount of the income tax base will be increased. If you take into account only the payment for the current year as profit, then the remaining funds must be taken into account as DBP, reflecting them in the balance sheet of profit in the next two years, thus proportionally distributing the tax base.