Free legal consultation by phone:

8

The new version of the federal accounting law was released on December 31, 2021. The main changes affected article number 9 , dedicated to primary accounting documents. The latest edition also addresses the issue of simplifying accounting for individual entrepreneurs. As an important part of the law, Article 9 of Federal Law 402 lists enterprises that must necessarily attach an assessment from auditors to the report.

Commentary to paragraph 1 of Art. 9

The general requirement for registration of all facts of economic life with primary accounting documents seems obvious. The difference from a similar requirement contained in the previous Accounting Law is that the primary documents will no longer be called supporting documents, and also in the fact that it is not business transactions that are subject to registration, but the facts of economic life.

In our opinion, this definition does not seem entirely correct, since at the level of terminology (used by the new Law on Accounting) the facts of economic life and the objects of accounting are not identical concepts.

Power of attorney to sign primary accounting documents

An employee of an organization has the right to sign if one of the following documents is drawn up:

Compared to an order giving the right to sign, a power of attorney can also be issued to persons who are not employees of the organization. By agreement of the parties, a facsimile may be used to sign primary documents (Article 160 of the Civil Code).

Commentary to paragraph 2 of Art. 9

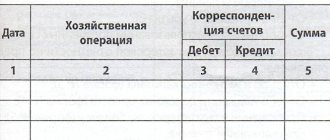

Clause 2 of Art. 9 of the commented Law contains a list of mandatory details that the primary accounting document must contain. In accordance with a similar rule contained in paragraph 2 of Art. 9 of the previous Law on Accounting, a list of mandatory details was established for documents whose form is not provided for in the albums of unified forms of primary accounting documentation.

On the one hand, since 2013, the use of unified forms is not mandatory. Therefore, the corresponding clause in the text of the norm of paragraph 2 of Art. 9 of the Accounting Law has not been reproduced. On the other hand, the list of mandatory details now applies to any form of accounting documentation used by an organization (economic entity).

All basic mandatory details have been saved. However, there are some peculiarities.

Firstly, the previous name of the requisite “measurements of a business transaction in physical and monetary terms” has actually been deciphered - it refers to the quantity in physical measurement, the unit of measurement and the amount of valuation of the corresponding asset or liability.

Secondly, in accordance with the general change in terminology, the concept of a fact of economic activity (instead of a business transaction) is used in the name of the details.

Finally, thirdly, in our opinion, the most significant change is that primary documents can now be signed not only by persons responsible for the correctness of its execution, but also by persons responsible for the completion (correct execution) of a transaction or event.

Fact of economic life: legislative definition of the category

It is curious that, having devoted a separate article to the definitions of the “basic” concepts for its norms, here the Law uses exclusively concepts that are not defined by it. At the same time, some of the elements of the definition we are considering are the subject of other branches of law, and, therefore, without receiving a special definition in the 2011 Law, these elements should be used precisely in the appropriate meaning.

First of all, this concerns the concept of “deal”. The 2011 Law does not define what a “transaction” is; therefore, here we must be guided by the definition of the Civil Code of the Russian Federation. According to Article 153 of the Civil Code of the Russian Federation, “transactions are the actions of citizens and legal entities aimed at establishing, changing or terminating civil rights and obligations.” At the same time, Article 154 of the Civil Code of the Russian Federation establishes that “transactions can be bilateral or multilateral (agreements) and unilateral.” According to subparagraphs 2 and 3 of Article 154 of the Civil Code of the Russian Federation, “a transaction is considered unilateral, for the conclusion of which, in accordance with the law, other legal acts or agreement of the parties, it is necessary and sufficient to express the will of one party. To conclude a contract, it is necessary to express the agreed will of two parties (bilateral transaction) or three or more parties (multilateral transaction).”

An event is not a transaction; an event does not depend on the will of the participants in economic relations. The Civil Code of the Russian Federation does not specifically define the concept of “event”. We find this term only in Article 190 of Part 1 of the Civil Code of the Russian Federation, dedicated to “determining deadlines.” According to the Civil Code of the Russian Federation, “the period may also be determined by an indication of an event that must inevitably occur.” Dictionary of the Russian language S.I. Ozhegova defines an event as “what happened” ([1], p. 659). The use of this concept separately from the terms “transaction”, “action”, etc. indicates its meaning precisely as independent of the will of the person keeping the record and/or his representatives. This may include any disasters, for example, fire, flood, etc., the passage of time, for example, the expiration of the statute of limitations, etc.

An operation, or business transaction, is, among other things, an integral part of a transaction. However, this is a broader concept. The term “operation” of the Civil Code of the Russian Federation is not used. The concept of an operation, a business transaction, as we could see, is a very common term in accounting regulations. In the commonly used official meaning, the concept of “operation” means a certain “individual action among other similar ones” ([1], p. 399). As an action, an operation represents acts regulated not only by civil law. Thus, an operation is the execution of an employment contract, the occurrence and repayment of tax obligations of organizations, etc.

According to the law, the facts we have listed, that is, transactions, events and operations, can only be considered as facts of economic life for accounting purposes when they “have or are capable of influencing the financial position of an economic entity, the financial result of its activities and (or) cash flows.” funds."

To understand what this condition means, we must refer to the definition given by the Accounting Act 2011 before us.

So the law says:

“Accounting is the formation of documented, systematized information about the objects provided for by this Federal Law, in accordance with the requirements established by this Federal Law, and the preparation of accounting (financial) statements on its basis” (clause 2 of Article 1).

In other words, the formation of information about objects provided for by law makes sense only for the purposes of preparing accounting (financial) statements. According to paragraph 1 of Article 13 of the 2011 Law,

“accounting (financial) statements must give a reliable picture of the financial position of an economic entity as of the reporting date, the financial result of its activities and cash flows for the reporting period, necessary for users of these statements to make economic decisions.”

So, the financial position of an economic entity, the financial result of its activities and cash flows are what the financial statements of the company reflect. The composition of the financial statements corresponds to these objects of reflection. In the 2011 Law we are considering, it is defined by Article 14, according to paragraph 1 of which:

“Annual accounting (financial) statements, with the exception of cases established by this Federal Law, consist of a balance sheet, a statement of financial results and appendices thereto.”

Accordingly, according to the Law, the balance sheet reflects the financial position of an economic entity, the income statement reflects the financial result of activities, and cash flows are appendices to the balance sheet (currently this is the cash flow statement).

Let's return to the definition of a fact of economic life. The legal norms we cited above indicate that any transactions, events and operations can only be considered as facts of economic life for accounting purposes when they are capable of influencing the content of its financial statements. The content of financial statements of organizations is determined by current regulations. And, therefore, by determining the content of financial statements, the authorities regulating accounting practices also determine the subject of accounting, thereby setting the framework for accounting (financial) information received by interested users of reporting data.

This is an extremely important point for understanding the capabilities of modern accounting to present information about business entities. And here we cannot do without making a short excursion into the theory of the issue.

Commentary to paragraph 4 of Art. 9

The rule in paragraph 4 is not fundamentally new. The head of the organization previously had the right (or was obliged) to approve the forms of primary accounting documentation. The difference is that previously this only applied to those forms that were not unified. Since 2013, the head of an economic entity is obliged to approve exclusively all forms used in the organization.

Please note that sample forms must be submitted for approval by the person responsible for accounting. Thus, in the case when accounting responsibilities are transferred to a third party (under the terms of an outsourcing agreement or similar), the specialist with whom the corresponding agreement was concluded must submit the document forms.

In public sector organizations (to which clause 4 of Article 9 of the Accounting Law does not apply), the procedure for using forms of primary accounting documents is regulated by separate norms of the Instructions for the Application of the Unified Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n, as well as Order of the Ministry of Finance of Russia dated December 15, 2010 N 173n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions and Guidelines for their use."

At the same time, as follows from the List of unified forms of primary accounting documents used by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions (Appendix 1 to the Order of the Ministry of Finance of Russia dated 15.12 .2010 N 173n), public sector organizations can use forms of primary accounting documents for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions (class 05 “Unified accounting system financial, accounting and reporting documentation of the public administration sector" OKUD), as well as forms of documents of class 03 "Unified system of primary accounting documentation" OKUD (that is, those that were previously used by business entities in other industries and types of activities). Thus, albums of unified forms of primary accounting documentation can continue to be used in the practice of document flow between economic entities, albeit on a limited scale.

Document flow schedule in accounting

A document flow schedule is understood as a description, which may take the form of a table or diagram, of procedures for the creation, movement, processing, and storage of accounting documents. The schedule can be approved as an annex to the accounting policy or as a local regulatory act. In the second case, the accounting policy must contain a reference to this act.

The document flow schedule must necessarily reflect:

Commentary to paragraph 5 of Art. 9

Fundamentally new in the norm of clause 5 of Art. 9 is a mention of electronic documents and electronic digital signatures.

As already noted, the currently valid Federal Law of January 10, 2002 N 1-FZ “On Electronic Digital Signature” loses force on July 1, 2013. Instead, after this date, the Federal Law of April 6, 2011 N 63- should come into force Federal Law “On Electronic Signature”.

Article 3 of the Federal Law of January 10, 2002 N 1-FZ introduced, in particular, the following basic concepts:

- electronic document - a document in which information is presented in electronic digital form;

- electronic digital signature - a detail of an electronic document intended to protect this electronic document from forgery, obtained as a result of cryptographic transformation of information using the private key of an electronic digital signature and allowing to identify the owner of the signature key certificate, as well as to establish the absence of distortion of information in the electronic document;

- private key of an electronic digital signature - a unique sequence of characters known to the owner of the signature key certificate and intended for creating an electronic digital signature in electronic documents using electronic digital signature tools;

- public key of an electronic digital signature - a unique sequence of characters corresponding to the private key of an electronic digital signature, available to any user of the information system and intended to confirm the authenticity of an electronic digital signature in an electronic document using electronic digital signature tools;

- signature key certificate - a paper document or an electronic document with an electronic digital signature of an authorized person of the certification center, which includes the public key of the electronic digital signature and which is issued by the certification center to a participant in the information system to confirm the authenticity of the electronic digital signature and identify the owner of the signature key certificate.

When using public signature keys, additional costs associated with the use of digital signatures are usually minimal, and additional measures to ensure the safety of the signature key certificate are not required. However, in practice, when making commercial payments, calculations related to the receipt of budget funds, submission of accounting and other reports, it seems most appropriate to use a private key.

The conditions for recognition of digital signatures are established by the norms of Art. 4 of the Federal Law of January 10, 2002 N 1-FZ.

An electronic digital signature in an electronic document is equivalent to a handwritten signature in a paper document, subject to the following conditions:

- the signature key certificate related to this electronic digital signature has not lost force (is valid) at the time of verification or at the time of signing the electronic document if there is evidence determining the moment of signing;

- the authenticity of the electronic digital signature in the electronic document is confirmed;

- The electronic digital signature is used in accordance with the information specified in the signature key certificate.

Features of the use of electronic digital signatures in the field of public administration are established by Art. 16 of the Federal Law of January 10, 2002 N 1-FZ.

Federal Law No. 63-FZ dated April 6, 2011, which is due to come into force on July 1, 2013, significantly changes the terminology. In particular, the concepts of unqualified and qualified electronic signatures were introduced, and the procedure for obtaining key certificates and organizing interaction between organizations using electronic signatures and certification centers was clarified.

Article 19 of the Federal Law dated 04/06/2011 N 63-FZ specifically stipulates that signature key certificates issued in accordance with the Federal Law dated 01/10/2002 N 1-FZ “On Electronic Digital Signature” are recognized as qualified certificates in accordance with this Federal Law .

An electronic document signed with an electronic digital signature before July 1, 2012 is recognized as an electronic document signed with a qualified electronic signature in accordance with Federal Law dated April 6, 2011 N 63-FZ.

Commentary to paragraph 6 of Art. 9

This norm is not fundamentally new. A similar requirement was contained in paragraph 7 of Art. 9 of the former Accounting Law. The differences from the new norm seem to be purely terminological.

Please note that in paragraph 6 of Art. 9 of the new Accounting Law deals specifically with primary accounting documents (and not with reporting). Thus, most often the need to duplicate data from an electronic document on paper will arise due to a commercial agreement (with suppliers and contractors, with buyers and customers, etc.). Such documents, in particular, can be settlement documents, as well as documents that mediate the movement of inventories (for example, invoices). It can also be assumed that at present such contractual requirements will be typical for the conditions relating to the submission of invoices (for VAT amounts). Invoices can now also be submitted electronically, but this practice is not yet widespread.

What do financial statements reflect and do not reflect?

The purpose of accounting is to inform interested parties (users of reporting data) about the state of affairs of accounting business entities.

Based on the analysis of this information, participants in the economic life of society make decisions about the management of their resources - decisions on the purchase or sale of securities, granting or not granting credit (loans), concluding other types of transactions, planning their future activities, etc., etc. As you know, information can be sufficient, insufficient or redundant. Do financial statements that contain reliable data, compiled in good faith, in accordance with current standards, confirmed by the opinion of auditors, etc., contain sufficient information for stakeholders to assess the state of affairs of the company. Are all the facts that may be of interest to users of the company’s reporting data reflected in its reporting? Of course not.

It should be noted that, determining the fact of economic life through the content of the balance sheet, Ya.V. Sokolov, of course, also noted its limitations as a financial model of a company, a model whose practical implementation is determined by the regulations in force at a particular point in time. “Many accountants,” noted Ya.V. Sokolov,” E.K. did this most clearly. Gilde (1904-1983), draw attention to the fact that not all facts and, accordingly, not all information presented in primary documents are of interest to the accountant. For example, a business agreement has been concluded, from which certain legal obligations arise. The fact and information about it are available, but this fact is not included in the subject of accounting. However,” adds Sokolov, “this can only be true for those regulatory documents that currently (highlighted by Y.V. Sokolov) regulate accounting” ([6], p. 13).

This is an extremely important point, and it, of course, is not limited to the issue of reflecting in the reporting the entire content of the company’s primary documents, since the state of affairs of the company and/or opinion about it may also be influenced by facts that are not included in the scope of its business transactions and other events directly related to its activities. The economic life of a society, as part of its social life, in which the accountants are participants, is too complex for it to be possible to say that only the business operations of a company and/or events affecting the composition of its funds and their sources determine its present and future. A change in market conditions, the dynamics of a company's personnel, the release of a new children's book, a revolution in a distant African country, the invention of a new type of technology - all these are facts that, without any exaggeration, can determine the life of a company preparing financial statements, but their presentation in such statements very difficult to imagine even for a “freethinking accountant”.

Based on this,

we should talk about business (economic) facts in general as actions and/or events that can change the state of affairs of the company and/or the opinion of interested parties about it and the facts of economic life as part of the business (economic) facts reflected in accounting in order to form accounting statements.

Understanding, therefore, the limitations of the current capabilities of accounting reporting, we can adequately evaluate the information contained in it, without harboring illusions regarding the “comprehensiveness” of accounting data. And it is very important that this characteristic of accounting statements is emphasized by the 2011 Law in defining the category “fact of economic life”.

* * *

The predetermination of the subject of accounting by a set of financial models of a company representing its financial position, financial results and cash flows, that is, elements of accounting statements, is reflected in the definition of the list of accounting objects in Article 5 of the 2011 Law. Our next article is about this.

Literature:

1. S.I.Ozhegov. Dictionary of the Russian language - M.: Russian language, 1984.

2. Ya.V. Sokolov. Accounting as the sum of the facts of economic life - M.: Master, 2010.

3. V.F. Paliy, Ya.V. Sokolov. ACS and accounting problems - M.: Finance and Statistics, 1981.

4. V.F. Paliy, Ya.V. Sokolov. Accounting Theory - M.: Finance and Statistics, 1984.

5. Ya.V. Sokolov. Fundamentals of accounting theory - M.: Finance and Statistics, 2000.

6. Ya.V. Sokolov. Accounting as the sum of the facts of economic life - M.: Master, 2010.

Commentary to paragraph 7 of Art. 9

The differences between the norm of the new Accounting Law regulating the procedure for making corrections in primary accounting documents and the previously valid one can also be considered significant.

First, the procedure for making corrections has been clarified. Previously, corrections to primary accounting documents could only be made in agreement with participants in business transactions, which must be confirmed by the signatures of the same persons who signed the documents, indicating the date of the corrections. However, it remained unclear how this agreement was to be formalized. Now, in fact, it has been established that to confirm the consent of the interested parties, their signature (and decryption of the signature) is sufficient. That is, for example, if it is necessary to make corrections to the expense report, the corrections must be confirmed not only by the person who actually made them (the accountant), but also by the accountable person. Corrections in bilateral acts (for example, when formalizing the acceptance of work performed or services provided) must be confirmed by representatives of both parties who signed the document, etc.

One more detail should be noted. The norm of paragraph 5 of Art. 9 of the previous Accounting Law directly prohibited making corrections to cash and banking documents. In the new Accounting Law, this provision is actually expanded. At the same time, the amended norm obliges the accountant to know for sure that making corrections to a particular primary accounting document is not prohibited.

Currently, according to our data, there is one explicitly formulated ban on making changes: in accordance with clause 2.1 of the Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation, approved by Order of the Bank of Russia dated October 12, 2011 N 373 -P, it is not allowed to make corrections to cash documents.

Making corrections to banking documents (prepared by organizations providing cash settlement services) will most likely be impossible in fact - a representative of a credit institution will simply not accept documents with corrections for execution.

Journal for recording primary documentation

Keeping such a journal is more a rule of rational document management, rather than accounting. It is necessary for registering accounting documents - incoming and outgoing primary documents. Experts advise keeping a similar journal in cases where accounting is carried out without the use of specialized accounting programs.

For example, when using 1C, a documentation log can be generated and printed as soon as necessary. Thus, the register of receipt documents will display the documents of suppliers, and the register of cash documents, respectively, will display the documentation for the company’s cash desk.

Accounting, unlike tax accounting, allows for the reflection of facts of economic activity in the absence of primary accounting documents, but only if they are received later anyway.

In this case, the facts of economic activity should be reflected in accounting using an estimated value. When a document is received, it is not reversed. You just need to adjust the date of its receipt.

This approach is regulated by 21/2008-PBU, 119n-P of the Ministry of Finance, AKPI16-443-R VS.

An exception to this procedure are documents relating to intermediary transactions. The intermediary is obliged to transfer all documentation. In cases where a report on a completed transaction was drawn up with errors or inaccuracies, the principal may have the right to raise objections within 30 days from the date of its receipt (Articles 999, 1008 of the Civil Code).