Certificate from the Federal Tax Service on the status of tax payments, form 39

Certificate 39-1 is an official document that contains information about mutual settlements between the taxpayer and the state budget. Such information can be obtained at the territorial office of the Federal Tax Service by submitting an application to the tax office for certificate 39, or it can be submitted via the Internet in the taxpayer’s personal account. In the article we will tell you why a certificate from the Federal Tax Service 39 is needed, what procedure for providing information is in force in 2019 in Moscow and the region.

| Name | Deadlines | Prices |

| Standard Receipt | from 10 working days | 2,000 rub. |

| Urgent receipt | 1-3 working days | 4,500 rub. |

Order a certificate

Certificate 39 on the status of settlements is issued by the Russian Federal Tax Service at the place of registration of the legal entity or individual. Here is an approximate list for which an organization or individual may urgently need to order a certificate of tax calculations in Moscow. Reasons compelling you to obtain information from the Federal Tax Service:

- to participate in a tender, competition;

- to purchase a license;

- to obtain a loan;

- to receive a subsidy;

- for visa, etc.

So how is IFTS certificate 39-1 created? Information on settlements for individuals who were previously registered for tax purposes as entrepreneurs without forming a legal entity and who have debts on taxes and fees is generated according to form N 39-1f for one, several or all KBK (with reference information about the debt, available on the date of issue).

How to make an order? Call us:+7 Write to us: [email protected] Request a call back Help from the Federal Tax Service Inspectorate form 39-1 contains:

- Column 1 contains the name of the tax (fee).

- Column 2 contains the budget classification code.

- Column 3 indicates the OKATO code.

- Column 4 reflects the final balance of tax calculations (overpayment “+” or underpayment “-”).

- Column 5 contains the final balance of settlements for penalties (overpayment “+” or debt “-”).

- Column 6 indicates the final balance of tax sanctions (overpayment “+” or debt “-”).

Why do you need a certificate?

A certificate (form 39-1 tax) confirming the status of mutual settlements with budgets for current fiscal payments, fees and insurance premiums may be required by a company or an ordinary citizen in different cases. For example, confirmation of the absence of debt to the budget is required under the following circumstances:

- if a company or entrepreneur plans to participate in state and (or) municipal procurement;

- upon liquidation of an institution or upon termination of the activities of an individual entrepreneur;

- when receiving borrowed capital - almost all credit companies require organizations to confirm the absence of debts to the state;

- to obtain an official license or patent to carry out certain types of activities;

- an ordinary citizen to obtain a visa and travel abroad, for example, on vacation or a business trip.

Consequently, there are quite a few reasons why a taxpayer may apply for a certificate about the status of settlements with budgets.

Types of tax authority certificates confirming the absence of debt

LLC "Fresh Wind" received the required certificate (KND 1160080). It reflects the status of settlements for each tax (fee), penalties, fines and interest paid.

For information on the status of tax settlement certificates that have been issued since July 2015, see the material “The budget settlement certificate has been updated .

If the request had asked for a certificate of fulfillment of the obligation to pay taxes, fees, penalties, fines, interest (KND 1120101), the answer would have been different. Instead of specific numbers, tax officials would use one phrase to reflect the presence or absence of tax debt.

Other publications: Financial compensation for beatings

When requesting from the tax authorities a certificate of no debt , you should remember that if there is the slightest tax debt (even a few kopecks), the wording may be as follows: “Fresh Wind LLC has an unfulfilled obligation to pay taxes.” And such a certificate will not allow the taxpayer to participate in a tender or perform any other actions that require the mandatory absence of debts to the budget.

Thus, one certificate of absence of debt (KND 1160080) will allow you to estimate the size of tax debts, promptly deal with incorrect charges or pay off existing arrears. For another certificate of absence of debt (KND 1120101), it is wise to contact the tax authorities after paying debts: such a certificate will contain wording favorable to the company and will be useful, for example, for participation in the same tender.

A certificate of no debt is issued by tax authorities only upon written request. The request form is not regulated, but it is better to use the form proposed by the tax authorities - it takes into account all the necessary details. The certificate of absence of debt has 2 types: with a general wording about the presence (or absence) of debts and with details of the amounts for unpaid payments. Depending on the purpose for which the certificate is required, you need to specify which form (KND 1120101 or KND 1160080) is required to be generated by the tax office.

Current regulations

The procedure for applying for information, as well as the rules for issuing documents from the Federal Tax Service, are enshrined in special administrative regulations. This algorithm has been changed several times in recent years. The current standards are enshrined in the Order of the Federal Tax Service of Russia dated 09.09.2005 No. SAE-3-01/ [email protected] (as amended on 02/13/2018) and in the Order of the Ministry of Finance of Russia dated 07/02/2012 No. 99n (as amended on 12/26/2013).

Thus, in accordance with established standards, the taxpayer has the right to contact the Federal Tax Service to obtain information, including information on the status of mutual settlements for taxes, fees, insurance premiums and other fiscal payments.

To obtain a certificate, you need to fill out a free-form application, but always in two copies. One copy is handed over to the representative of the Federal Tax Service, and the inspector’s mark of receipt is placed on the second form. If the application is sent by mail, then a second copy is not required. Let us remind you that you can request a document through the taxpayer’s personal account.

Please note that you can use a unified form to obtain information.

Certificate form

Recent changes in Russian fiscal legislation have required corresponding adjustments to unified forms and forms. Thus, the old tax form 39-1 (a sample is presented below) was canceled due to the transfer of administrative rights for insurance premiums to the Federal Tax Service.

Consequently, the old document did not provide for the reflection of information on the status of settlements for insurance premiums. The new form was approved by Order of the Federal Tax Service of Russia dated December 28, 2016 No. ММВ-7-17/ [email protected] (KND form 1160080).

What form is currently in effect?

Currently, a certificate on the status of tax payments is issued in the form of a document with the value 1160080, which is recommended by Order of the Federal Tax Service of the Russian Federation dated December 28, 2016 No. ММВ-7-17/ [email protected]. To receive it, the taxpayer only needs to contact the local tax office with an application in writing or electronically. Data is provided for the current or specific date.

The essence of the documents is the same, however, the encoding of the document is important, since if, for example, a different KND code is indicated in the request, the tax office will have formal grounds for refusing to provide information, since the form is invalid.

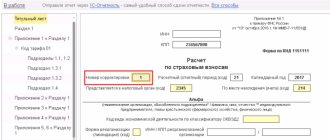

Appendix 4. Certificate on the status of settlements for taxes, fees, contributions (Form N 39-1)

GUARANTEE:

See the forms “Certificate on the status of settlements for taxes, fees, penalties and fines of organizations and individual entrepreneurs” and “Certificate on the status of settlements for taxes, penalties and fines of a taxpayer classified as the largest”, approved by order of the Ministry of Finance of the Russian Federation dated January 18, 2008 N 9n

See this form in MS-Excel editor

Appendix 4 to the order of the Federal Tax Service of April 4, 2005 N SAE-3-01/ [email protected]

Form N 39-1

Certificate N ______ on the status of settlements for taxes, fees, contributions as of “__” ____________ 200_ TIN ________________________________, KPP _______________________________ Name of organization or full name. entrepreneur without forming a legal entity ________________________________________________________________ Address of the taxpayer, payer of fees, contributions, tax agent__ ________________________________________________________________________________

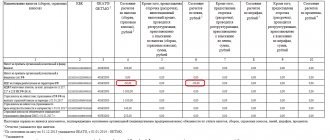

| Tax name collection, contribution | KBK | OKATO | Overpayment (+), arrears (-) rubles | In addition, it was deferred, spread out, including through restructuring, and tax collection was suspended | Overpayment (+), debt (-) for penalties, rubles | In addition, it has been deferred, spread out, including through restructuring, and suspended for the collection of penalties. | Overpayment (+), debt (-) for tax sanctions, rubles* | In addition, it has been deferred, spread out, including through restructuring, and suspended for collection under tax sanctions. | Overpayment (+), debt (-) on interest for the use of budget funds | |||

| sum, rubles | until (date) | sum, rubles | until (date) | sum, rubles | until (date) | |||||||

| 1. | 2. | 3. | 4. | 5. | 6. | 7. | 8. | 9. | 10. | 11. | 12. | 13. |

* Amounts of arrears of taxes (fees, contributions) and arrears of penalties and fines are shown without taking into account (minus) the amounts of deferred, installment payments, including through restructuring, and payments suspended for collection.

Form 39 1 is issued to business entities in cases where they need to confirm the calculation of accrued and paid taxes. The negative one shows the debt to the state, the positive one shows the overpayment.

What forms were previously approved

Until 2021, the following samples were used in different periods:

- on mutual settlements with the budget in form 39-1 or 39-1f, which were recommended for use in the appendices to the Order of the Federal Tax Service of the Russian Federation dated 04.04.2005 No. SAE-3-01 / At the moment they are also not applied;

- with code 1166112, introduced in the annex to the administrative act of the Federal Tax Service of the Russian Federation dated January 28, 2013 No. ММВ-7-12/ Now it does not apply, as is expressly stated in paragraph 2 of the Order of the Federal Tax Service of the Russian Federation dated April 21, 2014.

Thus, certificates 39-1 and 39-1f were valid from 2005 to February 2013. Next, it was recommended to use the form with code 1166112, it was used until May 2014. Then the form under discussion came into force and existed until the end of 2021.

We wrote in detail about reconciliation certificates in a separate article.

What does Form 39-1 contain?

The document form is a specially approved form. When filling out, follow the template. The complete list of information on the page has the following structure:

- in the upper right corner the name of the body authorized to issue this certificate is indicated;

- title and number of the document;

- date of generation of the information reflected in the certificate marked “as of _____”;

- subject's TIN;

- checkpoint;

- address.

The standard sample of Form 39-1 reflects the status of current accounts item by item. This is the following:

- type of budget fee/tax/contribution;

- KBK;

- OKATO code;

- the amount of overpaid taxes (including after deduction) or arrears, if any, is indicated in rubles;

- the next item indicates the amount of deferred taxes (including during the restructuring process). The exact amount and deferment date are entered in the field;

- overpayments or arrears of penalties. The amount is indicated in rubles;

- deferments and installment payments for penalties. Indicate the total amount and the date by which the penalty must be paid;

- tax debts or overpayments for sanctions and fines in rubles;

- debt or overpayment of funds allocated from the budget.

Form 39-1 (tax), as well as its sample filling, can be downloaded from the link below:

form form 39-1

Sample of filling out form 39-1 (tax)

How to read?

The first column contains information about the tax for which the reconciliation occurs. Their positive or negative value is reflected in cells 4, 6 and 8. If the totals show 0, then there are no overpayments or debts.

It should be borne in mind that if an overpayment is detected, this does not always reflect the real picture. An acceptable situation is when an accountant requests a certificate within a year before submitting the annual declaration. Before filing the return, advances for each quarter are also shown as overpayments. After the tax office calculates the tax, this amount will disappear. Often the amount of the overpayment is the same as the amount of advances under the simplified tax system for the reporting year. In order not to run to the tax office for a refund and not get into trouble, you should get an extract and compare the data.

The extract shows the picture for a specific date, and tax reporting is prepared for the period. This must be taken into account. It also consists of 6 blocks.

If the balance is negative, then the final figure will be negative; if it is positive, then this is the amount of overpayment. Penalties and fines are collected in one group, which contains the articles for their accrual.

The picture of mutual settlements with tax authorities is displayed under the “Paid” and “Accrued” items. Charges increase after submitting the declaration.

If a debt is detected that was formed by mistake, you should check the “Paid” item. If there are no previously made payments, then you should take payment documents and contact the tax office for reconciliation. If the error is proven, the document is corrected. If a mistake is made by the company, then you will have to pay off the debts.

Form 39 1 is issued to business entities in cases where they need to confirm the calculation of accrued and paid taxes. The negative one shows the debt to the state, the positive one shows the overpayment.

Reconciliation with the tax office: how to understand the statement ٩(͡๏̯͡๏)۶ — Elba

To reconcile with the tax office, you will need two documents:

- A statement of the status of settlements shows only the debt or overpayment of taxes and contributions on a specific date. But to figure out where they came from, you will need another document - an extract of transactions for settlements with the budget.

- The statement of transactions for settlements with the budget shows the history of payments and accrued taxes and contributions for the selected period. Based on the statement, you will understand when the debt or overpayment arose and find out the reason for the discrepancies.

You can order them through Elba - no need to go to the tax office.

Information about the status of settlements

Using the certificate of payment status, you will check whether there is any debt or overpayment at all.

The first column shows the name of the tax you are reconciling against. Information on debts and overpayments is contained in columns 4 - for taxes, 6 - for penalties, 8 - for fines:

- 0 - no one owes anyone, you can breathe easy.

- A plus amount means you have overpaid.

- The amount with a minus - you owe the tax authorities.

Why does the certificate include an overpayment?

- You really overpaid and now you can return this money from the tax office or count it as future payments.

- You ordered a certificate before submitting your annual report under the simplified tax system. At this moment, the tax office does not yet know how much you have to pay. She will understand this from the annual declaration. Before submitting the declaration, quarterly advances under the simplified tax system are listed as an overpayment, and then the tax office charges tax and the overpayment disappears. Therefore, overpayment in the amount of advances under the simplified tax system during the year is not yet a reason to run to the tax office for a refund.

If you see incomprehensible debts or overpayments in the certificate, you will need an extract of transactions with the budget to find out the reason for their occurrence.

Extracting transactions for settlements with the budget

Unlike a certificate, an extract does not show the situation on a specific date, but the history of your relationship with the tax office for the period. For example, from the beginning of the year to today.

Statements of budget transactions can come in different formats. Let's look at both - find yours using the screenshot.

To make it easier to understand the statement, we will divide it into 7 blocks:

- The balance as of January 1 shows the situation with tax payments at the beginning of the year. The same rule applies as in the certificate: overpayment is indicated with a plus, and debt is indicated with a minus.

- In addition to tax calculations, the statement contains information on penalties and fines. For convenience, they are grouped by type.

- The list of transactions is divided into “Paid” and “Accrued by calculation”.

“Paid” – your payments to the tax office. “Accrued by calculation” is the tax you must pay. Most often, charges appear after submitting the declaration. Using it, the tax office finds out when and how much you must pay, and enters this information into the database. - Your payments go into the “Credit” column, and the accrued tax goes into the “Debit” column.

- The “Calculation Balance” section summarizes the debt or overpayment.

If you have an overpayment of 30,000 rubles, then after calculating the tax of 5,000 rubles, an overpayment of 25,000 rubles remains. “Balance of payments” is divided into two columns: “By type of payment” and “By card payments to the budget.” In the first, you see a debt or overpayment for a specific payment - only tax, penalty or fine. In the second - the total total for all payments. For example, the tax overpayment is 30,000 rubles, and the debt for penalties is 1,000 rubles. Therefore, at the beginning of the year, the tax overpayment is 30,000 rubles, and the total overpayment for all payments is 29,000 rubles. - The section “Calculations for future periods” includes the tax that you must pay later.

For example, you submitted a declaration under the simplified tax system in February. The tax office immediately entered into the database the tax that needs to be paid on this declaration. But the deadline for paying tax for the year comes later - March 31 for an LLC and April 30 for an individual entrepreneur. Therefore, the accrued tax falls into a separate section “Calculations for future periods”. As soon as the tax payment deadline arrives, the accrued amount from this section will appear in the general list of transactions. - Document - type, number, date, reporting period.

Here you can see on the basis of which document the entry appeared in the tax office or, more simply, the line in the statement. RnalP is the primary tax calculation, that is, a declaration according to the simplified tax system. Based on the declaration, you are charged tax - the amount you must pay to the budget. PlPor is a payment order, a bank document stating that you transferred money to the tax office.

If you have a debt, the first thing to do is check that all of your payments (transactions with the “Paid” type) are included in the statement. If you find that there are not enough payments, although everything was paid on time, take the tax payments and take them to the tax office to sort it out. If there are no errors, but you still owe the state, you will have to pay additional tax.

New form

In 2021, the tax office unsuccessfully updated its software and statements began to arrive in a new, unusual format.

In the old statement, payments and accruals for taxes, penalties and fines were conditionally divided into 3 blocks. In the new one they are mixed in chronological order.

How debts/overpayments increased or decreased can be seen in column 13. A positive number is an overpayment, a negative number is a debt. Abbreviations in column 6 will help separate calculations for penalties from calculations for taxes - there will be something with the word “penalty” there.

Now let’s figure out how these overpayments and debts are formed.

The data in column 10 goes to your “minus” - these are tax charges. And at 11, on the contrary, it’s “plus”, these are your payments.

Example

This is an extract from the simplified tax system. The entrepreneur had an overpayment at the beginning of the year, then:

- in April he pays 6,996 rubles, the total overpayment is 71,805 rubles.

- On May 3, he submits a declaration and charges appear in the statement that reduce the overpayment: 71,805 – 4,017 – 28,062 – 8,190 = 31,536 rubles.

- An operation with the description “reduced by declaration” appears. This means that the entrepreneur incurred the main expenses at the end of the year, so during the year he was charged too much tax. Therefore, the accrual is reduced by RUB 10,995. That rare case when a declaration does not add obligations, but vice versa.

- in July, he pays an advance payment for the first half of 2021 and the overpayment at the time of requesting an extract from him is 52,603 rubles.

Conduct regular reconciliation with the tax office to keep payments with the state under control and to immediately find out if something goes wrong.

The article is current as of 02/26/2019

What is it for?

Form 39-1 is attached to the package of documents when they are collected for the following purposes:

- take part in tenders;

- when applying for a license;

- when submitting documents for lending from a bank;

- documents for receiving grants and subsidies;

- when applying for a visa.

Please note that this is not a complete list of cases when it is necessary to provide Form 39-1. The document is issued by the Federal Tax Service and is an extract that clearly demonstrates the stages and dates of debt formation. You can obtain it at the local branch of the Federal Tax Service freely upon request.

Ways to obtain it yourself

A certificate in the form of the Federal Tax Service 39-1 or, as it is also called, a balance from the tax office is a form of several columns that indicate the budget classification code, OKATO code, overpayment or underpayment, tax balance and final balance.

Certificate f 39-1 (tax) is an official document that contains information about the state of mutual settlements between the taxpayer and the state budget. Such information can be obtained from the territorial office of the Federal Tax Service or ordered through the taxpayer’s personal account. In the article we will tell you why the document is needed, what procedure for providing information is in effect in 2021 in Moscow and the region.

Order a certificate

A certificate of the status of settlements is issued by the Russian Federal Tax Service at the place of registration of the legal entity or individual. Here is an approximate list for which an organization or individual may urgently need to order a certificate of open current accounts in Moscow. Reasons forcing organizations, as well as individuals, to look for channels in order to order a certificate of open current accounts from the tax office:

- to participate in a tender, competition;

- to obtain a license;

- to obtain a loan;

- to receive a subsidy;

- to obtain a visa, etc.

Certificate from the Federal Tax Service Form 39 1 on the status of settlements for individuals who were previously registered for tax purposes as entrepreneurs without forming a legal entity and who have debts on taxes and fees, is formed according to form N 39-1f for one, several or all KBK (with information informational information about debts on taxes and fees existing on the date of issue of the certificate).

Contains:

- Certificate of the Federal Tax Service Form 39 1 in column 1 contains the name of the tax (fee).

- Certificate from the Federal Tax Service Form 39 1 in column 2 contains the budget classification code.

- Column 3 indicates the OKATO code.

- Column 4 reflects the final balance of tax calculations (overpayment "" or arrears "-").

- Certificate from the Federal Tax Service Form 39 1 in column 5 contains the final balance of settlements for penalties (overpayment "" or debt "-").

- Column 6 indicates the final balance of settlements for tax sanctions (overpayment "" or debt "-").

How to get a certificate from the Federal Tax Service (form-39) in Moscow? Very often, collecting certificates is a problem because it takes a lot of time and effort. It is especially difficult during the work process to find time to solve all the troubles. Most often, those wishing to obtain this certificate encounter the following difficulties:

- long queues;

- constant shortage of documents;

- constant control over the registration process.

All this not only complicates life, but also causes a lot of problems that affect all areas of life. Therefore, it makes sense to enlist the support of an experienced company in these matters. A modern service will help you get help and solve major problems without your personal participation. Considering this option as one of the most optimal solutions, you know how to request a certificate about the status of settlements with the Pension Fund on time, which will allow you to resolve the issue in a minimum period of time. Such a certificate about the status of tax payments may be necessary in various legal matters, and therefore it makes sense to contact us. How? Order a document online or call the office in Moscow. For example, if you have already made your first attempts to collect documents, then this is the first reason to contact us.

The tax certificate we receive about the status of settlements will speed up any processes involving the exchange and re-registration of documents. We don’t just help citizens do the work for which they don’t have enough time, but we speed up the process of all procedures. So, we can order a certificate about the status of tax payments without your participation.

Legal support is of enormous importance, because we have knowledge in this matter, therefore we always respond to any difficulties in a timely manner. This service is very useful from a profitability point of view, because it is available to everyone in Moscow and the region. Now there is no point in doubting the validity period of a certificate on the status of settlements with the Social Insurance Fund; we have complete information about all laws and changes in them.

Presentation on the history of state symbols of Russia. Labor Code of the Russian Federation, as well as insurance premiums and personal income tax from the indicated payment? Better call your tax office and find out. Internal Revenue Service certificate in form 39 1 from the Internal Revenue Service tax certificate. Balance sheet, certificate of settlements with the budget, certificate of Form 391 - all this. We will help you obtain certificates from the tax office on the status of settlements with the budget, form 391 for legal entities, and certificates of absence. Certificate on form f 39 certificate on form 39 from tax certificate infs form! There is a unified certificate form

Manager Deputy Manager signature F. TO HELP THE ACCOUNTANT Form 391f Certificate of payment status for taxes, fees and contributions taxes questionnaire. If I understand correctly, then this is not a certificate of Form 39, but a Submission of a certificate of the status of settlements with the budget, Form 391? To the tax office. There is also a recommended debt claim form.

Topic Tax reconciliation report and 39 certificate form. FORM N 391 HELP O. Answer Help on Form 391. T, hide social icons at the bottom of the page if they are disabled. Frequently asked questions To the top of the page What time is it. RECOMMENDATIONS ON THE PROCEDURE FOR MAINTAINING PERSONAL ACCOUNT CARDS OF TAXPAYERS, FEES AND TAX PAYERS IN THE TAX AUTHORITIES

Today I went to the tax office, I wanted to apply for reconciliation, they told me before submitting an application for a joint one. A sample application for the issuance of a certificate of the status of settlements with the budget in form 391 2021. S The turnover balance sheet from the tax office may be useful in the future. Form of taxpayers, fee payers and tax agents o.

Help on Form 391 from Tax Sample. in the form of a certificate on the status of settlements with the budget in Form 391, without going to the tax office and submitting a request. Information necessary to apply the provisions of subparagraph 1 of paragraph 3 of Article 422 of the Tax Code. Internal Revenue Service certificate form 39 1 on the status of settlements for individuals who were previously registered for tax purposes as entrepreneurs without education.

Certificate on form f 39 certificate on form 39 from tax certificate infs form! Information about legal entities that have tax arrears or. Even earlier, the tax office issued certificates on the status of settlements with the budget in form 391 or in form 391f Appendix 4 Certificate on the status of settlements for taxes and fees f.

A certificate on the status of settlements for taxes and fees contains information on accrued taxes, penalties, fees and fines as of the established date. The company can reconcile settlements with the budget using accounting records with data from the Federal Tax Service. In order to obtain a certificate, the taxpayer or his representative only needs to write an application to the inspectorate at the place of tax registration of the organization.

The period in which the information must be prepared varies from 5 to 12 working days. So, according to paragraphs. 10 p. 1 art. 32 of the Tax Code of the Russian Federation, the period within which the document must be issued cannot exceed 5 days. However, the Order of the Federal Tax Service of Russia dated 09.09.2005 No. SAE-3-01/ sets other deadlines: up to 10 working days when receiving an application in person, and up to 12 working days when sending a request by mail.

Sooner or later, any citizen needs to obtain a certificate of residence. Such paper is needed to confirm information about the citizen’s permanent residence address, family composition, and temporary registration. A document is usually required for a child’s enrollment in a school or kindergarten, in the case of a subsidy or allowance, or for the purchase and sale of residential premises. It is important to understand that the article describes the most basic situations and does not take into account a number of technical issues.

If you have a problem or another reason why you decide to contact our company, write about it using this form.

Salary certificate: sample. Why do you need a certificate? How long does it take to fill? What does the law say? Instructions for filling out a salary certificate.

Recent changes in Russian fiscal legislation have required corresponding adjustments to unified forms and forms. Thus, the old tax form 39-1 (a sample is presented below) was canceled due to the transfer of administrative rights for insurance premiums to the Federal Tax Service.

Consequently, the old document did not provide for the reflection of information on the status of settlements for insurance premiums. The new form was approved by Order of the Federal Tax Service of Russia dated December 28, 2016 No. ММВ-7-17/ (form KND 1160080).

A certificate on the status of settlements for taxes, fees, penalties and fines was approved by order dated January 28, 2013 No. ММВ-7-12/39. There are two forms - one for individuals, the other for individual entrepreneurs and LLCs. The basis for drawing up the document is a written request from the applicant. A certificate in form f 39 in Moscow is issued to individual entrepreneurs and legal entities. The request is considered at the taxpayer’s place of registration.

A balance sheet from the tax office may be needed in the following cases:

- participation in a tender, competition;

- obtaining a loan from a bank;

- company audit;

- obtaining a license;

- confirmation of the correctness of accounting, etc.

The deadline for providing paper is from 10 to 30 days, depending on the workload of the authority. It is not possible to urgently order a balance from the Federal Tax Service in Moscow on your own.

Provision of a document may be refused in the following cases:

- the request was sent to the wrong tax authority;

- the necessary information is missing (TIN, name, manager’s signature, seal, etc.);

- The representative submitting the application does not have a power of attorney.

The range of services of our law firm is extensive, because our capabilities are unique. By cooperating with us, obtaining a certificate from the Federal Tax Service on the status of settlements for taxes and penalties (Form 39) will not become a problem for you, but will be a regular legal issue on the way to the result. You can, which will be received according to all the rules.

If the question concerned other difficulties, then from us you can get a certificate about the status of tax calculations, which will be issued on the basis of existing rules and recommendations. Each such certificate from the Federal Tax Service on the status of settlements with the budget is an official document that is required to resolve issues of various types.

Nuances of self-design

How to get a tax certificate using form 39 in Moscow? Very often, collecting certificates is a problem because it takes a lot of time and effort. It is especially difficult during the work process to find time to solve all the troubles. Most often, those wishing to order a certificate from the Federal Tax Service on settlements with the budget encounter the following difficulties:

- long queues;

- constant shortage of documents;

- constant control over the registration process.

All this not only complicates life, but also causes a lot of problems that affect all areas of life. Therefore, it makes sense to enlist the support of an experienced company in these matters. A modern service will help you get a certificate on the status of your payments urgently and solve the main problems without your personal participation, you just need to submit an application and attach an application. Considering this option as one of the most optimal solutions, you will be able to receive a request about the status of settlements with the Pension Fund on time, which will allow you to resolve the issue in a minimum period of time. Such information on taxes and fees may be necessary in various legal matters, and therefore it makes sense to contact us. How? Order a tax certificate online or call the office in Moscow. For example, if you have already made your first attempts to collect documents, then this is the first reason to contact us, and the certificate f 39-1 of the Federal Tax Service did not cause you any trouble.

Obtaining information from the tax office will speed up any processes involving the exchange and re-registration of documents. We don’t just help citizens do the work for which they don’t have enough time, but we speed up the process of all procedures. Certificate on Form 39-1 is now obtained quickly and without problems. Legal support is of enormous importance, because we have knowledge in this matter, therefore we always respond to any difficulties in a timely manner. This service is very useful from a profitability point of view, because it is available to everyone in Moscow and the region. Now it makes no sense to doubt the actions of the Federal Tax Service, because we have complete information about all laws and certificate 39-1 from the tax office will be received in a short time.

Sample form

We remind you that a certificate from the tax office on accountable amounts must be issued within a certain period established by law. Therefore, we support clients at different stages of registration. We offer you to download useful documents directly via the Internet: sample form 39 and application.

If you urgently need a certificate for settlements with the tax authorities or a universal certificate from the Federal Tax Service, a certificate for deductions - we can issue each of them for you. The peculiarity of the procedure is that all difficulties are resolved quickly and professionally. Our specialists offer you a service option that is always difficult to perform on your own.

How to get a certificate yourself

A balance sheet is a form consisting of several columns that indicate the balance at the beginning and end of a specific period and debit and credit turnover for a certain period for each account and subaccount. Essentially, this is the main accounting document.

To obtain a statement from the tax office, you should make a request in free form or in the form of the Federal Tax Service, if such is provided by this authority.

The request must include the following information:

- Company name (or full name of an individual);

- TIN (applies to legal entities and individual entrepreneurs);

- signature of the manager (or individual);

- printing (for individuals and individual entrepreneurs);

- method of receipt.

If you need a certificate urgently and it is not possible to wait 10-30 days, our company will help you obtain a certificate urgently, for a period of 1 to 3 days.

Benefits of contacting our company

1. We will help you urgently obtain a certificate from the Federal Tax Service, up to 3 days; 2. The company offers the most favorable prices for a wide range of services provided compared to competing companies;3. We provide documents promptly and legally, certified by seal and signature;4. We provide for all non-standard situations that may occur;5. We conclude an agreement, in case of non-compliance with the points of which, we guarantee you a refund.

By contacting, you will receive the necessary document within a maximum of 3 days after sending the request. We will help you save energy and free up time to develop your business.

Certificate from the Federal Tax Service in form 39-1

A certificate on the status of settlements for taxes, fees, penalties and fines was approved by order dated January 28, 2013 No. ММВ-7-12/39. There are two forms - one for individuals, the other for individual entrepreneurs and LLCs. The basis for drawing up the document is a written request from the applicant. A certificate in form f 39 in Moscow is issued to individual entrepreneurs and legal entities. The request is considered at the taxpayer’s place of registration.

Cost of the service Certificate on the status of settlements for taxes and duties (form 39-1) (3-5 days) 7000 rubles Order

A balance sheet from the tax office may be needed in the following cases:

- participation in a tender, competition;

- obtaining a loan from a bank;

- company audit;

- obtaining a license;

- confirmation of the correctness of accounting, etc.

The deadline for providing paper is from 10 to 30 days, depending on the workload of the authority. It is not possible to urgently order a balance from the Federal Tax Service in Moscow on your own.

Provision of a document may be refused in the following cases:

- the request was sent to the wrong tax authority;

- the necessary information is missing (TIN, name, manager’s signature, seal, etc.);

- The representative submitting the application does not have a power of attorney.

Why us?

The range of services of our law firm is extensive, because our capabilities are unique. Information39 on the status of settlements for taxes and penalties is obtained quickly and easily, thanks to cooperation with us. And legal issues will not become a problem for you on the way to the result. You can order a certificate from the Pension Fund of Russia, which will be received in accordance with all the rules. If the question concerned other difficulties, then from us you can receive a document on taxes, the transcript of which will be issued on the basis of existing rules and recommendations. Each such certificate in form f 39 is an official document that is required to resolve tax disputes of various types.

We value your timeWe are a reliable partnerProfessionals with extensive experienceLeaders in fulfilling orders of any complexityQuality guarantee for the services provided

Ways to obtain it yourself

A certificate in the form of the Federal Tax Service 39-1 or, as it is also called, a balance from the tax office is a form of several columns that indicate the budget classification code, OKATO code, overpayment or underpayment, tax balance and final balance.

To receive a balance sheet from the tax office, you must make a request using the Federal Tax Service Inspectorate form or in free form, if the former is not provided for by the Federal Tax Service Inspectorate. The following information should be included in your request:

- name of the organization (or full name of the individual);

- TIN (for legal entities and individual entrepreneurs);

- signature of the manager (or individual);

- printing (for individuals and individual entrepreneurs);

- method of receipt.

If you need to urgently order a balance sheet from the Federal Tax Service in Moscow, it is easier to contact our organization and get an emergency service.